Propane Market Size, Share, Trends and Forecast by Form, Grade, End Use Industry, and Region, 2026-2034

Propane Market Size and Share:

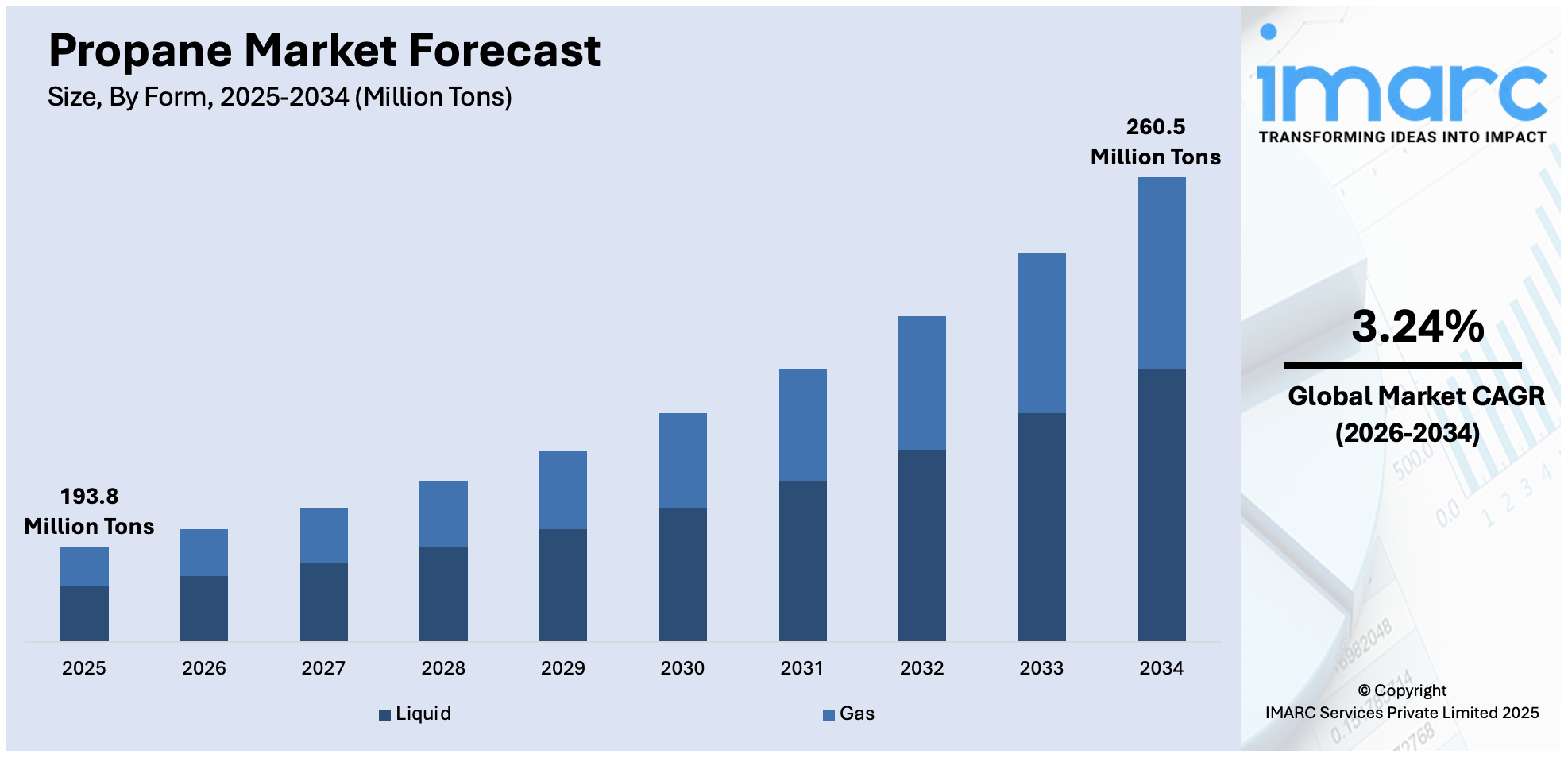

The global propane market size reached 193.8 Million Tons in 2025. Looking forward, IMARC Group estimates the market to reach 260.5 Million Tons by 2034, exhibiting a CAGR of 3.24% during 2026-2034. Asia Pacific currently dominates the market, holding a significant market share of over 51.2% in 2025. The market is primarily driven by rising industrial applications, the escalating energy demand, supply dynamics influenced by crude oil prices and geopolitical events, and the increasing transition to cleaner energy sources.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | 193.8 Million Tons |

| Market Forecast in 2034 | 260.5 Million Tons |

| Market Growth Rate 2026-2034 | 3.24% |

The global propane market is primarily driven by the growing demand for clean and efficient energy sources across residential, industrial, and commercial sectors. The increasing adoption of propane as a substitute for traditional fossil fuels, due to its lower greenhouse gas emissions, is enhancing market growth. Along with this, the rising use of propane in agricultural applications, such as crop drying and irrigation, further supports its demand. Additionally, the growing popularity of propane-powered vehicles and advancements in portable heating and cooking appliances are expanding its application scope. On 25th October 2024, the School District of Philadelphia ordered 38 propane-powered school buses from Blue Bird to support nearly 200,000 students at 218 schools. The Type C buses can carry 42 students for 300 miles on a single propane tank while reducing emissions by 96 percent compared to diesel buses. It is expected that fuel and maintenance savings will be achieved by the district annually at a rate of USD 3,700 per bus, amounting to a total of USD 2.1 million over 15 years. Government incentives promoting the use of liquefied petroleum gas (LPG) and favorable regulations supporting clean energy transition significantly contribute to the market's expansion. Rising urbanization and industrialization also play key roles in driving propane consumption worldwide.

To get more information on this market Request Sample

The United States stands out as a key regional market, primarily driven by a strong emphasis on energy independence and the availability of abundant shale gas reserves. Increasing the production of propane from natural gas processing and crude oil refining ensures a stable and cost-effective supply. In addition, the versatility of propane in powering household heating systems, water heaters, and backup generators enhances its residential demand. In the agricultural sector, propane is widely used for grain drying and weed control, further fueling market growth. The rising adoption of propane as an autogas in fleet vehicles, particularly in rural and off-grid areas, is another key driver. Furthermore, government initiatives promoting alternative fuels and the expansion of propane infrastructure across the country are propelling market dynamics.

Propane Market Trends:

Energy Demand and Transition

The escalating transition towards more sustainable and cleaner energy sources is supporting the propane market statistics. In line with this, the increasing requirement for propane in residential heating, cooking, and transportation purposes in place of coal or oil, as it emits lower carbon gases, is bolstering the market growth further. For instance, in the United States, about 12 million households use propane as their primary heating source, and around one-fifth of mobile homes use propane for heating. Moreover, the value of residential propane stood at USD 2.825/gallon, according to the United States Energy Information Administration (EIA). Furthermore, the elevating demand for propane in various applications, such as air conditioning, heating water, cooking, refrigerating foods, drying clothes, lighting, and fueling fireplaces, is offering a positive market outlook. For example, Suburban Propane Partners LP announced the extension of its agreement with U-Haul to provide eco-friendly and renewable propane in California.

Industrial Applications and Petrochemical Demand

The expanding petrochemical sector and the escalating demand for this fuel as a feedstock for the production of chemicals, plastics, and other essential materials are bolstering the propane market recent opportunities. In addition to this, the elevating product requirement for several commercial and industrial applications, including heating, cooking, hot water generation, and as a fuel for forklifts, machinery, and vehicles is propelling the market growth forward. For instance, LPG extracted from natural gas is estimated to be the highest in North America, which contributes to the maximum percentage of LPG produced globally. Moreover, according to the United Nations Data, natural gas liquids from the United States accounted for around 151,604 metric tons, the world's highest. In addition to this, according to the BP Statistical Review of World Energy, global natural gas liquids production was at 12,047 thousand barrels per day, recording a growth rate of 2.2% and an annual increase of 3.2% over the last decade.

Market Dynamics and Supply Factors

Geopolitical events, changes in crude oil prices, and supply disruptions are primarily driving the propane market demand. In line with this, the evolving climatic conditions, especially in cold regions where this fuel is essential for heating applications, are augmenting the market growth. Moreover, propane suppliers and distributors are increasingly focusing on optimizing supply chain operations, logistics, and storage facilities to ensure the reliable and efficient delivery of this fuel to customers, which is also catalyzing the global market. For instance, KBR and ExxonMobil Catalysts and Licensing LLC ("ExxonMobil") collaborated to bring significant advancements to propane dehydrogenation (PDH) technology. Under the collaboration, ExxonMobil's new proprietary catalyst technology was combined with KBR's proprietary K-PRO Propane Dehydrogenation (PDH) technology to convert propane into propylene. Moreover, Enterprise Products Partners announced plans to extend its natural gas liquid (NGL) pipeline system in the Permian Basin and build two processing plants to accommodate the basin's continuous production expansion. The company intends to expand its Shin Oak NGL pipeline infrastructure by looping new pipelines and modifying the current pump stations. This initial extension would increase the capacity to 275,000 bpd, with completion planned in 2024.

Propane Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global propane market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on form, grade, and end use industry.

Analysis by Form:

- Liquid

- Gas

Liquid propane, commonly referred to as LPG, is recognized for its portability and ease of storage, making it a favored choice for residential, commercial, and industrial settings. For instance, China produced 291.61 million mt of LPG, naphtha, gasoline, jet/kerosene, gasoil, and fuel oil, up 3.9% year on year, despite crude throughput falling 6.3% over the same period, as per NBS data. Furthermore, China imported 2.12 million mt of LPG, propane, and butane, in May 2022, up 7.1% month on month.

In the market, propane in its gaseous form is widely utilized for heating, cooking, and industrial processes due to its high energy efficiency and clean combustion properties. Its portability makes it ideal for off-grid applications, while its versatility supports use in both residential and commercial settings. Propane gas is a key component in energy transition strategies for sustainable energy solutions.

Analysis by Grade:

- HD-5 Propane

- HD-10 Propane

- Commercial Propane

HD-5 Propane leads the market due to its high purity and compliance with stringent quality standards, making it suitable for a wide range of applications. It is defined by a minimum propane content of 90% and minimal impurities and is widely preferred for residential heating, cooking, and automotive fuel. Its consistent performance and compatibility with modern equipment ensure reliability and efficiency, driving its adoption across industrial and commercial sectors. HD-5 propane is also extensively used in agricultural operations, such as crop drying and pest control, further solidifying its demand. The growing preference for clean-burning fuels and stringent environmental regulations enhance its appeal, establishing HD-5 propane as the benchmark for premium-grade propane in the market.

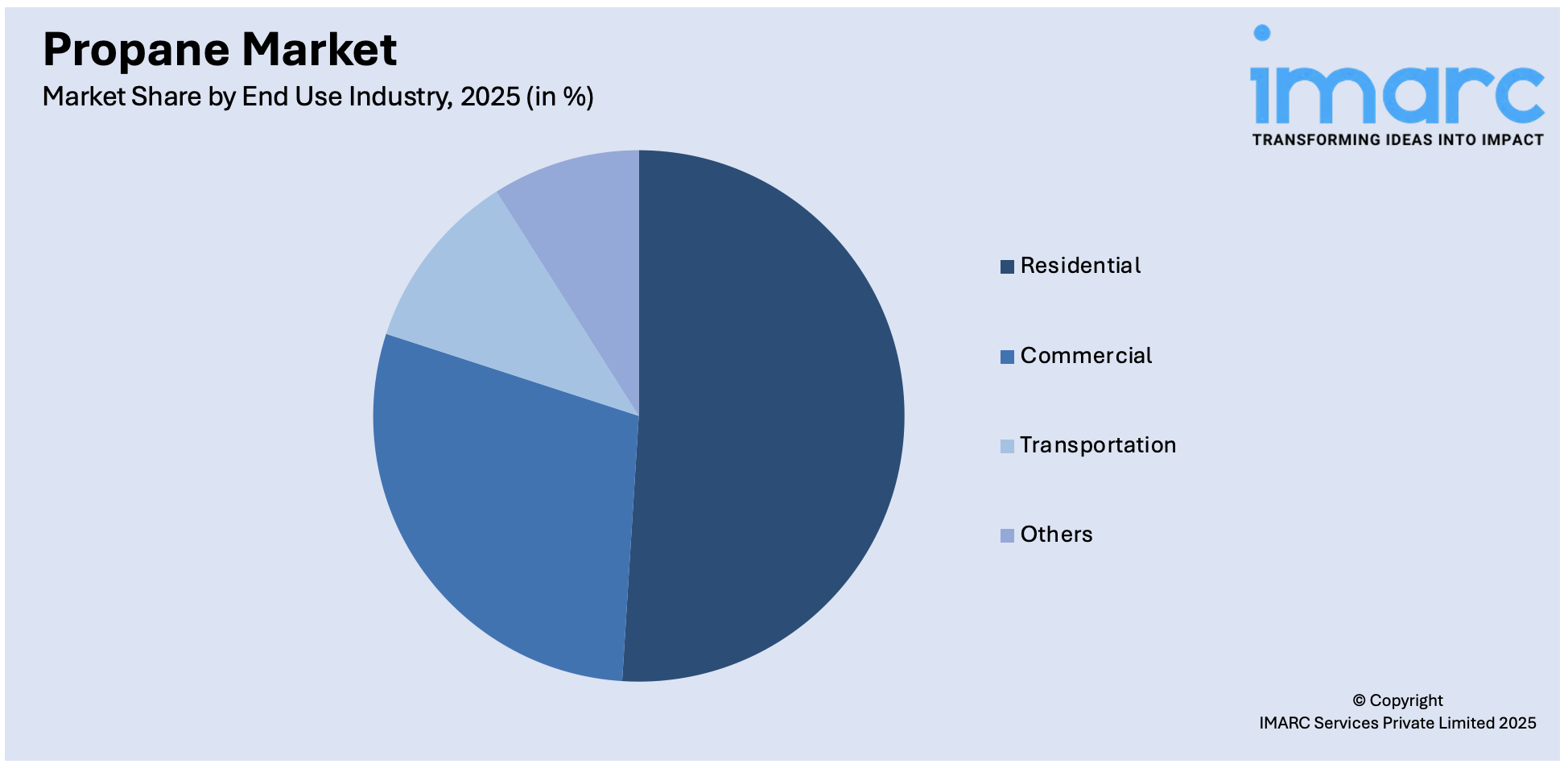

Analysis by End Use Industry:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

- Transportation

- Others

Residential leads the market with around 50.8% of market share in 2025. The growing popularity of propane in the residential sector is driven by its distinguishing advantages and contributions to modern living. As homeowners increasingly prioritize energy efficiency and environmental responsibility, this fuel emerges as a clean-burning alternative that significantly reduces GHG emissions compared to traditional fossil fuels. Moreover, the versatility of propane in powering various residential applications, including space and water heating, cooking, and backup power generation, is augmenting the market growth. In addition to this, propane's widespread availability, mainly in areas without natural gas infrastructure, ensures consistent access to energy for households. For instance, in the United States, about 12 million households use propane as their primary heating source, and around one-fifth of mobile homes utilize propane for heating. In the first week of February 2022, the value of residential propane stood at USD 2.825/gallon, according to the United States Energy Information Administration (EIA).

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, Asia Pacific accounted for the largest market share of over 51.2%. Asia Pacific represents the largest region as per the propane market overview, owing to the emerging trend of industrialization, urbanization, and economic development. Furthermore, the rising need for propane in several industries, including agriculture, manufacturing, and residential heating is catalyzing the expansion of the market further. Besides this, the expanding LPG distribution networks, the extensive utilization of this compound for fulfilling the rising energy needs in rural and urban areas, and the inflating number of investments by the major companies in propane infrastructure are positively influencing the market growth in this region. For instance, Indian Oil Corp. (IOC) announced plans to construct three new plants in Northeast India to increase its LPG bottling capacity by nearly 53% or to 8 crore cylinders annually by 2030 to meet the growing demand in the region. The total investment in the plant expansion is likely to range between USD 43-46 Million. Moreover, China produced 291.61 million mt of LPG, naphtha, gasoline, jet/kerosene, gasoil, and fuel oil, up 3.9% year on year, despite crude throughput falling 6.3% over the same period, as per NBS data. It imported 2.12 million mt of LPG, propane, and butane, up 7.1% month on month.

Key Regional Takeaways:

United States Propane Market Analysis

In 2024, the US accounted for around 85.60% of the total North America propane market. Propane is a crucial source of energy in the United States. It serves as the main heating fuel for about 6.3 million households, mainly located in the Midwest and Northeast regions. In the commercial sector, establishments like restaurants and hotels use propane for heating and cooking purposes. In transportation, propane is being accepted increasingly as an alternative fuel as there are more than 20,000 propane-powered vehicles operating in the country. The U.S. government encourages propane use through incentives and grants that promote clean energy solutions, such as funds set up by the Propane Education & Research Council (PERC) for infrastructure and technology development.

Apart from home consumption, the U.S. has emerged as a significant exporting country for LPG, which covers propane. According to World Integrated Trade Solutions, U.S. LPG exports reached 2.3 million barrels per day (MMbbls/d) as of September 2023. Yearly, the figure is up by 7%. In the first nine months of 2024, on average, it was 2.2 MMbbls/d, a year-over-year growth of 10%. It is mainly because production is growing, inventories are at high levels and domestic demand is flat. However, some challenges exist, including a lag in expanding export terminal capacity to account for this growth, as some experts think that the installed terminal capacity in the U.S. may be nearing its limits. This correlation between domestic consumption and rising exports points to the critical role propane plays both in U.S. energy needs and the global market.

Europe Propane Market Analysis

Propane has been of great importance in the energy mix of Europe, especially for residential heating and transportation. As per an industrial report, the demand for LPG in Europe was 39.87 million tonnes in 2020, and this number is estimated to increase to 69.89 million tonnes by 2030, reflecting the consistent increase in consumption by all sectors. Propane is employed as fuel in about 2.5% of all passenger cars, which would provide lower emissions and economies compared with petrol. Small split air conditioners also find some support from the European Commission in terms of employing propane to provide energy-efficient solutions.

Propane, as it is a by-product of the crude oil production process, generally mirrors trends in the oil market. Propane will be sold at a premium leading into winter, given high demand for heating fuel at that time. As with its role as a petrochemical feedstock, it adds to propane's crucial role in Europe's energy scene. Increasing demand and European Commission support are further testaments to propane's expanding application in both the residential and commercial markets.

Asia Pacific Propane Market Analysis

Propane consumption in the Asia Pacific region is expected to surge as a function of the growing population, rising disposable incomes, increased urbanization, and expanding demand for cooking gas and automotive vehicles.

According to an industrial report, China is the world's largest consumer of propane, accounting for nearly 20% of the global market. To meet the increasing demand in the country, China imports significant quantities of propane. In India, the consumption of propane is majorly driven by the cooking fuel market, with an average consumption of around 19-20 kg per capita. In Hong Kong, almost all taxis are autogas users, and nearly 30% of public buses are running on propane.

Northeast Asia is a region that imports propane in large quantities, with retail and petrochemical players using it as feedstock for various industrial applications. The growing demand for propane across these countries, driven by urbanization and industrial growth, underscores its critical role in supporting both residential and industrial needs. As propane demand continues to grow, the region's consumption will continue to grow with the expansion of the automotive and residential sectors.

Latin America Propane Market Analysis

Propane plays a very important role in the Latin American energy market, where it accounts for a significant share of consumption, especially in residential and commercial sectors. According to an industrial report, about 80% of LPG demand in Latin America is derived from these sectors, with Brazil being one of the countries where nearly 90% of LPG consumption comes from residential and commercial use. This makes Latin America unique among other global regions where chemical demand forms a larger share. In terms of consumption, the key countries in the region are Brazil, Argentina, Peru, and Venezuela, using an average of 1 million metric tons of propane annually. However, the region's heavy reliance on propane has made it vulnerable to global market fluctuations. Latin America's LPG market is heavily influenced by Mont Belvieu prices in the United States, with fluctuations directly impacting delivered prices across the region. Recent times have seen global price volatility caused by shifts in supply-demand dynamics and crude oil prices. For instance, in Brazil and Argentina, where the local currencies have declined, the propane prices have gone up significantly with a reflection of the international price trends. In addition, discussions on price regulation or stabilization are going on in Brazil, Chile, and Colombia as the costs rise and public anxiety over LPG price increases grows. Such interventions by governments could deter investment in infrastructure and affect the overall quality of service. Therefore, the sustainability of LPG markets in the region will be ensured by a balance of market fundamentals and political and economic pressures.

Middle East and Africa Propane Market Analysis

The Middle East and Africa is a significant player in the world energy market, with 31% of global oil and 18% of gas coming from this region. This position of power in the energy world extends into the LPG market, where Saudi Arabia leads consumption in the region and significant growth in the demand for LPG will be expected from Iran and Egypt in the future, reflecting broader regional trends. The increasing residential and commercial demand along with the production of energy in the region made the Middle East and Africa the major consumer as well as producer of LPG. LPG demand will further increase in the emerging countries of Iran and Egypt which are showing a growing pattern.

Competitive Landscape:

The global propane market statistics are characterized by a dynamic competitive landscape shaped by various factors. Key players in the market include major oil and gas companies, regional energy providers, and LPG distributors. These players often engage in exploration, production, and distribution activities, influencing supply dynamics. Market competitiveness is also driven by the diverse applications of propane, ranging from residential heating and cooking to industrial processes and transportation. The growth of cleaner energy trends has prompted these companies to invest in research and development to enhance propane efficiency and environmental performance. Geopolitical events, supply disruptions, and fluctuations in crude oil prices significantly shape the competitive environment, impacting pricing and trade dynamics. Regulatory frameworks, environmental policies, and technological advancements further contribute to competitive strategies as companies strive to meet evolving market demands.

The report provides a comprehensive analysis of the competitive landscape in the propane market with detailed profiles of all major companies, including:

- Air Liquide S.A.

- BP plc

- Chevron Corporation

- China National Petroleum Corporation

- China Petroleum & Chemical Corporation

- ConocoPhillips Company

- Eni S.p.A.

- Evonik Industries AG

- Exxon Mobil Corporation

- GAIL (India) Limited

- Gazprom

- Indian Oil Corporation Ltd.

- Royal Dutch Shell plc

- Saudi Arabian Oil Co.

- TotalEnergies SE

Latest News and Developments:

- November 2024: The U-Haul announced that it offers propane refills, exchanges, and autogas at its location at E. Stone Drive but added that the recently acquired storage facility at Fort Henry Drive joins the same company.

- November 2024: TSX-listed Superior Plus Corp. said that its Normal Course Issuer Bid was accepted for listing by the Toronto Stock Exchange, effective November 12, 2024. The company will be authorized to repurchase for cancellation up to 24,117,330 common shares in a 12-month period under the NCIB. Superior Plus is one of North America's largest distributors of propane, compressed natural gas (CNG), renewable energy, and related products, servicing around 770,000 customer locations in the United States and Canada. The company underlines the role it plays in energy transition, delivering clean-burning fuels to residential, commercial, and industrial customers not connected to a pipeline.

- November 2023: BPCL signs a 15-year propane supply agreement, worth Rs 63,000 Crore, with GAIL for latter’s PDH-PP (Propane Dehydrogenation and Polypropylene) Plant project in Usar, Maharashtra.

- November 2023: The West Virginia Department of Health and Human Resources (DHHR) announced a supplemental payment to assist eligible residents with propane heating expenses for the 2023-24 winter season.

- September 2023: Tankfarm, the tech-enabled propane distribution platform, announced the closure on a USD 23 Million Series-B round led by a handful of prominent family offices and existing investors. The capital will go towards customer acquisition, continued development of Tankfarm’s patent-pending technology platform, and extending its national propane delivery footprint which currently spans 37 states and over 400 locations.

Propane Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million Tons |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Forms Covered | Liquid, Gas |

| Grades Covered | HD-5 Propane, HD-10 Propane, Commercial Propane |

| End Use Industries Covered | Residential, Commercial, Transportation, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Air Liquide S.A., BP plc, Chevron Corporation, China National Petroleum Corporation, China Petroleum & Chemical Corporation, ConocoPhillips Company, Eni S.p.A., Evonik Industries AG, Exxon Mobil Corporation, GAIL (India) Limited, Gazprom, Indian Oil Corporation Ltd., Royal Dutch Shell plc, Saudi Arabian Oil Co., TotalEnergies SE., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, propane market forecast, and dynamics of the market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global propane market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the propane industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Propane is a colorless, odorless, and flammable hydrocarbon gas commonly used as a fuel in residential, commercial, industrial, and agricultural applications. It is a byproduct of natural gas processing and crude oil refining and is valued for its efficiency and cleaner-burning properties.

The propane market size reached 193.8 Million Tons in 2025.

IMARC estimates the global propane market to exhibit a CAGR of 3.24% during 2026-2034.

The propane market is driven by rising energy demand, adoption of cleaner fuels, increased industrial applications, government incentives for LPG use, and expanding adoption in vehicles, agriculture, and portable appliances.

HD-5 Propane represented the largest segment by grade, driven by its high purity, suitability for residential and industrial uses, and compliance with stringent quality standards.

Residential leads the market by end-use industry due to its widespread use in heating, cooking, and power generation, particularly in areas without access to natural gas.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the market.

Some of the major players in the global propane market include Air Liquide S.A., BP plc, Chevron Corporation, China National Petroleum Corporation, China Petroleum & Chemical Corporation, ConocoPhillips Company, Eni S.p.A., Evonik Industries AG, Exxon Mobil Corporation, GAIL (India) Limited, Gazprom, Indian Oil Corporation Ltd., Royal Dutch Shell plc, Saudi Arabian Oil Co., and TotalEnergies SE., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)