RBD Palm Olein Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2025 Edition

RBD Palm Olein Price Trend, Index and Forecast

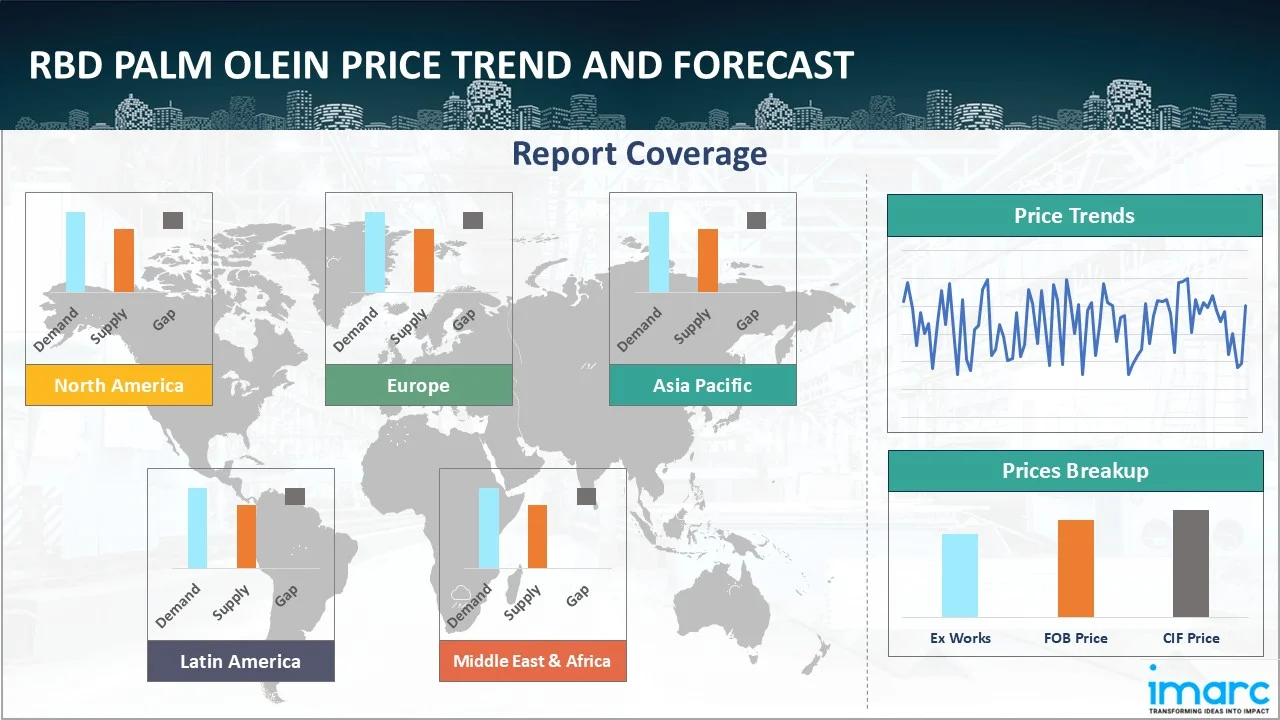

Track the latest insights on RBD palm olein price trend and forecast with detailed analysis of regional fluctuations and market dynamics across North America, Latin America, Central Europe, Western Europe, Eastern Europe, Middle East, North Africa, West Africa, Central and Southern Africa, Central Asia, Southeast Asia, South Asia, East Asia, and Oceania.

RBD Palm Olein Prices Outlook Q4 2025

- Malaysia: USD 1123/MT

- Indonesia: USD 1012/MT

- China: USD 991/MT

- India: USD 1117/MT

- Netherlands: USD 1148/MT

RBD Palm Olein Price Chart

Get real-time access to monthly/quarterly/yearly prices Request Sample

During the fourth quarter of 2025, the RBD palm olein prices in Malaysia reached 1123 USD/MT in December. Prices moved on a declining trajectory during the quarter due to softer export demand from key Asian and Middle Eastern destinations. Ample domestic palm oil inventories and steady plantation output continued to weigh on market sentiment. Reduced buying interest from downstream edible oil processors further pressured prices.

During the fourth quarter of 2025, the RBD palm olein prices in Indonesia reached 1012 USD/MT in December. The market experienced downward pressure driven by elevated domestic supply levels and moderate export offtake. Policy stability regarding export levies supported shipments, yet buying volumes remained restrained. Refiners faced limited margin expansion as downstream consumption softened. Increased availability of competing oils in regional markets also influenced buyer preferences.

During the fourth quarter of 2025, the RBD palm olein prices in China reached 991 USD/MT in December. Prices weakened as import demand slowed amid sufficient port inventories and cautious restocking by food processors. The presence of competitively priced soybean oil reduced reliance on palm-based oils. Seasonal consumption failed to generate significant procurement momentum. Additionally, high inventory visibility across major ports dampened spot buying interest.

During the fourth quarter of 2025, the RBD palm olein prices in India reached 1117 USD/MT in December. Unlike other markets, prices followed an upward trend supported by strong domestic consumption from the food processing and hospitality sectors. Festive season demand encouraged refiners to maintain steady procurement. Import flows were balanced, preventing oversupply conditions. Limited availability of substitute edible oils supported palm olein demand.

During the fourth quarter of 2025, the RBD palm olein prices in the Netherlands reached 1148 USD/MT in December. Prices declined amid subdued demand from the food manufacturing sector and ample availability across European ports. Sustainability-driven sourcing preferences influenced procurement patterns, moderating buying intensity. Imports remained steady, ensuring sufficient supply coverage.

RBD Palm Olein Prices Outlook Q3 2025

- Malaysia: USD 1165/MT

- Indonesia: USD 1047/MT

- China: USD 1060/MT

- India: USD 1068/MT

- Netherlands: USD 1198/MT

During the third quarter of 2025, the RBD palm olein prices in Malaysia reached 1165 USD/MT in September. Domestic production dynamics and harvesting rhythms combined with refiners’ processing schedules placed notable pressure on local availability, while export interest from major regional buyers tightened marketed volumes. Trade policy signals and logistic congestion at key loading ports influenced supplier behavior, prompting traders to adjust forward cover and inventories.

During the third quarter of 2025, the RBD palm olein prices in Indonesia reached 1047 USD/MT in September. A measured recovery in plant processing throughput helped restore market balance, while domestic edible oil refiners adjusted procurement to match throughput expectations. Export flows were moderated by logistical prioritization across major ports, which constrained spot availability for some overseas buyers and influenced traders’ willingness to maintain or roll open positions.

During the third quarter of 2025, the RBD palm olein prices in China reached 1060 USD/MT in September. Import demand from edible oil processors and industrial users improved as downstream manufacturers sought to rebuild inventories after a quieter period, lifting interest in spot shipments. Portside logistical throughput and customs clearance cadence affected the timing of shipments, creating episodic tightness in available volumes.

During the third quarter of 2025, the RBD palm olein prices in India reached 1068 USD/MT in September. Import-dependent refiners altered procurement rhythms to align with shifts in local edible oil demand and with refiners’ margin considerations, which constrained immediate spot appetite at times. Port congestion and inland logistics intermittently delayed arrivals, affecting availability for fast-moving food manufacturers. Policy signals and tariff expectations continued to guide sourcing decisions, while bulk buyers showed increased selectivity, preferring tracked supply lots.

During the third quarter of 2025, the RBD palm olein prices in the Netherlands reached 1198 USD/MT in September. European refiners and traders contended with intermodal logistics complexities and competing vegetable oil arrivals, which influenced availability of prompt physical lots. Demand from food processors remained measured, with purchasing driven by short-term production schedules and margin management. Trade flows through northern European hubs were affected by seasonal port operational factors, prompting traders to rely on contracted volumes and to be selective on spot exposure.

RBD Palm Olein Prices Outlook Q2 2025

- Malaysia: USD 1088/MT

- Indonesia: USD 972/MT

- China: USD 1026/MT

- India: USD 1014/MT

- Netherlands: USD 1238/MT

During the second quarter of 2025, the RBD palm olein prices in Malaysia reached 1088 USD/MT in June. In Malaysia, RBD palm olein prices this quarter were shaped by fluctuating crude palm oil production levels due to inconsistent rainfall patterns and labor availability in plantation regions. The export-oriented industry faced competitive pricing pressures from Indonesia and logistical bottlenecks at key ports. Refining margins were influenced by energy input costs, while demand from the food processing and oleochemical sectors remained stable. Inventory build-up and policy announcements related to biodiesel blending also played a role.

During the second quarter of 2025, RBD palm olein prices in Indonesia reached 972 USD/MT in June. In Indonesia, RBD palm olein pricing was impacted by shifts in domestic allocation policies that prioritized local biodiesel consumption over exports. Export levies and revised reference prices affected trade competitiveness, while production volumes experienced variability due to weather and fertilizer application trends. The refining sector faced higher costs linked to energy and transportation, while global demand fluctuations, especially from South and East Asia, created volatility in export contracting.

During the second quarter of 2025, the RBD palm olein prices in China reached 1026 USD/MT in June. In China, the price of RBD palm olein was driven by the pace of imports from Southeast Asia, which were affected by maritime freight costs and port congestion. Demand from the food manufacturing sector showed seasonal growth, while strategic stockpiling decisions by key importers influenced bulk purchasing patterns. Exchange rate movements and competition from other vegetable oils, such as soybean and sunflower oil, also shaped procurement strategies across major urban markets.

During the second quarter of 2025, the RBD palm olein prices in India reached 1014 USD/MT in June. In India, RBD palm olein prices were influenced by strong demand from the packaged food and hotel industries, alongside a notable shift in import volumes driven by changes in tariff structures and global pricing trends. Port-side inventories fluctuated due to variable discharge rates and congestion. Domestic refiners responded to competition from soft oils, while currency depreciation against the US dollar impacted import cost dynamics. Governmental policy on edible oil reserves added further complexity.

During the second quarter of 2025, the RBD palm olein prices in the Netherlands reached 1238 USD/MT in June. In the Netherlands, RBD palm olein pricing was affected by sourcing challenges linked to sustainability certification requirements and deforestation-free regulations, which limited supplier pools. The demand from the food processing and industrial lubricant sectors remained stable, while refinery input costs rose due to energy pricing trends in the European Union. Import patterns were influenced by competition with rapeseed and sunflower oils, and shifts in buyer preference based on traceability standards.

RBD Palm Olein Prices Outlook Q1 2025

- Malaysia: USD 1130/MT

- Indonesia: USD 1020/MT

- China: USD 1070/MT

- India: USD 1120/MT

- Netherlands: USD 1266/MT

During the first quarter of 2025, the RBD palm olein prices in Malaysia reached 1130 USD/MT in March. As per the RBD palm olein price chart, the market experienced disruptions due to labor shortages and erratic weather. These issues affected both supply and cost predictability. Besides, producers of soaps, skincare items, and bio-based lubricants felt the brunt of rising ingredient expenses.

During the first quarter of 2025, RBD palm olein prices in Indonesia reached 1020 USD/MT in March. The shift diverted raw materials away from edible oil producers, tightening the market. Industries relying on palm olein, like snacks, fast-food, and margarine, faced steeper input costs. This demand-supply imbalance created pressure across sectors, with companies either absorbing higher costs or modifying usage. The biodiesel policy shift was a key driver behind the reduced supply during the period.

During the first quarter of 2025, the RBD palm olein prices in China reached 1070 USD/MT in March. Rising input costs and shifts in regional supply had an impact on the market. Cost increases trickled down across several industries, and more cautious buying practices resulted from worries about the stability of the long-term supply.

During the first quarter of 2025, the RBD palm olein prices in India reached 1120 USD/MT in March. India’s consumption-heavy palm olein market felt cost increases ripple through multiple sectors. Processed food companies, edible oil brands, and cosmetic producers reported margin pressures. With regional supplies affected by developments in Malaysia and Indonesia, local buyers encountered tighter inventories and elevated quotes.

During the first quarter of 2025, the RBD palm olein prices in the Netherlands reached 1266 USD/MT in March. Importers of RBD palm olein faced rising prices amid stricter EU sourcing requirements. The food sector, especially processed snacks and margarine producers, was hit hardest. Cosmetic firms and biofuel companies also contend with higher expenses. Logistics added further pressure, with freight charges compounding overall input inflation.

Regional Coverage

The report provides a detailed analysis of the market across different regions, each with unique pricing dynamics influenced by localized market conditions, supply chain intricacies, and geopolitical factors. This includes price trends, price forecast and supply and demand trends for each region, along with spot prices by major ports. The report also provides coverage of FOB and CIF prices, as well as the key factors influencing RBD palm olein prices.

Europe RBD Palm Olein Price Trend

Q4 2025:

The RBD palm olein price index in Europe reflected a clear declining trend largely shaped by weakening downstream demand conditions. Food manufacturers reduced procurement volumes as consumer spending on packaged and processed foods softened, prompting cautious production planning. Adequate import availability across key European ports ensured uninterrupted supply, preventing any tightening in the market. Refiners and distributors operated with comfortable inventory positions, which further reduced urgency in spot purchasing.

Q3 2025:

During the third quarter of 2025, the RBD palm olein price index reflected constrained availability as competing vegetable oil arrivals and refinery schedules altered the flow of spot volumes. Buyers in the region prioritized certified and traceable supplies for premium end uses, which narrowed the pool of immediately acceptable physical lots and supported firmer bids for compliant cargoes. Freight and intermodal reliability influenced the landed competitiveness of alternate origins, shifting procurement toward suppliers able to offer tighter delivery windows.

Q2 2025:

As per the RBD palm olein price index, European RBD palm olein prices this quarter were influenced by regulatory pressures related to deforestation-free sourcing requirements and rising costs associated with certification compliance. The demand from the food processing and personal care sectors remained steady, while refiners faced increased energy costs due to fluctuations in natural gas and electricity prices across the European Union. Importers navigated shifting trade routes and maritime freight rates, especially in response to geopolitical tensions in the Middle East. Additionally, competition with rapeseed and sunflower oils, driven by domestic oilseed harvest dynamics, influenced substitution decisions among major buyers. Retailers and manufacturers also adjusted procurement strategies to align with consumer preference trends favoring sustainably sourced oils.

Q1 2025:

As per the RBD palm olein price index, prices elevated steadily in European markets. Cost challenges forced several manufacturers of processed foods, margarine, and snacks to raise retail prices or accept lower profit margins. Strict EU sustainability regulations that demanded confirmation of palm oil obtained ethically made supply issues worse. Cost hikes also affected producers of biofuels and personal care products. Imports were impacted by an increase in shipping costs.

This analysis can be extended to include detailed RBD palm olein price information for a comprehensive list of countries.

| Region | Countries Covered |

|---|---|

| Europe | Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal, and Greece, among other European countries. |

North America RBD Palm Olein Price Trend

Q4 2025:

The RBD palm olein price index in North America fluctuated as market conditions moved toward greater balance. Demand normalized following earlier stock-building activities, leading buyers to adopt more conservative procurement strategies. Import flows remained consistent and well-aligned with consumption requirements, preventing supply-side constraints. Food service demand showed limited expansion as discretionary spending remained subdued, while packaged food manufacturers focused on inventory optimization.

Q3 2025:

During the third quarter of 2025, the RBD palm olein price index in North America was influenced by import scheduling constraints and downstream demand that favored short-dated coverage. Large industrial users and consumer goods manufacturers preferred cargoes that could be matched tightly to production runs, reducing appetite for extended forward exposure and increasing the value of prompt shipments. Port handling cadence and inland logistics played important roles in arrival certainty, shaping landed cost expectations and traders’ willingness to offer prompt lots.

Q2 2025:

As per the RBD palm olein price index, in North America, the market was in a balanced state during the second quarter of 2025. Due to high refinery operating rates, major producing regions such as the Midwest and Gulf Coast reported steady output. However, seasonal variations, especially unfavorable winter conditions, created intermittent logistical challenges. The agricultural chemical segment's demand remained stable, and despite concerns about potential tariff effects, there were no significant price changes. There was little price fluctuation throughout the quarter, and the regional market remained stable in terms of supply and demand dynamics.

Q1 2025:

Due to limited supplies from Southeast Asia, the price of RBD palm olein steadily increased in the North American market. Due to difficulties with input costs, food makers who used it to fry and bake food items, changed their buying tactics. Brands of cleaning products that included components derived from palm oil also experienced supply constraints. The strain was escalated by growing interest in biofuels derived from palm oil. Demand remained high despite these obstacles, helped by enterprises' flexibility in sourcing and market adaptation. In addition to modifying inventory plans, buyers occasionally looked into blending or substituting oils.

Specific RBD palm olein prices and historical data within the United States and Canada can also be provided.

| Region | Countries Covered |

|---|---|

| North America | United States and Canada |

Middle East and Africa RBD Palm Olein Price Trend

Q4 2025:

As per the RBD palm olein price chart, the prices in the Middle East and Africa fluctuated due to a complex interplay of factors, primarily driven by supply chain disruptions, seasonal demand shifts, and geopolitical influences.

Q3 2025:

The report explores the RBD palm olein trends and RBD palm olein chart in the Middle East and Africa, considering factors like regional industrial growth, the availability of natural resources, and geopolitical tensions that uniquely influence market prices.

In addition to region-wise data, information on RBD palm olein prices for countries can also be provided.

| Region | Countries Covered |

|---|---|

| Middle East & Africa | Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco, among other Middle Eastern and African countries. |

Asia Pacific RBD Palm Olein Price Trend

Q4 2025:

The Asia Pacific RBD palm olein market exhibited mixed price trends reflecting divergent conditions between producing and consuming countries. Major producing nations faced downward price pressure due to ample supply and steady plantation output, which increased export availability. In contrast, select importing markets showed relative firmness supported by stable food sector demand. Export demand remained uneven as buyers adjusted procurement strategies based on inventory levels and consumption outlooks. High stock visibility in several markets reduced urgency for spot purchases, while others relied on contract volumes to ensure supply continuity.

Q3 2025:

During the third quarter of 2025, Asia Pacific markets experienced a steady tightening of prompt availability driven by regional refiners’ procurement strategies and resilient end-user demand. Importers and domestic processors synchronized buying to processing schedules, leading to more frequent short window purchases that elevated spot interest. Logistical constraints at major load ports and variations in regional freight capacity shaped which origins were most competitive for immediate delivery. Local policy communications and trade facilitation measures affected seller behavior, encouraging exporters to prioritize established contractual channels.

Q2 2025:

In the Asia Pacific region, RBD palm olein pricing was shaped by regional weather patterns impacting crude palm oil output in Malaysia and Indonesia, which are the primary supply sources. The food processing and HORECA sectors exhibited varied demand across key economies, influenced by consumer spending trends and post-holiday restocking activity. Port logistics constraints, particularly in Southeast Asia, disrupted shipment schedules, while refiners faced variable energy input costs. Exchange rate volatility across importing countries like India and China further impacted landed costs. Government policy interventions on edible oil imports and domestic food inflation mitigation efforts also affected buying behavior across regional markets.

Q1 2025:

The constancy of productivity was disrupted by labor shortages and unpredictable weather in Malaysia, which is frequently a stabilizer. Food makers' costs increased, especially for those making fast food, margarine, and snacks. Manufacturers of cosmetics and personal care products had to contend with soaring ingredient costs, which forced some to evaluate their sourcing methods. Besides, industrial buyers who depended on palm olein for coatings and lubricants also encountered procurement challenges.

This RBD palm olein price analysis can be expanded to include a comprehensive list of countries within the region.

| Region | Countries Covered |

|---|---|

| Asia Pacific | China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand, among other Asian countries. |

Latin America RBD Palm Olein Price Trend

Q4 2025:

Latin America's RBD palm olein market is predominantly influenced by its rich natural reserves, particularly in countries like Chile and Brazil. However, political instability and inconsistent regulatory frameworks can lead to significant volatility in RBD palm olein prices.

Q3 2025:

Infrastructure challenges and logistical inefficiencies often impact the supply chain, affecting the region's ability to meet international demand consistently. Moreover, the RBD palm olein price index, economic fluctuations, and currency devaluation are critical factors that need to be considered when analyzing RBD palm olein pricing trends in this region.

This comprehensive review can be extended to include specific countries within the region.

| Region | Countries Covered |

|---|---|

| Latin America | Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru, among other Latin America countries. |

RBD Palm Olein Pricing Report, Market Analysis, and News

IMARC's latest publication, “RBD Palm Olein Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2025 Edition,” presents a detailed examination of the RBD palm olein market, providing insights into both global and regional trends that are shaping prices. This report delves into the spot price of RBD palm olein at major ports and analyzes the composition of prices, including FOB and CIF terms. It also presents detailed RBD palm olein prices trend analysis by region, covering North America, Europe, Asia Pacific, Latin America, and Middle East and Africa. The factors affecting RBD palm olein pricing, such as the dynamics of supply and demand, geopolitical influences, and sector-specific developments, are thoroughly explored. This comprehensive report helps stakeholders stay informed with the latest market news, regulatory updates, and technological progress, facilitating informed strategic decision-making and forecasting.

RBD Palm Olein Industry Analysis

The global RBD palm olein market size reached USD 44.38 Billion in 2025. By 2034, IMARC Group expects the market to reach USD 74.35 Billion, at a projected CAGR of 5.90% during 2026-2034. The market is primarily driven by the expanding edible oil demand from food processing and institutional sectors, shifts in feedstock and refining economics, logistics and port throughput efficiency, evolving trade policy and certification requirements, and product substitution dynamics among vegetable oils that influence procurement strategies across regions.

Latest News and Developments:

- January 2025: A new analysis evaluating uncertainty in iodine value measurements of refined, bleached, and deodorized (RBD) palm oil confirmed that fractionated products meet key industry standards. Using the approved AOCS Cd 1–25 method, researchers assessed iodine values in RBD palm olein and RBD palm stearin following the fractionation process. The study found that both products aligned with PORAM quality specifications, reinforcing the reliability of refining and fractionation practices and supporting consistent quality control across the palm oil processing chain.

Product Description

RBD palm olein is a refined, bleached, and deodorized form of palm oil primarily used in cooking, food processing, and industrial applications. It is derived from the palm fruit's oil, which undergoes refining to remove impurities, color, and odor. The end result is a clear, golden-yellow liquid that remains stable at high temperatures, making it ideal for deep-frying and commercial food production. Its popularity is especially high in tropical countries due to its resistance to oxidation and long shelf life.

Compared to crude palm oil, RBD palm olein has a more neutral flavor and better clarity, which suits food manufacturers and fast-food chains that rely on consistent product quality. It is widely used in products such as margarine, instant noodles, snacks, and baked goods. In addition to food, it serves roles in personal care items like soaps and lotions, as well as in the production of bio-lubricants and surfactants.

Report Coverage

| Key Attributes | Details |

|---|---|

| Product Name | RBD Palm Olein |

| Report Features | Exploration of Historical Trends and Market Outlook, Industry Demand, Industry Supply, Gap Analysis, Challenges, RBD Palm Olein Price Analysis, and Segment-Wise Assessment. |

| Currency/Units | US$ (Data can also be provided in local currency) or Metric Tons |

| Region/Countries Covered | The current coverage includes analysis at the global and regional levels only. Based on your requirements, we can also customize the report and provide specific information for the following countries: Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand* Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece* North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru* Middle East & Africa: Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco* *The list of countries presented is not exhaustive. Information on additional countries can be provided if required by the client. |

| Information Covered for Key Suppliers |

|

| Customization Scope | The report can be customized as per the requirements of the customer |

| Report Price and Purchase Option |

Plan A: Monthly Updates - Annual Subscription

Plan B: Quarterly Updates - Annual Subscription

Plan C: Biannually Updates - Annual Subscription

|

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report presents a detailed analysis of RBD palm olein pricing, covering global and regional trends, spot prices at key ports, and a breakdown of FOB and CIF prices.

- The study examines factors affecting RBD palm olein price trend, including input costs, supply-demand shifts, and geopolitical impacts, offering insights for informed decision-making.

- The competitive landscape review equips stakeholders with crucial insights into the latest market news, regulatory changes, and technological advancements, ensuring a well-rounded, strategic overview for forecasting and planning.

- IMARC offers various subscription options, including monthly, quarterly, and biannual updates, allowing clients to stay informed with the latest market trends, ongoing developments, and comprehensive market insights. The RBD palm olein price charts ensure our clients remain at the forefront of the industry.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Why Choose Us

IMARC offers trustworthy, data-centric insights into commodity pricing and evolving market trends, enabling businesses to make well-informed decisions in areas such as procurement, strategic planning, and investments. With in-depth knowledge spanning more than 1000 commodities and a vast global presence in over 150 countries, we provide tailored, actionable intelligence designed to meet the specific needs of diverse industries and markets.

1000

+Commodities

150

+Countries Covered

3000

+Clients

20

+Industry

Robust Methodologies & Extensive Resources

IMARC delivers precise commodity pricing insights using proven methodologies and a wealth of data to support strategic decision-making.

Subscription-Based Databases

Our extensive databases provide detailed commodity pricing, import-export trade statistics, and shipment-level tracking for comprehensive market analysis.

Primary Research-Driven Insights

Through direct supplier surveys and expert interviews, we gather real-time market data to enhance pricing accuracy and trend forecasting.

Extensive Secondary Research

We analyze industry reports, trade publications, and market studies to offer tailored intelligence and actionable commodity market insights.

Trusted by 3000+ industry leaders worldwide to drive data-backed decisions. From global manufacturers to government agencies, our clients rely on us for accurate pricing, deep market intelligence, and forward-looking insights.

Request Customization

Request Customization

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst Request Brochure

Request Brochure

.webp)

.webp)