Philippines Edtech Market Size, Share, Trends and Forecast by Sector, Type, Deployment Mode, End User, and Region, 2026-2034

Philippines Edtech Market Size and Share:

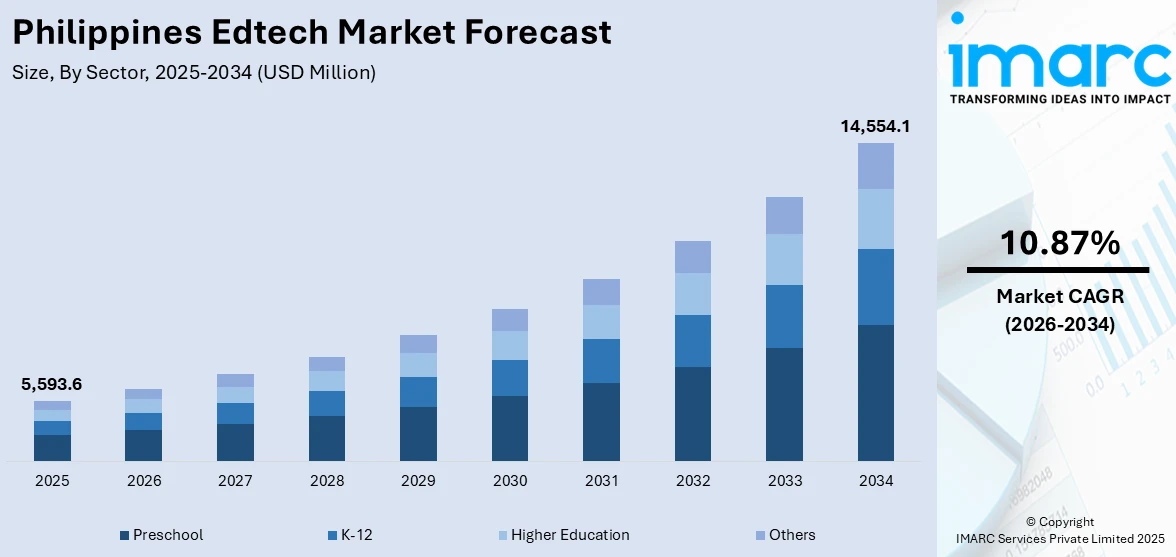

The Philippines Edtech market size reached USD 5,593.6 Million in 2025. The market is projected to reach USD 14,554.1 Million by 2034, exhibiting a growth rate (CAGR) of 10.87% during 2026-2034. The market is expanding due to increasing demand for digital learning platforms and career-focused tech training. In addition, growing investment in AI, Web3 education, and policy-driven digital tools continues to support Philippines EdTech market share across both academic and workforce development sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 5,593.6 Million |

| Market Forecast in 2034 | USD 14,554.1 Million |

| Market Growth Rate 2026-2034 | 10.87% |

Key Trends of Philippines Edtech Market:

Rising Focus on Regional Policy Alignment

The Philippines has been steadily moving toward stronger education policy frameworks that support the responsible integration of digital tools into learning systems. As regional collaboration becomes increasingly essential in addressing shared challenges, countries are aligning their efforts to design data-informed, inclusive, and technology-supported learning environments. A major step in this direction came in February 2025 when the country hosted the national launch of the 2023 Global Education Monitoring (GEM) Report on technology in education. Organized by SEAMEO INNOTECH, the event highlighted findings across 11 Southeast Asian countries and introduced localized insights through a Philippines-specific case study. The presence of education officials and participation from the public and private sectors reinforced the national commitment to adopting policies that address real classroom needs through digital innovation. By presenting comparative research, thematic papers, and practical case studies, the report helped identify actionable strategies to scale digital education fairly and effectively. This trend signals a maturing EdTech market where decisions are now shaped by regional benchmarks, context-specific data, and long-term planning rather than short-term technology adoption. As Southeast Asian countries become increasingly interconnected, the Philippines is positioning itself as a policy-shaping contributor to regional EdTech reform.

To get more information on this market Request Sample

Growing Demand for Future-Ready Skills

Digital upskilling has become central to the Philippine EdTech movement, driven by market demand for technology-literate workers. While traditional education still dominates, platforms are emerging to fill the skill gaps associated with fast-growing industries such as artificial intelligence and blockchain. A key example of this movement occurred in October 2024 when YGG Pilipinas launched Metaversity following an $80,000 grant from the Open Campus Accelerator. Designed to provide gamified and modular learning on AI and Web3, Metaversity aims to train 5,000 new learners over the course of one year. Making short courses free and accessible helps students transition from basic tech exposure to employable digital capabilities. This includes practical learning in marketing, leadership, and productivity using AI tools. The trend reflects a growing shift away from EdTech being used solely as a classroom supplement — it is now part of a wider strategy to develop the country’s digital workforce. The labor market is responding to automation, remote work, and global outsourcing by investing in scalable training programs that support these trends. As Filipino learners seek new career paths in emerging tech sectors, the demand for targeted, high-quality digital education continues to expand, further driving Philippines Edtech market growth.

Increased Adoption of Hybrid Learning Models

The EdTech landscape in the Philippines is experiencing a notable transition toward hybrid learning which integrates traditional classroom instruction with online resources to foster a more flexible and interactive educational setting. This model allows learners to engage with lessons, assignments, and materials at their convenience promoting self-directed learning while still benefiting from in-person interaction. Educational institutions are leveraging digital tools for teaching, assessments, and collaborative projects making education more suitable for diverse learning preferences and schedules. Hybrid learning effectively addresses issues like geographical obstacles and unexpected disruptions ensuring that education remains uninterrupted. With ongoing improvements in technology infrastructure this approach is anticipated to broaden its reach providing students with a more customized, engaging, and future-oriented learning experience in both urban and rural settings.

Growth Drivers of Philippines Edtech Market:

Expanding Internet and Mobile Connectivity

The swift development of internet networks and the availability of budget-friendly mobile data options are crucial in propelling the growth of the EdTech sector in the Philippines. Enhanced connectivity in both city and rural locations allows a greater number of students and teachers to utilize online learning tools, virtual classrooms, and digital resources. Smartphones have emerged as the primary access point for many learners making mobile-focused education increasingly prevalent. This improved accessibility helps bridge geographic divides enabling remote communities to access high-quality educational materials. As connectivity keeps advancing, EdTech solutions are reaching a wider audience facilitating better communication between educators and students and encouraging interactive learning experiences that were once restricted to more technologically advanced areas.

Growing Demand for Flexible Learning Options

The changing educational landscape in the Philippines is marked by a significant need for flexible learning solutions that accommodate varying lifestyles and timetables. A growing number of students and professionals favor online platforms that allow them to learn at their own pace and according to their convenience. This flexibility serves particularly well for individuals juggling their studies with work, caregiving, or other responsibilities. EdTech platforms are responding to this demand by providing modular courses, recorded lectures, and on-demand assessments, empowering learners to manage their time effectively. The option to pause, revisit, and personalize their learning journeys enables students to concentrate on their strengths while addressing areas for improvement, making education more accessible and tailored to individual needs.

Cost-Effective Access to Quality Education

Affordability plays a vital role in the expansion of the Philippine EdTech market, as digital platforms present cost-effective alternatives to conventional classroom instruction. By minimizing costs associated with transportation, printed materials, and physical facilities, EdTech solutions enhance educational access for students from diverse socio-economic backgrounds. Numerous platforms offer free or inexpensive courses while maintaining high-quality content delivered by experienced educators. This democratization of education allows students in remote or underserved areas to receive the same quality of education as those in larger urban centers. As technological advancements converge with affordability, EdTech continues to address educational disparities and foster inclusive learning opportunities throughout the country.

Opportunities of Philippines Edtech Market:

Providing Quality Education in Remote Regions

Enhancing digital infrastructure in the Philippines offers a substantial opportunity to provide high-quality education to remote and underserved populations. EdTech platforms can help close the educational gap by delivering online courses, engaging lessons, and digital resources to communities that lack access to traditional educational facilities. Solutions designed for mobile use and offline learning tools further improve accessibility for students with unreliable internet connectivity. By incorporating localized and culturally relevant content, these platforms can promote inclusivity and ensure relevance. This strategy tackles educational disparities and equips rural students with essential skills for future employment, fostering broader socio-economic development throughout the country.

Growth of Lifelong Learning and Upskilling Programs

The increasing demand for ongoing professional development in the Philippines is driving the need for lifelong learning and upskilling initiatives. As industries rapidly evolve due to technological progress, professionals are looking for flexible, cost-effective, and high-quality courses to maintain their competitiveness. EdTech platforms are addressing this need through modular learning, industry-recognized certifications, and specialized training in sectors like IT, finance, and healthcare. These offerings allow learners to juggle work and education while advancing their careers. This movement also supports employers by enhancing workforce readiness and adaptability. As more Filipinos commit to lifelong learning, the EdTech sector finds opportunities to broaden its reach and diversify its offerings.

Integration of Emerging Technologies

The application of advanced technologies such as Artificial Intelligence (AI), Augmented Reality (AR), Virtual Reality (VR), and gamification is revolutionizing the EdTech landscape in the Philippines. AI facilitates personalized learning journeys, while AR and VR create immersive experiences for hands-on learning, especially in disciplines such as science, engineering, and healthcare. Gamification boosts engagement by motivating learners with interactive challenges and rewards. These innovations enhance knowledge retention and create a more dynamic learning environment. EdTech companies that embrace these technologies can set themselves apart and provide greater value. With these tools becoming more accessible and affordable, their implementation in both academic and corporate training settings is expected to increase.

Government Supports Philippines Edtech Market:

ICT Integration in Education Policies

The Philippine government is actively working to incorporate Information and Communication Technology (ICT) into educational policies to modernize learning frameworks. This initiative encourages the utilization of online platforms, interactive digital resources, and electronic assessment methods in educational institutions. The goal of these policies is to enhance learning results, promote digital literacy, and prepare students for a technology-driven workforce. By integrating ICT into the curriculum, the government ensures future graduates are proficient with modern tools and platforms. This forward-thinking strategy creates opportunities for EdTech providers to align their offerings with national educational aims, facilitating broader adoption across public and private educational sectors.

Funding and Grants for Digital Learning Projects

Government support through funding and grants is essential for accelerating the growth of the EdTech market in the Philippines. Financial assistance is being provided to startups, educational institutions, and community initiatives focused on developing innovative digital learning solutions. These funds contribute to platform enhancement, expansion of content options, and improved accessibility for marginalized communities. Grants also encourage exploration and experimentation with new technologies, resulting in more effective educational tools. By alleviating financial obstacles, the government promotes innovation and competitive market dynamics. This support aids the EdTech industry and helps create a more inclusive and equitable educational system nationwide.

Public-Private Partnerships

Public-private partnerships (PPPs) are emerging as a significant force driving the expansion of digital education in the Philippines. These collaborations unite government resources and private sector expertise to enhance technological infrastructure, teacher training, and content delivery. PPPs can back large-scale initiatives such as equipping schools with digital devices, broadening broadband access, and developing localized educational platforms. They also encourage knowledge sharing, innovation, and cost-effectiveness in project implementation. By leveraging their combined capabilities, PPPs speed up the integration of EdTech solutions, particularly in rural and underserved areas. This collaborative framework ensures sustainable growth and lasting advantages for the nation's educational system.

Challenges of Philippines Edtech Market:

Digital Infrastructure Gaps

A significant challenge for the Philippines EdTech market is the disparity in digital infrastructure, especially in rural and remote regions. Inadequate broadband access and fluctuating internet speeds impede the reliable delivery of online lessons, live sessions, and interactive educational activities. Students in these areas frequently face issues like buffering, interrupted classes, and restricted access to digital resources, resulting in a disparity in learning quality compared to their urban counterparts. Without dependable connectivity, the complete potential of EdTech platforms cannot be achieved. Tackling this issue necessitates investments in expanding nationwide broadband, enhancing mobile network reach, and offering affordable internet plans to ensure fair access to digital education throughout all regions.

High Cost of Devices for Low-Income Families

For many families in the Philippines, particularly those with limited financial resources, the high costs of devices such as laptops, tablets, and smartphones pose a substantial obstacle. Although mobile-first learning is prevalent, not all households can afford a reliable device dedicated to educational purposes. In families with several school-age children, sharing devices further restricts learning time and overall productivity. This digital divide prevents numerous students from fully engaging in online classes or utilizing advanced EdTech tools. To alleviate this challenge, initiatives like device subsidies, installment payment options, and government-supported equipment distribution can assist in closing the gap, thereby enhancing accessibility and encouraging inclusive participation in digital learning.

Digital Literacy Barriers

Even with sufficient access to devices and the internet, digital literacy continues to be a major hurdle in the Philippine EdTech landscape. A large number of students, educators, and parents lack the necessary skills to navigate online platforms, manage digital content, or resolve technical problems. This deficiency can result in the underutilization of available resources, diminished engagement, and a slower adaptation to digital learning environments. Teachers, in particular, may find it difficult to effectively incorporate technology into their lessons without adequate training. Addressing this gap calls for specialized digital literacy initiatives, interactive workshops, and ongoing professional development to ensure that all participants can confidently and efficiently leverage EdTech solutions for effective learning.

Philippines Edtech Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2026-2034. Our report has categorized the market based on sector, type, deployment mode, and end user.

Sector Insights:

- Preschool

- K-12

- Higher Education

- Others

The report has provided a detailed breakup and analysis of the market based on the sector. This includes preschool, K-12, higher education, and others.

Type Insights:

- Hardware

- Software

- Content

The report has provided a detailed breakup and analysis of the market based on the type. This includes hardware, software, and content.

Deployment Mode Insights:

- Cloud-based

- On-premises

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes cloud-based and on-premises.

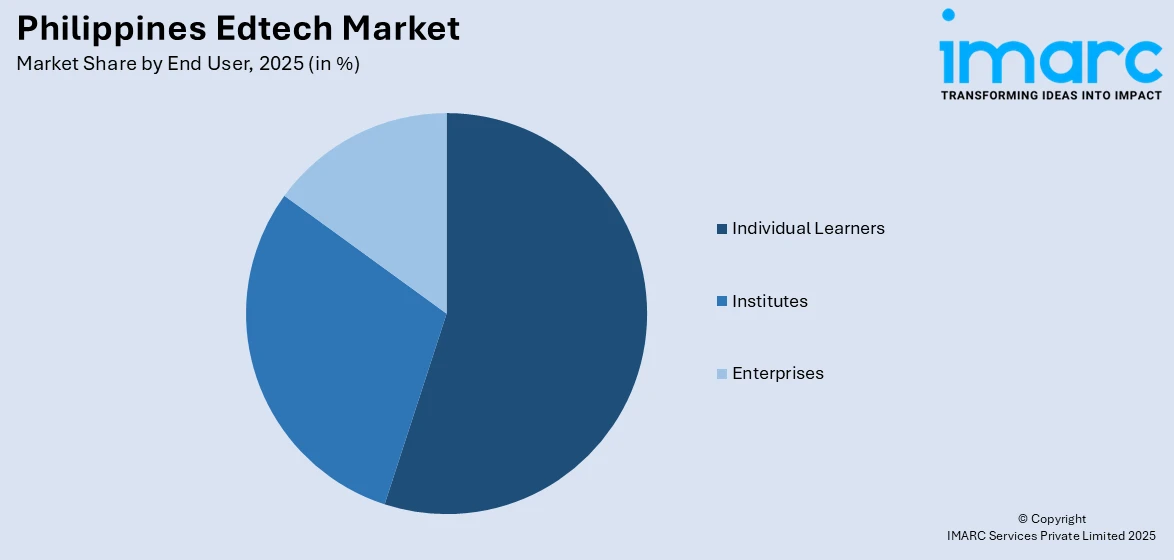

End User Insights:

Access the comprehensive market breakdown Request Sample

- Individual Learners

- Institutes

- Enterprises

The report has provided a detailed breakup and analysis of the market based on the end user. This includes individual learners, institutes, and enterprises.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Edtech Market News:

- February 2025: The Philippine Department of Education launched the Education Center for AI Research (E-CAIR) to boost AI use in teaching, assessment, and administration. This advanced EdTech integration strengthened public-private collaboration and positioned the Philippines as a Southeast Asian leader in AI-powered education.

- February 2025: EDGE Tutor, a Philippine EdTech firm, raised USD 1 Million in Pre-Series A funding to expand across the Americas and EMEA. The company scaled AI-driven online tutoring, boosting Filipino educator reach globally and accelerating digital tutoring’s share in the market.

Philippines Edtech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sectors Covered | Preschool, K-12, Higher Education, Others |

| Types Covered | Hardware, Software, Content |

| Deployment Modes Covered | Cloud-based, On-premises |

| End Users Covered | Individual Learners, Institutes, Enterprises |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines Edtech market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines Edtech market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines Edtech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Edtech market in Philippines was valued at USD 5,593.6 Million in 2025.

The Philippines Edtech market is projected to exhibit a compound annual growth rate (CAGR) of 10.87% during 2026-2034.

The Philippines Edtech market is expected to reach a value of USD 14,554.1 Million by 2034.

The Philippines EdTech market is evolving with the rise of hybrid learning models, mobile-first platforms, and AI-driven personalized learning. Gamification, interactive tools, and skills-focused courses are enhancing engagement, while teacher training technologies are improving digital teaching competencies across schools and universities.

Market growth is fueled by improved internet access, increasing demand for flexible and affordable learning, and the need for digital skills in the workforce. Government initiatives, private sector investments, and the expansion of localized, curriculum-aligned content are further accelerating EdTech adoption across diverse educational and professional sectors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)