Corrugated Boxes Market Size, Share, Trends and Forecast by Material Used, End Use, and Region, 2026-2034

Corrugated Boxes Market Size and Share:

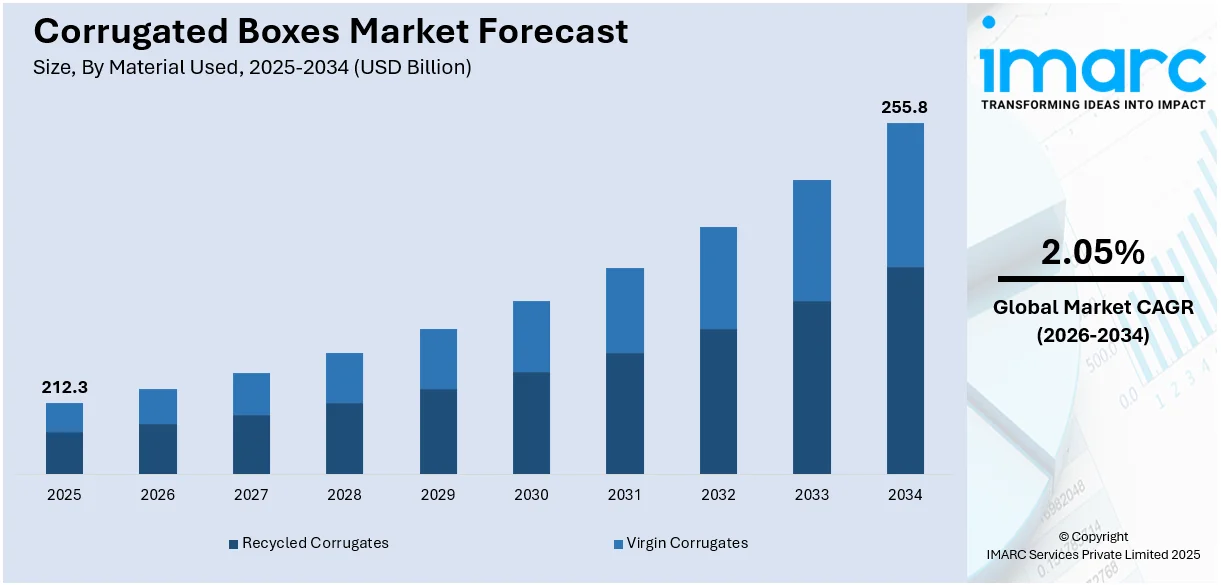

The global corrugated boxes market size was valued at USD 212.3 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 255.8 Billion by 2034, exhibiting a CAGR of 2.05% from 2026-2034. Asia Pacific currently dominates the market. The rapid expansion in the e-commerce sector, the growing demand for sustainable packaging solutions, and the rising utilization of corrugated boxes for customization and branding applications in several industries are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034 |

|

Historical Years

|

2020-2025 |

|

Market Size in 2025

|

USD 212.3 Billion |

|

Market Forecast in 2034

|

USD 255.8 Billion |

| Market Growth Rate 2026-2034 | 2.05% |

The corrugated boxes market is expanding due to increasing demand for sustainable and recyclable packaging solutions, driven by rising environmental awareness. The e-commerce sector has boosted the need for lightweight, durable packaging for shipping and storage. The food and beverage industry also drives growth with its demand for secure packaging. For instance, on September 24, 2024, Diageo launched a 90% paper-based bottle trial for Johnnie Walker Black Label, developed with PA Consulting and PulPac. The bottle is 60% lighter, with up to 47% lower emissions, showcasing efforts to reduce environmental impact. Technological advancements in printing and design customization enhance branding appeal, while government regulations promoting eco-friendly materials are further bolstering the global market.

To get more information on this market Request Sample

The United States stands out as a key regional market and is primarily expanding due to the rapid growth of e-commerce, driving demand for cost-effective and efficient packaging solutions. Consumer preference for sustainable materials encouraged businesses to adopt recyclable and biodegradable options, strengthening market demand. The reliance on packaged food and beverages further necessitates hygienic and durable corrugated boxes. Advancements in digital printing technology, such as AstroNova’s acquisition of MTEX NS on May 9, 2024, enhance branding through high-quality, customizable designs. MTEX NS contributes innovative solutions, including a breakthrough direct-to-film printer, expanding sustainable packaging capabilities. Additionally, retail and warehouse infrastructure growth and regulatory policies promoting eco-friendly materials support adoption across industries, ensuring steady market growth.

Corrugated Boxes Market Trends:

Significant Expansion in the E-Commerce Industry

The rise of online shopping is leading to an increased need for packaging materials, with corrugated boxes being a primary choice for shipping and delivering products to customers. The e-commerce sector relies heavily on these boxes due to their durability, versatility, cost-effectiveness, and the escalating demand for customized packaging solutions is contributing to the market growth. E-commerce companies recognize the value of branding and creating a memorable unboxing experience, achievable with customizable corrugated boxes featuring logos, graphics, and designs to strengthen brand identity and leave a lasting customer impression. Additionally, the industry prioritizes product protection during shipping, with corrugated boxes offering superior cushioning and structural strength to ensure safe delivery. An industrial report highlights the increasing global e-commerce sales within the sector over the last decade, with the global B2B e-commerce market projected to reach USD 36 Trillion by 2026. Major industries like advanced manufacturing, energy, healthcare, and professional business services are key drivers of the B2B sales value, further highlighting the growing demand for reliable and effective packaging solutions like corrugated boxes.

Rising Demand for Sustainable Packaging Solutions

The increasing awareness and importance of environmental sustainability have led to a growing demand for eco-friendly packaging options leading to the widespread adoption of corrugated boxes. Moreover, corrugated boxes are made from renewable and recyclable materials, primarily paperboard derived from trees. As consumers and businesses become more conscious of their ecological footprint, they are seeking packaging solutions that minimize environmental impact. Besides this, corrugated boxes can be easily recycled after use, which helps conserve resources, reduce waste sent to landfills, and promote a more sustainable economy. The American Forest & Paper Association (AF&PA) reported that the recycling rate for old, corrugated containers (OCC) reached 93.6 percent in 2022, marking an increase from 2021 and an overall three-year average of 91.3 percent. Furthermore, the lightweight nature of corrugated boxes contributes to energy efficiency during transportation, requires less fuel, and generates fewer carbon emissions during shipping, which is also contributing to the market growth.

Increasing Product Use for Customization and Branding Applications

The growing customization and branding applications in various industries is expanding the global corrugated box market size 2024. Businesses across sectors such as e-commerce, retail, food and beverage, and cosmetics are increasingly recognizing packaging as a marketing tool. In addition, corrugated boxes can be easily customized with logos, graphics, and branding elements, allowing companies to create a distinct visual identity and enhance their brand recognition. This ability to customize packaging to specific products and brand aesthetics is making corrugated boxes a popular choice, enabling businesses to deliver a unique unboxing experience that resonates with consumers and reinforces their brand image. When consumers have a positive experience with packaging, it can significantly drive brand loyalty. According to industry reports, 64% of consumers try a new product as the packaging grabs their attention, with 41% choosing to repurchase a product due to its preferred design. Well-designed packaging that is informative and incorporates premium features, such as reliability and sustainable materials, can render the product more appealing to consumers.

Corrugated Boxes Market Growth Drivers:

Food and Beverage Industry

The heightened innovations in the food and beverage (F&B) industry, mainly driven by the expansion of online food ordering services, is the key driver of the market. With customers increasingly opting for meal convenience in terms of ordering, demand for safe, strong, and eco-friendly packaging materials has shot up. Corrugated boxes, due to their strength, protective nature, and environmental-friendliness, are now the first choice in packaging and shipping food items. An increase in online shopping, along with heightened importance placed on sustainable packaging options, further drives the demand for corrugated boxes within this industry.

Healthcare and Personal Care Products

The increased need for packaging in the pharmaceutical and personal care sectors represents another key factor contributing to the market growth. The packaging requirements for drugs, medical devices, and personal care items must provide both protection and hygiene. Corrugated boxes satisfy these conditions by being strong, secure, and inexpensive for the shipment and storage of sensitive items. Besides this, the rising awareness about safety measures and sustainability in packaging is encouraging players in these industries to use corrugated solutions, thus driving the market growth further.

Corrugated Boxes Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global corrugated boxes market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on material used and end use.

Analysis by Material Used:

- Recycled Corrugates

- Virgin Corrugates

As per corrugated box industry analysis, recycled corrugates leads the market. The increasing consumer awareness regarding environmental issues and the importance of minimizing carbon footprint is generating a favorable outlook for the market. In addition to that, corrugated boxes produced from recycled fibers offer several advantages, including durability, lightweight, and cost-effectiveness. As a result, they are widely utilized in packaging applications for cosmetics, consumer electronics, and fast-food products. Moreover, the implementation of several government policies and standards promoting the use of recycled materials and sustainable packaging practices led to the widespread adoption of recycled corrugated materials as businesses seek to comply with these regulations and meet sustainability targets. Besides, various technological advancements and manufacturing processes that ensure that recycled corrugated boxes possess the necessary strength, durability, and protective properties required for packaging various products represent another leading factor increasing the market share of these boxes.

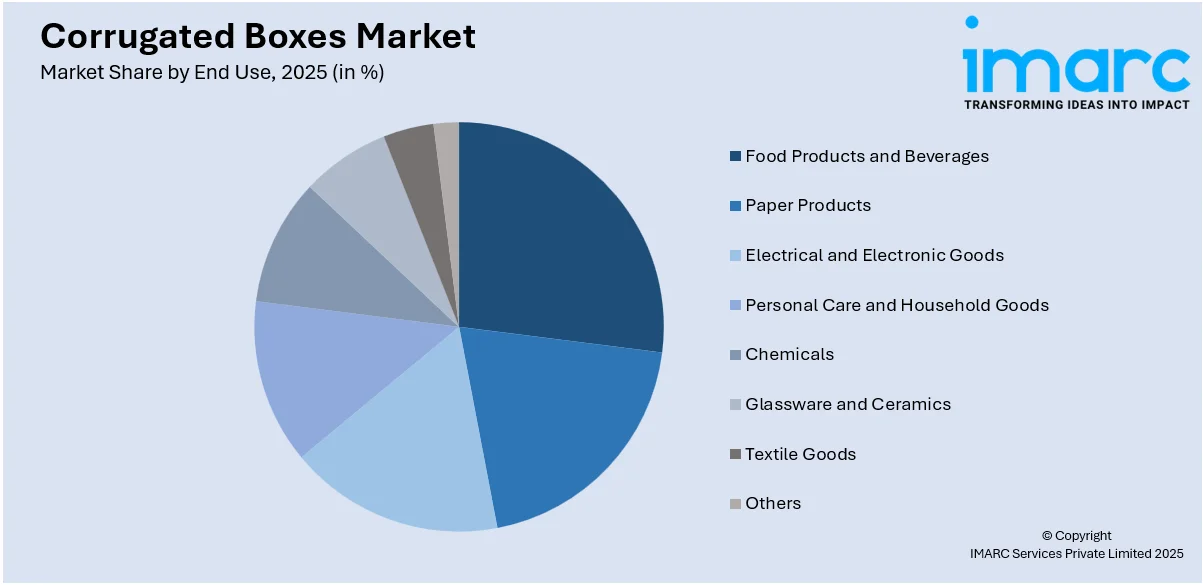

Analysis by End Use:

Access the comprehensive market breakdown Request Sample

- Food Products and Beverages

- Paper Products

- Electrical and Electronic Goods

- Personal Care and Household Goods

- Chemicals

- Glassware and Ceramics

- Textile Goods

- Others

The food products and beverages segment leads the market in 2025. Corrugated boxes are widely utilized as secondary packaging solutions for various products, including processed food, dairy items, and confectioneries due to their lightweight nature, structural rigidity, and ability to provide cushioning during transportation. Additionally, corrugated boxes are extensively employed in the food delivery sector for packaging ready-to-eat (RTE) products such as burgers, pizza, cookies, and cakes. Furthermore, the growing emphasis on sustainable packaging and product recycling is further contributing to the adoption of corrugated boxes as they are produced from non-toxic materials and are considered environmentally friendly, aligning with the sustainability objectives of many businesses. Besides, there is a rising demand for secured and hygienic packaging option for food products and beverages as corrugated boxes offer protection against physical damage, contamination, and moisture, ensuring that the products remain safe and fresh during storage and transportation.

Regional Analysis:

- Asia Pacific

- Europe

- North America

- Latin America

- Middle East and Africa

In 2025, Asia Pacific accounted for the largest market share since the region is growing due to the expanding e-commerce industry and the increasing consumer preference toward online shopping. Furthermore, the increasing demand for high-speed and cost-effective internet access is presenting remunerative growth opportunities for the market. Besides this, the increasing product application in several industries such as electronic goods, automotive components, home care, and personal care products is influencing the market growth. Another contributing aspect is rapid urbanization in the Asia Pacific leading to the development of modern infrastructure, including logistics networks, warehousing facilities, and transportation systems which support the growth of industries and facilitate the product demand in the region. Moreover, Asia Pacific is known for its cost-effective manufacturing capabilities. Hence, the production of corrugated boxes, including their raw materials is more affordable in the region in comparison with other parts of the world.

Key Regional Takeaways:

United States Corrugated Boxes Market Analysis

Considerable growth in the e-commerce sector is positively impacting the corrugated packaging market. Leading e-commerce companies, such as Amazon, mainly use plastic packaging for individual goods but rely heavily on corrugated boxes for bulk shipments. The market is poised for further expansion as e-commerce players increasingly replace single-use plastics with corrugated boxes and paper bags, aligning with sustainability goals. According to an industrial report, online sales in the United States will grow to an estimated USD 1.8 Trillion by 2029; electronics and fashion will take the lion's share from consumers. On environmental pressure, companies are taking extra efforts to avoid plastic products. Graphic Packaging International presented its KeelClip solution in the U.S. markets in August 2022. This innovation, brought into Liberty Coca-Cola Beverages' production facility in Elmsford, NY, using the AutoClip KC1600 multipacking machine, represents a sustainable alternative for multipacks of cans. So far, it has already been successful in Europe and shows the industry's change of direction toward more environmentally friendly solutions, which in turn drives the growth of the corrugated packaging market.

Europe Corrugated Boxes Market Analysis

The Europe corrugated boxes market is experiencing robust growth, propelled by stringent European Union regulations focusing on promoting sustainability and reducing packaging waste. Under the EU Packaging Waste Directive, member states are required to establish producer responsibility schemes for all packaging by 2024-end. Additionally, the directive sets ambitious recycling targets for paper and cardboard-based packaging, currently at 60%, the highest among all materials, and projected to reach 75% by 2025 and 85% by 2030. As corrugated boxes are both recyclable and reusable, these regulations are encouraging businesses to adopt paperboard-based packaging solutions, thereby driving market demand. Germany, a leading player in this market, exported corrugated boxes worth USD 1.45 Billion in 2022, as per Observatory of Economic Complexity (OEC). The country’s robust manufacturing base, supported by a significant presence of corrugating companies as noted by the European Federation of Corrugated Board Manufacturers (FEFCO), further highlights the positive market outlook for corrugated boxes in Europe. These regulatory measures and market dynamics collectively highlight the strong growth potential for the corrugated boxes market in the region, particularly as businesses increasingly prioritize sustainable and compliant packaging solutions.

Asia Pacific Corrugated Boxes Market Analysis

Asia-Pacific region is the leading consumer of corrugated boxes across the globe, due to its large consumer base and economic growth in countries like China and India. The corrugated boxes are highly used in breweries, glassware, cigarettes, pharmaceuticals, food products, cosmetics, footwear, toys, and others, which contribute significantly to the market size of this region. In India, the market potential for corrugated boxes has increased manifolds, especially after banning plastic packaging, which enhances demand for eco-friendly products. China is the biggest e-commerce market in the world, and it is again pushing the demand for corrugated packaging. The per capita income and the demographic changes in the country are changing the packaging market, and hence there is a need for innovative materials and processes. E-commerce giants such as Alibaba are major growth drivers in the market, and China accounts for nearly 50% of global e-commerce transactions, according to the International Trade Administration. This combination of diverse applications, regulatory shifts, and the e-commerce boom underlines the robust growth potential of the corrugated boxes market in the Asia-Pacific region.

Latin America Corrugated Boxes Market Analysis

Latin America's corrugated packaging market is experiencing primarily organic growth, driven by increasing demand for quality and convenience, particularly in Brazil. The expanding middle class in Brazil is fostering a preference for premium packaging, aligning with strategies that offer sophisticated, branded solutions. According to industry reports, shipments of corrugated board boxes, accessories, and sheets in Brazil are projected to grow by approximately 200,000 tons in 2024, reaching a record 4.2 million tons by year-end. Improved consumption conditions in Brazil are expected to be a key driver of demand, augmenting local industrial production to meet the needs of a growing consumer base. While Brazil’s economy has seen a shift toward extractive industries over manufacturing and high-tech sectors since the 2000s, current exchange rate levels and favorable consumption trends are poised to stimulate industrial production. This industrial growth is anticipated to support increased usage of corrugated board boxes and related products, cementing Brazil's role as a significant driver in Latin America's packaging market expansion.

Middle East and Africa Corrugated Boxes Market Analysis

The Middle East's corrugated packaging sector is witnessing notable expansion, fuelled by a rising awareness of eco-friendly packaging options and efforts to minimize the carbon emissions associated with conventional materials. The Qatari government, as part of the National Vision 2030, has launched various green economy initiatives to reduce waste and encourage renewable resources, facilitating the transition to environmentally friendly packaging solutions. The food and beverage sector, a significant user of packaging in the area, is driving market demand as a result of elevated rates of packaged food consumption. This trend is driven by swift urbanization, an increasing expatriate community, and travellers who frequently choose processed foods for safety. Moreover, stringent packaging laws for food and drinks underscore the significance of resilient and eco-friendly corrugated packaging. Tourism represents another vital growth engine, as nations such as Saudi Arabia aim for 25 million international visitors in 2023 while investing in improved tourism facilities. In the UAE, the travel and tourism industry added AED 167 Billion (USD 45.47 Billion) to the GDP, representing 9% of the overall economy. The rise in tourism has resulted in a boost in food delivery services and higher sales of packaged foods, generating a corresponding increase in the need for corrugated packaging products, setting the stage for significant market growth in the near future.

Competitive Landscape:

The market is highly competitive, dynamic and diverse, with key players competing for market share. Presently, the leading players are providing comprehensive packaging solutions, including corrugated boxes. They are offering providing customized packaging solutions for different sectors, using advanced technologies and design capabilities. Besides this, they are developing sustainable packaging solutions tailored to meet customer requirements. Furthermore, various leading manufacturers are developing and launching corrugated cardboard boxes for e-commerce shipments of medical devices featuring a single-material solution in place of glued packaging with a single-use plastic insert. They are also investing in facility expansions and mergers and acquisitions (M&As) to strengthen their foothold in the market.

The report provides a comprehensive analysis of the competitive landscape in the corrugated boxes market with detailed profiles of all major companies, including:

- International Paper Company

- Nine Dragons Worldwide (China) Investment Group Co., Ltd.

- WestRock Company

- Smurfit Kappa Group plc

- Lee and Man Paper Manufacturing Ltd.

Latest News and Developments:

- April 2025: International Paper (IP) is in exclusive negotiations with Germany's PALM Group to sell five European corrugated box plants-three in Normandy, France, one in Ovar, Portugal, and one in Bilbao, Spain. This divestment satisfies regulatory commitments tied to IP’s acquisition of DS Smith Plc, pending European Commission approval. The sale is expected to close by Q2 2025 after required employee consultations. This move completes IP’s obligations to the Commission, enabling focus on sustainable packaging leadership across North America and EMEA.

- March 2025: ND Paper, owned by Chinese firm Nine Dragons, plans to restart its recycled paper machine PM25 at the Biron, Wisconsin mill in late 2025 due to rising packaging demand. The machine, idled in April 2024, will produce recycled containerboard and kraft paper. Biron is a fully integrated recycled fiber operation with over 2,000 metric tons daily capacity, supported by new OCC pulping units.

- March 2025: UFP Packaging, a subsidiary of UFP Industries, opened a new 165,000-square-foot corrugated manufacturing facility in Jeffersonville, Indiana, enhancing its production capabilities for retail and e-commerce markets. Launched in late 2024, the facility will expand throughout 2025, adding advanced machinery such as dual-sided color printers, high-speed flexo folder gluers, flatbed and rotary die cutters.

- March 2025: Saica Group announced plans to invest over USD 110 million to build its second US corrugated packaging plant in Anderson, Indiana, with construction starting May 2025 and operations by Q4 2026. The 350,000 sq. ft. facility will produce over 110 million sq. meters of corrugated packaging annually, create 50+ jobs initially, and exceed 100 jobs after ramp-up. Connected to rail for cost-efficient logistics, it will back up Saica’s Hamilton plant. This investment aligns with Saica’s USD 800 million US growth plan, supported by Indiana incentives, benefiting local economy and workforce.

- February 2025: International Paper is investing USD 260 million to build a new plant and a 900,000-square-foot warehouse in Waterloo, Iowa, near the regional airport, on 66 acres sold by the city for USD 1. The project will create 90 jobs paying at least USD 23.01 per hour and is expected to take two years to complete. The company received tax incentives, including a 50% property tax rebate for 15 years. The plant will be the city's second largest manufacturing facility and include a city-built rail spur.

Corrugated Boxes Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD, Billion Sq. Meters |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Used Covered | Recycled Corrugates, Virgin Corrugates |

| End Uses Covered | Food Products and Beverages, Paper Products, Electrical and Electronic Goods, Personal Care and Household Goods, Chemicals, Glassware and Ceramics, Textile Goods, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | International Paper Company, Nine Dragons Worldwide (China) Investment Group Co., Ltd., WestRock Company, Smurfit Kappa Group plc and Lee and Man Paper Manufacturing Ltd. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the corrugated boxes market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global corrugated boxes market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the corrugated boxes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Corrugated boxes are durable, lightweight packaging solutions made from corrugated fiberboard, which consists of a fluted layer sandwiched between two flat linerboards. Widely used across industries, these boxes offer excellent strength, cushioning, and versatility, making them ideal for storing, shipping, and protecting goods during transit.

The corrugated boxes market was valued at USD 212.3 Billion in 2025.

IMARC estimates the global corrugated boxes market to exhibit a CAGR of 2.05% during 2026-2034.

The global market is primarily driven by the rapid expansion of e-commerce, increasing demand for sustainable and recyclable packaging solutions, continual advancements in digital printing technologies, and rising utilization in industries such as food and beverage for secure and hygienic packaging.

In 2025, recycled corrugates represented the largest segment by material used, driven by sustainability initiatives and cost-effectiveness.

Food products and beverages leads the market by end use attributed to their need for hygienic, durable, and eco-friendly packaging solutions.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global corrugated boxes market include International Paper Company, Nine Dragons Worldwide (China) Investment Group Co., Ltd., WestRock Company, Smurfit Kappa Group plc and Lee and Man Paper Manufacturing Ltd., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)