Philippines Cosmetics Market Size, Share, Trends and Forecast by Product Type, Category, Gender, Distribution Channel, and Region, 2026-2034

Philippines Cosmetics Market Size and Share:

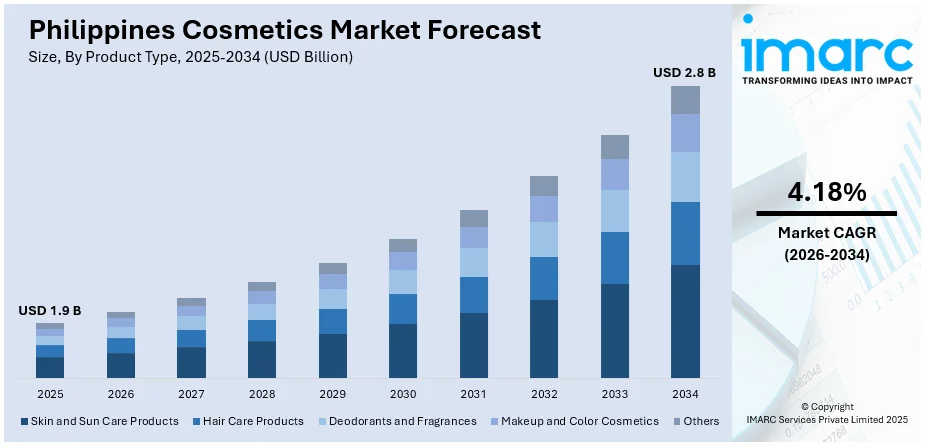

The Philippines cosmetics market size reached USD 1.9 Billion in 2025. Looking forward, the market is projected to reach USD 2.8 Billion by 2034, exhibiting a growth rate (CAGR) of 4.18% during 2026-2034. The market is driven by rising disposable incomes, increasing beauty consciousness, and social media influence. Growth in e-commerce, demand for organic products, and K-beauty trends further fuel expansion. Additionally, celebrity endorsements, urbanization, and a strong preference for skincare contribute to market momentum, supported by innovations in product formulations and packaging.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.9 Billion |

| Market Forecast in 2034 | USD 2.8 Billion |

| Market Growth Rate 2026-2034 | 4.18% |

Key Trends of Philippines Cosmetics Market:

Rise of Organic and Sustainable Beauty Products

Filipino consumers are gravitating more toward organic, cruelty-free, and eco-friendly cosmetics with increased awareness of environmental and wellness issues. The demand for natural ingredients like aloe vera, coconut oil, and plant extracts is on the increase as consumers opt for chemical-free makeup and skincare. The reaction from companies is through sustainable packaging, vegan products, and ethical sourcing initiatives. Moreover, authorities are encouraging cleaner cosmetics, additionally boosting the implementation of clean beauty. Dermatologists and social media influencers recommending organic products expand the trend such that sustainability emerges as a center point. Even local and international brands are not far behind as they innovate through plant-based applications and biodegradable materials, appealing to environmental-conscious Filipino shoppers. Apart from this, a whopping 75 % of Filipinos consciously look for brands that provide means to balance their carbon footprint.

To get more information on this market Request Sample

Growth of E-commerce and Social Media Influence

Social media and online platforms are revolutionizing the beauty market in the Philippines, as companies use digital media to directly target consumers. The emergence of e-commerce websites like Lazada, Shopee, and Zalora has increased accessibility to cosmetics through promotions, reviews, and recommendations from influencers. Live streaming, makeup tutorials, and TikTok trends have a huge impact on purchasing behavior, particularly among youth consumers. Global brands are growing their online presence, while domestic brands leverage social media marketing to drive engagement and loyalty. The ease of online purchase, combined with cash-on-delivery and installment payment options, continues to propel market growth, making digital engagement a necessary tactic for beauty brands in the Philippines.

Dominance of K-Beauty and J-Beauty Trends

Korean and Japanese beauty trends dominate the Philippine cosmetics market, shaping consumer preferences with their innovative skincare and minimalist makeup products. The popularity of K-beauty is fueled by Korean dramas, pop culture, and social media influencers, leading to high demand for products such as BB creams, cushion foundations, sheet masks, and serums infused with ingredients like snail mucin and centella asiatica. J-beauty’s focus on simplicity and hydration has also gained traction, particularly in cleansing oils and lightweight sunscreens. However, in the Philippines, the beauty market is diverse, with American brands holding a 35% market share, closely followed by K-beauty at 34%. Moreover, both trends emphasize skincare-first routines, influencing local brands to incorporate Asian beauty principles into their formulations. As Filipinos seek effective yet gentle skincare solutions, K-beauty and J-beauty continue to shape product innovation and marketing strategies.

Growth Drivers of Philippines Cosmetics Market:

Rising Disposable Income

With the ongoing increase in disposable income in the Philippines more consumers are now willing to invest in personal grooming resulting in a heightened demand for cosmetics. As income levels rise consumers are more inclined to prioritize beauty and skincare products that were once deemed luxury items. The expanding middle class is also paving the way for increased purchases of premium and specialized products targeting individual needs such as anti-aging, sun protection, and skin repair. This surge in demand across various income levels broadens the consumer base and fortifies the overall cosmetics market. As purchasing power grows consumers are opting for basic cosmetic items and exploring a diverse range of beauty and skincare offerings, significantly contributing to the Philippines cosmetics market share.

Rapid Urbanization

The urbanization trend in the Philippines highly impacts the cosmetics industry as more people move to cities where they are exposed to global beauty trends. Cities are generally where international brands focus, and they offer a wide selection of products to cater to various consumer needs. As urban centers become more cosmopolitan Filipinos increasingly succumb to universal beauty standards thereby stimulating demand for domestic as well as foreign cosmetics. In addition, urban consumers tend to place greater emphasis on convenience with the demand for easy access to beauty products via traditional retailing or online platforms. With urbanization still ongoing these cities will continue to be essential for cosmetic sales, driving the wider cosmetics market.

Changing Beauty Standards

Shifting beauty standards and a heightened awareness of personal grooming are pivotal in driving the growth of the cosmetics market in the Philippines. As beauty ideals evolve and consumers become more engaged in self-care, there is a pronounced emphasis on skincare and personal hygiene. This cultural shift generates increased demand for products that cater to a wide range of beauty needs, including specialized skincare routines and inclusive beauty solutions. Social media particularly the influence of beauty advocates plays a significant role in reshaping beauty perceptions highlighting self-expression and individual beauty. Consequently, the Filipino consumer market is becoming more receptive to innovative offerings. These changing attitudes toward beauty have a direct impact on the Philippines cosmetics market demand, further propelling industry growth.

Opportunities of Philippines Cosmetics Market:

Personalized and Customized Products

The need for specialized and customized beauty products is on the rise in the Philippines as consumers seek more solutions that respond to their unique skincare and beauty needs. This phenomenon is particularly strong among consumers seeking products that are in line with their individual preferences such as color or complexion of the skin, skin type, and specific issues like acne or sensitivity. Beauty brands that offer personalized beauty experiences like tailored skincare regimens or customized makeup can build a loyal customer base. Tailored products enable brands to differentiate in a crowded market. This customization trend is projected to keep increasing providing profitable opportunities for companies to reach a niche but growing demographic of savvy beauty shoppers.

Anti-Aging and Skincare Trends

The increased focus on skincare and anti-aging products in the Philippines is a result of heightened sensitivity about the importance of having healthy, youthful skin. The trend is most evident among the older generations who are now more proactive in fighting signs of aging. As more premium skincare products enter the market, companies offering such alternatives as anti-aging serums, moisturizers, and treatments have a great opportunity to capture consumer attention. Increased emphasis on wellness and self-care also drives the demand for skincare products that guarantee long-lasting outcomes. This intense spotlight on skincare is a key driving force in the industry, and the anti-aging category is anticipated to witness considerable growth.

Expansion of Male Grooming

The male grooming scene in the Philippines has seen remarkable evolution, with more men dedicating resources to personal care and beauty products. This transformation in consumer behavior is influenced by shifting views on masculinity and an increasing desire among men to maintain a polished look. Cosmetics brands now have the chance to develop and promote products specifically for men, such as skincare lines, hair care solutions, and even makeup. With a growing acceptance of grooming routines, brands can leverage this emerging market by providing tailored solutions for male consumers. According to Philippines cosmetics market analysis, the male grooming segment is set for substantial growth as more men adopt skincare and beauty products.

Challenges of Philippines Cosmetics Market:

Price Sensitivity

Price sensitivity is a significant challenge within the Philippines cosmetics market, especially among consumers from lower and middle-income backgrounds. Many Filipinos emphasize affordability, which creates obstacles for premium or high-end cosmetic brands in reaching a broader audience. Consequently, these brands need to find a way to balance quality with pricing, which may involve modifying their pricing strategies or offering smaller product sizes. While there is interest in luxury and international cosmetic brands, the majority of consumers are still inclined to seek budget-friendly options that deliver good value for their money. This price-sensitive behavior often encourages local brands to provide more affordable alternatives, intensifying competition within the cosmetics sector.

Counterfeit Products

The widespread issue of counterfeit products in the Philippines cosmetics market poses a considerable challenge for both consumers and reputable brands. Fake cosmetics, typically sold at lower prices, attract budget-conscious buyers who may be unaware of the potential risks to their health and skin. These counterfeit items can contain harmful substances, leading to safety issues and eroding consumer trust in the industry. This situation also negatively impacts the reputation of established, legitimate brands, as counterfeits often bear the same brand names. With counterfeit cosmetics rapidly saturating the market, it's essential for both government agencies and companies to work together on stricter regulations and to enhance consumer awareness in order to safeguard public health and maintain brand integrity.

Regulatory Compliance

The cosmetics market in the Philippines encounters challenges concerning regulatory compliance, as it must adhere to both local and international standards for product safety and distribution. Companies are faced with the task of navigating complex laws pertaining to ingredient safety, labeling, packaging, and advertising. Failing to adhere to these regulations can result in penalties, the necessity for product recalls, and a deterioration of consumer trust. Furthermore, international cosmetics standards, particularly for exports, require brands to modify their products to align with the specific regulations of various markets. Import and export restrictions, along with tariffs, further complicate business operations for cosmetics brands. Therefore, keeping current with regulations and ensuring full compliance is essential for companies aiming to thrive in this competitive and tightly regulated market.

Philippines Cosmetics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on product type, category, gender, and distribution channel.

Product Type Insights:

- Skin and Sun Care Products

- Hair Care Products

- Deodorants and Fragrances

- Makeup and Color Cosmetics

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes skin and sun care products, hair care products, deodorants and fragrances, makeup and color cosmetics, and others.

Category Insights:

- Conventional

- Organic

A detailed breakup and analysis of the market based on the category have also been provided in the report. This includes conventional and organic.

Gender Insights:

- Men

- Women

- Unisex

The report has provided a detailed breakup and analysis of the market based on the gender. This includes men, women and unisex.

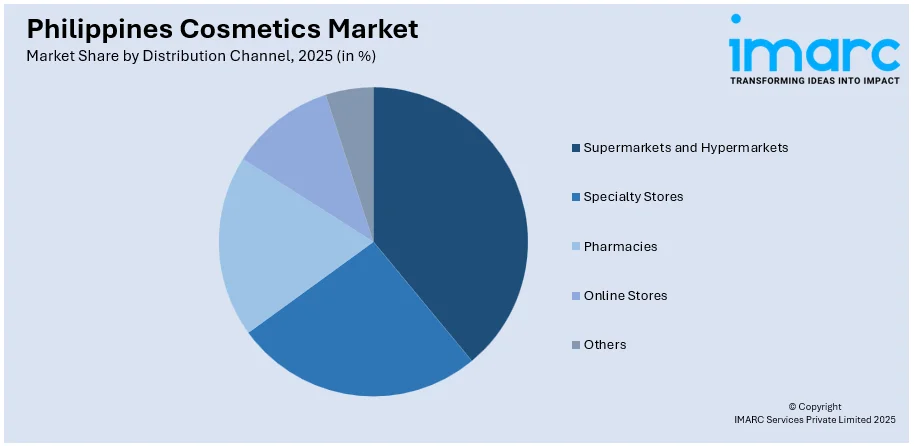

Distribution Channel Insights:

Access the Comprehensive Market Breakdown Request Sample

- Supermarkets and Hypermarkets

- Specialty Stores

- Pharmacies

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, specialty stores, pharmacies, online stores and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Cosmetics Market News:

- In November 2024, Actress Lovi Poe launched her debut makeup collection, Love, You By Lovi," under local cosmetics brand Ready Set Glow. As an ambassador since 2022, Lovi designed the line to promote self-love and individuality. Featuring five skincare-infused products, the collection empowers users to embrace their unique beauty. Lovi sees makeup as more than aesthetics—it's a tool for self-expression, making this launch a personal and entrepreneurial milestone.

- In October 2024, Chanel Beauty debuted its first boutique in the Philippines, located in Greenbelt 5. Spanning 167 square meters, the store features dedicated sections for makeup, skincare, and fragrance, including the exclusive Les Exclusifs de Chanel collection. A central discovery table offers expert-guided makeup exploration, while the Chanel Privé spa provides personalized skincare treatments. This launch reinforces Chanel’s commitment to global expansion and luxury beauty accessibility in new markets.

- In April 2024, DMark Beauty introduced French skincare brand Isispharma Dermatologie to the Philippines, offering three innovative product lines designed to restore and maintain skin balance. As a leading skincare distributor since 1998, DMark Beauty continues to bring top-tier dermatological solutions from globally renowned brands. This launch reinforces its commitment to delivering premium beauty innovations and advanced skincare methodologies to the local market.

Philippines Cosmetics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Skin And Sun Care Products, Hair Care Products, Deodorants and Fragrances, Makeup and Color Cosmetics, Others. |

| Categories Covered | Conventional, Organic |

| Genders Covered | Men, Women, Unisex |

| Distribution Channels Covered | Supermarkets And Hypermarkets, Specialty Stores, Pharmacies, Online Stores, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines cosmetics market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines cosmetics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines cosmetics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cosmetics market in the Philippines was valued at USD 1.9 Billion in 2025.

The Philippines cosmetics market is projected to exhibit a compound annual growth rate (CAGR) of 4.18% during 2026-2034.

The Philippines cosmetics market is expected to reach a value of USD 2.8 Billion by 2034.

The expansion of the cosmetics market in the Philippines is fueled by increasing disposable incomes, enabling more consumers to afford high-end products. Social media influencers significantly impact consumer preferences, especially among younger demographics. Moreover, urbanization is playing a role, as more city dwellers gain access to a wide range of cosmetic offerings.

In the Philippines, there is a growing demand for natural and organic cosmetics as consumers increasingly focus on health and sustainability. The male grooming segment is also on the rise, with a greater number of men seeking customized cosmetic solutions. Additionally, the e-commerce sector is thriving, as online shopping platforms become a prominent way to purchase beauty products.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)