Plating on Plastics Market Size, Share, Trends and Forecast by Plastic Type, Plating Type, Application, Plastic Type, Plating Type, Application, and Region, 2025-2033

Plating on Plastics Market Size and Share:

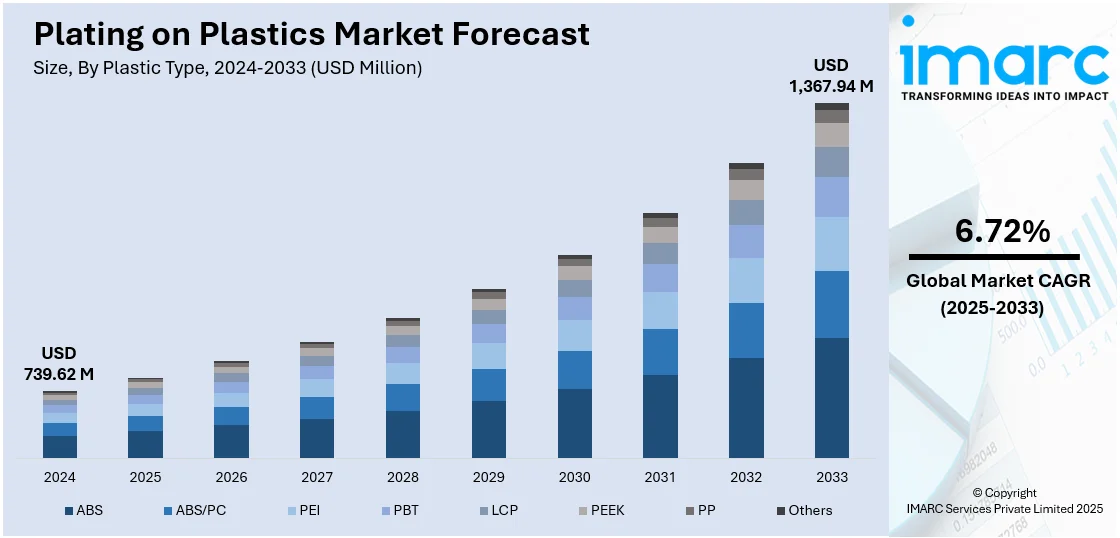

The global plating on plastics market size was valued at USD 739.62 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,367.94 Million by 2033, exhibiting a CAGR of 6.72% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 55.3% in 2024. The market is majorly driven by the rapid product utilization in the construction sector, an increasing demand for electronics and consumer goods products, advancements in plating technology that improve adhesion and finish, and the widespread product adoption in the automotive sector to enhance the appearance of vehicles.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 739.62 Million |

|

Market Forecast in 2033

|

USD 1,367.94 Million |

| Market Growth Rate (2025-2033) | 6.72% |

The market is influenced by several driving factors, such as the increasing requirement for light, strong, and corrosion-resistant parts in automotive, electronics, and consumer goods industries. With manufacturers aiming to improve the functionality and appearance of plastic components, plating on plastics market trends highlight the rising use of cost-saving solutions for decorative and functional parts. The growing demand for high-performance plastic substrates for use in advanced electronics and automotive components, including connectors, switches, and trim, is also pushing the market forward. Furthermore, the surging demand for environmentally friendly and sustainable products has prompted the creation of new, environmentally friendly plating technologies.

In the United States, the POP market is witnessing high growth, driven by strong demand from the automotive, electronics, and consumer durable industries. For instance, as per industry reports, in 2024, U.S. new-car sales are increasing, nearing 16 Million vehicles, further facilitating the trend. Furthermore, the requirement for high-grade plastic parts that are light weight and corrosion proof is especially needed in the auto sector, with manufacturers emphasizing fuel efficiency and automobile looks. There is also increasing demand in the U.S. market for environment-friendly manufacturing, which is making companies inclining towards more environmentally friendly plating operations. In addition, plating technology developments are enhancing efficiency, lowering costs, and broadening application fields, further fueling plating on plastics market growth.

Plating on Plastics Market Trends:

Rapid Technological Advancements

Rapid technological advancements in the industry are bolstering the market. Numerous developments in electroplating technology have been witnessed by the industry as a whole, improving the overall quality of the final product. For instance, in January 2024, DIC Corporation announced the development of DIC.PPS MP-6060 BLACK, a plateable polyphenylene sulfide (PPS) compound, enabling mass production of electroless and electroplated PPS for durable applications in EVs, electronics, and automotive components, targeting ¥3.0 billion annual sales by 2030. In line with this, to increase corrosion resistance, double layer nickel systems with a bright nickel topcoat over a semi-bright underlying layer have been introduced. The launch of the micro discontinuous chromium system, which increases the deposits of nickel and chromium's resistance to corrosion during the metallization process, is another noteworthy breakthrough. This, in turn, is expanding the plating on plastics market size.

Increasing Product Demand in the Automotive Industry

The rising use of materials such as polyethylene terephthalate and thermoplastic polymer in manufacturing automotive parts is majorly bolstering the demand for plating on plastics in the global automotive industry. According to the International Organization of Motor Vehicle Manufacturers, the total production of the automotive worldwide during the second quarter of the year 2021 crossed 40 million units mark, an increase of 29% as compared to the production of the automotive during the second quarter of 2020. This will accelerate the production of automotive parts, thereby providing a boost to the plating on plastics market share.

Rising Product Demand from Electrical and Electronics Industry for Carbon Fiber Plating

Carbon fiber plating is mainly used in the electrical and electronics industry for lowering electric conductivity to a certain extent wherever required. It is also used in various electronic devices such as semiconductors, transmitters, etc. According to the US-based Semiconductor Industry Association (SIA), global semiconductor industry sales increased 6.5% from USD 412.3 billion in 2019 to USD 439 billion in 2020. The global sales of the semiconductor for one month during December increased 8.3% from USD 36.19 billion in 2019 to USD 39.2 billion in 2020. This is rapidly accelerating the demand for plating on plastics coating in the semiconductor industry, as it is widely used for managing and directing conductivity in semiconductors. This is also increasing the demand for carbon fiber plating, which, in turn, is bolstering the plating on plastics demand.

Plating on Plastics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global plating on plastics market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on plastic type, plating type, and application.

Analysis by Plastic Type:

- ABS

- ABS/PC

- PEI

- PBT

- LCP

- PEEK

- PP

- Others

ABS leads the market with around 74.3% of market share in 2024, due to its robust combination of mechanical properties, ease of processing, and cost-effectiveness. This thermoplastic polymer is highly valued for its strength, durability, and impact resistance, which make it ideal for a wide range of applications across various industries including automotive, consumer electronics, construction, and household appliances. Its suitability for processes such as electroplating further aligns with the increasing interest reflected in the plating on plastics market forecast, emphasizing its role in enhanced aesthetic and functional features of consumer goods.

Analysis by Plating Type:

- Chrome

- Nickel

- Others

Chrome leads the market with around 41.9% of market share in 2024. Plastic components are frequently decorated with chrome plating, which offers excellent corrosion resistance, a smooth surface finish, and high visual appeal. Chrome plating on plastic, also known as chrome-like finishes or chrome plating, can create ornamental or non-functional items with a finish similar to that of chromed metal, which is significantly lighter and less expensive. It can also improve the appearance of plastic trim on computers and mobile phones, as well as the numerous control knobs, switches, and buttons on a variety of home electronics and electrical appliances. This, in turn, is propelling the plating on plastics market growth.

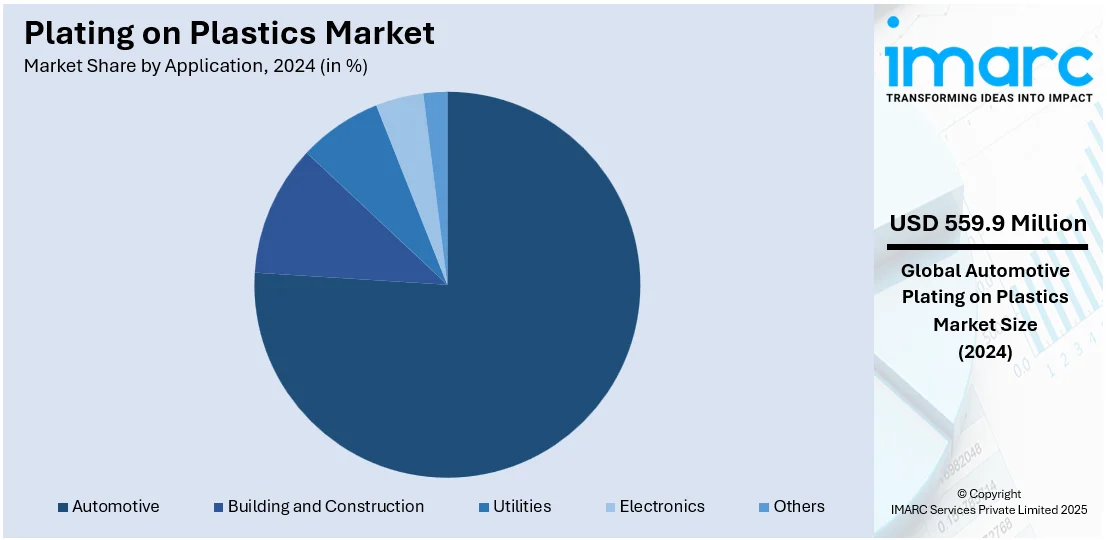

Analysis by Application:

- Automotive

- Building and Construction

- Utilities

- Electronics

- Others

Automotive leads the market with around 75.7% of market share in 2024. In the automotive sector, plating plastics is the application of metallic coatings to plastic parts in order to improve their visual appeal and provide practical advantages. Due to its capacity to adhere to strict regulations, this approach has gained prominence. Additionally, manufacturers can now replicate the appearance of metal parts while reducing weight and costs. The longevity of automobile components can be extended by applying metallic coatings, such as nickel or chrome, to plastic parts. This enhances the overall dependability and performance of automotive systems. Functional applications for plated plastic components include corrosion prevention, which helps to prevent delamination and ensures long-term durability, and EMI shielding in electronic modules.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 55.3%. The market in Europe is majorly driven by the expanding automotive industry in the UK and Germany. Chrome-finished automotives have attained considerable popularity in Europe and North America region. The region is witnessing increasing environmental regulations which has led to a rising demand for lighter aerodynamic cars. The presence of auto giants such as BMW, Volvo, Volkwagen, Diamer AG, and others in this region is likely to drive the demand for the product in the future.

Key Regional Takeaways:

United States Plating on Plastics Market Analysis

In 2024, United States accounted for 86.80% of the market share in North America. The U.S. plating on plastics (POP) industry benefits from government investments in key sectors. According to industrial reports, huge support is also visible for the automotive industry, with USD 7.5 billion for EV charging stations in the Infrastructure Investment and Jobs Act, furthering demand for lighter plated plastic components. In building and construction, roads, bridges, and infrastructure all receive USD 110 billion, which supports demand for tough and corrosion-resistant materials. USD 65 billion is given to the utilities sector to modernize the power grid and step up demand for plated plastic parts in electrical enclosures. Electronics can be upgraded by the CHIPS and Science Act by allotting USD 52.7 billion to enhance semiconductor production and thus demand for plated plastics in circuit boards and casings. All these investments translate into steady growth in the U.S. POP market.

North America Plating on Plastics Market Analysis

The North America plating on plastics (POP) market is experiencing significant growth, driven by increasing demand in industries such as automotive, electronics, and consumer goods. For instance, as per industry reports, in 2024, the Canadian vehicle market grew 8.8%, reaching 1.83 Million units, reflecting a strong demand across automotive sectors. The region’s focus on lightweight, corrosion-resistant components and advanced manufacturing techniques is fueling market expansion. Environmental regulations are also pushing the adoption of eco-friendly plating technologies, while technological innovations improve process efficiency. Moreover, the automotive sector, in particular, is a key driver, with a rising need for high-performance, aesthetic plastic parts. Furthermore, the market is competitive, with companies focusing on enhancing product quality, offering tailored solutions, and expanding their presence through strategic collaborations and partnerships.

Europe Plating on Plastics Market Analysis

A positive future for the European plating on plastics market is due to sustainability initiatives and industrial investment. In industrial reports, it is noted that the automotive sector transitioned to electric mobility under the European Green Deal targeting 30 million zero-emission vehicles by 2030, increasing demand for lightweight plated plastics in EV components. The building and construction sector also benefits from sustainable infrastructure and energy-efficient materials worth €672.5 billion (USD 693.536 billion) Recovery and Resilience Facility. Utilities amount to €1 trillion (USD 1.03 trillion) in sustainable investments over the next decade-a developing opportunity for corrosion-resistant POP applications. The European Chips Act is strengthening the electronics sector. It mobilized €43 billion (USD 4.3 billion) toward the expansion of semiconductor production in the region and, therefore increases demand for plated plastics in electronic devices. That puts Europe right at the helm of the world's POP industries.

Asia Pacific Plating on Plastics Market Analysis

Infrastructure and industrial investment have opened the Asia-Pacific market to plating on plastics. Indian automobile manufacturers profit from the initiative called "Make in India," while major investments are coming to Gujarat to increase its industrial capacities. The overall EV market is increasing in China, according to industrial reports. Therefore, a high demand exists for light-plated plastics for their manufacture. According to an industry report, India's National Infrastructure Pipeline (NIP) has committed ₹111 lakh crore (USD 1.3 trillion) to the building and construction sector, which drives the use of POP in structural components. India's railway electrification investment of ₹2.55 lakh crore (USD 30.6 billion) has expanded demand for plated plastic components in electrical and signaling systems in the utilities sector. The electronics industry will reach USD 500 billion by 2030, with the revised PLI scheme offering incentives of USD 2 billion in driving POP demand in semiconductor packaging and device housings. The Asia-Pacific region continues to lead in POP growth.

Latin America Plating on Plastics Market Analysis

Latin America's POP market continues to grow because of industrial development and infrastructure, with the auto industry being an important driver: Brazil sold 2,308,689 new vehicles in 2023 including trucks and buses, up by 9.7% on 2022, as per reports. This surge in vehicle output increases demand for lightweight, corrosion-resistant plated plastics in interiors, exteriors, and functional parts. Public-Private partnerships in the building and construction industries are seen through the extension of transportation and residential projects which drive their application of POP in fixtures and piping. In utilities, investments in renewable energy projects on wind and solar power require plated plastic components in the electrical infrastructure. The electronics industry is expanding with the installation of the different governments promoting local manufacturing and technology hubs which equally increase the demand for POP in consumer electronics and telecommunication. These investments further cement Latin America's position in the expanding global POP market.

Middle East and Africa Plating on Plastics Market Analysis

The plating on plastics (POP) market in the Middle East and Africa is growing due to car sales, infrastructure, and industrial development. In fact, the car industry is one of the largest contributors. In 2023, the United Arab Emirates (UAE) posted sales of 259,139 new vehicles, with a spectacular growth rate of 24.9% from 2022. This growth in car sales increases the demand for plated plastic parts in the interior, exterior, and functional parts. Large-scale infrastructure projects, such as smart cities, commercial, and utility undertakings, include major building and construction projects, thereby significantly increasing the use of corrosion-resistant POP materials. Further, investments in power and water infrastructure create plated plastic components in electrical distribution and water management systems within utilities. Investments in technology hubs and manufacturing of smart devices are propelling the electronics industry forward, which increases POP usage in consumer electronics and telecom devices. The main factors position the Middle East and Africa for sustainable POP market growth.

Competitive Landscape:

The plating on plastics (POP) industry is very competitive due to the mounting demand for durable, lightweight, and corrosion-resistance components among industries like the automotive, electronic, and consumer goods sectors. Some of the driving factors contributing to competition involve plating technological advancements, embracement of greener processes, and product improvement and efficiency prioritization. For instance, in January 2024, Galvanoplast announced the launch of a new production line for hexavalent chromium-free galvanic plating of plastics, enhancing environmental protection, worker safety, energy efficiency, and product quality, while supporting sustainable manufacturing and global ecological efforts. Moreover, plating on plastics market outlook indicates that industries are competing against each other as they attempt to differentiate themselves with the provision of tailor-made products that address exacting industry-specific needs. Besides this, strategic partnerships, acquisitions, and mergers are rampant as companies move to increase market share and geographies, yet further compounding competition in the worldwide POP marketplace.

The report provides a comprehensive analysis of the competitive landscape in the plating on plastics market with detailed profiles of all major companies, including:

- Artcraft Plating and Finishing Company Inc.

- Atotech

- Bolta Werke GmbH

- Cybershield Inc.

- DuPont de Nemours Inc.

- Galva Decoparts Pvt. Ltd.

- JCU Corporation

- Leader Plating on Plastic Ltd

- MacDermid Incorporated (Element Solutions Inc)

- MPC Plating Inc.

- Phillips Plating Corporation

- Precision Plating (Aust) Pty Ltd.

Latest News and Developments:

- October 2024: DuPont expanded its photoresist manufacturing capacity at its Sasakami Site in Japan, enhancing its lithography offerings. The site also produces metallization chemicals for plating applications, supporting global demand. The expansion includes advanced cleanrooms and automation, reinforcing DuPont’s commitment to innovation and supply reliability.

- April 2024: Cybershield Inc., a U.S.-based provider of metalized plastic components, revealed its partnership with SABIC, a worldwide frontrunner in the chemical sector, to enhance the application of plated ULTEM resins within the aerospace industry. This collaboration, set to be showcased at both NPE2024 and the 2024 Aircraft Interiors Expo (AIX), will see SABIC's experts share their in-depth knowledge of injection molding techniques for high-temperature ULTEM resins with Cybershield.

- November 2023: MacDermid Enthone Industrial Solutions hosted its second Sustainability Summit in Guadalajara, Mexico, highlighting sustainable plating solutions. Discussions covered low-metal electroless nickel processes, PFAS-free decorative coatings, and water treatment innovations, emphasizing compliance with new regulations and promoting sustainability in automotive and other industries.

- July 2023: Atotech has unveiled the Atotech CMA Closed-Loop System for alkaline zinc-nickel plating. This innovative technology, certified by TÜV Rheinland, facilitates near wastewater-free operations, significantly reduces waste, and lowers carbon emissions. As a comprehensive solution, it seamlessly integrates all stages of the alkaline zinc-nickel plating process, including rinsing, within its closed-loop framework.

Plating on Plastics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Plastic Types Covered | ABS, ABS/PC, PEI, PBT, LCP, PEEK, PP, Others |

| Plating Types Covered | Chrome, Nickle, Others |

| Applications Covered | Automotive, Building and Construction, Utilities, Electronics, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Artcraft Plating and Finishing Company Inc., Atotech, Bolta Werke GmbH, Cybershield Inc., DuPont de Nemours Inc., Galva Decoparts Pvt. Ltd., JCU Corporation, Leader Plating on Plastic Ltd, MacDermid Incorporated (Element Solutions Inc), MPC Plating Inc., Phillips Plating Corporation, Precision Plating (Aust) Pty Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the plating on plastics market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global plating on plastics market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the plating on plastics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The plating on plastics market was valued at USD 739.62 Million in 2024.

IMARC estimates the global plating on plastics market to reach USD 1,367.94 Million in 2033, exhibiting a CAGR of 6.72% during 2025-2033.

The market is driven by the increasing demand for lightweight, durable, and corrosion-resistant components across automotive, electronics, and consumer goods industries. Technological advancements in plating processes, the growing emphasis on aesthetics and functionality, and the rising need for eco-friendly solutions further fuel market growth.

Asia Pacific currently dominates the market, holding a market share of over 55.3% in 2024, due to its strong automotive, electronics, and consumer goods sectors. The region's advanced manufacturing technologies, focus on lightweight, high-performance components, and growing demand for sustainable, eco-friendly solutions drive its market dominance.

Some of the major players in the plating on plastics market include Artcraft Plating and Finishing Company Inc., Atotech, Bolta Werke GmbH, Cybershield Inc., DuPont de Nemours Inc., Galva Decoparts Pvt. Ltd., JCU Corporation, Leader Plating on Plastic Ltd, MacDermid Incorporated (Element Solutions Inc), MPC Plating Inc., Phillips Plating Corporation, Precision Plating (Aust) Pty Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)