Philippines Hair Care Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

Philippines Hair Care Market Overview:

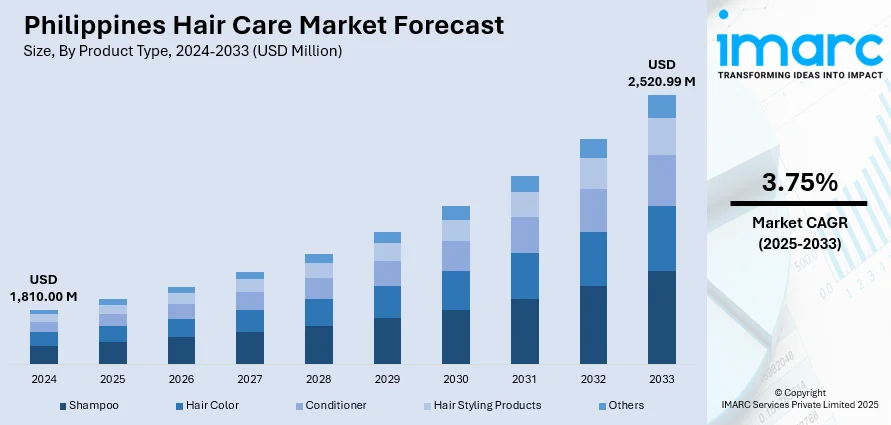

The Philippines hair care market size reached USD 1,810.00 Million in 2024. Looking forward, the market is expected to reach USD 2,520.99 Million by 2033, exhibiting a growth rate (CAGR) of 3.75% during 2025-2033. The market is spurred by increasing beauty awareness, urbanization, and high social media influence. Customers are looking for natural, multi-tasking, and climate-friendly products to respond to issues such as frizz, scalp dryness, and sun protection. Popularity of K-beauty and J-beauty trends has also encouraged local innovation, particularly among young consumers. E-commerce and influencer-based marketing continue to influence purchasing habits and brand loyalty, ultimately affecting the changing Philippines hair care market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,810.00 Million |

| Market Forecast in 2033 | USD 2,520.99 Million |

| Market Growth Rate 2025-2033 | 3.75% |

Key Trends of Philippines Hair Care Market:

Local Ingredients and Scalp-Friendly Formulations

In the Philippines, a burst of tropical biodiversity influences expectations for hair care, with local players integrating native botanical treasures into product offerings. Local ingredients such as virgin coconut oil, mango butter, pandan extract, and calamansi are commonly infused into shampoos, conditioners, and leave-in treatments. The fragrance and functional characteristics of these local ingredients touch a chord with Filipino consumers who relate them to healing and rejuvenating properties—particularly in a hot and humid tropical climate that can drain moisture from both scalp and hair. Scalp-friendly products are also picking up steam, since long-term exposure to heat and humidity is the cause of issues like itchiness, dandruff, and oil imbalance. Brands have reacted with creating weightless gel‑like serums or cooling scalp tonics, frequently drawing inspiration from old remedies like guava leaf wash or vinegar‑based rinses but reinterpreted using contemporary technology. Products also frequently include sun‑protective ingredients and hydration enhancers, specifically intended to counteract sun‑exposure effects prevalent in the archipelago. Filipino consumers are attracted to products that are culturally resonant but scientifically valid—a dynamic that characterizes the way regional products are developed and sold, which also fuels the Philippines hair care market growth.

To get more information of this market, Request Sample

Halal, Herbal and Multi‑Purpose Innovation

Being the country with a large Muslim population in Mindanao and culturally diverse values, the Philippines has seen remarkable development of halal-certified hair care products. Such products tend to converge with the multi-purpose herbal fusion trend, blending halal purity with conventional plant-based effectiveness. Shoppers more and more demand from their hair care to provide anti-frizz, heat protection, scalp care, and even styling advantage in one go. To meet the needs, most local players have launched multi-function oils or creams that have lotus seed extract, ginger, coconut water, and turmeric. Such multi-tasking products are particularly attractive in an urban environment with a hectic lifestyle where shoppers may prefer to simplify routines without compromising on performance. In addition, traditional herbal tonics based on folk practices, like ampalaya leaf tea infusions for scalp care or tuba vinegar, are being reinvented and reformatted into convenient forms like mist sprays or conditioner enhancers. This overlap of halal, herbal, and multi-purpose innovation signals a changing marketplace where local values, convenience, and clean-formulation ideals converge and inform product strategy.

Digital Community Influence and Salon Evolution

Filipinos are keen online users of social media sites like TikTok, YouTube, and Instagram to post tips, tutorials, and product reviews, which directly impinge on hair care behavior nationwide. Locally created content features do-it-yourself hair masks from ingredients found in the kitchen such as calamansi or coconut oil, which tends to encourage viewers to replicate similar mixtures or look for pre-made products containing the same components. These micro-influencer trends create viral phenomena in terms of scalp scrub recipe or low‑pH conditioners with botanical extracts—so companies have ramped up launches to catch the wave of grassroots support. Aside from product use, the salon culture also kept pace: metro Manila and Cebu are now home to specialized parlors for keratin smoothing, rebonding, scalp-detox ceremonies, and virgin blowouts—all adapted to the Filipino hair texture, type, and the needs of urban life in hot climates. The salons often tie up with local influencers to record makeovers on social streams, fueling aspirational buying. At the same time, e-commerce sites such as Shopee, Lazada, and local brand webstores are making serious investments in interactive capabilities such as AR try‑ons and Q&A livestreams, to close the gap between experiential salon visits and home routines. This digital‑salon convergence is driving more personalized and daring hair care decisions in the Philippines.

Growth Drivers of Philippines Hair Care Market:

Growing Urbanization and the Premiumization Trend

The Philippines' urbanization has greatly altered the behavior of consumers, especially in the personal care category. With more Filipinos settling in urban hubs such as Metro Manila, Davao, and Cebu, country-specific lifestyle exposure and higher disposable income are changing the way hair care products are selected and consumed. Urban consumers are increasingly looking for premium and multi-functional products which deliver salon-quality results within the comfort of their homes. This increasing demand for quality is reflected in the heightened demand for sulfate-free shampoos, deep conditioning treatments, and specific scalp care regimens. Premiumization is also spurred by aspirational lifestyles found in global beauty trends, with Filipinos eager to keep up with the gloss of international influencers. Also, the hectic lifestyles that come with living in the city generate great interest in functional, do-it-all products that will solve several issues at once, like dandruff, frizz, and color care. This move toward higher-value formats is a major growth driver for the Philippines hair care market demand, creating opportunities for innovation and value-added positioning.

Health-Conscious Consumer Behavior and Scalp-Focused Solutions

As interest in holistic health increases within the Philippines, customers are broadening their self-care regimens to encompass their hair and scalp. Hair is increasingly considered not only a fashion statement but also an indicator of inner well-being and self-care. This trend is placing pressure on companies for mild, non-toxic, and dermatologically proven products that emphasize feeding the hair and overall hair health rather than frequent styling and chemicals. Scalp health has become a point of focus, with the consumer identifying the correlation between a healthy, balanced scalp and robust, resilient hair. Increasing concern about hair loss, thinning, and scalp irritation, usually related to stress, pollution, and heat, has opened fertile ground for dedicated scalp serums, exfoliating shampoos, and oil-balancing therapies. Brands are addressing the challenge with ingredients such as tea tree, aloe vera, and prebiotics to maintain microbiome health. As Filipinos take hair care more seriously as a component of their overall health, this health-oriented mentality is generating stronger brand loyalty and long-term demand for specialized hair solutions.

Building Inclusive Market Segments and Male Grooming Momentum

According to the Philippines hair care market analysis, one major growth axis is derived from building inclusivity and expanding the consumer base. Historically aimed at women, hair care is increasingly sold to men, driven by growing interest in grooming and appearance. Products marketed specifically for men, like scalp tonics, texture creams, and beard-compatible shampoos are becoming more popular, reflecting shifts in social attitudes and self-care priorities. At the same time, there's greater respect for varied hair textures, such as natural curls, waves, and coils, even as residual cultural preferences exist for straight hair. Grassroots organizations and online forums such as Curly Girls Philippines, are fighting for curl acceptance, education, and representation, challenging brands to create gentle, curl-gentle formulas. As there is better representation in beauty and media, consumers with non-straight hair feel more acknowledged and addressed. Products react by increasingly shifting toward multi-tasking formulas that do many different things for all types of hair needs like moisture, frizz management, and styling, responding to urban, busy lives. Overall, increasing market inclusivity and enhancing awareness about diverse hair types are driving growth in the country across geographies and demographics.

Philippines Hair Care Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Shampoo

- Hair Color

- Conditioner

- Hair Styling Products

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes shampoo, hair color, conditioner, hair styling products, and others.

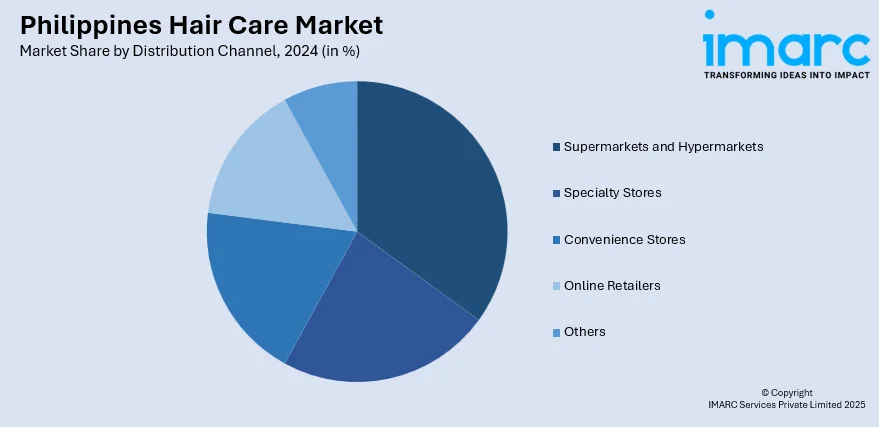

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Specialty Stores

- Convenience Stores

- Online Retailers

- Others

A detailed breakup and analysis of the market based on the distribution channel has also been provided in the report. This includes supermarkets and hypermarkets, specialty stores, convenience stores, online retailers, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major country markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Hair Care Market News:

- In May 2024, Pupa Milano, an Italian cosmetics brand, introduced its new hair care line in Malaysia. This strategic move follows Pupa's recent entry into the flourishing hair care industry, driven by increased consumer awareness about hair and scalp health. Their initial offerings included various styling products and a specialized brand for color-treated hair.

Philippines Hair Care Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Shampoo, Hair Color, Conditioner, Hair Styling Products, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Convenience Stores, Online Retailers, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines hair care market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines hair care market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines hair care industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Philippines hair care market was valued at USD 1,810.00 Million in 2024.

The Philippines hair care market is projected to exhibit a CAGR of 3.75% during 2025-2033.

The Philippines hair care market is expected to reach a value of USD 2,520.99 Million by 2033.

The Philippines hair care market trends include growing shift toward natural and organic ingredients, scalp-focused treatments, and multifunctional products. The rise of gender-inclusive and curl-friendly lines reflects evolving beauty standards. Social media, influencer marketing, and e-commerce channels are shaping consumer choices and boosting demand for personalized hair care solutions.

The Philippines hair care market is driven by rising urbanization, increased focus on scalp health, and demand for natural, locally inspired ingredients. Social media influence, premiumization, and expanding male grooming trends also fuel growth. Consumers seek multifunctional, climate-suited products that reflect wellness, convenience, and cultural identity.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)