Philippines Online Travel Market Size, Share, Trends and Forecast by Service Type, Platform, Mode of Booking, Age Group, and Region, 2025-2033

Philippines Online Travel Market Size and Share:

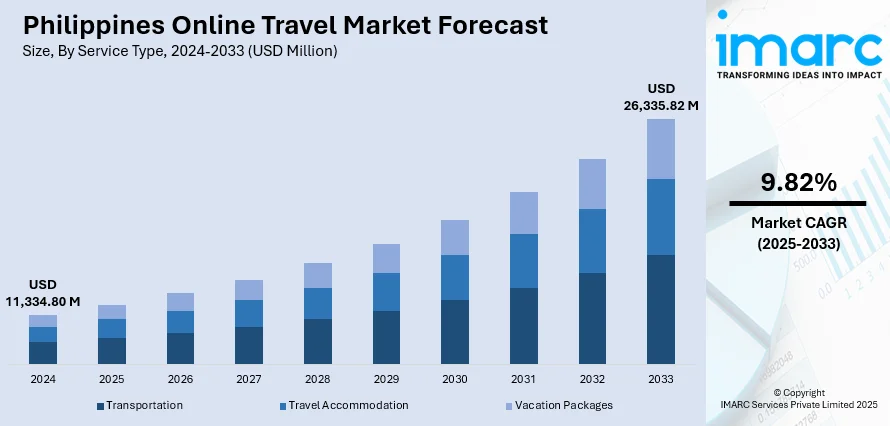

The Philippines online travel market size reached USD 11,334.80 Million in 2024. The market is projected to reach USD 26,335.82 Million by 2033, exhibiting a growth rate (CAGR) of 9.82% during 2025-2033. The market is expanding steadily, fueled by increasing internet access, mobile usage, and a rising preference for digital travel solutions. Services such as flight bookings, hotel reservations, and tour packages are increasingly managed through online platforms. Younger consumers and urban travelers are driving this trend, supported by targeted promotions and improved payment systems. With growing interest in both domestic and international travel, digital adoption continues to shape the future of the Philippines online travel market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 11,334.80 Million |

| Market Forecast in 2033 | USD 26,335.82 Million |

| Market Growth Rate 2025-2033 | 9.82% |

Philippines Online Travel Market Trends:

Embracing “Slow Travel” for Deeper Connections

Filipino travelers are increasingly choosing slow travel, opting for longer stays that foster deeper engagement with destinations. In January 2025, insights highlighted a growing preference for trips lasting ten days or more, especially among culture-seeking travelers. This trend aligns with rising interest in immersive experiences such as homestays in heritage towns, culinary workshops in provincial kitchens, and multi-day wellness retreats. Booking platforms are responding by curating extended itinerary options and promoting slower-paced stays through dedicated filters and extended-stay packages. These offerings emphasize cultural authenticity and emotional well-being, appealing to both domestic and international tourists. With improved transport links and rural accommodation standards advancing in early months of the year, slow travel is becoming both feasible and attractive. As travelers deliberately extend their stays, travel apps that spotlight meaningful, multi-day experiences are gaining a competitive edge. This move toward slower, more purposeful travel reflects a significant shift in consumer values and is reshaping the landscape of the Philippines’ online travel market trends.

To get more information of this market, Request Sample

Rise of Digital Nomads Fuels Platform Evolution

The appeal of the Philippines as a digital nomad destination continues to strengthen. In February 2025, a Senate bill proposing a digital nomad visa was introduced to attract location-independent professionals to live and work in the country for up to one year. Destinations like Cebu, Siargao, and Palawan are already seeing a rise in long-term visitors seeking both natural beauty and dependable connectivity. Online travel platforms are adapted by highlighting coworking access, long-stay rates, high-speed internet availability, and wellness amenities tailored to remote professionals. These platforms are also building partnerships with local workspaces and community hubs to offer comprehensive digital nomad packages combining accommodation, workspace, transport services, and curated local experiences. Tools within booking apps increasingly include extended stay options, peer-reviewed coworking listings, flexible cancellation policies, and suggestions based on lifestyle needs. Some apps also offer budgeting calculators and local networking features. As more travelers blend professional obligations with leisure, platforms that accommodate the digital nomad lifestyle will gain relevance. This evolving demand is helping to reshape the Philippines online travel market growth, positioning it as a leading destination for the future of work and travel.

Smart Tourism and Eco-Conscious Experiences Grow

Tech-enabled and eco-conscious travel is rapidly shaping the future of tourism in the Philippines. In April 2025, sources report noted a surge in interest among Filipino travelers for more sustainable and responsible travel choices. Online platforms are adapted by integrating smart tourism features such as eco-certification tags, carbon offset options, and IoT-enabled property listings that allow travelers to monitor energy and water usage. Virtual previews of nature reserves, marine sanctuaries, and heritage areas help users explore destinations responsibly before booking. Booking tools now offer sustainability filters, highlighting low-impact travel choices, green accommodations, and locally sourced tour options. These features support greater transparency and align with a growing preference for environmental responsibility. Additionally, partnerships with conservation groups and community-based tourism projects are helping travelers connect more meaningfully with local ecosystems and cultures. As user expectations evolve, smart, eco-aligned experiences are becoming a central pillar of the Philippines’ online travel market, shaping both consumer behavior and industry standards.

Philippines Online Travel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on service type, platform, mode of booking, and age group.

Service Type Insights:

- Transportation

- Travel Accommodation

- Vacation Packages

The report has provided a detailed breakup and analysis of the market based on the service type. This includes transportation, travel accommodation, and vacation packages.

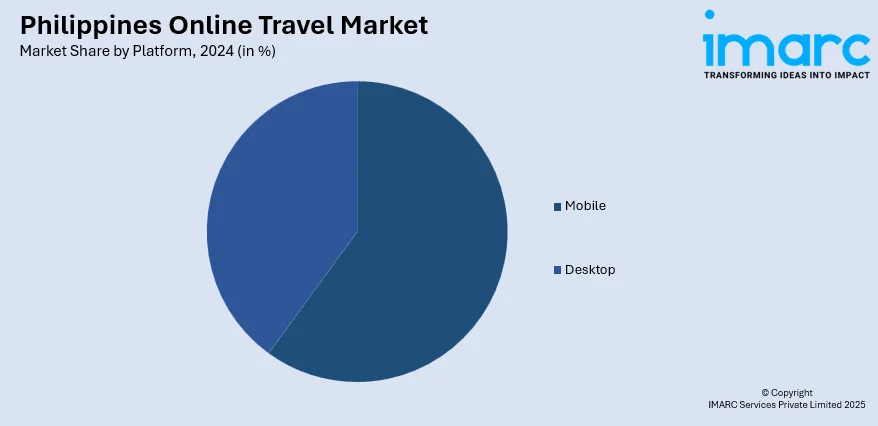

Platform Insights:

- Mobile

- Desktop

A detailed breakup and analysis of the market based on the platform have also been provided in the report. This includes mobile and desktop.

Mode of Booking Insights:

- Online Travel Agencies (OTAs)

- Direct Travel Suppliers

The report has provided a detailed breakup and analysis of the market based on the mode of booking. This includes online travel agencies (OTAs) and direct travel suppliers.

Age Group Insights:

- 22-31 Years

- 32-43 Years

- 44-56 Years

- Above 56 Years

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes 22-31 years, 32-43 years, 44-56 years, and above 56 years.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Online Travel Market News:

- August 2024: Corporate International Travel and Tours (CITTI) has launched CITTI Elite, a luxury travel sister company in the Philippines designed to cater to affluent travelers seeking bespoke, ultra-premium itineraries. Under CEO Shan Dioquino David, the agency offers seamless planning services for extraordinary destinations, prioritizing exclusivity, luxury details, and unique experiences. With operations spanning outbound and plans for inbound travel, CITTI Elite curates personalized expeditions across cruise lines, luxury trains, and African safari camps. This initiative reinforces the Philippines’ emergence as a high-end travel hub.

Philippines Online Travel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | Transportation, Travel Accommodation, Vacation Packages |

| Platforms Covered | Mobile, Desktop |

| Mode of Bookings Covered | Online Travel Agencies (OTAs), Direct Travel Suppliers |

| Age Groups Covered | 22-31 Years, 32-43 Years, 44-56 Years, Above 56 Years |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines online travel market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines online travel market on the basis of service type?

- What is the breakup of the Philippines online travel market on the basis of platform?

- What is the breakup of the Philippines online travel market on the basis of mode of booking?

- What is the breakup of the Philippines online travel market on the basis of age group?

- What is the breakup of the Philippines online travel market on the basis of region?

- What are the various stages in the value chain of the Philippines online travel market?

- What are the key driving factors and challenges in the Philippines online travel market?

- What is the structure of the Philippines online travel market and who are the key players?

- What is the degree of competition in the Philippines online travel market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines online travel market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines online travel market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines online travel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)