Retinal Surgery Devices Market Size, Share, Trends and Forecast by Equipment Type, Application, End-Use, and Region, 2025-2033

Retinal Surgery Devices Market Size and Share:

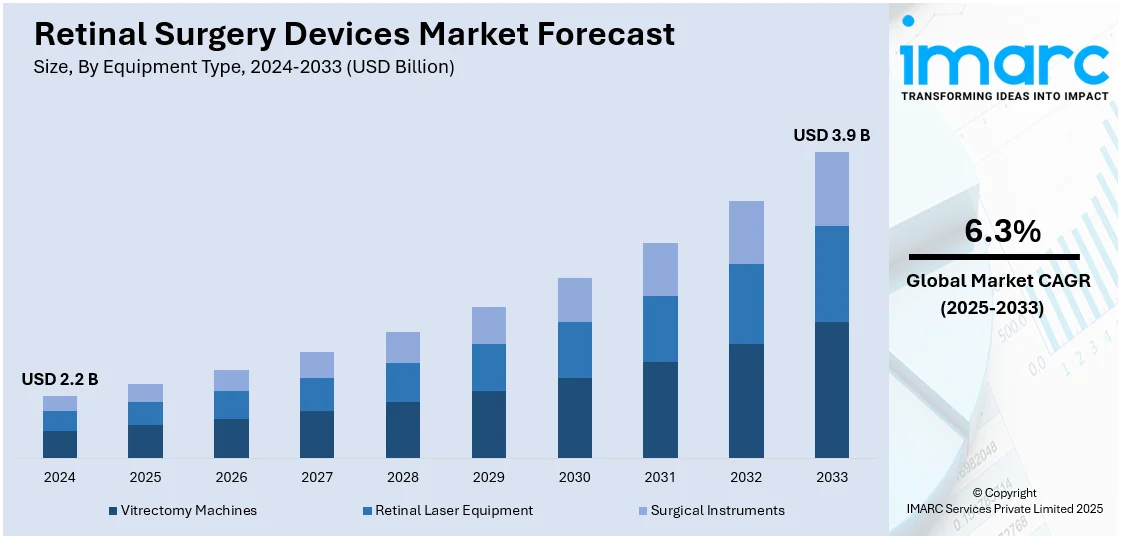

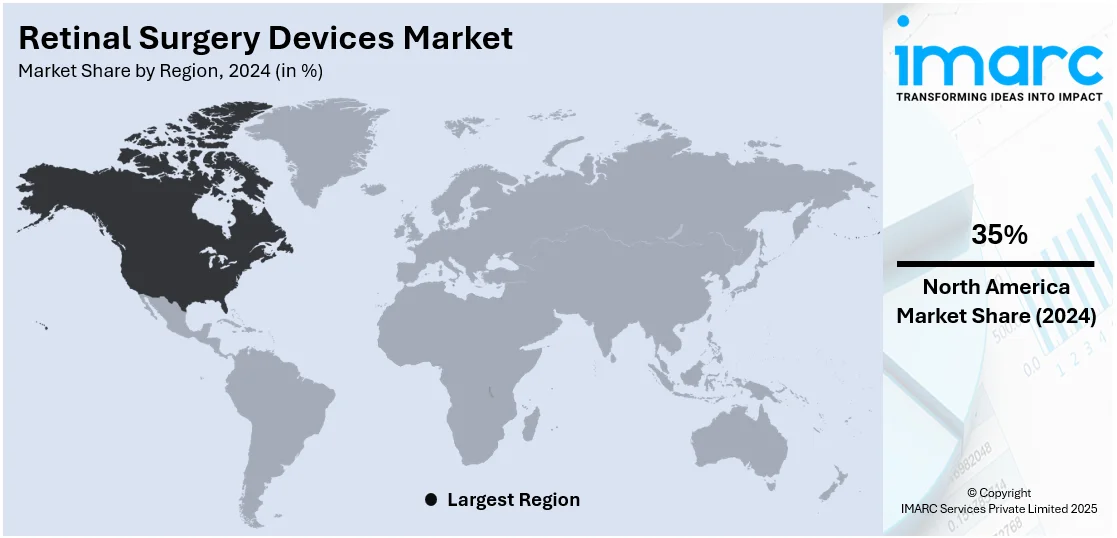

The global retinal surgery devices market size was valued at USD 2.2 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 3.9 Billion by 2033, exhibiting a CAGR of 6.3% during 2025-2033. North America currently dominates the market, holding a significant market share of around 35% in 2024. The market is driven by the rising prevalence of retinal disorders, including diabetic retinopathy and AMD, fueled by aging population and increasing diabetes cases. Technological advancements in minimally invasive surgeries, such as microincision vitrectomy, enhance treatment efficacy. Growing healthcare expenditure, improved access to eye care in emerging markets, and government initiatives promoting early diagnosis further propel demand. Additionally, increasing R&D investments and the introduction of innovative devices are further expanding the retinal surgery devices market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.2 Billion |

|

Market Forecast in 2033

|

USD 3.9 Billion |

| Market Growth Rate (2025-2033) | 6.3% |

The market is driven by the rising prevalence of retinal disorders such as age-related macular degeneration (AMD), diabetic retinopathy, and retinal detachment. Technological advancements in minimally invasive surgical techniques, such as microincision vitrectomy surgery (MIVS), enhance treatment efficacy and patient outcomes. Additionally, the growing geriatric population, which is more susceptible to retinal diseases, fuels market demand. By 2080, the global number of individuals aged 65 and above is expected to stand at 2.2 billion, outnumbering children under the age of 18, against a background of a peak global population of 10.3 billion in the 2080s. Life expectancy is also increasing, rising from 73.3 years in 2024 to 77.4 years in 2054, resulting in increased demand for eye care services among the elderly population. The changing demographics of the aging population indicate the urgent need for investment in cutting-edge retinal surgery technologies to improve vision health in the fast-growing geriatric markets around the world. Increased healthcare expenditure and improved access to advanced ophthalmic care in emerging economies further contribute to the retinal surgery devices market growth. Supportive government initiatives and increasing awareness about early diagnosis and treatment also play a significant role in expanding the market.

The United States stands out as a key regional market, primarily driven by the rising incidences of chronic eye conditions, particularly among the aging population. Over 12 million U.S. adults aged 40 and older have vision impairment, including 1 million who are blind. The number is estimated to more than double by the year 2050, mostly due to aging and chronic conditions such as diabetes. Vision disability ranks among the leading ten health problems in U.S. adults, with diabetic retinopathy causing 90% of cases of preventable blindness. Since the economic cost of vision impairment is likely to hit USD 373 Billion by 2050, demand for innovative retinal surgery equipment to treat such inescapable disorders is high. Increasing cases of diabetes contribute to higher demand for diabetic retinopathy treatments, while innovations in vitrectomy systems and surgical lasers improve procedural outcomes. Strong healthcare infrastructure and the presence of major industry players drive rapid adoption of advanced technologies. Additionally, heightened patient awareness and proactive screening programs facilitate early disease detection, improving surgical interventions. Regulatory approvals for novel devices and strategic collaborations among manufacturers further stimulate market expansion, ensuring a steady pipeline of cutting-edge retinal surgical solutions.

Retinal Surgery Devices Market Trends:

Rising Eye Disorder Prevalence

The increasing global prevalence of vision-related disorders among the masses is a major catalyst for growth in the market. Conditions such as macular degeneration, retinitis pigmentosa, and diabetic retinopathy are becoming more widespread, especially among diabetic and aging populations across the globe. Along with this, diabetic retinopathy alone affects 25.2% of individuals living with diabetes worldwide, with a significantly higher occurrence in type 1 diabetics (approximately 75%) compared to 50% in type 2 diabetics. According to the retinal surgery devices market forecast, these alarming statistics are pushing the demand for effective and efficient surgical solutions. The rise in cases requiring precise treatment is leading to increased adoption of retinal surgery devices, which are considered cost-effective, time-saving, and highly efficient during procedures. With a growing global diabetic population, this trend is expected to persist, supporting market expansion. In response, healthcare providers are prioritizing early diagnosis and advanced surgical interventions to manage progressive eye diseases effectively.

Geriatric Population and Age-Related Vision Loss

The aging demographic worldwide is another prominent factor enhancing the retinal surgery devices market demand. Elderly individuals are more susceptible to age-related ocular diseases such as cataracts, glaucoma, and presbyopia. Cataract prevalence provides a clear example: among individuals aged 45–54, the condition affects 4% of females and 2.4% of males, which dramatically increases to 30.49% in females and 27.97% in males aged 75 and above. As the global population continues to age, the healthcare sector is experiencing a corresponding rise in the need for advanced surgical interventions tailored to the unique requirements of older patients. Retinal surgery devices offer significant benefits, including less pain, minimal scarring, and quicker recovery times, which are particularly appealing for geriatric patients. This demography’s growing vulnerability to chronic vision issues is encouraging healthcare systems and device manufacturers to invest in technologies that improve outcomes while ensuring comfort and safety for older individuals. Therefore, this is further creating a positive retinal surgery devices market outlook.

Technological Advancements and Rising Diabetes Incidence

Technological progress in minimally invasive surgical tools and equipment is significantly shaping the future of the retinal surgery devices market. Simultaneously, the steep rise in global diabetes cases is creating further demand for specialized eye care solutions. According to the International Diabetes Federation (IDF), nearly 589 million adults currently live with diabetes, a number projected to rise to 853 million by 2050. This chronic condition contributes to more than 3.4 million deaths each year and is a key driver behind the increasing cases of diabetic retinopathy and related vision issues. The shift towards minimally invasive surgeries aligns with the broader push for better patient outcomes, faster recovery, and enhanced safety. Innovations in retinal surgery devices are offering these benefits while catering to the growing diabetic population’s unique medical needs. As awareness of treatment options spreads globally, this convergence of technological innovation and health demographics is propelling market growth.

Retinal Surgery Devices Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global retinal surgery devices market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on equipment type, application, and end-use.

Analysis by Equipment Type:

- Vitrectomy Machines

- Retinal Laser Equipment

- Surgical Instruments

- Cannulas

- Forceps

- Cutters

- Cryoprobes

- Others

Vitrectomy machines stand as the largest component in 2024, holding around 44.8% of the market, driven by their critical role in treating complex retinal conditions, such as diabetic retinopathy, retinal detachment, and macular holes. These advanced systems enable precise removal of vitreous gel and scar tissue while minimizing trauma to surrounding structures, improving surgical outcomes. According to the retinal surgery devices market research report, the shift toward minimally invasive vitrectomy surgery (MIVS) with smaller-gauge instruments has further increased adoption, reducing recovery times and complications. Technological advancements, including high-speed cutters, integrated fluidics, and enhanced visualization systems, enhance surgical efficiency and safety. Additionally, the rising prevalence of retinal diseases, an aging population, and increasing diabetic cases contribute to sustained demand. Leading manufacturers continue to innovate, introducing portable and user-friendly systems that expand accessibility in both hospitals and ambulatory surgical centers. With superior efficacy and expanding applications, vitrectomy machines remain indispensable in retinal surgery, securing their position as the leading equipment type in the market.

Analysis by Application:

- Diabetic Retinopathy

- Retinal Detachment

- Others

Diabetic retinopathy leads the market with around 40.6% of market share in 2024, primarily due to the escalating global prevalence of diabetes and its associated ocular complications. As a leading cause of vision loss among working-age adults, this progressive condition demands advanced surgical interventions such as vitrectomy and laser photocoagulation to manage vitreous hemorrhages, retinal detachment, and macular edema. The growing diabetic population, coupled with poor glycemic control in many patients, fuels the need for early and aggressive treatment, driving demand for specialized retinal surgery devices. Additionally, increasing awareness about diabetes-related eye complications and improved screening programs have led to earlier diagnosis, expanding the patient pool requiring surgical care. Technological advancements in imaging and microsurgical tools further enhance treatment precision, supporting segment growth. With diabetes rates continuing to rise worldwide, particularly in aging populations, diabetic retinopathy is expected to maintain its dominance as the key application driving the retinal surgery devices market.

Analysis by End-Use:

- Hospitals

- Ophthalmology Clinics

- Others

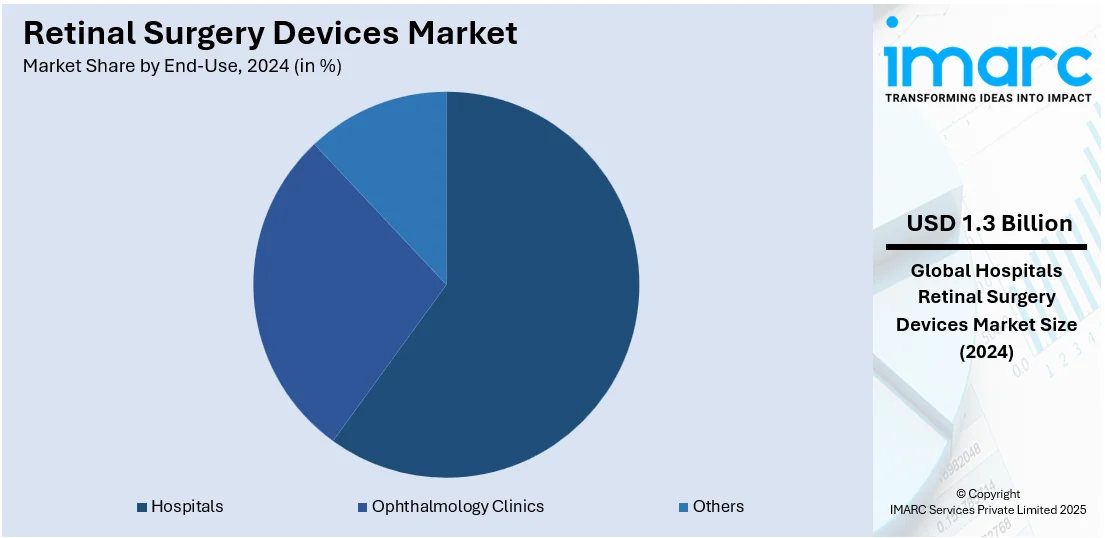

Hospitals lead the market with around 60.1% of market share in 2024, due to their advanced infrastructure, availability of skilled ophthalmologists, and ability to handle complex retinal procedures. Equipped with state-of-the-art operating rooms and diagnostic tools, hospitals are the primary settings for vitrectomies, retinal detachment repairs, and other intricate eye surgeries. The increasing prevalence of retinal disorders, coupled with rising hospital admissions for vision-related conditions, further drives demand in this segment. Additionally, hospitals often serve as referral centers for specialized ophthalmic care, attracting patients requiring advanced surgical interventions. The growing adoption of minimally invasive retinal surgeries in hospital settings, supported by favorable reimbursement policies, also contributes to segment dominance. With continuous investments in healthcare infrastructure and the integration of cutting-edge surgical technologies, hospitals remain the preferred choice for retinal treatments, reinforcing their position as the leading end-use segment in the market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 35%, driven by advanced healthcare infrastructure, high adoption of innovative surgical technologies, and a significant patient pool suffering from retinal disorders. The region's leadership is reinforced by the rising prevalence of diabetes and age-related macular degeneration (AMD), increasing demand for vitrectomy and other retinal procedures. Well-established reimbursement policies, particularly in the U.S., enhance patient access to advanced treatments, while strong R&D investments by key industry players accelerate product development. Additionally, the presence of leading ophthalmic centers and skilled surgeons supports the adoption of cutting-edge devices. High awareness about retinal health and proactive screening programs further contribute to early diagnosis and surgical intervention. With continuous technological advancements and favorable regulatory frameworks, North America remains the largest and most influential regional segment in the global retinal surgery devices market.

Key Regional Takeaways:

United States Retinal Surgery Devices Market Analysis

In 2024, the US accounted for around 85.80% of the total North America retinal surgery devices market. The United States market is primarily driven by the increasing prevalence of retinal disorders, including age-related macular degeneration (AMD) and diabetic retinopathy. According to the CDC, in 2021, approximately 9.6 million individuals in the United States were affected by diabetic retinopathy (DR). Among them, 1.84 million were experiencing vision-threatening forms of DR. In line with this, continual advancements in retinal imaging and diagnostic technologies, enabling earlier detection and more accurate treatment of retinal conditions, are propelling market growth. Furthermore, the rising aging population, which is more susceptible to retinal diseases, is contributing to market demand. Additionally, the growing adoption of minimally invasive procedures, with these techniques offering quicker recovery times and reduced risks, is driving the market expansion. The enhanced surgical outcomes facilitated by innovations in retinal surgery devices, such as improved lasers and surgical microscopes, are stimulating market appeal. Similarly, the increased awareness of retinal diseases and advancements in personalized medicine are expanding the market scope. Moreover, favorable reimbursement policies and government initiatives promoting eye health are creating lucrative opportunities in the market.

Europe Retinal Surgery Devices Market Analysis

The market in Europe is experiencing growth due to increasing geriatric population leading to a higher prevalence of age-related macular degeneration and diabetic retinopathy. As per an industry report, in Europe, age-related macular degeneration (AMD) affects about 67 million individuals, projected to reach 77 million by 2050. Prevalence rises from 5% in ages 55–64 to 17.4% in those over 85, with 1.4 late-stage AMD cases per 1,000 individuals aged 60+, annually. Similarly, enhanced reimbursement policies in key European countries are making retinal procedures more accessible in the market. The growing adoption of minimally invasive vitreoretinal surgery techniques fueling the need for precision instruments, is fostering market expansion. Furthermore, continuous innovation by European manufacturers in micro-incision and illumination technologies is accelerating higher product uptake. The rising awareness campaigns and proactive screening initiatives improving early diagnosis rates are enhancing market appeal. Additionally, the expansion of ophthalmology training programs contributing to a skilled workforce, enabling the safe use of complex devices, is bolstering market development. Besides this, numerous cross-border healthcare collaborations and harmonized regulatory frameworks within the EU encouraging product approvals and regional distribution, are providing an impetus to the market.

Asia Pacific Retinal Surgery Devices Market Analysis

The Asia Pacific market is being propelled by the changing lifestyles, rising diabetes rates, and increasing diabetic retinopathy cases. According to NCBI, the number of individuals with diabetes in India rose sharply from 33 million in 2000 to 72 million in 2021 and is expected to reach 125 million by 2045. In accordance with this, rising investments in public and private healthcare infrastructure, improving access to advanced ophthalmic procedures, are supporting market expansion. The increasing presence of a large patient pool and rising disposable incomes is increasing the affordability and demand in the market. Furthermore, the expansion of medical tourism across Southeast Asia, heightening the requirement for cutting-edge retinal surgical technologies, is a significant market driver. Additionally, the growing presence of device makers in the region, augmenting access to innovative retinal surgery tools suited to local needs, is impelling the market. Moreover, favorable government-led health initiatives in countries including India and China, promoting eye health awareness and early detection, are impacting the market dynamics.

Latin America Retinal Surgery Devices Market Analysis

In Latin America, the market is advancing due to increasing rates of chronic eye conditions such as retinal detachment and macular holes, particularly in aging populations. Furthermore, various government-led efforts to expand universal healthcare coverage are enhancing access to ophthalmic surgeries in the market. As per NCBI, 14.14% of the population in Latin America suffers from moderate to severe vision impairment and blindness. Blindness is most prevalent in Tropical Latin America at 3.89%, and least in Southern Latin America at 0.96%. The rising awareness about preventable blindness fostering early diagnosis and timely interventions, is propelling the market growth. In addition to this, numerous regional partnerships with global manufacturers are driving advanced surgical tech and training adoption, augmenting outcomes in public and private care.

Middle East and Africa Retinal Surgery Devices Market Analysis

The market in the Middle East and Africa is significantly progressing attributed to the growing burden of inherited retinal disorders. Similarly, increasing penetration of vision care services in underserved rural areas, expanding the treatment base, is impelling development in the market. Furthermore, the rising prevalence of hypertension and lifestyle-related conditions is leading to a rise in retinal vascular complications is driving the need for precision retinal surgery tools and advanced diagnostic equipment, thereby expanding market reach. According to NCBI, hypertension affects approximately 36% of the general population in the African region. Apart from this, strategic collaborations with international ophthalmic organizations, enhancing clinical training and knowledge transfer, are influencing the market dynamics.

Competitive Landscape:

The competitive landscape of the market is characterized by intense rivalry among key players striving to strengthen their market position. Companies are focusing on technological advancements, launching next-generation devices with enhanced precision, efficiency, and minimally invasive capabilities. Strategic collaborations, mergers, and acquisitions are common as firms aim to expand their product portfolios and geographic reach. Investments in research and development are prioritized to introduce innovative solutions for complex retinal conditions. Additionally, players are emphasizing regulatory approvals and clinical validations to ensure product efficacy and safety. Marketing strategies include educational initiatives to raise awareness among healthcare professionals, while competitive pricing and after-sales support further drive adoption. The market also sees a growing emphasis on portable and user-friendly systems to cater to diverse clinical settings, reinforcing competition.

The report provides a comprehensive analysis of the competitive landscape in the retinal surgery devices market with detailed profiles of all major companies, including:

- Alcon Management S. A.

- Bausch & Lomb Incorporated

- Carl Zeiss

- Ellex Medical Lasers

- Erbe Elektromedizin

- Escalon Medicals

- Iridex Corporation

- Leica Microsystems GmbH

- Lumenis

- Nidek Co. Ltd.

- Optos PLC

- Second Sigh Medical Products

- Synergetics USA Inc.

- Topcon Corporation

Latest News and Developments:

- February 2025: Optos unveiled MonacoPro, an advanced ultra-widefield and OCT retinal imaging system. Building on the original Monaco, it offered enhanced OCT image quality, the new AreaAssist tool for workflow efficiency, and a larger reference database, aiming to enhance diagnostic precision and streamline eye care practices.

- January 2025: Norlase received FDA 510(k) clearance and CE Mark for LYNX, a fully integrated pattern scanning laser indirect ophthalmoscope. Designed for retina treatments, LYNX enhanced portability, efficiency, and precision with wireless controls, advanced laser patterns, and voice activation.

- September 2024: ZEISS unveiled advanced AI tools and surgical technologies at EURETINA 2024 to enhance retinal care. Highlights included the ARTEVO 850 3D visualization system, CIRRUS PathFinder AI for OCT review, EVA NEXUS surgical system, and Surgery Optimizer for video analysis, streamlining diagnostics, and improving surgical outcomes.

- June 2024: Alcon announced US FDA 510(k) clearance for its Unity VCS and Unity CS systems, part of its new Unity portfolio for cataract and vitreoretinal surgery. These innovations offered enhanced workflow efficiency and would reportedly begin broad commercialization in 2025.

Retinal Surgery Devices Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Equipment Types Covered |

|

| Applications Covered | Diabetic Retinopathy, Retinal Detachment, Others |

| End-Uses Covered | Hospitals, Ophthalmology Clinics, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Alcon Management S. A., Bausch & Lomb Incorporated, Carl Zeiss, Ellex Medical Lasers, Erbe Elektromedizin, Escalon Medicals, Iridex Corporation, Leica Microsystems GmbH, Lumenis, Nidek Co. Ltd., Optos PLC, Second Sigh Medical Products, Synergetics USA Inc., Topcon Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the retinal surgery devices market from 2019-2033.

- The retinal surgery devices market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the retinal surgery devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The retinal surgery devices market was valued at USD 2.2 Billion in 2024.

IMARC estimates the retinal surgery devices market to exhibit a CAGR of 6.3% during 2025-2033, reaching a value of USD 3.9 Billion by 2033.

The market is driven by the rising prevalence of retinal disorders such as diabetic retinopathy and AMD, an aging population, technological advancements in minimally invasive surgeries, increasing healthcare expenditure, and expanding access to eye care in emerging regions.

North America currently dominates the retinal surgery devices market, accounting for a share exceeding 35%. This dominance is fueled by advanced healthcare infrastructure, rising cases of retinal disorders, technological innovation, and robust reimbursement policies.

Some of the major players in the retinal surgery devices market include Alcon Management S. A., Bausch & Lomb Incorporated, Carl Zeiss, Ellex Medical Lasers, Erbe Elektromedizin, Escalon Medicals, Iridex Corporation, Leica Microsystems GmbH, Lumenis, Nidek Co. Ltd., Optos PLC, Second Sigh Medical Products, Synergetics USA Inc., and Topcon Corporation, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)