Philippines Lingerie Market Size, Share, Trends and Forecast by Product Type, Material, Price Range, Distribution Channel, and Region, 2026-2034

Philippines Lingerie Market Summary:

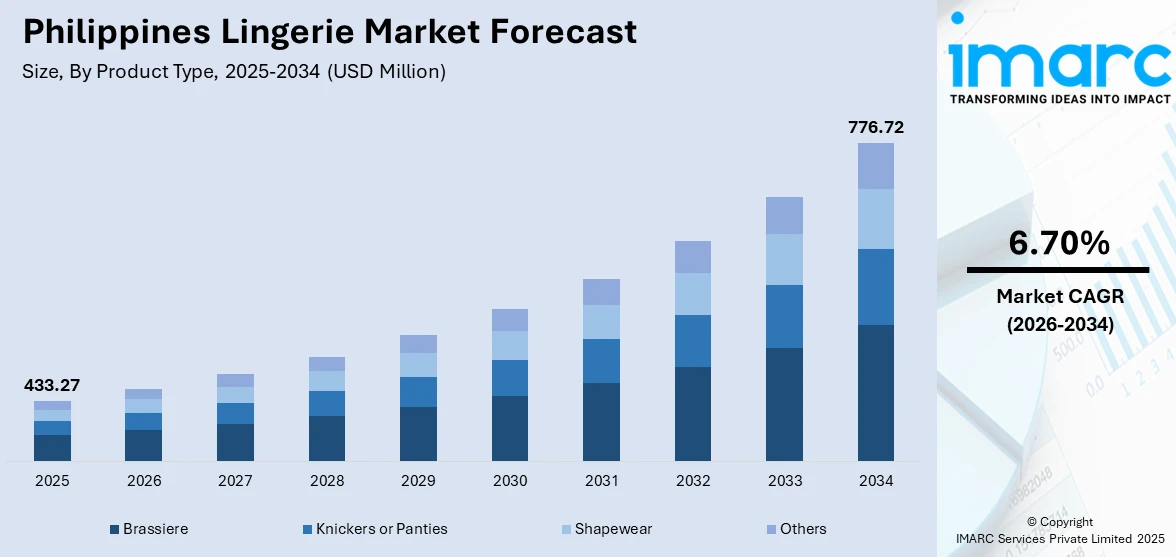

The Philippines lingerie market size was valued at USD 433.27 Million in 2025 and is projected to reach USD 776.72 Million by 2034, growing at a compound annual growth rate of 6.70% from 2026-2034.

The Philippines lingerie market is experiencing robust expansion driven by evolving consumer preferences, rising disposable incomes, and increasing emphasis on comfort and personal expression in intimate apparel. Urbanization and expanding retail infrastructure are reshaping purchasing patterns across metropolitan and provincial areas. Digital retail transformation and body positivity movements are further accelerating market penetration, positioning the sector for sustained growth throughout the forecast period and strengthening the Philippines lingerie market share.

Key Takeaways and Insights:

- By Product Type: Brassiere dominates the market with a share of 52% in 2025, owing to its essential status in everyday intimate wear, diverse style availability ranging from basic to fashion-forward designs, and continuous product innovation addressing varying support and comfort needs. Rising fashion consciousness is fueling market expansion.

- By Material: Cotton leads the market with a share of 43% in 2025. This dominance is driven by superior breathability and moisture-wicking properties ideally suited for the tropical Philippine climate, natural softness providing all-day comfort, and hypoallergenic qualities preferred by consumers with sensitive skin.

- By Price Range: Economy represents the largest segment with a market share of 58% in 2025, reflecting the purchasing preferences of price-conscious Filipino consumers seeking affordable yet quality intimate apparel. Mass merchandisers and online platforms offering competitive pricing support this segment dominance.

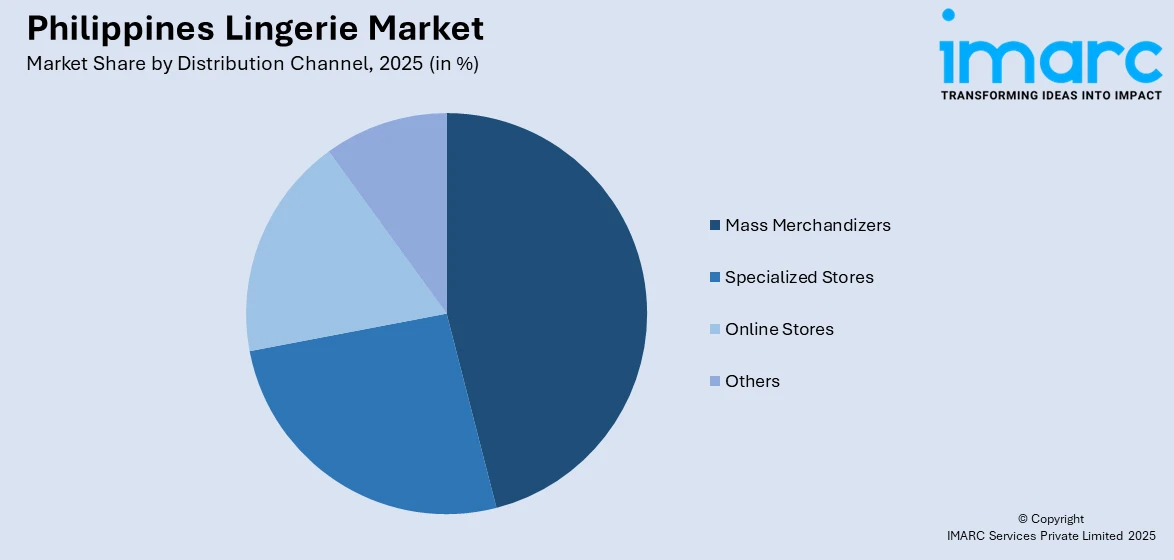

- By Distribution Channel: Mass merchandizers exhibit a clear dominance in the market with 34% share in 2025, benefiting from widespread accessibility across urban and provincial areas, competitive pricing strategies, and integrated shopping experiences that combine lingerie with broader apparel purchases.

- By Region: Luzon is the largest region with 62% share in 2025, driven by Metro Manila's concentration of retail infrastructure, highest population density, superior purchasing power, and extensive presence of both local and international lingerie brands in major commercial centers.

- Key Players: Key players drive the Philippines lingerie market by expanding product portfolios, improving comfort technologies and fabric innovations, and strengthening nationwide distribution networks. Their investments in marketing campaigns, affordability initiatives, and partnerships with retail platforms boost consumer awareness, accelerate adoption, and ensure consistent product availability across diverse consumer segments.

To get more information on this market Request Sample

The Philippines lingerie market is advancing as consumers increasingly prioritize comfort, style, and self-expression in their intimate apparel choices. Growing urbanization and expanding middle-class demographics are creating substantial demand for quality undergarments that balance functionality with fashion appeal. According to the Philippine Statistics Authority, approximately 21.9 Million women participate in the national labor force, representing a significant consumer base driving demand for comfortable, versatile lingerie suitable for professional and casual settings. Digital transformation in retail is reshaping how Filipino consumers discover and purchase intimate apparel, with e-commerce platforms providing unprecedented access to diverse brands and styles across metropolitan and provincial markets. Body positivity movements and inclusive sizing initiatives are encouraging brands to expand their product offerings to accommodate diverse body types, fostering greater consumer confidence and market participation. Climate-adapted designs featuring breathable materials and moisture management technologies address the tropical weather conditions prevalent throughout the archipelago, enhancing product appeal and customer satisfaction while strengthening the Philippines lingerie market growth.

Philippines Lingerie Market Trends:

Digital Retail Transformation and E-Commerce Expansion

Digital retail platforms that give consumers broad access to a variety of intimate apparel options are significantly changing the Philippines' lingerie business. Traditional hurdles to lingerie purchases are addressed by online platforms that provide comprehensive size guides, user evaluations, virtual fitting technologies, and flexible return policies. Particularly among younger groups, social commerce integration through influencer partnerships and live-streaming events is increasing engagement. Customers in rural locations that were previously underserved by specialized brick-and-mortar merchants can avail discreet and quick shopping experiences on account of e-commerce platforms.

Body Positivity and Inclusive Sizing Movements

Product development tactics are changing in the Philippines' lingerie sector due to consumer desire for inclusive sizes and body-positive designs. Companies are creating supportive designs for different body types, presenting a variety of cup forms, and increasing size ranges. Diverse representation is becoming more prevalent in marketing initiatives, which replace conventional restricted beauty standards with real-life imagery that boosts consumer confidence. This societal shift encourages women to embrace a variety of styles and sizes while fostering comfort and self-expression, viewing lingerie as an extension of personal identity rather than a covert necessity.

Climate-Adapted and Sustainable Material Innovation

Demand for eco-friendly underwear options with recycled materials, organic cotton, and bamboo fibers is rising as consumers become more conscious of environmental sustainability. Manufacturers are implementing sustainable production methods, such as using renewable energy and water-saving dyeing techniques. To fulfill the demands of tropical environments, climate-adapted product development employs improved moisture-wicking materials, antimicrobial treatments, and breathable constructions. In keeping with worldwide sustainability trends, these inventions cater to Filipino consumers' preferences for cozy intimate clothing appropriate for year-round tropical temperatures.

Market Outlook 2026-2034:

The Philippines lingerie market demonstrates strong growth prospects driven by structural economic improvements, evolving consumer preferences, and expanding retail infrastructure. Rising disposable incomes among the growing middle class are enabling greater investment in quality intimate apparel that balances comfort with style. The market generated a revenue of USD 433.27 Million in 2025 and is projected to reach a revenue of USD 776.72 Million by 2034, growing at a compound annual growth rate of 6.70% from 2026-2034. Digital retail expansion continues to democratize access to diverse lingerie options, with e-commerce platforms reaching previously underserved provincial markets. Body positivity movements and inclusive sizing initiatives are broadening consumer participation, while climate-adapted product innovations address tropical weather requirements. Local and international brand expansion, supported by strategic marketing campaigns and omnichannel retail strategies, is strengthening market penetration across diverse consumer segments throughout the archipelago.

Philippines Lingerie Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Brassiere |

52% |

|

Material |

Cotton |

43% |

|

Price Range |

Economy |

58% |

|

Distribution Channel |

Mass Merchandizers |

34% |

|

Region |

Luzon |

62% |

Product Type Insights:

- Brassiere

- Knickers or Panties

- Shapewear

- Others

Brassiere dominates with a market share of 52% of the total Philippines lingerie market in 2025.

The brassiere segment maintains commanding market leadership driven by its essential status as foundational intimate wear required by women across all demographics and age groups. Continuous product innovation has expanded offerings from basic everyday styles to specialized categories including sports bras, nursing bras, and fashion-forward designs that transition seamlessly from functional undergarments to visible style statements. Rising fashion consciousness among Filipino women is driving demand for diverse brassiere styles that complement varying outfits and occasions.

Technological advancements in brassiere design are enhancing consumer experience through innovations including seamless construction, wireless comfort options, and adaptive fit technologies that accommodate diverse body shapes. Premium offerings featuring intricate lacework, specialized support engineering, and sustainable materials are attracting discerning consumers willing to invest in quality intimate apparel. The segment benefits from continuous brand investment in product development, marketing campaigns, and retail expansion. Major brands are introducing size-inclusive collections and virtual fitting technologies that reduce return rates and improve customer satisfaction, strengthening segment performance throughout the forecast period.

Material Insights:

- Cotton

- Silk

- Satin

- Nylon

- Others

Cotton leads with a share of 43% of the total Philippines lingerie market in 2025.

Cotton maintains dominant market position owing to its superior suitability for the tropical Philippine climate characterized by high temperatures and humidity levels throughout the year. The natural fiber's exceptional breathability, moisture-wicking properties, and temperature regulation capabilities make it the preferred choice for everyday intimate apparel. Consumer preference for natural, hypoallergenic materials that minimize skin irritation further reinforces cotton's market leadership in lingerie manufacturing.

The segment benefits from growing sustainability consciousness among Filipino consumers who increasingly prefer natural, biodegradable materials over synthetic alternatives. Organic cotton offerings are gaining traction as environmentally aware consumers seek intimate apparel that aligns with ecological values. Cotton's versatility enables manufacturers to create diverse product styles ranging from basic everyday essentials to premium fashion lingerie featuring cotton blends with modal, bamboo, or spandex for enhanced comfort and stretch. The material's ease of care, durability, and affordability compared to premium fabrics like silk positions cotton as the practical choice for mainstream consumer segments throughout the archipelago.

Price Range Insights:

- Economy

- Premium

Economy exhibits a clear dominance with 58% share of the total Philippines lingerie market in 2025.

The economy segment commands market leadership reflecting the purchasing preferences of price-conscious Filipino consumers who prioritize affordability without compromising basic quality requirements. Mass merchandisers, department stores, and online platforms offering competitive pricing have expanded accessibility to budget-friendly intimate apparel across urban and provincial markets. Local brands have secured prominent market positions through affordable yet stylish offerings that resonate with mainstream consumer demographics.

E-commerce platforms are strengthening economy segment performance by enabling price comparison, promotional discounts, and direct-to-consumer sales that reduce distribution costs passed to consumers. The segment benefits from bulk purchasing options, multi-pack offerings, and seasonal sale events that deliver value to budget-conscious households. Rising inflation awareness has reinforced consumer focus on essential purchases at competitive price points, supporting economy segment stability. However, growing middle-class prosperity and exposure to international fashion trends are gradually shifting preferences toward mid-range offerings that balance affordability with enhanced quality, design sophistication, and brand recognition throughout the forecast period.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Mass Merchandizers

- Specialized Stores

- Online Stores

- Others

Mass merchandizers represent the leading segment with 34% share of the total Philippines lingerie market in 2025.

Mass merchandisers maintain channel leadership through extensive retail footprints spanning metropolitan commercial centers and provincial shopping destinations across the Philippine archipelago. Department stores and hypermarket chains including SM, Robinsons, and Puregold provide convenient one-stop shopping experiences where consumers purchase lingerie alongside broader apparel and household needs. According to the Philippine Retailers Association, the retail industry generated approximately 4.7 Trillion Philippine pesos in revenue for 2024, with mass merchandisers capturing significant share through competitive pricing and nationwide accessibility. These retailers leverage economies of scale to offer affordable intimate apparel options that appeal to mainstream consumer segments.

The channel benefits from integrated omnichannel strategies combining physical store presence with click-and-collect services that enhance customer convenience. Mass merchandisers are expanding lingerie sections with dedicated fitting areas and trained staff to improve the shopping experience and reduce hesitation associated with intimate apparel purchases. Strategic partnerships with local and international brands ensure diverse product assortments across price points. Ongoing mall expansion across provincial cities is extending mass merchandiser reach to previously underserved markets, while promotional events and loyalty programs strengthen customer retention and drive repeat purchases throughout the retail ecosystem.

Regional Insights:

- Luzon

- Visayas

- Mindanao

Luzon holds the largest share at 62% of the total Philippines lingerie market in 2025.

Luzon dominates the Philippines lingerie market driven by Metro Manila's concentration of affluent consumers, extensive retail infrastructure, and headquarters of major lingerie brands and distributors. The region's highest population density and superior purchasing power create substantial demand across all product categories ranging from everyday essentials to premium designer collections. Major commercial developments in CALABARZON and Central Luzon are extending market reach beyond the metropolitan core, bringing modern retail formats and branded lingerie selections to rapidly urbanizing provincial areas.

The presence of numerous shopping malls, department stores, and specialty boutiques ensures comprehensive product availability catering to diverse consumer preferences and budget requirements. Advanced e-commerce logistics networks centered in Luzon enable efficient doorstep delivery services that expand accessibility for consumers preferring online shopping convenience and privacy. The region's fashion-forward urban population demonstrates strong receptivity to emerging lingerie trends, new product launches, and international brand offerings that shape nationwide consumption patterns. Educational and employment opportunities attracting young professionals to Metro Manila further concentrate the core demographic driving lingerie purchases within this dominant regional market.

Market Dynamics:

Growth Drivers:

Why is the Philippines Lingerie Market Growing?

Expanding Middle Class and Rising Disposable Incomes

The Philippines lingerie market is benefiting significantly from the country's expanding middle-class population and increasing household disposable incomes that enable greater discretionary spending on quality intimate apparel. Economic development is creating a consumer base increasingly willing to invest in comfortable, fashionable undergarments that reflect personal style preferences rather than purely functional necessity. According to the World Bank, the Philippines' gross national income per capita increased to approximately USD 4,470 in 2024, approaching upper-middle-income classification threshold. This rising prosperity is enabling consumers across metropolitan and provincial areas to upgrade from basic economy lingerie to mid-range and premium offerings featuring enhanced comfort technologies, superior materials, and fashionable designs. Shopping habits are evolving as consumers prioritize quality, brand reputation, and product innovation when selecting intimate apparel. The growing affordability of quality lingerie through expanded retail channels and competitive pricing strategies is broadening market participation across diverse income segments.

E-Commerce Expansion and Digital Retail Transformation

Digital retail transformation is fundamentally reshaping the Philippines lingerie market by eliminating traditional barriers to intimate apparel purchases and expanding consumer access nationwide. E-commerce platforms including Shopee, Lazada, and Zalora provide comprehensive product selections, detailed specifications, size guides, and customer reviews that enhance informed purchasing decisions. Online retail particularly benefits provincial consumers who lack access to specialized brick-and-mortar lingerie stores, enabling private and convenient shopping experiences. Social commerce integration through live-streaming events, influencer collaborations, and flash sales drives engagement among digitally native younger demographics. Virtual fitting technologies and AI-powered size recommendations are reducing return rates and improving customer satisfaction. The convergence of mobile payment adoption and flexible delivery options creates seamless purchasing experiences that accelerate market penetration across diverse consumer segments.

Growing Female Workforce and Changing Lifestyle Patterns

Increasing female labor force participation is driving demand for comfortable, versatile lingerie suitable for professional and active lifestyles. Working women require intimate apparel that provides all-day comfort and support while maintaining appearance under business attire and transitioning seamlessly between office and personal activities. Career advancement and financial independence are empowering women to make confident purchasing decisions prioritizing quality and self-expression in intimate apparel selections. Urbanization and evolving social attitudes are normalizing lingerie as fashion rather than hidden necessity, encouraging investment in diverse styles for various occasions. The rise of athleisure trends is blurring boundaries between functional undergarments and lifestyle apparel, with bralettes and sports-inspired intimates gaining popularity as visible fashion statements that complement contemporary wardrobes and active lifestyles.

Market Restraints:

What Challenges the Philippines Lingerie Market is Facing?

High Prices of Quality Lingerie Products

Premium quality lingerie products remain significantly more expensive than basic alternatives, creating accessibility barriers for price-sensitive Filipino consumers who constitute the majority of the market. Import dependency for quality fabrics and brand licensing fees contribute to elevated retail prices that limit adoption among middle and lower-income segments. While consumers increasingly recognize the value of quality intimate apparel, the substantial price premium over economy options constrains purchasing frequency and quantity, particularly in provincial markets where disposable incomes remain lower than metropolitan averages.

Import Dependency and Supply Chain Vulnerabilities

The Philippines textile industry relies heavily on imported raw materials, with approximately 80% of fibers sourced from abroad according to government data. This import dependency creates supply chain vulnerabilities that can impact product availability and pricing stability. Currency fluctuations, international shipping disruptions, and global commodity price volatility affect production costs passed to consumers. Limited domestic manufacturing capacity for specialized lingerie fabrics constrains local brands' ability to compete effectively with international players on quality and pricing, restricting market development potential.

Counterfeit Products and Brand Integrity Concerns

The proliferation of counterfeit lingerie products undermines brand integrity and consumer confidence throughout the Philippine market. Fake products flooding informal retail channels and unauthorized online sellers offer inferior quality at deceptively low prices, damaging legitimate brand reputations and eroding consumer trust. Quality control concerns with counterfeit intimate apparel pose potential health risks through substandard materials and manufacturing practices. Enforcement challenges in combating counterfeiting require sustained regulatory effort and consumer education to protect market integrity and ensure product safety standards.

Competitive Landscape:

The Philippines lingerie market features dynamic competition among local champions and international brands vying for consumer attention across diverse price segments and distribution channels. Established domestic players including Bench Body leverage brand familiarity, nationwide retail presence, and cultural relevance to maintain strong market positions. International brands such as Triumph International and Avon bring global design expertise, quality assurance, and marketing sophistication that appeal to aspirational consumers. Competition intensifies as brands invest in product innovation, digital marketing, influencer partnerships, and omnichannel retail strategies to differentiate offerings and capture market share. E-commerce platforms democratize market access, enabling emerging brands to compete alongside established players through targeted digital campaigns and competitive pricing. Strategic focus on inclusive sizing, sustainability, and climate-adapted designs shapes competitive positioning throughout the forecast period.

Philippines Lingerie Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Brassiere, Knickers or Panties, Shapewear, Others |

| Materials Covered | Cotton, Silk, Satin, Nylon, Others |

| Price Ranges Covered | Economy, Premium |

| Distribution Channels Covered | Mass Merchandizers, Specialized Stores, Online Stores, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Philippines lingerie market size was valued at USD 433.27 Million in 2025.

The Philippines lingerie market is expected to grow at a compound annual growth rate of 6.70% from 2026-2034 to reach USD 776.72 Million by 2034.

Brassiere dominated the market with a share of 52%, driven by its essential status as foundational intimate wear, continuous product innovation across diverse styles, and rising fashion consciousness among Filipino women seeking comfortable yet stylish undergarments.

Key factors driving the Philippines lingerie market include expanding middle-class prosperity, rising disposable incomes, e-commerce expansion enabling nationwide accessibility, growing female workforce participation, body positivity movements promoting inclusive sizing, and climate-adapted product innovations.

Major challenges include high prices of quality lingerie products creating accessibility barriers, import dependency for raw materials causing supply chain vulnerabilities, counterfeit product proliferation undermining brand integrity, and limited domestic manufacturing capacity constraining local brand competitiveness.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)