Portable Optical Time Domain Reflectometer Market Size, Share, Trends, and Forecast by Deployment Type, Application, and Region, 2025-2033

Portable Optical Time Domain Reflectometer Market Size and Share:

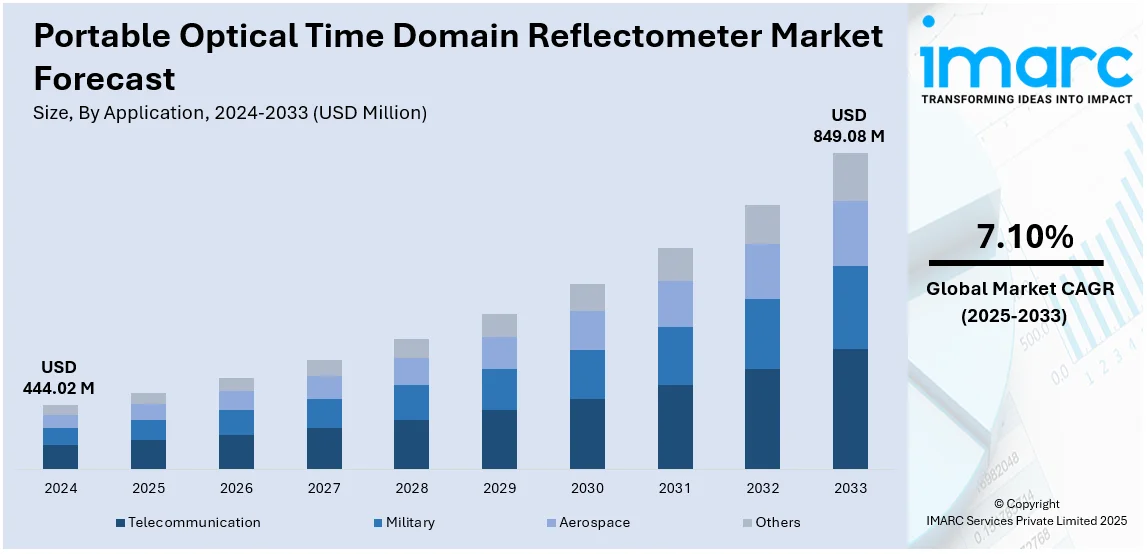

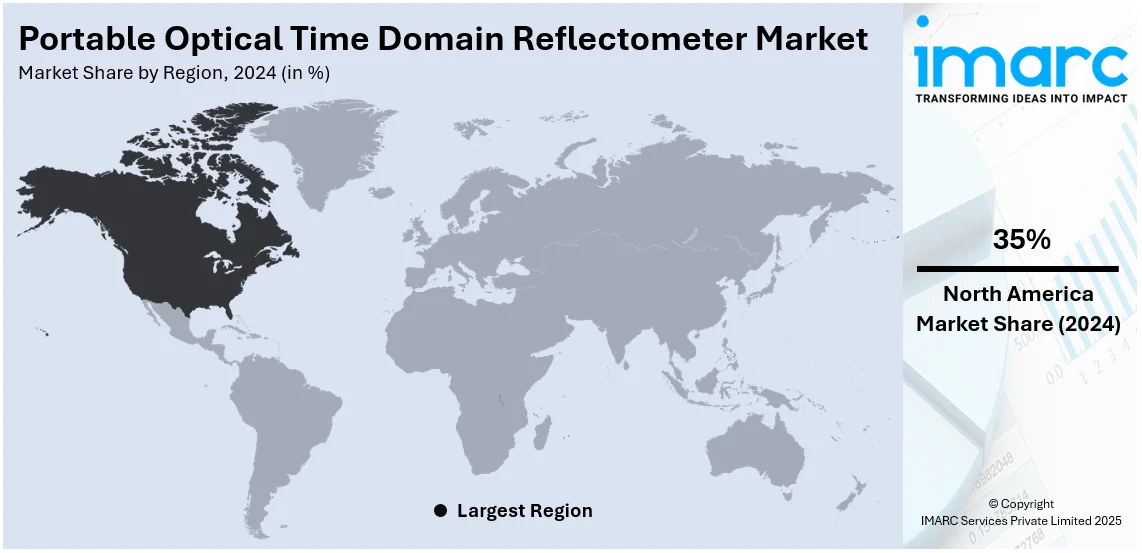

The global portable optical time domain reflectometer market size was valued at USD 444.02 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 849.08 Million by 2033, exhibiting a CAGR of 7.10% during 2025-2033. North America currently dominates the market, holding a significant market share of over 35% in 2024, driven by 5G expansion, fiber optic deployments, data center growth, and increasing demand for high-speed broadband and network reliability solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 444.02 Million |

| Market Forecast in 2033 | USD 849.08 Million |

| Market Growth Rate (2025-2033) | 7.10% |

One major driver of the portable optical time domain reflectometer (OTDR) market growth is the increasing deployment of fiber optic networks for high-speed broadband and 5G infrastructure. As demand for reliable, high-bandwidth communication grows, telecom providers and network operators require advanced testing and troubleshooting solutions to ensure optimal fiber performance and minimal signal loss. Portable OTDRs enable real-time fault detection, network diagnostics, and maintenance, improving efficiency and reducing downtime. Additionally, the rising adoption of fiber-to-the-home (FTTH), data centers, and smart city projects further accelerates market growth, as companies invest in portable, high-precision optical testing equipment to meet evolving connectivity demands. For instance, in 2025, 224G SERDES for 1.6Tb links demand advanced tools beyond BERT. VIAVI, leveraging 53G PAM-4 expertise, supports companies in developing, debugging, and delivering next-gen 1.6Tb devices with 224G SERDES technology.

The United States plays a crucial role in the Portable Optical Time Domain Reflectometer (OTDR) market through technological innovation, strong telecommunications infrastructure, and increasing fiber optic deployments. Leading U.S.-based companies drive market growth by developing advanced OTDR solutions with enhanced precision, automation, and portability to meet rising demand from 5G expansion, fiber-to-the-home (FTTH) projects, and data centers. For instance, in September 2024, Platinum Tools launched the PT-OTDR-100 mini OTDR tester at BICSI 2024 in Las Vegas, featuring a 5.5-inch OLED touchscreen, OTDR, OPM, VFL, laser source, copper and fiber network testing, and exportable reports. Additionally, stringent network reliability standards and government initiatives promoting broadband expansion in rural areas fuel the adoption of portable OTDRs. For instance, in 2025, The U.S. market also benefits from investments in smart cities and high-speed connectivity, further strengthening its position in the global optical testing industry.

Portable Optical Time Domain Reflectometer Market Trends:

Adoption of OTDR in Residential and Commercial Sectors

Due to its superior integrity, security, and bandwidth capabilities, fiber-optic media is widely utilized in residential and commercial sectors to deliver communications services. For instance, in 2023, foreign investors accounted for 45% of total commercial property transactions in Dubai. This represents one of the key factors stimulating the portable OTDR market growth. Apart from this, OTDR is gaining preference as a debugging and monitoring tool for Fiber to Home (FTTH) and Dense Wavelength Division Multiplexing (DWDM) transport networks. Moreover, the introduction of smart portable OTDR with robust wireless connectivity options is expanding its application in different sectors for qualifying passive optical network (PON) networks and characterizing point-to-point access and metro fiber networks.

Rising Deployment of 5G and Fiber-to-the-Home (FTTH) Networks

Furthermore, the escalating demand for fast and secure telecommunications networks on account of the widespread adoption of the Internet of Things (IoT) technology and the increasing utilization of high-end electronic devices is contributing to the market growth. For instance, number of connected IoT devices is growing 13% to 18.8 billion globally. The rising focus on the deployment of 5G networks worldwide is anticipated to drive the market further. The expansion of 5G networks and fiber-to-the-home (FTTH) projects is driving demand for portable OTDR solutions. With higher bandwidth requirements and an increasing number of fiber optic connections, network operators require precise, real-time testing tools to ensure low latency and high-speed connectivity. Governments and telecom providers are heavily investing in broadband expansion, especially in rural and underserved areas, further boosting the need for efficient OTDR testing. This trend is expected to accelerate as 5G infrastructure development continues, requiring robust fiber optic backhaul networks supported by advanced portable OTDR devices for seamless deployment and maintenance.

Rising Demand for Portable OTDRs in Data Centers

A key trend in the Portable Optical Time Domain Reflectometer (OTDR) market is the growing demand from data centers for precise fiber optic testing and maintenance. As hyperscale and colocation data centers expand, the need for high-speed, low-latency fiber networks intensifies. Portable OTDRs enable real-time fault detection, fiber characterization, and loss measurement, ensuring network reliability and minimal downtime. The increasing adoption of 400G and beyond optical infrastructure further drives demand for advanced OTDR solutions with automation, AI-driven diagnostics, and cloud-based data integration. For instance, in September 2024, EXFO launches the FIP-200 Connector Checker and AXS-120 mini-OTDR, simplifying FTTH network testing. These entry-level solutions ensure efficient broadband activation and last-mile diagnostics, showcased at Connected Britain in London. Data center operators rely on compact, high-precision OTDRs to support efficient fiber network deployment and maintenance.

Portable Optical Time Domain Reflectometer Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global portable optical time domain reflectometer market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on deployment type and application.

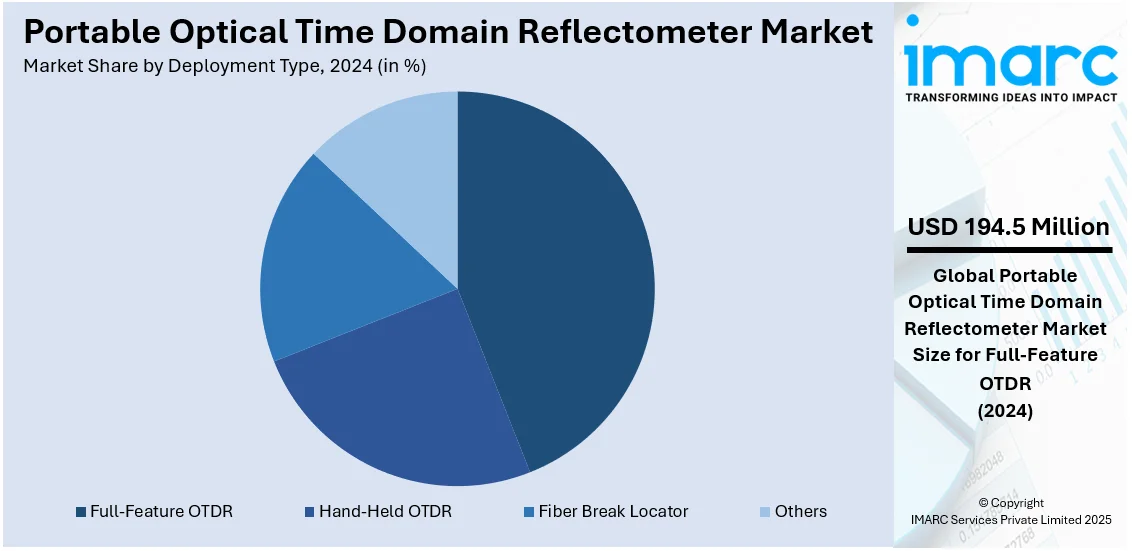

Analysis by Deployment Type:

- Full-Feature OTDR

- Hand-Held OTDR

- Fiber Break Locator

- Others

Full-feature OTDR stand as the largest deployment type in 2024, holding around 43.8% of the market. These advanced OTDRs offer higher dynamic range, multi-wavelength support, and enhanced analysis capabilities, making them ideal for fiber network installation, maintenance, and troubleshooting. Their ability to perform long-distance testing, high-resolution fault detection, and real-time monitoring drives their adoption across telecommunications, data centers, and utility networks. With increasing demand for 5G, fiber-to-the-home (FTTH), and hyperscale data centers, network operators prefer full-feature OTDRs for their precision, automation, and AI-enhanced diagnostics, further strengthening their market position in fiber optic network expansion.

Analysis by Application:

- Telecommunication

- Military

- Aerospace

- Others

The telecommunication sector drives significant demand for portable OTDRs, essential for fiber network deployment, maintenance, and troubleshooting. As 5G, fiber-to-the-home (FTTH), and high-speed broadband networks expand, OTDRs enable real-time fault detection, loss measurement, and optical link validation. Their portability ensures on-site diagnostics, minimizing network downtime and improving service reliability for telecom operators and internet service providers.

The military relies on portable OTDRs for secure fiber optic communication networks, ensuring mission-critical connectivity in battlefield, naval, and aerospace operations. OTDRs assist in rapid fault detection, cable integrity testing, and secure data transmission, supporting command and control infrastructure. Their rugged, high-precision capabilities ensure reliable optical networks under extreme environmental conditions, vital for defense communications.

In aerospace applications, portable OTDRs ensure the integrity of fiber optic networks in aircraft, satellites, and ground control systems. As modern aerospace systems rely on high-speed data transmission, OTDRs help detect fiber faults, signal losses, and connectivity issues. Their compact design allows engineers to conduct on-site testing and preventive maintenance, enhancing safety, reliability, and operational efficiency in aviation and space technologies.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest Portable Optical Time Domain Reflectometer (OTDR) market share of over 35%, driven by expanding fiber optic networks, 5G rollout, and increasing data center deployments. The region’s strong focus on fiber-to-the-home (FTTH), high-speed broadband, and cloud-based infrastructure has fueled demand for advanced OTDR solutions. Additionally, industries such as telecommunications, aerospace, and defense rely heavily on portable OTDRs for network testing, maintenance, and troubleshooting. Government initiatives supporting rural broadband expansion and smart city projects further contribute to market growth. With leading companies investing in AI-powered diagnostics and automation, the region continues to dominate the fiber optic testing and measurement market.

Key Regional Takeaways:

United States Portable Optical Time Domain Reflectometer Market Analysis

US accounts for 86.7% share of the market in North America. The United States is witnessing an increasing adoption of portable optical time domain reflectometer driven by the growing aerospace industry. The United States Aerospace and Defense industry is currently experiencing significant expansion, with a substantial increase in sales revenue reaching over USD 955 Billion in 2023. With advancements in aircraft communication systems and satellite networks, the demand for precise fiber optic testing has surged. The aerospace sector relies on highly efficient optical networks to ensure seamless data transmission, making portable optical time domain reflectometer a critical tool for maintenance and troubleshooting. The increasing deployment of fiber optics in avionics and ground communication networks further boosts the need for advanced testing solutions. Additionally, the expansion of fiber optic infrastructure in defense aviation enhances the requirement for compact and efficient testing equipment. As aerospace manufacturers integrate fiber optics in navigation, radar, and control systems, ensuring the reliability of these networks becomes essential. The rise in aerospace research and development fosters the demand for precise fiber optic testing instruments. The focus on lightweight, high-performance communication networks accelerates the adoption of portable optical time domain reflectometer. Continuous innovation in fiber optic technology within the aerospace sector strengthens the market, leading to significant adoption across critical applications.

Asia Pacific Portable Optical Time Domain Reflectometer Market Analysis

Asia-Pacific is experiencing a rapid increase in the adoption of portable optical time domain reflectometer, primarily driven by growing investment and expansion in telecommunication projects. According to Ministry of Commerce and Industry India, there were 85 investment projects in telecommunication sector in India worth USD 37.67 Billion. The region’s telecommunication infrastructure is undergoing significant modernization with widespread deployment of fiber optic networks. The rising number of internet users and increasing mobile broadband penetration contribute to the expanding fiber optic connectivity. Telecommunication operators are heavily investing in high-speed networks to support the growing data traffic, creating a surge in demand for precise optical fiber testing solutions. Governments and private enterprises are allocating substantial funds to enhance fiber optic coverage in urban and rural areas, further propelling the requirement for portable optical time domain reflectometer. The deployment of 5G networks necessitates advanced fiber optic testing tools to ensure seamless connectivity and network stability. Telecommunication companies are prioritizing network reliability, driving the adoption of advanced optical testing solutions. As service providers upgrade existing infrastructures, portable optical time domain reflectometer plays a vital role in maintaining and optimizing fiber optic networks. The emphasis on uninterrupted and high-speed connectivity accelerates the adoption of efficient optical testing equipment.

Europe Portable Optical Time Domain Reflectometer Market Analysis

Europe is witnessing increased adoption of portable optical time domain reflectometer, driven by the growing military spending across the region. According to the European Defence Agency (EDA), in 2023, European Union member states spent a record approximately USD 289 Billion on military expenditure, marking a 10% increase from the previous year. Defense forces are heavily investing in fiber optic networks for secure and high-speed communication in battlefield operations, surveillance, and intelligence systems. Military applications require robust and interference-free optical networks, leading to a greater need for advanced fiber optic testing tools. Portable optical time domain reflectometer is becoming an essential component for defense infrastructure maintenance, ensuring operational efficiency in critical communication systems. The modernization of military networks, including battlefield communication and secure data transmission, further strengthens the demand for efficient optical fiber testing. Military agencies are prioritizing optical technologies to enhance connectivity in remote and high-security areas, increasing the reliance on portable optical time domain reflectometer for precise fault detection and performance optimization. As defense organizations continue to expand their network capabilities, the need for accurate and compact optical testing solutions grows. The emphasis on strategic communication and real-time data exchange fuels the rising adoption of advanced fiber optic testing instruments in the defense sector.

Latin America Portable Optical Time Domain Reflectometer Market Analysis

Latin America is witnessing increasing adoption of portable optical time domain reflectometer due to the growing number of smartphone users. As stated by GSMA, the number of smartphone connections in Latin America is expected to hit 500 million by the conclusion of 2021, resulting in a 74% adoption rate. The expansion of mobile networks and increasing penetration of high-speed internet contribute to the rising demand for fiber optic infrastructure. Telecommunication providers are expanding their fiber optic networks to enhance mobile connectivity, leading to a growing requirement for optical testing solutions. The rising preference for high-speed data services is driving network operators to invest in advanced fiber optic deployment. Portable optical time domain reflectometer plays a crucial role in maintaining network performance and ensuring seamless data transmission. The expansion of mobile broadband networks accelerates the demand for efficient optical testing solutions. As mobile service providers enhance their infrastructure, the requirement for portable optical time domain reflectometer continues to grow.

Middle East and Africa Portable Optical Time Domain Reflectometer Market Analysis

The Middle East and Africa are experiencing an increased use of portable optical time domain reflectometers due to rising investments and a growing IT sector. For example, total expenditures on information and communications technology (ICT) throughout the Middle East, Türkiye, and Africa (META) will exceed USD 238 billion this year, representing a 4.5% rise compared to 2023. The increasing investment in digital transformation and cloud computing is driving the demand for high-speed fiber optic networks. IT companies are deploying fiber optic communication to support data centers and enterprise networks, leading to a greater need for efficient optical testing solutions. The rising focus on cybersecurity and secure data transmission further accelerates the requirement for advanced optical testing tools. Portable optical time domain reflectometer plays a crucial role in optimizing fiber optic networks for IT applications. As enterprises expand their digital operations, the demand for reliable optical fiber infrastructure continues to grow. The emphasis on uninterrupted and high-performance network connectivity strengthens the adoption of portable optical time domain reflectometer.

Competitive Landscape:

The competitive landscape of the Portable Optical Time Domain Reflectometer (OTDR) market is characterized by the presence of established players, emerging technology providers, and strategic partnerships. Leading companies focus on product innovation, enhanced accuracy, and compact designs to meet evolving customer needs. For instance, in March 2025, Yokogawa's AQ7290 Series OTDR enhanced optical fiber network construction and maintenance with improved operability. Available in six models with two or three wavelengths, it meets diverse fiber-optic testing and measurement needs. Key players invest in R&D for automation, AI-driven diagnostics, and cloud-based data integration. Competitive differentiation is driven by pricing strategies, feature advancements, and after-sales support services. Additionally, mergers, acquisitions, and regional expansions shape market dynamics as companies seek to strengthen their global presence. Growing demand from telecom, data centers, and network service providers further intensifies market competition.

The report provides a comprehensive analysis of the competitive landscape in the portable optical time domain reflectometer market with detailed profiles of all major companies, including:

- Agilent Technologies

- Alnair Labs Corporation

- Anritsu Electric

- Corning Incorporated

- Dintek Electronic Ltd.

- EXFO Inc.

- Fluke Corporation (Fortive Corporation)

- Multicom Inc.

- Viavi Solutions Inc.

- Yokogawa Electric Corporation

Latest News and Developments:

- September 2024: KOMSHINE will exhibit its offerings, including OTDR, fiber fusion, and optical fiber identifier products during the 2024 Middle East International High Technology IT Exhibition in Dubai from October 14-18. It will be at booth H15-E48 to participate in full depth talks and new opportunities explorations. The event expects to call convergence to industry players to discuss the vast pool of knowledge and advancements made in fiber optics. Attendees are invited to experience firsthand the futuristic solutions in the Dubai World Trade Centre.

- September 2024: EXFO has launched the AXS-120 mini-OTDR in order to improve the efficiency of field tests in FTTH applications. This portable OTDR makes last-mile network assessments by any technician easy. Alongside the FIP-200 Connector Checker™, EXFO assures the public it will deliver end-to-end broadband activation. Both solutions are presented during Connected Britain in London.

- August 2024: Platinum Tools® launched the mini OTDR tester PT-OTDR-100, which will make its debut at the markets next October. The PT-OTDR-100 is equipped with a 5.5-inch OLED touch screen for smooth functionality in OTDR. It lends support to OTDR, OPM, VFL, laser source capabilities for fiber optics, and TDR for Category cable. Made for a simple manner, it would provide test saving and export.

- July 2024: Viavi Solutions Inc. unveiled NITRO® Fiber Sensing, integrating OTDR technology in real-time monitoring of fiber optic infrastructures. This solution would allow detection of threats to pipelines, power grids, and data centers while minimizing damages and operational costs of such events. With the use of Distributed Acoustic Sensing and Fiber Test Heads, one can further enhance asset protection. Precise alerts thereof regarding potential risks and damage can be sent to operators for proactive maintenance and response.

- May 2024: SUNET is now using Adtran's ALM fiber monitoring to make its national research and education network more resilient. The system offers real-time generation of events that potentially detect incidents with fiber quickly or timeously. It provides support to RAMAN-amplified links, which can save downtime and operational costs on the part of the users. NetNordic partnered in this endeavor to guarantee reliable and high-quality services for the R&E community of Sweden.

- March 2024: PE Fiberoptics, parent company of PFO, has entered into an acquisition for Luciol Instruments SA, a manufacturer of Optical Time-Domain Reflectometry (OTDR) instruments. Luciol's strong background in photon-counting technology increases the value of classical OTDR performance from the perspective of superior spatial resolution. This acquisition further strengthens the high-resolution OTDR solutions portfolio of PE Fiberoptics. In addition to this, Luciol's technology allows advanced optical temperature sensing over standard fibers.

Portable Optical Time Domain Reflectometer Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Deployment Types Covered | Full-Feature OTDR, Hand-Held OTDR, Fiber Break Locator, Others |

| Applications Covered | Telecommunication, Military, Aerospace, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Agilent Technologies, Alnair Labs Corporation, Anritsu Electric, Corning Incorporated, Dintek Electronic Ltd., EXFO Inc., Fluke Corporation (Fortive Corporation), Multicom Inc., Viavi Solutions Inc., Yokogawa Electric Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the portable optical time domain reflectometer market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global portable optical time domain reflectometer market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the portable optical time domain reflectometer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The portable optical time domain reflectometer market was valued at USD 444.02 Million in 2024.

IMARC estimates the portable optical time domain reflectometer market to reach USD 849.08 Million by 2033, exhibiting a CAGR of 7.10% during 2025-2033.

The portable optical time domain reflectometer market is driven by expanding fiber optic networks, 5G deployment, increasing FTTH adoption, and rising data center demand. Growth in telecommunications, aerospace, and defense sectors, coupled with advancements in AI-driven diagnostics, automation, and compact designs, further fuels market expansion, ensuring efficient network maintenance, fault detection, and performance optimization.

North America currently dominates the market with a 35% share, driven by expanding fiber optic infrastructure, 5G rollout, growing FTTH deployments, increasing data center investments, and strong demand from telecommunications, aerospace, and defense sectors. Government initiatives supporting broadband expansion and smart city projects further contribute to market growth in the region.

Some of the major players in the portable optical time domain reflectometer market include Agilent Technologies, Alnair Labs Corporation, Anritsu Electric, Corning Incorporated, Dintek Electronic Ltd., EXFO Inc., Fluke Corporation (Fortive Corporation), Multicom Inc., Viavi Solutions Inc., Yokogawa Electric Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)