Polyester Staple Fiber Market Size, Share, Trends and Forecast by Origin, Product, Application, and Region, 2026-2034

Polyester Staple Fiber Market Size and Share:

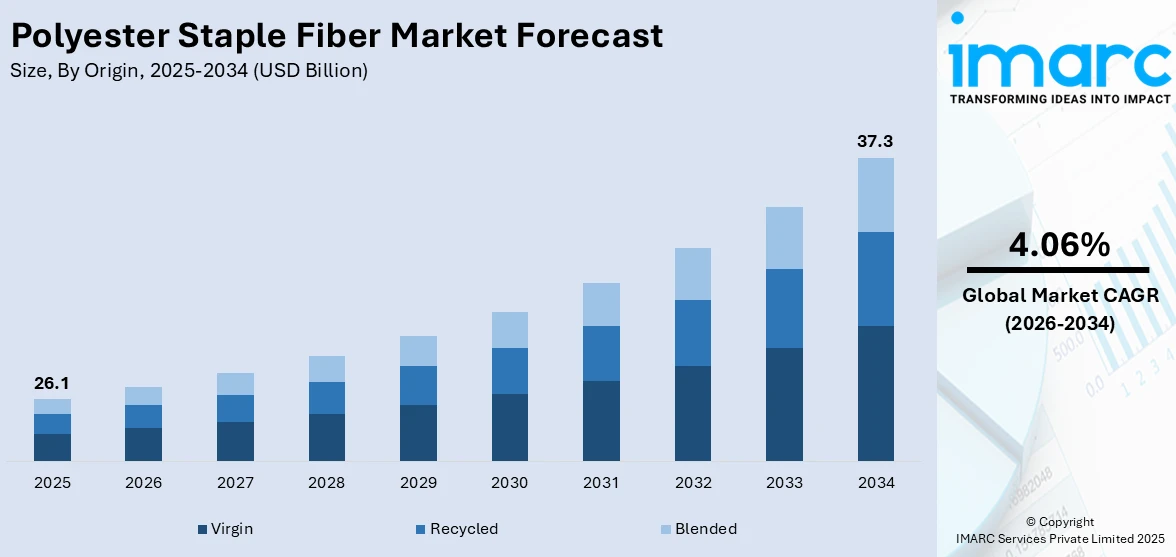

The global polyester staple fiber market size was valued at USD 26.1 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 37.3 Billion by 2034, exhibiting a CAGR of 4.06% during 2026-2034. Asia-Pacific currently dominates the market, holding a significant market share of over 77.6% in 2025. The market is driven by rising textile demand, particularly in fast-fashion and activewear, due to its affordability and durability. Growth in non-woven applications such as automotive, construction, and hygiene products enhances consumption. Urbanization and disposable income growth in emerging economies are further expanding the polyester staple fiber market share. Additionally, PSF’s cost and performance advantages over natural fibers drive adoption, while innovations in fiber technology and expanding industrial uses sustain long-term market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 26.1 Billion |

|

Market Forecast in 2034

|

USD 37.3 Billion |

| Market Growth Rate 2026-2034 | 4.06% |

The market is driven by increasing demand from the textile and apparel industry due to its durability, affordability, and versatility. Growth in non-woven applications, such as automotive, home furnishings, and hygiene products, further increases demand. Rising population and urbanization, particularly in emerging economies, fuel textile consumption. Additionally, technological advancements in recycling and sustainable PSF production align with environmental regulations, promoting eco-friendly alternatives. The shift from natural to synthetic fibers due to cost efficiency and performance benefits is creating a positive polyester staple fiber market outlook. In 2023, world production of virgin synthetic fibers rose from 67 million to 75 million tonnes, driven by low-cost polyester, which represented 57% of total fiber production. On the other hand, recycled polyester shares dropped to 12.5% due to cost pressures and lack of recycling technology, while cotton production dipped by a marginal amount to 24.4 million tonnes. Certifications for cashmere, mohair, and wool increased, and the manufacturing of artificial cellulosic fibers (MMCF) grew to 7.9 million tonnes, reflecting a diversified change in the world scenario of polyester staple fibers. Furthermore, expanding industrial applications and innovations in fiber blending techniques contribute to sustained polyester staple fiber market growth worldwide.

To get more information on this market Request Sample

The United States stands out as a key regional market, primarily driven by rising demand in the construction and filtration industries, where PSF is used for insulation and geotextiles. The expanding automotive sector also drives consumption, as PSF reinforces tires and interior components. Increasing adoption of recycled PSF, driven by corporate sustainability goals and circular economy initiatives, supports market growth. Additionally, the decline in cotton production and fluctuating natural fiber prices make PSF a cost-effective alternative for textiles. Government investments in domestic manufacturing and trade policies favoring local production further stimulate the market, ensuring stable supply chains and competitive pricing for end-users. The United States has imposed a Section 201 safeguard on fine denier polyester staple fiber (PSF), setting a zero-import quota on November 23, 2024, with 1 million pound increments every year for four years. Imports from Canada, Mexico, and some Free Trade Agreement (FTA) and Generalized System of Preferences (GSP) countries are exempted, thus protecting domestic PSF manufacturers while fulfilling the needs of the downstream industry. This move marks a fundamental trade policy shift designed to shore up the U.S. polyester staple fiber business.

Polyester Staple Fiber Market Trends:

Real Estate Expansion Boosting Demand for PSF

Significant growth in the real estate industry is positively influencing the demand for polyester staple fiber (PSF) worldwide. In particular, India witnessed a milestone year in 2024, with institutional real estate investments reaching a record USD 8.9 Billion across 78 deals, a 51% increase compared to 2023, according to JLL. This rise in investment is driving robust construction activities, where PSF plays a crucial role by enhancing concrete quality. It is commonly used to fill cracks and improve the durability of walls, tanks, tiles, blocks, and maintenance hole covers. As global urbanization accelerates and the need for high-quality construction materials rises, PSF’s application in the real estate and construction industries is poised to further strengthen market growth.

Rising Disposable Incomes and Sustainable Textile Trends

The global textile sector is witnessing increased utilization of polyester staple fiber, driven by rising disposable incomes and the growing preference for sustainable and fast fashion. The USD 185 Billion fast fashion sector, fueled by the need for inexpensive, trendy clothing, also accounts for over half of all fibers used being polyester. Even with growing awareness among consumers, affordable synthetic fashion remains popular, as 73% of Generation Z consumers opt for fast fashion due to financial limitations. Synthetic fibers, led by polyester, are expected to comprise 73% of all textiles by 2030, which will further aggravate environmental issues. Consumers are increasingly seeking eco-friendly yet affordable clothing options, pushing manufacturers to adopt PSF to produce durable and cost-effective textiles. According to the polyester staple fiber market forecast, PSF’s use extends to speaker felts, geotextiles, wadding, and sound absorption fillers, further diversifying its market presence. The material’s ability to meet performance and environmental standards is solidifying its position as a preferred fiber in the textile industry. As consumer trends continue to favor sustainability and affordability, the global demand for PSF in textile manufacturing is expected to maintain a strong upward trajectory.

Rapid Automotive Industry Expansion

The automotive sector is emerging as a vital growth avenue for the market. PSF is extensively used in manufacturing automotive textiles, including roofs, airbags, trunk liners, carpet backing, glove boxes, door panels, safety belts, and sound insulation materials. The rising production of light commercial vehicles (LCVs) is particularly contributing to this trend. In India alone, the demand for LCVs is projected to reach 858.61 thousand units by 2025 and 970.05 thousand units by 2030. As vehicle production scales up globally, the need for high-quality, lightweight, and cost-efficient materials such as PSF will intensify. This rise in automotive manufacturing is set to create lucrative growth opportunities for PSF manufacturers worldwide.

Polyester Staple Fiber Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global polyester staple fiber market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on origin, product, and application.

Analysis by Origin:

- Virgin

- Recycled

- Blended

Virgin stand as the largest component in 2025, holding around 42.2% of the market due to its superior quality, consistency, and performance in high-end textile and industrial applications. Unlike recycled PSF, virgin fiber offers enhanced strength, uniformity, and dyeability, making it preferred for premium apparel, home textiles, and technical fabrics. The growing demand for durable and high-performance synthetic fibers in industries such as automotive, construction, and filtration further drives their consumption. Additionally, virgin PSF benefits from well-established production infrastructure and cost efficiencies in key manufacturing regions including Asia. While sustainability trends enhance recycled PSF, virgin fiber remains irreplaceable in applications requiring purity and optimal mechanical properties. Continuous innovations in polymerization and spinning technologies also reinforce its market leadership, ensuring sustained demand across diverse sectors.

Analysis by Product:

- Solid

- Hollow

Solid leads the market with around 64.2% of market share in 2025, driven by its versatility and widespread use across multiple industries. Its uniform structure and consistent properties make it ideal for textiles, apparel, home furnishings, and industrial applications such as automotive upholstery and filtration. Compared to hollow or other variants, solid PSF offers superior strength, durability, and ease of processing, meeting the demands of high-volume manufacturing. The growth of fast fashion and technical textiles further amplifies its dominance, while cost-effectiveness and compatibility with blending (including cotton or wool) enhances its appeal. Additionally, advancements in fiber engineering have expanded its use in non-wovens and geotextiles. Despite rising interest in sustainable alternatives, solid PSF remains indispensable due to its reliability and performance, ensuring its continued leadership in the market.

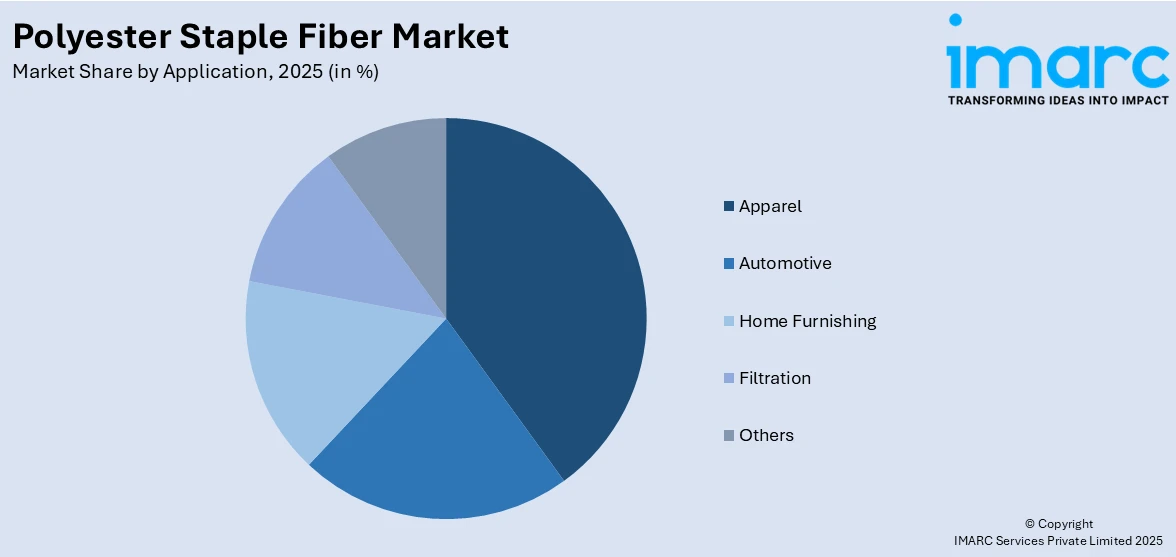

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Automotive

- Home Furnishing

- Apparel

- Filtration

- Others

Apparel leads the market with around 45.8% of market share in 2025, driven by its widespread use in affordable, durable, and versatile clothing. The fast-fashion industry heavily relies on PSF for its quick production cycles, cost efficiency, and ability to mimic natural fibers such as cotton. Its moisture-wicking, wrinkle-resistant, and easy-care properties make it ideal for activewear, casual wear, and uniforms. Additionally, the growing demand for blended fabrics (polyester-cotton) enhances its adoption. Emerging economies, with rising disposable incomes and urbanization, further fuel apparel demand. While sustainability concerns push recycled PSF, virgin PSF remains dominant due to superior dyeability and consistency. Innovations in fiber technology, such as microfiber and antimicrobial finishes, continue to expand its applications, ensuring polyester’s enduring dominance in the global apparel market.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

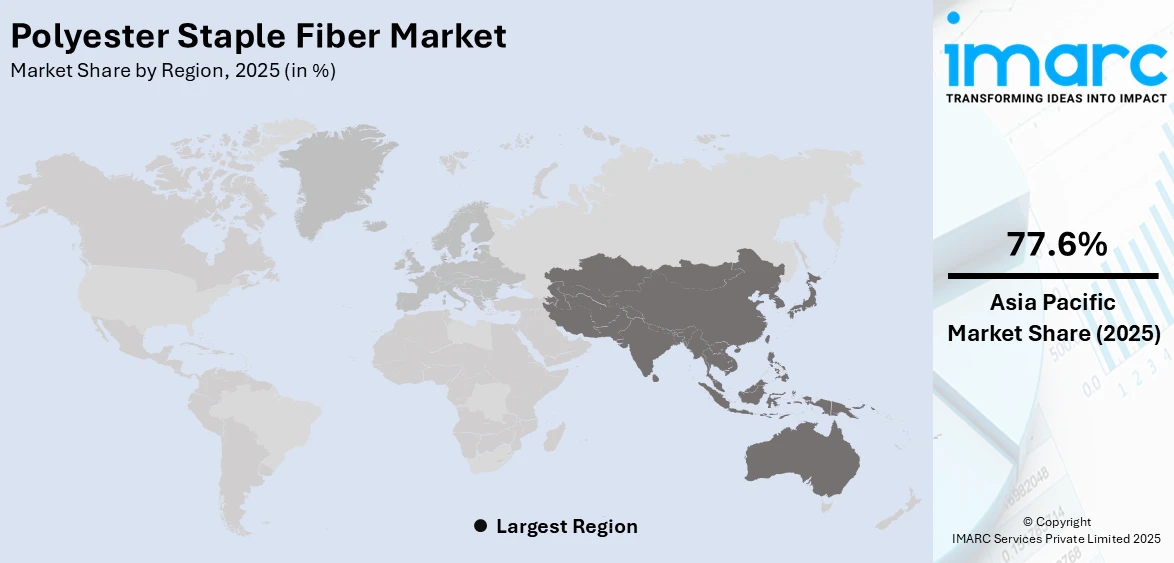

In 2025, Asia-Pacific accounted for the largest market share of over 77.6%, accounting for the largest regional share and driving polyester staple fiber market demand due to expanding textile and industrial applications.due to robust textile manufacturing, cost-competitive production, and strong domestic demand. Countries including China, India, and Vietnam lead consumption, driven by expanding apparel industries, export-oriented garment production, and growing non-woven applications. The region’s well-established supply chains, low labor costs, and government support for synthetic fiber industries further strengthen its position. Rapid urbanization, rising disposable incomes, and fast-fashion trends amplify PSF demand, while industrial growth in the automotive and construction sectors enhances non-textile usage. Additionally, investments in recycling infrastructure align with sustainability trends, ensuring long-term market growth. With continuous capacity expansions and technological advancements, Asia-Pacific remains the epicenter of PSF production and consumption, reinforcing its leadership in the global market.

Key Regional Takeaways:

United States Polyester Staple Fiber Market Analysis

In 2025, the US accounted for around 82.00% of the total North America polyester staple fiber market. The United States is witnessing increased product adoption due to expanding home renovation trends, particularly in the home furnishing segment. For instance, Americans spent around USD 420 Billion in 2020 on remodeling their homes. Rising consumer interest in modernizing interiors and investing in décor enhancements is improving the demand for polyester-based products including carpets, curtains, and upholstery. Home furnishing continues to be a strong application area for polyester staple fiber, benefiting from its durability, affordability, and ease of maintenance. Additionally, increased housing refurbishment activity and improvements in interior aesthetics are leading to a consistent rise in polyester usage across the home textile space, driving the market growth further. Consumers are inclined toward high-quality materials that align with contemporary living standards, which complement the functionality and performance attributes of polyester staple fiber in home furnishing applications.

Asia-Pacific Polyester Staple Fiber Market Analysis

Asia-Pacific is witnessing increased product adoption supported by the expansion of textile manufacturing units across emerging industrial zones. According to reports, there are over 100,000 textile manufacturing units currently operating in India. The availability of cost-effective labor and raw materials, combined with rising domestic and export demand, is encouraging capacity enhancement among textile manufacturers. Polyester staple fiber is being increasingly used in apparel, nonwoven textiles, and industrial fabrics, driving bulk procurement among textile manufacturing units. As production clusters grow and specialization, procurement of synthetic fibers such as polyester staple fiber is becoming more strategic. Textile manufacturing units prefer polyester fiber for its performance, affordability, and adaptability to various end-use applications. The modernization of textile processing technologies further aligns with the use of polyester fiber, increasing adoption across Asia-Pacific’s growing textile sector.

Europe Polyester Staple Fiber Market Analysis

Europe is seeing heightened product adoption due to growing focus on recycling and circular economy practices across industries. For instance, in 2023, 11.8% of materials used in the EU came from recycling. As regulatory frameworks tighten on plastic and textile waste, manufacturers are shifting toward recycled polyester staple fiber to align with sustainability goals. Demand is rising for recycled synthetic fibers in fashion, automotive, and home furnishing sectors, all of which are embracing eco-friendly sourcing. Recycling initiatives are increasingly integrated into supply chains, where polyester staple fiber from post-consumer and post-industrial waste supports material efficiency. The focus on recycling is also influencing procurement strategies among brands and producers who seek reduced environmental footprints. With consumers preferring sustainable products, recycled polyester staple fiber is emerging as a viable material choice, fueling its growth across multiple application areas in Europe.

Latin America Polyester Staple Fiber Market Analysis

Latin America shows rising product adoption driven by increased availability and usage of recycled polyethylene terephthalate (PET) bottle flakes. For instance, in Brazil, the recycling rate of PET packaging reached 56.4% in 2021, marking a 15.4% increase compared to 2019. With recycling initiatives gaining momentum, the supply of PET flakes is expanding, encouraging fiber manufacturers to produce eco-conscious alternatives. The use of recycled PET bottle flakes in polyester staple fiber production aligns with environmental goals and cost efficiency, making it attractive for regional industries. This shift toward sustainable raw materials supports the market’s long-term growth across Latin America.

Middle East and Africa Polyester Staple Fiber Market Analysis

The Middle East and Africa are observing rising product adoption supported by the expansion of the real estate sector, fueled by a growing construction industry. According to reports, Saudi Arabia's construction sector is booming, with over 5,200 projects underway, valued at USD 819 Billion. As construction projects proliferate across residential and commercial spaces, the demand for durable interior materials such as carpets, upholstery, and wall fabrics are rising. Polyester staple fiber, with its strong performance characteristics and affordability, is becoming integral to construction-related furnishing needs. This connection between real estate growth and fiber consumption drives sustained adoption in the region.

Competitive Landscape:

The competitive landscape of the market is characterized by intense rivalry among key players, who are focusing on capacity expansions, technological advancements, and sustainability initiatives to strengthen their market position. Many are investing in research and development to enhance fiber properties, such as durability and eco-friendliness, while others are expanding production facilities to meet rising demand, particularly in emerging economies. Strategic collaborations and mergers are common, enabling companies to broaden their product portfolios and geographic reach. Sustainability remains a key differentiator, with leading players increasingly adopting recycled polyester and cleaner production processes to align with environmental regulations and consumer preferences. Cost optimization and vertical integration strategies are also being prioritized to maintain competitiveness in this price-sensitive market.

The report provides a comprehensive analysis of the competitive landscape in the polyester staple fiber market with detailed profiles of all major companies, including:

- Alpek Polyester

- Bombay Dyeing

- Diyou Fibre (M) Sdn Bhd.

- Huvis Corp.

- Indorama Corporation

- Reliance Industries Limited

- Thai Polyester Co., Ltd

- Toray Industries, Inc.

- Vnpolyfiber

- William Barnet and Son, LLC

- Xin Da Spinning Technology Sdn. Bhd.

Latest News and Developments:

- April 2025: Ganesha Ecosphere invested INR 2 crores in its associate company, Ganesha Recycling Chain (GRCPL), through a rights issue. This investment aimed to strengthen the raw material supply chain of PET waste, including staple fibers.

- March 2025: Toray Industries, Inc. adopted the mass balance approach to manufacture its TORAYLON™ acrylic staple fiber. This method combines characteristics from both biomass and plastic waste, earning ISCC PLUS certification.

- February 2025: Barmag announced that it would soon unveil its sustainable and efficient solutions for the Vietnamese textile industry, including the Oerlikon Neumag EvoSteam staple fiber process, now bluesign® verified. The company highlighted its comprehensive end-to-end solutions from Oerlikon Neumag, Oerlikon Barmag, and Oerlikon Nonwoven brands.

- January 2025: SHEIN developed an innovative polyester recycling process in collaboration with Donghua University, aimed at enhancing sustainability in fashion. Testing confirmed that the recycled polyester, used to create staple fibers, could be repeatedly recycled without degrading material quality, with large-scale production scheduled to begin in June 2025.

- January 2025: Ambercycle and Benma announced a strategic partnership to enhance polyester fiber circularity. The collaboration advanced the production of Cycora staple fibers.

Polyester Staple Fiber Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Origins Covered | Virgin, Recycled, Blended |

| Products Covered | Solid, Hollow |

| Applications Covered | Automotive, Home Furnishing, Apparel, Filtration, and Others |

| Regions Covered | Asia-Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Alpek Polyester, Bombay Dyeing, Diyou Fibre (M) Sdn Bhd., Huvis Corp., Indorama Corporation, Reliance Industries Limited, Thai Polyester Co., Ltd, Toray Industries, Inc., Vnpolyfiber, William Barnet and Son, LLC, Xin Da Spinning Technology Sdn. Bhd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the polyester staple fiber market from 2020-2034.

- The polyester staple fiber market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the polyester staple fiber industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The polyester staple fiber market was valued at USD 26.1 Billion in 2025.

IMARC estimates the polyester staple fiber market to exhibit a CAGR of 4.06% during 2026-2034, reaching a value of USD 37.3 Billion by 2034.

Rising demand from the textile and apparel industry, increasing non-woven applications across automotive and construction sectors, growing urbanization and disposable incomes in emerging economies, technological advancements in recycling, and the shift from natural to synthetic fibers are key drivers fueling market growth.

Asia-Pacific currently dominates the polyester staple fiber market, accounting for a share exceeding 77.6%. This dominance is fueled by robust textile manufacturing, cost-competitive production, strong domestic demand, rapid urbanization, and investments in recycling infrastructure across key countries, including China, India, and Vietnam.

Some of the major players in the polyester staple fiber market include Alpek Polyester, Bombay Dyeing, Diyou Fibre (M) Sdn Bhd., Huvis Corp., Indorama Corporation, Reliance Industries Limited, Thai Polyester Co., Ltd, Toray Industries, Inc., Vnpolyfiber, William Barnet and Son, LLC., and Xin Da Spinning Technology Sdn. Bhd, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)