Public Cloud Market by Service (Infrastructure as a Service (IaaS), Platform as a Service (PaaS), Software as a Service (SaaS)), Enterprise Size (Large Enterprise, Small and Medium-sized Enterprises), End Use (BFSI, IT and Telecom, Retail and Consumer Goods, Manufacturing, Energy and Utilities, Healthcare, Media and Entertainment, Government and Public Sector, and Others), and Region 2025-2033

Global Public Cloud Market Size:

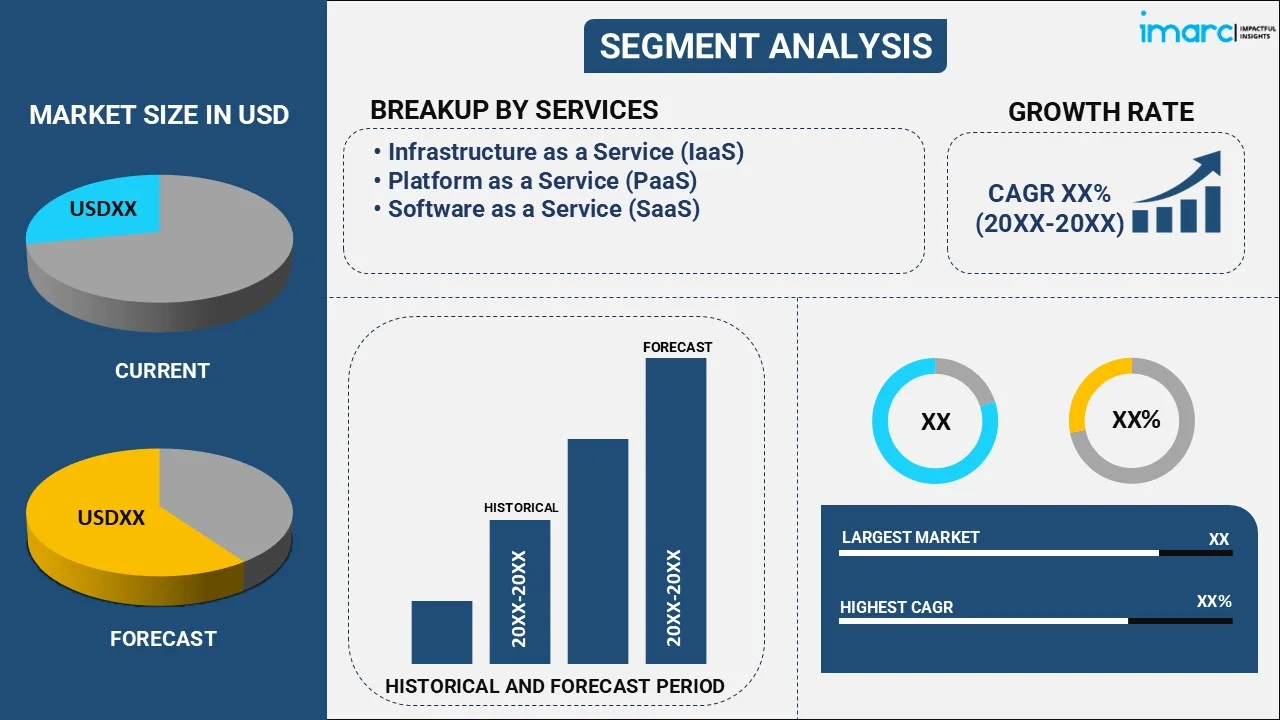

The global public cloud market size reached USD 855.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4,382.3 Billion by 2033, exhibiting a growth rate (CAGR) of 18.91% during 2025-2033. The market is experiencing steady growth driven by the growing need for cost-effective solutions, rising focus on scalability to reduce the risks of downtime, and increasing need for solutions that are suitable for remote work settings.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 855.7 Billion |

| Market Forecast in 2033 | USD 4,382.3 Billion |

| Market Growth Rate 2025-2033 | 18.91% |

Public Cloud Market Analysis:

- Major Market Drivers: The rising focus on optimizing IT operations and the escalating demand for flexible and specialized IT services are primarily driving the global public cloud market. Moreover, the increasing application of public cloud solutions across numerous industries, such as healthcare, finance, and manufacturing are also contributing to the public cloud market demand.

- Key Market Trends: Innovations in areas like edge computing and the Internet of Things (IoT) integration are enhancing the capabilities of cloud services and opening new possibilities for companies. Moreover, the rising need for sustainable solutions is expected to propel the public cloud market share.

- Geographical Trends: According to the public cloud market report, North America accounted for the largest market share due to the presence of key market players. North America has a robust digital infrastructure and IT ecosystem. Moreover, the presence of numerous vendors in the region such as Microsoft Corporation, Oracle Corporation, Amazon.com Inc., and IBM Corporation, is also contributing to the public cloud market revenue.

- Competitive Landscape: Some of the leading public cloud market companies include Alibaba Group Holding Limited, Amazon Web Services Inc., Cisco Systems, Inc., Google LLC (Alphabet Inc.), Hewlett Packard Enterprise Development LP, International Business Machines Corporation, Microsoft Corporation, Oracle Corporation, and Rackspace Technology Inc., among many others.

- Challenges and Opportunities: The increasing need for skilled cloud professionals is one of the significant challenges faced by the global public cloud market. However, the public cloud market opportunities, including a rising focus on enhanced security solutions and the expanding IT sector, are anticipated to catalyze market growth.

Public Cloud Market Trends:

Rising Need for Cost-Effective Solutions

The increasing focus on cost efficiency in organizations is contributing to the public cloud market growth. Furthermore, various industries are shifting from traditional on-premises information technology (IT) infrastructure, which requires high investment, to public cloud providers since they are affordable as companies pay only for the resources they use. For instance, according to Thales Group, as of 2022, over 60% of all business data is stored in the cloud. As businesses progressively move their resources into cloud environments to enhance security, dependability, and business agility, this balance hit 30% in 2015 and has increased significantly since then. These factors create a massive growth opportunity for the market-studied vendors to expand their offerings in the coming years. Moreover, the pay-as-you-go pricing model benefits startups and small businesses with limited capital and allows larger enterprises to scale and optimize their IT spending without committing to significant expenses. For instance, according to the Fortinet Cloud Security Report 2022, cloud users guarantee that the cloud is delivering on the promise of adaptable capacity and scalability (53%), increased agility (50%), and improved availability and business continuity (45%). Such massive adoption of cloud solutions would drive the market.

Increasing Remote Work Settings

The escalating demand for a public cloud on account of the growing number of remote work settings is offering a positive market outlook. In line with this, the public cloud allows employees to access data, applications, and resources from anywhere with an internet connection. Moreover, the surge in remote work situations after the outbreak of COVID-19 has been contributing to the demand for public cloud solutions. Considering this, businesses are increasingly embracing cloud computing and migrating to cloud data. According to the Hosting Tribunal, in 2020, about 94% of enterprises were estimated to be already using cloud services, and about 83% of enterprise workloads were on the cloud. In addition to this, Flexera Software 2023, states that 75% of enterprise respondents adopted Microsoft Azure for public cloud usage. AWS, Microsoft Azure, and Google Cloud, or hyperscalers, are among the leading cloud computing platform providers worldwide. Their solutions offer a geographically distributed network of data centers, allowing businesses to deploy applications and services close to their end users regardless of location. This global reach ensures low-latency access, improving performance and user experience.

Rising Acquisitions and Mergers Activity

The growing demand for cloud services, the need for companies to expand their cloud offerings, and the desire to capitalize on the potential synergies and efficiencies that can be gained through consolidation are further driving mergers and acquisition activities in the global public cloud market. For instance, in May 2023, Stibo Systems, a global provider of master data management software, joined Microsoft's Partner Program as an independent software exporter to create and host cloud-based Software as a Service on Microsoft Azure. Stibo Systems improved its cloud services with support and guidance from Microsoft. This integration will enable clients to improve the short and long-term performance of their cloud investments and resources. Similarly, in September 2022, Lyve Global, an Abu Dhabi-based B2B logistics SaaS platform, announced the acquisition of Shopini World, a cross-border e-commerce logistics and solutions provider, to expand its business across the Middle East and North Africa region. With the bolstering IT sector and rising complexities of businesses, the players in the market are looking for strategic acquisitions and mergers to expand their offerings and cater to the rising demand for SaaS in the country.

Public Cloud Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on service, enterprise size, and end use.

Breakup by Service:

- Infrastructure as a Service (IaaS)

- Platform as a Service (PaaS)

- Software as a Service (SaaS)

Software as a service (SaaS) account for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the service. This includes infrastructure as a service (IaaS), platform as a service (PaaS), and software as a service (SaaS). According to the report, software as a service (SaaS)represented the largest segment.

Software as a Service (SaaS) is a cloud service model that delivers software applications over the internet on a subscription basis. Users access these applications through web browsers, and the software is hosted and maintained by the cloud provider. Various companies are increasingly investing in the adoption of SaaS based cloud services. For instance, in June 2022, Aqua Security, the pure-play cloud-native security provider, announced the general availability (GA) of cloud-native security SaaS in Singapore, serving the broader APJ region. With SaaS in Singapore, Aqua customers in government, banking, financial services, and other regulated sectors can leverage the service for comprehensive cloud-native security, risk management, and compliance through an in-region service that addresses their governance and data sovereignty requirements.

Breakup by Enterprise Size:

- Large Enterprise

- Small and Medium-sized Enterprises

Small and medium-sized enterprises hold the largest market share

A detailed breakup and analysis of the market based on the enterprise size have also been provided in the report. This includes large enterprise and small and medium-sized enterprises. According to the report, small and medium-sized enterprises accounted for the largest market share.

Small and medium-sized enterprises (SMEs) are increasingly adopting public cloud services due to their cost-effectiveness, scalability, and the ability to access advanced technology without significant upfront investments. Moreover, the pay per subscription-based model offered by the service providers has provided Small and Medium Enterprises (SMEs) the flexibility to grow to their full potential. SMEs generally leverage SaaS solutions for productivity, collaboration, and basic infrastructure needs, such as web hosting and data storage.

Breakup by End Use:

- BFSI

- IT and Telecom

- Retail and Consumer Goods

- Manufacturing

- Energy and Utilities

- Healthcare

- Media and Entertainment

- Government and Public Sector

- Others

BFSI represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the end use. This includes BFSI, IT and telecom, retail and consumer goods, manufacturing, energy and utilities, healthcare, media and entertainment, government and public sector, and others. According to the report, BFSI represented the largest segment.

The BFSI sector leverages public cloud services for a wide range of applications, such as data analytics, risk management, fraud detection, and customer relationship management (CRM). Cloud-based solutions enable agility and scalability in responding to market dynamics and regulatory changes. Various market players are increasingly working on providing robust cloud services to the BSFI sector. For instance, in October 2023, Kyndryl, the world’s largest technology infrastructure services provider, announced the availability of new services for financial services organizations seeking to use Google Cloud to safely store and protect their confidential and sensitive data. Kyndryl’s new services are designed to enable a unified, scalable, and security-rich data platform to support customers’ regulatory and compliance requirements.

Breakup by Region:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest public cloud market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share due to the presence of key market players.

North America has a robust digital infrastructure and IT ecosystem. Moreover, the presence of numerous vendors in the region, such as Microsoft Corporation, Oracle Corporation, Amazon.com Inc., and IBM Corporation, is also fostering a conducive environment for growth in the region. It is estimated that more than 50% of the government organizations in the US have deployed the services. In addition to this, according to a report published by Stormforge, 18% of respondents from North America state that their organization has a monthly cloud spend that ranges between US$ 100,000 and US$ 250,000. Such massive investments in cloud services in the region are contributing to its growth.

Key Regional Takeaways:

United States Public Cloud Market Analysis:

The United States is still the most developed and largest public cloud market in the world, fueled by a highly digital economy, enterprise adoption of cloud, and a healthy tech vendor ecosystem. Leading cloud service providers like Google Cloud, Microsoft Azure, and Amazon Web Services (AWS) maintain their strong market positions by making large investments in infrastructure, AI/ML capabilities, and cloud solutions for many industries. Finance, healthcare, and retail enterprises have adopted multi-cloud as their way forward due to building resilience, scalability, and innovation. In fact, the U.S. government's dependence on cloud for hosting sensitive data and AI led digital transformation contributes significantly to growth in the market, whereas the growing amount of workloads accelerated by AI demand high-performance cloud platforms. The demand is also fueled by increasing investments in hybrid cloud solutions and edge computing, which facilitate real-time processing nearer to the source of data. Cybersecurity issues, regulatory compliance, and the lack of talent are still challenges, but generally, the U.S. public cloud market will be able to maintain double-digit growth throughout the forecast period based on ongoing innovation and maturity of enterprise clouds.

Europe Public Cloud Market Analysis:

The public cloud market in Europe is growing gradually thanks to initiatives for enterprise modernization, digital transformation, and the emergence of cloud-native development. Germany, the UK, and France are among the top countries to adopt, especially in industries like manufacturing, banking, and public services. The market is influenced by highly regulated data privacy rules, in particular GDPR, resulting in growing demand for local data centers and sovereign cloud solutions. European cloud providers such as OVHcloud and Deutsche Telekom are pitted against hyperscalers including AWS, Microsoft, and Google, and frequently through strategic partnerships. Sustainability is a top priority, with providers going green by investing in carbon-neutral operations and green data centers. As businesses need flexibility without sacrificing control over their data, hybrid and multi-cloud models are becoming more and more popular. Among the difficulties include regional regulatory hurdles and established firms' slow acceptance. However, the European public cloud market is also anticipated to keep growing, driven by robust governmental backing and the trend toward AI-centric digital ecosystems.

Asia Pacific Public Cloud Market Analysis:

The Asia Pacific public cloud market is growing strongly, powered by digitalization, rising internet penetration and a growth in mobile-first business models. Strategic markets like China, India, Japan, and Australia are leading the demand across sectors like e-commerce, finance, and telecom. International cloud players are investing in deepening their regional presence, and domestic players like Alibaba Cloud continue to be strong players. Governments throughout the region are driving cloud-first practices and smart city programs, having an additional impact on adoption. Infrastructure holes and regulatory heterogeneity remain challenges, but with AI adoption and increasing cloud maturity, Asia Pacific is a high-growth market for public cloud services.

Latin America Public Cloud Market Analysis:

Latin America's public cloud market is steadily expanding, driven by Brazil and Mexico, where business is adopting digital transformation. Cloud consumption is on the increase in industries such as retail, finance, and education. Multinational vendors are investing in local infrastructure to enhance latency and regulatory compliance. But economic uncertainty and talent shortages can slow the growth. Despite this, government digitization initiatives and surging demand for remote services following the pandemic are driving a good outlook for the region's use of public cloud.

Middle East and Africa Public Cloud Market Analysis:

Middle East and Africa's public cloud business is picking up speed, fueled by digital government adoption, smart city initiatives, and enterprise modernization. The UAE, Saudi Arabia, and South Africa are front runners in cloud adoption with significant hyperscaler investments in local data centers. Infrastructure challenges and regulatory issues continue to persist, but growing demand for scalable, cost-effective IT solutions is driving growth. The area is set to expand further as companies focus on digital resilience, innovation, and agility.

Leading Key Players in the Public Cloud Industry:

Key players are expanding their service portfolios by introducing new features and enhancing existing offerings to cater to the different needs of individuals. In addition, they are developing industry-specific cloud solutions and obtaining industry-specific certifications to address the unique needs and regulatory requirements of different sectors, such as healthcare and finance. Apart from this, companies are forming strategic partnerships and alliances with software vendors, system integrators, and other service providers to create integrated solutions. Furthermore, cloud providers are investing in renewable energy, energy-efficient data centers, and carbon-neutral operations to reduce their environmental footprint. In line with this, companies are enhancing their security features, providing robust encryption options, and offering compliance certifications to ensure that the data of individuals is protected.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Alibaba Group Holding Limited

- Amazon Web Services Inc.

- Cisco Systems, Inc.

- Google LLC (Alphabet Inc.)

- Hewlett Packard Enterprise Development LP

- International Business Machines Corporation

- Microsoft Corporation

- Oracle Corporation

- Rackspace Technology Inc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News and Developments:

- In April 2025, TCS launched the Sovereign Secure Cloud, a secure, India-focused cloud solution designed for government and public sector enterprises, ensuring sensitive data remains within national borders via data centers in Mumbai and Hyderabad. The offering supports AI integration to boost digital transformation. Alongside, TCS introduced DigiBOLT, an AI-driven low-code platform, and its Cyber Defense Suite in India to enhance innovation and cyber resilience, reinforcing the country’s digital and data sovereignty initiatives.

- In September 2024, Avaya launched its Avaya Experience Platform (AXP) Public Cloud in India, completing its local unified CX offerings. The platform enables businesses across sectors like public services, healthcare, BFSI, telecom, and BPO to choose between public, private, or on-premise models. With advanced AI and journey orchestration tools, AXP helps organizations deliver personalized, seamless customer and employee experiences, enhancing loyalty and driving growth across India’s evolving digital landscape.

Public Cloud Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Infrastructure as a Service (IaaS), Platform as a Service (PaaS), Software as a Service (SaaS) |

| Enterprise Sizes Covered | Large Enterprise, Small and Medium-sized Enterprises |

| End Uses Covered | BFSI, IT and Telecom, Retail and Consumer Goods, Manufacturing, Energy and Utilities, Healthcare, Media and Entertainment, Government and Public Sector, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Alibaba Group Holding Limited, Amazon Web Services Inc, Cisco Systems, Inc., Google LLC (Alphabet Inc.), Hewlett Packard Enterprise Development LP, International Business Machines Corporation, Microsoft Corporation, Oracle Corporation, Rackspace Technology Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the public cloud market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global public cloud market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the public cloud industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The public cloud market reached USD 855.7 Billion in 2024.

The public cloud market is projected to exhibit a CAGR of 18.91% during 2025-2033, reaching a value of USD 4,382.3 Billion by 2033.

The market is expanding due to rising demand for cost-efficient infrastructure, scalable computing, and flexible work solutions. Cloud platforms support remote teams, reduce IT complexity, and offer robust data handling capabilities, making them critical for digital transformation across both enterprises and startups.

North America leads the market, accounting for the largest public cloud market share.

Some of the major players in the global public cloud market include Alibaba Group Holding Limited, Amazon Web Services Inc., Cisco Systems, Inc., Google LLC (Alphabet Inc.), Hewlett Packard Enterprise Development LP, International Business Machines Corporation, Microsoft Corporation, Oracle Corporation, and Rackspace Technology Inc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)