Plant-Based Meat Market Size, Share, Trends and Forecast by Product Type, Source, Meat Type, Distribution Channel, and Region, 2025-2033

Plant-Based Meat Market Size and Share:

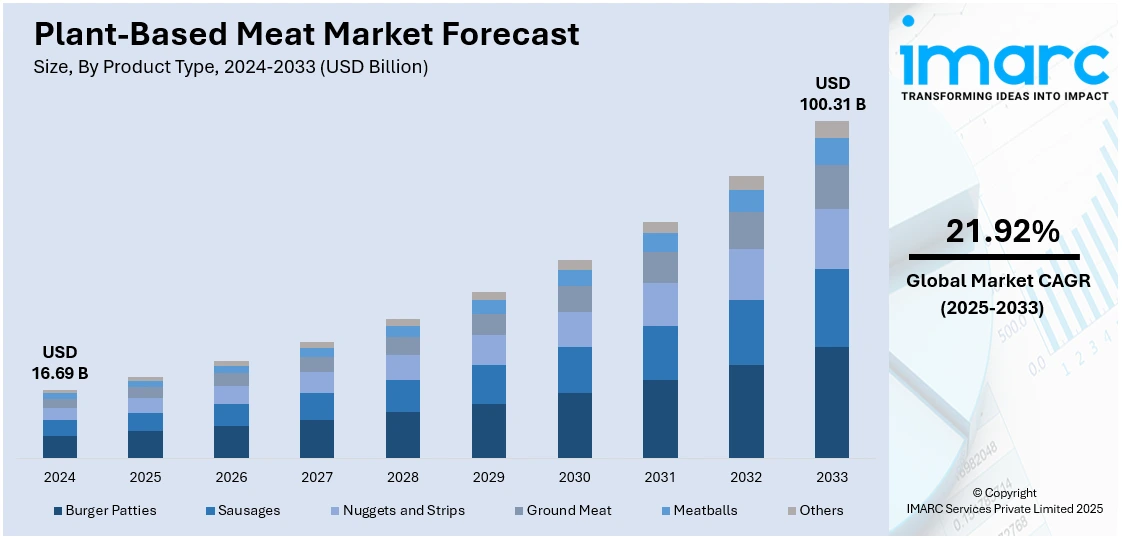

The global plant-based meat market size was valued at USD 16.69 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 100.31 Billion by 2033, exhibiting a CAGR of 21.92% from 2025-2033. North America currently dominates the market, holding a market share of 36.2% in 2024. The market is witnessing significant growth mainly due to the shifting dietary habits, rising environmental concerns, and growing demand for sustainable protein alternatives, along with increasing product innovation and retail penetration further accelerating adoption and influencing overall plant-based meat market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 16.69 Billion |

| Market Forecast in 2033 | USD 100.31 Billion |

| Market Growth Rate 2025-2033 | 21.92% |

The market for plant-based meat is fueled by a surge in consumer interest in sustainable and ethical dietary options, heightened awareness of the ecological effects of livestock farming, and rising concerns about health and eating habits. Improvements in food technology have enhanced the flavor and texture of plant-based products, making them more attractive to a broader audience. For instance, in July 2024, Plantaway launched India’s first plant-based chicken fillet, the Chick’n Fillet, made from pea protein and offering 19g of protein per pack. With no trans fats or preservatives, it targets health-conscious consumers. Available online and through delivery platforms, Plantaway aims to revolutionize the plant-based food market in India. Expanding retail availability, support from food service chains, and marketing targeting flexitarians are further fueling interest and accelerating the plant-based meat market growth.

The United States plant-based meat market is driven by shifting consumer preferences toward healthier and more sustainable diets, particularly among millennials and flexitarians. Increased availability of plant-based options in grocery stores, quick-service restaurants, and meal delivery services has boosted accessibility. For instance, in June 2024, Tender Food, a Massachusetts-based plant-based meat company, raised $11M in Series A funding led by Rhapsody Venture Partners. The investment will enhance production and product development. Additionally, Tender secured a deal with Clover Food Lab to feature its innovative vegan meats in all 13 restaurant locations around Boston. Innovation in product formulation has enhanced taste, texture, and protein content, narrowing the gap with traditional meat. Health concerns, climate awareness, and ethical considerations continue to shape purchasing decisions, supporting steady growth in the United States plant-based meat market.

Plant-Based Meat Market Trends:

The Growing Number of Health-Conscious Individuals

The expanding flexitarian and vegetarian population, accounting for around 4.98 Million vegetarians worldwide, who aim to minimize the risk of chronic diseases, is augmenting the use of plant-based meat. In addition, out of these, 3.8 Million were from India, a country where individuals generally prefer to consume meat-like texture products as a healthy alternative to meat. Furthermore, the growing expatriate population in numerous countries and the elevating number of new start-ups, including Fazenda Futuro, KBW ventures, Vbites, etc., are attracting customers towards plant-based meat, which is acting as another significant growth-inducing factor.

The Rising Need for Environmental Sustainability

In a survey conducted in the U.S., 71% of consumers were concerned about climate change, and 67% were conscious of the impact of food production on climate change. In addition to this, 47% of the respondents preferred plant-based meat, as it generates less carbon dioxide emissions and has a significantly less environmental impact when compared to animal meat. Consequently, the widespread adoption of sustainable practices is also positively influencing the purchasing decisions of consumers across the globe. Moreover, one research study used life cycle assessment (LCA), where ground beef was replaced by plant-based protein sources. The substitution of 25%, 10%, and 50% of ground beef with plant-based burgers at the national scale resulted in reductions in annual GHG emissions, water consumption, and land occupation. This, in turn, will bolster the future of the plant-based meat industry.

The Increasing Animal Welfare and Ethical Considerations

The growing concerns among individuals across the globe about the living conditions and treatment of animals in industrial farming systems are acting as significant growth-inducing factors. This has prompted individuals to seek alternatives that do not contribute to such practices. Moreover, government bodies across the globe are promoting the use of labels. For example, according to the survey, labels, such as “organic,” “natural,” and “locally produced,” were perceived as conveying a positive impact on climate change, with around a 42% share. Also, as stated by the Good Food Institute, the Food Safety and Standards Authority of India (FSSAI) is setting a regulatory framework for the approval of cell-based foods, including cultivated meat and seafood. Also, BECA, a committee on treating cancer, is promoting plant-based meat products as an alternative to meat consumption, owing to the increasing mortality rate of cancer, accounting for 1.9 Million deaths.

The Elevating Popularity of Plant-Based Meat Variants

The rising emergence of textured vegetable protein (TVP) that is prepared from various sources, including soy, wheat, peas, etc., is acting as another significant growth-inducing factor. For example, among women, a soy-rich diet is scientifically proven to pose a lower risk of breast cancer, which affects approximately 2.3 Million women worldwide. Consequently, tempeh is widely used, as it is often fortified with vitamin B12, which is not bioavailable in plant-based foods, making it an alternative to animal-derived meat accommodated in their diet plan. This is expected to contribute positively to plant-based meat market outlook across the world.

Plant-Based Meat Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global plant-based meat market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, source, meat type, and distribution channel.

Analysis by Product Type:

- Burger Patties

- Sausages

- Nuggets and Strips

- Ground Meat

- Meatballs

- Others

Burger patties stand as the largest product type in 2024, holding around 31.8% of the market. The increasing demand for plant-based burger patties as alternatives to traditional meat options like chicken, beef, and pork is a significant factor driving market growth. These patties closely mimic the texture and consistency of meat, are high in protein, easily accessible, and can be prepared quickly. For instance, Beyond Meat launched its Beyond Burger 3.0, crafted from a mix of mung beans, peas, and rice. The company has also collaborated with fast food giants like KFC, McDonald's, and Taco Bell to introduce plant-based items on their menus. In a similar vein, Nestle has created the Awesome Burger in the U.S., which combines soy and wheat protein. Additionally, the company plans to launch a plant-based tuna product under its well-known Garden Gourmet brand.

Analysis by Source:

- Soy

- Wheat

- Peas

- Others

Soy leads the market with around 33.2% of market share in 2024. The rising popularity of soy-based meat alternatives, due to their capability to mimic the flavor and consistency of traditional meats, is driving growth in the global market. For instance, approximately half of the soybean consumption in Indonesia is utilized for tempeh. It is anticipated that the demand for imported soybeans necessary for producing soy-based products, such as tempeh, in Indonesia will escalate to 3 million metric tons annually.

Analysis by Meat Type:

- Chicken

- Beef

- Pork

- Others

Beef leads the market with around 35.8% of market share in 2024. The rising popularity of plant-based beef reflects a change in consumer dietary choices. Many people are still looking for meat-centered meals but prefer more ethical and sustainable options. As a result, companies are launching these alternatives, contributing to market expansion. For instance, Beyond Meat has created steak and bacon substitutes to complement its current range of vegan sausage and beef products for flexitarian customers.

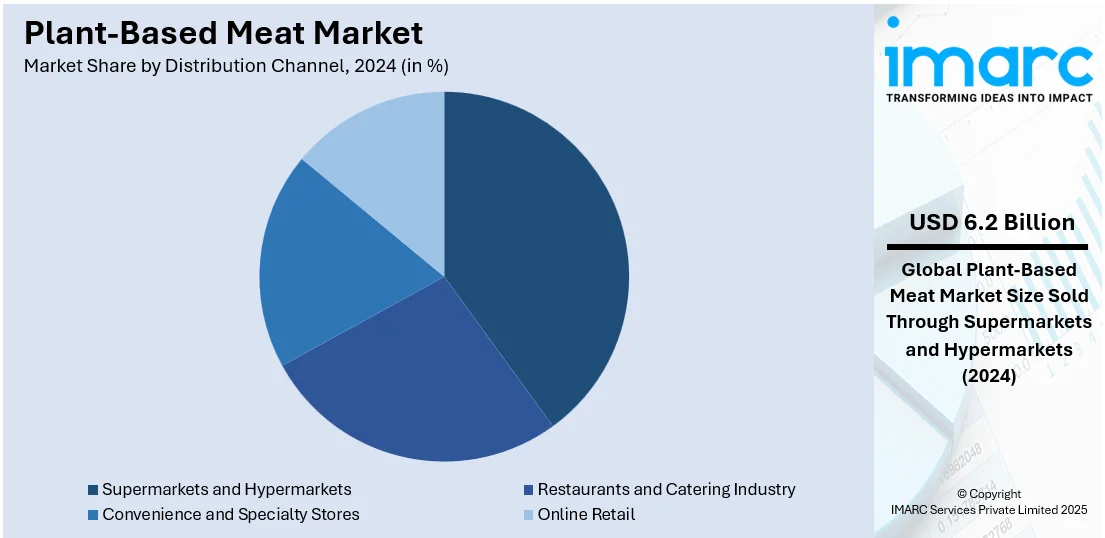

Analysis by Distribution Channel:

- Restaurants and Catering Industry

- Supermarkets and Hypermarkets

- Convenience and Specialty Stores

- Online Retail

Supermarkets and hypermarkets leads the market with around 36.9% of market share in 2024. The increasing availability of plant-based meat in grocery stores and large retail chains is contributing to market growth by enabling ethical and sustainable purchasing decisions. These retail outlets provide ample shelf space, employ promotional tactics, and offer a wide variety of brands and products, making them the go-to shopping destination. Strategies such as in-store samples, discounts, and marketing campaigns centered on health also draw in curious and health-minded shoppers.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- United Kingdom

- Germany

- Italy

- France

- Netherlands

- Sweden

- Others

- Asia Pacific

- China

- Australia

- South Korea

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

- Turkey

- Saudi Arabia

- UAE

- Others

In 2024, North America accounted for the largest market share of over 36.2%. According to the plant-based meat market research report, North America leads the market due to the growing consumer awareness towards environmental sustainability is promoting various players to develop restaurants that offer plant-based meat products. For example, Amy's Kitchen Inc., a manufacturer of vegetarian and vegan foods based in the US, launched its third plant-based and vegan-friendly “Amy’s Drive-Thru” restaurant in Walnut Creek, California. The region also benefits from strong retail infrastructure and high demand for clean-label, meat-free alternatives. Government support for sustainable food initiatives is further reinforcing market expansion.

Key Regional Takeaways:

United States Plant-Based Meat Market Analysis

In 2024, the United States accounted for over 77.80% of the plant-based meat market in North America. The United States is witnessing a significant rise in the popularity of plant-based meat, largely due to the growth of the online eCommerce sector. Recent reports indicate that eCommerce sales in the U.S. have been on a steady upward trajectory for over ten years, reaching an all-time high of $1.12 trillion in 2023. This marks a 330% increase from $341.4 billion in 2013. Digital platforms are enhancing the availability of plant-based meat products, providing a variety of choices that appeal to health-conscious and environmentally responsible consumers. Subscription-based meal kits and direct-to-consumer brands are capitalizing on the digital marketplace, enhancing convenience and product variety. Online marketing strategies, including targeted advertising and influencer endorsements, are amplifying consumer awareness. Additionally, advancements in cold chain logistics ensure efficient delivery, addressing concerns about product freshness. The rising preference for quick and contactless purchases supports the demand for plant-based meat through digital channels. Competitive pricing, promotional discounts, and user-friendly interfaces further strengthen the online eCommerce sector’s role in market growth.

Asia Pacific Plant-Based Meat Market Analysis

Asia-Pacific is witnessing rising plant-based meat adoption, influenced by the expanding supermarkets and hypermarkets sector. According to reports, there are 66,225 supermarkets in India as of January 23, 2025, which is an 3.88% increase from 2023. Retail chains are increasingly dedicating shelf space to plant-based alternatives, appealing to evolving dietary preferences. In-store promotions, dedicated plant-based food aisles, and exclusive product launches are enhancing consumer engagement. The growing supermarket and hypermarket infrastructure supports wider distribution, ensuring accessibility across urban and suburban areas. Enhanced cold storage capabilities contribute to preserving product quality, encouraging frequent restocking. Retail chains are also forming strategic collaborations with plant-based meat brands to introduce private-label offerings, fostering market expansion. The shift toward convenient, ready-to-cook alternatives aligns with the preferences of modern consumers seeking healthier options. Loyalty programs, discounts, and promotional campaigns drive consumer interest, reinforcing supermarket and hypermarket influence on purchasing decisions.

Europe Plant-Based Meat Market Analysis

Europe is witnessing strong plant-based meat adoption, supported by the growth of the food processing sector. According to reports, in 2020, there were 291,000 enterprises in the EU processing food and beverages. Innovations in food technology and ingredient sourcing are enabling manufacturers to develop plant-based alternatives with improved taste, texture, and nutritional profiles. The rising demand for processed and packaged plant-based foods is encouraging companies to invest in advanced production techniques. Expansion in food processing facilities is driving mass production capabilities, enhancing affordability and market penetration. The introduction of new formulations, including alternative protein sources and fortification with essential nutrients, is attracting health-conscious consumers. Companies are also utilizing sustainable packaging solutions, aligning with environmental concerns. The food processing sector’s role in diversifying product portfolios is broadening consumer choices, making plant-based meat more appealing.

Latin America Plant-Based Meat Market Analysis

Latin America is witnessing an increase in the popularity of plant-based meat, driven by a rise in disposable income. As of December 2024, Brazil's households reported a disposable income of around USD 127,664 million, which reflects a growth from approximately USD 121,298 million in November 2024.Higher purchasing power is allowing consumers to explore alternative protein sources beyond conventional meat. Economic improvements are driving interest in premium plant-based options that align with health and wellness trends. The affordability of plant-based meat is increasing as demand scales, making it a viable choice for a larger consumer base. Improved financial stability is encouraging consumers to experiment with new dietary choices, accelerating the shift toward plant-based alternatives.

Middle East and Africa Plant-Based Meat Market Analysis

The Middle East and Africa are witnessing a rise in the popularity of plant-based meat, largely fueled by the hospitality sector's expansion and increasing tourism. For example, from January to October 2024, Dubai attracted 14.96 million overnight visitors, representing an 8% increase from the same timeframe in 2023, which underscores significant tourism growth. To cater to diverse dietary needs, hospitality businesses are enhancing their menus to include a variety of plant-based options. The rising influx of international tourists is encouraging restaurants and catering services to introduce innovative plant-based dishes. Culinary establishments are incorporating plant-based meat to attract health-conscious travellers and accommodate shifting food preferences. The increasing prominence of plant-based cuisine in fine dining and casual restaurants is elevating consumer acceptance.

Competitive Landscape:

The plant-based meat market is witnessing rising competition as numerous companies enter the space with innovative product lines catering to health-conscious and environmentally aware consumers. Firms are investing heavily in research to improve taste, texture, and nutritional profiles, aiming to match or exceed traditional meat standards. Marketing strategies are increasingly focused on flexitarian buyers rather than just vegetarians or vegans. Private labels and foodservice collaborations are also intensifying rivalry. Regional expansion, pricing strategies, and retail visibility remain key differentiators. As demand grows globally, these competitive efforts are shaping the overall plant-based meat industry size and influencing future market dynamics.

The report provides a comprehensive analysis of the competitive landscape in the plant-based meat market with detailed profiles of all major companies, including:

- Beyond Meat Inc.

- Gooddot

- Impossible Foods, Inc.

- Kellanova

- Maple Leaf Foods Inc.

- Moving Mountains

- Ojah B.V.

- Sunfed

- The Kraft Heinz Company

- The Vegetarian Butcher

- Tofurky

- VBites Foods

- Yves Veggie Cuisine (The Hain-Celestial Canada, ULC)

Latest News and Developments:

- March 2025: CV Sciences, Inc. entered the plant-based food market with the launch of Lunar Fox Food Co., a new brand offering a range of plant-based, gluten-free products aimed at health-conscious consumers. The Lunar Fox lineup features innovative offerings such as CHEDDRLY MAC!, a vegan mac and cheese; WHISKED!, a plant-based egg substitute; and MANGIA!, a meatless alternative to beef inspired by Italian cuisine. The launch marks CV Sciences' strategic diversification beyond its core health and wellness portfolio into the growing plant-based food segment.

- March 2025: Schouten Europe, a leading Dutch company in plant-based protein products, has introduced two new snacks, Power Bites and Sea Bites as part of its strategy to revive consumer interest in plant-based meat and fish alternatives. The launch comes amid a broader industry slowdown, with the company positioning these products to cater to evolving consumer preferences for healthier, sustainable, and convenient snack options. Schouten stated that this initiative aligns with its ongoing mission to bring innovation and renewed momentum to the plant-based food segment.

- November 2024: Beyond Meat launched Beyond Sun Sausage™ nationwide at Whole Foods Market after a successful debut. Unlike traditional meat alternatives, it offers a unique plant-based protein made with spinach, bell peppers, and legumes. The Pesto flavor is available nationwide, with Cajun rolling out in select stores.

- July 2024: UNLIMEAT launched its K-Vegan plant-based products in 149 GIANT and MARTIN'S stores. The lineup includes Korean BBQ Bulgogi, Pulled Pork, and frozen kimbap, catering to growing plant-based demand. This expansion brings authentic Korean-inspired vegan meals to the U.S. market.

- March 2024: The Kraft Heinz Not Company LLC launched Oscar Mayer NotHotDogs and NotSausages, its first plant-based meat products. This marks the debut of plant-based Oscar Mayer offerings, combining Kraft Heinz and NotCo’s expertise. The new products deliver the classic savory, smoky flavor fans love.

- March 2024: Chunk Foods, a biotechnology firm, launched a new range of plant-based meats, including a 6-oz steakhouse cut, 4-oz steak, and pulled meat. These products are crafted from cultured soy and wheat protein, providing a texture similar to traditional meat. Fortified with B12 and iron, they aim to offer a nutritious alternative for consumers seeking plant-based options.

Plant-Based Meat Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Burger Patties, Sausages, Nuggets and Strips, Ground, Meat, Meatballs, Others |

| Sources Covered | Soy, Wheat, Peas, Others |

| Meat Types Covered | Chicken, Beef, Pork, Others |

| Distribution Channels Covered | Restaurants and Catering Industry, Supermarkets and Hypermarkets, Convenience and Specialty Stores, Online Retail |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, Italy, France, Netherlands, Sweden, China, Australia, South Korea, Brazil, Mexico, Turkey, Saudi Arabia, UAE |

| Companies Covered | Beyond Meat Inc., Gooddot, Impossible Foods, Inc., Kellanova, Maple Leaf Foods Inc., Moving Mountains, Ojah B.V., Sunfed, The Kraft Heinz Company, The Vegetarian Butcher, Tofurky, VBites Foods, Yves Veggie Cuisine (The Hain-Celestial Canada, ULC), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the plant-based meat market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global plant-based meat market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the plant-based meat industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The plant-based meat market was valued at USD 16.69 Billion in 2024.

The plant-based meat market is projected to reach USD 100.31 Billion by 2033, exhibiting a CAGR of 21.92% from 2025-2033.

Key factors driving the plant-based meat market include rising health awareness, demand for sustainable food options, concerns over animal welfare, and growing adoption of flexitarian diets. Technological advancements improving taste and texture, along with wider retail availability, are further accelerating consumer interest and market expansion.

North America currently dominates the plant-based meat market, driven by rising health consciousness, strong retail presence, and sustainability-focused consumer behavior.

Some of the major players in the plant-based meat market includes Beyond Meat Inc., Gooddot, Impossible Foods, Inc., Kellanova, Maple Leaf Foods Inc., Moving Mountains, Ojah B.V., Sunfed, The Kraft Heinz Company, The Vegetarian Butcher, Tofurky, VBites Foods, Yves Veggie Cuisine (The Hain-Celestial Canada, ULC), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)