Global Power Rental Market Expected to Reach USD 36.3 Billion by 2033 - IMARC Group, North America Led with 33.7% Market Share in 2024 - IMARC Group

Global Power Rental Market Statistics, Outlook and Regional Analysis 2025-2033

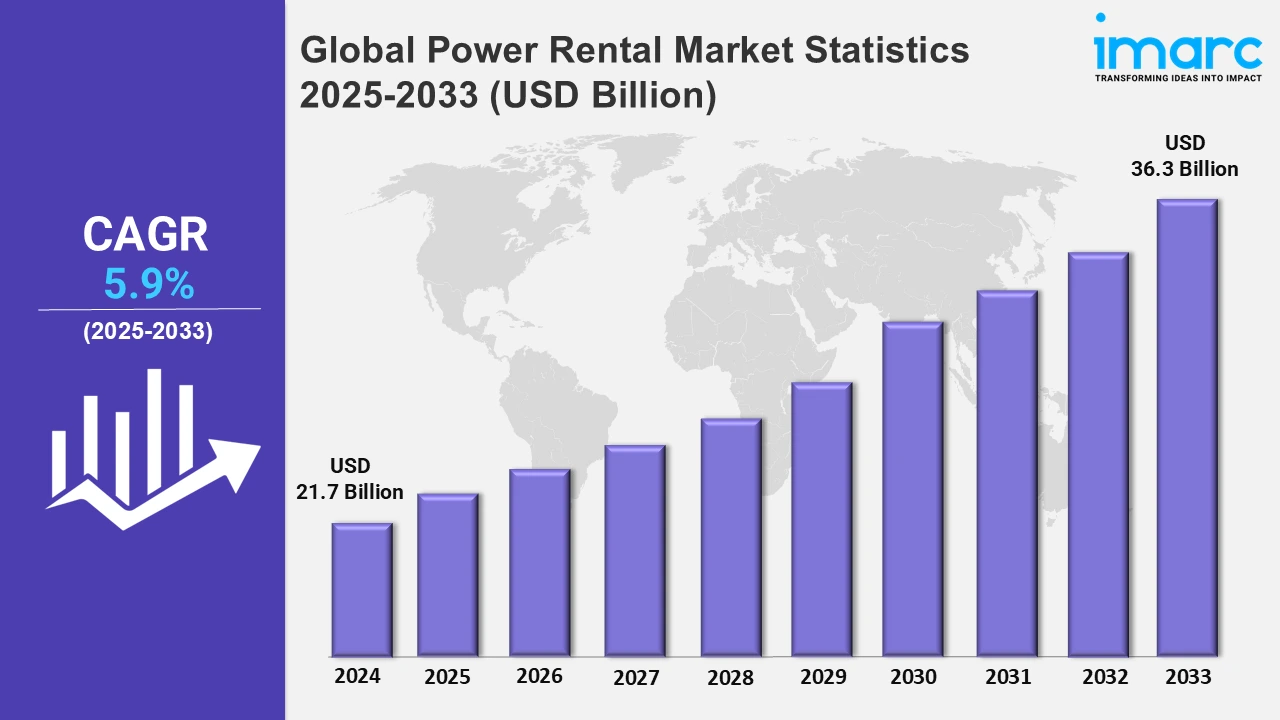

The global power rental market size was valued at USD 21.7 Billion in 2024, and it is expected to reach USD 36.3 Billion by 2033, exhibiting a growth rate (CAGR) of 5.9% from 2025 to 2033.

To get more information on this market, Request Sample

The global power rental market is experiencing significant growth due to the rapid urbanization and industrialization in emerging economies. This has led to a heightened demand for consistent and reliable power sources, especially in regions where the electricity grid is either underdeveloped or unstable, aiding the market growth. For example, In India, the electricity demand is expected to grow by over 6% annually until 2026, reflecting the country's industrial growth. Moreover, frequent power outages and the inability of aging grid infrastructure to meet the rising electricity requirements compel industries, construction projects, and events, making rental solutions a flexible and cost-effective alternative, thus providing an impetus to the market. Additionally, the surge in construction activities, especially in the oil and gas, mining, and manufacturing sectors, creates an immediate need for portable and reliable power sources to maintain operational continuity in remote and temporary locations, impelling the market growth. Furthermore, natural disasters and climate-related incidents often require immediate and substitute power solutions to support emergency services and restore basic utilities, thereby catalyzing the market growth.

Concurrently, the increasing adoption of renewable energy (RE) sources such as solar and wind introduces intermittency issues, prompting the need for backup power systems during periods of low production, which is supporting the market expansion. For instance, Germany increased its power grid battery capacity by nearly a third in 2024, reaching 1.8 gigawatt-hours (GWh) by September, showcasing how investments in energy storage address these challenges. Besides this, regulatory compliance and the rising shift towards cleaner energy have encouraged the development of more fuel-efficient and environmentally friendly rental power equipment. This is further making the market more attractive to environmentally conscious organizations and strengthening the market share. In line with this, the growing emphasis on reducing upfront capital expenditure by organizations is acting as another growth-inducing factor, as renting power equipment eliminates the need for heavy investments in owning and maintaining permanent systems. Moreover, events and entertainment industries require temporary power solutions for large-scale gatherings, concerts, and festivals, contributing to market expansion. Apart from this, ongoing technological advancements in rental power systems, including smart monitoring and remote management, enhance operational efficiency and reliability, which is increasing customer adoption and propelling the market forward.

Global Power Rental Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, the United Kingdom, France, Russia, Italy, and others); Asia-Pacific (China, Japan, South Korea, India, Australia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa (Saudi Arabia, United Arab Emirates, South Africa and others). According to the report, North America accounted for the largest market share on account of increasing investments in oil and gas projects, rising demand for temporary power during emergencies, aging grid infrastructure, and growing adoption of advanced rental power technologies.

North America Power Rental Market Trends:

The demand for power rental in North America is expanding primarily due to the abrupt occurrence of hurricanes and snowstorms during the year. According to the U.S. Energy Information Administration (EIA), most of the weather-related power outages in 2023, were caused by severe weather events (58%), winter storms (23%), and tropical cyclones, including hurricanes (14%). These situations result in power outages and require an immediate power source on the market. In addition, the increasing market for data centres contributes to the need for continual power supply since these centres need constant electricity to provide their service. Furthermore, compliance with the strict legal standards for power resilience in the facilities that are considered lifelines, including healthcare and transportation, promotes the adoption of power rentals in the region. Apart from this, the increasing use of modular and scalable rental power systems by businesses seeking to achieve maximum energy efficiency and operational adaptability is providing an impetus to the market.

Asia-Pacific Power Rental Market Trends:

In Asia Pacific, the demand for power rentals is growing, driven by rapid population growth and an increase in manufacturing industries that require dependable electricity solutions, especially in emerging markets with immature power infrastructure. Concurrently, the increasing number of large construction projects and the surging use of rental power for temporary requirements during events and festivals, which is supporting the market growth.

Europe Power Rental Market Trends:

The demand for power rental In Europe is significantly expanding due to the shifting trend to renewables where intermittency calls for backup. Apart from this, the utilization of rental power during major events, robust infrastructure development, and high stringency of emission norms are driving cleaner and more efficient rental power technologies in the region, contributing to the market expansion.

Latin America Power Rental Market Trends:

In Latin America, the demand for power rental is rising because the availability of electricity for rental solutions is inconsistent in remote areas due to more power cuts which compels people to seek rental services. Also, continuous advancement in mining and agricultural industries along with the investment by the government for improving infrastructure is strengthening the market share.

Middle East and Africa Power Rental Market Trends:

The demand for power rentals in the Middle East and Africa is witnessing significant growth due to the rising massive projects in the oil and gas and construction sectors, along with energy scarcity in the countryside of the region. In confluence with this, the use of rental power to meet industrial requirements during the higher demand seasons is catalyzing the market growth.

Top Companies Leading in the Power Rental Industry

Some of the leading power rental market companies include Aggreko Plc, Caterpillar, Inc., Atlas Copco Group, Cummins, Inc., United Rentals, Inc., HIMOINSA S.L., Horizon Acquisition (Horizon Power Systems), The Hertz Corporation, Generac Power Systems, Wacker Neuson SE, Wärtsilä Oyj Abp, Speedy Hire Plc, Smart Energy Solutions (SES), and SoEnergy International, Inc., among many others.

- In May 2024, Aggreko announced a $200 million investment to expand its Battery Energy Storage Systems (BESS) fleet, aiming to support clients in decarbonizing power supply and enhancing energy efficiency.

- In September 2024, Atlas Copco acquired Generator Rental Services Limited (GRS), a New Zealand based provider of power solutions, to broaden the company's footprint in Oceania.

Global Power Rental Market Segmentation Coverage

- On the basis of the fuel type, the market has been categorized into diesel, natural gas, and others, wherein diesel represents the leading segment due to easy accessibility, relatively inexpensive price, high power density, and reliability of operation. It is favored for heavy use in construction, mining, and oil and gas companies where reliability and longevity of the battery are paramount, especially in locations where access to electricity is limited, boosting the market demand.

- Based on the equipment type, the market is classified into generator, transformer, load bank, and others, amongst which generators dominate the market as they are portable, durable, efficient intermittent power producers in different applications. They are widely used in construction sites, events, and manufacturing with temporary power requirements for power outages in regions that are difficult to access, contributing to the market expansion.

- On the basis of the power rating, the market has been divided into up to 50 kW, 51-500 kW, 501-2500 kW, and above 2500 kW. Among these, 51-599 kW accounts for the majority of the market share owing to its versatility in medium-sized businesses including construction, events, and manufacturing industries. Its ability to tackle different power requirements, relatively lower cost, and simple installation make it the preferred solution for temporary and backup power, impelling the market growth.

- Based on the application, the market is segregated into peak shaving, standby power, and base load/continuous power. Base Load/continuous power holds the biggest market share because it is a major source of backup electricity that is needed during blackouts and calamities. It is extensively used in all industries including healthcare, data centers, and factories to ensure continuity of business and reduce business disruption. They also play a crucial role in critical applications because of the reliability and readiness of the equipment, thus aiding in the market expansion.

- On the basis of end use industry, the market is segmented into utilities, oil & gas, events, construction, mining, data centers, and others, amongst which utilities lead the market as they require temporary power solutions to meet requirements such as grid upgrades, augmentation of capacity, and blackouts. The need to ensure a constant electric power supply to the growing urban and rural populace due to growing energy needs and old equipment is bolstering the market demand.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 21.7 Billion |

| Market Forecast in 2033 | USD 36.3 Billion |

| Market Growth Rate 2025-2033 | 5.9% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fuel Types Covered | Diesel, Natural Gas, Others |

| Equipment Types Covered | Generator, Transformer, Load Bank, Others |

| Power Ratings Covered | Up to 50 kW, 51 –500 kW, 501 –2,500 kW, Above 2,500 kW |

| Applications Covered | Peak Shaving, Standby Power, Base Load/Continuous Power |

| End Use Industries Covered | Utilities, Oil & Gas, Events, Construction, Mining, Data Centers, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States , Canada, Germany, United Kingdom, France, Russia, Italy, China, Japan, South Korea, India, Australia, Brazil, Mexico, Saudi Arabia, United Arab Emirates, South Africa |

| Companies Covered | Aggreko Plc, Caterpillar, Inc., Atlas Copco Group, Cummins, Inc., United Rentals, Inc., HIMOINSA S.L., Horizon Acquisition (Horizon Power Systems), The Hertz Corporation, Generac Power Systems, Wacker Neuson SE, Wärtsilä Oyj Abp, Speedy Hire Plc, Smart Energy Solutions (SES), SoEnergy International, Inc.,etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Power Rental Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)