Philippines Sauces, Dips, and Condiment Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, End User, and Region, 2025-2033

Philippines Sauces, Dips, and Condiment Market Size and Share:

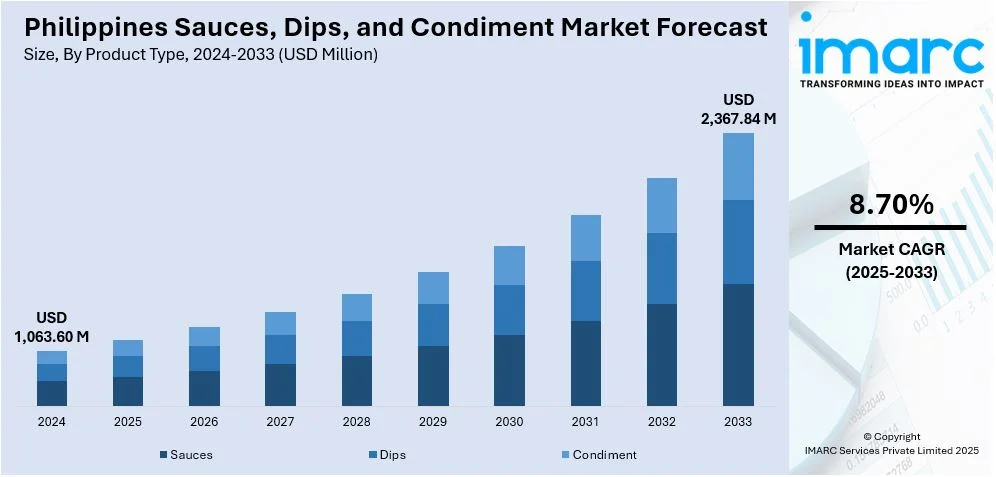

The Philippines sauces, dips, and condiment market size reached USD 1,063.60 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,367.84 Million by 2033, exhibiting a growth rate (CAGR) of 8.70% during 2025-2033. The market is experiencing growth due to increased home cooking, rising health-conscious choices, and expanding e-commerce. Consumers seek convenient, flavorful, and healthier options, driving innovation and competition among local and international brands.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,063.60 Million |

| Market Forecast in 2033 | USD 2,367.84 Million |

| Market Growth Rate 2025-2033 | 8.70% |

Philippines Sauces, Dips, and Condiment Market Trends:

E-commerce Growth

E-commerce growth has significantly influenced consumer behavior in the Philippines with more shoppers opting for the convenience of online grocery platforms. This shift has contributed to the Philippines sauces, dips, and condiment market growth as brands leverage digital channels to expand their reach. According to the report published by the International Trade Administration (ITA), the Philippines' eCommerce market is projected to reach $24 billion by 2025, fueled by 73 million online users and a 17% growth rate. Consumers now enjoy a wider selection of local and international products often with attractive discounts and doorstep delivery options. Online marketplaces provide smaller and niche brands with opportunities to gain visibility further diversifying choices. Subscription services and bundled deals also enhance customer loyalty. Additionally, data-driven insights from e-commerce platforms help brands optimize marketing strategies. As digital adoption continues it is expected to increase the Philippines sauces, dips, and condiment market share of both established and emerging brands reflecting the growing influence of e-commerce in shaping market dynamics.

To get more information on this market, Request Sample

Increased Home Cooking

With increased numbers of people staying at home the home cooking trend has picked up strongly. Consumers are looking for easy ways to flavor their food driving demand for a range of sauces, dips and condiments. Prepared sauces and seasoning mixes are particularly popular providing time-saving alternatives for busy homes. Classic Filipino flavors are still a mainstay while international cuisines have also been on the rise. Brands are responding by introducing versatile and easy-to-use products that cater to different taste preferences. Additionally, cooking tutorials and recipe content on social media have further inspired consumers to experiment in their kitchens. This shift continues to shape the Philippines sauces, dips, and condiments market outlook contributing to sustained growth and innovation.

Health-Conscious Choices

Health-conscious consumers in the Philippines are increasingly prioritizing their well-being leading to a rising demand for healthier sauces, dips and condiments. Shoppers are seeking products with lower sodium, reduced sugar and fewer preservatives often favoring natural, organic and clean-label options. Many brands have responded by introducing reformulated versions of traditional condiments offering healthier alternatives without compromising on taste. Functional ingredients such as probiotics and antioxidants are also being incorporated into products to enhance nutritional value. Plant-based and gluten-free condiments are gaining traction catering to vegan, vegetarian and allergen-sensitive consumers. Clear labeling and transparent ingredient sourcing have become essential for building consumer trust. Additionally, the influence of social media and wellness influencers has further accelerated the shift toward mindful consumption. This health-driven trend continues to shape product innovation and marketing strategies in the Philippines' food industry.

Philippines Sauces, Dips, and Condiment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type, distribution channel, and end user.

Product Type Insights:

- Sauces

- Soy Sauce

- Tomato Sauce

- Chili Sauce

- Dips

- Cheese-based

- Mayonnaise-based

- Condiments

- Vinegar

- Fish Sauce

- Shrimp Paste

The report has provided a detailed breakup and analysis of the market based on the product type. This includes sauces (soy sauce, tomato sauce and chili sauce), dips (cheese-based and mayonnaise-based), and condiments (vinegar, fish sauce and shrimp paste).

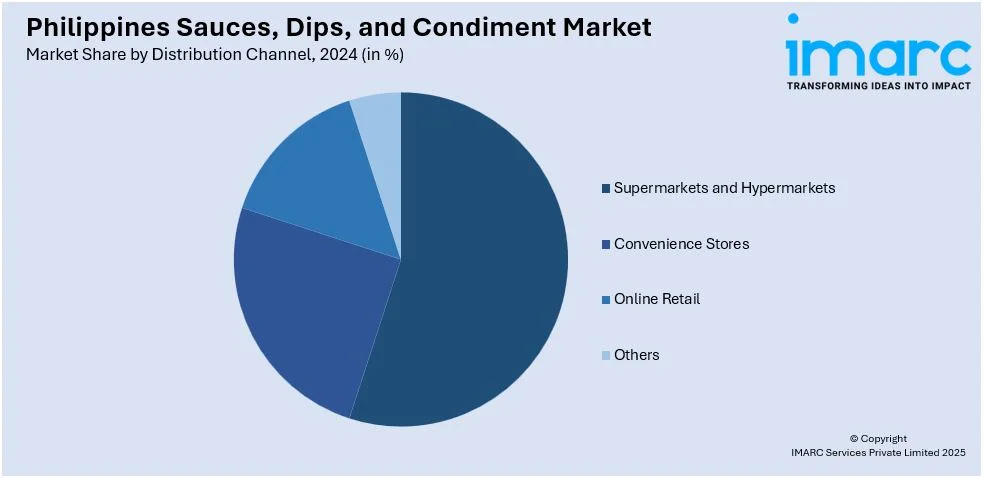

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Retail

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, online retail, and others.

End User Insights:

- Household

- Foodservice Industry

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes household and foodservice industry.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Sauces, Dips, and Condiment Market News:

- In July 2024, Kitchen Magic Spaghetti Sauce launched in the Philippines featuring Tito Boy Abunda as its celebrity endorser. The sauce promises to elevate Filipino dishes with quality ingredients and is Halal-certified. It aims to become a household favorite across the nation.

Philippines Sauces, Dips, and Condiment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Online Retail, Others |

| End Users Covered | Household, Foodservice Industry |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines sauces, dips, and condiment market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines sauces, dips, and condiment market on the basis of product type?

- What is the breakup of the Philippines sauces, dips, and condiment market on the basis of distribution channel?

- What is the breakup of the Philippines sauces, dips, and condiment market on the basis of end user?

- What is the breakup of the Philippines sauces, dips, and condiment market on the basis of region?

- What are the various stages in the value chain of the Philippines sauces, dips, and condiment market?

- What are the key driving factors and challenges in the Philippines sauces, dips, and condiment market?

- What is the structure of the Philippines sauces, dips, and condiment market and who are the key players?

- What is the degree of competition in the Philippines sauces, dips, and condiment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines sauces, dips, and condiment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines sauces, dips, and condiment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines sauces, dips, and condiment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)