Rare Earth Elements Market Size, Share, Trends and Forecast by Application and Region, 2026-2034

Rare Earth Elements Market Size and Share:

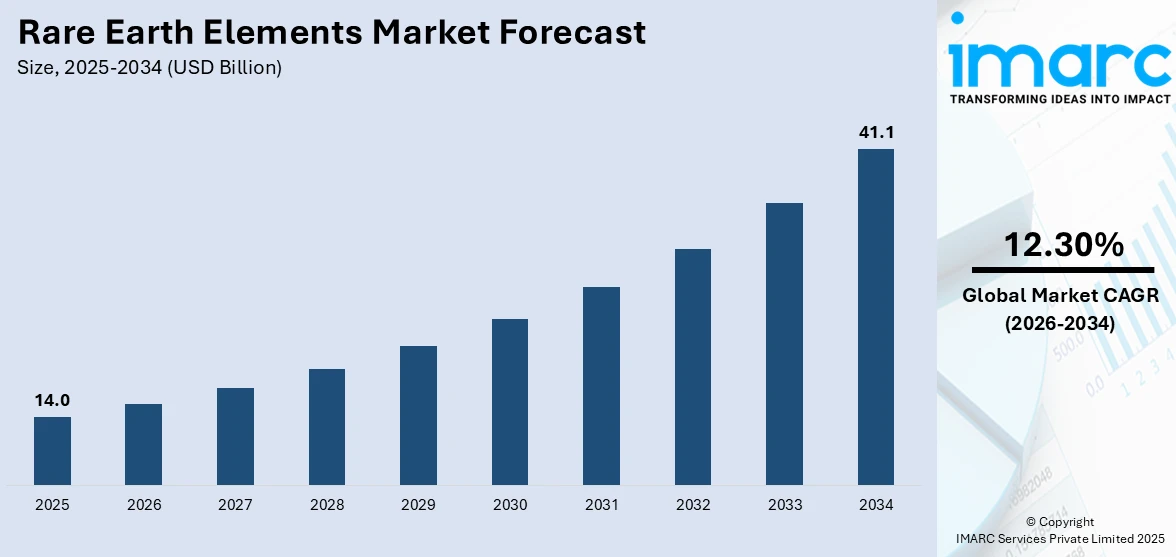

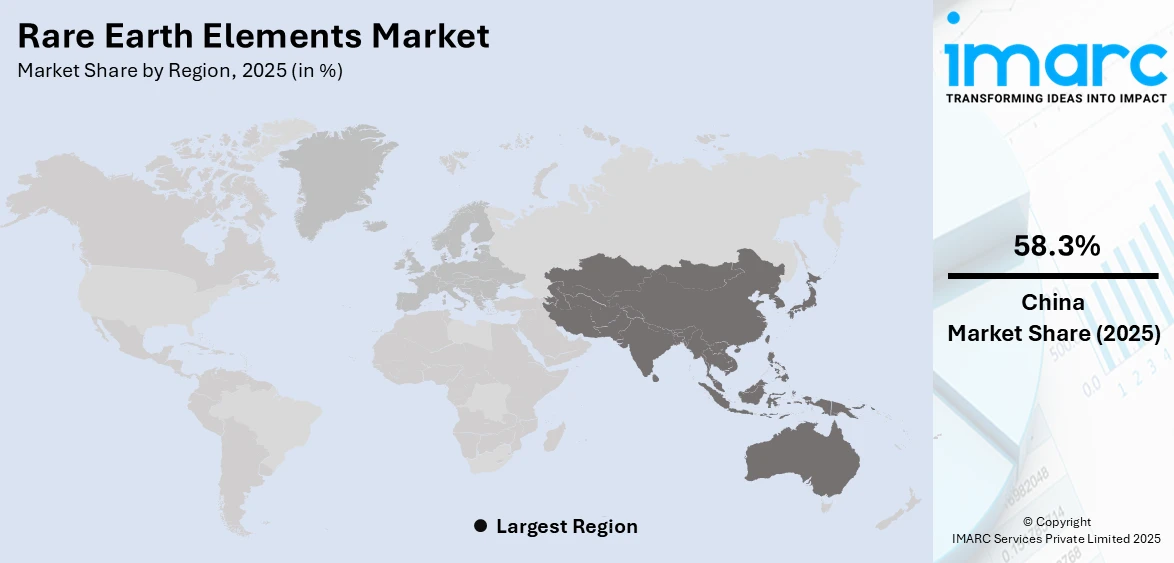

The global rare earth elements market size was valued at USD 14.0 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 41.1 Billion by 2034, exhibiting a CAGR of 12.30% from 2026-2034. China currently dominates the market, holding a market share of over 58.3% in 2025. The market is growing due to the rising shift towards clean energy and the high use of consumer electronics worldwide, further increasing rare earth elements market share. The 2022 price surge, caused by supply shortages and geopolitical tensions with China, boosted revenues through 2022 and 2023. Additionally, steady demand for permanent magnets and catalysts in the automotive sector is expected to support further market expansion over the coming years.

Rare Earth Elements Market Highlights:

- China was the dominant region, with a revenue share of 58.3% in 2025.

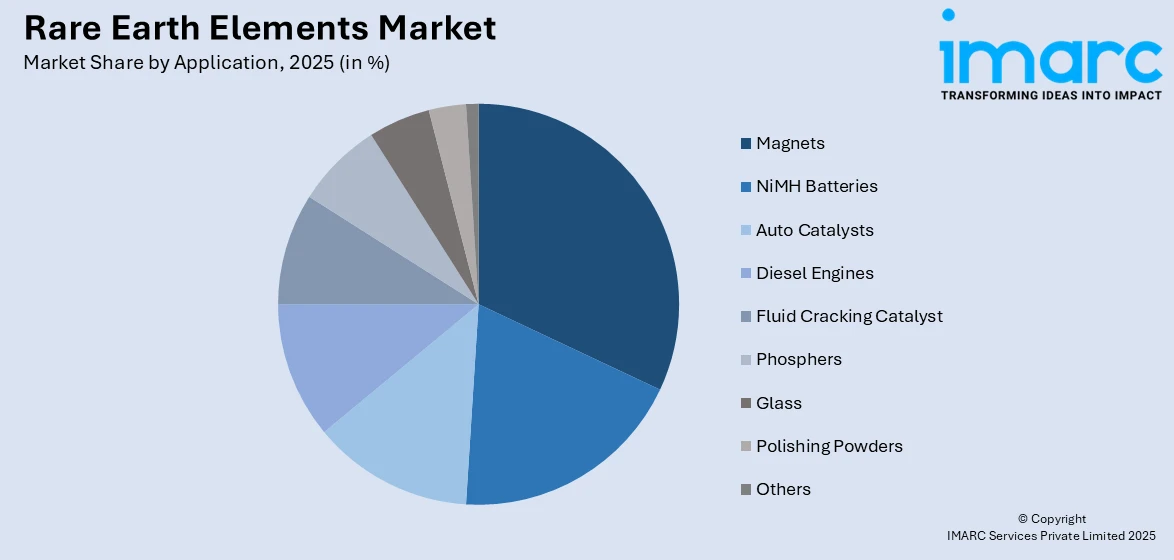

- By application, magnets are crucial for electric vehicles, wind turbines, and consumer electronics and accounted for the highest revenue share of 31.2% driven by their essential role in advanced technologies.

Market Size & Forecast:

- 2025 Market Size: USD 14.0 Billion

- 2034 Projected Market Size: USD 41.1 Billion

- CAGR (2026-2034): 12.30%

- China: Largest market in 2025

One major driver in the rare earth elements (REE) market is the growing demand for clean energy technologies. REEs are essential for producing permanent magnets used in wind turbines and electric vehicle (EV) motors, both of which are expanding rapidly due to global sustainability targets. Governments are actively promoting renewable energy adoption, increasing the need for high-performance materials like neodymium and dysprosium. According to research a study revealed that dysprosium demand could rise by 2,600% and neodymium by 700% over the next 25 years. Additionally, advancements in battery and energy storage technologies are boosting REE usage, as these elements improve the efficiency and lifespan of next-generation power systems.

To get more information on this market Request Sample

The U.S. rare earth elements market is advancing as the country works to reduce reliance on Chinese imports, which currently account for 83.20% of the supply. Government-backed initiatives, including over USD 28 million in Department of Energy investments for REE and critical mineral processing projects, are strengthening domestic capabilities. Growing demand from defense, EVs, and renewable energy sectors is aiding the rare earth elements market growth. Companies are expanding refining operations to increase U.S.-based production, while strategic partnerships with allied nations support resource diversification. Recycling technologies are also gaining attention. These coordinated efforts aim to secure a reliable REE supply chain and bolster industries dependent on these essential materials.

Rare Earth Elements Market Trends:

Rising Adoption in Numerous Industries

The widespread usage of rare earth elements, including neodymium, lanthanum, cerium, praseodymium, yttrium, dysprosium, etc., in the manufacturing of magnets and catalysts across the automotive industry is one of the primary factors stimulating the rare earth element industry growth analysis. Moreover, according to the International Energy Agency, the global stock of electric cars was over five Million in 2018, which was more than a 63% increase from 2017. The escalating demand for electric vehicles to minimize CO2 emissions levels is driving the usage of permanent magnets in battery production, acting as another significant growth-inducing factor. Besides this, the elevating usage of rare earth elements, such as gadolinium, on account of the rising production of nuclear reactors, is further fueling the global market. For example, in December 2018, the Department of Energy's Oak Ridge National Laboratory (ORNL) announced

the collaborations for six new industry projects to advance commercial nuclear energy technologies. These collaborations were supported by the Department of Energy (DOE), which provided the funding of USD 14 Million for research in fusion energy and USD 18 Million for transformative energy technologies. Apart from this, praseodymium is gaining extensive traction as an alloying agent with magnesium to manufacture high-strength metals for aircraft engines. The rising number of travelers is propelling the need for aircraft, which, in turn, is bolstering the global rare earth element market production. For instance, GE Aviation, a subsidiary of General Electric invested USD 4.3 Billion to increase the production capabilities of aircraft engines. In line with this, the elevating adoption of consumer electronics, particularly in regions, including the Asia-Pacific, is further strengthening the rare earth element market share. According to the India Brand Equity Foundation, the production of LED and LCD TVs across the country reached 16 Million units in 2018 from 8.75 Million units in 2015. The rising usage of rare earth elements, such as lanthanum, cerium, praseodymium, etc., in the consumer electronics industry is expected to bolster the rare earth element industry price over the forecasted period.

Continuous Technological Advancements

Prominent key players across countries are focusing on strategic approaches and exploring collaborations and partnerships, not just with other mining and chemical firms but also with end-users, such as defense contractors, technology companies, renewable energy providers, etc., which is driving the global rare earth metals market forward. In addition to this, some of them are working closely with government bodies to ensure stable supply chains, especially given the geopolitical sensitivities surrounding rare earth elements. In August 2022, Lynas Rare Earths Ltd in Australia announced the plan to expand capacity at its Western Australia-based Mt Weld mine having deposits of praseodymium (Pr) and neodymium (Nd). The company began to work by early 2023, with full operation planned for 2024. In line with this, in April 2022, Iluka Resources Ltd announced an investment worth USD 1.2 Billion for developing the Eneabba Phase 3 rare earth refinery in Western Australia for the dedicated production of rare earth oxides. The investment aimed to make Iluka a strategic hub for the downstream processing of rare earth resources in Australia. Additionally, Arafura Resources Ltd planned to develop a separation plant for its Nolans Neodymium-Praseodymium (NdPr) Project, strengthening the rare earth metal market in the region.

Favorable Government Initiatives

Government authorities and organizations across the globe are emphasizing on environmental sustainability, thereby positively influencing the rare earth elements market demand for clean energy technologies and supporting growth in the US rare earth elements market through increased focus on local sourcing and greener production methods. Rare earth elements play an important role in this sector. Elements, such as dysprosium and neodymium, are used in the manufacturing of permanent magnets that are integral to the function of wind turbines. For instance, in 2021, nearly 85% of the auto manufacturers were utilizing neodymium-incorporated permanent magnet motors. As countries and companies around the world increasingly invest in renewable energy infrastructure to reduce reliance on fossil fuels and mitigate climate change, the demand for rare earth elements necessary for these technologies is expected to grow substantially. For example, to counter India’s reliance on China for imports of critical rare earth minerals, key players have urged government bodies to encourage private-sector mining and diversify sources of supply for these strategic raw materials. Furthermore, in May 2023, government authorities in India initiated a plan to auction newly discovered lithium and other rare earth minerals. The mines ministry across the country proposed an amendment to mineral concession rules 2016 to determine the methodology for fixing the value of the estimated resources.

Growing Demand for Clean Energy Technologies

The shift towards cleaner energy sources has steadily increased the need for rare earth elements, which play a critical role in building technologies like electric vehicles, wind turbines, and energy-efficient motors. Countries aiming to cut carbon emissions depend on renewable power systems and electrified transport, both of which rely heavily on parts made using rare earths, boosting the rare earth elements market size 2025 further. These elements are used in strong permanent magnets that help boost the output and reliability of clean energy equipment. Companies producing next-generation vehicles and turbines seek dependable sources to keep up with rising production without facing supply issues. This growing use has also encouraged new mining projects, better recycling methods, and research into ways to extract these resources with less environmental impact. As renewable power and electric transport expand worldwide, secure supplies of rare earth elements remain vital. This ongoing need strengthens the market’s prospects and ties it closely to global efforts for cleaner, greener energy.

Expansion of the Electronics Industry

The steady growth of the electronics sector has made rare earth elements more important than ever. These materials are used in essential parts of everyday gadgets like mobile phones, laptops, televisions, and audio systems. Certain rare earths help deliver clear sound, sharp displays, and compact batteries that charge faster and last longer. Each year, new devices with better features reach the market, raising the demand for high-performance materials. The increase in smart devices, home automation, and wearable tech has also added to this need. Electronics manufacturers rely on a consistent supply to avoid production delays and maintain quality standards. To secure enough material, many companies are looking at new suppliers, local refining options, and more responsible mining. Some producers are exploring ways to recycle rare earths from old electronics to reduce waste and protect supply chains. The expansion of electronics continues to be a strong driver behind steady rare earth demand.

Rare Earth Elements Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global rare earth elements market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on application.

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Magnets

- NiMH Batteries

- Auto Catalysts

- Diesel Engines

- Fluid Cracking Catalyst

- Phosphers

- Glass

- Polishing Powders

- Others

Magnets hold a significant rare earth elements market share of 31.2% driven by their essential role in advanced technologies. Permanent magnets, particularly those made from neodymium, praseodymium, and dysprosium, are crucial for electric vehicles, wind turbines, and consumer electronics. The transition to clean energy and electrification of transportation fuels demand growth, as high-performance magnets improve efficiency and durability. Additionally, industrial automation and robotics rely on rare earth magnets for precision and miniaturization. Government policies supporting renewable energy and electric mobility further boost demand. As industries prioritize lightweight, high-strength materials, the reliance on REE-based magnets continues to expand, reinforcing their strong position in the rare earth elements market outlook.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- China

- Japan & Northeast Asia

- United States

Based on the rare earth elements market forecast, China dominates the rare earth elements (REE) market, holding a 58.3% share due to its vast reserves, well-developed mining infrastructure, and advanced refining capabilities. The country has established a highly integrated supply chain, from extraction to processing, giving it a strategic advantage. Government policies, including export controls and production quotas, further strengthen its market influence. Additionally, China's investments in research and development enhance extraction efficiency and sustainability. The country’s dominance is also attributed to lower production costs and a strong domestic demand from key industries such as electronics, electric vehicles, and renewable energy. This market control enables China to influence global REE pricing and supply, making it a critical player in the industry’s overall dynamics.

Key Regional Takeaways:

China Rare Earth Elements Market Analysis

China is witnessing a significant rise in the adoption of rare earth elements, driven by the rapid expansion of its electronics manufacturing sector. For instance, there are 7,597 businesses in the electronic component manufacturing industry in China, which has grown at a CAGR of 1.2 % between 2020 and 2025. As demand surges for high-performance components in smartphones, electric vehicles, and advanced computing devices, rare earths like neodymium, dysprosium, and terbium are increasingly critical. These elements are essential for producing magnets, batteries, and semiconductors that power modern electronics. With China accounting for a good share of global electronics production, domestic consumption of rare earth elements is intensifying. This trend supports China’s strategic push for technological self-sufficiency and strengthens its position in the global high-tech manufacturing supply chain.

Japan and Northeast Asia Rare Earth Elements Market Analysis

Japan and Northeast Asia are experiencing a surge in the use of specialty minerals driven by rapid growth in the renewable energy sector and expanding consumer electronics manufacturing. According to U.S. Energy Information Administration, from 2018 to 2022, the share of renewable generation in Japan grew from 21% to 26%. The demand for wind turbines, electric vehicles, and solar panels has intensified the need for these critical materials, essential for components like magnets, batteries, and energy-efficient motors. Simultaneously, the booming production of smartphones, laptops, and high-performance gadgets has amplified regional consumption. Governments and industries in the region are increasingly investing in local sourcing, recycling technologies, and strategic partnerships to secure stable supply chains and reduce reliance on imports for these vital resources.

United States Rare Earth Elements Market Analysis

United States is witnessing increasing demand for rare earth elements due to growing investment in the automobile sector. For instance, since the start of 2021, auto manufacturers have announced investments of more than USD 75 Billion in the U.S. The expansion of automotive manufacturing is accelerating the use of these elements in catalytic converters, magnets, and electronic components. As automakers focus on enhancing vehicle performance, lightweight materials and advanced electronics are becoming more prominent. The push for fuel efficiency and lower emissions is driving the integration of rare earth-based components in engines and exhaust systems. Rising research into sustainable automotive solutions further contributes to market expansion. Additionally, the push for advanced infotainment systems, navigation, and electronic power steering systems is increasing reliance on these critical materials. The shift towards electric and hybrid models is also influencing supply chains, emphasizing the need for stable access to essential rare earth elements. With technological advancements shaping the industry, the long-term growth prospects for rare earth consumption in automotive applications remain significant.

Top Rare Earth Elements Companies in the World:

The competitive landscape of the rare earth elements (REE) market is shaped by geographic dominance, supply chain constraints, and technological advancements. A few key regions control the majority of REE production and processing, creating a highly concentrated market. Companies are focusing on securing stable supply chains through mining expansion, refining capabilities, and recycling initiatives. Governments play a significant role by implementing policies to reduce dependence on foreign sources and incentivizing domestic production. Technological innovation, particularly in extraction and separation processes, is driving competition, with efforts to develop cost-effective and environmentally sustainable methods. Additionally, strategic alliances and investments in alternative sources, including deep-sea mining and urban mining, are influencing market dynamics and shaping future competitive advantages.

The report provides a comprehensive analysis of the competitive landscape in the rare earth elements market with detailed profiles of all major companies, including:

- Arafura Rare Earths Limited

- Avalon Advanced Materials Inc.

- Baotou Jinmenghui Magnetic Materials Co., Ltd

- Canada Rare Earth Corporation

- Iluka Resources Limited

- IREL (India) Limited

- Lynas Rare Earths Ltd

- Neo Performance Materials Inc

- Northern Minerals

- Shin-Etsu Chemical Co., Ltd.

- Ucore Rare Metals Inc.

Latest News and Developments:

- May 2025: The U.S. allocated over USD 439 Million through a bipartisan Defense Department effort to build a complete domestic rare earth supply chain under the Defense Production Act. This move supports the rare earth elements sector by reducing reliance on imports and strengthening national production.

- April 2025: Canada’s Cyclic Materials announced a USD 20 Million rare-earth recycling plant in Mesa, Arizona. By processing scrap from EV motors and hard drives, this project supports the Rare Earth Elements Market and helps balance supply amid global trade tensions and export limits.

- December 2024: Defense Metals confirmed the release of its Wicheeda Rare Earth Element Project Pre-feasibility Study (PFS) during the week of February 10, 2025. The study was prepared by Hatch Ltd., with contributions from SRK Consulting and other experts. Price projections for the expected mixed rare earth carbonate were provided by Argus Media. The full PFS report was set to be filed within 45 days under NI 43-101 standards.

- August 2024: The University of Wyoming’s Blockchain Center collaborated with ClimateChain to track rare earth elements through Project NorthStar. ClimateChain’s Layer Zero blockchain technology was utilized to enhance traceability and emission reduction tracking. The CBDI contributed by developing tools for monitoring the supply chain from U.S. production to Chinese processing and back. This partnership aimed to strengthen domestic rare earth production by improving efficiency and sustainability.

- April 2024: The Saskatchewan Research Council finalized a five-year agreement with Vietnam-based Hung Thinh Group to facilitate rare earth carbonate imports. The deal ensured the supply of 3,000 tons annually, strengthening global rare earth trade. This partnership aimed to enhance Vietnam’s processing capabilities while securing Canada’s role in the supply chain. The agreement marked a strategic move to stabilize the rare earth market amid increasing global demand.

- April 2024: MP Materials secured USD 58.5 Million to advance the construction of the first integrated rare earth magnet manufacturing facility in the U.S. The plant, situated in Fort Worth, Texas, moved forward with development. It aimed to strengthen the domestic supply chain for rare earth materials. Commercial production was projected to commence by late 2025.

- March 2024: Australian Strategic Materials (ASM) partnered with Bechtel for the Dubbo Project in NSW, with Bechtel providing FEED services. This strengthened ASM's funding opportunities, including potential support from a US government entity. In August 2023, ASM signed a five-year agreement with USA Rare Earth (USARE) to supply NdFeB alloy. In May 2021, Lynas Corporation and Blue Line Corporation formed a joint venture to develop Rare Earth separation capacity in the US.

- January 2024: Kazakhstan announced planned to collaborate with international partners to develop its 15 rare earth deposits. The country aimed to capitalize on these resources for electronics and clean energy applications. Officials emphasized Kazakhstan’s strategic position in the global rare earth supply chain. The initiative sought to attract foreign investment and boost technological advancements in resource extraction.

Rare Earth Elements Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | 000’ Metric Tons, Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Magnets, NiMH Batteries, Auto Catalysts, Diesel Engines, Fluid Cracking Catalyst, Phosphers, Glass, Polishing Powders, Others |

| Regions Covered | China, Japan & Northeast Asia, United States |

| Companies Covered | Arafura Rare Earths Limited, Avalon Advanced Materials Inc., Baotou Jinmenghui Magnetic Materials Co., Ltd, Canada Rare Earth Corporation, Iluka Resources Limited, IREL (India) Limited, Lynas Rare Earths Ltd, Neo Performance Materials Inc, Northern Minerals, Shin-Etsu Chemical Co., Ltd., Ucore Rare Metals Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the rare earth elements market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global rare earth elements market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Rare Earth Elements industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The rare earth elements market was valued at USD 14.0 Billion in 2025.

The rare earth elements market is projected to exhibit a CAGR of 12.30% during 2026-2034, reaching a value of USD 41.1 Billion by 2034.

The rare earth elements market is driven by the need for high-performance magnets used in electric vehicles, wind turbines, and electronics. Efforts to expand local supply chains, rising clean energy goals, and steady tech industry growth keep rare earth demand increasing globally.

Rare earth elements are in steady demand because they are critical for making magnets, batteries, screens, and energy-saving motors. As industries like electric transport, renewable energy, and consumer electronics grow, these materials remain essential for new technologies and reliable performance.

In 2025, China dominated the rare earth elements market accounted for a 58.3% market share, driven by strong manufacturing networks, large industrial bases, and high export volumes keep this region leading the market ahead of other global players.

Neodymium, dysprosium, terbium, praseodymium, and europium rank among the most valuable rare earth elements. Their importance lies in applications such as electric motors, wind energy systems, and high-tech devices. These elements are key to powering sustainable technologies and maintaining modern defense capabilities.

Some of the major players in the global rare earth elements market include Arafura Rare Earths Limited, Avalon Advanced Materials Inc., Baotou Jinmenghui Magnetic Materials Co., Ltd, Canada Rare Earth Corporation, Iluka Resources Limited, IREL (India) Limited, Lynas Rare Earths Ltd, Neo Performance Materials Inc, Northern Minerals, Shin-Etsu Chemical Co., Ltd., Ucore Rare Metals Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)