Philippines Skin Care Products Market Size, Share, Trends and Forecast by Product Type, Ingredient, Gender, Distribution Channel, and Region, 2026-2034

Philippines Skin Care Products Market Overview:

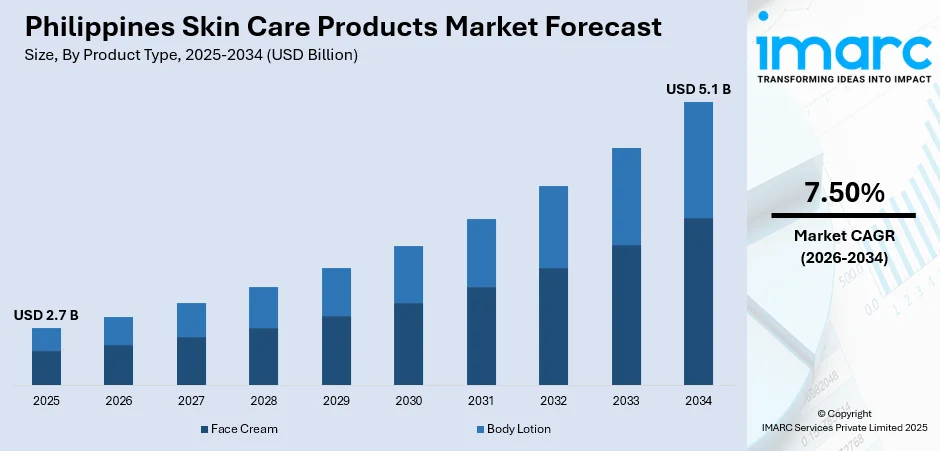

The Philippines skin care products market size reached USD 2.7 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 5.1 Billion by 2034, exhibiting a growth rate (CAGR) of 7.50% during 2026-2034. The market is driven by rising consumer consciousness about skin health, increasing disposable incomes, the influence of K-beauty and international brands, and a tropical climate that fuels the demand for skin repair solutions. Additionally, the broadening of e-commerce platforms is fueling the Philippines skin care products market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2.7 Billion |

| Market Forecast in 2034 | USD 5.1 Billion |

| Market Growth Rate (2026-2034) | 7.50% |

Philippines Skin Care Products Market Trends:

Rising Consumer Awareness and Demand for Personal Care

Over the past few years, Filipino consumers have become more aware of personal skin health and hygiene. This increased awareness has created a boom in skin care product sales. Most people now follow complete facial care regimens, ranging from cleansing to toning and moisturizing. This trend is seen by the fact that reported sales of facial washes, toners, and moisturizers went up by a recorded 13% in one year. In addition, there has been a significant increase in the use of sun protection products. This indicates increased awareness about the need to protect the skin from damaging ultraviolet rays, which can cause premature aging and other skin issues. Increased use of sun protection reflects a forward-thinking attitude among consumers in ensuring healthy skin. Significant growth has also been observed in the eye cosmetics segment, this suggests that consumers are investing in products that improve skin health, as well as their appearance, especially with the eyes. The emphasis on eye cosmetics is associated with cultural factors and cosmetic criteria, which are expressive and well-defined priorities of the eye. This growing consumer consciousness and demand for personal care products have built a strong market for skin care products in the Philippines. Retailers and manufacturers are taking advantage of this by providing a wide variety of products suited to the unique needs and tastes of Filipino consumers.

To get more information on this market, Request Sample

Economic Growth and Increased Disposable Income

The Philippines has been enjoying steady economic growth, which has benefited many industries, including the skin care industry and the service sector, contributing almost 62.42% to the economy. This economic boom has resulted in a growth in disposable income levels in Filipino households. With higher financial endowments available to them, consumers opt to spend on discretionary products such as beauty and skin care products. The need to spend on personal care is always related to enhanced self-esteem and social status, translating into increased demand in the market. Additionally, the Philippines wellness economy has experienced significant growth, up to USD 41 Billion in 2022. This makes the country a major contributor to the wellness economy globally, coming in at number eighth in Asia and 22nd in the world. The growing wellness industry includes segments such as skin care and signifies people's changing attitudes toward caring for their health and well-being. The synergy of economic expansion and a developing wellness culture has created an environment that supports the Philippines skin care products market growth. Customers are more likely to spend a portion of their rising income on products that contribute to their health and beauty, resulting in consistent growth in the market. Moreover, the Philippines skin care products industry is being pushed by increased consumer consciousness on personal care and the positive impact of economic growth on disposable income. These factors combined push the dynamic and growing country's skin care market.

Key Growth Drivers of Philippines Skin Care Products Market:

Growing Male Grooming and Skincare Adoption

Male grooming in the Philippines is expanding rapidly, contributing notable growth to the skincare market. Filipino men are increasingly prioritizing personal appearance, hygiene, and skin health due to workplace expectations, social media influence, and rising self-image awareness. The stigma around men using skincare has reduced, encouraging the adoption of cleansers, toners, sunscreens, and anti-acne products designed for male skin. Brands are launching gender-neutral or targeted men’s product ranges for oil control, brightening, and acne management, catering to tropical climate challenges. Barbershops and men’s salons are also promoting grooming routines and curated starter kits for men. Younger men, especially in urban regions, emulate Korean idols and influencers, normalizing skincare as part of daily lifestyle. This shift is expanding the overall customer base, increasing product frequency of use, and encouraging premiumization within the male grooming category.

Expanding E-Commerce and Digital Beauty Retailing

At present, digital transformation is stimulating the Philippines skin care products market demand. E-commerce platforms, social commerce, and brand-owned online stores enable convenient product discovery, price comparison, and doorstep delivery, especially for users outside major cities. Livestream shopping, influencer-led product demos, and flash sales on platforms boost impulse buying and trial of new brands. Online reviews, before-and-after results, and dermatologist content empower informed decision-making and reduce purchase hesitation. Digital-only beauty brands and subscription models provide curated skincare bundles, enhancing engagement and repeat purchases. Mobile payment adoption, cash on delivery (COD) options, and widespread smartphone usage are making online beauty retail accessible to broad consumer segments. As more consumers are shifting to online beauty shopping for convenience, variety, and better deals, e-commerce continues to drive the market expansion and product experimentation.

Rising Demand for Natural, Mild, and Dermatologist-Tested Products

Filipino consumers are increasingly shifting towards natural, gentle, and dermatologically tested skincare products due to heightened awareness about skin sensitivity, allergies, and long-term health effects of harsh formulations. Products with botanical extracts, fragrance-free claims, hypoallergenic labels, and dermatologist recommendations are gaining preference. The tropical climate and common issues, such as acne, oiliness, pigmentation, and sun damage, encourage users to seek safe, lightweight, and non-comedogenic products suitable for humid weather. Local and global brands are responding with clean beauty lines, minimalist ingredient lists, and transparent labeling. Consumers also value science-backed actives like niacinamide, vitamin C, ceramides, and probiotics, favoring products offering visible but skin-friendly results. As per the Philippines skin care products market analysis, this ‘skin health first’ mindset is fueling the demand for gentle cleansers, sunscreens, and moisturizers, fostering brand trust and long-term customer loyalty.

Philippines Skin Care Products Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on product type, ingredient, gender, and distribution channel.

Product Type Insights:

- Face Cream

- Skin Brightening Cream

- Anti-Aging Cream

- Sun Protection Cream

- Body Lotion

- Mass Body Care

- Premium Body Care

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes face cream (skin brightening cream, anti-aging cream, and sun protection cream) and body lotion (mass body care, premium body care, and others).

Ingredient Insights:

- Chemical

- Natural

A detailed breakup and analysis of the market based on the ingredients have also been provided in the report. This includes chemical and natural.

Gender Insights:

- Male

- Female

- Unisex

A detailed breakup and analysis of the market based on gender have also been provided in the report. This includes male, female, and unisex.

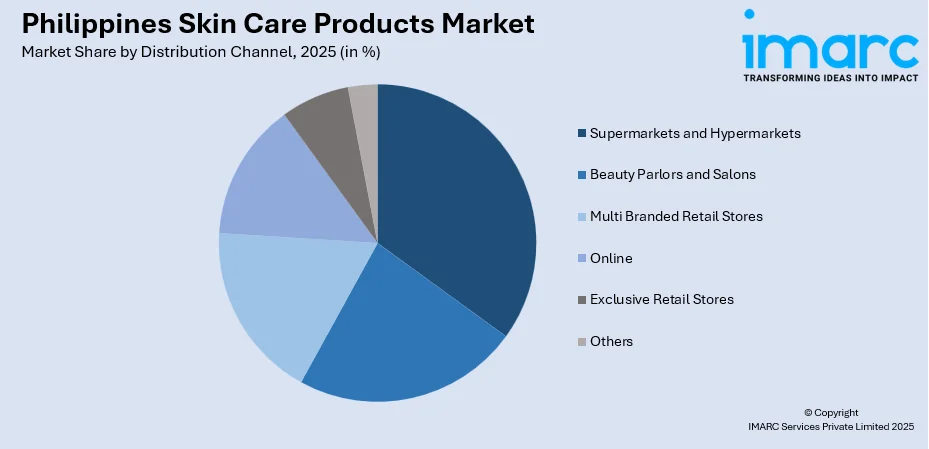

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Beauty Parlors and Salons

- Multi Branded Retail Stores

- Online

- Exclusive Retail Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, beauty parlors and salons, multi branded retail stores, online, exclusive retail stores, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Skin Care Products Market News:

- February 2025: The beauty and skincare category in the SEA region including the Philippines has been led by K-beauty products, which was the main driver of growth for Shopee Korea in 2024, with a 77% year-on-year increase in order volume. Shopee Korea's growth rate was 1.8 times higher than Shopee's global growth rate during the same period, indicating a stronger growth trend.

- August 2024: The arrival of TIA’M, a South Korean skincare label, via its collaboration with AnyMind Group propelled the skincare products market in the Philippines. This partnership harnessed e-commerce, logistics, and influencer marketing, transforming market dynamics by improving accessibility and brand exposure.

Philippines Skin Care Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Face Cream (Skin Brightening Cream, Anti-Aging Cream, Sun Protection Cream), Body Lotion (Mass Body Care, Premium Body Care, Others) |

| Ingredients Covered | Chemical, Natural |

| Genders Covered | Male, Female, Unisex |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Beauty Parlors and Salons, Multi Branded Retail Stores, Online, Exclusive Retail Stores, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines skin care products market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines skin care products market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines skin care products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The skin care products market in the Philippines was valued at USD 2.7 Billion in 2025.

The Philippines skin care products market is projected to exhibit a CAGR of 7.50% during 2026-2034, reaching a value of USD 5.1 Billion by 2034.

Young consumers are adopting multi-step routines focused on hydration, brightening, acne care, and sun protection, increasing product usage frequency. Expanding male grooming culture and reduced stigma around men using skincare are broadening the target consumer base. E-commerce, influencer marketing, and livestream shopping are making skincare more accessible nationwide, encouraging product discovery and experimentation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)