Pumps Market Size, Share, Trends and Forecast by Product Type, Application, and Region, 2026-2034

Pumps Market 2025, Size and Trends:

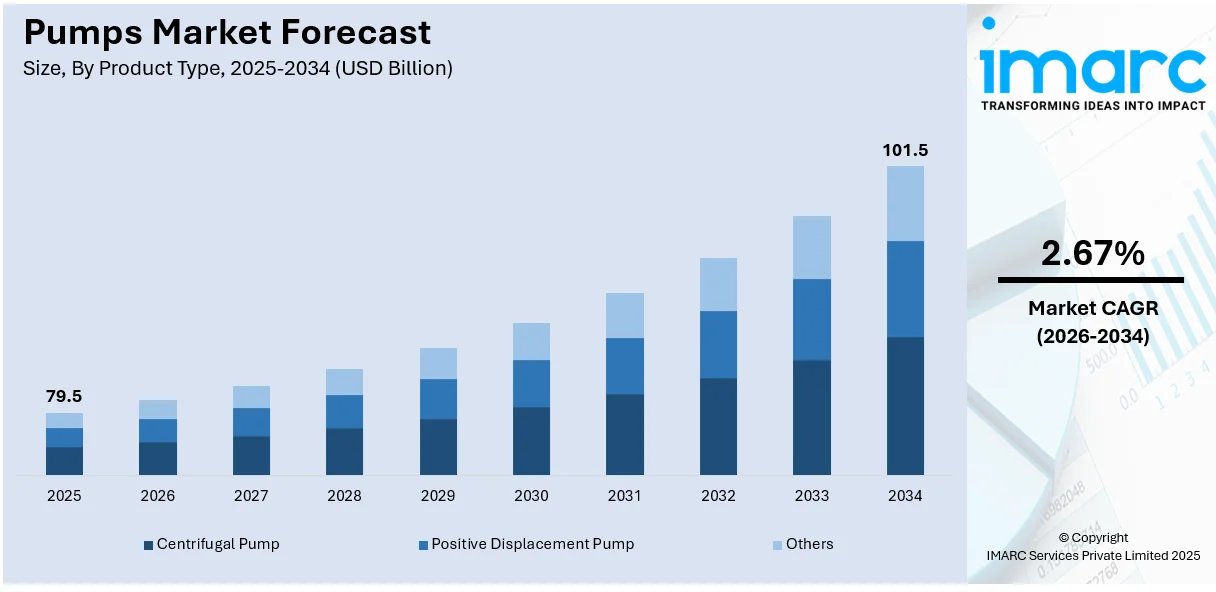

The global pumps market size was valued at USD 79.5 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 101.5 Billion by 2034, exhibiting a CAGR of 2.67% during 2026-2034. Asia-Pacific currently dominates the market, holding a significant market share of over 46.5% in 2025. The rapid urbanization and industrialization, significant technological advancements, increasing infrastructure development, rising demand for water and wastewater management, integration of IoT and smart pump technologies, shift toward energy-efficient and eco-friendly pumps, and growing adoption of variable frequency drives (VFDs) are major factors boosting the pumps market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 79.5 Billion |

| Market Forecast in 2034 | USD 101.5 Billion |

| Market Growth Rate 2026-2034 | 2.67% |

The ongoing expansion of urban areas and infrastructure development projects worldwide is significantly boosting the pumps market demand. Urbanization is driving the construction of residential, commercial, and industrial facilities. In 2023, total construction spending reached $1.98 trillion in the United States, marking a 7.4% increase from the year 2022. This growth was primarily driven by nonresidential construction, which saw a 17.6% year-over-year increase. These developments necessitate robust water and wastewater management systems, where pumps play an essential role. Additionally, infrastructure investments in smart cities are also amplifying the demand. Smart water management systems that are designed to optimize water usage and minimize losses rely heavily on advanced pump technologies like variable-speed pumps, which enhance energy efficiency.

To get more information on this market Request Sample

The United States stands out as a key market disruptor, driven by the rise in environmental concerns and increased energy costs that steer industries and municipalities toward energy-efficient and sustainable pumping solutions. Traditional pumps often consume significant energy, making them expensive to operate and environmentally detrimental. According to the U.S. Department of Energy (DOE), pumping systems often consume between 25% to 50% of the total energy usage. As a result, industries are adopting innovative technologies such as variable frequency drives (VFDs) and high-efficiency motors that reduce energy consumption and carbon emissions. This has led to the development of pumps equipped with VFDs that adjust their operating speed based on real-time demand, ensuring optimal performance and significant energy savings

Pumps Market Trends:

Rapid Urbanization and Industrialization

One of the primary factors driving the global pumps market is the rapid urbanization and industrialization seen across various regions, especially in developing economies. According to the World Health Organization, almost 68% individuals are expected to reside in urban areas by 2050. As more individuals migrate to urban areas, the demand for essential infrastructure such as water supply systems, sewage systems, and heating, ventilation, and air conditioning (HVAC) systems increases significantly. This urban expansion necessitates the deployment of a wide range of pumps to ensure the efficient delivery of water and the proper functioning of sanitation systems, thereby creating a positive pumps market outlook. Industrialization also plays a critical role. The expansion of manufacturing and processing industries requires robust pump systems to manage fluids, chemicals, and other materials used in production processes. Pumps are integral to a myriad of industrial applications, from cooling and heating to the transfer of hazardous substances. For instance, in the manufacturing sector, pumps are crucial for maintaining the cooling systems necessary to keep machinery operational and efficient.

Technological Advancements

Technological advances in pump designs coupled with innovations are some of the major contributors of the global pumps market growth. The advancements in the pumps industry, such as smart pumps with the Internet of Things (IoT) embedded technology and advanced monitoring systems, have transformed the industry. According to IoT Analytics’ State of IoT Summer 2024 report, the number of connected IoT devices is expected to reach 16.6 billion by the end of 2023, growing by 15% in comparison to 2022. These smart pumps can be monitored and controlled in real time, optimizing efficiency, eliminating downtime, and narrowing operational costs. They also provide predictive maintenance alerts that enable the prevention of breakdowns that are expensive, as well as extending the life cycle of the pump systems. Advanced material science has also created more life and energy-efficient pump components. Nowadays, pumps can handle all types of fluids, including corrosives and abrasives, which allows for increased application across various sectors. Another technological spur that is molding the growth of the pumps market is the use of variable frequency drives (VFDs) that permit pumps to operate at different adjustable speeds to save energy and decrease abrasion.

Increasing Infrastructure Development

Infrastructure development, particularly in emerging economies is significantly leading to a significant rise in the pumps demand. Governments and private entities are investing heavily in building and upgrading infrastructure, including transportation networks, water and wastewater treatment facilities, and energy generation plants. For instance, in February 2024, the Biden-Harris Administration announced nearly USD 6 Billion in funding for clean drinking water and wastewater infrastructure. The initiative includes over USD 2.6 Billion designated for upgrading wastewater and sanitation systems, contributing to a total of USD 7 Billion in funding for these projects. These infrastructure projects require a wide array of pumps for various applications. Water and wastewater management are particularly crucial in infrastructure development, thus contributing to the expansion of the pumps market share. As urban areas expand, the need for effective water treatment and distribution systems becomes paramount. Pumps play a vital role in ensuring the efficient movement and treatment of water, making them indispensable in infrastructure projects.

Pumps Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global pumps market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on product type and application.

Analysis by Product Type:

- Centrifugal Pump

- Axial Flow Pump

- Radial Flow Pump

- Mixed Flow Pump

- Positive Displacement Pump

- Reciprocating Pump

- Rotary Pump

- Others

Centrifugal pump stands as the largest component in 2025, holding around 66.8% of the market. The market is dominated by centrifugal pumps due to their efficiency and adaptability in a wide range of applications. These pumps work on the basis of the idea that centrifugal force converts kinetic energy into hydrodynamic energy. Water, chemicals, and even petroleum products are among the many fluids that can get pumped. These pumps are renowned for their excellent dependability and cheap operating costs in addition to their useful and simple maintenance design elements. As per the pumps market overview, centrifugal pumps are also noted for their impressive energy efficiency, an important requirement for applications that seek continuity in operations like water supply, wastewater treatment, and industrial procedures. They are also capable of handling exceedingly large volumes of fluids at comparatively lower costs than any other types of pumps, thereby adding to their popularity. With the improvement brought about through technological advancements, their performance, durability, and adaptability are optimized with regard to any operating conditions, thus making them the popular choice in the industry.

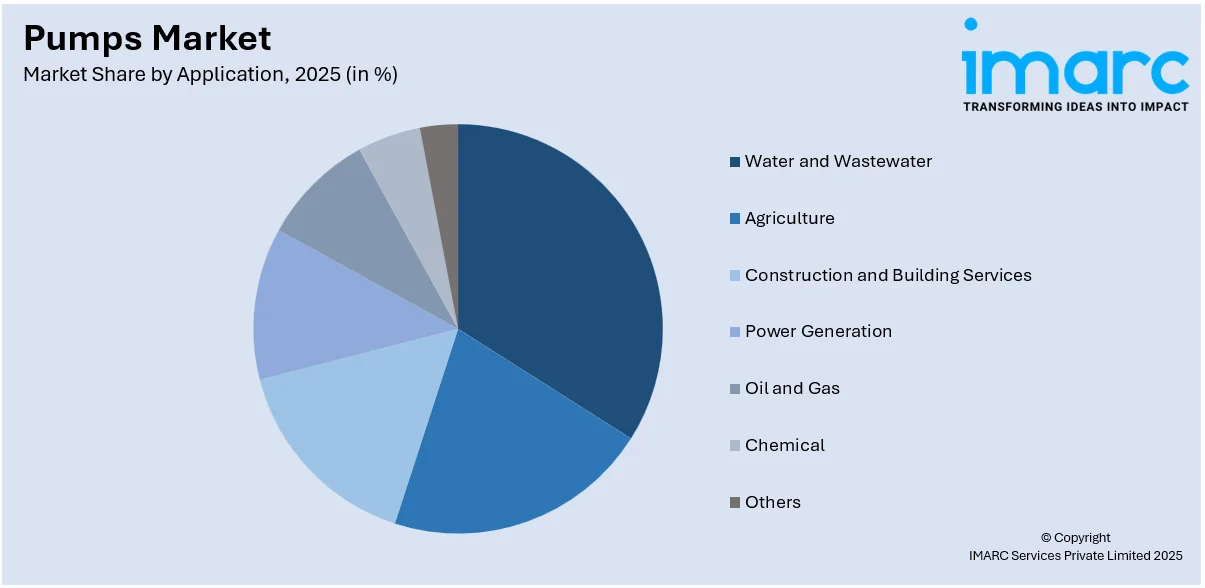

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Agriculture

- Construction and Building Services

- Water and Wastewater

- Power Generation

- Oil and Gas

- Chemical

- Others

As per the pumps market forecast, water and wastewater lead the industry with around 18.5% of market share in 2025. The water and wastewater segment occupies a major portion of the market as it is the first requisite and universal need of clean water coupled with effective wastes disposal. The requirement and demand for efficient water supply and sanitation systems have escalated through urbanization and population increases worldwide. A wide range of pumps employed in various municipal and industrial operations are essential to keep public health and environment standards through water distribution, sewage treatment, and wastewater management. Also, these pumps have recently stimulated further development in advanced pump technologies because of stringent government regulations and policies targeting water conservation and pollution control. Furthermore, investments in huge water and wastewater projects has increased due to the imperative upgrading of aging infrastructure in developed countries as well as the densely populated developing parts, where infrastructure still requires lots of new constructions. According to the pumps market forecast, the dominance of this industry is also attributed to the critical role pumps play in various processes, including water treatment, sludge handling, and wastewater recycling, ensuring the continuous and reliable operation of water and wastewater facilities.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, Asia-Pacific accounted for the largest market share of over 46.5%. Because of its rapid urbanization and industrialization, the Asia Pacific region is the single largest segment of the global pumps market. With increased growth, the economies in these regions are in increasing need of infrastructure development, such as water supply systems, sewage treatment, and industrial processes with heavy dependencies on pump systems. Significant investments in manufacturing, construction, and energy sectors are also escalating pump demand. The agricultural sector plays a crucial role in countries such as India and China and contributes to the development of irrigation pumps. Thus, the Asia Pacific constitutes a major population base and economic growth to create an attractive market for pumps, further amplified by strengthening foreign investments and enlarging local industries.

Key Regional Takeaways:

North America Pumps Market Analysis

According to the pumps market trends, the North American market is characterized by its steady growth. It is attributed to extensive industrialization, strong infrastructure development, and increases in energy-efficient technologies. The rising importance of sustainable water and wastewater modern management systems boosted by strict environmental legislation is increasing the demand for advanced pumps. Coupled with the expanding oil and gas thriving industry, the rise in smart technologies adopted in manufacturing and irrigation systems, also fuel the market growth. Furthermore, investments in modernization projects and the focus on integrated systems with IoT enablement for enhanced operational efficiency are some of the trends shaping the industry in North America. The well-established industry base and technology innovation in the region also make it a prominent player in the global pumps market. Aside from this, the region's well-established industrial base has continued to build and capitalize on technological innovations to entrench its significant contribution to the global pumps market.

United States Pumps Market Analysis

The United States account for 78.9% of the market share in North America. It is driven by robust investments in infrastructure development, including water and wastewater management systems, as part of initiatives like the Infrastructure Investment and Jobs Act. Rising industrialization, particularly in oil and gas, chemical processing, and power generation, is further propelling demand for advanced pumping solutions. The growing emphasis on energy efficiency and sustainability has led to an increased adoption of smart pumps equipped with IoT and AI technologies, enabling real-time monitoring and optimization. According to Census BTOS, states with the largest share of firms adopting AI, such as Colorado (7.4%), Florida (6.6%), Utah (6.5%), Nevada (6.5%), and Delaware (6.5%), are likely to see more rapid growth in demand for technologically advanced pumping solutions. In addition, the agricultural sector's reliance on irrigation systems to address water scarcity is fueling the market for submersible and centrifugal pumps. Stringent government regulations on emissions and energy efficiency standards are incentivizing industries to upgrade to high-efficiency and environmentally compliant pumps. The ongoing expansion in the residential construction sector, driven by urbanization and population growth, is also contributing to the demand for pumps used in HVAC systems and water supply networks.

Asia Pacific Pumps Market Analysis

The Asia-Pacific pump market is expanding rapidly as a result of rising industrialization and urbanization. Countries like China and India are adding funds into developing infrastructure projects, from water supply to wastewater treatment to energy generation, which in turn spurs future demand on pumping applications. The biggest urban population growth in the Asia-Pacific region in 2023 was witnessed in Singapore, with a whopping 4.9%, as reported by the World Bank. This further adds to the residential and commercial demand for pumps in HVAC systems and water supply networks. Expansion in manufacturing and agriculture, particularly into the development of submersible and centrifugal pump usage for irrigation and industrial processes, contributes to this region's growing economy. An increasing awareness regarding energy efficiency and sustainability has also strengthened the use of smart and high-efficiency pumps. Improved systems of water management are being promoted through government programs to fight against water scarcity, further fueling the progress of the market. Construction activities also keep on surging in developing economies across Southeast Asia to keep up with the growing need for plumbing to accommodate the increase in water treatment applications.

Europe Pumps Market Analysis

The European pumps market is primarily driven by stringent environmental regulations and the region's commitment to achieving net-zero carbon emissions by 2050. This has catalyzed investments in energy-efficient and eco-friendly pumping solutions across industries. The demand for pumps in wastewater treatment is particularly high, driven by aging infrastructure and strict EU directives aimed at reducing water pollution. Additionally, the increasing adoption of renewable energy sources, which represented an estimated 24.1% of the European Union’s final energy use in 2023, necessitates advanced pump systems for energy storage and fluid management applications in wind, solar, and hydroelectric projects. The industrial sector, including chemical, pharmaceutical, and food processing industries, continues to expand, boosting demand for specialized pumps capable of handling diverse materials and operating conditions. The region's strong focus on research and development fosters innovations in smart pump technologies, enhancing operational efficiency. Urbanization and retrofitting of existing infrastructure, coupled with increasing investments in district heating and cooling systems, further augment the market’s growth prospects.

Latin America Pumps Market Analysis

Latin America’s pumps market is largely driven by the agriculture sector, where pumps are essential for irrigation in countries like Brazil and Argentina. In 2022, approximately 13.64% of employees in Latin America and the Caribbean were working in the agricultural sector, highlighting the region’s heavy reliance on agriculture as a critical economic driver. This dependence fuels strong demand for pumps used in irrigation and water management systems. Additionally, the mining industry, a significant contributor to the region’s economy, generates robust demand for heavy-duty pumps. Urbanization and industrialization are boosting the adoption of pumps in construction, water supply, and wastewater management systems. Furthermore, the oil and gas sector, particularly in countries like Mexico and Venezuela, continues to drive demand for specialized pumps. Government investments in infrastructure modernization and renewable energy projects further enhance the market’s growth, with a growing focus on sustainable and energy-efficient pumping solutions.

Middle East and Africa Pumps Market Analysis

The Middle East and Africa pumps market is driven by the oil and gas sector, a cornerstone of the region's economy. According to the IEA, in the Middle East and Eurasia, the energy workforce makes up a relatively high share of economy-wide employment, averaging 3.6%, further emphasizing the importance of this sector to the regional economy. Increased exploration and production activities, coupled with the need for enhanced water injection and crude transfer systems, are fueling demand for advanced pumping solutions. Water scarcity challenges have also led to significant investments in desalination plants and wastewater treatment facilities, creating further opportunities for pump manufacturers. Urbanization and infrastructure development, particularly in GCC countries, drive the demand for pumps in construction, HVAC, and water supply applications. Additionally, the growing focus on renewable energy projects and agricultural advancements in Africa is contributing to the adoption of energy-efficient and innovative pumps.

Competitive Landscape:

The major players in the market are emphasizing innovation and sustainability to enhance their competitiveness and address growing global demand. They are investing in advanced technologies such as IoT-enabled systems, smart monitoring solutions, and energy-efficient designs to align with regulatory standards and customer preferences. Efforts include the development of modular and customizable pumps for diverse applications across industries like water management, oil and gas, and manufacturing. Besides this, companies are also focusing on expanding their geographical footprint by establishing new production facilities and service centers, particularly in emerging markets where infrastructure development is accelerating. Apart from this, strategic partnerships, acquisitions, and collaborations with technology firms are enabling them to strengthen their product portfolios and access new customer segments.

The report provides a comprehensive analysis of the competitive landscape in the keyword market with detailed profiles of all major companies, including:

- Baker Hughes Company

- Ebara Corporation

- Flowserve Corporation

- Grundfos Holding A/S

- ITT Inc.

- KSB SE & Co. KGaA

- Pentair plc

- Schlumberger Limited

- Sulzer Ltd.

- The Weir Group PLC

- Vaughan Co. Inc.

- Xylem Inc.

Latest News and Developments:

- September 2024: EBARA Corporation announced plans to establish a new testing and development center for hydrogen infrastructure equipment in Futtsu City, Chiba Prefecture, Japan. The project encompasses an approximately 18,000m2 site area, involving an investment of around 16 Billion yen. The center will serve as the world's first full-scale commercial product testing facility for liquid hydrogen pumps, utilizing liquid hydrogen at -253°C.

- August 2024: Flowserve announced its plan to acquire MOGAS Industries, a move aimed at enhancing its growth strategy in the 3D (digital, decarbonization, and decentralization) sectors. This acquisition is expected to strengthen Flowserve's position in the market by expanding its product offerings and capabilities.

- May 2024: Grundfos announced its agreement to acquire Culligan’s Commercial & Industrial business, which operates in Italy, France, and the UK. This acquisition aims to enhance Grundfos' water treatment portfolio and strengthen its position as a leader in water technologies. This move follows previous acquisitions by Grundfos, including EUROWATER, MECO, and Water Works, and is part of their strategy to bolster innovation in water treatment solutions.

- July 2023: Grundfos has acquired UK-based Metasphere, a leader in telemetry and analytics, to enhance its smart pumping solutions for municipal water networks. By integrating Metasphere’s IoT-enabled technology and analytics, Grundfos aims to improve pump system efficiency and resilience, addressing rising costs from water system failures currently estimated at USD 194 Billion annually amid increasing climate challenges.

- May 2023: ClydeUnion Pumps has entered a multi-year agreement with ONGC to deliver dedicated pump maintenance and spare parts services across its crude oil and natural gas assets in India. The partnership, formalized during a signing ceremony in Mumbai, underscores ClydeUnion Pumps’ role as a key OEM partner supporting ONGC’s operational efficiency and reliability. The event also featured a Share and Learn session where regional leaders and experts shared updates and best practices to optimize asset performance.

Pumps Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Applications Covered | Agriculture, Construction and Building Services, Water and Wastewater, Power Generation, Oil and Gas, Chemical, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Baker Hughes Company, Ebara Corporation, Flowserve Corporation, Grundfos Holding A/S, ITT Inc., KSB SE & Co. KGaA, Pentair plc, Schlumberger Limited, Sulzer Ltd., The Weir Group PLC, Vaughan Co. Inc., Xylem Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the pumps market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global pumps market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the pumps industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

A pump is a mechanical device designed to move fluids, such as liquids or gases, from one location to another by creating pressure or suction. It is commonly used in industries, households, and infrastructure for applications like water supply, irrigation, oil transport, and wastewater management.

The Pumps market was valued at USD 79.5 Billion in 2025.

IMARC Group estimates the market to reach USD 101.5 Billion by 2034, exhibiting a CAGR of 2.67% during 2026-2034.

The pumps market is driven by increasing infrastructure development, rapid industrial growth, rising agricultural irrigation needs, growing demand for energy-efficient technologies, and heightened advancements in smart pumping solutions.

According to the report, centrifugal pump represented the largest segment by product type, due to their versatile applications across industries such as water management, oil and gas, and manufacturing.

Water and wastewater lead the market by application owing to the increasing demand for clean water and effective wastewater treatment solutions worldwide.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global pumps market include Baker Hughes Company, Ebara Corporation, Flowserve Corporation, Grundfos Holding A/S, ITT Inc., KSB SE & Co. KGaA, Pentair plc, Schlumberger Limited, Sulzer Ltd., The Weir Group PLC, Vaughan Co. Inc., Xylem Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)