Philippines Vegetable Oil Market Size, Share, Trends and Forecast by Oil Type, Application, and Region, 2026-2034

Philippines Vegetable Oil Market Size and Share:

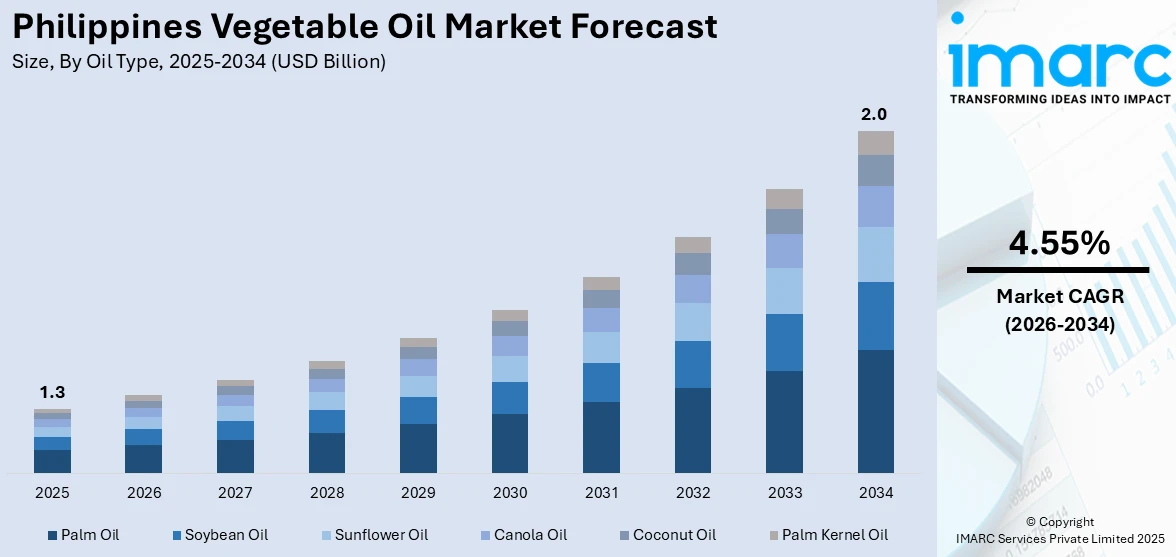

The Philippines vegetable oil market size reached USD 1.3 Billion in 2025. Looking forward, the market is projected to reach USD 2.0 Billion by 2034, exhibiting a growth rate (CAGR) of 4.55% during 2026-2034. The market is driven by consistent household consumption across traditional cooking and street food sectors, underpinned by affordability and nutritional initiatives. A mix of domestic coconut oil production and imported palm oil ensures stable supply across regions and applications. Expansion in processed food manufacturing and oleochemical exports is further augmenting the Philippines vegetable oil market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.3 Billion |

| Market Forecast in 2034 | USD 2.0 Billion |

| Market Growth Rate 2026-2034 | 4.55% |

Key Trends of Philippines Vegetable Oil Market:

Local Copra-Based Oil Production and Import Supplementation

The Philippines has a longstanding domestic vegetable oil industry anchored in coconut oil production derived from copra. It is the world’s leading coconut oil producer, contributing 51% of global supply with 1.2 million tons in 2023, 83% of its total oils and fats output. Roughly 90% (1.1 million tons) of coconut oil is exported, leaving limited supply for domestic use. With 63,380 hectares of oil palm plantations producing 140,000 tons annually, palm oil represents 10% of the country’s oils and fats production. Small and mid-sized processors operate throughout Luzon, Visayas, and Mindanao, producing refined coconut oil for culinary use and byproducts for animal feed and industrial applications. However, due to limited soybean and sunflower oil cultivation, the country imports significant volumes of other vegetable oils, especially palm oil from Indonesia and Malaysia, to meet demand in food processing and foodservice sectors. Coconut oil remains a household staple, particularly in rural communities, due to its availability and cultural familiarity. Meanwhile, urban consumers increasingly use blended oils for cost and functionality, such as palm-coconut or palm-canola blends. The government continues to support local coconut farmers through the replanting of senile trees, copra price stabilization schemes, and post-harvest facility upgrades. These efforts aim to raise yield, improve oil quality, and reduce the volatility of supply. Imports, meanwhile, ensure consistent availability of low-cost oils during domestic supply disruptions. The dynamic balance between homegrown production and global sourcing ensures steady Philippines vegetable oil market growth, supporting both household cooking and commercial use.

To get more information on this market Request Sample

Growth of Packaged Food and Manufacturing Applications

Vegetable oil plays a critical role in the Philippines’ expanding processed food sector, which includes noodles, biscuits, snacks, canned goods, and baked products. Major food companies use oil for frying, dough softening, and preservation functions. As demand for shelf-stable, ready-to-eat, and affordable packaged food continues to rise, especially in densely populated regions like Metro Manila and Davao, so does the industrial requirement for vegetable oil. In addition to food use, oil byproducts such as stearic acid and glycerin are used in cosmetics, cleaning products, and pharmaceuticals. Coconut oil-based oleochemicals produced locally are exported and used in soaps and surfactants, supporting a value-added product stream. Moreover, the growing logistics and distribution networks, driven by e-commerce and nationwide grocery chains, have improved oil access in secondary cities and remote provinces. Producers are also beginning to introduce sustainable packaging and traceable sourcing in response to global retail demands. As international food brands expand their presence and local firms scale operations, consistent and high-quality oil supply becomes a crucial input. The industrial linkages between food manufacturing, consumer goods, and export-oriented oleochemicals continue to solidify the strategic role of vegetable oil in the national economy.

Growth Drivers of Philippines Vegetable Oil Market:

Expanding Food Processing and Fast-Food Industry Growth

The rapid expansion of the Philippines' food processing sector serves as a fundamental growth driver for vegetable oil consumption across multiple applications. Major food manufacturers are scaling production of instant noodles, biscuits, snacks, and ready-to-eat meals, which require significant quantities of vegetable oils for frying, texture enhancement, and preservation. Fast food chains like Jollibee and international brands such as McDonald's are aggressively expanding their store networks. This expansion directly translates to increased demand for cooking oils in commercial food preparation. Additionally, the growing middle class in urban centers is driving consumption of processed and convenience foods, creating sustained demand for vegetable oils in manufacturing applications. Food service establishments, including restaurants, cafeterias, and street food vendors, represent another significant consumption segment requiring consistent oil supplies. The integration of modern food safety standards and quality requirements is also pushing processors toward premium oil grades, supporting market value growth and driving the Philippines vegetable oil market analysis toward higher-value segments.

Strategic Government Support for Domestic Coconut Industry Development

Government initiatives and policy support represent crucial catalysts for the Philippines vegetable oil market, particularly through comprehensive programs aimed at enhancing domestic coconut production capabilities. The Philippine Coconut Authority continues implementing farmer support programs including replanting initiatives for aging coconut trees, copra price stabilization mechanisms, and infrastructure upgrades for post-harvest processing facilities. These government interventions aim to improve productivity, enhance oil quality standards, and reduce supply volatility that historically affected market stability. Investment in modern processing technologies, supported by government incentives, is enabling local producers to meet international quality standards and expand export opportunities. Furthermore, agricultural research and development programs are introducing high-yielding coconut varieties and sustainable farming practices that increase per-hectare productivity. This comprehensive government support framework ensures stable raw material supply while encouraging value-added processing, thereby strengthening the foundation for sustained Philippines vegetable oil market demand growth.

Rising Health Consciousness and Premium Oil Adoption

Increasing health awareness among Filipino consumers is driving significant shifts in vegetable oil consumption patterns, creating opportunities for premium and health-oriented oil products. Urban consumers are becoming more selective about cooking oil choices, seeking products with better nutritional profiles, reduced trans-fat content, and natural processing methods. This trend has led to growing demand for specialty oils including olive oil, avocado oil, and premium coconut oil variants that command higher price points. Educational campaigns about the health benefits of different oil types are influencing purchasing decisions, particularly among middle and upper-income households. The foodservice sector is also adapting to these preferences, with restaurants and fast-food chains exploring healthier oil alternatives to meet consumer expectations. Additionally, the growing fitness and wellness culture in major cities is creating niche markets for organic, cold-pressed, and specialty cooking oils. Manufacturers are responding by diversifying product portfolios to include premium oil blends, functional oils with added vitamins, and organic-certified products. This health-driven market segmentation is contributing to overall market value growth by shifting consumption toward higher-priced, premium oil categories while maintaining volume growth in traditional segments.

Philippines Vegetable Oil Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on oil type and application.

Oil Type Insights:

- Palm Oil

- Soybean Oil

- Sunflower Oil

- Canola Oil

- Coconut Oil

- Palm Kernel Oil

The report has provided a detailed breakup and analysis of the market based on the oil type. This includes palm oil, soybean oil, sunflower oil, canola oil, coconut oil, and palm kernel oil.

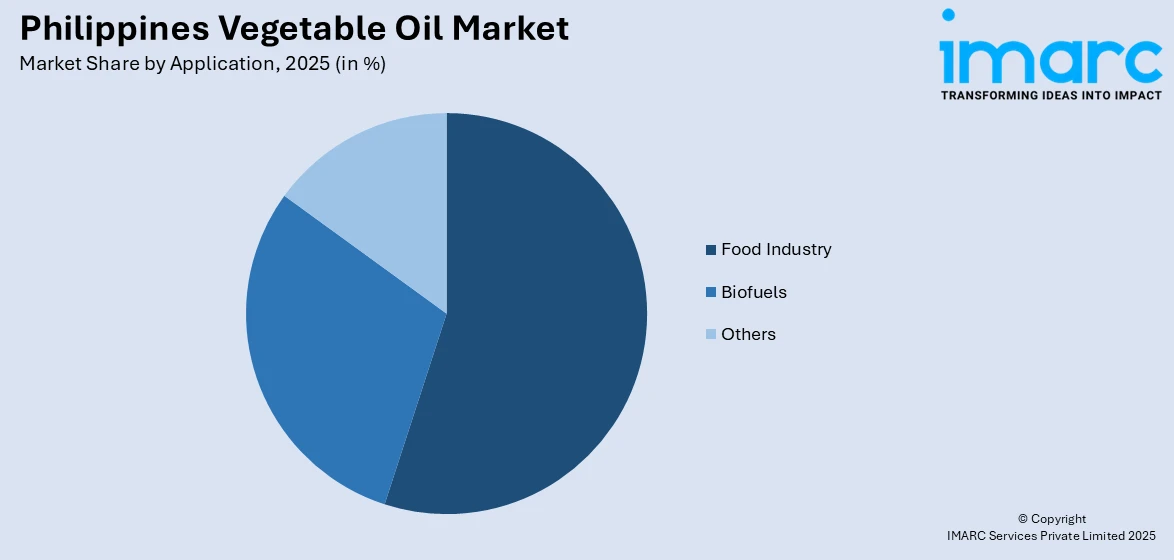

Application Insights:

Access the comprehensive market breakdown Request Sample

- Food Industry

- Biofuels

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes food industry, biofuels, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all major regional markets. This includes Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Vegetable Oil Market News:

- In December 2023, Fly Ace Corporation, a leading name in the Philippines edible cooking oil segment, introduced its new offering in the vegetable oil category, Jolly Prito King. Amid rising costs of everyday consumer products, many Filipinos have been opting for unbranded cooking oils, facing uncertainty regarding their quality, origin, and composition.

Philippines Vegetable Oil Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Oil Types Covered | Palm Oil, Soybean Oil, Sunflower Oil, Canola Oil, Coconut Oil, Palm Kernel Oil |

| Applications Covered | Food Industry, Biofuels, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines vegetable oil market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines vegetable oil market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines vegetable oil industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Philippines vegetable oil market was valued at USD 1.3 Billion in 2025.

The Philippines vegetable oil market is projected to exhibit a CAGR of 4.55% during 2026-2034.

The Philippines vegetable oil market is projected to reach a value of USD 2.0 Billion by 2034.

The market experiences growth driven by local copra-based production expansion, import supplementation strategies, and growing packaged food manufacturing applications. Advanced processing technologies and government support for coconut farmers are enhancing domestic production capabilities while ensuring supply stability.

The Philippines vegetable oil market is driven by expanding food processing industries, fast food chain growth, strategic government support for coconut development, and rising health consciousness promoting premium oil adoption across diverse consumer segments nationwide.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)