Philippines Gaming Market Size, Share, Trends and Forecast by Device Type, Platform, Revenue Type, Type, Age Group, and Region, 2025-2033

Philippines Gaming Market Overview:

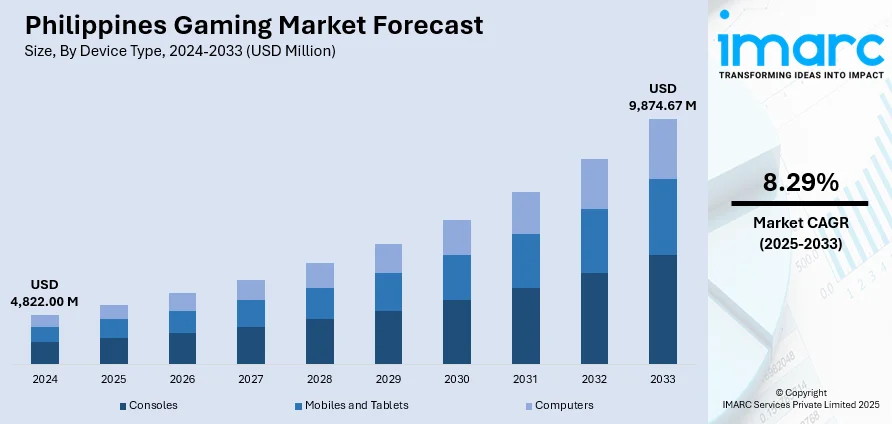

The Philippines gaming market size reached USD 4,822.00 Million in 2024. The market is projected to reach USD 9,874.67 Million by 2033, exhibiting a growth rate (CAGR) of 8.29% during 2025-2033. The market is propelled by the growing adoption of smartphones and internet penetration, which is enabling increased access to platforms for gaming. Besides this, growth in esports and the widespread appeal of mobile games also drive market demand, especially among youth. Further, government backing for digital industries, coupled with the presence of global game developers, supports a favorable environment for market innovations, which is further augmenting the Philippines gaming market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4,822.00 Million |

| Market Forecast in 2033 | USD 9,874.67 Million |

| Market Growth Rate 2025-2033 | 8.29% |

Key Trends of Philippines Gaming Market:

Growth of Mobile Gaming

The Philippines has witnessed a great movement towards mobile gaming due to the popularity of smartphones and affordable data plans. Mobile games now lead the way in gaming as they appeal to a diverse range of consumers, from casual gamers to hardcore gamers. As per industry reports, the smartphone market in the country recorded a 6.1% year-over-year (YoY) growth, with almost 18 million units sold in 2024. Smartphone growth directly aids the development of mobile gaming in the nation as more Filipinos have devices that can support quality games. Moreover, the Philippines has a large youth population, with 30 million people aged 10-24 composing 28% of the population. This youth group constitutes an important target market for mobile games since this segment often attracts to wide variety of mobile games. Furthermore, mobile gaming's convenience, offering games that can be played anywhere and anytime, appeals to the busy lifestyles of many Filipinos. Moreover, the popularity of mobile gaming is also fueled by the increasing number of social media sites, where players can participate in multiplayer modes, share information, and communicate with other enthusiasts. While the gaming market continues to grow, mobile gaming will continue to be a driving force in the Philippines, propelled by growing smartphone penetration and the creation of excellent-quality mobile games designed to appeal to local tastes.

To get more information of this market, Request Sample

Digital Payment Systems and In-Game Transactions

Digital payment solutions play a pivotal role in the market, facilitating the ease of in-game purchases and microtransactions. According to an industry report, the Philippines digital payments market size reached USD 541.56 Million in 2024. The market is expected to reach USD 1,733.50 Million by 2033, exhibiting a growth rate (CAGR) of 13.80% during 2025-2033. The rise in digital payments will further support the Philippines gaming market growth. Besides, the growing usage of mobile wallets like GCash and PayMaya has simplified how gamers can purchase premium content and virtual items, thus improving their gaming experience. Moreover, online payment convenience leads to more gamers spending on in-game items such as skins, character level-ups, and battle passes, which have become a staple in the monetization scheme of many hit games. With the growing mobile gaming and digital payments, Filipinos now have access to and can play a variety of international games that provide varied in-game purchases. This has led to increased expenditure on the gaming platform, especially among the youth sectors. Aside from this, creating secure payment gateways has also enhanced consumer trust, with players being inclined to make return purchases. As the trend of digital payments proceeds, it will further increase the financial growth and sustainability of the gaming market.

Growth Drivers of Philippines Gaming Market:

Expanding Esports Ecosystem

The Philippines' booming esports industry is catalyzing high levels of participation by players, viewers, and investors. Leagues of competitive games, ranging from local tournaments to huge national championships, offer budding gamers opportunities to exhibit their talents. Sponsorship by both foreign and domestic companies provides financial backing, allowing improved event management, prize money, and player training. The emergence of professional esports teams also opens career opportunities for not only players but also coaches, analysts, and event personnel. Live-streaming sites and media coverage bring the games to an even wider audience, both domestically and internationally. This growing environment fortifies the nation's image in the worldwide esports scene, attracting further investment and cementing gaming as a mainstream entertainment industry.

Improved Internet Infrastructure

Improved internet connectivity is the biggest growth driver of gaming in the Philippines. Recent improvements in broadband speeds, increased fiber-optic reach, and upgraded mobile networks have enabled smoother online gameplay and wider access to the public. Reduced latency and constant connections allow gamers to play competitively in multiplayer games, esports competitions, and live-streaming with minimal technical interruptions. These advancements also spur the adoption of cloud gaming services, eliminating the necessity for costly hardware and opening access to more homes for gaming. Enhanced connectivity not only favors the players but also the developers, streamers, and organizers of esports events, whose success relies on rapid, consistent internet to reach people effectively. This infrastructure development is vital for maintaining long-term growth in casual and professional gaming industries.

Rise of Influencer Marketing

Influencer marketing has become a powerful growth driver for the Philippine gaming market, with streamers, vloggers, and content creators significantly shaping player behavior and game popularity. Popular personalities on platforms like YouTube, Facebook Gaming, and TikTok introduce new titles, provide gameplay reviews, and engage audiences through interactive streams. Their content creates a sense of community and authenticity, making recommendations more persuasive than traditional advertising. Collaborations between influencers and game publishers often lead to viral campaigns, boosting downloads and in-game spending. Beyond promoting games, influencers also help attract sponsorships, expand merchandise sales, and raise awareness for esports events. As the gaming audience continues to grow, influencer-led marketing will remain a key strategy for reaching younger demographics and driving deeper engagement in the market.

Opportunities of Philippines Gaming Market:

Esports Tourism Potential

Hosting international esports tournaments presents a significant opportunity for the Philippines to boost both its gaming industry and its tourism sector. Large-scale events can attract professional teams, fans, media, and sponsors from around the world, generating substantial revenue for hotels, restaurants, transportation services, and local businesses. Beyond the direct economic impact, such tournaments can showcase the Philippines as a modern, tech-savvy destination capable of hosting world-class events. The exposure from global live streams and media coverage further strengthens the country’s image in the international esports community. With strategic investment in event infrastructure, marketing campaigns, and partnerships, the Philippines can create a sustainable esports tourism model, driving recurring economic benefits while strengthening the nation’s position as a competitive hub in the global gaming arena.

Educational and Skill-Based Games

The rising demand for educational and skill-based games presents an untapped opportunity for Philippine game developers to diversify their offerings. Gamified learning platforms can cater to schools, training institutions, and corporate programs, making education more interactive and engaging. These games can cover subjects such as language learning, mathematics, science, and soft skills, while incorporating challenges and rewards to enhance retention. With the growing adoption of e-learning, both locally and globally, developers can create products that serve dual purposes—entertainment and skill development. By targeting not just the youth but also professionals seeking upskilling opportunities, the Philippines can position itself as a key supplier of edutainment content. This niche market offers long-term growth potential, especially with increasing integration of technology in education systems.

Merchandising and Licensing

Merchandising and licensing offer a lucrative pathway for revenue diversification in the Philippines gaming market. Popular game titles, esports teams, and gaming influencers can expand their brand presence through the sale of official merchandise, such as apparel, accessories, collectibles, and themed gadgets. Licensing agreements can also open doors for collaborations with lifestyle brands, toy manufacturers, and media producers, extending the reach of gaming IPs beyond digital platforms. These products generate additional income and also strengthen fan loyalty by allowing gamers to express their passion in everyday life. With the right marketing strategies, online stores, and retail partnerships, merchandising can become a major revenue contributor, while licensing arrangements create long-term brand value and broaden the gaming industry’s commercial footprint.

Government Support for Philippines Gaming Market:

Policy Frameworks for Esports

The Philippine government has taken steps to formalize and legitimize esports by introducing policy frameworks that recognize it as an official sport. This recognition provides a structured environment for competitions, ensuring that tournaments operate under clear rules and fair play standards. It also opens doors for players and teams to receive official representation in international events, boosting the country’s presence in the global esports arena. By treating esports with the same seriousness as traditional sports, policymakers encourage greater investment from sponsors, event organizers, and media partners. This regulatory support also strengthens athlete protection, sets guidelines for prize distribution, and creates opportunities for grassroots programs, ensuring sustainable industry growth and nurturing future professional players in a competitive, well-regulated landscape.

Investment in Technology Hubs

The establishment of government-backed technology hubs is playing a vital role in supporting the Philippines’ growing gaming industry. These hubs provide affordable access to state-of-the-art facilities, high-speed internet, and advanced development tools, enabling startups and indie game developers to create competitive products for both local and international markets. By clustering talent, investors, and resources in a collaborative environment, these hubs foster innovation, knowledge sharing, and faster project development cycles. Additionally, they often offer incubation programs, mentorship, and funding opportunities, reducing entry barriers for new businesses. This strategic investment not only boosts the country’s creative economy but also positions the Philippines as an attractive destination for global gaming companies seeking to establish development studios or partnerships in Southeast Asia.

Training and Scholarship Programs

Training and scholarship initiatives introduced by the Philippine government are helping build a skilled workforce for the gaming and esports industry. These programs target aspiring developers, designers, animators, and professional gamers, providing them with technical skills, creative training, and industry exposure. Scholarships make education in game design and digital arts more accessible, particularly for talented students from underprivileged backgrounds. Some initiatives also partner with international institutions, offering specialized courses, internships, and exchange programs to enhance global competitiveness. For esports athletes, structured training programs improve performance, teamwork, and career management skills. By investing in human capital, the government ensures a steady supply of professionals capable of contributing to game development, esports management, and related creative industries, driving long-term market growth.

Challenges of Philippines Gaming Market:

Infrastructure Gaps in Rural Areas

One of the biggest challenges for the Philippines gaming market is the disparity in internet infrastructure between urban and rural regions. While major cities enjoy access to high-speed broadband and stable mobile networks, many provincial areas still face slow connections, limited coverage, and frequent service interruptions. This restricts opportunities for competitive online play, esports participation, and access to cloud-based games. As a result, potential gamers in these areas are often excluded from mainstream gaming trends and community engagement. The lack of reliable internet also affects game developers and content creators, limiting their ability to reach broader audiences. Bridging this digital divide through nationwide infrastructure upgrades is crucial for ensuring equal access and unlocking the full potential of the gaming market.

High Equipment Costs

The high cost of gaming equipment is a significant barrier to market expansion in the Philippines. Gaming PCs, consoles, high-refresh-rate monitors, and accessories often carry price tags well beyond the average consumer’s budget, especially with added import taxes and limited local manufacturing options. As a result, many gamers resort to lower-end devices, which may not support modern titles at optimal performance, affecting their overall experience. While internet cafés and gaming lounges provide an alternative, they are not always accessible in rural areas. Subscription-based cloud gaming services offer some relief, but their adoption is limited by internet speed and stability. Reducing equipment costs through local assembly, financing options, or trade-in programs could make gaming more affordable and widely accessible.

Cybersecurity and Fraud Risks

As online gaming activity grows in the Philippines, cybersecurity threats and fraud risks are becoming increasingly prevalent. Players face dangers such as account hacking, phishing scams, identity theft, and the use of cheats or hacks that undermine fair play. Payment fraud, particularly in in-game purchases, poses additional risks to both players and developers. The lack of widespread cybersecurity awareness leaves many users vulnerable, especially younger gamers. These issues not only damage player trust but also deter potential investors and advertisers from supporting the gaming ecosystem. Strengthening cybersecurity measures, implementing stricter verification protocols, and promoting online safety education are essential to protect users, ensure fair competition, and maintain the credibility and long-term growth of the gaming market.

Philippines Gaming Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on device type, platform, revenue type, type, and age group.

Device Type Insights:

- Consoles

- Mobiles and Tablets

- Computers

The report has provided a detailed breakup and analysis of the market based on the device type. This includes consoles, mobile and tablets, and computers.

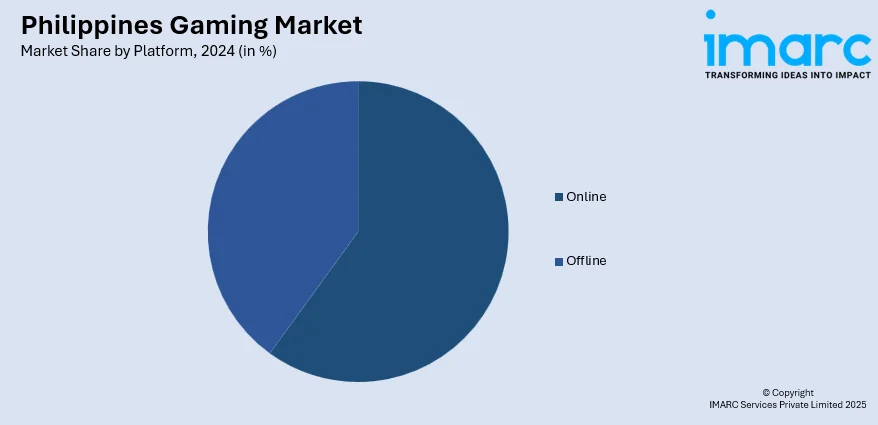

Platform Insights:

- Online

- Offline

A detailed breakup and analysis of the market based on the platform have also been provided in the report. This includes online and offline.

Revenue Type Insights:

- In-Game Purchase

- Game Purchase

- Advertising

The report has provided a detailed breakup and analysis of the market based on the revenue type. This includes in-game purchases, game purchase, and advertising.

Type Insights:

- Adventure/Role Playing Games

- Puzzles

- Social Games

- Strategy

- Stimulation

- Others

A detailed breakup and analysis of the market based on the type also been provided in the report. This includes adventure/role playing games, puzzles, social games, strategy, stimulation, and others.

Age Group Insights:

- Adults

- Children

The report has provided a detailed breakup and analysis of the market based on the age group. This includes adults and children.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Gaming Market News:

- On June 18, 2025, the Philippine Amusement and Gaming Corporation (PAGCOR) officially launched the "PAGCOR Guarantee" subsite to curb illegal online gaming and protect consumers. The platform enables the public to verify the legitimacy of online gaming providers and provides direct access to PAGCOR‑licensed sites, addressing a growing number of fraud complaints). This initiative is part of an intensified regulatory campaign to safeguard players, restore public trust, and secure government revenues.

- On May 15, 2025, Bloomberry Resorts Corporation announced the upcoming launch of its proprietary online gaming platform, “MegaFUNalo,” set to debut nationwide within the next few weeks. The platform, currently in a soft-launch phase, will offer a broad array of casino-style games, complemented by secure payment integrations via UnionBank, GCash, GrabPay, and BPI. Company executives emphasize that the new service positions Bloomberry as a direct competitor to established electronic gaming license holders in the Philippines and reflects a strategic move into the rapidly expanding digital gaming market.

Philippines Gaming Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Device Types Covered | Consoles, Mobiles and Tablets, Computers |

| Platforms Covered | Online, Offline |

| Revenue Types Covered | In-Game Purchase, Game Purchase, Advertising |

| Types Covered | Adventure/Role Playing Games, Puzzles, Social Games, Strategy, Stimulation, Others |

| Age Groups Covered | Adults, Children |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines gaming market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines gaming market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines gaming industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The gaming market in the Philippines was valued at USD 4,822.00 Million in 2024.

The Philippines gaming market is projected to exhibit a CAGR of 3.42% during 2025-2033.

The Philippines gaming market is projected to reach a value of USD 9,874.67 Million by 2033.

Key trends in the Philippines gaming market include rapid growth of mobile gaming, rising popularity of esports tournaments, and increased in-game spending. Expanding internet connectivity, streaming platforms, and influencer-driven promotions are further boosting engagement, while collaborations between developers and brands are enhancing gaming experiences and market reach.

The Philippines gaming market is driven by high internet and smartphone penetration, boom in mobile gaming and esports, large young population, supportive government regulations (e.g., reduced e-gaming fees), and increasing local and international investments in the sector.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)