Philippines Diaper Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2026-2034

Philippines Diaper Market Summary:

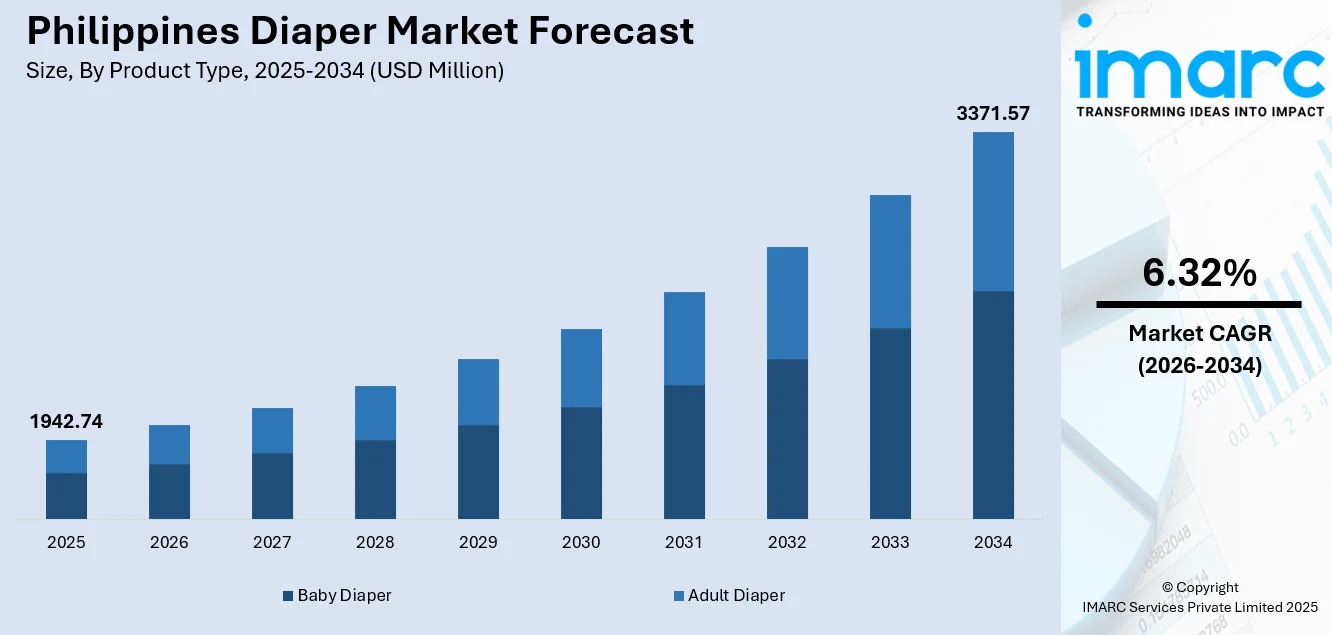

The Philippines diaper market size was valued at USD 1,942.74 Million in 2025 and is projected to reach USD 3,371.57 Million by 2034, growing at a compound annual growth rate of 6.32% from 2026-2034.

The driving forces in the market comprises of the rise in birth rates, increasing urbanization, and baby hygiene knowledge among the parents. The boost in the middle-class population and growing purchasing power are leading to increased spending on high-end baby care products. Modern retail and online growth are also amplifying accessibility and availability of products in rural and urban areas. Moreover, the rise in lifestyles and women joining the workforce is propelling the demand for convenient diaper solutions, pushing the Philippines diaper market share.

Key Takeaways and Insights:

- By Product Type: Baby diaper dominates the market with a share of 91% in 2025, driven by high birth rates, increasing parental awareness regarding infant hygiene, and growing preference for convenient disposable options.

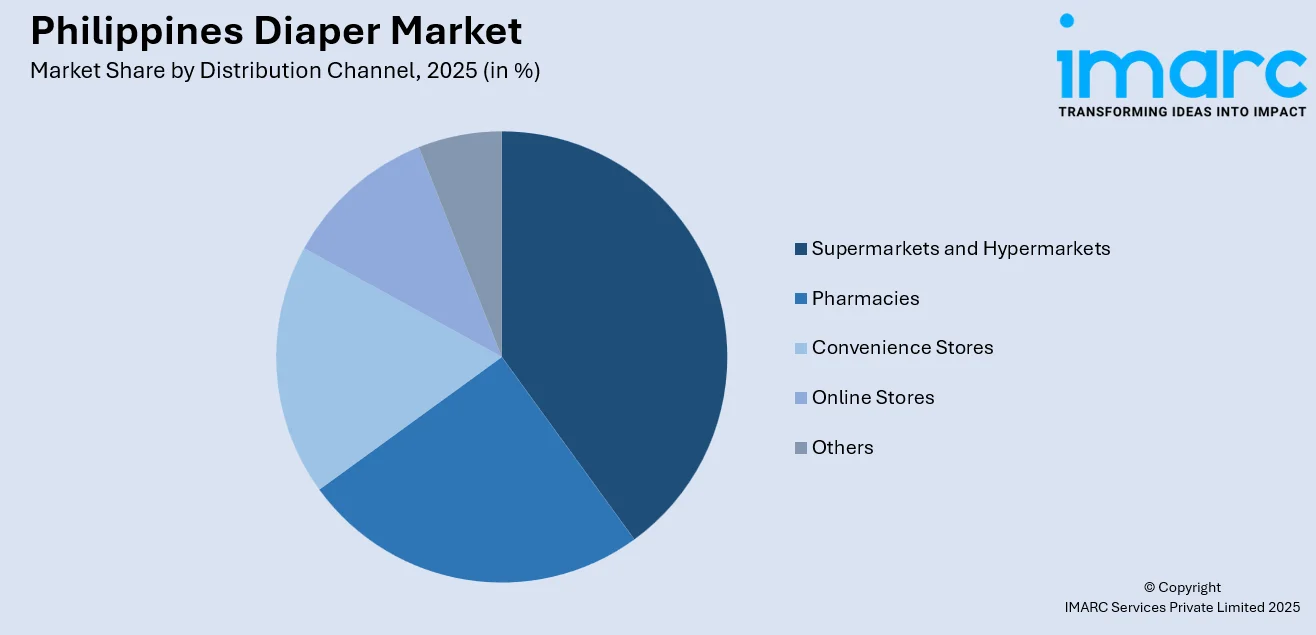

- By Distribution Channel: Supermarkets and hypermarkets lead the market with a share of 38% in 2025, owing to a large retail setup in the urban and provincial regions along with competitive pricing strategies being adopted by the company.

- By Region: Luzon leads the market with a share of 62% in 2025, driven by population concentration in Metro Manila and surrounding provinces, higher urbanization levels, and elevated disposable income levels.

- Key Players: The Philippines diaper market exhibits a moderately consolidated competitive structure, with established multinational personal care corporations competing alongside regional manufacturers. Market participants differentiate through product innovation, pricing strategies, distribution network expansion, and targeted marketing campaigns addressing diverse consumer segments across income levels.

To get more information on this market Request Sample

The Philippines diaper market is experiencing sustained growth propelled by several interconnected demographic and socioeconomic factors. Rising birth rates coupled with increasing urbanization are expanding the consumer base for baby care products across the archipelago. Growing parental awareness regarding infant health and hygiene is driving preference for quality diaper products that offer superior absorption and skin protection. As per sources, in February 2025, Lazada Philippines donated nearly 1,000 baby diaper packs through its Lazada For Good initiative, aiding typhoon‑affected families in Cabuyao, Laguna, with products from multiple well-known brands. Moreover, the expanding middle-class population with rising disposable incomes is enabling Filipino families to allocate greater spending toward premium and branded diaper options. Additionally, increasing female workforce participation is accelerating demand for convenient disposable diaper solutions that simplify childcare responsibilities. Modern retail expansion and e-commerce penetration are improving product accessibility across urban and rural areas.

Philippines Diaper Market Trends:

Growing Preference for Eco-Friendly and Sustainable Diaper Options

Filipino consumers are increasingly demonstrating environmental consciousness, driving demand for biodegradable and eco-friendly diaper alternatives. Parents are seeking products manufactured using sustainable materials that minimize environmental impact while maintaining performance standards. In May 2025, Baby Company, an SM Retail affiliate, expanded its Green Finds eco-friendly range, offering diapers and baby essentials to support environmentally conscious parenting. Moreover, this trend is particularly pronounced among urban, educated consumers who prioritize environmental responsibility alongside infant care quality. Manufacturers are responding by developing products incorporating plant-based materials, recycled packaging, and reduced chemical compositions.

Expansion of Premium and Specialized Diaper Segments

The market is witnessing growing demand for premium and specialized diaper products catering to specific infant needs and parental preferences. Consumers are increasingly willing to invest in diapers offering enhanced features including superior absorption technology, hypoallergenic materials, wetness indicators, and dermatologically tested compositions. Specialized products addressing sensitive skin concerns, overnight protection requirements, and active baby mobility needs are gaining popularity. This premiumization trend reflects evolving consumer expectations for product quality and performance, supported by rising household incomes and greater product awareness through digital marketing channels and parenting communities.

Digital Commerce Transformation and Direct-to-Consumer Channels

E-commerce platforms are revolutionizing diaper distribution in the Philippines, offering consumers unprecedented convenience and product variety. Online shopping adoption is accelerating as digital-savvy parents embrace home delivery services, subscription models, and exclusive online promotions. According to reports, in 2025, Shopee Philippines reported that 60 % of buyers made purchases after seeing products promoted by influencers, underscoring the impact of social commerce on diaper buying behavior. Furthermore, social media marketing and influencer partnerships are significantly shaping purchasing decisions among younger parents.

Market Outlook 2026-2034:

The Philippines diaper market is positioned for sustained revenue growth throughout the forecast period, driven by favorable demographic trends and evolving consumer preferences. Continued urbanization, rising disposable incomes, and expanding middle-class population are expected to support market expansion. Revenue growth will be further supported by product innovation, premiumization trends, and distribution channel diversification. E-commerce penetration and modern retail expansion will enhance product accessibility across diverse geographic regions, positioning the market for robust performance. The market generated a revenue of USD 1,942.74 Million in 2025 and is projected to reach a revenue of USD 3,371.57 Million by 2034, growing at a compound annual growth rate of 6.32% from 2026-2034.

Philippines Diaper Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Baby Diaper |

91% |

|

Distribution Channel |

Supermarkets and Hypermarkets |

38% |

|

Region |

Luzon |

62% |

Product Type Insights:

- Baby Diaper

- Disposable Diaper

- Training Diaper

- Cloth Diaper

- Swim Pants

- Biodegradable Diaper

- Adult Diaper

- Pad Type

- Flat Type

- Pant Type

Baby diaper dominates with a market share of 91% of the total Philippines diaper market in 2025.

Baby diaper commands the leading position in the Philippines diaper market, reflecting the country's demographic profile characterized by a young population and sustained birth rates. Filipino parents increasingly prioritize infant hygiene and comfort, driving consistent demand for disposable diaper products offering convenience and superior protection. According to reports, MAKUKU Philippines hosted a PR and blogger event to showcase its new ultra‑thin, super‑absorbent diaper products, engaging key influencers and gifting a year’s supply to the world’s symbolic 8 billionth baby. Moreover, growing awareness regarding the importance of maintaining infant skin health and preventing diaper-related irritations further supports demand.

Product innovation within the baby diaper category continues advancing, with manufacturers introducing enhanced features including improved absorption cores, breathable materials, and flexible designs accommodating infant mobility needs. The preference for disposable options remains strong among working parents seeking time-efficient childcare solutions. Distribution expansion through modern retail channels and e-commerce platforms is improving product accessibility across urban and rural areas. Competitive pricing strategies and promotional activities effectively maintain consumer engagement across diverse income levels and demographic groups.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Pharmacies

- Convenience Stores

- Online Stores

- Others

Supermarkets and hypermarkets lead with a share of 38% of the total Philippines diaper market in 2025.

Supermarkets and hypermarkets represent the leading distribution channel for diapers in the Philippines, leveraging extensive retail networks spanning metropolitan centers and provincial locations across the archipelago. These retail formats offer consumers significant advantages including competitive pricing, bulk purchase discounts, and comprehensive product assortments enabling in-store comparison across various brands and variants. The shopping experience allows parents to physically evaluate products before purchase, building confidence in selection decisions and supporting brand loyalty development among discerning Filipino consumers.

The growing dominance of the supermarket and hypermarket based channels represents the continued modernization of retail infrastructure in the Philippines, where the key modern retail companies are rapidly expanding their reach in the developing city centers. These stores are the key focal points for the majority of households for essential goods, thus offering an opportunity to buy diapers at these centers during the usual purchase of essential items. The key factor of the channel is its favorable positioning on the shelves of the stores.

Regional Insights:

- Luzon

- Visayas

- Mindanao

Luzon dominates with a market share of 62% of the total Philippines diaper market in 2025.

Luzon maintains the leading position in the Philippines diaper market, driven by the concentration of the national population within Metro Manila and surrounding key provinces. The region benefits from superior urbanization levels, advanced retail infrastructure, and elevated household income profiles supporting premium product purchases. Metro Manila serves as the primary commercial and economic hub, hosting extensive modern retail networks and sophisticated distribution channels ensuring comprehensive product availability across diverse consumer demographics and geographic areas.

Beyond the national capital region, rapidly developing provinces within Luzon contribute significantly to market growth through expanding urban centers and improving retail penetration rates. The region's demographic concentration and economic vitality create favorable conditions for sustained market expansion, while higher education levels and greater exposure to marketing communications drive awareness and adoption of branded diaper products. Infrastructure development and logistics improvements continue enhancing distribution efficiency, supporting market accessibility across diverse geographic areas within the island.

Market Dynamics:

Growth Drivers:

Why is the Philippines Diaper Market Growing?

Rising Birth Rates and Young Population Demographics

The Philippines maintains one of the highest birth rates in Southeast Asia, creating substantial and sustained demand for baby care products including diapers. The country's young population demographic profile ensures continuous market replenishment as new parents enter the consumer base annually. Furthermore, cultural factors emphasizing family values and larger household sizes contribute to elevated birth rates compared to regional neighbours. This demographic advantage provides the diaper market with reliable demand fundamentals, supporting consistent consumption patterns regardless of short-term economic fluctuations.

Expanding Middle-Class Population and Rising Disposable Incomes

Economic development in the Philippines is expanding the middle-class population, enabling greater household spending on quality consumer goods including premium diaper products. Rising disposable incomes allow Filipino families to transition from basic or economy diaper options toward branded products offering enhanced features and superior performance. As per sources, in 2024, Smart Parenting Village moms tested EQ Pants diapers, giving an average approval rating of 4.9 out of 5 across ease of use, comfort, absorbency, fit, dryness, and affordability. Moreover, increasing purchasing power supports premiumization trends within the market, driving demand for products incorporating advanced absorption technology and skin-friendly materials.

Increasing Urbanization and Modern Retail Expansion

Rapid urbanization across the Philippines is transforming consumer purchasing patterns and expanding market accessibility for diaper products. Urban migration concentrates populations in areas served by modern retail infrastructure, improving product availability and shopping convenience. The expansion of supermarkets, hypermarkets, and convenience store chains creates additional distribution touchpoints throughout metropolitan and provincial areas. According to reports, 7‑Eleven Philippines announced plans to open between 450 and 500 new convenience stores nationwide, broadening access to daily necessities including baby care products for urban and peri‑urban consumers. Furthermore, urban lifestyles characterized by dual-income households and time constraints favor convenient disposable diaper options over traditional alternatives. Additionally, urban environments facilitate exposure to marketing communications and brand awareness campaigns shaping purchasing decisions.

Market Restraints:

What Challenges the Philippines Diaper Market is Facing?

Price Sensitivity Among Lower-Income Consumer Segments

Significant portions of the Philippine population remain price-sensitive, limiting penetration of premium and mid-tier diaper products among lower-income households. Economic constraints force budget-conscious consumers toward economy options or traditional cloth alternatives, restricting market value growth despite volume demand. Price sensitivity intensifies during economic downturns or inflationary periods, prompting trade-down behaviors among vulnerable consumer segments.

Limited Infrastructure in Rural and Remote Areas

Geographic fragmentation across the Philippine archipelago creates distribution challenges, limiting product accessibility in rural and remote island communities. Inadequate transportation infrastructure and logistics constraints increase distribution costs, resulting in higher retail prices or limited product availability in underserved areas. Island geography complicates supply chain management, while lower population densities reduce commercial viability for extensive distribution investments.

Competition from Traditional Cloth Diaper Practices

Traditional cloth diaper usage remains prevalent in certain demographic segments, particularly among rural households, older-generation caregivers, and budget-constrained families. Cultural practices favoring reusable cloth options compete against disposable diaper adoption, limiting market expansion potential. Environmental concerns among conscious consumers additionally support preference for washable alternatives perceived as more sustainable than disposable products.

Competitive Landscape:

The Philippines diaper market features a competitive environment characterized by the presence of established multinational corporations alongside regional and local manufacturers competing across diverse market segments. Market competition centers on product innovation, pricing strategies, distribution network expansion, and brand building initiatives targeting Filipino parents. Leading participants invest significantly in research and development to introduce products incorporating advanced absorption technologies, skin-friendly materials, and convenience features responding to evolving consumer expectations. Pricing competition remains intense particularly within economy and mid-tier segments serving price-sensitive consumers, while premiumization strategies differentiate offerings in higher-value categories.

Recent Developments:

- In December 2025, luxury diaper brand Millie Moon officially entered the Philippines, launching exclusively on Shopee. Known for CloudTouch softness and dermatologically tested, fragrance-free designs, the brand quickly gained traction among Filipino parents seeking premium comfort, skin protection, and up to 12-hour leak prevention.

Philippines Diaper Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Supermarkets and Hypermarkets, Pharmacies, Convenience Stores, Online Stores, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Philippines diaper market size was valued at USD 1,942.74 Million in 2025.

The Philippines diaper market is expected to grow at a compound annual growth rate of 6.32% from 2026-2034 to reach USD 3,371.57 Million by 2034.

Baby diaper held the largest market share, driven by the country's high birth rates, young population demographics, increasing parental awareness regarding infant hygiene and skin health protection, and growing preference for convenient disposable options among working Filipino parents and caregivers.

Key factors driving the Philippines diaper market include rising birth rates, expanding middle-class population, increasing urbanization, growing hygiene awareness among parents, modern retail expansion, e-commerce growth, and rising disposable incomes enabling premium product purchases.

Major challenges include price sensitivity among lower-income consumer segments, limited distribution infrastructure in rural and remote island areas, competition from traditional cloth diaper practices, geographic fragmentation complicating logistics, and economic vulnerabilities affecting household spending capacity.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)