Philippines Craft Beer Market Size, Share, Trends and Forecast by Product Type, Age Group, Distribution Channel, and Region, 2025-2033

Philippines Craft Beer Market Overview:

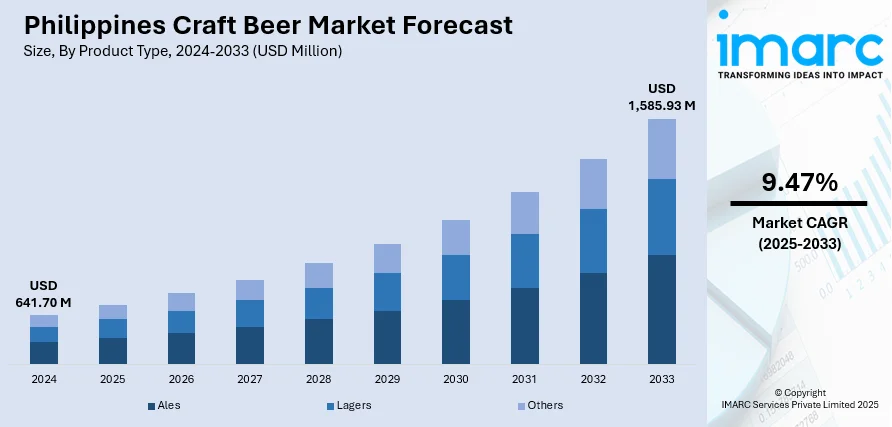

The Philippines craft beer market size reached USD 641.70 Million in 2024. The market is projected to reach USD 1,585.93 Million by 2033, exhibiting a growth rate (CAGR) of 9.47% during 2025-2033. The market is expanding as consumers seek alternatives to mass-produced options, favoring distinctive, locally inspired brews. A surge in microbreweries and brewpubs is reshaping the landscape, particularly in key cities like Manila and Cebu. Younger demographics are driving demand for artisanal quality and storytelling around heritage and ingredients. Enhanced availability through bars, festivals, and online platforms is boosting market reach. These trends are actively contributing to the growing Philippines craft beer market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 641.70 Million |

| Market Forecast in 2033 | USD 1,585.93 Million |

| Market Growth Rate 2025-2033 | 9.47% |

Key Trends of Philippines Craft Beer Market:

Local Ingredients Revitalize Brew Identity

Philippine craft breweries are increasingly integrating indigenous ingredients such as ube, mango, hibiscus, and calamansi into their brewing processes to create distinctive flavor profiles that reflect regional identity and cultural heritage. In May 2024, the Craft Beer Fest in Makati featured more than 50 local beers, showcasing new brews infused with tropical fruits and traditional botanicals. This trend of hyperlocal brewing is capturing growing consumer interest in authenticity and sustainability. By sourcing ingredients locally, brewers not only reduce environmental impact but also support regional agriculture and strengthen community ties. Events and tasting sessions are becoming platforms to educate drinkers about the provenance of ingredients and traditional brewing methods. These efforts are nurturing an appreciation for locally inspired beers while creating more diversified portfolios for craft producers. These initiatives are fostering greater appreciation for locally inspired beers while allowing craft producers to diversify their offerings. This movement aligns with Philippines craft beer market trends, where culture-driven innovation is increasingly shaping consumer preferences and adding market value. As palates become more refined, the use of native flavors continues to set Philippine craft beer apart in both local and global markets, paving the way for resilient and originality-driven industry growth.

To get more information of this market, Request Sample

Festival Growth Spurs Market Expansion

There has been a notable increase in the scale and scope of craft beer festivals across the Philippines, particularly throughout 2024, indicating rising consumer engagement and market momentum. Events such as the Craft Beer Fest held in May 2024 reportedly drew over 7,000 attendees, demonstrating robust public appetite for artisanal brews. These festivals serve as dynamic platforms for introducing new products, fostering brewer-consumer connections, and educating the public on brewing culture. Participating in breweries often reports increased brand visibility, direct sales, and new distribution opportunities post-event. Activities like beer and food pairings, homebrew workshops, and brewery collaborations further enrich the attendee’s experience. The festive environment encourages experimentation and feedback, enabling brands to fine-tune their offerings. This active community engagement is directly contributing to Philippines craft beer market growth by expanding customer bases, boosting production, and strengthening the overall supply chain. As festival culture continues to evolve and expand geographically, its influence is reshaping consumer behaviors and helping solidify the craft beer sector’s footprint across the Philippines.

Sustainability and Health-Conscious Brews Gain Ground

Philippine craft breweries are increasingly embracing sustainability and health-forward practices, aligning with evolving consumer priorities. Trends include the introduction of low-alcohol beers, botanical-infused blends, and gluten-reduced options, which are resonating with health-conscious consumers. Breweries are adopting waste-reduction strategies like repurposing spent grain into animal feed, using biodegradable packaging, and implementing energy-saving production methods. In 2024, several brewers at the Manila Craft Brewers Expo highlighted their transition to solar-powered operations and water reuse systems, reflecting an industry-wide commitment to greener practices. At the same time, digital content about wellness and sustainability is gaining traction, providing transparency and boosting consumer trust. This convergence of environmental responsibility and mindful drinking habits signifies a shift in the sector’s values. The trend illustrates how innovation and ethical production are reinforcing Philippines craft beer market, enabling long-term relevance and resilience. As brewers align their values with consumer expectations, the market continues to mature, with environmentally and health-conscious products helping define the next phase of growth.

Growth Drivers of Philippines Craft Beer Market:

Rising Consumer Preference for Premium Beverages

The Philippine beverage market is witnessing a steady shift toward premium, artisanal products as consumers become more discerning about quality and taste. This trend is fueling demand for craft beer, which offers richer, more complex flavor profiles and emphasizes authentic brewing methods. Craft beer is most attractive to consumers with its handmade quality, rare ingredient combinations, and small-scale production. Younger demographics, especially, cherish the experience and storytelling behind each brew as something to be a part of a larger lifestyle choice. Premiumization of the industry welcomes higher prices and motivates the brewers to take risks and explore radical new recipes. Local craft breweries stand well to serve quality, locality, and unique drinking experiences based on the trend and awareness created.

Expanding Urban Nightlife and Tourism

The rapid development of nightlife hubs, upscale bars, and dining establishments in Philippine cities is providing fertile ground for the growth of the craft beer sector. Tourism, both domestic and international, further fuels demand, as visitors seek unique, locally inspired beverages that reflect the country’s culture and flavors. Popular tourist destinations and entertainment districts are increasingly incorporating craft beer into their offerings, creating high-visibility platforms for local brewers. Seasonal festivals, brewery tours, and taproom events also help attract curious customers, encouraging trial and repeat purchases. This combination of vibrant nightlife and tourism creates consistent exposure and distribution opportunities for craft beer brands. By aligning with hospitality and event partners, brewers can strengthen brand presence while tapping into diverse and high-spending consumer groups.

Influence of Social Media and Digital Marketing

Social media and digital marketing have become powerful tools for Philippine craft beer brands to connect directly with their audience, which is further driving the Philippines craft beer market demand. Breweries are using platforms like Instagram, Facebook, and TikTok to showcase brewing processes, share tasting notes, and promote new or limited-edition releases. Behind-the-scenes content, storytelling about ingredients, and collaborations with influencers create deeper engagement and brand authenticity. Digital campaigns allow breweries to target niche audiences, foster online communities, and generate excitement around events or seasonal offerings. The ability to quickly share updates and respond to customer feedback helps build loyalty and trust. As more consumers discover products online before purchasing, an effective digital presence not only boosts awareness but also drives foot traffic to taprooms and retail outlets, amplifying sales potential.

Opportunities in Philippines Craft Beer Market:

Export Potential to Niche International Markets

Philippine craft brewers have an opportunity to extend their reach beyond domestic consumers by targeting niche international markets that value unique, exotic flavors. Beers infused with tropical fruits, indigenous spices, or locally sourced ingredients can appeal to global audiences seeking distinctive brewing styles. Such products can carve out a premium segment in countries with a growing appreciation for artisanal beverages. Exporting also helps diversify revenue streams, reducing reliance on local market fluctuations. By leveraging the Philippines’ cultural heritage and biodiversity, brewers can create compelling brand stories that resonate overseas. Strategic participation in international beer festivals, trade fairs, and distributor partnerships can further boost brand visibility, positioning Philippine craft beer as a rare and desirable category in global niche markets.

Collaborations with Food and Hospitality Businesses

Partnering with restaurants, hotels, and resorts offers Philippine craft beer brands a powerful avenue for increasing market presence and consumer awareness. Through these collaborations, breweries can integrate their products into curated dining experiences, where each beer is paired with dishes designed to enhance its flavor profile. Such partnerships not only elevate the perception of craft beer as a premium, gastronomic choice but also introduce it to both local and international clientele in upscale settings. Seasonal beer menus, themed tasting events, and resort-based promotions can create memorable customer experiences that foster brand loyalty. By aligning with food and hospitality establishments, craft brewers gain consistent exposure, access to diverse consumer segments, and the opportunity to showcase the versatility of their products.

Expansion into Supermarkets and Specialty Stores

Increasing the availability of craft beer in supermarkets, convenience stores, and specialty beverage retailers can significantly boost brand reach and accessibility. While bars and breweries remain key sales channels, retail distribution enables consumers to enjoy craft beer in the comfort of their homes, encouraging repeat purchases. Placement in premium grocery chains and dedicated craft beer sections can attract curious shoppers and beer enthusiasts alike. Attractive packaging, informative labeling, and limited-edition releases can further stand out on crowded shelves. This approach also caters to consumers who may not frequent bars or craft taprooms, tapping into untapped demographics. Strategic retail partnerships, coupled with promotional campaigns and in-store tasting sessions, can enhance visibility, strengthen brand recognition, and drive sustainable market growth.

Challenges of Philippines Craft Beer Market:

High Production Costs and Taxation

Small-scale craft beer producers in the Philippines often operate under tight financial constraints, as they deal with expensive imported ingredients such as specialty malts, hops, and yeast strains. The cost burden is further amplified by the need for advanced brewing equipment, which requires substantial upfront investment and ongoing maintenance. Additionally, excise taxes on alcoholic beverages add to overall operational expenses, limiting the ability of small brewers to competitively price their products. These high costs not only impact profitability but also restrict production scalability, making it difficult for emerging players to expand market reach. As a result, many craft brewers must balance quality with affordability while seeking innovative solutions to streamline costs and remain competitive in an increasingly crowded beer market.

Limited Consumer Education on Craft Beer

A significant challenge facing the Philippine craft beer industry is the lack of widespread consumer understanding of craft brewing styles, flavor profiles, and brewing techniques. While beer consumption in the country is high, many consumers are accustomed to mainstream lagers and may be hesitant to try more complex or unconventional flavors. According to the Philippines craft beer market analysis, this knowledge gap can slow adoption rates, particularly in areas where craft beer is less accessible. Without adequate education on the value, uniqueness, and cultural relevance of craft beer, many potential customers may perceive it as overpriced or unnecessary. Breweries and industry stakeholders must invest in awareness campaigns, tasting events, and collaborations with hospitality businesses to gradually introduce consumers to craft offerings, thereby fostering appreciation and long-term loyalty.

Competition from Established Commercial Brands

The presence of dominant mainstream breweries in the Philippines poses a significant barrier to growth for craft beer producers. These large companies benefit from extensive distribution networks, economies of scale, and substantial marketing budgets, enabling them to maintain strong brand recognition and consumer loyalty. Their ability to offer lower prices and launch new flavored beer products quickly can overshadow smaller, artisanal breweries that lack similar resources. Additionally, commercial brands often secure prime shelf space and tap handles in bars, restaurants, and supermarkets, making it harder for craft beer to gain visibility. To compete effectively, craft brewers must differentiate themselves through unique flavors, storytelling, and premium experiences that appeal to niche markets and emphasize authenticity over mass production.

Philippines Craft Beer Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, age group, and distribution channel.

Product Type Insights:

- Ales

- Lagers

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes ales, lagers, and others.

Age Group Insights:

- 21–35 Years Old

- 40–54 Years Old

- 55 Years and Above

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes 21–35 years old, 40–54 years old, and 55 years and above.

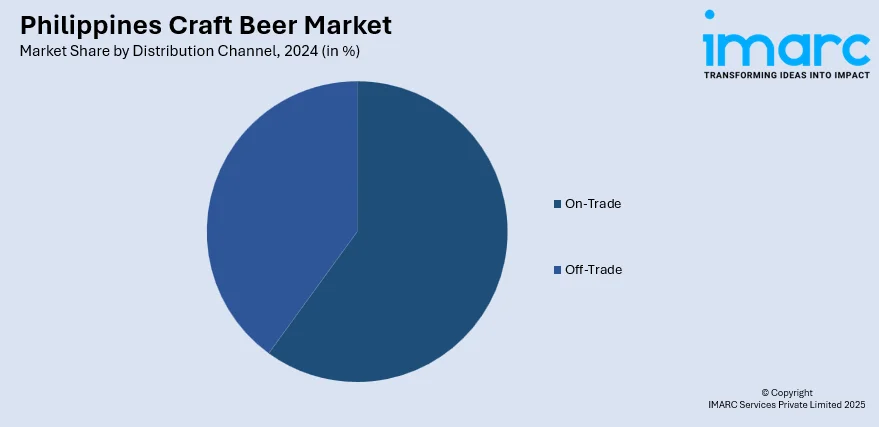

Distribution Channel Insights:

- On-Trade

- Off-Trade

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes on-trade and off-trade.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Craft Beer Market News:

- May 2025: Solomon Craft Beer won Brew King Philippines 2025 at the Engkanto Mabrewhay Craft Beer Festival in Manila with its “Washington Breeze” Pale Ale, a hazy, juicy brew featuring mango, pineapple, and citrus notes. The competition, held May 16 to 18, challenged brewers to create a “Tropical Fusion Ale” using SafAle S-04 yeast. Founded in late 2023, Solomon Craft Beer earned a ₱10,000 prize and the Brew King Paddle, marking its first major industry win.

- May 2025: The MNL Craft Beer Festival took place at Bridgetowne Central Park in Pasig City, uniting over 30 Filipino craft breweries including Engkanto, Joe’s Brew, Fat Pauly’s, and Sagada Brewery. Organized by the Philippine Craft Beer Association with partners like GoTyme and Velaris Residences, the event featured diverse beer styles, from IPAs to seasonal specialties. Attendees enjoyed food trucks, live performances by DJ Luane and indie acts, and direct engagement with brewers highlighting the vibrant growth of the Philippines’ craft beer community.

Philippines Craft Beer Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Ales, Lagers, Others |

| Age Groups Covered | 21–35 Years Old, 40–54 Years Old, 55 Years and Above |

| Distribution Channels Covered | On-Trade, Off-Trade |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines craft beer market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines craft beer market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines craft beer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight

Key Questions Answered in This Report

The craft beer market in the Philippines was valued at USD 641.70 Million in 2024.

The Philippines craft beer market is projected to exhibit a CAGR of 9.47% during 2025-2033.

The Philippines craft beer market is projected to reach a value of USD 1,585.93 Million by 2033.

The Philippines craft beer market is witnessing trends such as the rise of local microbreweries, growing consumer preference for unique flavors, and increased experimentation with ingredients. Expanding distribution channels, including bars, restaurants, and e-commerce platforms, are further enhancing accessibility and supporting the market’s steady growth and diversification.

The Philippines craft beer market is fueled by growing preference for premium, small-batch brews, rising tourism and vibrant nightlife scenes, and increasing consumer curiosity for diverse flavors. Brewer collaborations, beer festivals, and innovative product launches further enhance market reach and strengthen brand presence.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)