Red Biotechnology Market Size, Share, Trends and Forecast by Product Type, Application, End User, and Region, 2025-2033

Red Biotechnology Market Size and Share:

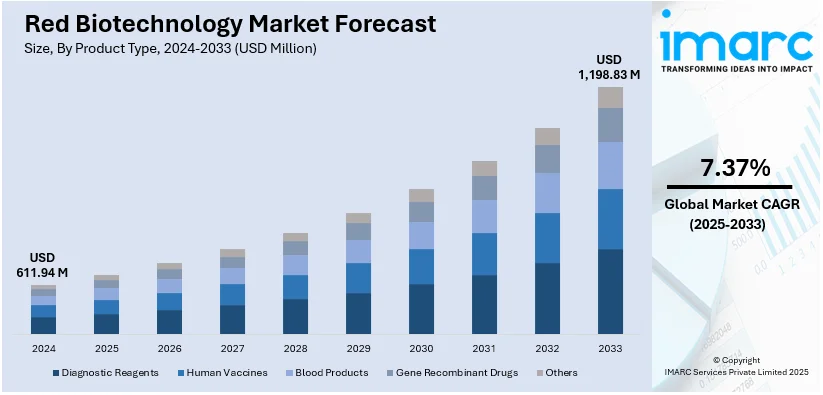

The global red biotechnology market size was valued at USD 611.94 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,198.83 Million by 2033, exhibiting a CAGR of 7.37% during 2025-2033. North America currently dominates the market, holding a significant market share of over 38.0% in 2024. The increasing demand for personalized medicine, extensive investments in the R&D of biotechnology products, and innovative technological advancements in genetic research represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 611.94 Million |

| Market Forecast in 2033 | USD 1,198.83 Million |

| Market Growth Rate (2025-2033) | 7.37% |

The rising prevalence of chronic diseases such as cancer, diabetes, and genetic disorders has increased the demand for biopharmaceuticals and gene therapies, which is driving the red biotechnology market growth. Advances in genetic engineering, stem cell research, and personalized medicine are accelerating innovation in drug development. Government funding, regulatory support, and increased investments from pharmaceutical companies are also fueling market growth. On the other hand, the increased use of biologics, monoclonal antibodies, and recombinant proteins elevates the efficiency of treatment. The aging population and increasing cost of healthcare increase demand across the globe. Also, partnerships among biotech companies and research organizations enhance research activity. The domination of AI and big data in biotechnology helps reduce the time spent on research, increases efficiency in drug discovery, and widens the prospects within the market. All these factors combine to create the global red biotechnology market outlook.

The market in the United States is driven by advanced healthcare infrastructure, high R&D investments, and strong government support through funding and regulatory approvals. The increasing prevalence of chronic diseases, including cancer and genetic disorders, boosts demand for biopharmaceuticals, gene therapies, and personalized medicine. The presence of leading biotech and pharmaceutical companies fosters innovation, while AI and big data enhance drug discovery. New treatments are accelerated by favorable FDA policies and fast-track approvals. Furthermore, an increasingly adopting clientele base in terms of biologics, monoclonal antibodies, and stem cell therapies with an aging population and increasing healthcare expenses represent key red biotechnology market trends in the United States. For example, in December 2024, Charles River Laboratories International, Inc. said it was launching the Charles River Incubator Program (CIP), targeting early-stage biotechnology companies to enable the identification, development, and manufacture of novel medicines in a phase-appropriate manner.

Red Biotechnology Market Trends:

Rising Prevalence of Chronic Diseases

The rising prevalence of chronic diseases, including cancer, diabetes, cardiovascular diseases, and genetic disorders, is a significant factor driving the red biotechnology market. Such diseases require advanced therapies, such as biologics, monoclonal antibodies, gene therapies, and personalized medicine. For example, in 2022, nearly 9.7 million people worldwide died from cancer, and 20 million new cases were diagnosed. The growing global burden of such diseases has increased the demand for innovative biopharmaceuticals. Furthermore, lifestyle and demographic changes, especially due to an aging population, also make heavy contributions to an increase in chronic diseases. Biotechnology solutions are, therefore gaining much investment by governments and healthcare organizations to develop better and more targeted treatments with higher efficiency, which boosts the red biotechnology market demand significantly.

Advancements in Biopharmaceuticals & Gene Therapy

Continuous innovation in biopharmaceuticals such as recombinant proteins, monoclonal antibodies, and gene editing technologies like CRISPR is very much driving the red biotechnology market. Gene and stem cell therapies are now revolutionizing approaches to treatment with solutions for previously untreatable diseases. Biopharmaceuticals offer a targeted treatment that has fewer side effects than drugs. Breakthroughs in regenerative medicine and personalized medicine also further expand the potential of this market. As research and development strive forward, the efficiency, effectiveness, and availability of biotechnological treatments are accelerating, making them a preferred choice in modern health care. For example, in August 2024, Tecelra (afamitresgene autoleucel) gene therapy obtained approval from the U.S. Food and Drug Administration, is for the treatment of adults with metastatic or unresectable synovial sarcoma who have received chemotherapy, who have an HLA antigen(s) of A*02:01P, -A*02:02P, -A*02:03P, or -A*02:06P, and whose tumor expresses the MAGE-A4 antigen as identified by FDA-approved companion diagnostic devices.

Integration of AI, Big Data, and Advanced Research Tools

Artificial intelligence (AI), machine learning, and big data analytics are transforming red biotechnology by accelerating drug discovery, optimizing clinical trials, and improving precision medicine. AI-driven research enhances the identification of drug candidates, predicts treatment outcomes, and reduces development costs. Big data allows for the analysis of vast amounts of genomic and patient information, leading to more accurate diagnoses and tailored therapies. Additionally, automation in biopharmaceutical manufacturing and advanced bioinformatics tools are increasing efficiency and scalability. These technological advancements are reshaping the biotechnology landscape, making research and production more effective and cost-efficient. For instance, in January 2025, AllSci started its Development Partner Program for R&D-driven life science organizations seeking to use the power of its revolutionary AI platform. Early access to AllSci's proprietary pharmaceutical hypothesis database, sophisticated visualization engine, and AERIS—AllSci's state-of-the-art artificial intelligence system designed specifically for research and scientific knowledge discovery—are provided by this exclusive program.

Red Biotechnology Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global red biotechnology market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, application, and end user.

Analysis by Product Type:

- Diagnostic Reagents

- Human Vaccines

- Blood Products

- Gene Recombinant Drugs

- Others

Diagnostic reagents will be the most significant contributor to the red biotechnology market since people need more accurate early disease detection and screening for infectious diseases and personalized medicine. The market expands because the customers need point-of-care testing and molecular diagnostics as health spending levels rise. Adoption is driven further by the government's initiatives for disease surveillance and the introduction of AI into diagnostic tools. Research into reagents must constantly be developed since their basic existence supports diagnostic medicine as well as laboratory operations and biopharmaceutical processes.

The market for human vaccines is the largest because of growing immunization programs, government funding, and recombinant and mRNA vaccine technology. The growing infectious diseases, new viral threats, and innovations in biopharmaceuticals create demand. The public health agencies and manufacturers are working in partnership to ensure that distribution becomes smoother. There is a strong focus on pandemic preparedness, and investments in rapid vaccine development platforms will sustain growth. Continuous R&D on novel vaccine formulations, including adjuvants and delivery systems, further consolidates their position in the market.

Blood products, therefore, dominate the red biotechnology market due to their crucial importance in transfusions, immune therapies, and rare disease treatments. Increasing demand for plasma-derived therapies is evident along with government support towards blood donation and improvements in fractionation technologies form the basis of growth. Cases of hemophilia, immunodeficiency disorders, and trauma-related injuries rise. Improvements in pathogen reduction and recombinant blood components enhance the safety and efficiency of products for better health, biopharmaceuticals, and regenerative medicine.

Analysis by Application:

- Biopharmaceutical Production

- Gene Therapy

- Pharmacogenomics

- Genetic Testing

- Others

Biopharmaceutical production dominates the red biotechnology market due to increasing demand for targeted therapies, monoclonal antibodies, and recombinant proteins. The production efficiency improves because of recent improvements in cell culture techniques as well as advancements in bioprocess optimization and gene expression systems. The demand for biologic treatments expands because chronic diseases including cancer and autoimmune disorders continue to increase in population numbers. The market expands through government backing along with approval processes and development initiatives for biosimilars. The field of bioreactors together with upstream/downstream processing along with single-use technologies spurs breakthroughs that boost scale-up and decrease operational expenses. The ongoing advancement of personalized medicine and gene therapy strengthens biopharmaceutical production through their contribution to stable market growth and market dominance of red biotechnology.

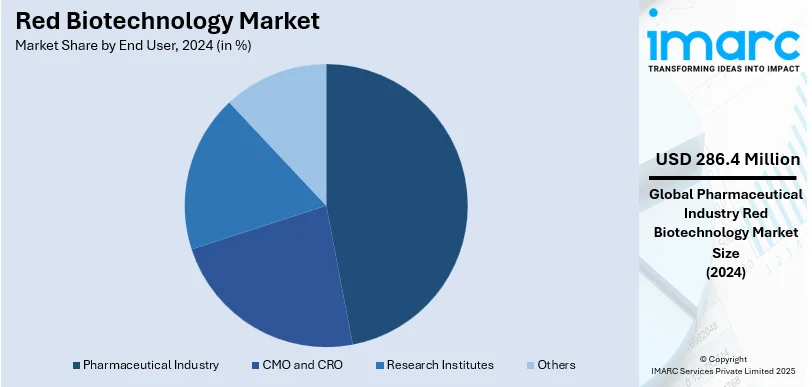

Analysis by End User:

- Pharmaceutical Industry

- CMO and CRO

- Research Institutes

- Others

The pharmaceutical industry leads the market with around 46.8% of the market share in 2024. The pharmaceutical industry holds the largest share of the red biotechnology market due to its extensive use of biotechnological innovations in drug development, biologics, and gene therapies. The market experiences growth because of rising requirements for targeted medicines, monoclonal antibodies, and biosimilar products. The combination of improved recombinant DNA techniques alongside cell-based testing procedures and enhanced protein development platforms enables better medical drug development and production technologies. The markets excel due to government financial grants combined with regulatory backing and thorough research and development activities. Precise medicinal practices and orphan drug production along with biopharmaceutical contract manufacturing have accelerated market development patterns. Oncological and immunological diseases alongside infectious disorders are becoming primary applications that secure pharmaceutical companies their position as leaders in red biotechnological ventures.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 38.0%. The increasing occurrence of chronic diseases like cancer, diabetes, and genetic disorders also drives the need for innovative biologics and gene therapies. Positive government and regulatory policies with priority approvals from the FDA stimulate innovation and expedite drug development. The region also enjoys heavy R&D investment from biotech and pharmaceuticals, enabling advances in personalized medicine, monoclonal antibodies, and stem cell research. Moreover, AI, big data, and bioinformatics are boosting drug discovery and clinical trials. The market growth of red biotechnology in North America advances through an established pharmaceutical infrastructure, rising biologic adoption and leading biotechnology companies leading the globe.

Key Regional Takeaways:

United States Red Biotechnology Market Analysis

In 2024, the United States accounted for the largest red biotechnology market share of over 96.40% in North America. The growing red biotechnology adoption in the United States is significantly driven by growing investment in the pharmaceutical industry. According to reports, in Q3 2024, 25 private equity acquisitions totaling USD 2.3 Billion were disclosed in the US pharmaceutical business. The increasing funding for biopharmaceutical research is fostering the development of innovative therapies, including monoclonal antibodies, gene therapy, and regenerative medicine. With the presence of leading biotechnology firms, the country is experiencing rapid advancements in biologics and biosimilars, which are becoming pivotal in treating chronic diseases. The demand for personalized medicine is rising, propelling investments in genomic research and biopharmaceutical production. The U.S. government and private sector are actively collaborating to enhance biotechnological innovation through initiatives like the Biomedical Advanced Research and Development Authority (BARDA) and National Institutes of Health (NIH) grants. The expansion of clinical trials and biopharmaceutical manufacturing plants is further strengthening red biotechnology adoption. Additionally, regulatory frameworks such as the FDA’s expedited drug approval programs are encouraging investment in cutting-edge biotechnological solutions.

Asia Pacific Red Biotechnology Market Analysis

The growing red biotechnology adoption in Asia-Pacific is largely attributed to rising diabetes cases across the region. According to the World Health Organization, around 25 million Indians over the age of 18 have prediabetes, or are at a higher risk of acquiring diabetes in the near future, while an estimated 77 million have type 2 diabetes. The prevalence of Type 2 diabetes has surged due to lifestyle changes, urbanization, and genetic predisposition. Countries such as India and China are witnessing a sharp increase in diabetes-related complications, necessitating advanced biologics and biosimilars for effective treatment. The demand for insulin analogs, recombinant proteins, and stem cell therapy is driving biopharmaceutical companies to invest in red biotechnology innovations. The expansion of diabetes management programs, along with government-led healthcare initiatives, is further encouraging the adoption of advanced biotechnological solutions. Growing collaborations between international pharmaceutical firms and regional biotech startups are fuelling research in gene-based therapies and regenerative medicine. With Asia-Pacific emerging as a key hub for biosimilar production, the rising diabetes burden is expected to drive continuous advancements in red biotechnology applications across the region.

Europe Red Biotechnology Market Analysis

The growing red biotechnology adoption in Europe is being driven by rising cancer cases, which have become a major healthcare concern. In 2022, there were 2.74 million new cases of cancer, up 2.3% from 2020, according to the European Cancer Information System (ECIS). Similarly, compared to 2020, the number of cancer fatalities increased by 2.4%. The increasing incidence of lung, breast, and colorectal cancer is accelerating the demand for targeted therapies, immunotherapy, and personalized medicine. Biopharmaceutical companies in Europe are investing heavily in red biotechnology to develop innovative cancer treatments such as CAR-T cell therapy, monoclonal antibodies, and gene editing techniques. The European Medicines Agency (EMA) has streamlined regulatory pathways for biopharmaceutical approvals, encouraging research and development in oncology-focused biotechnology. The presence of established biotech clusters in Germany, France, and the United Kingdom is fostering innovation through partnerships between research institutions and pharmaceutical firms. Additionally, government funding initiatives, such as Horizon Europe, are supporting cancer-related biotechnological advancements. As precision medicine gains traction, red biotechnology is playing a crucial role in transforming cancer treatment approaches across Europe.

Latin America Red Biotechnology Market Analysis

The growing red biotechnology adoption in Latin America is being fuelled by growing healthcare facilities and privatization. According to International Trade Administration, Brazil is the largest healthcare market in Latin America with 7,191 hospitals, 62% are private. Many countries in the region are expanding their healthcare infrastructure, leading to an increased demand for biopharmaceutical products. The privatization of healthcare services is driving investments in advanced therapies, including biosimilars, stem cell treatments, and gene therapy. With an increasing focus on biotechnology-driven pharmaceuticals, governments and private entities are investing in research and manufacturing capabilities. Brazil, Mexico, and Argentina are emerging as key players in red biotechnology, benefiting from international collaborations and favourable policies supporting biopharmaceutical innovation. The growing emphasis on personalized medicine and biologic drug development is further strengthening the adoption of red biotechnology in Latin America. As healthcare access improves, biotechnology advancements are expected to accelerate, making the region a promising market for biopharmaceutical solutions.

Middle East and Africa Red Biotechnology Market Analysis

The growing red biotechnology adoption in the Middle East and Africa is being driven by growing cardiovascular disorders (CVD) cases. For instance, in 2021, at 11066.8 (10490.2 to 11668.2) cases per 100,000, the United Arab Emirates had the highest age-standardized prevalence rate of CVD. The region is witnessing a surge in CVD prevalence due to lifestyle changes, obesity, and genetic predisposition. The increasing demand for biologic drugs, including monoclonal antibodies and recombinant proteins, is fostering investments in red biotechnology. Governments are prioritizing healthcare reforms, boosting biotechnology research and manufacturing. Countries such as Saudi Arabia, the UAE, and South Africa are advancing biopharmaceutical capabilities to address CVD-related healthcare challenges. Additionally, increasing partnerships between regional biotech firms and global pharmaceutical companies are accelerating innovation in cardiovascular treatments. As biotechnology-driven therapeutics gain momentum, the region is expected to witness significant growth in red biotechnology adoption to combat cardiovascular diseases.

Competitive Landscape:

The red biotechnology market focused on medical and pharmaceutical applications, is highly competitive, driven by advancements in gene therapy, personalized medicine, and biopharmaceuticals. Leading companies in the red biotechnology market are Roche alongside Pfizer, Novartis and Amgen coupled with new biotech startups. The market sustains its growth through escalating demand for three segments: biologics and biosimilars along with cell & gene therapies. Due to vigorous research investment, North America leads the market yet Asia-Pacific shows rising growth supported by government backing together with developing biomanufacturing systems. The market faces challenges because of expensive research and development, demanding regulatory procedures and disputes about intellectual property. Competitive positioning in the market requires companies to undertake strategic partnerships and execution of merger and acquisition deals. The industry’s fate depends on technical developments combined with artificial intelligence for drug development and expanded biological production facilities.

The report has also analysed the competitive landscape of the market with some of the key players being:

- Amgen Inc.

- AstraZeneca Plc

- Biogen Inc.

- Bristol-Myers Squibb Company

- Gilead Sciences Inc.

- Merck & Co. Inc.

- Pfizer Inc.

- Regeneron Pharmaceuticals Inc.

Latest News and Developments:

- November 2023: PTC Therapeutics announced the FDA's accelerated approval of KEBILIDI™ (eladocagene exuparvovec-tneq), the first-ever gene therapy directly administered to the brain for treating AADC deficiency. This groundbreaking gene therapy is approved for both children and adults, offering a broad label for the full spectrum of the disease. PTC pioneers a new approach for CNS drug delivery, with launch preparations already in progress.

- November 2024: A novel gene therapy trial has launched at UCSF Benioff Children’s Hospital Oakland, using CRISPR-Cas9 to correct the sickle cell mutation. This non-viral gene-editing approach aims to free patients from the disease by directly targeting the faulty beta-globin gene. The trial marks a breakthrough in gene therapy for sickle cell disease, offering hope to thousands affected.

- November 2024: iotaSciences is set to launch its advanced Single-Cell Cloning Platform XT at the Cell 2024 event in London, enhancing gene therapy research. The platform, an upgrade from the original, utilizes proprietary fluid-shaping technology to support stem cell handling and gene editing, benefiting researchers globally.

- August 2024: Red Queen Therapeutics, backed by Apple Tree Partners with USD 55 Million, is advancing red biotechnology by developing broad-spectrum antivirals. Its COVID-19 treatment has completed Phase 1 trials, with U.S. government support for a pan-influenza drug. The company’s technology, based on Harvard research, uses stapled lipopeptides to block viral fusion. Red Biotechnology innovations aim to combat infectious diseases like COVID-19, influenza, and RSV.

- May 2024: Bio-Rad Laboratories, Inc. expanded its red biotechnology offerings with three new StarBright™ Red Dyes - 715, 775, and 815, enhancing immunological research. These dyes, excitable by the 640 nm laser, provide superior brightness with minimal background. The launch strengthens Bio-Rad’s presence in multicolor flow cytometry solutions.

Red Biotechnology Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Diagnostic Reagents, Human Vaccines, Blood Products, Gene Recombinant Drugs, Others |

| Applications Covered | Biopharmaceutical Production, Gene Therapy, Pharmacogenomics, Genetic Testing, Others |

| End Users Covered | Pharmaceutical Industry, CMO and CRO, Research Institutes, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Amgen Inc., AstraZeneca Plc, Biogen Inc., Bristol-Myers Squibb Company, Gilead Sciences Inc., Merck & Co. Inc., Pfizer Inc., Regeneron Pharmaceuticals Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the red biotechnology market from 2019-2033.

- The red biotechnology market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the red biotechnology industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The red biotechnology market was valued at USD 611.94 Million in 2024.

The red biotechnology market is projected to exhibit a CAGR of 7.37% during 2025-2033, reaching a value of USD 1,198.83 Million by 2033.

The market is driven by rising chronic diseases, advancements in biopharmaceuticals and gene therapy, strong government and regulatory support, and AI-driven drug discovery. Increasing R&D investments, the adoption of biologics, and biotech innovation further fuel growth, while personalized medicine and bioinformatics enhance treatment precision and development efficiency.

North America currently dominates the red biotechnology market, accounting for a share of 38.0%. High disease prevalence, strong R&D investments, government support, AI integration, advanced biologics, biotech innovation, regulatory approvals, and robust infrastructure.

Some of the major players in the red biotechnology market include Amgen Inc., AstraZeneca Plc, Biogen Inc., Bristol-Myers Squibb Company, Gilead Sciences Inc., Merck & Co. Inc., Pfizer Inc., Regeneron Pharmaceuticals Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)