Pico Projectors Market Size, Share, Trends and Forecast by Technology, Product Type, Component, Compatibility, Application, and Region, 2025-2033

Pico Projectors Market Size and Share:

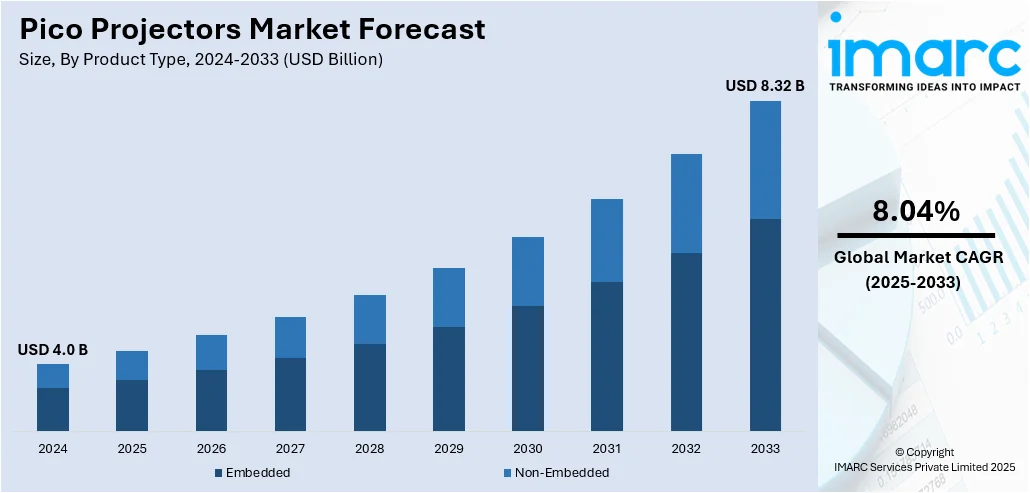

The global pico projectors market size was valued at USD 4.0 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 8.32 Billion by 2033, exhibiting a CAGR of 8.04% from 2025-2033. North America currently dominates the market, holding a market share of 37.5% in 2024. The dominance of the market is attributed to strong technological infrastructure, high user purchasing power, and rapid adoption of advanced display solutions. Supportive industry initiatives, continuous product innovation, and a well-established distribution network further contributing to the expansion of the pico projectors market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 4.0 Billion |

|

Market Forecast in 2033

|

USD 8.32 Billion |

| Market Growth Rate 2025-2033 | 8.04% |

Individuals and professionals are looking for slender, portable devices that provide versatility in showcasing visual material. Pico projectors fulfill this requirement by allowing high-quality projections without the need for large equipment. Their portability allows for use in various environments, making them appealing for both personal and professional applications. Besides this, continuous advancements in light-emitting diode (LED), laser, and digital light processing technologies are boosting image brightness, sharpness, and energy efficiency in pico projectors. These advancements enhance the dependability and aesthetics of devices, encouraging their adoption by offering superior performance, extended longevity, and lower maintenance needs relative to traditional projection systems. Furthermore, decreases in the prices of crucial parts, like LEDs and microchips, are making pico projectors less expensive. Reduced production expenses allow for competitive pricing, drawing in price-sensitive buyers and broadening the market.

To get more information on this market, Request Sample

The United States is a crucial segment in the market, driven by an extensive system of retail stores, online shopping sites, and wholesale suppliers. This accessibility allows individuals to easily locate and buy pico projectors across the country. In May 2025, the Census Bureau of the Department of Commerce estimated US retail e-commerce sales for the first quarter of 2025, amounted to $300.2 billion. Moreover, robust supply chain effectiveness ensures steady product availability and promotes market entry into both urban and rural areas. In addition, the presence of advanced research centers, qualified technical professionals, and a well-developed electronics sector, is resulting in advancements in pico projector design and functionality.

Pico Projectors Market Trends:

Growing Demand for Compact Projection Solutions

The pico projectors market is growing, supported by an increasing demand for portable, small display devices in various sectors. Companies and individuals are placing greater importance on mobility, with these projectors acting as suitable devices for presentations, leisure, and learning. In 2024, Pico Genie launched the Pico Genie Impact 2.0 Plus Elite, a highly portable projector aimed at sports enthusiasts, outdoor adventurers, and art aficionados, providing premium viewing experiences anywhere. Their compact design allowed for impromptu use in meetings or at home, increasing convenience and adaptability. The rise of flexible and remote work is catalyzing the demand for portable presentation tools. These devices are preferred by professionals and educators for their capability to connect smoothly to laptops, smartphones, and tablets, allowing easy content sharing in diverse environments. Integrating lightweight designs with wireless technology, pico projectors are becoming a vital for contemporary workflows and educational settings, reflecting the growing focus on adaptability and productivity.

Rapid Advancements in Laser and LED Technologies

Ongoing advancements are improving image clarity, brightness, and energy efficiency while prolonging the lifespan of devices and removing the necessity for bulb changes. These enhancements lower power usage and boost reliability, allowing for the development of more compact, lightweight projectors without sacrificing clarity or performance. The outcome is an array of versatile devices packed with features that are ideal for diverse uses, ranging from corporate needs to home leisure, expanding the market's attractiveness. In 2024, AAXA Technologies announced a significant enhancement to its LED Pico+ Max pico projector, which improved native 1080P resolution and a Texas Instruments DLP optical engine providing three times the brightness of the earlier model. Leveraging DLP’s high contrast micro-mirror projection imager, the device offered a native resolution of 1920x1080, highlighting the advantages of cutting-edge light source technologies in fulfilling user needs and promoting market uptake.

Rising Demand for Mobile and On-the-Go Presentations

The increasing demand for presentations outside of conventional office and classroom environments is driving the need for portable pico projectors. With more than 264 million students worldwide and rising workplace mobility, these devices facilitate impromptu content sharing across diverse settings. Companies utilize them for client discussions and teamwork, while teachers take advantage of their portability for engaging education beyond traditional classrooms. This corresponds with the changing work and learning methods that prioritize convenience and adaptability. In 2024, JMGO introduced the PicoFlix, a portable projector powered by a battery and featuring a lightweight 1.3 kg aluminum alloy casing. It offered a 127-degree adjustment range, JMGO's gimbal design, and real-time image correction for smooth projection on walls, ceilings, or at unique angles. This combination of portability, performance, and versatility addresses the requirements of contemporary professionals and students, emphasizing the importance of pico projectors as vital resources in the current presentation and communication environment.

Pico Projectors Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global pico projectors market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on technology, product type, component, compatibility, and application.

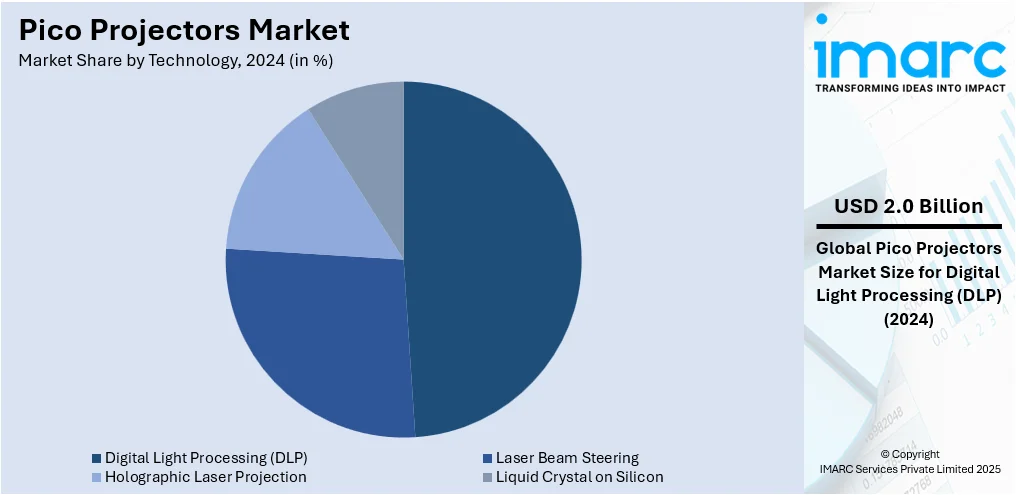

Analysis by Technology:

- Digital Light Processing (DLP)

- Laser Beam Steering

- Holographic Laser Projection

- Liquid Crystal on Silicon

Digital light processing (DLP) leads the market with 48.9%, because it provides high-quality, sharp, and vibrant images with outstanding color precision and contrast. The technology provides enhanced reliability owing to its solid-state structure, reducing maintenance requirements and guaranteeing stable performance over long durations of use. Its streamlined design allows producers to develop lightweight and portable equipment while maintaining high projection quality. DLP technology is highly efficient in terms of power, promoting extended operational life and enhanced battery performance in portable devices. The technology's ability to function well in different lighting situations increases its adaptability for various applications. Moreover, innovations in micro-mirror array technology and optical accuracy are enhancing resolution and image clarity, strengthening DLP’s edge in competition. Robust industry acceptance and ongoing advancements in DLP design and production secure its significant position in fulfilling the need for high-performance, portable projection options.

Analysis by Product Type:

- Embedded

- Non-Embedded

Embedded holds the biggest market share owing to its ability to seamlessly integrate into various portable electronic devices, providing increased convenience and functionality. This integration removes the necessity for individual projection devices, decreasing size and enhancing portability for users. Embedded model offers enhanced power efficiency and compact designs, guaranteeing a slight effect on device dimensions or battery longevity. Its capacity to provide high-quality projection directly from multifunctional devices improves user experience and facilitates wider acceptance in both personal and professional environments. Continuous advancements in miniaturization, optical efficiency, and heat management are further strengthening the performance and reliability of embedded systems. Additionally, the growing incorporation of embedded system into a range of advanced devices reflects strong market confidence in their practicality and value. The embedded segment is expected to maintain its dominance as per the pico projectors market forecast, driven by ongoing innovation and expanding application areas.

Analysis by Component:

- Light Source

- Illumination System

- Projector Lens

- Others

The light source component is essential in determining the quality and performance of pico projectors. Improvements in LED and laser technologies are increasing brightness, energy efficiency, and longevity. Portable light sources allow for mobility without sacrificing image quality, and advancements in thermal management enhance usage duration and dependability.

Illumination system guarantees even light spread and stable image display, directly influencing visual efficacy. Contemporary illumination systems in pico projectors are engineered for minimal energy use, decreased heat generation, and enhanced optical performance. Components designed with high precision improve brightness and contrast, facilitating use in various lighting conditions while preserving small sizes.

Projector lens influences image clarity, focus precision, and the ability to project over distances. Improvements in lens design, featuring superior optical materials and coatings, are enhancing clarity and reduced distortions. Concise but efficient lenses allow for versatile projection angles and suitability for various application situations.

Others include additional parts like cooling systems, image processors, and connectivity modules that improve overall device functionality. These components facilitate consistent performance, allow for wireless or wired links, and help create compact designs.

Analysis by Compatibility:

- Laptop/Desktop

- Smartphones

- Digital Camera

- Portable Media Players

- Others

The laptop/desktop is an important segment because of the extensive utilization of these devices in work and academic environments. Pico projectors intended for easy connectivity with computers facilitate effective presentations, training activities, and teamwork. Improved connectivity choices and plug-and-play features guarantee seamless integration and reduced setup duration.

Smartphones segment profits from the increasing demand for mobile-focused projection solutions. Smartphone-compatible pico projectors enable portable content sharing, facilitated by both wired and wireless connection technologies. Compact designs and intuitive interfaces appeal to users looking for portable, high-quality visual displays directly from their mobile devices.

The digital camera segment serves users needing immediate display of images and videos without needing to transfer files to different devices. Enhanced connectivity with cameras enables rapid display of high-resolution images, attracting photography lovers and professionals who value ease and quality.

Portable media players cater to users looking for projection solutions centered on entertainment. Pico projectors within this category enable direct playback from different media formats, ensuring versatility and ease of use. Enhanced multimedia compatibility and lightweight designs make them ideal for personal and recreational purposes.

Others include compatibility with devices like gaming consoles, tablets, and streaming sticks, broadening the spectrum of possible applications. Wide compatibility guarantees flexibility for various user preferences, while continuous improvements in connectivity standards boost performance, dependability, and user-friendliness across multiple device ecosystems.

Analysis by Application:

- Consumer Electronics

- Business & Education

- Retail

- Healthcare

- Others

Business and education represent the largest segment accredited to their high demand for portable, high-quality display options that enhance communication and interaction. In business settings, pico projectors provide adaptability for both in-person and remote presentations, allowing smooth information exchange without depending on permanent infrastructure. In education, their convenience and simple installation enable flexible teaching approaches, promoting engaging learning interactions and improving visual communication. Pico projectors are suitable for regular use in various locations owing to their small size and efficient energy usage, guaranteeing reliable performance and reduced downtime. Advancements in resolution, brightness, and connectivity are greatly enhancing their usefulness, establishing them as a favored option for contemporary businesses and educational settings. Ongoing product innovations, expanding adoption in hybrid work models, and the growing focus on interactive learning are among the key pico projectors market trends shaping this segment’s continued growth.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market with 37.5%, because of its advanced technological infrastructure, rapid acceptance of cutting-edge consumer electronics, and substantial investment in product development. The involvement of major industry stakeholders encourages competitive innovation is leading to ongoing advancements in performance, design, and functionality. Encouraging regulatory policies and a positive business climate promote research activities and the market introduction of cutting-edge projection technologies. Additionally, the extensive use of portable visual communication devices in professional, educational, and entertainment fields is offering a pico projectors market outlook. The area also benefits from a developed distribution system and strong manufacturing alliances, guaranteeing effective market entry and accessibility. The rise of digital retail channels contributes to wider product reach. According to the International Trade Administration (ITA), e-commerce accounted for 6.1% of total Canadian retail sales in December 2024, with online retail sales totaling approximately US$3.14 Billion. The combination of strong user demand, innovation, and distribution capabilities secures North America’s position as the leading segment in the market.

Key Regional Takeaways:

United States Pico Projectors Market Analysis

In North America, the market portion held by the United States was 87.70%, owing to the increasing need for ultra-compact and portable display options in business, education, and entertainment industries. The rise in remote work and mobile presentations is driving the demand for portable, compact devices that can seamlessly link to laptops, smartphones, or tablets for immediate projection wherever users find themselves. The Census Bureau reports that in 2023, 13.8% of people in the United States predominantly worked remotely, marking a considerable rise from 2019's figure of 5.7%. In 2023, a total of 22 million people were engaged in remote work, compared to 9 million in 2019. Consumers are progressively leaning towards pico projectors for home entertainment, gaming, and portable video streaming, valuing their ease of use and capability to display large images without cumbersome devices. Furthermore, progress in light source technologies like high-efficiency LEDs and laser diodes are enhancing brightness, contrast, and color accuracy while ensuring low power usage and prolonged device lifespan. Moreover, support for wireless connectivity standards like Wi-Fi, Bluetooth, and HDMI, along with integrated smart platforms, is enhancing the versatility and user-friendliness of these devices. Apart from this, competitive pricing fueled by economies of scale and the miniaturization of components is allowing pico projectors to be more available to a larger number of individuals and small enterprises. The increasing popularity of experiential marketing, temporary exhibits, and immersive events is driving the need for mobile projection solutions.

Europe Pico Projectors Market Analysis

The pico projectors market growth in Europe is driven by the region's rising emphasis on sustainability and energy-efficient solutions, which corresponds with the minimal power usage and small size of pico projectors. With individuals and institutions in Europe transitioning towards more sustainable options, there is an increase in the demand for devices that reduce energy utilization while maintaining their functionality. Additionally, the rise in hybrid and remote work arrangements is catalyzing the demand for lightweight, portable technological tools that enhance productivity while traveling, making pico projectors a viable option for mobile workers. As per the Organization for Economic Co-operation and Development (OECD), the average share of people working remotely in Europe hit 14% in 2021, marking a notable rise from 5% in 2019. It rose almost fourfold in capital regions, attaining 22% in 2021 compared to 6% in 2019. The tourism and hospitality sectors are also utilizing pico projectors for guest entertainment, in-room media options, and portable visual tools for conferences and events. In addition, the incorporation of augmented reality (AR) and projection mapping in marketing and public installations is generating novel uses for pico projectors in art displays, retail experiences, and digital signage, supporting the overall growth in the industry.

Asia Pacific Pico Projectors Market Analysis

The pico projector market in the Asia-Pacific is growing because of the increase in mobile-focused lifestyles and heightened digital adoption in both developed and emerging markets. In rapidly urbanizing regions like China, India, and Southeast Asia, portable projectors are gaining popularity for compact entertainment, on-the-go gaming, and spontaneous video streaming, providing large-screen experiences without requiring space for conventional TVs. Moreover, the region's growing e-learning ecosystem and the rising utilization of visual content in education and training are also offering a favorable pico projectors market outlook. A report from the IMARC Group stated that the e-learning market in the Asia-Pacific area attained USD 83.75 Billion in 2024 and is expected to expand at a CAGR of 11.32% between 2025 and 2033. With the growth of digital learning platforms in urban and rural settings, compact projectors are increasingly vital for providing captivating visual lessons in locations without conventional AV setup, facilitating their broad utilization.

Latin America Pico Projectors Market Analysis

The pico projectors market in Latin America is witnessing growth owing to the rising individual demand for compact multimedia devices for small-venue entertainment and remote work scenarios. In city areas and regional centers, buyers are adopting compact projection devices for film nights, on-the-go gaming, and streaming without depending on big TVs or stationary screens. The robust tourism and hospitality industries in the area are utilizing these devices for guest entertainment in rooms, event displays, and small conference arrangements. For example, Brazil experienced 3.6 million foreign tourists in the initial half of 2024, highlighting a strong tourism and hospitality sector. Additionally, business and field teams are increasingly utilizing pico projectors for impromptu presentations, workshops, and training sessions where transporting large equipment is inconvenient.

Middle East and Africa Pico Projectors Market Analysis

The pico projectors market in the Middle East and Africa is influenced by the rising penetration of smartphones and mobile internet, which require portable display devices that work with personal electronics. For example, according to the International Trade Administration (ITA), Qatar achieved an internet penetration rate of 99% in 2024. In addition, in 2021, the nation achieved a smartphone penetration rate of 144%. As content watching shifts toward mobile platforms, users are increasingly seeking compact solutions to project videos, games, and presentations from their phones and tablets. The application of pico projectors in religious ceremonies, cultural activities, and traveling film screenings is further bolstering the market growth, enabling adaptable content distribution in outdoor and unconventional venues.

Competitive Landscape:

Leading companies in the market are concentrating on technological advancements to provide superior resolution, better brightness, and enhanced connectivity in compact formats. They are funding research activities to enhance optical efficiency, minimize power usage, and prolong product lifespan. For example, in October 2024, Portronics launched the Pico 13, a 4K UHD DLP portable projector running on Android OS. It featured 3500 lumens brightness, screen mirroring, and a rechargeable battery, making it suitable for entertainment and presentations. Moreover, efforts are underway to establish strategic alliances and collaborations aimed at broadening distribution networks and enhancing global market presence. Firms are expanding their product ranges to address diverse individual and professional demands. Marketing strategies focus on emphasizing portability, versatility, and performance, while manufacturing methods are being optimized to enhance cost-effectiveness and production scalability.

The report provides a comprehensive analysis of the competitive landscape in the pico projectors market with detailed profiles of all major companies, including:

- Lenovo Group Limited

- Aaxa Technologies Inc.

- Texas Instruments

- Acer Inc.

- LG Electronics Inc.

- Microvision Inc.

- Sony Corporation

- ZTE Corporation

- Koninklijke Philips N.V.

- RIF6 LLC

- Celluon Inc.

- Cremotech Co. Ltd.

- Global Aiptek Corporation

- Miroir USA

- Optoma Technology Corporation

Latest News and Developments:

- July 2025: JMGO introduced the PicoPlay range, a novel collection of coffee-cup-sized portable pico projectors designed for modern life. The line features two innovative models, the PicoPlay and PicoPlay+, which combine a small size, strong projection, and built-in social entertainment capabilities.

- May 2025: Kodak launched its new Luma 500 FHD Ultra Smart Pico Projector, a feature-rich, small portable pico projector that can be used both indoors and outdoors. With a slim, palm-sized design and a weight of only 544 grams, the new model is portable and an ideal solution for glamping or spontaneous movie nights.

- February 2025: Pico Genie officially launched the Pico Genie L700, a portable pico projector that blends strong performance and cutting-edge features with cost-efficiency. With its 700 ANSI Lumens of brightness, full HD (1080p) resolution, Smart TV capabilities, and user-friendly auto-setup features, the L700 makes movie nights, light gaming, and even creative art projects a seamless experience.

Pico Projectors Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Digital Light Processing (DLP), Laser Beam Steering, Holographic Laser Projection, Liquid Crystal on Silicon |

| Product Types Covered | Embedded, Non-Embedded |

| Components Covered | Light Source, Illumination System, Projector Lens, Others |

| Compatibilities Covered | Laptop/Desktop, Smartphones, Digital Camera, Portable Media Players, Others |

| Applications Covered | Consumer Electronics, Business & Education, Retail, Healthcare, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Lenovo Group Limited, Aaxa Technologies Inc., Texas Instruments, Acer Inc., LG Electronics Inc., Microvision Inc., Sony Corporation, ZTE Corporation, Koninklijke Philips N.V., RIF6 LLC, Celluon Inc., Cremotech Co. Ltd., Global Aiptek Corporation, Miroir USA, Optoma Technology Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the pico projectors market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global pico projectors market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the pico projectors industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The pico projectors market was valued at USD 4.0 Billion in 2024.

The pico projectors market is projected to exhibit a CAGR of 8.04% during 2025-2033, reaching a value of USD 8.32 Billion by 2033.

The pico projectors market is influenced by increasing demand for portable and lightweight display devices, rise in demand for consumer electronics, the growing adoption in business and education sectors, and advancements in projection technology. Expanding applications in entertainment and personal use, coupled with declining component costs, also contribute to wider market adoption and competitive product development.

North America currently dominates the pico projectors market, accounting for a share of 37.5%. The dominance of the market is attributed to strong technological infrastructure, high user purchasing power, and rapid adoption of advanced display solutions. Supportive industry initiatives, continuous product innovation, and a well-established distribution network further strengthen the region’s position and support consistent market growth.

Some of the major players in the pico projectors market include Lenovo Group Limited, Aaxa Technologies Inc., Texas Instruments, Acer Inc., LG Electronics Inc., Microvision Inc., Sony Corporation, ZTE Corporation, Koninklijke Philips N.V., RIF6 LLC, Celluon Inc., Cremotech Co. Ltd., Global Aiptek Corporation, Miroir USA, Optoma Technology Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)