Portable Oxygen Concentrators Market Size, Share, Trends and Forecast by Technology, Application, End User, and Region, 2025-2033

Portable Oxygen Concentrators Market Size and Share:

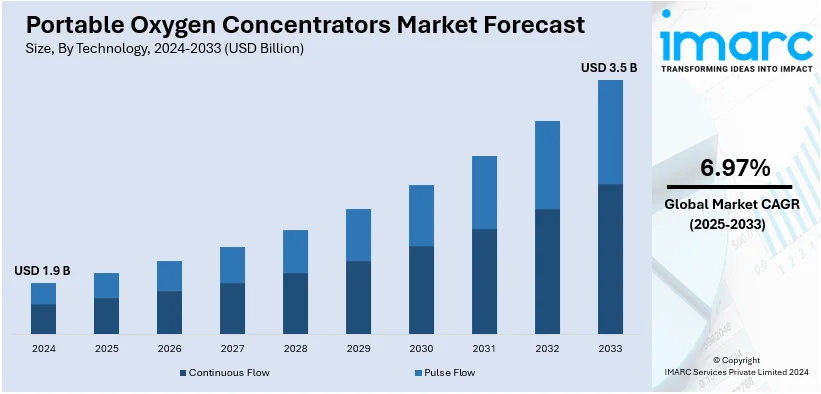

The global portable oxygen concentrators market size was valued at USD 1.9 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 3.5 Billion by 2033, exhibiting a CAGR of 6.97% from 2025-2033. North America currently dominates the market, holding a significant market share of over 38.9% in 2024. The major factors driving the market are the rising cases of respiratory diseases such as chronic obstructive pulmonary disease, asthma, and cystic fibrosis, rising geriatric population and growing affinity for home-based medical treatment.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1.9 Billion |

|

Market Forecast in 2033

|

USD 3.5 Billion |

| Market Growth Rate 2025-2033 | 6.97% |

The growing incidence of respiratory conditions like emphysema and chronic obstructive pulmonary disease (COPD) is propelling the market for portable oxygen concentrators (POCs). With age, more people are becoming vulnerable to chronic respiratory issues. The portable oxygen concentrator technology has also seen its advancements with regards to increased efficiency with longer battery life and reduced and lighter designs that increase user appeal for the need for mobility and independence while receiving treatment. Market trends reflect increased preference toward home-based care solutions since they are cost-effective and convenient as opposed to a hospital stay. This shift has prompted the manufacturers to innovate POCs to meet patient-specific needs. In addition, the increasing adoption of portable devices in the emerging market is backed up by improved healthcare infrastructure and the spreading of awareness programs for oxygen therapy. The integration of smart technologies, including connectivity to mobile applications for remote monitoring and adjustment, is gaining momentum in tandem with the increasing adoption of digital health tools. Additionally, government initiatives that provide subsidies and reimbursements for medical devices in developed countries improve market access. These drivers and trends collectively underscore the market's direction toward advanced, user-friendly, and accessible portable oxygen concentrators.

The United States has emerged as a key regional market for portable oxygen concentrators. The United States portable oxygen concentrators market is growing due to the increasing prevalence of respiratory conditions like COPD and asthma, driven by aging demographics and environmental factors. Increasing healthcare spending and patient preference for home-based care are accelerating the adoption of portable devices, offering convenience and mobility for oxygen therapy. Technological innovations including lightweight designs, extra-long battery life, and smart features like app connectivity are molding the market trends. Further, the government policies supporting Medicare reimbursement have widened access to these devices. With the value-based care model and personalized treatment, more patients need such advanced, user-oriented concentrators. Higher consciousness toward respiratory health and increasing desire for a better quality of patients' lives are also positive contributors to the market.

Portable Oxygen Concentrators Market Trends:

Increasing cases of respiratory conditions

The increasing cases of patients diagnosed with respiratory conditions such as lung cancer, COPD, asthma, pulmonary fibrosis, and flu require an efficient oxygen therapy system. As reported by WHO, it is estimated that 545 million people suffer from chronic respiratory diseases, including COPD, asthma, and pulmonary fibrosis, thus forming a vast potential patient base for the requirement of oxygen therapy. POCs provide convenient and portable oxygen delivery to patients with the ability to care for their conditions and improve their overall quality of life. Increases in respiratory disease incidence rates account for the growth in POC demand in the market. Additionally, POCs allow healthcare providers to administer care outside the walls of the hospital by delivering care in the home thus alleviating the burden on the hospitals. In addition, POCs also are a low-cost option as compared with other conventional oxygen therapy methods where frequent refills of cylinders or maintenance of stationary concentrators are done away with.

Growing demand for home medical care

The increasing need for home medical care grows the demand to have portability in medical devices at the time of treatment. POCs fit well within this need as they allow for the easy and portable use of oxygen therapy within a home setting. According to the European Respiratory Society, in 2022 it was revealed that 60% of patients with chronic respiratory diseases prefer to be cared for at home rather than within a hospital, citing convenience and comfort as major factors. With this growing trend toward care at home, the increasing need for portable oxygen concentrators is at its peak. In addition, home-based medical care can potentially save healthcare systems money in terms of decreasing hospital stays, readmissions, and emergency department visits. POCs allow patients to receive oxygen therapy at home, which reduces the likelihood of being admitted to a hospital due to respiratory disease. Optimization of healthcare resources and cost-effectiveness drive the integration of POCs into home-based care strategies.

Increasing geriatric population

As people age, their susceptibility to respiratory diseases such as chronic obstructive pulmonary disease, pneumonia, and other lung disorders increases. These conditions typically require long-term oxygen therapy to alleviate symptoms and enhance the quality of life. The increasing geriatric population directly contributes to the increased prevalence of respiratory diseases. As a result, POCs are in greater demand as a necessary medical device for oxygen therapy. For example, according to the European Commission, the number of elderly increased dramatically in Europe in 2023 as well. More than 21.3% of people above 65 years made up the entire population in that region. Also, POCs ensure mobility and portability that enables elderly people to live actively and carry on with their lifestyles, and in doing so, receive the necessary oxygen supply. The aspiration for active aging by the geriatric population fuels the demand for POCs that enable them to participate fully in their desired activities.

Portable Oxygen Concentrators Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global portable oxygen concentrators market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on technology, application, and end user.

Analysis by Technology:

- Continuous Flow

- Pulse Flow

In 2024, pulse flow represents the leading segment with 69.5% of the portable oxygen concentrators market share. The delivery of oxygen makes an oxygen flow that would go synchronized with breathing by a patient, with low oxygen wastage that contributes to higher usability of this type of technology, valued because of its lightweight design that contributes to portability. It is suitable for active patients requiring mobility during oxygen therapy. This segment has been further strengthened by innovations such as longer battery life, compact form factors, and advanced sensors that adapt to varying respiratory patterns. Pulse flow devices cater to the growing preference for home-based care and ambulatory use, especially among individuals with chronic respiratory conditions. Moreover, the integration of smart features, including app-based monitoring and real-time adjustments, has elevated user experience and encouraged adoption. The increasing prevalence of chronic respiratory diseases, coupled with technological advancements and awareness about portable oxygen solutions, continues to propel this segment's growth and reinforce its market leadership.

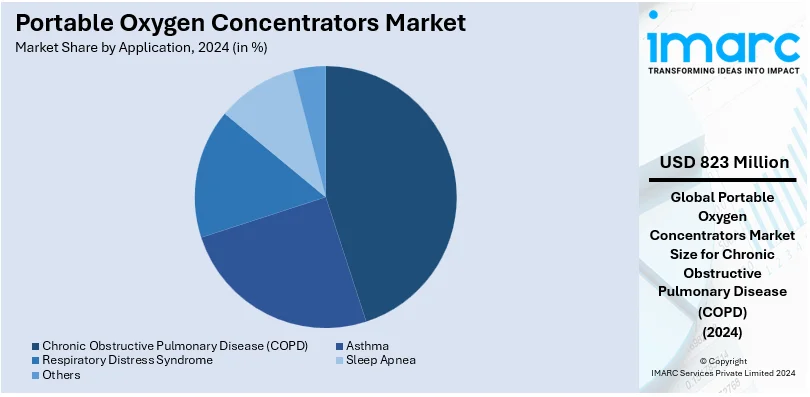

Analysis by Application:

- Chronic Obstructive Pulmonary Disease (COPD)

- Asthma

- Respiratory Distress Syndrome

- Sleep Apnea

- Others

COPD dominates the segment and holds a 43.2% market share since this chronic condition has a high prevalence globally. As a result, patients using COPD often require supplemental oxygen therapy for the elongated periods to control and improve their quality of life. The portable oxygen concentrators will be of great importance, as these patients cannot use an oxygen tank for mobility since it has limited space. The aging population, more vulnerable to COPD, is a prime growth driver for this market. Increased awareness campaigns of the importance of early diagnosis and treatment are also contributing to wider adoption. The device manufacturers are tailoring products to meet COPD-specific needs, integrating features such as adjustable oxygen flow rates, extended operating times, and lightweight designs. In addition, the trend toward affordable, home-based care options has increased demand for portable oxygen concentrators among COPD patients.

Analysis by End User:

- Hospitals

- Ambulatory Surgery Centers

- Others

Ambulatory surgery centers hold the largest market share, which is an emerging trend toward outpatient care as it is more cost-effective and convenient. The centers often use portable oxygen concentrators for pre-operative and post-operative respiratory support in patients with chronic underlying conditions, such as COPD. The portability and mobility of these devices are best suited for ASCs where space and efficiency are critical. The growth in the number of ASCs and the trend toward delivering high-quality care in shorter patient stays have played a significant role in ASC dominance. Portable concentrators allow for faster patient recovery and turnover, which meets the operational needs of an ASC. There is an increasing trend toward minimally invasive procedures, which require oxygen support for respiratory stability, increasing demand. Technological improvements through compact designs and user-friendly interfaces enhance adoption. With healthcare trends being set in favor of outpatient settings versus traditional hospital care, portable oxygen concentrators in the ASC continue to gain relevance and establish further leadership within this segment.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America held the largest portable oxygen concentrators market share with 38.9%. North America hosts a high prevalence of respiratory diseases, including COPD, asthma, and other lung conditions. The region's demographic aging, environmental factors, and lifestyle choices contribute to higher rates of respiratory conditions. The higher incidence rate of such diseases leads to the creation of a larger patient group, who require oxygen therapy in the given region. Therefore, there will be a hike in demand for POCs in North America. Also, the region houses well-established healthcare infrastructure, especially high-quality medical facilities, a better health system, and the required funds for healthcare-related research and development. A superior class of hospitals, clinics, and ambulatory surgery centers provide an enhanced platform for the acceptance of POCs. Moreover, the POC market experienced relentless technological advancements, during which North America was always at the forefront of those developments. The region has several key players in the health care and medical device industry which creates a culture of research and development.

The Asia Pacific portable oxygen concentrators market is growing due to the prevalence of respiratory disease and the graying population across the region. Rapid urbanization leads to increased levels of air pollutants, which creates a greater incidence of COPD and asthma, boosting demand. Additionally, the rapid development of the health infrastructure and improving awareness about the use of oxygen therapy propel this market growth. The most important drivers in this region are government initiatives to enhance access to medical devices, as well as the growing popularity of homecare solutions, particularly in emerging markets such as China and India.

The European portable oxygen concentrators market is driven by a high prevalence of chronic respiratory conditions and a growing elderly population. Increasing awareness about early diagnosis and oxygen therapy encourages adoption. The expansion of the market is also supported by favorable reimbursement policies across countries such as Germany, France, and the UK. Technological advancements in medical devices and the region's focus on home-based care solutions further increase demand. Furthermore, increasing healthcare expenditure and the drive to promote respiratory health are pushing the market, with a growing emphasis on patient-centric, portable healthcare solutions.

The market for portable oxygen concentrators in Latin America is increasing as respiratory diseases, including COPD and asthma, continue to rise because of pollution and smoking rates. The economies of countries like Brazil and Mexico have improved healthcare accessibility and affordability, increasing the demand for sophisticated medical equipment. Increased awareness campaigns and acceptance of homecare oxygen therapy have become crucial factors. In addition, investments in healthcare infrastructure and the increasing availability of compact, cost-effective portable concentrators are further supporting market growth in the region.

The market is growing in the Middle East and Africa due to increased awareness about respiratory health and a growing prevalence of conditions such as asthma and COPD. Main Enablers of Improvement in Healthcare Infrastructure and Economic Development, particularly in Countries like UAE and South Africa Adoption of Home-Based Oxygen Therapy Solutions, with Help from the Governments to Improve Medical Devices and Further Enhanced Availability due to Increased Partnering with International Manufacturers as Well as Local Distributors Across This Region.

Key Regional Takeaways:

United States Portable Oxygen Concentrators Market Analysis

The United States accounts for 80% of the portable oxygen concentrators market in North America. Advanced healthcare infrastructure and high prevalence of chronic respiratory conditions help the U.S. portable oxygen concentrators market. The Centers for Disease Control and Prevention (CDC) reported that around 16 million Americans have chronic obstructive pulmonary disease (COPD), leading to demand for oxygen therapy devices. Medicare reimbursement policies also enhance affordability and adoption. Market leaders like Inogen and Invacare drive the market through technological innovation in lightweight, battery-powered models. Awareness about respiratory health and government support for homecare solutions are the other factors driving growth. Canada and Mexico export opportunities increase the U.S. share as an important international player in the global market for portable oxygen concentrators.

Europe Portable Oxygen Concentrators Market Analysis

The growth of the European market for portable oxygen concentrators is closely related to both the growing demand for long-term oxygen therapy and the changing clinical practices that are increasingly based on individualized care. According to the 2023 European Lung Foundation report, many people in Europe use long-term oxygen therapy, thus directly creating a need for portable devices. This is in line with the trend of individualizing oxygen prescriptions that have emerged in clinical practice and are widely done in countries such as Italy, France, and the Netherlands. For example, according to the European Respiratory Society, in Italy, 67% of respirologists screen patients at night to tailor nocturnal prescriptions, a practice also reflected in the increased use of portable oxygen devices. The strategy is an even more significant trend toward personalization of treatment, to which the growth of e-commerce sites such as Amazon and Mediq, providing greater access to patients, contributes. Moreover, more aggressive goals for Sa, O2 levels, such as the 35% in Spain and 36% in Italy targeting ≥92%, are linked to the enhanced complexity of portable oxygen concentrators, which are intended to be more patient-specific. This is part of the USD 36 Billion in medical devices allocated in Germany's 2022 healthcare budget, clearly reflecting investment in respiratory care equipment, including portable oxygen concentrators. The demand for this is supported by regulatory standards and public health awareness campaigns, so ensuring that both safety and accessibility gains the trust of patients in the devices. This correlation between the growing number of respiratory illness cases, individualized oxygen prescriptions, and innovation in portable oxygen technology is driving the growth of the market in Europe.

Asia Pacific Portable Oxygen Concentrators Market Analysis

The Asia Pacific portable oxygen concentrator market is expanding significantly as a result of rising healthcare costs and the high incidence of respiratory illnesses. The WHO estimates that more than 100 million in China suffer from COPD, which leads to demand for oxygen therapy equipment. The Chinese government allocated a sum of 1.5 Billion USD toward medical equipment during the year 2023 as part of its medical reform. Making in India-India has motivated domestic production, reduced costs, and increased availability. Panasonic, one of the Japanese major manufacturers, is now releasing premium models with innovative features to satisfy the needs of technology-conscious customers. Additionally, the association between global companies and local distributors allows the product to access a wider range of consumers. Malaysia and Thailand are now increasingly witnessing medical tourism, thereby increasing the demand for portable oxygen concentrators. Tie-ups between global companies and local distributors also ensure that the product reaches more consumers.

Latin America Portable Oxygen Concentrators Market Analysis

The portable oxygen concentrators market is emerging in Latin America due to rising healthcare investment and the prevalence of respiratory diseases in the region. International Trade Government cited Brazil as the largest healthcare market in this region as it spent 9.47% of its GDP on healthcare. This high investment boosts access to modern medical devices, which in this case includes an oxygen concentrator. The International Pharmaceutical Federation reports that over 6.3 million people in Brazil suffer from COPD and this amounts to a huge market for portable oxygen therapy. Government initiatives like Mexico's Seguro Popular offer subsidies to increase the adoption rates within the region. This encourages big players like Philips and GCE Group to launch energy-efficient models that are affordable to meet regional needs. Latin America will be a growth region for portable oxygen concentrators, with increasing market demand due to an improving healthcare infrastructure and rising demand for home healthcare services.

Middle East and Africa Portable Oxygen Concentrators Market Analysis

The increased incidence rates of respiratory ailments and the interest by the governments to improve health care drive the demand for portable oxygen concentrators across the Middle East and Africa. The International Respiratory Foundation puts the regional prevalence of the entire patient population with COPD to be more than 6 Million. Saudi Arabia dedicated USD 5 Billion in 2023 for health sector modernization in purchasing oxygen concentrators and other health products within Vision 2030. One of South Africa's home-based manufacturers is Afrox. They provide patients with home-based medical products very reasonably. The rise of home care products in the cities of Egypt and the United Arab Emirates is leading to a boost in demand. Strategic collaborations with overseas producers are making products more available and affordable and therefore spur growth in the regional market.

Competitive Landscape:

Key players are emphasizing innovation and strategic plans as they look to meet increased demands for efficient and user-friendly devices. The key companies in the portable oxygen concentrator industry are investing substantially in research and development. Technologically advanced products would feature extended battery life, greater portability, and the use of smart technologies such as Bluetooth connectivity and mobile app monitoring. One important trend, that involves a lot of partnerships and collaboration, is where companies form agreements to bolster their networks, expand their presence, and push into worldwide markets. As is the case with players like several being aligned to providers for smooth availability in healthcare systems, home care service providers for easy use, and awareness about adoption, among other combinations. It is through merger and acquisition wherein companies continue strengthening their offerings and geographical markets. In regions such as North America and Europe, which are highly regulated, companies are focusing on obtaining regulatory approvals and certifications to comply with healthcare standards. Most companies are also targeting emerging markets by offering cost-effective solutions to budget-conscious consumers. The combination of innovation, strategic alliances, and geographic expansion underscores the proactive approach of market players to capitalize on the increasing demand for portable oxygen concentrators.

The report provides a comprehensive analysis of the competitive landscape in the portable oxygen concentrators market with detailed profiles of all major companies, including:

- Caire Inc. (NGK Spark Plug Co. Ltd)

- Chart Industries Inc.

- Drive Devilbiss Healthcare Limited (Drive International LLC)

- Inogen Inc.

- Invacare Corporation

- Koninklijke Philips N.V

- Nidek Medical India Pvt Ltd

- O2 Concepts LLC

- Precision Medical Inc. (BioHorizons Inc.)

- Teijin Limited

Latest News and Developments:

- November 2024: Belluscura secured a $4 million credit facility with Sallyport Commercial Finance to expand its manufacturing, distribution, and sales efforts. The funding, combined with Medicare clearance received on October 28, enables the company to launch its DISCOV-R portable oxygen concentrator into the B2B market.

- November 2024: The Indian government launched a Rs 500 crore initiative to strengthen its medical devices industry. The scheme, aimed at enhancing India's self-reliance, will focus on boosting local production of medical devices, including oxygen concentrators, by improving infrastructure, reducing dependency on imports, and funding clinical studies. This initiative is expected to make India a key player in the global medical devices market, projected to grow to $30 billion by 2030.

- September 2024: Oxymed launched the P2 Portable Oxygen Concentrator in India, designed for individuals with chronic respiratory conditions like COPD. Weighing 1.98 kg, it delivers oxygen with 90-95% purity across five pulse flow settings and offers up to 10 hours of battery life with a double battery. The device is FAA and FDA approved, featuring a user-friendly interface and is supported by home installation and service across 50 cities in India.

- March 2024: Drive DeVilbiss Healthcare and Sanrai International unveiled the PulmO2 10L Oxygen Concentrator, designed for global use, especially in low-resource settings. The concentrator is energy-efficient, with savings of up to 64% compared to traditional models, and is built to endure harsh clinical environments. The innovation, supported by the UK government, aims to provide life-saving oxygen in under-served areas worldwide.

- October 2024: Inogen Inc. introduced the Rove 4 Portable Oxygen Concentrator, which features a fourth flow setting that delivers 840ml/min of oxygen and offers up to 5.75 hours of operation in a portable design that enhances ambulatory oxygen therapy for patients.

- August 2024: O2 Concepts announced a new partnership with VGM & Associates. This alliance is further enhancing the VGM Respiratory portfolio by providing members with innovative POC devices from O2 Concepts along with the DNA platform for a more effective respiratory care solution and fleet management.

- June 2024: Inogen announced the publication of a study that appeared in Pulmonary Therapy showing that portable oxygen concentrators improve survival rates and cut costs in comparison to other oxygen therapies. The study, using data from 244,000 patients, confirms POCs' value in improving health outcomes and reducing healthcare costs.

Portable Oxygen Concentrators Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Continuous Flow, Pulse Flow |

| Applications Covered | Chronic Obstructive Pulmonary Disease (COPD), Asthma, Respiratory Distress Syndrome, Sleep Apnea, others |

| End Uses Covered | Hospitals, Ambulatory Centers, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Caire Inc. (NGK Spark Plug Co. Ltd), Chart Industries Inc., Drive Devilbiss Healthcare Limited (Drive International LLC), Inogen Inc., Invacare Corporation, Koninklijke Philips N.V., Nidek Medical India Pvt Ltd, O2 Concepts LLC, Precision Medical Inc. (BioHorizons Inc.), Resmed Inc. and Teijin Limited |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the portable oxygen concentrators market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global portable oxygen concentrators market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the portable oxygen concentrators industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

A portable oxygen concentrator is a medical device designed to offer oxygen therapy to patients having respiratory disorders. It filters oxygen from the ambient air and provides it to the user through a hose. Portable and very light, it offers a sense of mobility and convenience, both in home use and outdoors.

The portable oxygen concentrators market was valued at USD 1.9 Billion in 2024.

IMARC estimates the global portable oxygen concentrators market to exhibit a CAGR of 6.97% during 2025-2033.

The increasing incidence of respiratory diseases such as emphysema and COPD, technological advancements, longer battery life, and lighter designs are appealing to users who want mobility and independence is fueling the demand for portable oxygen concentrators.

In 2024, pulse flow represented the largest segment, offering synchronized oxygen delivery, low oxygen wastage, lightweight design, and portability.

Chronic obstructive pulmonary disease leads the market due to high global prevalence, necessitating supplemental oxygen therapy for patients to improve their quality of life.

Ambulatory surgery centers are the leading segment, due to the emerging trend of outpatient care, which is more cost-effective and convenient.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global portable oxygen concentrators market include Caire Inc. (NGK Spark Plug Co. Ltd), Chart Industries Inc., Drive Devilbiss Healthcare Limited (Drive International LLC), Inogen Inc., Invacare Corporation, Koninklijke Philips N.V., Nidek Medical India Pvt Ltd, O2 Concepts LLC, Precision Medical Inc. (BioHorizons Inc.), Resmed Inc. and Teijin Limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)