Philippines Health and Wellness Market Size, Share, Trends and Forecast by Product Type, Functionality, and Region, 2025-2033

Philippines Health and Wellness Market Size and Share:

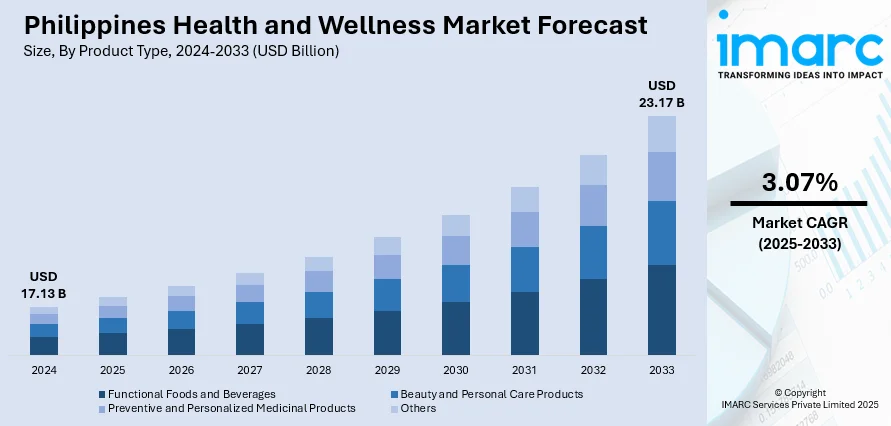

The Philippines health and wellness market size reached USD 17.13 Billion in 2024. Looking forward, the market is expected to reach USD 23.17 Billion by 2033, exhibiting a growth rate (CAGR) of 3.07% during 2025-2033. The market is fueled by growing lifestyle disease awareness, expanding middle class with an emphasis on preventive healthcare, and growing demand for fitness, organic eating, and mental wellness. Government wellness programs and corporate investments in health clubs, healthy food establishments, and wellness tourism also help fuel the growth of the industry. Demands for indigenous superfoods and traditional healing systems are also a manifestation of a strong combination of heritage and contemporary wellness which further contributes to the Philippines health and wellness market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 17.13 Billion |

| Market Forecast in 2033 | USD 23.17 Billion |

| Market Growth Rate 2025-2033 | 3.07% |

Key Trends of Philippines Health and Wellness Market:

Boom in Preventive and Holistic Health Practices

The Philippines health and wellness market is increasingly influenced by a cultural move toward prevention and all-around well-being. Consumers are embracing traditional and integrative therapies in addition to modern medical practice—such as herbal tonics like lagundi and moringa-based supplements—practices based on centuries-old native traditions. Wellness retreats in Batangas and Bukidnon provinces are integrating yoga, meditation, and farm-to-table organic experiences as a sign of people's yearning for active holistic getaways. Wellness centers in Metro Manila's urban areas provide integrative health packages integrating nutritional consultations, stress-management sessions, and mindfulness exercises. Alternatives aligned with people's spiritual and familial values are also being sought, including community-focused wellness circles and faith-based health programs. This fusion of old and new results in a distinctively Filipino wellness philosophy based on heritage, community, and harmony that is more than mere symptom treatment and focuses on a holistic lifestyle change.

To get more information of this market, Request Sample

Digital Health, Tele wellness, and Home Care Innovation

The steep growth of digital connectivity in the Philippines, driven by a tech-literate population and ubiquitous mobile access, has sped up the development of digital health and tele wellness platforms. Online consulting with nutritionists, virtual fitness training, and mental health care are becoming popular among urban working professionals in Manila, Cebu, and Davao. Home wellbeing services like the delivery of healthy meals at home, personalized smoothies made from local superfoods, and demand-for-fitness websites have resonated, especially during health-driven post-lockdown rehabilitation. Local entrepreneurs are disrupting remote health monitoring, allowing older Filipinos in provincial towns to get regular check-ups through telehealth. These digital-first strategies fill gaps in access to healthcare—countering the issue of uneven resource distribution for health—while anticipating the conveniences, individualization, and safety demanded by today's consumers. As connectivity continues to improve outside the metro areas, tele wellness is set to be an increasingly powerful market driver.

Functional Nutrition and Revival of Local Ingredients

Another major trend contributing to the Philippines health and wellness market growth is the emergence of functional nutrition based on native ingredients. Food companies and wellness entrepreneurs are highlighting local botanicals like calamansi, malunggay (moringa), guyabano (soursop), and turmeric and their antioxidant, immune-boosting, and digestive health properties. Local food producers are also making functional juices and tea infused with these ingredients, and snack food companies are creating chips and bars that are fortified with quinoa-like local crops like pili and kamote (sweet potato). Filipino consumers, especially millennials and Gen Zers, are keen on products that tie them to local heritage while providing wellness benefits. While this, restaurants and juice bars are broadening functional menus with signature offerings such as turmeric lattes and moringa smoothies. This indigenous ingredient renaissance backs rural agricultural communities in places like Ilocos and Mindanao that instills national pride within the wellness industry.

Growth Factors of Philippines Health and Wellness Market:

Rising Health-Conscious Population

Increased consciousness of healthy living among Filipinos is driving demand for healthy food, natural health supplements, and chemical-free beauty products. More consumers are going out of their way to read labels, steering away from highly processed foods, and opting for organic or plant-based products. This trend is also affecting eating habits, as restaurants are adding healthier options to their menus to serve this market segment. Fitness clubs, wellness spas, and health-focused festivals are becoming popular, inducing lifestyle changes in different age groups. Social media personalities and health champions also propagate wellness trends, driving market growth further. With increasing Filipinos embracing healthy eating habits and regular exercise, demand for high-quality wellness products and services will continue to increase, providing room for businesses to offer innovative, research-backed solutions that focus on consumer needs.

Fitness and Wellness Tourism

The Philippines is emerging as a destination for wellness tourism, offering spa resorts, yoga retreats, and eco-friendly accommodations that promote relaxation and health restoration, further driving the Philippines health and wellness market demand. Tourists are more and more interested in experiences that incorporate travel with physical and mental regeneration. Beaches, mountains, and rural countryside are natural environments for meditation, detoxification programs, and fitness-oriented activities. Entrepreneurs in these areas are teaming up with tourist agencies to offer packages of healthy eating, guided exercise, and wellness workshop packages. The sector gains advantage from the rich biodiversity of the country, which caters to nature-based treatments and therapies. With global tourists prioritizing health-conscious vacations, the Philippines is poised to maximize its own natural endowments and cultural warmth to welcome domestic as well as international health tourists, generating revenue while fostering sustainable and responsible tourism practices.

Corporate Wellness Initiatives

Employers in the Philippines are investing in employee health and wellness programs to improve productivity, reduce absenteeism, and lower healthcare expenses. These initiatives include subsidized gym memberships, on-site fitness classes, health screenings, and mental health counseling. Companies are also incorporating wellness education into their workplace culture, encouraging better nutrition, physical activity, and stress management. With the growing awareness that employee well-being directly impacts business performance, corporate wellness is becoming a competitive advantage in attracting and retaining talent. Partnerships with wellness service providers and health insurance companies further enhance program effectiveness. Over time, such initiatives not only improve employee satisfaction but also contribute to a healthier, more engaged workforce, reinforcing the overall growth of the health and wellness market in the Philippines.

Opportunities of Philippines Health and Wellness Market:

Expansion of Wellness Retail Chains

The growing interest in healthier lifestyles is creating a strong opportunity for specialized wellness retail chains in the Philippines. Stores offering organic food, plant-based supplements, eco-friendly personal care products, and fitness accessories can cater to a rising niche market. Strategic placement in malls, business districts, and residential hubs can capture urban consumers who value convenience and quality. Partnerships with local farmers and ethical suppliers ensure a steady flow of authentic, sustainable goods. By integrating in-store nutrition consultations, workshops, and sampling events, retailers can deepen customer engagement and encourage repeat purchases. As consumers become more health-conscious and informed, branded wellness retail spaces can establish trust, differentiate themselves from general supermarkets, and become go-to destinations for premium health and wellness products.

Integration with the Hospitality Industry

The hospitality sector offers a significant opportunity to integrate health and wellness into guest experiences. Hotels, resorts, and boutique accommodations in the Philippines can attract wellness-focused travelers by offering spa services, organic dining options, guided fitness sessions, and mindfulness activities. Collaborations with nutritionists, fitness trainers, and holistic practitioners can enhance these offerings. Coastal resorts can provide water sports for fitness, while mountain retreats can host yoga and meditation workshops in serene settings. Wellness-themed packages appeal to both leisure and corporate travelers seeking rejuvenation. The rise of “staycations” among locals also supports this trend. By merging hospitality with wellness, businesses can command premium rates, differentiate themselves in a competitive tourism market, and contribute to positioning the Philippines as a wellness travel hub.

Export Potential for Natural Products

The Philippines has rich biodiversity and a long tradition of herbal remedies, which present an excellent opportunity for exporting natural health and wellness products. Locally produced herbal teas, virgin coconut oil, calamansi-based skincare, and plant-derived supplements have strong appeal in global markets that value authenticity and sustainability. By meeting international quality and safety standards, Philippine manufacturers can tap into demand in Asia, Europe, and North America. Government support through trade fairs, export incentives, and capacity-building programs can further strengthen competitiveness. Branding products with a “Philippine origin” identity can enhance their marketability. As global consumers increasingly prefer natural, eco-friendly solutions, the country’s agricultural and cultural heritage can serve as a foundation for developing high-value exports that benefit both rural communities and the national economy.

Challenges of Philippines Health and Wellness Market:

High Cost of Premium Wellness Products

Premium health and wellness products, such as organic food, imported supplements, and specialized skincare, often come with high price tags in the Philippines. Import taxes, limited local production, and distribution costs make these products less accessible to price-sensitive consumers. While demand is growing among middle- and upper-income groups, the broader population struggles to afford them regularly. This creates a market gap that limits mass adoption. Retailers and manufacturers need to explore strategies such as local sourcing, product bundling, and smaller, more affordable packaging to widen accessibility. Without addressing affordability, the wellness industry risks remaining a niche market. Bridging this gap is crucial for inclusive growth, allowing more Filipinos to integrate health and wellness products into their daily lives.

Lack of Standardized Regulations

Inconsistent regulation of health and wellness products, especially supplements, herbal remedies, and alternative therapies, is a challenge for the Philippine market. Without clear and enforceable standards, product quality can vary widely, leading to cases of misleading claims or unsafe formulations. According to the Philippines health and wellness market analysis, this undermines consumer trust and poses risks to public health. The absence of a unified certification process also makes it harder for legitimate producers to differentiate themselves from counterfeit or substandard competitors. Strengthening regulatory frameworks, implementing mandatory testing, and increasing public awareness of certified products can help protect consumers while encouraging industry professionalism. A reliable system of quality assurance will not only safeguard health but also enhance the reputation of Philippine wellness products in domestic and international markets.

Urban-Rural Accessibility Gap

Wellness services and products in the Philippines are heavily concentrated in urban centers like Metro Manila and Cebu, leaving rural areas underserved. Residents in provincial towns often have limited access to fitness facilities, wellness clinics, and specialty health products, restricting participation in the growing wellness trend. High distribution costs and logistical challenges contribute to this imbalance. The gap also limits opportunities for rural communities to benefit economically from the wellness industry. Expanding distribution networks, supporting local wellness entrepreneurs, and introducing mobile wellness services can help bridge this divide. Ensuring equitable access to health and wellness offerings across regions will foster nationwide market growth while improving public well-being and reducing disparities in lifestyle quality.

Government Support for Philippines Health and Wellness Market:

Nutrition and Public Health Campaigns

The Philippine government actively promotes health and wellness through nationwide nutrition and public health campaigns. These initiatives aim to encourage healthier eating habits, regular exercise, and disease prevention practices. Programs such as school-based feeding schemes, community fitness drives, and awareness campaigns on balanced diets help educate the public. Government agencies also partner with non-profits and private companies to amplify outreach, particularly in rural areas. These efforts target both communicable and lifestyle-related diseases, aligning with broader national health objectives. By fostering early adoption of healthy habits, such campaigns not only improve population health but also create sustained demand for wellness products and services. This integrated approach strengthens the foundation for long-term growth in the health and wellness market.

Support for Traditional and Herbal Medicine

Recognizing the value of indigenous wellness practices, the Philippine government supports the research, development, and commercialization of traditional and herbal medicine. Agencies collaborate with universities, research institutions, and local communities to study the safety and efficacy of native plants and remedies. Approved products can be marketed domestically and exported, providing livelihood opportunities for rural farmers and indigenous groups. Policies promoting herbal medicine also help preserve cultural heritage while offering affordable healthcare alternatives. This support includes capacity-building programs, quality certification processes, and inclusion of approved herbal treatments in public healthcare facilities. By integrating tradition with science, the government enables the wellness industry to offer diverse, credible, and culturally relevant solutions for both local and international markets.

Infrastructure Development for Wellness Tourism

The Philippine government is investing in infrastructure projects that directly support wellness tourism. This includes developing eco-parks, spa resorts, hiking trails, and health retreat centers in key destinations. Upgrades to transport facilities, such as airports and roads, improve accessibility for domestic and international wellness travelers. Public-private partnerships encourage the creation of world-class wellness facilities that integrate natural surroundings with therapeutic services. These investments aim to position the Philippines as a competitive player in the global wellness tourism market, appealing to travelers seeking relaxation, fitness, and holistic health experiences. By combining natural resources, cultural assets, and modern facilities, the country can generate substantial economic benefits while promoting sustainable tourism that aligns with environmental and community well-being goals.

Philippines Health and Wellness Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type and functionality.

Product Type Insights:

- Functional Foods and Beverages

- Beauty and Personal Care Products

- Preventive and Personalized Medicinal Products

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes functional foods and beverages, beauty and personal care products, preventive and personalized medicinal products, and others.

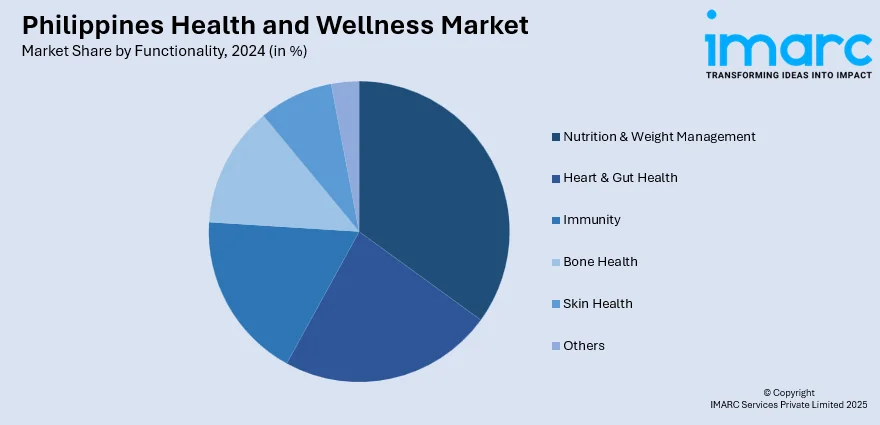

Functionality Insights:

- Nutrition & Weight Management

- Heart & Gut Health

- Immunity

- Bone Health

- Skin Health

- Others

A detailed breakup and analysis of the market based on the functionality has also been provided in the report. This includes nutrition & weight management, heart & gut health, immunity, bone health, skin health, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Health and Wellness Market News:

- In January 2025, to diversify its tourism options, the Philippines declared that it has begun promoting its Filipino wellness campaign internationally with positive outcomes. To distinguish itself from other Asian nations, the wellness initiatives emphasize Filipino characteristics of malasakit (compassionate care) and aruga (nurturing care), according to Paulo Tugbang, director of health and wellness tourism as well as product and market development at the Department of Tourism (DoT).

- In June 2025, the Philippines attained full market status following a multi-year establishment procedure, according to Zinzino, the world leader in test-based, customized nutritional supplements. The Philippines boasts a thriving direct selling sector, propelled by extensive customer networks and adaptable revenue streams. Businesses in this industry concentrate on domestic, cosmetic, and health products, and digital channels are being utilized more and more for hiring and sales.

- In March 2025, a leading European pharmaceutical producer, Sole Pharma, announced its entry into the Southeast Asian market in response to the Philippines' growing demand for high-end health supplements. In addition to Sole Pharma's own stores on Lazada and Shopee, products are available online through Mercury Drug, Watson's, Rose's Pharmacy, and Allgreen RX.

- In October 2024, Insular Life (InLife), the leading and largest life insurer in the Philippines, collaborated with mWell, the nation’s first comprehensive digital health and wellness platform, to offer various services focusing on preventive care.

Philippines Health and Wellness Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Functional Foods and Beverages, Beauty and Personal Care Products, Preventive and Personalized Medicinal Products, Others |

| Functionalities Covered | Nutrition and Weight Management, Heart & Gut Health, Immunity, Bone Health, Skin Health, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines health and wellness market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines health and wellness market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines health and wellness industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The health and wellness market in the Philippines was valued at USD 17.13 Billion in 2024.

The Philippines health and wellness market is projected to exhibit a CAGR of 3.07% during 2025-2033.

The Philippines health and wellness market is projected to reach a value of USD 23.17 Billion by 2033.

The Philippines health and wellness market is shaped by a growing focus on preventive healthcare, holistic wellness approaches (including traditional Filipino therapies like hilot), and increased demand for natural and clean-label food products. Digital health services and wellness tourism are also experiencing significant growth.

The Philippines health and wellness market is driven by increasing health awareness and the rising prevalence of lifestyle diseases. A growing middle class with higher disposable incomes is also investing more in preventive healthcare, fitness, organic foods, and mental wellness. Government initiatives and the expansion of wellness tourism are further significantly contributing to market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)