Plant-Based Beverages Market Size, Share, Trends and Forecast by Type, Product, Distribution Channel, and Region, 2025-2033

Plant-Based Beverages Market Overview:

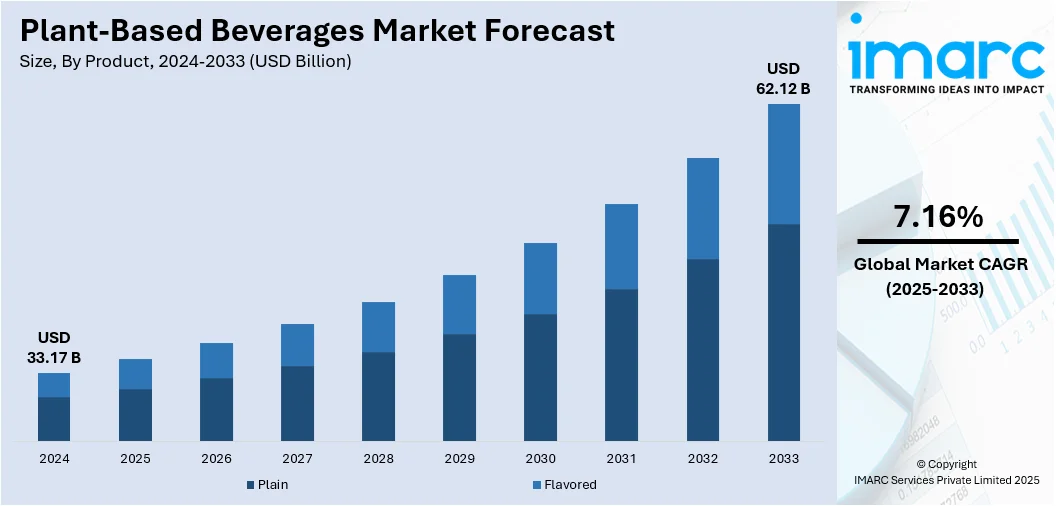

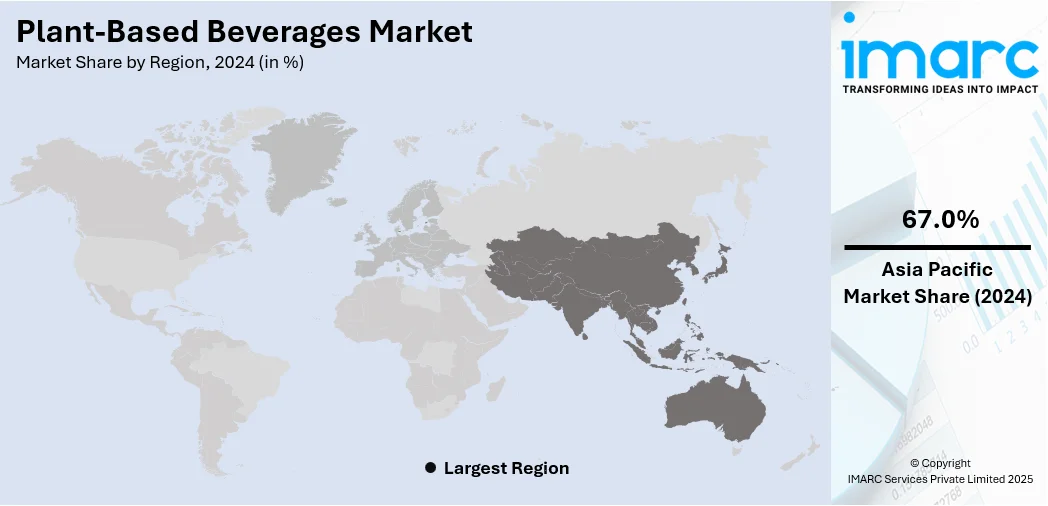

The global plant-based beverages market size was valued at USD 33.17 Billion in 2024. The market is projected to reach USD 62.12 Billion by 2033, exhibiting a CAGR of 7.16% from 2025-2033. Asia-Pacific currently dominates the market, holding a market share of 67.0% in 2024. The growing health and wellness trends, rising preferences for vegan and vegetarian diets, increasing cases of lactose intolerance and dairy allergies, and continuous innovations in product varieties are some of the factors expanding the plant-based beverages market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 33.17 Billion |

| Market Forecast in 2033 | USD 62.12 Billion |

| Market Growth Rate (2025-2033) | 7.16% |

Because more people are becoming aware about the benefits of dairy substitutes, the market is experiencing robust growth. As plant-based beverages like soy milk, oat milk, and coconut-based drinks are considered to be healthier, lactose-free, and frequently lower in calories, people are consuming them. In addition to promoting the adoption of plant-based diets, rising concerns about environmental sustainability and animal cruelty are driving the demand for plant-based beverages. Improved nutritional profiles, better textures, and new flavor developments are positively influencing the market. An increase in the number of flexitarians is also affecting consumer choices, particularly among Gen Z and millennials.

To get more information on this market, Request Sample

The United States has emerged as a major region in the plant-based beverages market owing to many factors. Rising health awareness and evolving dietary preferences are fueling the plant-based beverages market growth. Many individuals are adopting dairy-free and vegan lifestyles due to increasing concerns about lactose intolerance, cholesterol, and animal welfare. The demand for plant-based options like almond, oat, soy, and coconut beverages is rising, as they offer perceived health benefits and align with sustainable living choices. The growing availability of fortified and flavored variants is attracting both health-conscious and mainstream consumers. Additionally, the broadening of retail channels, foodservice outlets, and coffee chains is making plant-based alternatives more accessible in the United States. As per the information provided on the official website of the United States Census Bureau, preliminary estimates of US retail and food services sales for June 2025 totaled USD 720.1 Billion, representing an increase of 0.6% from May 2025 and a rise of 3.9% compared to June 2024.

Plant-Based Beverages Market Trends:

Rising Health and Wellness Trends

The growing health and wellness trends are offering a favorable plant-based beverages market outlook. As per the IMARC Group, the global health and wellness market size reached USD 3,805.84 Billion in 2024. People are becoming concerned about the impact of their diets on their overall well-being. Plant-based beverages are perceived as a healthier alternative to dairy milk due to their lower levels of saturated fats and cholesterol. They are often fortified with essential nutrients like vitamins, minerals, and antioxidants, further enhancing their health appeal. Moreover, the association between dairy consumption and certain health issues, such as concerns about hormones in cow's milk, has led many individuals to seek out non-dairy options. The demand for plant-based beverages is bolstered by the perception that they offer a safer and more health-conscious choice, aligning with the broader global trend of prioritizing personal health and well-being.

Growing Adoption of Vegan and Vegetarian Diets

Ethical considerations related to animal welfare, environmental sustainability, and personal health have motivated a growing number of individuals to embrace plant-based eating. For instance, 6.4% of UK adults are set to follow a vegan diet in 2025, an estimated 3.4 Million people, including 2.1% who are already vegan. These diets exclude dairy products, making plant-based beverages a natural and nutritious replacement. Veganism, in particular, has gained momentum as a lifestyle choice that abstains from all animal-derived products, including dairy. This demographic shift has led to a surge in the demand for non-dairy milk alternatives, such as almond, soy, and oat milk. Additionally, plant-based beverages often offer plant protein sources, appealing to those seeking protein-rich options within vegan and vegetarian diets. As these dietary trends continue to gain traction, the plant-based beverages market is expected to flourish.

Increasing Cases of Lactose Intolerance and Dairy Allergies

Rising cases of lactose intolerance and dairy allergies are among the major plant-based beverages market trends. As per the World Population Review 2025 data, approximately 65% of adults around the world experienced lactose intolerance. Lactose intolerance is characterized by the body's inability to digest lactose, the sugar found in dairy products, leading to digestive discomfort. More cases of lactose intolerance are encouraging manufacturers to focus on developing lactose-free dairy options. Besides this, dairy allergies involve adverse reactions to proteins in milk of cow, often resulting in allergic symptoms like hives, gastrointestinal distress, and anaphylaxis. Plant-based beverages, being naturally lactose-free and devoid of common dairy allergens, provide a safe and palatable alternative for individuals with these conditions. They offer a way to enjoy milk-like beverages without experiencing the adverse effects associated with traditional dairy. This accessibility to a broader consumer base with dietary restrictions has significantly expanded the market for plant-based beverages, making them a staple in many households and foodservice establishments.

Plant-Based Beverages Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global plant-based beverages market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, product, and distribution channel.

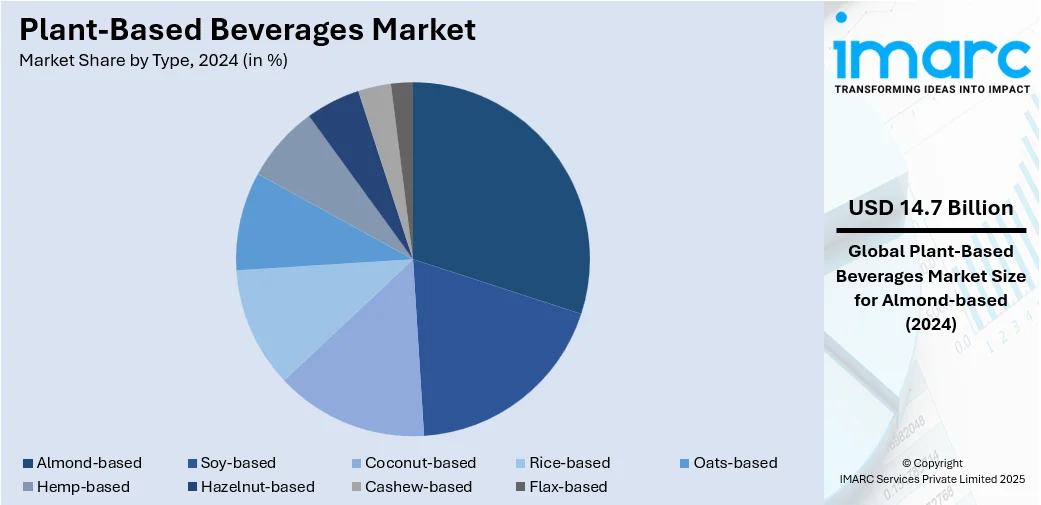

Analysis by Type:

- Soy-based

- Coconut-based

- Almond-based

- Rice-based

- Oats-based

- Hemp-based

- Hazelnut-based

- Cashew-based

- Flax-based

Almond-based held 44.2% of the market share in 2024. It is widely recognized for its nutritional value. Almond milk is naturally low in saturated fats and cholesterol while being a good source of vitamins and essential minerals like calcium. This nutritional profile aligns with the health-conscious desire of consumers for a dairy alternative that not only tastes good but also offers potential health benefits. Additionally, almonds have a mild, neutral flavor that makes almond-based beverages versatile. They can be used in a wide range of culinary applications, including coffee, smoothies, cereal, baking, and cooking. This adaptability has contributed to their popularity and widespread adoption in both household and commercial settings. Other than this, almonds are sustainable to cultivate, requiring less water compared to some other nut crops. This aligns with the growing user interest in environment friendly items, further boosting the appeal of almond-based beverages. Moreover, almond milk caters to a broad audience, including those with lactose intolerance, dairy allergies, and vegans. As per the plant-based beverages market forecast, with the broadening of e-commerce portals and rising marketing efforts, almond-based beverages will continue to lead the industry.

Analysis by Product:

- Plain

- Flavored

Plain holds a significant share of the market, as its appeal lies in its simplicity, making it suitable for those who want to avoid added sugars or artificial flavors in their diets. It often serves as a base for customizing flavors at home, allowing people to control the sweetness and flavorings according to their preferences. Moreover, plain plant-based beverage is a preferred choice for individuals who have specific dietary restrictions, such as those with allergies or sensitivities to certain ingredients, as they provide a clean and allergen-free option.

Flavored offers a convenient and enjoyable way to transition from dairy milk to plant-based alternatives, as it can replicate the familiar taste experiences associated with traditional dairy. Flavored plant-based beverage is infused with various natural savors, such as vanilla, chocolate, strawberry, and coffee, to enhance taste and appeal to a wider range of consumer palates. Additionally, it often comes sweetened to different degrees, catering to those with a preference for sweeter beverages. It is commonly used as a standalone drink in breakfast cereals and as a flavorful addition to smoothies and coffee.

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Stores

Supermarkets and hypermarkets are pivotal distribution channels for plant-based beverages. These large retail establishments offer a wide range of brands and product varieties under one roof, making them highly convenient for people. The sheer size and purchasing power of these stores enable them to carry a diverse selection of plant-based beverages, catering to a broad customer base. Shoppers often appreciate the accessibility and competitive pricing found in these stores, making them a primary destination for their regular grocery needs.

Convenience stores play a crucial role in the distribution of plant-based beverages, particularly for on-the-go consumers. These smaller retail outlets are strategically located for quick and easy access. They offer a selection of ready-to-drink (RTD) plant-based beverages in single-serving containers, making them ideal for individuals seeking a convenient and portable refreshment option. As the demand for convenient and healthier beverage choices is growing, convenience stores are stocking plant-based options to meet the requirements of busy consumers.

Specialty stores, such as health food stores and organic markets, cater to a niche audience of health-conscious and specialty diet consumers. These stores often prioritize organic and unique product offerings, making them a preferred destination for plant-based enthusiasts seeking high-quality, specialty plant-based beverages. Specialty stores provide a curated selection of items, including artisanal and small-batch brands, appealing to individuals with specific dietary preferences and a strong focus on product quality and sourcing.

Online stores hold a considerable share of the market because of their practicality, wide product availability, and ability to cater to specific dietary preferences. They allow people to explore a broad range of options, compare ingredients, read reviews, and access numerous products not always found in physical stores. Subscription services and home delivery also enhance consumer loyalty and repeat purchases. Additionally, targeted digital marketing and influencer collaborations on social media are driving awareness and sales, especially among health-conscious and tech-savvy individuals.

Analysis by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia-Pacific, accounting for a share of 67.0%, enjoys the leading position in the market. The region boasts a massive and diverse population, with a rising middle class. This demographic shift has led to increased consumer spending power and a growing interest in health and dietary choices. The sheer size of this market is creating substantial opportunities for plant-based beverage manufacturers. Additionally, numerous countries in the area have a rich history of plant-based diets, influenced by cultural practices, such as Buddhism and Hinduism. Rising interest in plant-based foods and vegan diets has laid a strong foundation for the adoption of plant-based beverages. A 2024 survey revealed that 98% of Chinese consumers planned to increase their intake of vegan food items upon learning about the advantages of a vegan diet. Other than this, a significant portion of the Asian population is lactose intolerant. As a result, there is a natural inclination towards non-dairy milk alternatives like soy milk, almond milk, and coconut milk, which are well-suited to the dietary needs of lactose-intolerant individuals. Besides this, the growing awareness about health and wellness, particularly in urban areas, is encouraging the shift towards healthier lifestyles and dietary choices. Plant-based beverages are perceived as a better alternative to traditional dairy, aligning with these evolving consumer preferences.

Key Regional Takeaways:

North America Plant-Based Beverages Market Analysis

The North America plant-based beverages market is primarily driven by growing awareness about health, wellness, and sustainability. An increasing number of individuals are shifting towards dairy alternatives due to lactose intolerance, vegan preferences, and concerns about animal welfare. People are actively seeking nutritious options with lower cholesterol, fewer calories, and added health benefits, due to the rising incidence of obesity and diabetes, which is making plant-based beverages like almond milk and soy milk attractive choices. The market is also benefiting from the increasing adoption of clean-label items. Urban population with busy lifestyles prefers RTD functional beverages that offer convenience without compromising on nutrition. Major food and beverage (F&B) companies in North America are investing in new product development, fortification, and flavor innovations to meet evolving consumer preferences. Retail giants and online platforms are increasing shelf space and visibility for plant-based drinks, enhancing market penetration. The popularity of fitness trends and plant-forward diets, such as flexitarianism, is further boosting the employment of plant-based beverages. With rising internet penetration, aggressive online advertising strategies and endorsements by health experts and influencers are increasing product awareness. As per the statistics released by EMarketer, in 2024, 90.0% of people in North America were expected to use the internet.

United States Plant-Based Beverages Market Analysis

The United States holds 84.30% of the market share in North America. The United States has witnessed an increase in plant-based beverage adoption due to rising health and wellness trends, as people are shifting towards clean-label products, reduced sugar intake, and nutrient-dense beverage alternatives. According to a study published in June 2024 by Research! America, in partnership with the American Heart Association, as many as 77% of people wanted to have a healthier diet. This movement aligns with heightened awareness about obesity, heart health, and digestive wellness, which is encouraging more people to explore non-dairy and fortified plant-based drinks. The health and wellness trends have also driven food manufacturers and diagnostic providers to invest in personalized nutrition and allergen detection, enabling tailored plant-based solutions. As health-focused lifestyles are becoming mainstream, diagnostic innovations supporting plant-based beverages are gaining momentum, helping people make informed choices. Animal welfare considerations are also influencing this trend, especially among millennials and Gen Z, who are more vocal about ethical sourcing and cruelty-free products. Food innovation plays a key role as companies experiment with improved taste, texture, and nutritional profiles, making dairy alternatives more appealing.

Europe Plant-Based Beverages Market Analysis

In Europe, the market is expanding, fueled by the growing influence of online e-commerce platforms. For instance, by 2029, Europe will feature 485.6 Million individuals making purchases online. Digital retail channels are expanding the reach of plant-based products across demographics, offering access to a broader variety of beverages. E-commerce has enabled better brand visibility, targeted promotions, and doorstep delivery of niche dairy alternatives. Convenience and comparison tools are supporting informed purchase decisions for people interested in sustainability and clean ingredients. The growing online e-commerce infrastructure has facilitated the entry of both established and emerging brands into the plant-based segment. Influencer marketing and online reviews are significantly impacting consumer behavior. A surge in environmental awareness is also motivating people to opt for eco-friendly products with lower carbon footprints, including drinks made from oats, almonds, soy, and coconut. The demand for organic and clean-label products is rising, encouraging manufacturers to focus on transparent ingredient sourcing and minimal processing. Supermarkets and convenience stores are dedicating more shelf space to plant-based drinks, improving accessibility.

Asia-Pacific Plant-Based Beverages Market Analysis

The Asia-Pacific region is experiencing a surge in plant-based beverage adoption, influenced by the rise in vegan and vegetarian diets. According to World Animal Foundation statistics, in 2024, India ranked first as a vegetarian country, with an estimated 42% of the population practicing vegetarianism. Shifting dietary preferences are driving the demand for dairy-free alternatives as younger generations increasingly avoid animal-based products. The rise in vegan and vegetarian diets has been fueled by cultural values, environmental concerns, and social media influence, reinforcing a plant-forward lifestyle. The growing awareness about animal welfare and plant protein benefits is also encouraging people to switch from traditional dairy to soy, almond, and rice-based drinks. Urban population growth and foodservice expansion are further amplifying this dietary trend.

Latin America Plant-Based Beverages Market Analysis

Latin America is showing growth in plant-based beverage consumption owing to rising urbanization, an expanding middle class, and increasing disposable incomes. For instance, Latin America and the Caribbean experienced swift urbanization, establishing itself as one of the most urbanized areas globally. In 2022, 82% of individuals resided in urban regions, while the worldwide average was 58%. These socioeconomic shifts are influencing lifestyle preferences towards convenient and healthier beverage alternatives. Rising urbanization is also fostering modern retail environments that stock plant-based options.

Middle East and Africa Plant-Based Beverages Market Analysis

The Middle East and Africa region is observing growing plant-based beverage adoption, driven by the expansion of supermarkets and hypermarkets. For instance, there were 2,370 supermarkets in the UAE, as of May 2025, which was a 3.58% increase from 2023. These large retail formats are increasingly stocking diverse plant-based beverage options, enabling better visibility and accessibility. The growing presence of supermarkets and hypermarkets is helping educate people about dairy-free alternatives, thereby enhancing trial and repeat purchases of such items.

Competitive Landscape:

Key players are continuously innovating, investing in product development, and expanding distribution channels. These companies are introducing new flavors, functional ingredients, and fortified options to cater to evolving preferences. By launching targeted marketing campaigns, they are generating awareness about the benefits of plant-based drinks and influencing consumer choices. Leading brands are also partnering with supermarkets, e-commerce platforms, and foodservice providers to improve product accessibility and visibility. Their investments in sustainability resonate with eco-conscious buyers. Moreover, mergers, acquisitions, and collaborations with startups help key players diversify offerings and stay competitive. Their ability to scale production, maintain consistent quality, and adapt to trends is significantly shaping the growth and global reach of the market. For instance, in April 2025, Minor Figures introduced Hyper Oat, a range of functional oat drinks, to address the increasing demand for plant-based beverages that promoted wellness and aided autoimmune conditions. The collection, featuring flavors like Turmeric and Matcha, included ingredients, such as Vitamin D and adaptogens, in line with health-oriented trends.

The report provides a comprehensive analysis of the competitive landscape in the plant-based beverages market with detailed profiles of all major companies, including:

- Blue Diamond Growers

- Califia Farms LLC

- Coca-Cola HBC

- Danone

- Drink Koia Online

- Harmless Harvest

- Noumi Ltd.

- PureHarvest

- Ripple Foods

- SunOpta

- Vitasoy International Holdings Ltd

Latest News and Developments:

- July 2025: Danone's Alpro introduced fortified plant-based yogurts and drinks for children, targeting health-aware parents and dietary requirements associated with autoimmune conditions. The dairy-free offerings launched in ASDA included oat and soya-based choices that were rich in nutrients, with lower sugar content and no artificial additives.

- June 2025: Country Delight released a new oat-based drink and ventured into the plant-based sector, highlighting its possible advantages for controlling autoimmune conditions. The brand marketed the beverage as a natural option that could aid those with such health issues via improved nutrition.

- May 2025: Novonesis introduced Vertera Velvet to elevate plant-based beverages by enhancing foam quality and texture, especially for coffee uses. The component tackled frequent problems, such as curdling and inadequate foam, which had earlier created obstacles for users, including individuals with autoimmune conditions looking for dairy-free options.

- May 2025: Asahi unveiled Japan's inaugural yeast-derived dairy-free drink, ‘LIKE MILK,’ omitting all 28 primary allergens to assist people with allergies and autoimmune conditions. The product was developed with exclusive yeast technology and provided nutritional advantages comparable to conventional milk.

Plant-Based Beverages Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Soy-based, Coconut-based, Almond-based, Rice-based, Oats-based, Hemp-based, Hazelnut-based, Cashew-based, Flax-based |

| Products Covered | Plain, Flavored |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Stores |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Blue Diamond Growers, Califia Farms LLC, Coca-Cola HBC, Danone, Drink Koia Online, Harmless Harvest, Noumi Ltd., PureHarvest, Ripple Foods, SunOpta, Vitasoy International Holdings Ltd, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the plant-based beverages market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global plant-based beverages market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the plant-based beverages industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The plant-based beverages market was valued at USD 33.17 Billion in 2024.

The plant-based beverages market is projected to exhibit a CAGR of 7.16% during 2025-2033, reaching a value of USD 62.12 Billion by 2033.

The growing preferences for dairy alternatives among the lactose-intolerant and vegan population are promoting the use of plant-based beverages. Ecological concerns linked to animal-based products are further encouraging people to opt for plant-derived options. Additionally, the availability of diverse flavors, improved taste profiles, and nutritional benefits in almond, oat, soy, and rice-based drinks is attracting more buyers.

Asia-Pacific currently dominates the plant-based beverages market, accounting for a share of 67.0% in 2024, due to its large population, traditional consumption of plant-based drinks like soy and rice milk and increasing health awareness. High demand for dairy alternatives is further supporting the region’s dominance in the market.

Some of the major players in the plant-based beverages market include Blue Diamond Growers, Califia Farms LLC, Coca-Cola HBC, Danone, Drink Koia Online, Harmless Harvest, Noumi Ltd., PureHarvest, Ripple Foods, SunOpta, Vitasoy International Holdings Ltd, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)