Refurbished Medical Equipment Market Size, Share, Trends and Forecast by Product Type, Application, End-User, and Region, 2026-2034

Refurbished Medical Equipment Market Size and Share:

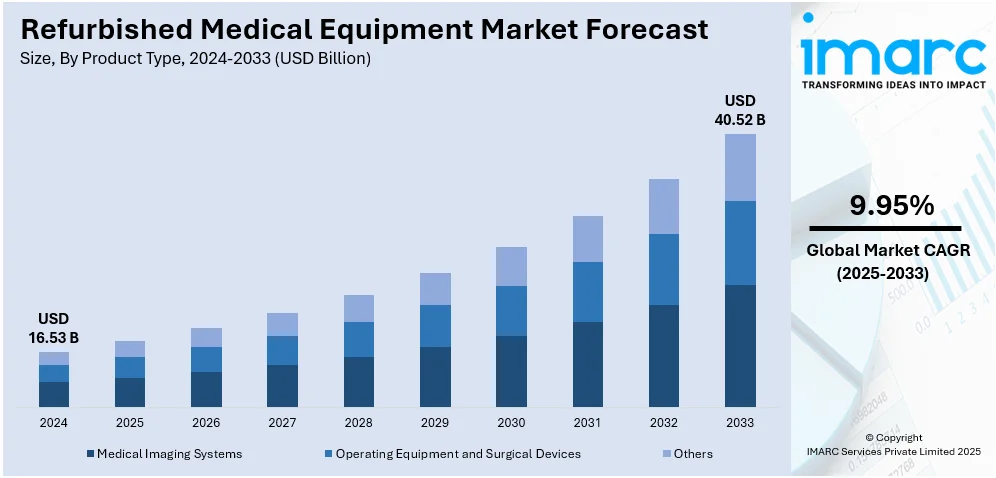

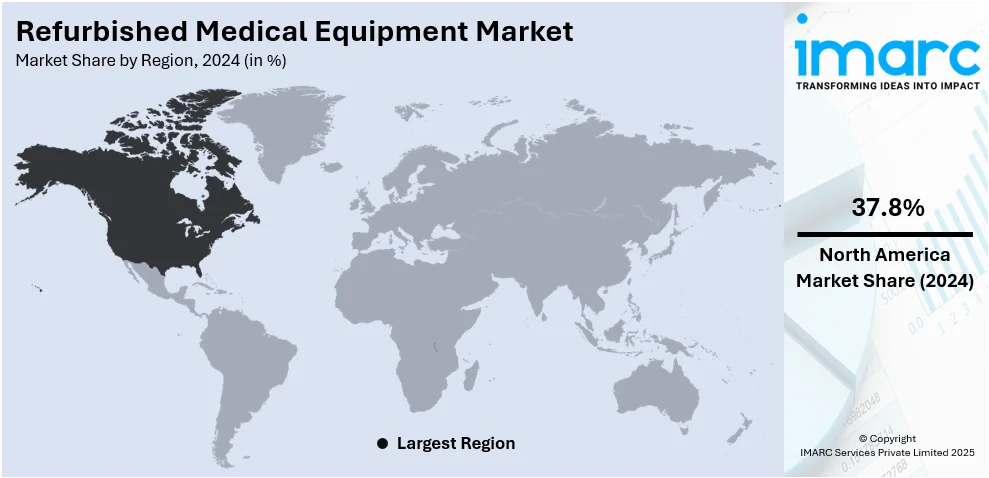

The global refurbished medical equipment market size was valued at USD 16.53 Billion in 2025. The market is projected to reach USD 40.52 Billion by 2034, exhibiting a CAGR of 9.95% from 2026-2034. North America currently dominates the market, holding a market share of 37.8% in 2024. Diseases, such as cancer, cardiovascular disorders, and neurological conditions, require advanced medical devices like imaging systems, ventilators, infusion pumps, and surgical equipment. Besides this, increasing privatization of the healthcare sector is contributing to the expansion of the refurbished medical equipment market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 16.53 Billion |

|

Market Forecast in 2034

|

USD 40.52 Billion |

| Market Growth Rate 2026-2034 | 9.95% |

At present, the refurbished medical equipment market is growing steadily due to its affordability, practicality, and increasing acceptance in the healthcare industry. As hospitals and clinics are facing budget constraints, especially in developing regions, they are turning to refurbished devices to access essential diagnostic and treatment tools at lower costs. These machines offer reliable performance when restored to original standards, making them a smart alternative to expensive new equipment. Small and mid-sized healthcare facilities benefit greatly, enabling them to expand services without heavy financial investment. Refurbished equipment is also employed for training, research, and backup purposes. The growing awareness about sustainable practices is further driving the demand, as refurbishing reduces electronic waste and promotes reuse.

To get more information on this market, Request Sample

The United States has emerged as a major region in the refurbished medical equipment market owing to many factors. Rising healthcare costs, increased demand for affordable solutions, and expanding access to quality care are offering a favorable refurbished medical equipment market outlook. Hospitals, clinics, and diagnostic centers are seeking economical alternatives to new devices without compromising performance and reliability. Refurbished equipment provides a practical solution, especially for facilities with limited budgets or those in rural areas. The growing number of outpatient centers and private practices is also driving the demand for used but certified medical devices. In March 2025, Kaiser Permanente upgraded its Sunnyside Medical Center in Clackamas, US, by building a new, cutting-edge private hospital tower. The new facility, covering 615,000 square feet, would incorporate state-of-the-art technology, increased service capabilities, and contemporary patient features, such as fully private patient rooms. Apart from this, technological advancements in refurbishment processes are improving the safety, functionality, and lifespan of refurbished products, boosting confidence among healthcare providers.

Refurbished Medical Equipment Market Trends:

Growing incidence of critical ailments

Rising incidence of critical ailments is creating the need for timely diagnosis, monitoring, and treatment across healthcare settings. The World Health Organization (WHO) reported that around 20 Million new cancer cases were documented in 2022, leading to 9.7 Million fatalities. Cardiovascular diseases ranked as the top cause of death globally, accounting for roughly 17.9 Million fatalities annually. Diseases, such as cancer, cardiovascular disorders, and neurological conditions, require advanced medical devices like imaging systems, ventilators, infusion pumps, and surgical equipment. As more patients require frequent and specialized care, healthcare providers must expand their infrastructure and capabilities. Refurbished equipment offers an affordable and efficient way to meet this growing demand, especially for hospitals and clinics facing financial constraints. These devices help maintain care quality while reducing capital expenses. In both urban and rural areas, refurbished tools allow medical facilities to handle higher patient volumes and improve service delivery.

Rising privatization of healthcare sector

Increasing privatization of the healthcare sector is among the major refurbished medical equipment market trends. The private healthcare market in India reached USD 116.4 Billion in 2024 and is set to grow at a CAGR of 5.4% during 2025-2033, according to a report published by the IMARC Group. As more private hospitals, diagnostic centers, and specialty clinics are entering the healthcare space, they are seeking affordable, reliable equipment to set up and expand operations quickly. Refurbished medical devices offer a practical choice, enabling new entrants to manage capital expenditures while ensuring access to advanced technology. Private players are also facing competitive pressure to provide high-quality care without excessive costs, making refurbished systems an attractive alternative to expensive new equipment. These facilities often operate in underserved regions, where affordability and quick availability are critical. Refurbished equipment allows them to meet patient requirements, maintain service quality, and allocate resources more efficiently.

Increasing geriatric population

Rising geriatric population is fueling the refurbished medical equipment market growth. According to the WHO, by 2050, the population of individuals aged 60 years and above is set to hit 2.1 Billion. The count of people aged 80 and above is expected to increase threefold from 2020 to 2050, totaling 426 Million. Older adults are more prone to chronic ailments, such as arthritis and respiratory issues, which require frequent medical evaluations and long-term care. Healthcare facilities need to expand their equipment inventory to meet the growing needs of aging patients, often while working within budget constraints. Refurbished medical devices offer a practical and affordable solution, allowing providers to maintain high service levels without heavy financial investment. Equipment like imaging systems, patient monitors, and mobility aids are in constant demand among elderly patients, making refurbished options especially valuable.

Refurbished Medical Equipment Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global refurbished medical equipment market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on product type, application, and end-user.

Analysis by Product Type:

- Medical Imaging Systems

- Computed Tomography Systems

- MRI Systems

- X-ray, C-arm and Radiography Equipment

- Ultrasound Systems

- Mammography Equipment

- Nuclear Medicine Devices

- Others

- Operating Equipment and Surgical Devices

- Anesthesia Machines and Agent Monitors

- Endoscopes and Microscopes

- Vascular Closure Devices

- Electrosurgical Units

- Altherectomy Devices

- Others

- Others

- Patient Monitoring Devices

- Defibrillators

- Coagulation Analyzers

- Neurology Equipment

- Endoscopy Equipment

- Others

Medical imaging systems (computed tomography systems, MRI systems, X-ray, C-arm and radiography equipment, ultrasound systems, mammography equipment, nuclear medicine devices, and others) held 38.9% of the market share in 2024. They are high-cost devices that many healthcare facilities need but cannot always afford new. Imaging systems, such as MRI machines, CT scanners, X-rays, and ultrasound devices, are essential for diagnosis, treatment planning, and monitoring, making them a priority for hospitals and diagnostic centers. However, due to their high initial investment, many institutions are opting for refurbished options that offer similar performance at significantly reduced prices. These systems are also durable and retain their utility over time, making them suitable for refurbishment and resale. Smaller clinics, rural hospitals, and emerging markets particularly benefit from refurbished imaging equipment to expand their diagnostic capabilities. With the growing patient volumes, the need for reliable imaging tools continues to rise. Consequently, refurbished medical imaging systems are becoming an ideal choice, balancing cost, functionality, and access, supporting their leading position in the market.

Analysis by Application:

- Diagnostic Imaging Systems

- Minimally Invasive Devices

- Biotechnology Instruments

- Others

Diagnostic imaging systems account for 45.0% of the market share. They are essential for timely identification, precise assessment, and tracking of diverse health issues. These systems, inculcating CT scanners, X-rays, MRI machines, and ultrasound devices, are widely used across all levels of healthcare, ranging from large hospitals to small diagnostic centers. Due to their high purchase and maintenance costs, many facilities are choosing refurbished options that offer dependable performance at a lower investment. As the demand for diagnostic services is increasing with high patient awareness and rising chronic disease cases, the need for accessible imaging solutions is growing. Refurbished systems help meet this demand in a cost-effective manner. They allow healthcare providers, especially in underserved or rural areas, to offer critical diagnostic services without straining budgets. Additionally, improvements in refurbishment standards ensure that these systems deliver reliable image quality and safety. According to the refurbished medical equipment market forecast, innovations in products will continue to stimulate the market growth, making diagnostic imaging systems the dominant application in the industry.

Analysis by End-User:

- Hospitals and Clinics

- Diagnostic Centres

- Ambulatory Surgical Centres

- Others

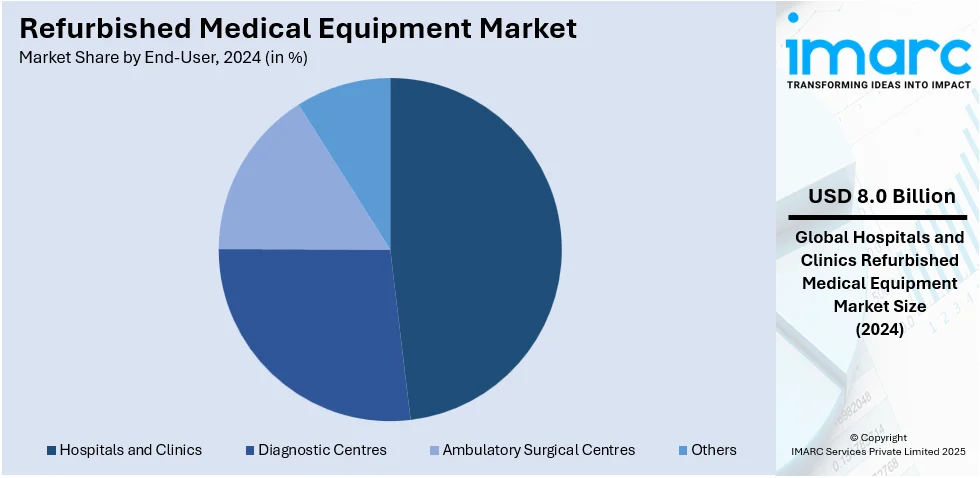

Hospitals and clinics account for 48.2% of the market share. They are the primary providers of a wide range of healthcare services and require continuous access to reliable medical devices. These facilities often operate under strict budget constraints, especially in developing regions and smaller community settings, making cost-effective solutions essential. Refurbished equipment allows hospitals and clinics to access high-quality diagnostic, surgical, and therapeutic tools at significantly lower prices than new machines. This enables them to expand their capabilities, upgrade outdated technology, and serve more patients without compromising care standards. Additionally, with the growing patient population and rising demand for advanced medical services, healthcare providers are seeking faster and more economical ways to scale operations. Refurbished devices, which meet performance and safety standards, offer a practical solution. Many hospitals and clinics are also employing them for training, backup, and secondary use. Their ongoing need for diverse, affordable, and functional equipment ensures hospitals and clinics remain the dominant end-users in the market.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America, accounting for a share of 37.8%, enjoys the leading position in the market. The region is noted for its well-established healthcare infrastructure, high demand for cost-effective solutions, and widespread acceptance of refurbished devices. The region is experiencing increasing healthcare costs, encouraging hospitals and clinics to adopt budget-friendly alternatives that maintain quality and performance. Many healthcare providers in North America prefer refurbished equipment to manage operational expenses while expanding service offerings. The presence of major refurbishment companies with advanced facilities and strong distribution networks is further strengthening the market growth. Technological advancements and strict regulatory standards in the area ensure that refurbished devices meet safety and efficiency requirements, increasing buyer confidence. Rising Internet of Things (IoT) integration in North America is enabling smart monitoring, maintenance, and connectivity of used devices. As per the IMARC Group, the US IoT integration market is set to attain USD 8.8 Billion by 2033, exhibiting a growth rate (CAGR) of 25.9% during 2025-2033.

Key Regional Takeaways:

United States Refurbished Medical Equipment Market Analysis

The United States holds 85.80% of the market share in North America. The market is significantly driven by cost containment within healthcare systems. With the increasing financial pressures on hospitals and healthcare providers due to high operational costs and insurance reimbursements, refurbished devices offer a viable solution for maintaining budgets while still delivering quality healthcare. According to the AHA, in 2024 alone, total hospital expenditure grew 5.1% in the United States. Additionally, regulatory compliance is a major factor, as refurbished medical devices must adhere to strict FDA standards, which assure healthcare providers that these devices are safe and effective. Another critical driver is supply chain disruptions, which have been prevalent, making refurbished equipment a necessary alternative when there is a scarcity of new devices. Furthermore, environmental concerns related to e-waste disposal are leading healthcare providers towards more sustainable solutions, and refurbished medical equipment is seen as a way to contribute to sustainability by minimizing waste and promoting the reuse of materials.

Europe Refurbished Medical Equipment Market Analysis

In Europe, the growth of the market is largely fueled by several converging trends focused on cost efficiency, sustainability, and healthcare accessibility. Hospitals, private clinics, and diagnostic centers are increasingly constrained by budget limitations and rising healthcare spending, motivating them to explore high-quality refurbished imaging devices, patient monitors, defibrillators, and surgical tools as affordable alternatives to new units. According to reports, in 2022, the average expenditure on healthcare in the European Union was €3,685 per person, marking a 38.6% increase from €2,658 in 2014. Luxembourg exhibited the highest average expenditure, at €6,590 for each resident. Moreover, public procurement policies in numerous EU countries are actively encouraging circular economy principles, prioritizing reuse and refurbishment when feasible. This aligns with sustainable healthcare mandates aimed at reducing waste and carbon footprints. Additionally, digital platforms and specialist refurbishers are streamlining equipment sourcing, certification, maintenance, and parts supply, improving asset lifecycle transparency. Academic institutions, teaching hospitals, and training centers are also relying on refurbished technology for education and simulation, maximizing limited resources.

Asia-Pacific Refurbished Medical Equipment Market Analysis

In the Asia-Pacific region, the growing demand for affordable healthcare is a major driver of the refurbished medical equipment market. As healthcare needs continue to rise due to rapidly expanding populations and an increasing burden of chronic diseases, the affordability of new medical equipment remains a significant challenge, especially in developing regions like India, China, and Southeast Asia. According to the Asian Development Bank, in 2024, over 20 nations in the area faced a 20% or greater risk of premature deaths from chronic illnesses. These included India, Indonesia, and the Philippines. Certain Pacific countries had rates that nearly reached or surpassed 40%. Refurbished devices offer an affordable alternative to new equipment, enabling healthcare providers to meet this demand without exceeding budgets. Furthermore, government support in various countries in the region, such as India and Indonesia, is promoting the utilization of refurbished medical devices as part of efforts to improve access to healthcare. Many government agencies in these countries are incentivizing the use of refurbished equipment in public health systems, particularly in rural areas where new equipment may be unaffordable or unavailable.

Latin America Refurbished Medical Equipment Market Analysis

In Latin America, one of the most significant drivers for the refurbished medical equipment market is economic constraints. With many countries in the region facing economic challenges, healthcare systems are under pressure to provide services with limited budgets. Refurbished medical devices offer a more affordable option for hospitals and clinics to equip themselves with the necessary tools without exceeding their financial capabilities. Additionally, increased healthcare access due to the rise in chronic diseases and the growing elderly population in countries like Brazil and Mexico is catalyzing higher demand for medical equipment. In 2022, over 78,000 women received a cervical cancer diagnosis, and over 40,000 passed away due to the illness in the Americas region. Refurbished devices help fill the gap between the rising healthcare needs and the available budget for equipment. Another important driver is the scarcity of new equipment in certain areas, particularly in rural and remote regions, where new medical devices may not be easily accessible or affordable.

Middle East and Africa Refurbished Medical Equipment Market Analysis

In the Middle East and Africa region, the market is significantly influenced by the increasing demand for healthcare services due to population growth and limited access to advanced medical technologies in several countries. Numerous smaller hospitals and clinics across the region are opting for refurbished equipment to expand service offerings without overstretching budgets. The rising number of private healthcare investors and startups is also creating a market for affordable, functional equipment that enables rapid setup of diagnostic centers and specialized facilities. For instance, the Saudi Arabian government intended to boost private sector investments in healthcare from 25% to 35% of total healthcare spending as part of the Vision 2030 initiative, as reported by the Foundation for Research on Equal Opportunity (FREOPP). The growing emphasis on sustainability and reduction of electronic waste (e-waste) is also supporting the use of refurbished machines.

Competitive Landscape:

Key players are investing in advanced refurbishment processes that restore used devices to near-original condition, meeting strict performance and safety standards. They are offering certification, warranties, and after-sales support, which builds confidence among hospitals and clinics. Key players also help expand market access by supplying refurbished equipment to underserved and cost-sensitive regions. Their strong distribution networks and partnerships with healthcare providers ensure timely delivery and service. Many large manufacturers include refurbishment divisions, promoting sustainability and extending product life cycles. By providing training, maintenance, and customization services, these companies are adding value to their offerings. Their efforts are not only making medical technology more affordable but also ensuring that quality healthcare reaches a broader population, supporting steady market growth. For instance, in March 2025, Green Pulse revealed plans for an auction of pre-owned medical devices. This auction represented a significant achievement in the company's efforts to promote sustainable practices in healthcare by redistributing medical devices that would otherwise remain unused.

The report provides a comprehensive analysis of the competitive landscape in the refurbished medical equipment market with detailed profiles of all major companies, including:

- Philips Electronics Nederland B.V.

- Block Imaging

- EverX Pty Ltd.

- The General Electric Company

- Integrity Medical Systems, Inc.

- Radiology Oncology Systems

- Rad Medical Associates

- Siemens Healthineers AG

- Soma Technology Inc.

Latest News and Developments:

- April 2025: The Philippine Food and Drug Administration (FDA) revealed intentions to implement a new regulation for the storage and distribution of medical devices aimed at enhancing the management standards of medical devices in the Philippines. The RMP regulation would be applicable to producers and suppliers of refurbished medical devices.

- April 2025: Siemens Healthineers AG revealed a decade-long value partnership with Tower Health to upgrade technology, improve patient experiences in clinical environments, and optimize equipment. The alliance would additionally offer the Tower Health system’s radiology, oncology, and cardiology divisions significant improvements in diagnostic imaging and digital intelligence functionalities.

Refurbished Medical Equipment Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Applications Covered | Diagnostic Imaging Systems, Minimally Invasive Devices, Biotechnology Instruments, Others |

| End-Users Covered | Hospitals and Clinics, Diagnostic Centres, Ambulatory Surgical Centres, Others |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Philips Electronics Nederland B.V., Block Imaging, EverX Pty Ltd, The General Electric Company, Integrity Medical Systems, Inc., Radiology Oncology Systems, Inc., Rad Medical Associates, Siemens Healthineers AG, and Soma Technology, Inc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the refurbished medical equipment market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global refurbished medical equipment market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the refurbished medical equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The refurbished medical equipment market was valued at USD 16.53 Billion in 2024.

The refurbished medical equipment market is projected to exhibit a CAGR of 9.95% during 2025-2033, reaching a value of USD 40.52 Billion by 2033.

Increasing demand for healthcare services, especially in rural areas, is positively influencing the market, as refurbished equipment makes advanced care more accessible. Environmental concerns are also supporting the market growth, with refurbishment helping reduce e-waste and promote sustainability. Moreover, advancements in technology and refurbishment techniques improve the quality, lifespan, and safety of used equipment, enhancing trust among buyers.

North America currently dominates the refurbished medical equipment market, accounting for a share of 37.8% in 2024, driven by high healthcare costs, strong demand for affordable solutions, advanced refurbishment facilities, regulatory support, and wide acceptance of used equipment among hospitals, clinics, and diagnostic centers seeking reliable and cost-effective options.

Some of the major players in the refurbished medical equipment market include Philips Electronics Nederland B.V., Block Imaging, EverX Pty Ltd, The General Electric Company, Integrity Medical Systems, Inc., Radiology Oncology Systems, Inc., Rad Medical Associates, Siemens Healthineers AG, Soma Technology, Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)