Philippines Kitchen Appliances Market Size, Share, Trends and Forecast by Product Type, Structure, Fuel Type, Application, Distribution Channel, and Region, 2025-2033

Philippines Kitchen Appliances Market Size and Share:

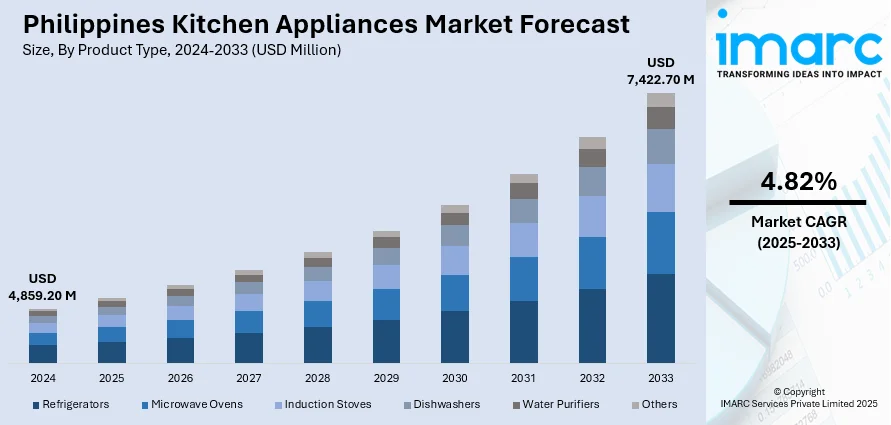

The Philippines kitchen appliances market size reached USD 4,859.20 Million in 2024. Looking forward, the market is expected to reach USD 7,422.70 Million by 2033, exhibiting a growth rate (CAGR) of 4.82% during 2025-2033. The market is expanding steadily, driven by urban lifestyle shifts, growing interest in home cooking, and rising demand for compact, multifunctional appliances. Increasing digital adoption, energy efficiency awareness, and wider product availability through online and offline retail channels are also shaping consumer preferences. This growth reflects the strengthening of the Philippines kitchen appliances market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4,859.20 Million |

| Market Forecast in 2033 | USD 7,422.70 Million |

| Market Growth Rate 2025-2033 | 4.82% |

Key Trends of Philippines Kitchen Appliances Market:

Changing Dietary Preferences and Rise in Home Cooking

A noticeable shift in dietary habits, fueled by health consciousness and culinary experimentation, is encouraging more Filipinos to prepare meals at home. The resulting rise in popularity of homemade food has led to a huge demand in user-friendly kitchen gadgets like blenders, food processors, slow cookers and steam ovens. Consumers are also looking into appliances that make meals easier to prepare and that aid healthier lifestyles. The popularity of social media and cooking videos on websites and applications such as YouTube or TikTok also encouraged people to experiment more with various types of recipes, which increases the consumption of appliances. As more individuals embrace cooking as both a necessity and a hobby, manufacturers are focusing on compact, intuitive, and multi-functional appliances that cater to a wide range of cooking preferences across diverse Filipino households.

To get more information of this market, Request Sample

Rise in Dual-Income Households and Time-Saving Preferences

The increasing prevalence of dual-income families in urban and semi-urban areas is creating strong demand for time-efficient kitchen solutions, which is further fueling the Philippines kitchen appliances market growth. With both partners engaged in full-time work, convenience and speed have become top priorities in the kitchen. This shift has boosted sales of quick-cooking appliances such as microwave ovens, air fryers, electric pressure cookers, and smart rice cookers. Additionally, busy lifestyles have increased reliance on appliances that reduce manual labor and cooking time, making automated, programmable devices highly attractive. To meet this growing need, brands are introducing features like pre-set cooking modes, auto-cleaning systems, and app connectivity. As Filipino consumers strive to balance work and home life, kitchen appliances that enhance productivity and reduce effort are gaining widespread popularity.

Improved Access to Financing and Consumer Credit Options

The growth of consumer financing services and flexible credit schemes has made it easier for Filipinos to invest in quality kitchen appliances. Retailers and appliance brands are increasingly offering installment plans, “buy now, pay later” options, and low-interest credit programs through both online and offline channels. This trend has broadened access for middle-income and budget-conscious households, enabling them to purchase premium and energy-efficient appliances that were once considered out of reach. Moreover, digital payment platforms and mobile banking have streamlined the financing process, encouraging more consumers to upgrade their kitchens with modern equipment. As financial inclusion improves and consumer lending expands, appliance adoption is expected to rise further across various income segments in the Philippines.

Growth Drivers of Philippines Kitchen Appliances Market:

Growth of E-Commerce Platforms Driving Appliance Accessibility

The rapid expansion of e-commerce platforms in the Philippines has greatly enhanced the accessibility and selection of kitchen appliances for consumers. Online marketplaces provide a wide array of products ranging from affordable options to high-end brands allowing customers to easily compare features, prices, and reviews. This trend has opened up access to international brands and specialized appliances that were once hard to find in local retail shops. With promotional discounts, flexible payment plans, and home delivery services consumers are increasingly encouraged to shop online. The convenience of purchasing from home resonates with the growing desire for easy buying experiences particularly among urban families contributing to rising Philippines kitchen appliances market demand.

Urbanization and Rising Middle-Class Driving Modern Kitchen Needs

The increasing urbanization in the Philippines, along with the growth of the middle class, is driving the need for modern and convenient kitchen solutions. As more individuals relocate to cities, compact living spaces necessitate efficient and space-saving appliances. The middle-class demographic, benefiting from greater purchasing power, is also leaning toward premium products that blend style, performance, and energy efficiency. Increased exposure to global lifestyle trends and the heightened importance of home aesthetics further reinforce this change. Additionally, busier urban lifestyles prompt consumers to invest in appliances that streamline cooking and cleaning tasks, making them essential for contemporary household requirements.

Technological Innovations

Technological progress is reshaping the Philippine kitchen appliances market, making products smarter, more energy-efficient, and multifunctional. Innovations such as IoT connectivity, touch controls, voice activation, and AI-assisted cooking are enhancing user convenience and personalization. Devices with multiple functions, like combination ovens or all-in-one food processors, are becoming popular due to their space-saving and versatile nature. Designs focused on energy efficiency also attract eco-conscious consumers, while improved safety features boost trust in premium offerings. These innovations enhance functionality and enrich the overall cooking experience, motivating more households to upgrade their appliances. Such advancements are a significant growth factor according to Philippines kitchen appliances market analysis.

Philippines Kitchen Appliances Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, structure, fuel type, application, and distribution channel.

Product Type Insights:

- Refrigerators

- Microwave Ovens

- Induction Stoves

- Dishwashers

- Water Purifiers

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes refrigerators, microwave ovens, induction stoves, dishwashers, water purifiers, and others.

Structure Insights:

- Built-In

- Free Stand

A detailed breakup and analysis of the market based on the structure have also been provided in the report. This includes built-in and free stand.

Fuel Type Insights:

- Cooking Gas

- Electricity

- Others

A detailed breakup and analysis of the market based on the fuel type have also been provided in the report. This includes cooking gas, electricity, and others.

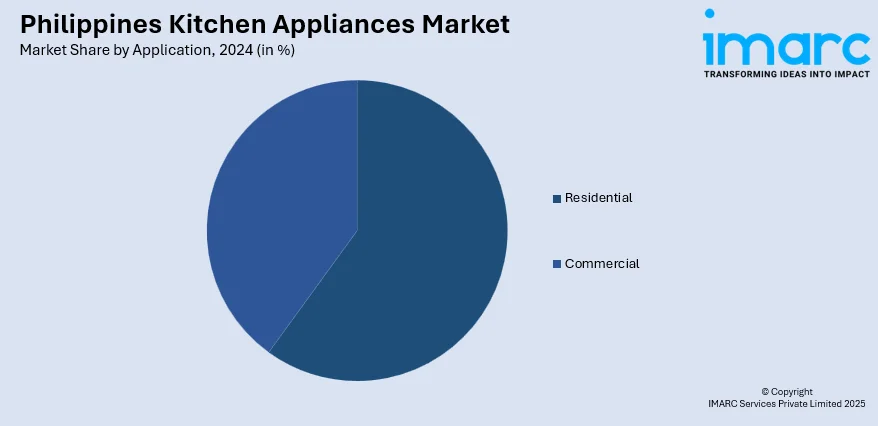

Application Insights:

- Residential

- Commercial

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential and commercial.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Departmental Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, specialty stores, online stores, departmental stores, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Kitchen Appliances Market News:

- In September 2024, Samsung, a renowned global innovator in technology, presented its latest lineup of smart home solutions during an exclusive showcase at Abenson’s Greenhills Madison flagship store. As part of its advanced Bespoke AI series, the brand introduced the Side-by-Side Refrigerator, Washing Machine, and All-In-One Smart Oven, crafted to cater to the changing lifestyles of Filipino households.

- In May 2024, Hitachi Home Appliances marked its entry into the Philippine market with an exclusive soft launch event, highlighting its dedication to advancing innovation and technology in the home appliance sector. The event underscored Hitachi’s aim to redefine quality and performance standards for modern Filipino homes.

Philippines Kitchen Appliances Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Refrigerators, Microwave Ovens, Induction Stoves, Dishwashers, Water Purifiers, Others |

| Structures Covered | Built-In, Free Stand |

| Fuel Types Covered | Cooking Gas, Electricity, Others |

| Applications Covered | Residential, Commercial |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online Stores, Departmental Stores, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines kitchen appliances market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines kitchen appliances market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines kitchen appliances industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The kitchen appliances market in Philippines was valued at USD 4,859.20 Million in 2024.

The Philippines kitchen appliances market is projected to exhibit a compound annual growth rate (CAGR) of 4.82% during 2025-2033.

The Philippines kitchen appliances market is expected to reach a value of USD 7,422.70 Million by 2033.

The Philippines kitchen appliances market is witnessing rising adoption of smart and connected devices, growing demand for compact and multifunctional appliances, and increased preference for energy-efficient models. Premium and aesthetically designed products are also gaining traction alongside stronger online sales driven by e-commerce expansion and digital marketing contributing to market growth.

Market growth is driven by rising disposable incomes, evolving consumer lifestyles, and greater emphasis on convenience and time-saving solutions. Expanding urban housing developments, exposure to global cooking trends, and continuous product innovation are further boosting demand, while competitive pricing and broader product availability enhance market accessibility across diverse consumer segments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)