Pan Masala Market in India Size, Share, Trends and Forecast by Type, Price, Packaging, and State, 2026-2034

Market Overview:

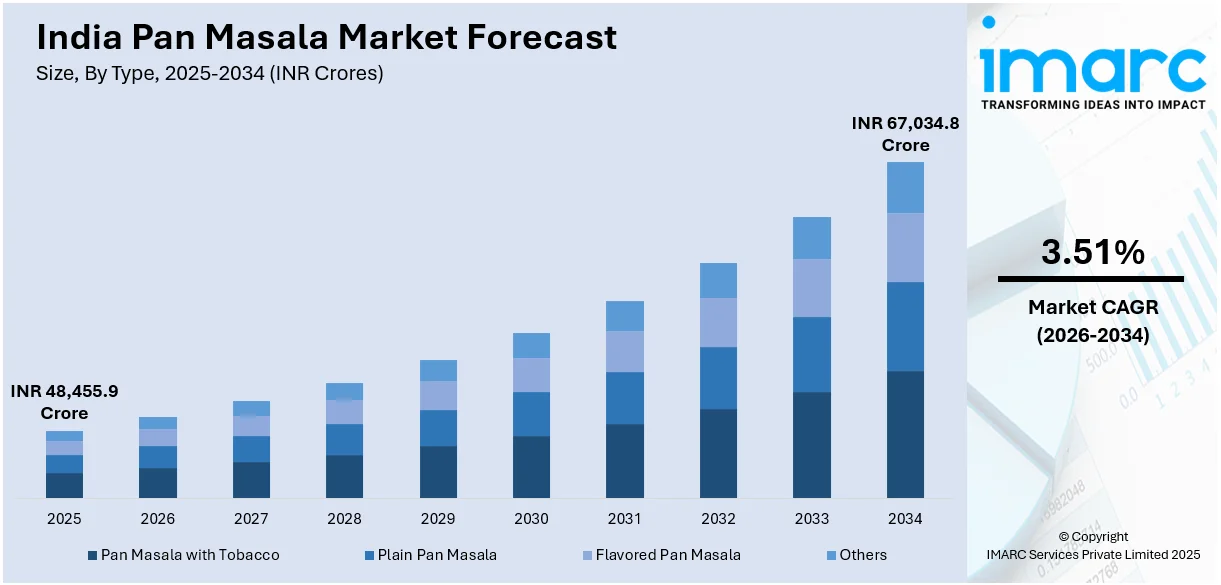

The pan masala market in India size reached INR 48,455.9 Crore in 2025. Looking forward, IMARC Group expects the market to reach INR 67,034.8 Crore by 2034, exhibiting a growth rate (CAGR) of 3.51% during 2026-2034. The rising availability of diverse flavors and variants, rapid expansion of distribution networks, increasing product promotions by manufacturers and inflating consumer disposable incomes, are among the key factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | INR 48,455.9 Crore |

| Market Forecast in 2034 | INR 67,034.8 Crore |

| Market Growth Rate 2026-2034 | 3.51% |

Pan masala is a traditional Indian chewable tobacco product that consists of areca nut, slaked lime, catechu, sweet or savory flavorings, and various aromatic spices. It is commonly consumed by placing a small quantity in the mouth, and the user may chew or suck on it to release the flavors and stimulate salivation. Pan masala is often offered as a refreshing and aromatic mouth freshener after meals or during social gatherings. However, it is essential to note that the consumption of pan masala, especially those containing tobacco or areca nut, has been associated with various health risks and is discouraged by health authorities due to its potential links to oral health problems and addiction issues.

To get more information on this market Request Sample

The cultural significance of pan masala as a traditional chewable tobacco product, has contributed to their uptake in India. It is often considered a part of social customs and is offered as a gesture of hospitality during social gatherings and festivities. Moreover, the increasing disposable incomes and changing lifestyle choices have augmented the demand for convenient and flavorful mouth fresheners, contributing to the higher consumption of pan masala among urban and rural consumers. Apart from this, aggressive marketing activities and product promotions by manufacturers for popularizing pan masala and reaching a broader consumer base are propelling the market growth. Additionally, the introduction of innovative and diverse flavors and variants attracting consumers, catering to their evolving taste preferences is another major growth-inducing factor. Other factors, including the easy product availability across various e-commerce platforms and continual product innovations by key players, are also anticipated to drive the market further.

Pan Masala Market in India Trends/Drivers:

Changing Lifestyles and Rising Disposable Income

With the evolving lifestyles of consumers in India, there has been a noticeable shift in their preferences for convenience and indulgence. As disposable income rises, people seek products that offer a quick and enjoyable experience. Pan masala, with its wide range of flavors and easy availability, caters precisely to these changing consumer patterns. It provides a convenient and refreshing option for those looking for a quick pick-me-up during their busy routines or social gatherings. Additionally, the increasing affluence of consumers has expanded their spending power, allowing them to explore and experiment with various products, including different varieties of pan masala. The combination of changing lifestyles and rising consumer expenditure capacities has significantly contributed to the sustained growth of the pan masala market in India.

Increasing Cultural Significance of Pan Masala in India

The cultural significance of pan masala in India holds deep-rooted traditions and customs. It is not just a mere product but an integral part of social interactions, religious practices, and festivities. Serving pan masala to guests is considered a gesture of hospitality and respect, fostering social bonds and reinforcing cultural values. The consumption of pan masala has been passed down through generations, becoming an inherent part of various communities and their way of life. As a result, the cultural relevance of pan masala continues to drive its market demand, as people associate it with cherished memories, shared experiences, and traditional practices, making it a sought-after product in the country.

Pan Masala Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the pan masala market in India, along with forecasts at the country and state levels from 2026-2034. Our report has categorized the market based on type, price and packaging.

Breakup by Type:

- Pan Masala with Tobacco

- Plain Pan Masala

- Flavored Pan Masala

- Others

Pan masala with tobacco represents the most widely used type

The report has provided a detailed breakup and analysis of the market based on the type. This includes pan masala with tobacco, plain pan masala, flavored pan masala and others. According to the report, pan masala with tobacco represented the largest segment.

Pan masala with tobacco accounts for the majority share in the pan masala market in India due to its traditional popularity and cultural significance. Despite the growing awareness of the health risks associated with tobacco consumption, the demand for pan masala with tobacco persists among certain segments of the population. This variant is favored for its strong and distinctive flavor, offering a unique sensory experience.

Additionally, the addictive properties of tobacco contribute to sustained consumption, which has accelerated the product adoption rate. Manufacturers are catering to this demand by continuously innovating and introducing new flavors and packaging to attract consumers, which in turn is driving the market growth. Furthermore, the affordability of pan masala with tobacco is contributing to its popularity among price-sensitive consumers, further fueling its demand in the Indian market.

Breakup by Price:

Access the comprehensive market breakdown Request Sample

- Premium

- Non-Premium

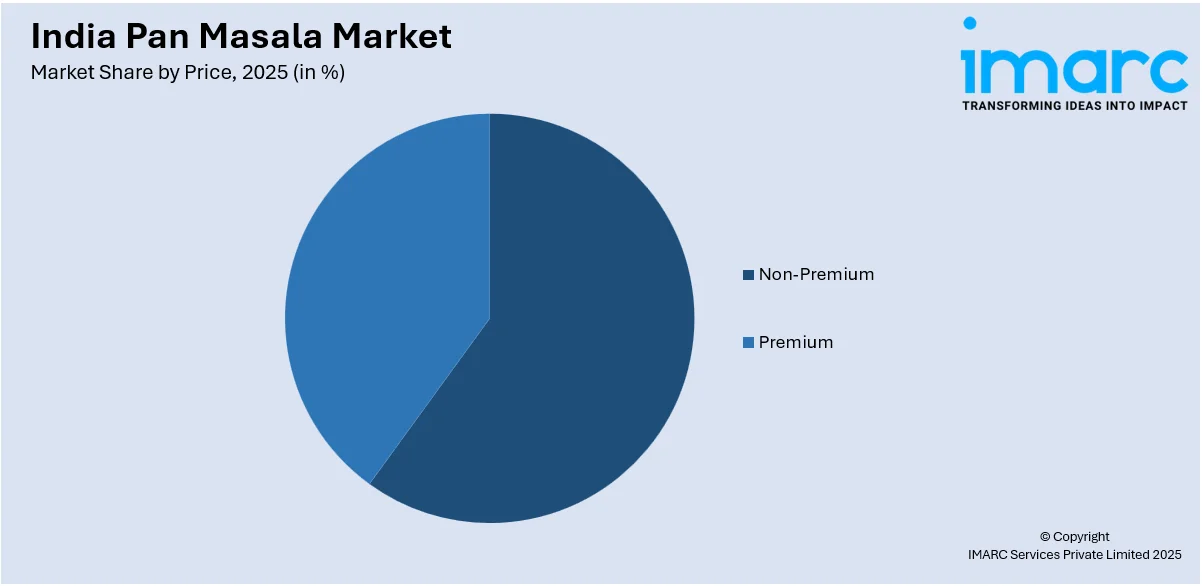

Non-premium accounts for the majority of the market share

A detailed breakup and analysis of the market based on price has also been provided in the report. This includes premium and non-premium. According to the report, non-premium accounted for the largest market share.

The non-premium price segment plays a crucial role in driving the pan masala market in India. As a diverse and price-sensitive market, a significant portion of consumers prefer affordable options without compromising on taste and quality. The non-premium price segment caters to this demand, offering a wide range of budget-friendly pan masala products that resonate with a vast consumer base. These products are accessible to a broader audience, including lower-income groups and rural consumers. Additionally, aggressive marketing and promotional strategies employed by manufacturers in the non-premium segment enhance product visibility and attract price-conscious buyers. The affordability and availability of these offerings stimulate consumption and contribute substantially to the overall growth of the pan masala market in India, making it a driving force in sustaining the industry's expansion and catering to the varied preferences of consumers across the country.

Breakup by Packaging:

- Pouch

- Cans

- Others

Pouch holds the largest share in the market

A detailed breakup and analysis of the market based on the packaging has also been provided in the report. This includes pouch, cans and others. According to the report, pouch accounted for the largest market share.

Pouch packaging plays a significant role in driving the pan masala market in India. The shift towards pouch packaging has been instrumental in appealing to modern consumers seeking convenience and portability. Pouches offer a practical and hygienic way to carry and consume pan masala, making it easy for on-the-go consumption and storage. The compact and lightweight nature of pouches also makes them ideal for urban lifestyles and travel. Moreover, pouch packaging provides manufacturers with opportunities for product differentiation, allowing them to introduce various flavors and sizes to cater to diverse consumer preferences. The visual appeal of attractive pouch designs and the ease of use further enhance the overall consumer experience, leading to increased adoption of pan masala products in pouch packaging. This packaging innovation has become a key driver in the market growth, aligning with changing consumer lifestyles and contributing to the sustained popularity of pan masala in India.

Breakup by State:

- Uttar Pradesh

- Bihar

- Maharashtra

- Madhya Pradesh

- Odisha

- Jharkhand

- Delhi

- Others

Uttar Pradesh exhibits a clear dominance in the market share

The report has also provided a comprehensive analysis of all the major regional markets that include Uttar Pradesh, Bihar, Maharashtra, Madhya Pradesh, Odisha, Jharkhand, Delhi, and others. According to the report, Uttar Pradesh was the largest market for pan masala in India.

Uttar Pradesh is one of the major production hubs and consumer markets for pan masala products. The state's geographical location and cultural preferences contribute to its prominence in the industry. With a large population and diverse consumer base, Uttar Pradesh presents a significant market for pan masala manufacturers, attracting both local and national brands. The state's favorable business environment and infrastructure facilitate production and distribution, ensuring a steady supply of pan masala products across the country. Moreover, Uttar Pradesh's rich tradition and cultural heritage contribute to the popularity of pan masala as a favored mouth freshener and traditional product among its residents. As a result, the state's strong presence as a producer and consumer drives the growth and dynamics of the pan masala market in India.

Competitive Landscape:

Manufacturers in the industry have introduced nicotine-free and tobacco-free pan masala variants, catering to health-conscious consumers seeking alternatives to traditional tobacco-based products. These innovative formulations contain ingredients that mimic the traditional flavors of pan masala while eliminating harmful components, making them a more appealing choice among a wider audience. Additionally, key players are investing in eco-friendly and sustainable packaging solutions to address environmental concerns and align with the growing demand for greener products. Moreover, the incorporation of advanced food processing technologies enhances the quality and consistency of pan masala products, ensuring uniform flavors and textures. These innovations not only attract health-conscious and environmentally conscious consumers but also reflect the industry's commitment to adapt to changing consumer preferences and propel growth in the competitive pan masala market in India.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the companies covered include:

- Dinesh Pouches Private Ltd.

- DS Group

- Manikchand Group

- Pan Bahar Products Private Limited

- Pan Parag India Limited

- Red Rose Group Of Companies

- Shikhar Group

- Vimal Pan Masala Company

Pan Masala Market in India Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | INR Crores |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Pan Masala with Tobacco, Plain Pan Masala, Flavored Pan Masala, Others |

| Prices Covered | Premium, Non-Premium |

| Packagings Covered | Pouch, Cans, Others |

| States Covered | Uttar Pradesh, Bihar, Maharashtra, Madhya Pradesh, Odisha, Jharkhand, Delhi, Others |

| Companies Covered | Dinesh Pouches Private Ltd., DS Group, Manikchand Group, Pan Bahar Products Private Limited, Pan Parag India Limited, Red Rose Group Of Companies, Shikhar Group, Vimal Pan Masala Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the pan masala market in India from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the pan masala market in India.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the pan masala industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The pan masala market in India reached a value of INR 48,455.9 Crore in 2025.

The market is witnessing growth as the leading manufacturers are offering innovative product variants, such as chocolate, sugar-coated fennel seeds, cardamom, saffron (Kesar), gulkand (sweet-preserved rose petals) and silver-coated betel nuts, to expand their consumer base.

There is a decline in the overall sales of pan masala with tobacco on account of the bans imposed on the consumption of tobacco-based products in various states. However, market players are focusing on value-added products to offset declining sales.

The market has been segmented on the basis of the type into pan masala with tobacco, plain pan masala, flavored pan masala and others.

On the basis of the price, the market has been bifurcated into premium and non-premium pan masala.

Based on the packaging, the market has been segregated into pouches, cans and others.

On the geographical front, the market has been divided into Uttar Pradesh, Bihar, Maharashtra, Madhya Pradesh, Odisha, Jharkhand, Delhi and others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)