Philippines Subscription Box Market Size, Share, Trends and Forecast by Type, Gender, Application, and Region, 2026-2034

Philippines Subscription Box Market Summary:

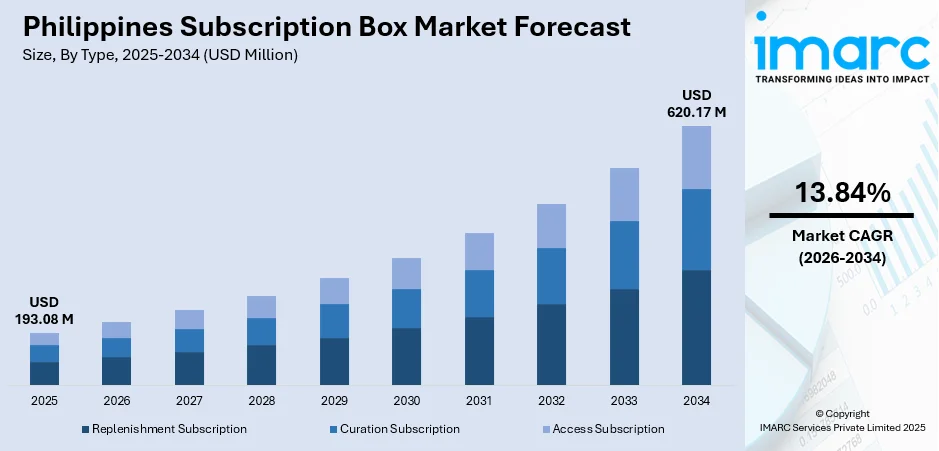

The Philippines subscription box market size was valued at USD 193.08 Million in 2025 and is projected to reach USD 620.17 Million by 2034, growing at a compound annual growth rate of 13.84% from 2026-2034.

The Philippines subscription box market is experiencing robust expansion driven by growing e-commerce adoption, improved digital connectivity, and rising demand for personalized consumer experiences. The convergence of busy urban lifestyles, increasing disposable incomes, and strong social media engagement creates favorable conditions for curated subscription services. Filipino consumers are increasingly seeking convenient, personalized shopping solutions that deliver excitement and discovery directly to their doorsteps, strengthening the Philippines subscription box market share.

Key Takeaways and Insights:

- By Type: Curation Subscription dominates the market with a share of 50% in 2025, driven by Filipino consumers' strong preference for discovery-based experiences, personalized product selections, and the excitement of receiving expertly curated items tailored to individual preferences and interests.

- By Gender: Female leads the market with a share of 65% in 2025, attributed to the strong engagement of Filipino women in beauty, skincare, and self-care routines, coupled with their active participation in social media communities that drive subscription box discovery and recommendations.

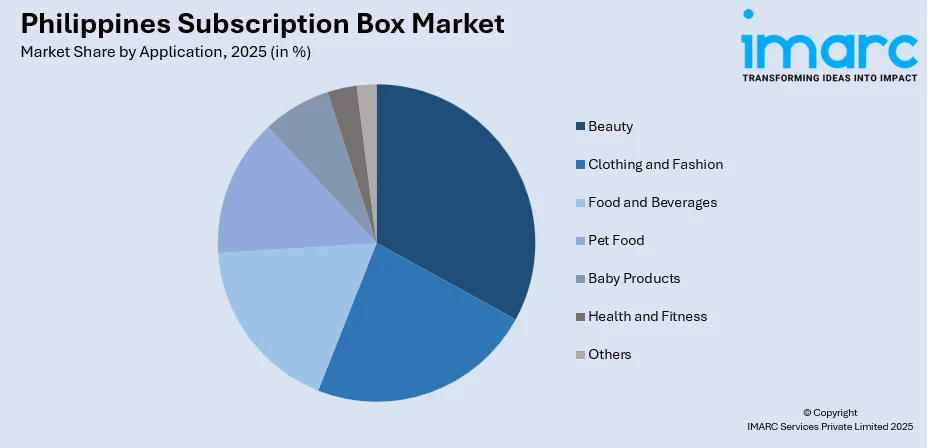

- By Application: Beauty represents the largest segment with a market share of 25% in 2025, owing to the thriving skincare industry, rising consumer interest in personalized beauty solutions, and the convenience of sampling premium and niche brands through curated subscription offerings.

- Key Players: The Philippines subscription box market features a competitive landscape with local entrepreneurs and emerging brands competing across diverse product categories, leveraging social media marketing and community engagement to build subscriber loyalty and brand visibility.

To get more information on this market, Request Sample

The Philippine subscription box market benefits from the nation's vibrant digital ecosystem and strong social commerce culture. Filipino consumers actively engage with brands through social media platforms, sharing unboxing experiences and product recommendations that drive organic market growth. In 2025, Visa announced its new “Visa Intelligent Commerce” initiative — bringing AI‑powered payment tools and better digital‑wallet integration to the Philippines, which simplifies online checkouts for subscription‑box services and boosts overall e‑commerce convenience. The cultural emphasis on gift-giving traditions and community connections creates unique opportunities for experiential subscription services. Additionally, the integration of diverse payment options including digital wallets and cash-on-delivery addresses local preferences, while improving logistics infrastructure enables broader market reach across the archipelago's geographically dispersed population.

Philippines Subscription Box Market Trends:

Rising Demand for Personalized and Curated Experiences

Filipino consumers are increasingly seeking personalized subscription experiences that cater to their unique preferences and lifestyle needs. Reflecting this shift, in 2024 Lazada Philippines rolled out AI powered tools that build personalized catalogs based on user data, tracking preferences, past purchases and even skin care goals, making curated and customized subscription box offerings easier to deliver and more relevant to individual consumers. Brands are responding by implementing sophisticated preference assessments, thematic curation, and customized product selections that enhance subscriber engagement. This personalization trend extends across categories from beauty and skincare to food and lifestyle products, driving higher retention rates and subscriber satisfaction.

Integration of Social Commerce and Influencer Marketing

The Philippines' vibrant social media landscape is transforming how subscription boxes reach and engage consumers. In a 2024 survey, 86% of Filipino respondents said they use social platforms like TikTok and Facebook to search for reviews and validate purchase decisions — underscoring how much influence social content now carries in buying behavior. Brands leverage platforms like Facebook, Instagram, and TikTok for product discovery, unboxing content, and community building. Influencer partnerships and user-generated content create authentic brand narratives that resonate with Filipino consumers, while live streaming events and interactive shopping experiences enhance subscriber acquisition and engagement.

Celebration of Local Products and Cultural Heritage

Subscription services showcasing Filipino-made products, regional delicacies, and indigenous ingredients are gaining significant traction. Recently, in 2025 the Department of Trade and Industry (DTI) unveiled a new array of innovative products from local MSMEs at a regional fair — spotlighting goods rooted in traditional knowledge and indigenous materials. Consumers are drawn to offerings that celebrate local craftsmanship, support micro-entrepreneurs, and highlight cultural authenticity. This trend reflects growing national pride and desire for unique discovery experiences that connect subscribers with products representing diverse Philippine regions and traditions.

Market Outlook 2026-2034:

The Philippines subscription box market is positioned for exceptional growth over the forecast period, supported by expanding e-commerce infrastructure and evolving consumer preferences. The convergence of digital connectivity, urbanization, and changing lifestyles creates favorable conditions for subscription services across diverse product categories. Innovation in logistics, payment solutions, and personalization technologies will continue driving market penetration across urban and provincial areas. The market generated a revenue of USD 193.08 Million in 2025 and is projected to reach a revenue of USD 620.17 Million by 2034, growing at a compound annual growth rate of 13.84% from 2026-2034.

Philippines Subscription Box Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Curation Subscription | 50% |

| Gender | Female | 65% |

| Application | Beauty | 25% |

Type Insights:

- Replenishment Subscription

- Curation Subscription

- Access Subscription

The curation subscription dominates with a market share of 50% of the total Philippines subscription box market in 2025.

The curation subscription segment leads the Philippine market, reflecting consumers' strong appetite for discovery-based experiences and personalized product selections. For example, StyleGenie — the first clothing‑subscription service in the Philippines, offers curated wardrobe boxes based on a subscriber’s style profile, body type, and lifestyle needs. Filipino subscribers value the excitement of receiving expertly curated items that introduce them to new brands, products, and experiences they might not encounter through traditional retail channels. This model particularly resonates with younger demographics who prioritize novelty and personalization in their shopping experiences, creating opportunities for brands to build lasting subscriber relationships through thoughtful curation.

The replenishment subscription segment serves consumers seeking convenient, automated delivery of essential products, while access subscriptions provide exclusive benefits and member-only pricing. Both segments complement the curation model by addressing different consumer needs and preferences within the broader subscription economy.

Gender Insights:

- Male

- Female

The female leads with a share of 65% of the total Philippines subscription box market in 2025.

Female consumers dominate the Philippine subscription box market, driven by strong engagement in beauty, skincare, and self-care categories that form the foundation of the subscription industry. According to a survey published by a Philippine e‑commerce insights firm, about 72% of Filipino online shoppers are female. Filipino women actively participate in social media communities where subscription box discoveries and recommendations circulate, creating powerful word-of-mouth marketing effects. The female demographic demonstrates high receptivity to personalized beauty experiences, curated lifestyle products, and the convenience of doorstep delivery, making them the primary growth driver for subscription services.

The male segment represents emerging growth potential as subscription services expand into categories such as grooming, fitness, and lifestyle products targeted at male consumers. Increasing male interest in personal care and convenience-oriented shopping solutions creates opportunities for market expansion.

Application Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Clothing and Fashion

- Beauty

- Food and Beverages

- Pet Food

- Baby Products

- Health and Fitness

- Others

Beauty dominates with a market share of 25% of the total Philippines subscription box market in 2025.

The beauty segment leads the Philippine subscription box market, reflecting the nation's thriving skincare industry and strong consumer investment in personal care routines. Filipino consumers increasingly seek convenient ways to explore premium and niche beauty brands without committing to full-size purchases, making curated beauty boxes an attractive proposition. The segment benefits from rising skincare awareness, social media influence, and the desire for personalized beauty solutions tailored to individual skin types and preferences. For example, in 2025 Cosmobeauté Philippines, a major B2B beauty trade show, spotlighted innovations across cosmetics, wellness, and salon care sectors, underscoring growing supplier interest and demand in beauty and personal care products in the Philippines.

Food and beverages, clothing and fashion, and health and fitness segments represent significant growth opportunities as consumers embrace subscription models across diverse product categories. Pet food and baby products segments cater to specific household needs, while lifestyle and hobby subscriptions attract consumers seeking entertainment and enrichment experiences.

Regional Insights:

- Luzon

- Visayas

- Mindanao

Luzon plays an important role in the Philippines subscription box market, driven by Metro Manila's concentrated population, advanced e-commerce infrastructure, and high internet penetration rates. The region's urbanized consumer base demonstrates strong digital adoption, higher disposable incomes, and demand for convenient shopping solutions. Robust logistics networks enable efficient last-mile delivery, while the concentration of young professionals and tech-savvy consumers creates ideal conditions for subscription service adoption.

Visayas represents a growing market driven by Cebu's expanding e-commerce ecosystem, tourism-influenced consumer behaviors, and strong OFW remittance flows. The region exhibits increasing digital connectivity and modern retail development, supporting subscription service expansion beyond Metro Manila. Community-oriented purchasing patterns and growing middle-class demographics create opportunities for localized subscription offerings that celebrate regional products and cultural heritage.

Mindanao emerges as a promising growth frontier with improving logistics infrastructure and expanding digital access. Davao and other urban centers demonstrate increasing e-commerce adoption and consumer interest in subscription services. The region's unique cultural identity and artisanal product heritage create opportunities for subscription boxes featuring Mindanaoan delicacies, crafts, and indigenous ingredients, connecting subscribers nationwide with the island's distinctive offerings.

Market Dynamics:

Growth Drivers:

Why is the Philippines Subscription Box Market Growing?

Expanding E-commerce Adoption and Digital Connectivity

The swift growth of e-commerce platforms and rising internet access across the Philippines catalyze subscription box demand. According to reports in 2025, More than 80 percent of Filipinos are now active internet users, making the country one of the most digitally connected in Southeast Asia. Increasing numbers of consumers benefit from seamless online shopping experiences, promoting both initial trials and recurring subscriptions. Enhanced digital connectivity enables consumers to discover specialized, personalized products through social media, targeted advertisements, and influencer promotions. The integration of video commerce through platforms like YouTube Shopping enhances purchasing confidence through creator endorsements, accelerating subscription model adoption among digitally-engaged Filipino consumers.

Changing Consumer Lifestyles and Urbanization Patterns

Evolving consumer lifestyles driven by rapid urbanization and changing household structures significantly contribute to market development. Zalora Philippines and Lazada are boosting delivery capabilities ahead of the holiday surge. Zalora has launched “Zalora Now,” a P500-a-year subscription offering unlimited next-day delivery across key Luzon cities. Lazada has expanded its Premium Service to Metro Cebu and Davao, strengthening same-day and next-day delivery as both platforms prepare for major 11.11 and 12.12 sales events. As more Filipinos juggle demanding work schedules, education, and social commitments in concentrated urban areas like Metro Manila, Cebu, and Davao, convenience becomes paramount. Subscription boxes address these needs by delivering carefully curated products directly to doorsteps, reducing shopping time and decision fatigue. The model appeals to working professionals, young adults, and families seeking reliable, personalized access to quality products that enhance their daily routines and lifestyle experiences.

Thriving Skincare Industry and Beauty Consciousness

The rapid growth of the Philippine skincare industry serves as a vital market driver, particularly within the beauty and personal care segment. The Philippines skin care products market size reached USD 2.7 Billion in 2025, and looking forward, IMARC Group expects it to reach USD 5.1 Billion by 2034, exhibiting a CAGR of 7.50% during 2026-2034. As consumers become increasingly invested in skincare routines and self-care practices, they seek convenient ways to explore new products tailored to their individual needs. Subscription boxes provide curated selections of skincare items, allowing users to sample premium and niche brands without full-size purchase commitments. Rising consumer awareness and interest in personalized beauty solutions create a favorable environment for subscription services focused on skincare and wellness categories.

Market Restraints:

What Challenges the Philippines Subscription Box Market is Facing?

Logistical Complexity Across Archipelagic Geography

The Philippines' archipelagic terrain presents significant logistical challenges for subscription services. Delivering boxes across numerous islands requires complex coordination involving trucks, ferries, and provincial couriers, increasing costs and delivery times. While urban centers are readily serviceable, reaching consumers in outlying provinces and isolated islands remains challenging and expensive.

Consumer Payment Preferences and Subscription Skepticism

Filipino consumers' traditional preference for transactional purchasing over recurring payment plans affects subscription adoption. Varying levels of trust in online vendors and concerns about quality and value deter potential subscribers. Subscription services must accommodate diverse payment methods including digital wallets and cash-on-delivery to address local preferences and build consumer confidence.

Inventory Management and Local Sourcing Constraints

Creating compelling, consistently curated subscription boxes requires reliable product sourcing and inventory management. Obtaining locally-made products, particularly artisanal items from regional suppliers, faces challenges including variable supply levels, seasonal availability, and irregular production schedules. Balancing cultural authenticity with operational reliability remains an ongoing challenge for subscription providers.

Competitive Landscape:

The Philippines subscription box market features a dynamic competitive landscape with local entrepreneurs and emerging brands competing across diverse product categories. Market participants differentiate through product curation quality, personalization capabilities, and community engagement strategies. Digital marketing, influencer partnerships, and social media presence serve as primary competitive tools for building subscriber bases. Companies emphasize cultural authenticity, local product sourcing, and experiential value to establish brand loyalty. The market structure encourages innovation as providers develop unique value propositions addressing Filipino consumers' preferences for convenience, discovery, and community connection.

Recent Developments:

- In April 2025, YouTube Shopping launched in the Philippines via a tie‑up with Shopee, making it the sixth Southeast Asian market to adopt the feature. The integration lets creators tag products directly in videos, enabling streamlined purchases — especially in beauty and tech — boosting discovery and video‑commerce engagement.

- In February 2024, Bare Pets launched the country’s first premium dog‑food subscription service, offering convenient delivery of kibble, wet food, and bundled options for pet owners. The move taps into the growing demand for high-quality pet care in the Philippines, reflecting broader Southeast Asian trends in subscription-based pet nutrition.

Philippines Subscription Box Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Replenishment Subscription, Curation Subscription, Access Subscription |

| Genders Covered | Male, Female |

| Applications Covered | Clothing and Fashion, Beauty, Food and Beverages, Pet Food, Baby Products, Health and Fitness, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Philippines subscription box market size was valued at USD 193.08 Million in 2025

The Philippines subscription box market is expected to grow at a compound annual growth rate of 13.84% from 2026-2034 to reach USD 620.17 Million by 2034.

Curation subscription held the largest market share of 50% in 2024, driven by Filipino consumers' strong preference for discovery-based experiences and personalized product selections curated to their individual interests.

Key factors driving the Philippines subscription box market include expanding e-commerce adoption, improved digital connectivity, changing consumer lifestyles, thriving skincare industry, strong social media engagement, and cultural gift-giving traditions.

Major challenges include logistical complexity across the archipelagic geography, consumer skepticism toward recurring payment models, variable payment preferences, inventory management difficulties, and local sourcing constraints affecting product curation consistency.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)