Ready to Drink Tea and Coffee Market Size, Share, Trends and Forecast by Product, Additives, Packaging, Price Segment, Distribution Channel, and Region, 2025-2033

Ready to Drink Tea and Coffee Market Size and Share:

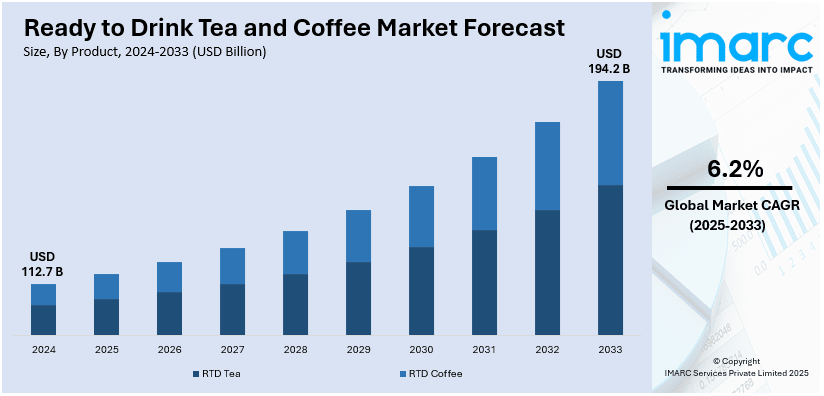

The global ready to drink tea and coffee market size was valued at USD 112.7 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 194.2 Billion by 2033, exhibiting a CAGR of 6.2% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 43.7% in 2024. The increasing purchasing power of individuals and the installation of ready to drink tea and coffee vending machines in various places and stations are some of the major factors propelling the market demand across the region.

|

Report Attribute

|

Key Statistics |

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 112.7 Billion |

| Market Forecast in 2033 | USD 194.2 Billion |

| Market Growth Rate 2025-2033 | 6.2% |

The international ready-to-drink coffee and tea market is spurred by evolving consumer demands for easy, healthy, and on-the-go beverages. Improved health awareness regarding the health effects of tea and coffee like antioxidants and energy-boosting properties is escalatong their demand. Increased urbanization and hectic lifestyle are also encouraging consumers to opt for ready-to-drink products that need no effort to prepare as 57.5% of the world's total population resides within urban centers in 2024, according to Worldometers. Furthermore, advances in flavor, packaging, and functional ingredients, such as low-sugar and plant-based varieties, increase market demand. Widening distribution channels, such as e-commerce and specialty stores, also increase access. Moreover, the growing emphasis on sustainable packaging and responsible sourcing appeals to the environmentally aware consumer, enabling further industry growth.

The United States is particularly noteworthy as a market disruptor, fueled by the increased desire for healthy and convenient drink alternatives. Consumers increasingly look for functional beverages with natural ingredients, low sugar content, and added health benefits like antioxidants or energy boosts. Increased distribution through supermarkets, coffee shops, and online stores also guarantees greater accessibility of these products. According to a report released by the IMARC Group, the United States e-commerce industry is expected to reach USD 2,083.97 Billion by the year 2032, demonstrating a CAGR of 6.80% from 2024-2032. Besides, the increased demand for on-the-go living, along with creative packaging offerings, makes ready-to-drink beverages more desirable. Additionally, the popularity of cold brew coffee and specialty tea is also supporting market growth.

Ready to Drink Tea and Coffee Market Trends:

Rising trend for convenience and on-the-go lifestyles

The increasing demand for ready-to-drink tea and coffee can be attributed significantly to the fast-paced lifestyles of modern consumers and their desire for convenience. Presently, individuals are constantly on the move, juggling work, family, and social commitments, leaving little time for traditional brewing or coffee shop visits. Ready-to-drink beverages offer a quick and hassle-free solution, as they come pre-packaged and ready for immediate consumption. For instance, according to the US Bureau of Labor Statistics, 74.6 Million women are in the civilian labor force, accounting for 47 percent of US workers. This growing demographic of working women also significantly boosts the demand for convenient RTD tea and coffee products. Whether it is a bottled iced tea for a refreshing pick-me-up during a hectic workday or a canned cold brew coffee for a boost of energy before hitting the gym, these beverages fit seamlessly into the fast-paced routines of consumers, eliminating the need for preparation without compromising on taste or quality.

Popularity of health and wellness trends

The growing focus on health and wellness among consumers is propelling the ready to drink tea and coffee market size. As individuals are becoming more health-conscious and are seeking ways to make better dietary choices, they are turning away from sugary sodas and carbonated drinks. Ready-to-drink tea and coffee products have capitalized on this trend by offering healthier alternatives, such as low-calorie, low-sugar, and natural ingredient-based options. Moreover, green tea, herbal infusions, and organic coffee varieties have gained popularity due to their perceived health benefits and antioxidant properties. For instance, according to the National Coffee Association, the number of American adults who have coffee on a daily basis has increased by 37% since 2004. Additionally, manufacturers are incorporating functional ingredients, including vitamins, minerals, and adaptogens, into their products to appeal to health-conscious consumers seeking beverages that offer more than just a caffeine boost.

Diverse flavor profiles and premiumization

The increasing availability of diverse flavors is contributing substantially to the ready to drink tea and coffee market growth. Manufacturers are continuously innovating with a wide range of flavors, appealing to various tastes and cultural preferences. From traditional black tea and classic coffee to exotic fruit-infused teas and indulgent mocha coffee blends, the options are ever-expanding. This extensive flavor variety attracts new consumers and also encourages existing consumers to explore and experiment with different offerings. Moreover, the trend toward premiumization has elevated the perception of ready-to-drink tea and coffee from a mere convenience product to a sophisticated and upscale beverage choice. Artisanal cold brews, single-origin coffee blends, and handcrafted tea concoctions have garnered a dedicated following among connoisseurs who are willing to pay a premium for high-quality and exclusive taste experiences. This is creating a positive outlook for the ready to drink tea and coffee market share.

Ready to Drink Tea and Coffee Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global ready to drink tea and coffee market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, additives, packaging, price segment, and distribution channel.

Analysis by Product:

- RTD Tea

- Black Tea

- Fruit & Herbal Based Tea

- Oolong Tea

- Green Tea

- RTD Coffee

- Ginseng

- Vitamin B

- Taurine

- Guarana

- Yerba Mate

- Acai Berry

RTD tea stands as the largest component in 2024, holding around 64.8% of the market. There is a strong cultural heritage and tradition involved with the consumption of tea worldwide. As such, the concept of bottled or canned RTD tea resonates well with consumers who seek the convenience of consuming desired flavors of tea on an on-the-go basis. The growing health-conscience trend among consumers ensures enhanced demand for RTD tea, which is perceived as relatively healthier than sugary carbonated beverages. Furthermore, the availability of diverse and refreshing RTD tea flavors, such as green tea, herbal infusions, and fruit-infused blends, has broadened its appeal to a wide range of consumers. Additionally, good marketing and branding strategies have helped promote RTD tea as an attractive beverage option. Companies have used social media, influencers, and attractive packaging designs to attract young consumers and build a strong brand presence. This modern approach has contributed significantly to the dominance of RTD tea in the market, particularly among millennials and gen Z consumers.

Analysis by Additives:

- Flavors

- Artificial Sweeteners

- Acidulants

- Nutraceuticals

- Preservatives

- Others

Based on the additives, the market has been segregated into flavors, artificial sweeteners, acidulants, nutraceuticals, preservatives, and others. Flavors are a significant aspect of the ready-to-drink tea and coffee market, enhancing product appeal and catering to diverse consumer preferences. Popular options include fruit, floral, and spice infusions for tea and vanilla, caramel, or mocha for coffee. The demand for innovative flavor combinations and natural flavoring agents is growing, aligning with consumer trends for unique and clean-label products.

Most ready-to-drink tea and coffee products contain artificial sweeteners to cater to low-calorie or sugar-free needs. Sweetness is added through ingredients such as sucralose, aspartame, and stevia that do not contain significant amounts of calories. As a result, such sweetener-based products find their audience among health-conscious consumers who either manage diabetes or are on diets. Thus, the increase in consumption of functional and diet-friendly drinks also fuels demand for this product in the market.

Acidulants are important additives in RTD tea and coffee products as they maintain an appropriate taste, increase shelf life, and exhibit microbial stability. Some popular acidulants, such as citric acid and malic acid, improve flavor by adding a sour note, particularly to fruity teas. Their function in maintaining product consistency and prolonging freshness makes acidulants essential in beverage formulation.

Analysis by Packaging:

- Glass Bottle

- Canned

- PET Bottle

- Aseptic

- Others

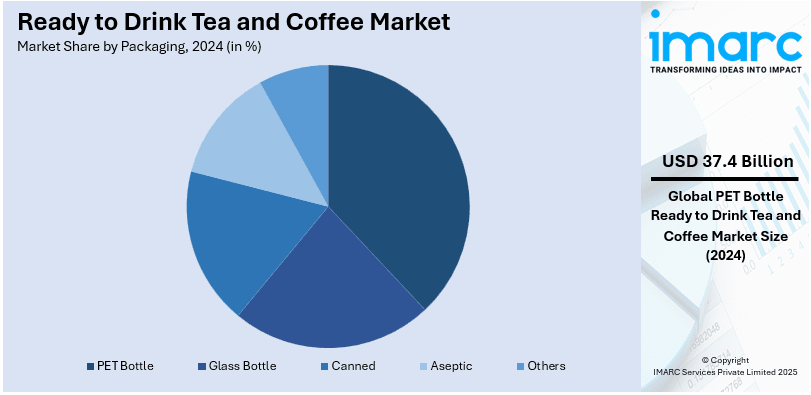

PET bottle leads the market with around 33.2% of market share in 2024. PET bottles offer a perfect balance between functionality, convenience, and sustainability, making them a popular choice for both manufacturers and consumers. Their lightweight nature makes them easy to transport and handle, enhancing the overall convenience for consumers, particularly those on the go. Additionally, PET bottles are known for their excellent transparency, allowing consumers to visually assess the quality and freshness of the product before making a purchase. Moreover, PET is recyclable, aligning with the growing consumer demand for eco-friendly and sustainable packaging options. As a result of these advantages, beverage companies widely adopt PET bottles for their RTD products, making it the largest packaging segment and an integral part of the thriving RTD beverage industry.

Analysis by Price Segment:

- Premium

- Regular

- Popular Priced

- Fountain

- Super Premium

On the basis of the price segment, the market has been categorized into premium, regular, popular priced, fountain, and super premium. The premium segment serves the demands of consumers who want superior, specialty beverages that use organic, ethically sourced, or unique ingredients. The premium product line is about artisanal products, innovative flavors, and premium packaging. Demand from health-conscious and environmentally conscious consumers, as well as rising disposable incomes, drives the expansion of premium ready to drink tea and coffee options.

The regular segment leads the ready to drink tea and coffee market, striking the right balance between value for money and quality. These products target the mass market with well-known brands and traditional flavor profiles. Strong consumer reach comes through convenient availability in supermarkets, convenience stores, and vending machines. This segment offers value-for-money beverages that have consistent quality to appeal to everyday drinkers.

The popular priced segment is focused on affordability, making ready to drink tea and coffee available to a broader consumer group. Their sales are mostly in packages or discount stores, appealing to price-sensitive consumers. Simple packaged form and basic flavors characterize this segment, which also remains important in emerging economies where cost plays a major role in the purchasing decision process.

Analysis by Distribution Channel:

- Off-Trade

- Independent retailers

- Supermarkets and Hypermarkets

- Convenience Stores

- Others

- On-Trade

- Food Service

- Vending

Off-trade represents the leading market segment in 2024. The off-trade segment appears to be gaining popularity by virtue of being easily accessible to end-users. Retail outlets are very easily accessible throughout both urban and rural areas, thus ensuring a broad reach for ready-to-drink beverage brands. Moreover, consumers appreciate the convenience of being able to purchase their favorite ready-to-drink beverages along with their regular groceries or other shopping needs. Off-trade distribution also enables ready-to-drink beverage companies to reach a massive consumer market and utilize retail visibility as a marketing tool for their brands, particularly through eye-catching point-of-sale displays and promotion campaigns. Collaborations between retailers and brands, such as co-branded promotions or exclusive product launches from the brand side, build up excitement in consumers regarding ready-to-drink tea and coffee products and further intensify the dominance of off-trade channels in the market.

Regional Analysis:

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

In 2024, Asia-Pacific accounted for the largest market share of over 43.7%. Fast urbanization, along with adopting Western lifestyles and preferences, have increased the consumption of convenience-oriented products such as ready-to-drink beverages in this region. Also, the diverse and lively culinary cultures in Asia Pacific influence the creation of unique ready-to-drink beverage flavors in diverse ranges. This trend has been driven by higher disposable incomes in several countries within the region and the willingness among consumers to experiment with and indulge in premium and high-quality ready-to-drink offerings. Also, the dynamic growth of modern retail channels and widespread convenience stores and supermarkets have provided easy access to ready-to-drink beverages and driven their popularity.

Key Regional Takeaways:

United States Ready to Drink Tea and Coffee Market Analysis

In 2024, the United States accounts for over 82.70% of the ready to drink tea and coffee market in North America. The growing demand for on-the-go, convenient beverages is driving the ready-to-drink tea and coffee market in the United States. Urbanization is contributing to fast-paced lifestyles, where individuals tend to rely more on a quick refreshing drink option while going about their work commutes or breaks. According to NCA's Spring 2024 NCDT report, 67% of American adults consumed coffee in the last day, with significant growth in those aged 25 and over, driving opportunities for ready-to-drink tea and coffee products to tap into evolving consumption trends. Consumers are shifting toward healthier beverage options that include reduced sugar, natural ingredients, and functional benefits such as antioxidants or energy boosts. Advancements in packaging technology have also added to product shelf life and portability, making access easy. Rising wellness consciousness combined with hectic lifestyles makes this category highly adopted. New flavors, such as cold brew and plant-based cream-infused ones, have resonated with changing preferences in the market while maintaining strength in their appeal.

Asia Pacific Ready to Drink Tea and Coffee Market Analysis

The increasing affordability of ready-to-drink tea and coffee is closely tied to rising disposable incomes. For instance, India's per capita disposable income is projected to reach approximately USD 2,600 in 2023-24, growing by 8%. This is also driving demand for ready-to-drink tea and coffee, reflecting increased affordability and changing lifestyles. As incomes grow, individuals are more willing to spend on premium and innovative beverages that provide enhanced flavor and health benefits. Rapid urbanization has altered consumption habits, with more individuals seeking alternatives to traditional options. Flavor diversification, including regional tastes such as matcha or spiced tea, resonates with a broad demographic. Expansion of retail networks ensures accessibility, particularly in suburban areas, where purchasing behaviors are shifting toward convenient solutions. Enhanced marketing strategies are targeting younger consumers through modernized, sleek packaging and smaller sizes, further expanding product adoption.

Europe Ready to Drink Tea and Coffee Market Analysis

With the increased adoption of green practices, the preference for sustainable ready-to-drink tea and coffee products is growing. Consumers are now seeking biodegradable materials-based packaging, which aligns with broader environmental priorities. Increased attention to organic, fair-trade ingredients and ethical sourcing is reflecting the focus on sustainability. Europe, which stands at 31% of global consumption with 55,000 bags in 2022, is the biggest coffee market driving ready-to-drink coffee and catering to steady demand among 47% of 18-24-year-olds. Also popular are functional beverages enhanced with vitamins, adaptogens, or probiotics that are gaining attention mainly because of health concerns. Luxury options, such as nitrogen-infused cold brew or herbal blends, fulfill a niche requirement for sophisticated tastes. This sustainability-driven innovation appeals to eco-aware buyers while creating opportunities for brands to differentiate in an increasingly competitive landscape.

Latin America Ready to Drink Tea and Coffee Market Analysis

The ready-to-drink tea and coffee market in Latin America is driven by the changes in consumer lifestyles and a growing demand for convenient beverage options. Increasing urbanization and busy routines are driving on-the-go consumption, which tends to increase among younger consumers. Ready-to-drink teas with natural ingredients, low sugar, and functional benefits such as antioxidants are preferred by health-conscious consumers. A robust coffee culture is also emerging in the region, which has significantly boosted the demand for ready-to-drink coffee, cold brews, and flavored products. The expansion of retail networks, combined with the growing acceptance of e-commerce platforms, is making ready-to-drink beverages increasingly accessible to both urban and rural markets. For instance, Brazil, accounting for 57% of Latin America's e-commerce sector, drives significant growth in ready-to-drink coffee sales, leveraging its expanding online retail sector to boost accessibility and sales, with the regional e-commerce market surpassing approximately USD 160 Billion. Key players are also launching innovative flavors and locally inspired offerings to better suit regional tastes, thus augmenting market growth.

Middle East and Africa Ready to Drink Tea and Coffee Market Analysis

Shifting preference toward ready-to-drink, convenient refreshing beverages and consumption among young consumers is driving demand in the Middle East and Africa ready-to-drink tea and coffee market. The population in the region is highly urbanized, which drives on-the-go beverage demands. Increasing tourism and hospitality in these regions also promotes the visibility and adoption of ready-to-drink tea and coffee. For instance, international visitors to Dubai rose by 19.43% in 2023 to around 14.36 Million. The ready-to-drink coffee business is also being fueled by the growing UAE and Saudi coffee culture, with both premium and cold-brew flavors gaining popularity. An extensive retail network comprising supermarkets, convenience stores, and e-commerce makes it more accessible and readily available. Moreover, the use of new flavors and country-specific formulations attracts regional demand and enhances consumption. Investments by key players in marketing campaigns and sustainable packaging further support market growth.

Competitive Landscape:

The ready-to-drink tea and coffee market players are leading growth through product innovations, strategic partnerships, and improved distribution networks. This includes new flavors, functional ingredients, and health-formulated offerings that cater to emerging consumer preferences. Sustainable packaging and sourcing investments are becoming popular, appealing to environmentally conscious consumers. Besides this, collaborations with retail giants and expansion into e-commerce channels are improving product access and visibility. In addition, industry players are using advanced marketing strategies that include social media and influencer campaigns in order to reach a broader audience. These actions, combined with the premiumization strategy and regional product variations, contribute greatly to the growth of the market.

The report provides a comprehensive analysis of the competitive landscape in the ready to drink tea and coffee market with detailed profiles of all major companies, including:

- Asahi Breweries

- Dr Pepper Snapple Group

- Starbucks

- PepsiCo

- The Coca Cola Company

- Ajinomoto General Foods Inc.

- Ting Hsin International Group

- Uni-President Enterprises Corporation

- Nestlé

- Dunkin' Brands

- Ferolito Vultaggio & Sons

- Keurig Dr Pepper

- Hangzhou Wahaha Group

- Lotte Chilsung

- Monster Beverage

- Acqua Minerale San Benedetto

- Kirin Holdings Company

- Unilever

- Arizona Beverage Company

- Suntory

Latest News and Developments:

- November 2024: Dunkin’ has launched its Spiked Peppermint Mocha Iced Latte, a festive ready-to-drink treat for the holiday season. Available in supermarkets and liquor stores, this limited-edition beverage combines coffee flavors with a cheerful 6% ABV twist. Part of Dunkin’s Spiked drink line, it follows the popular Spiked Pumpkin Spice Latte.

- October 2024: Trader Joe’s has launched a new Ready-to-Drink cold brew, offering a budget-friendly alternative to drive-thru coffee. The seasonal flavor provides a quick and affordable way to enjoy a refreshing start to the day. Consumers are thrilled at this new, convenient option, saving both time and money.

- September 2024: Twinings has launched its new ready-to-drink Sparkling Tea range, offering three fruit-infused flavors: Juicy Raspberry Lemonade, Zesty Orange & Passionfruit, and Zingy Lemon & Ginger. Fortified with vitamins and minerals, the teas contain no artificial sweeteners, colors, or added sugar, with under 50 calories per can. Crafted with 300 years of expertise, Twinings Sparkling Tea serves as a refreshing, health-focused pick-me-up to combat afternoon slumps.

- September 2024: Nespresso is launching its first-ever ready-to-drink canned coffee, just in time for National Coffee Day. The Master Origins Colombia offers a grab-and-go option sweetened with Nespresso’s Coffee Blossom Honey, creating a unique flavor twist. This release expands on the brand's honey range introduced in August, delivering a full-circle coffee experience.

- March 2024: Starbucks has launched its latest ready-to-drink coffee lineup, featuring the new Oatmilk Frappuccino® Chilled Coffee Drink and expanded Cold Brew offerings. This rollout, inspired by café favorites, caters to evolving consumer preferences. The drinks are now available across U.S. grocery stores through the North American Coffee Partnership (NACP).

Ready to Drink Tea and Coffee Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Additives Covered | Flavors, Artificial Sweeteners, Acidulants, Nutraceuticals, Preservatives, Others |

| Packagings Covered | Glass Bottle, Canned, Pet Bottle, Aseptic, Others |

| Price Segments Covered | Premium, Regular, Popular Priced, Fountain, Super Premium. |

| Distribution Channels Covered |

|

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Asahi Breweries, Dr Pepper Snapple Group, Starbucks, PepsiCo, The Coca Cola Company, Ajinomoto General Foods Inc., Ting Hsin International Group, Uni-President Enterprises Corporation, Nestlé, Dunkin' Brands, Ferolito Vultaggio & Sons, Keurig Dr Pepper, Hangzhou Wahaha Group, Lotte Chilsung, Monster Beverage, Acqua Minerale San Benedetto, Kirin Holdings Company, Unilever, Arizona Beverage Company, Suntory, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the ready to drink tea and coffee market from 2019-2033.

- The ready to drink tea and coffee market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the ready to drink tea and coffee industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Ready-to-drink tea and coffee are pre-packaged beverages designed for immediate consumption, offering convenience and portability. They are available in various flavors, sweetness levels, and formulations, including sugar-free and functional options. Available in cans, bottles, and cartons, ready to drink tea and coffee cater to on-the-go lifestyles, combining refreshment with the benefits of tea and coffee extracts.

The global ready to drink tea and coffee market was valued at USD 112.7 Billion in 2024.

IMARC estimates the global ready to drink tea and coffee market to exhibit a CAGR of 6.2% during 2025-2033.

The rising consumer demand for convenient and on-the-go beverages, increasing health awareness and preference for functional drinks, expansion of product innovations, including unique flavors and formulations, growth of e-commerce and improved distribution networks, and popularity of sustainable and eco-friendly packaging solutions are the primary factors driving the global ready to drink tea and coffee market.

According to the report, RTD tea represented the largest segment by product due to its numerous health benefits, such as antioxidants, and its appeal as a refreshing, low-calorie beverage.

PET bottle leads the market by packaging due to its lightweight, durable, and cost-effective nature, ensuring convenience for consumers.

Off-trade represents the leading segment by distribution channel due to its extensive reach through supermarkets, convenience stores, and online platforms, offering consumers easy access.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global ready to drink tea and coffee market include Asahi Breweries, Dr Pepper Snapple Group, Starbucks, PepsiCo, The Coca Cola Company, Ajinomoto General Foods Inc., Ting Hsin International Group, Uni-President Enterprises Corporation, Nestlé, Dunkin' Brands, Ferolito Vultaggio & Sons, Keurig Dr Pepper, Hangzhou Wahaha Group, Lotte Chilsung, Monster Beverage, Acqua Minerale San Benedetto, Kirin Holdings Company, Unilever, Arizona Beverage Company, Suntory, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)