Philippines Packaging Market Size, Share, Trends and Forecast by Packaging Material, End-Use Vertical, and Region, 2026-2034

Philippines Packaging Market Size and Share:

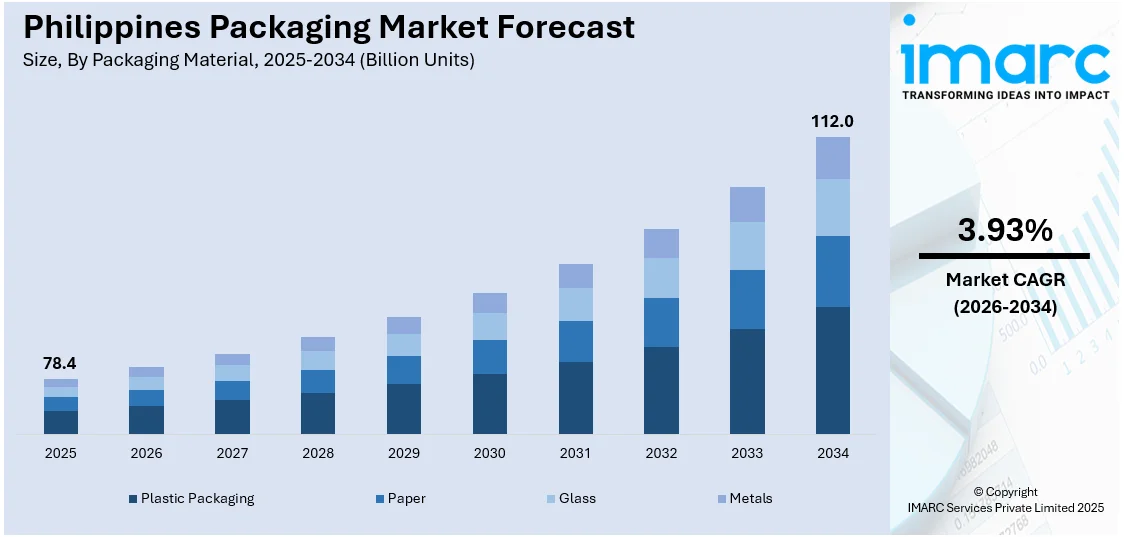

The Philippines packaging market size was valued at 78.4 Billion Units in 2025. Looking forward, the market is expected to reach 112.0 Billion Units by 2034, exhibiting a CAGR of 3.93% from 2026-2034. The market is driven by growing consumer demand, e-commerce expansion, sustainability trends, and technological advancements. Increasing disposable incomes and urbanization boost packaged goods demand, while the rise of online shopping necessitates protective packaging. Additionally, eco-conscious consumer preferences and innovations in smart, recyclable packaging support market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | 78.4 Billion Units |

| Market Forecast in 2034 | 112.0 Billion Units |

| Market Growth Rate (2026-2034) | 3.93% |

Rising disposable incomes, a growing middle class, and urbanization are significant drivers of the Philippines packaging market. According to the World Bank's compilation of development indicators, which was based on officially recognized sources, the Philippines' urban population was estimated to be 48.29 percent in 2023. As the population becomes more urbanized, there is an increasing demand for convenience, resulting in a higher consumption of packaged food, beverages, and consumer goods. The fast-paced lifestyle of modern Filipinos, especially in urban areas, has led to a rise in on-the-go consumption, driving the demand for single-serve and ready-to-eat products. This, in turn, creates a robust market for packaging solutions that ensure product safety, convenience, and freshness. With the rapid growth of e-commerce, especially driven by platforms like Lazada and Shopee, packaging requirements have evolved.

To get more information on this market Request Sample

Environmental concerns are shaping the future of the packaging industry in the Philippines. Consumers are becoming more eco-conscious, driving the demand for sustainable packaging solutions such as biodegradable, recyclable, and compostable materials. This has led to a shift in the industry, with businesses increasingly adopting sustainable packaging to reduce their environmental footprint and comply with local government regulations aimed at minimizing plastic waste. For instance, in June 2023, The Philippine Department of Science and Technology (DoST) and Nestlé Philippines announced their partnership to research and actively work on sustainable packaging. The Manila Times further reported that DoST Secretary Renato Solidum Jr. and Kais Marzouki, the CEO and chair of Nestlé Philippines, also signed a memorandum of agreement (MoU) sealing this endeavor.

Key Trends of Philippines Packaging Market:

E-commerce Growth

The rapid expansion of e-commerce in the Philippines has created a surge in the demand for packaging solutions, particularly for safe and efficient product delivery. According to the International Trade Administration, with 73 million active internet users, the Philippines' e-commerce business generated USD17 Billion in sales in 2021. By 2025, this is predicted to have grown by 17% to USD24 Billion. As online shopping becomes increasingly popular, businesses require secure, cost-effective packaging to ensure products arrive in optimal condition. This trend is driving innovation in protective, tamper-proof, and lightweight packaging materials. Additionally, the growth of e-commerce encourages packaging that is environmentally friendly and easy to handle. The rising popularity of local e-commerce platforms and international giants like Lazada and Shopee further fuels packaging demand across sectors, from consumer goods to electronics.

Sustainability Trends

Increasing consumer awareness about environmental issues is driving the shift toward sustainable packaging in the Philippines. As concerns over plastic waste and its impact on the environment grow, businesses are adopting more eco-friendly materials, such as biodegradable, recyclable, and compostable packaging. This trend is supported by government policies aimed at reducing plastic pollution, including plastic waste bans and extended producer responsibility regulations. Packaging companies are responding by investing in alternative materials and developing solutions that align with global sustainability standards. Consumers, particularly in urban areas, are increasingly prioritizing brands that use sustainable packaging options, further boosting this market shift. For instance, in October 2023, Coca-Cola Philippines introduced bottles for its Wilkins Pure and Coca-Cola Original brands that are 100% rPET (caps and labels excluded), as well as a new sustainable packaging platform to inform consumers about reducing plastic waste.

Technological Advancements

Advancements in packaging technology represent one of the major Philippines packaging market trends. Innovations such as smart packaging, automation in manufacturing, and improved printing techniques are enhancing the functionality, appeal, and efficiency of packaging solutions. Smart packaging, which includes features like QR codes, temperature sensors, and RFID technology, is gaining traction in sectors such as food and pharmaceuticals for better inventory management and consumer engagement. Automation and precision in packaging processes improve production speed and reduce costs. These technological advancements enable businesses to provide better, more customizable packaging options while improving operational efficiency. For instance, in February 2024, Asahi Beverages Philippines owns Goodday, a cultured milk beverage that is distributed in the Philippines by Universal Robina Corporation. Appetite Creative, a creative technology firm, announced collaboration with the company to create an entertaining and engaging linked packaging experience. Through a web app-based connected experience that can be accessed through QR codes, the Goodday Drinks smart packaging campaign provides registered customers instant prizes.

Growth Drivers of Philippines Packaging Market:

Urbanization and Shifting Consumer Habits

The Philippines is undergoing rapid urbanization, where almost half of its population lives in urban centers. This demographic phenomenon is leading to critical transformations in consumer behavior, especially in urbanized areas such as Metro Manila, Cebu, and Davao. As urban residents get increasingly busy lives, convenience demand increases, affecting packaging choices directly. Single-serve, ready-to-eat, and on-the-go food and drink products are gaining traction, requiring packaging solutions that are centered around portability and convenience. In addition, the increasing number of e-commerce websites like Lazada and Shopee further pushed the demand for protective and efficient packaging that guarantees safety in transport. This intersection of urbanization and changing consumer behavior is driving the packaging industry, with producers looking to create packaging that meets the changing needs of the new Filipino consumer.

Environmental Awareness and Regulatory Pressures

Environmental issues are also impacting the packaging sector in the Philippines. Consumers are becoming environmentally aware, which generates increased demand for sustainable packaging. This transformation is making companies implement biodegradable, recyclable, and compostable packaging to suit customer demands and satisfy local laws designed to limit the use of plastic. The government in the Philippines has initiated policies to discourage plastic use, nudging corporations to venture into environmentally friendly packaging. For example, the Department of Science and Technology (DoST) has been working with Nestlé Philippines among other companies in conducting research and developing greener packaging solutions. These efforts promote environmental concerns and build brand reputation since customers prefer firms that show concern for society. Increasing focus on sustainability is pushing innovation in the packaging industry toward creating material and design that have reduced environmental footprint while retaining functionality and affordability.

Growth of the Food and Beverage Sector

The fast expansion of the Philippines' food and beverage industry is a major motivator behind the packaging market. The nation's vibrant food culture, coupled with rising consumer demand for processed, packaged, and convenience foods, has put more emphasis on adaptable packaging products. Food processors and manufacturers need packaging that maintains product freshness, maximizes shelf life, and offers tamper-proof functionalities, while complying with regulatory requirements. Further, the rise in local snacks, ready-to-cook foods, and drink products has generated more demand for creative and appealing packaging styles that can draw consumer attention among saturated shelf space. This industry is also favored by the emerging middle class, who crave better-quality and safer packaged food. Consequently, packaging firms are investing in technology and materials that possess barrier properties, sustainability, and attractiveness to help fuel the country's vibrant food and beverage sector in the Philippines.

Opportunities of Philippines Packaging Market:

Growing Demand from the Pharmaceutical and Healthcare Industry

The rising pharmaceutical and healthcare industries in the Philippines offer a promising prospect for the packaging industry. As hospitals, clinics, and pharmaceutical factories increase, there is a growing requirement for specialized packaging with product safety, integrity, and adherence to stringent regulatory requirements. This encompasses tamper-evident, child-resistant cap, blister pack, and cold chain packaging for temperature-sensitive products such as vaccines and biologics. The COVID-19 pandemic has also underlined the need for strong healthcare packaging, fueling demand for innovative and secure solutions. Furthermore, the government's initiatives to enhance healthcare infrastructure and ramp up access to medicines in rural and underserved regions have increased the demand for strong, transportable packaging. Companies that are able to create packaging that is specific to the needs of the pharmaceutical and healthcare industries, while maintaining cost-effectiveness and sustainability, will be able to gain a competitive advantage in the industry.

Expansion of Agribusiness Supply Chain

Agriculture is still a core sector in the Philippines, with numerous small and medium enterprises engaged in processing and marketing fruits, vegetables, seafood, and local delicacies. While the nation is endeavoring to advance its food supply chain and enhance food safety, there is an increasing demand for functional and hygienic packaging solutions specific to agricultural and perishable products. Shelf-extending packaging innovations that also avoid spoilage and offer transparent labeling for traceability have high market potential. Furthermore, government assistance for agribusiness growth, mainly in Mindanao and the Visayas, spurs private sector cooperation and infrastructure development, including packaging and cold storage facilities. These improvements are opening up opportunities for packaging companies with affordable, scalable, and environmentally friendly solutions that are acceptable to smallholder and large-scale farmers. With the agribusiness industry growing more organized and export-oriented, need for intelligent, robust, and green packaging will keep growing.

Smart and Digital Packaging Technology Adoption

The advent of digital technologies and the Internet of Things (IoT) is creating new opportunities for innovation in the Philippine packaging industry. Smart packaging, which integrates features like QR codes, NFC tags, temperature sensors, and anti-counterfeiting, is gaining popularity in sectors such as food, pharmaceuticals, and consumer goods. These technologies enhance product traceability and safety, along with consumer interaction through informative and interactive packaging. For the Philippines, where counterfeit products are an ongoing issue, smart packaging can be a key solution to brand protection and regulatory compliance. Additionally, the expansion of e-commerce and logistics industries increases the demand for packaging that can convey product information digitally in a manner that is transparent and authentic. Firms investing in these innovative packaging solutions have the opportunity to stand out in the competitive marketplace while serving the changing demands of customers and regulators.

Philippines Packaging Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Philippines packaging market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on packaging material and end-use vertical.

Analysis by Packaging Material:

- Plastic Packaging

- Material Type

- PE (Polyethylene)

- PP (Polypropylene)

- PVC (Poly Vinyl Chloride)

- PET (Polyethylene Terephthalate)

- Others

- Type

- Rigid Plastic Packaging

- Bottles and Jars

- Trays and Containers

- Others

- Flexible Plastic Packaging

- Pouches and Bags

- Films and Wraps

- Others

- Rigid Plastic Packaging

- Material Type

- Paper

- Carton Board

- Carton Board Containerboard and Linerboard

- Others

- Glass

- Metals

The most dominant part of the Philippine packaging market is held by plastic packaging because of its cost-effectiveness, versatility, and durability. It has gained a great percentage in the food, beverage, and consumer goods sectors since it provides excellent barrier properties, is lightweight, and can be molded into any desired shape. Another reason why plastic is widely used is its recyclability and high availability. Increased e-commerce further demands more plastic packaging because of better protection in shipping.

Paper packaging is projected to be an important share in the country, Philippines, due to its eco-friendly appeal and versatility. Consumer attention and business demand for the consumption of recyclable and biodegradable materials are on the rise due to their growing concerns with sustainability. Paper is very easily customizable for branding purposes and has widespread usage in the food, beverage, and retail sectors. Government regulations that promote environmental sustainability and reduce plastic waste further promote the use of paper packaging solutions in the country.

Glass packaging remains popular in the Philippines due to its premium feel, recyclability, and ability to preserve product quality. Commonly used in beverages, particularly alcohol, juices, and cosmetics, glass offers superior protection against contamination and external factors. Its growing use in the food industry, driven by increasing consumer demand for high-quality, sustainable products, reinforces its market share. Additionally, glass packaging’s ability to maintain product taste and aroma, especially for beverages, helps sustain its strong market position.

Metal types hold a strong share in the Philippines packaging market, on account of its strength, durability, and ease of recyclability. It has superior protection against moisture, light, and air, prolonging shelf life and thus more used by food, beverage, and pharmaceutical industries. Growth in popularity of canned products like beverages and ready-to-eat meals also fuel this market. Additionally, the increased demand for eco-friendly packaging solutions; aluminium being highly recyclable, further strengthens metal packaging's market position in that country.

Analysis by End-Use Vertical:

Access the comprehensive market breakdown Request Sample

- Food

- Beverage

- Healthcare

- Cosmetics, Personal Care and Household Care

- Others

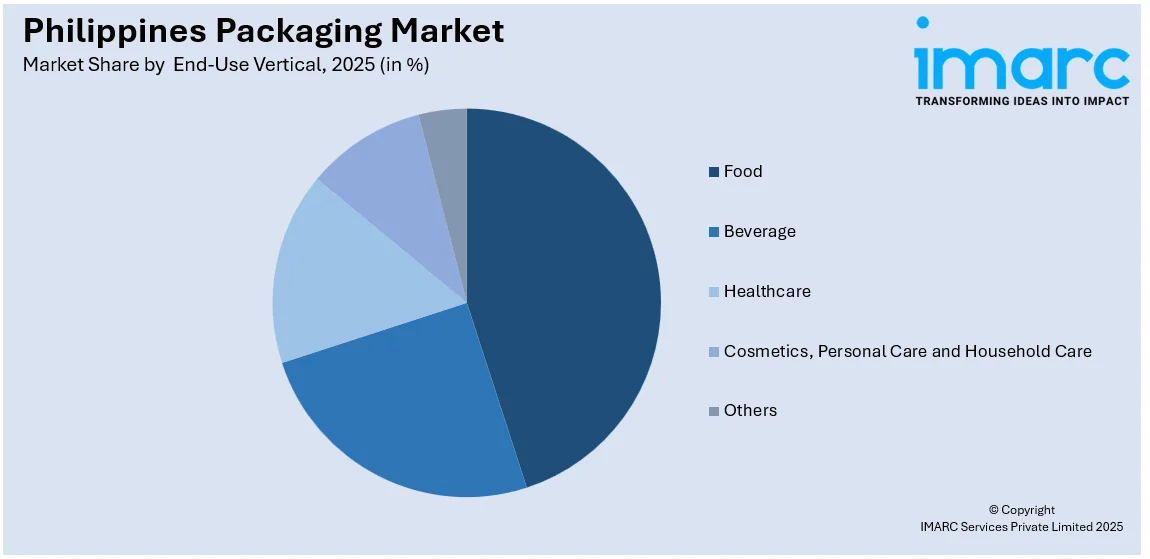

Food packaging is likely to share a considerable size of the market in the Philippines as the food processing industry in the country increases and the consumers look for such products that increase convenience for them. With the trend changing towards ready-to-eat, processed, and frozen foods, it ensures product safety, freshness, and shelf life. Consumers are increasingly opting for sustainable and eco-friendly packing materials, hence leading to an increase, based on their increasing awareness of the environment. Another is the evolution of packaging technologies to satisfy the food sector's ever-changing needs.

Packaging holds the lead for beverages as its market shares grow due to an ever-booming beverage market across soft drinks, bottled water, and alcohol products. This type of packaging also ensures preservation and convenience to brand differentiation, therefore increasing consumer purchases. Another force driving market demand is increased healthy-conscious customers that require the sale of more bottled beverages and more environmentally conscious people demanding a safer plastic replacement for their everyday drinking, further demanding innovative types of packaging which continue to support this market increase.

Healthcare packaging is projected to be one of the categories with a high market share in the Philippines due to increased health awareness, an aging population, and the growing pharmaceutical sector. Packaging needs to ensure safety, efficacy, and shelf life are achieved with medical devices, medications, and healthcare products. High regulations and quality standards regarding packaging materials, especially sterile products, also contribute to demand growth. The expansion of the local healthcare industry and increasing access to medicines are major factors responsible for the solid position of healthcare packaging.

Cosmetics, personal care, and household care packaging are likely to lead the Philippines market, driven by growing consumer demand for beauty, skincare, grooming, and cleaning products. Premium and functional packaging are being driven by the growth of the middle class, urbanization, and rising disposable incomes. Innovations in sustainable, eco-friendly packaging also resonate with consumer preferences for environmentally conscious choices. The growing competition from local and international brands of these products creates a need for attractive, good-quality packaging solutions.

Regional Analysis:

- Luzon

- Visayas

- Mindanao

Luzon is the economic and industrial hub of the Philippines, and it drives significant packaging demand due to its dense population, urbanization, and thriving manufacturing sectors. The growing demand for packaged food, beverages, pharmaceuticals, and consumer goods in Metro Manila and surrounding regions contributes to the market's growth. The expansion of e-commerce further accelerates the need for packaging solutions that ensure product safety and convenience during transit. In addition, awareness of sustainability has increased the demand for sustainable packaging in this region.

In the Visayas, the packaging market is driven by the region's growing agricultural production and increasing tourism. With significant exports of agricultural products, the demand for packaging solutions to preserve freshness and quality is high. The growing retail and consumer goods sector in cities like Cebu also fuels packaging needs. Additionally, the rise in disposable incomes and urbanization in key cities increases demand for packaged food, beverages, and personal care products, pushing the market forward in Visayas.

Packaging market in the Visayas region is fueled by increasing agricultural production in the region and rising tourism. Since a huge portion of agricultural produce is exported, there is an enormous demand for packaging solutions to preserve freshness and quality. The growing retail and consumer goods sector in cities like Cebu also fuels packaging needs. Increasing disposable incomes and urbanization in key cities lead to higher demand for packaged food, beverages, and personal care products, pushing the market forward in Visayas.

The packaging market in Mindanao is also expanding because the economy is mainly driven by agriculture. The growing production and export of bananas, pineapples, and seafood demand specialized packaging. Infrastructure projects such as retail chains and food processing plants contribute to the demand for packaging. Urbanization in Mindanao is pushing demand for packaged consumer goods and e-commerce packaging. Sustainable packaging solutions also gain traction with eco-conscious consumers of the region, further expanding the market.

Competitive Landscape:

The packaging market in the Philippines is competitive in nature with international and local companies offering various solutions across sectors, including food, beverage, healthcare, and personal care. These key players are Amcor, Tetra Pak, Crown Holdings, SC Johnson Professional, and Huhtamaki, all of which have innovative and sustainable packaging materials. In addition, local players like Manila Paper, Ace Pack Corporation, and Primex Group are also crucial, catering to regional demand and offering customized packaging solutions. Innovation in eco-friendly packaging, with the advent of biodegradable and recyclable materials, drives the market. Companies are also focusing on advanced packaging technologies such as smart packaging to differentiate themselves. The growth in e-commerce increased competition, where there is pressure for efficient cost-effective packaging.

Latest News and Developments:

- In April 2023, Mondelez Philippines, a snack manufacturer, announced a collaboration with Plastic Credit Exchange (PCX) to collect and repurpose all of the plastic packaging that it uses for its food items that are sold in the marketplace.

- In January 2025, The AIP added a third training session, the fifth edition of the annual Philippines Packaging Forum, to its ProPak Philippines programs. This adds to the two mini-training courses, and intend to focus on sustainable packaging designs and balancing between food waste and packaging waste.

- In March 2024, Liwayway Marketing Corp. and CEMEX Holdings Philippines Inc. announced their partnership to address the Philippines' plastic waste management issue. The agreement calls for Liwayway Marketing Corp, the leading snack food provider in the nation, to co-process its post-consumer plastic packaging waste at CEMEX's Solid Cement Plant. The factory intends to then use the plastic waste to produce raw materials for cement and alternative energy.

Philippines Packaging Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion Units |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Packaging Materials Covered |

|

| End-Use Verticals Covered | Food, Beverage, Healthcare, Cosmetics, Personal Care and Household Care, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines packaging market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Philippines packaging market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The packaging market in the Philippines was valued at 78.4 Billion Units in 2025.

The market is driven by rising consumer demand, e-commerce growth, sustainability trends, and technological advancements. Urbanization and higher disposable incomes fuel packaged goods consumption, while the demand for eco-friendly, recyclable packaging and smart technology innovations further support market expansion.

The Philippines packaging market is projected to exhibit a CAGR of 3.93% during 2026-2034, reaching a value of 112.0 Billion Units by 2034.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)