Philippines Steel Market Size, Share, Trends and Forecast by Type, Product, Application, and Region, 2025-2033

Philippines Steel Market Overview:

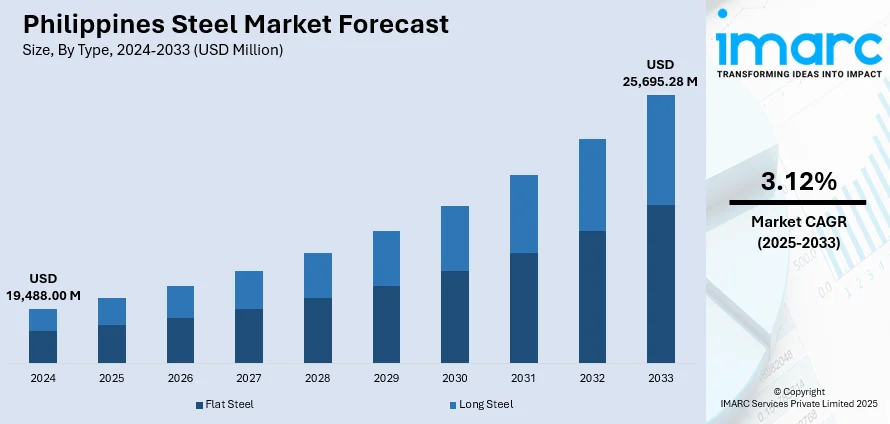

The Philippines steel market size reached USD 19,488.00 Million in 2024. The market is projected to reach USD 25,695.28 Million by 2033, exhibiting a growth rate (CAGR) of 3.12% during 2025-2033. The market is expanding driven by increasing infrastructure projects and government support for local manufacturing. Growing emphasis on sustainable production and circular economy practices also strengthens Philippines steel market share, promoting self-reliance and reducing dependence on imports across construction and industrial sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 19,488.00 Million |

| Market Forecast in 2033 | USD 25,695.28 Million |

| Market Growth Rate 2025-2033 | 3.12% |

Key Trends of Philippines Steel Market:

Focus on Sustainable Steel Production

The Philippine steel industry has increasingly prioritized environmentally sustainable practices to align with global climate goals and resource efficiency. This shift responds to growing awareness of steel’s environmental footprint and the country’s ambition to reduce reliance on imported raw materials, which often come with higher costs and carbon emissions. Domestic steel producers have been adopting more energy-efficient technologies, such as electric arc furnaces, which enable the recycling of scrap metal, a resource the Philippines has in abundance, being a net scrap exporter. This approach helps reduce waste and promotes a circular economy, where raw materials are reused rather than discarded. By focusing on sustainability, the steel industry can also meet stricter environmental regulations and attract investments driven by green policies. In January 2024, SteelAsia announced major capacity expansions, including electric arc furnace projects in Luzon and Davao, which are scheduled for completion in 2025. These include a 750,000-ton large section mill and smaller units. These investments represent a commitment to cleaner production and improved efficiency using domestic scrap steel. Such expansions increase output and support long-term sustainability goals by minimizing raw material import dependence and lowering the industry’s carbon footprint. This development highlights an emerging market trend where environmental responsibility and economic growth are pursued simultaneously, positioning the Philippine steel sector for a more resilient and sustainable future.

To get more information of this market, Request Sample

Expansion of Domestic Manufacturing Scale

The Philippine steel market has been actively expanding its domestic manufacturing capabilities in response to rising infrastructure and construction demand. Driven by national development programs like “Build Better More” and supported by laws such as the ‘Tatak Pinoy’ initiative, the government encourages import substitution and self-reliance in steel production. With ongoing large-scale public infrastructure projects and housing developments, the demand for reinforcing steel bars (rebars) and structural steel products has grown significantly. Local steel producers are investing in modern, high-capacity facilities to meet these needs, which not only improves supply stability but also reduces the country’s trade deficit associated with steel imports. Increasing domestic production capacity strengthens the steel value chain and provides employment opportunities in key regions. In July 2024, President Marcos inaugurated SteelAsia’s Compostela Works in Cebu, the Philippines’ largest and most modern steel mill, with a one-million-ton annual rebar capacity. This facility plays a crucial role in enhancing local steel supply for infrastructure projects in Visayas and Mindanao, thereby reducing reliance on imported steel products. Its establishment marks a significant milestone in industrial modernization and regional development. By producing steel domestically at scale, the industry enhances competitiveness and supports economic growth while addressing national priorities for infrastructure and housing. The development exemplifies a broader trend of strengthening self-sufficiency and industrial resilience in the Philippines steel market growth.

Growth Drivers of Philippines Steel Market:

Industrialization and Infrastructure Growth

The Philippines steel industry is supported by a shift toward industrialization and widespread infrastructure growth. National initiatives and long-term development plans have spurred road, bridge, railway, and port construction, driving demand for steel used in construction. This modernization of infrastructure, coupled with accelerated urbanization, fuels the application of structural steel in constructing high-rise residential complexes, commercial areas, and public buildings, which solidifies the position of steel as the backbone of contemporary construction. Furthermore, the establishment of locally focused steel plants like new beam and structural mills, has bolstered home country manufacturing capability. These plants supply essential material to support the nation's infrastructure goals while fueling regional development and provide jobs in several provinces. With public infrastructure and urban projects being generated in abundance throughout the archipelago, the steel industry continues to be a key driver of the country's industrial progress, filling historic gaps in being self-sufficient and allowing the Philippines to be even more capable of fulfilling its own construction material requirements.

Demand from Real Estate and Housing Developments

Another key growth driver of the Philippines steel industry is rising demand from the real estate and housing industry. With the population growth and rural-urban migration, demand for affordable and mid-rise housing keeps rising. Real estate developers are building residential villages not just in Metro Manila but also in fast-emerging areas like Cebu, Davao, and Pampanga. These innovations rely significantly on steel products, ranging from rebars to reinforce concrete to prefabricated steel buildings to construct fast, long-lasting structures. State-backed mass housing initiatives further increase steel use by inspiring the building of strong homes, especially in disaster-hit areas. The demand for disaster-resilient and sustainable housing also pushes innovation in steel framing systems, providing structural integrity and durability against environmental stresses such as typhoons and earthquakes, which are parameters specific to the Philippine terrain. With home ownership becoming a priority for both public and private sectors, steel continues to be a key building material that will underpin this vision.

Rising Automotive and Shipbuilding Sectors

The increasing pace of the automobile and shipbuilding sectors in the region is another key stimulus contributing to the growth of Philippines steel market demand. As the Philippines becomes a strategic hub in Southeast Asia for vehicle assembly and shipbuilding manufacturing, the demand for niche steel products like high-strength sheets, coils, and plates has greatly escalated. The nation's coastal location and historic maritime heritage have promoted investment in shipyards, especially in locations such as Subic and Cebu. Such yards need enormous amounts of steel of marine grade for hulls of ships, cargo ships, and ferries for domestic and foreign markets. Likewise, the growth of automobile assembly plants, spurred by domestic demand as well as export markets, calls for precision-processed steel for frames, engines, and safety parts. Domestic steel manufacturers are reacting by enhancing their facilities to be able to live up to strict industry demands, underpinning the growth of these transportation industries. This diversification of the industrial base makes steel a building material input and a critical input for manufacturing and export industries.

Opportunities of Philippines Steel Market:

Emerging Metro Rail and Mass Transit Projects

The developing web of metro rail and mass transit networks in the Philippines is a major opportunity for the nation's steel sector. Metropolitan cities such as Metro Manila, Cebu, and other fast-growing cities are moving toward improving public transportation infrastructure to fight congestion and pollution issues. These transit projects require specialized structural steel elements, ranging from rails and support beams to station structures and maintenance buildings. The shift toward elevated or subterranean mass transit greatly increases the requirement for high-strength steel that can resist dynamic loads and withstand seismic or typhoon-induced stresses. Local steel mills are excellently positioned to capitalize on such projects, particularly when such developments coincide with long-term strategies for decreased reliance on imports. In addition, transit interchanges, where rail stations are integrated with commercial and retail spaces, also fuel demand for architectural-grade steels that strike a balance between strength and beauty. With the Philippines speeding up transit modernization, the steel industry can take advantage of the opportunity to become an enabling factor in building cityscapes of the future and greener modes of commuting.

Renewable Energy Infrastructure Expansion

The Philippines increasing interest in renewable energy provides a precious opportunity window for the local steel industry. As the country strengthens its power grid with solar farms, geothermal power plants, and wind power facilities, the market for specialized steel substructures like solar panel mounts, wind turbine towers, and reinforcing elements for geographically spread-out power plants increases substantially. Steelmakers who shift towards clean-energy compliant products stand the opportunity to finance projects ranging from remote islands to forested highlands, where the synergy of corrosion resistance and structural versatility is at a premium. Moreover, most renewable energy schemes are financed by public-private collaborations for achieving greater energy access in rural villages, particularly on peripheral islands, inducing a wider geographic demand pattern for steel. Strengthened local supply chains servicing these scattered energy zones can assist local producers in facilitating logistics cost savings and domestic resilience. With green infrastructure becoming more ingrained in environment policy, the Philippines transition toward cleaner energy presents steel producers with an innovative future market of immense consequence.

Special Economic Zones and Industrial Parks Development

According to the Philippines steel market analysis, Special Economic Zones (SEZs) and industrial parks located throughout Luzon, Visayas, and Mindanao are providing fertile ground for strategic expansion in the industry. These zones, intended to encourage foreign and local investment using incentives for manufacturing, logistics, and export-oriented activities, tend to comprise integrated facilities such as warehouses, factories, and business complexes. Steel becomes a key material in constructing these industrial habitats, ranging from building structures to roofing systems exposed to tropical climates. As SEZs grow and change, use of sophisticated steel products like composite panels for climate-controlled buildings and pre-engineered metal structures, increases. Steel producers find incentives in the priority needs of speed, longevity, and modularity of the zones to experiment with designs of simple installation and extended service life. Moreover, their location near ports and transshipment hubs adds to the efficiency of logistics for local steel supplies, providing domestic firms with a solid advantage over importers. With the government persisting in encouraging SEZ development as an economic decentralization tool, the steel sector has the potential to harness long-term opportunities in constructing the industrial backbone of the Philippines' future.

Challenges of Philippines Steel Market:

Vulnerability to Global Price Volatility and Imported Competition

Perhaps the most enduring problem confronting the Philippine steel market is its vulnerability to global price fluctuations and continued imported competition. The country's dependence on foreign sources for unprocessed materials such as iron ore and high-value steel alloys makes domestic manufacturers less competitive when international prices go up. Regional centers' exporters tend to enjoy economies of scale, which enables them to provide goods priced competitively below local supply. Filipino manufacturers, by contrast, find it difficult to sustain margins, particularly for projects requiring low-cost inputs. The long coastlines and use of seafaring logistics also make the market vulnerable to subject freight prices, which change markedly as a result of international shipping fluctuations. Additionally, during international steel surplus, particularly from large exporters, the market is flooded with low-cost offers that might capture local demand, pushing aside domestic production. This setting discourages the establishment of industrial self-sufficiency and makes long-term strategic planning difficult, putting local steel companies to the test in terms of their ability to adapt and resist.

Infrastructure Limitations and Logistical Disintegration

The Philippines' geographic placement, an archipelago consisting of many islands, poses huge logistical challenges to the distribution of steel and supply chain integration. Moving heavy and large steel around islands requires multimodal systems such as inland haulage, ferries, trucks, and ports; coordinating such layers is expensive and time-consuming. Provincial regions largely still depend on limited or obsolete port facilities and rural road networks, which are not always designed to receive heavy steel loads effectively. This fragmentation not only delays delivery but also increases cost, making it more difficult for local manufacturers to match imported steel packaged with integrated logistics and distribution benefits. Also, localized traffic jams in major cities such as Metro Manila, Cebu City, and Davao cause delays and accumulate surcharges. These infrastructural constraints disproportionately burden smaller producers, who do not have the economies of scale or logistics networks to optimize distribution. What follows is skewed market access, as industrial zones bordering well-equipped ports are prosperous, and the peripheral areas are under-served.

Regulatory Complexity and Environmental Compliance Burdens

Another daunting obstacle for Philippine steel companies, especially the changing environmental and permitting needs, lies in the regulatory complexity. As governments tighten regulations on emissions, waste control, and environmental protections, steel plants have to adjust and invest in cleaner technology in order to comply. These changes stretch financial and technical resources, particularly for plants outside central metropolises that can be limited in their ability to access capital or cutting-edge infrastructure. Securing the permits—from environmental approval through to industrial zone registration—can also be a time-consuming process, with bureaucratic duplication at the local and national levels pushing back project schedules. This is amplified in the case of priority development zones or proximity to preserved ecosystems, where steelmaking makes increased scrutiny inevitable. In addition, local issues like the frequency of tropical cyclones, sea-level rise in coastal areas, and requirement for resilient waste treatment, complicate environmental design and can compel expensive site adjustments. Combined, administrative requirements and environmental protections must balance national resource conservation with the promotion of industrial development.

Philippines Steel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on type, product, and application.

Type Insights:

- Flat Steel

- Long Steel

The report has provided a detailed breakup and analysis of the market based on the type. This includes flat steel and long steel.

Product Insights:

- Structural Steel

- Prestressing Steel

- Bright Steel

- Welding Wire and Rod

- Iron Steel Wire

- Ropes

- Braids

The report has provided a detailed breakup and analysis of the market based on the product. This includes structural steel, prestressing steel, bright steel, welding wire and rod, iron steel wire, ropes, and braids.

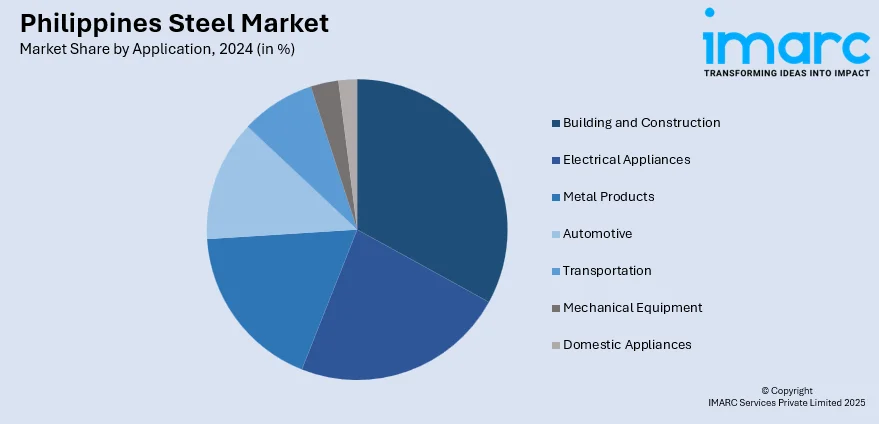

Application Insights:

- Building and Construction

- Electrical Appliances

- Metal Products

- Automotive

- Transportation

- Mechanical Equipment

- Domestic Appliances

The report has provided a detailed breakup and analysis of the market based on the application. This includes building and construction, electrical appliances, metal products, automotive, transportation, mechanical equipment, and domestic appliances.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Steel Market News:

- May 2025: Panhua Group commissioned a 200,000-ton coated steel production line in Maasim, Sarangani. As part of a USD 3.5 Billion integrated steel project, it marked a major step in reducing steel imports, strengthening local manufacturing, and upgrading the Philippines' steel industry infrastructure.

- March 2025: SteelAsia and TotalEnergies ENEOS launched a 1.9 MWp solar rooftop system at Meycauayan, producing 2,700 MWh annually. This reduced 2,300 tons of CO₂ emissions yearly, lowered energy costs, and supported SteelAsia’s shift to renewable energy, advancing sustainable steel production in the Philippines.

Philippines Steel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Flat Steel, Long Steel |

| Products Covered | Structural Steel, Prestressing Steel, Bright Steel, Welding Wire and Rod, Iron Steel Wire, Ropes, Braids |

| Applications Covered | Building and Construction, Electrical Appliances, Metal Products, Automotive, Transportation, Mechanical Equipment, Domestic Appliances |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines steel market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines steel market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines steel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Philippines steel market was valued at USD 19,488.00 Million in 2024.

The Philippines steel market is projected to exhibit a CAGR of 3.12% during 2025-2033.

The Philippines steel market is expected to reach a value of USD 25,695.28 Million by 2033.

The Philippines steel market is witnessing trends like increased local production, rising demand for green and high-strength steel, and a shift toward automation and modern mill technologies. Growth in infrastructure, housing, and renewable energy sectors is shaping product development, while sustainability and reduced import reliance drive industry transformation.

The Philippines steel market is driven by rapid urbanization, infrastructure development, and growing demand from construction, automotive, and shipbuilding sectors. Government-led initiatives, such as “Build, Better, More,” support public works expansion. Additionally, rising local manufacturing and energy projects increase the need for structural and specialized steel products nationwide.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)