Railway Maintenance Machinery Market Size, Share, Trends and Forecast by Product Type, Application, Sales Type and Region, 2025-2033

Railway Maintenance Machinery Market Size and Share:

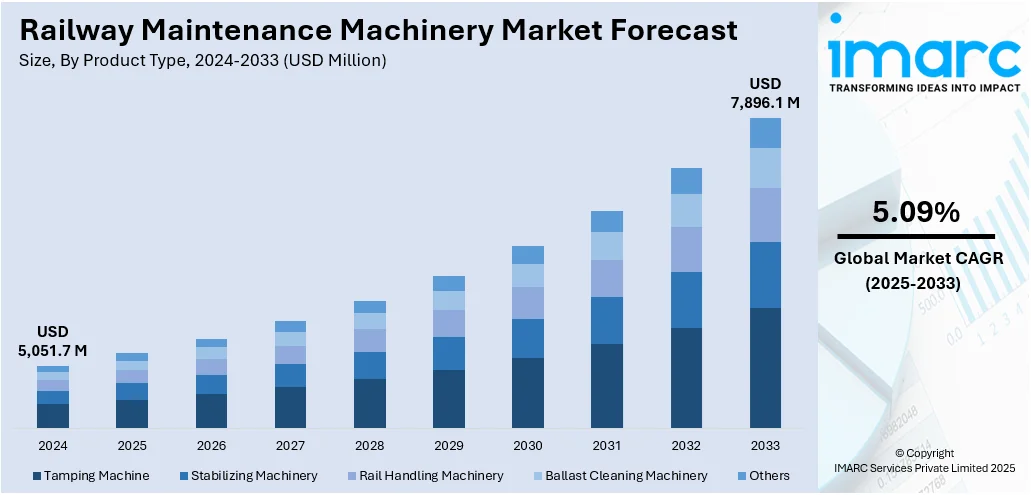

The global railway maintenance machinery market size was valued at USD 5,051.7 Million in 2024. The market is projected to reach USD 7,896.1 Million by 2033, exhibiting a CAGR of 5.09% from 2025-2033. Europe currently dominates the market in 2024. At present, increasing instances of railway accidents and train derailments are creating the need for better track upkeep and safety measures. Besides this, the growing adoption of electric trains around the world is contributing to the expansion of the railway maintenance machinery market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 5,051.7 Million |

|

Market Forecast in 2033

|

USD 7,896.1 Million |

| Market Growth Rate (2025-2033) | 5.09% |

At present, the market is growing due to the increasing demand for safe and reliable rail transport. As railway networks are expanding and train frequencies are rising, the need for regular track maintenance is becoming more critical. Government agencies and private operators are investing in modernizing infrastructure, which is boosting the adoption of advanced maintenance machines. Aging rail systems in many countries also require frequent upgrades and repairs. The rise of high-speed rail and heavier freight trains is increasing stress on tracks, driving the demand for precise and efficient machinery. Automated and technology-oriented solutions help reduce downtime, improve accuracy, and lower labor costs. Environmental concerns and the requirement for energy optimization are further propelling the railway maintenance machinery market growth.

To get more information on this market, Request Sample

The United States has emerged as a major region in the railway maintenance machinery market owing to many factors. The market is growing due to the country’s vast rail network, aging infrastructure, and strong focus on operational safety. With heavy use of rail for both freight and passenger transport, regular and efficient maintenance is becoming essential. Many rail lines are decades old and require constant upgrades, repairs, and inspections to ensure reliability and prevent disruptions. The rise in freight movement across states is putting additional stress on tracks, creating the need for durable and high-performance maintenance machinery. Investments in high-speed rail projects and the modernization of existing systems are also driving the demand. Technological advancements in automation and predictive maintenance are promoting the employment of advanced machinery. According to the IMARC Group, the United States predictive maintenance market is set to attain USD 20.1 Billion by 2033, exhibiting a growth rate (CAGR) of 20.43%

Railway Maintenance Machinery Market Trends:

Improvements in railway infrastructure

Significant improvements in railway infrastructure are offering a favorable railway maintenance machinery market outlook. Authorities are heavily funding the upgrade and renovation of existing rail tracks to ensure a safer, more reliable, and efficient transportation experience for the public. As per industry reports, in 2024, Indian Railways refurbished 6,450 km of track, increased speeds to 130 km/h across 2,000 km, and electrified 3,210 Rkm, expanding the electrified BG network to 97%. As railways are broadening and modernizing, there is a growing demand for precision in track alignment and overall system upkeep, which is boosting the use of specialized maintenance machinery. New high-speed rail projects require frequent inspections and maintenance using advanced technology. Additionally, the emphasis on minimizing delays and improving passenger comfort is encouraging rail operators to wager on high-quality, automated maintenance machines. These improvements in infrastructure, supported by government initiatives and long-term transportation strategies, are fueling the steady growth of the market, ensuring that the rail network remains resilient and future-ready.

Rising instances of railway accidents and train derailments

Increasing instances of railway accidents and train derailments are among the major railway maintenance machinery market trends. In 2023, it was reported that 1,567 major train accidents in the EU led to 841 deaths and 569 serious injuries. These incidents often result from poor track conditions, misalignment, or structural fatigue, leading rail authorities to invest more in regular and precise maintenance. The pressure to reduce such occurrences leads to the adoption of advanced machinery that ensures accurate inspections, timely repairs, and consistent track geometry. Government agencies and railway operators continue to focus on improving safety standards and preventing service disruptions, catalyzing the demand for efficient tamping, leveling, and diagnostic machines. Public and regulatory scrutiny after accidents is further motivating operators to modernize their maintenance practices. As safety is becoming a top priority, the railway industry is turning to automated and high-performance equipment to prevent accidents and protect passenger and cargo transport.

Growing adoption of electric trains

The widespread adoption of electric trains is bolstering the market growth. Electric trains operate at higher speeds and require smoother, well-aligned tracks for safe and efficient functioning, increasing the frequency and precision of maintenance activities. The shift from diesel to electric is also leading to the expansion of electrified rail lines, which need consistent inspection and servicing using advanced machinery. Overhead lines, tracks, and power systems must be maintained with accuracy, boosting the use of modern, automated equipment. Additionally, electric trains promote sustainable and high-performance rail transport, encouraging government agencies and operators to invest in long-term rail infrastructure and maintenance solutions. In April 2025, Bulgaria finalized a EUR 328.4 Million agreement with Stadler for 35 new electric trains, focusing on upgrading its railway system, lowering carbon emissions, and improving passenger comfort. As electric trains are becoming a standard across urban and intercity routes, the need for reliable, fast, and technology-oriented maintenance machines is growing.

Railway Maintenance Machinery Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global railway maintenance machinery market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, application, and sales type.

Analysis by Product Type:

- Tamping Machine

- Stabilizing Machinery

- Rail Handling Machinery

- Ballast Cleaning Machinery

- Others

Tamping machine held the largest market share in 2024. They play a vital role in maintaining track stability and alignment. These machines compact and adjust the ballast under railway tracks, ensuring proper track geometry and smooth train operations. As train speeds and axle loads increase, regular tamping becomes essential to prevent misalignment and reduce wear and tear on both tracks and rolling stock. Tamping machines are widely employed in both freight and passenger rail networks due to their efficiency and ability to maintain large sections of track in less time. They help reduce manual labor and improve accuracy, making them indispensable for modern rail systems. Technological advancements like automated controls are further enhancing their precision and ease of use. Since track alignment directly impacts safety, comfort, and operational efficiency, railway operators are prioritizing tamping activities.

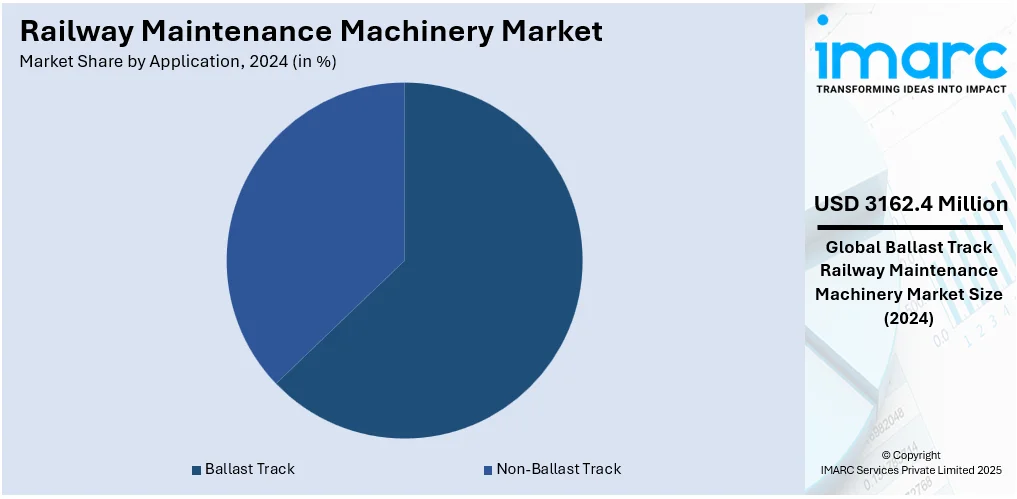

Analysis by Application:

- Ballast Track

- Non-Ballast Track

Ballast track accounts for 62.6% of the market share. It is the most commonly used track structure worldwide, including in both freight and passenger rail systems. Ballast tracks consist of crushed stone that provides stability, drainage, and support to the railway sleepers and rails. They require regular maintenance to preserve track geometry and ensure safe and efficient train movement. Over time, ballast shifts due to train loads and environmental conditions, leading to misalignment and uneven track surfaces. This makes maintenance machinery like tamping machines, ballast regulators, and stabilizers essential for consistent upkeep. The frequent need for leveling, compacting, and cleaning of ballast is catalyzing the demand for specialized maintenance equipment. Since ballast tracks are cost-effective and flexible, they are preferred in many regions, especially in heavy-load and long-distance operations. The high volume of existing and newly constructed ballast tracks is promoting the utilization of maintenance machinery, making this application segment dominant in the overall market.

Analysis by Sales Type:

- New Sales

- Aftermarket

Aftermarket represents the largest market share. It plays an important role in ensuring the longevity of existing machinery. Railway maintenance equipment is subject to frequent use, heavy workloads, and harsh environmental conditions, which lead to wear and require regular servicing and part replacement. Because aftermarket solutions include spare parts, refurbishments, upgrades, and technical support, they are essential for maintaining operational efficiency without investing in new machinery frequently. Many rail operators prefer to extend the life of their equipment through cost-effective aftermarket options rather than purchasing expensive new machines. Additionally, the large number of aging machines in use is catalyzing the demand for reliable aftermarket support. Service providers are also offering maintenance contracts, faster part availability, and customized solutions, making aftermarket a convenient and practical choice. As per railway maintenance machinery market forecast, with the expansion of rail networks, the aftermarket segment will continue to remain the most relied upon and widely adopted sales type in the industry.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Europe is enjoying the leading position in the market due to its extensive and well-developed rail infrastructure, strong focus on safety, and commitment to modernization. The region has a dense network of high-speed and conventional rail lines that require regular, efficient, and precise maintenance. European countries are prioritizing public transportation and taking initiatives related to rail upgrades, catalyzing the demand for advanced maintenance machinery. In October 2024, UK Chancellor Rachel Reeves revealed major rail improvements in the Autumn 2024 Budget, featuring the electrification of trains and funding to enhance connectivity throughout Northern England. Besides this, stringent regulations and safety standards are motivating operators to adopt the latest technologies to ensure track reliability and minimize disruptions. Leading European companies are at the forefront of innovations, offering state-of-the-art machines equipped with automation, diagnostics, and predictive maintenance features. Additionally, cross-border rail connectivity and the European Union’s funding support are further driving infrastructure development and maintenance needs. Environmental concerns also play a role, as maintaining efficient rail systems supports sustainable transport goals. With strong government backing, skilled labor, and advanced technological capabilities, Europe continues to dominate the market.

Key Regional Takeaways:

United States Railway Maintenance Machinery Market Analysis

The United States railway maintenance machinery market is primarily driven by the continuous expansion of the railway network, which requires advanced equipment to maintain safety and efficiency. In line with this, increasing investments in infrastructure modernization are promoting the adoption of state-of-the-art maintenance machinery. As such, in October 2024, the Biden-Harris Administration revealed USD 2.4 Billion in funding for rail enhancements, backing 122 projects in 41 states. These initiatives focused on enhancing safety, broadening capacity, improving service, and supporting workforce development in the US railway system. Rising demand for high-speed rail systems is further creating the need for specialized machinery capable of maintaining such advanced networks. Similarly, the growing emphasis on sustainability, which aids in promoting the use of eco-friendly and energy-efficient machinery, is also enhancing market appeal. Additionally, the emerging trend of automation and digitization is encouraging the integration of artificial intelligence (AI) and the Internet of Things (IoT) into maintenance equipment. Moreover, favorable government initiatives aimed at enhancing freight transportation efficiency are positively influencing the market. At the same time, the heightened need to minimize train delays and improve operational uptime is fostering continuous investments in high-performance maintenance machinery.

Europe Railway Maintenance Machinery Market Analysis

The European market for railway maintenance machinery is expanding due to the region’s heightened focus on enhancing high-speed rail networks. As such, in May 2025, FlixTrain placed an order for 65 high-speed trains in a €2.4 Billion agreement with Talgo and Siemens. This investment aimed to broaden services across Germany and Europe, facilitating cross-border operations with trains attaining speeds of 230 km/h, thereby enhancing affordability and sustainability. In accordance with this, the growing adoption of smart technologies in railway systems is driving the demand for automated maintenance solutions. Similarly, rising freight transport requirements, particularly for cross-border logistics, as well as high investments in better infrastructure and machinery, are fueling the market expansion. The growing emphasis on sustainability is promoting the utilization of energy-optimized maintenance equipment, while aging infrastructure in several countries is accelerating the need for upgrades. Furthermore, stringent regulatory safety standards are leading the market towards more advanced maintenance machinery. The emerging urbanization trends, particularly the demand for efficient public transportation, are also contributing to the market growth.

Asia-Pacific Railway Maintenance Machinery Market Analysis

The Asia-Pacific market is predominantly propelled by rapid urbanization activities across developing regions, which is driving the demand for advanced rail infrastructure and maintenance solutions. In addition to this, increasing government investments in rail network expansion, particularly in China and India, are significantly augmenting market demand. Furthermore, the heightened focus on enhancing rail safety standards is encouraging the adoption of advanced maintenance equipment. The rise in freight transportation across the region is creating the need for regular rail infrastructure upgrades. As such, in 2024, Chinese Railways carried a total of 4.715 Billion tons of cargo, indicating a 2.5% growth compared to 2023. In November, freight volumes soared to 455 Million Tons, indicating a 6.4% increase compared to November 2023. Similarly, the rapid integration of digital technologies in rail operations is fueling the market expansion. Besides this, the ongoing shift towards energy-efficient and sustainable machinery, driven by environmental concerns, is providing an impetus to the market.

Latin America Railway Maintenance Machinery Market Analysis

In Latin America, the railway maintenance machinery market is progressing, attributed to increasing government investments in modernizing rail infrastructure to enhance regional connectivity and support economic integration. Similarly, the growing demand for efficient freight transportation is catalyzing the demand for robust and reliable rail maintenance solutions to ensure seamless logistics operations. Accordingly, in January 2025, Brazil finalized a USD 2.74 Billion agreement with Vale to upgrade two major railway systems, enhancing infrastructure and increasing freight capacity. This initiative aimed to improve logistics, draw in investments, and foster economic development via public-private collaborations. Furthermore, the broadening of urban rail networks, particularly in major metropolitan areas, is accelerating the adoption of advanced machinery to maintain safety and operational efficiency. Moreover, tightening environmental regulations and regional encouragement for greener transportation alternatives are further influencing the market positively.

Middle East and Africa Railway Maintenance Machinery Market Analysis

The market in the Middle East and Africa is significantly influenced by rapid urbanization activities, which are catalyzing the demand for efficient rail infrastructure and advanced maintenance solutions. Additionally, large-scale government investments in rail projects, particularly in Saudi Arabia and the United Arab Emirates (UAE), are contributing to the market growth. As such, in September 2024, Jordan and the UAE agreed on a USD 2.3 Billion railway investment project to connect Aqaba's port with the mining areas in Al-Shidiya and Ghor es-Safi. Furthermore, the growing emphasis on rail safety standards and minimizing operational disruptions is promoting the adoption of modern machinery. Apart from this, increasing demand for eco-friendly and energy-efficient solutions is leading to the development and use of sustainable maintenance technologies across the region.

Competitive Landscape:

Key players are developing advanced, efficient, and reliable solutions that meet the evolving needs of the rail industry. They are investing in research and innovations to create automated and smart machinery that enhances precision, reduces downtime, and improves safety during maintenance operations. These companies are also offering end-to-end services, including machine leasing, technical support, and training, which make it easier for rail operators to adopt and utilize their equipment effectively. Key players are collaborating with government agencies, rail authorities, and infrastructure developers to support large-scale modernization and expansion projects. By participating in international rail exhibitions and forging strategic partnerships, they help promote technological advancement across markets. Their focus on durability, efficiency, and customization aids in shaping industry standards and contributing significantly to the steady growth of the market. For instance, in July 2024, Texmaco Rail and Engineering purchased Jindal Rail Infrastructure for INR 615 Crore, establishing itself as India’s top rolling stock producer. This agreement increased Texmaco's production capability, taking advantage of expansion in the wagon sector and government initiatives favoring dedicated freight corridors, improving railway maintenance machinery output.

The report provides a comprehensive analysis of the competitive landscape in the railway maintenance machinery market with detailed profiles of all major companies, including:

- American Equipment Company Inc (Fluor Corporation)

- China Railway Construction Corporation Limited

- Geatech Group srl

- Harsco Corporation

- Loram Maintenance of Way Inc. (Coril Holdings Ltd.)

- MATISA Industrial Materials S.A

- Plasser & Theurer

- Speno International SA

- Strukton

- Teräspyörä-Steelwheel Oy

Latest News and Developments:

- May 2025: Liebherr presented the RE 25 M Litronic railroad excavator at the 29th International Exhibition for Track Technology. The 25-ton equipment included hydrostatic rail wheel drive, an innovative undercarriage, a user-friendly operator’s cab, and a space-saving design. It provided excellent performance, security, and improved grip for railway construction.

- January 2025: Alstom obtained a EUR 144 Million agreement to provide traction components and maintenance services for 17 Vande Bharat Sleeper trains in India. The agreement contained locally produced parts and a five-year maintenance agreement. The trains would operate at speeds reaching 180 km/h, reinforcing India’s "Make-in-India" initiative.

- December 2024: RELAM purchased Falcon Equipment, enhancing its footprint in the Canadian market and bolstering its status in the railway maintenance-of-way (MOW) industry. Falcon, located in Surrey, British Columbia, focused on custom trucks and machinery for lifting, snow clearing, and utility services. The purchase improved RELAM’s rental and leasing services.

- October 2024: HS2 Ltd initiated a USD 124 Million procurement for railway maintenance equipment to aid the high-speed rail connection between London and Birmingham. The initiative encompassed three agreements for overall infrastructure, supervision, and track access equipment, seeking to improve operational effectiveness, automate evaluations, and guarantee uniform maintenance throughout the system.

- October 2024: Sona Comstar purchased the Railway Equipment Division (RED) of Escorts Kubota for INR 1,600 Crore, signifying its entrance into the railway components industry. The acquisition boosted its clean mobility services, as RED's knowledge in essential railway parts, such as brake systems and suspension, aided India's growing railway infrastructure and maintenance demands.

- July 2024: West Japan Railways launched a humanoid robot for railway infrastructure upkeep, created in collaboration with Jinki Ittai Co and Nippon Signal Co. With the ability to lift 40kg and operate at heights of 12 meters, it assisted in activities, such as repairing overhead lines, clearing obstructions, and enhancing safety, resulting in a 30% decrease in workforce requirements.

Railway Maintenance Machinery Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Tamping Machine, Stabilizing Machinery, Rail Handling Machinery, Ballast Cleaning Machinery, Others |

| Applications Covered | Ballast Track, Non-Ballast Track |

| Sales Types Covered | New Sales, Aftermarket |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | American Equipment Company Inc (Fluor Corporation), China Railway Construction Corporation Limited, Geatech Group srl, Harsco Corporation, Loram Maintenance of Way Inc. (Coril Holdings Ltd.), MATISA Industrial Materials S.A, Plasser & Theurer, Speno International SA, Strukton and Teräspyörä-Steelwheel Oy |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the railway maintenance machinery market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global railway maintenance machinery market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the railway maintenance machinery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The railway maintenance machinery market was valued at USD 5,051.7 Million in 2024.

The railway maintenance machinery market is projected to exhibit a CAGR of 5.09% during 2025-2033, reaching a value of USD 7,896.1 Million by 2033.

As railway networks are expanding and train traffic is increasing, regular maintenance is becoming essential to prevent accidents, minimize delays, and extend the lifespan of infrastructure. Aging rail tracks and equipment in many regions also require frequent repairs and upgrades, driving the demand for advanced maintenance machinery. Government agencies and railway authorities are investing heavily in infrastructure modernization, further fueling the market growth.

Europe currently dominates the railway maintenance machinery market in 2024, due to its advanced rail infrastructure, strong regulatory standards, and continuous investments in modernization. The region is emphasizing safety, sustainability, and technology adoption, driving consistent demand for high-performance and automated maintenance equipment.

Some of the major players in the railway maintenance machinery market include American Equipment Company Inc (Fluor Corporation), China Railway Construction Corporation Limited, Geatech Group srl, Harsco Corporation, Loram Maintenance of Way Inc. (Coril Holdings Ltd.), MATISA Industrial Materials S.A, Plasser & Theurer, Speno International SA, Strukton, Teräspyörä-Steelwheel Oy, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)