Ride-Hailing Service Market Size, Share, Trends and Forecast by Vehicle Type, Service Type, Payment Method, Location Type, End User, and Region, 2025-2033

Ride-Hailing Service Market Size and Share:

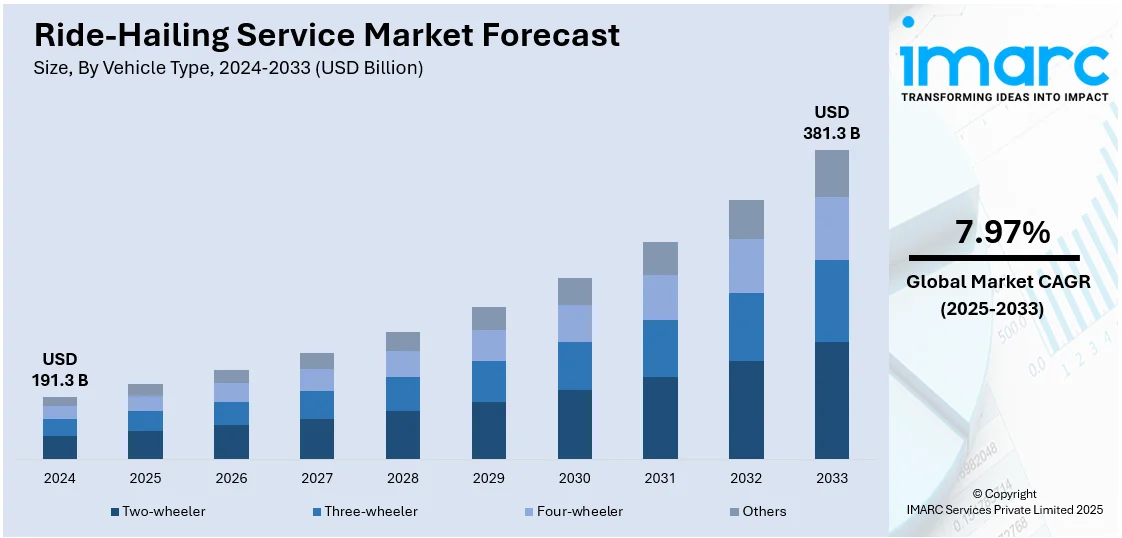

The global ride-hailing service market size was valued at USD 191.3 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 381.3 Billion by 2033, exhibiting a CAGR of 7.97% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 35.0% in 2024. The market is driven by urbanization, increasing smartphone penetration, rising disposable income, convenience, affordability, traffic congestion concerns, digital payment adoption, growing demand for shared mobility, fuel cost fluctuations, government policies, sustainability initiatives, AI-driven route optimization, safety features, and the expansion of electric and autonomous vehicles, fostering competition.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 191.3 Billion |

|

Market Forecast in 2033

|

USD 381.3 Billion |

| Market Growth Rate 2025-2033 | 7.97% |

One major driver in the ride-hailing service market is the growing demand for cost-effective and convenient transportation. Urbanization and increasing traffic congestion have led consumers to seek alternatives to traditional taxis and personal vehicles. Ride-hailing services offer affordability, real-time tracking, and ease of booking through mobile apps, enhancing user experience. Additionally, younger demographics and professionals prefer on-demand mobility solutions over car ownership, further fueling market growth. Integration of AI-based route optimization and dynamic pricing models also improves efficiency and service availability. Expanding internet penetration and smartphone adoption continue to support the widespread adoption of ride-hailing services across various regions.

The U.S. ride-hailing service market is driven by high urbanization, strong digital infrastructure, and increasing consumer preference for on-demand mobility with 87.20% market share. Major players like Uber and Lyft dominate the market, offering extensive coverage and diverse service options, including ride-sharing and luxury rides. The rise of cashless transactions and AI-driven route optimization enhances user convenience. Regulatory challenges and labor classification issues for drivers remain key hurdles. Growing adoption of electric and autonomous vehicles is shaping the market’s future. Additionally, corporate partnerships and integration with public transit systems contribute to the expansion of ride-hailing services across U.S. cities and suburbs.

Ride-Hailing Service Market Trends:

Strategic Partnerships and Collaborations

The global ride-hailing service market has witnessed significant growth in the last couple of years driven by strategic partnerships and alliances for improving service delivery and customer experience. For instance, in April 2021, Gett partnered with Curb for improving post-pandemic business travel, offering corporate clients access to an array of services ranging from limousine to local taxi, as well as ride-hailing services like Lyft. This partnership sought to increase the ease of business travel and adapt to changing customer demands. Also, in June 2021, Hyundai Motor Group and Grab Holdings Inc. (Grab) formed a strategic alliance to speed up the use of electric vehicles (EVs) in Southeast Asia. The alliance is directed towards lowering obstacles to EV take-up by reducing overall cost of ownership and soothing range anxiety issues. These efforts are a testament to the increasing focus on sustainability and the move towards cleaner transport options, which are likely to be instrumental in fueling the further growth of the global ride-hailing service market.

Technological Advancements and Innovations

The ride-hailing services market is experiencing unprecedented expansion due to the adoption of newer technologies, such as mobile applications, GPS-enabled navigation, and AI-driven algorithms, that enhance customer experience as well as the efficiency of the operations. The technologies make the process of booking, route optimisation, and overall service much more convenient and reliable. Furthermore, the growing demand for electric vehicles (EVs) and autonomous cars is also playing a crucial role in reducing operational expenses, minimizing the environmental impact, and meeting the growing demand for eco-friendly means of transport. For instance, in November 2022, Motional and Lyft launched self-driving electric "robotaxis" in Los Angeles, which is a significant step towards autonomous, green ride-hailing services. In addition, BluSmart, a startup for electric mobility, in December 2023 raised USD 24 million to scale its electric ride-hailing business by constructing large-scale charging superhubs, once again enhancing the market's potential for growth and sustainability.

Rising Demand for Convenient and Cost-Effective Transportation

With urbanization accelerating further, the need for cost-effective, efficient, and convenient transport systems is increasing fast. Ride-hailing has turned out to be a favorite because of its versatility, lower fare compared to classic taxis, and ample vehicle selection. These rides meet the needs of customers in search of affordability and convenience, particularly in congested city environments. As per the United Nations, 55% of the global population is now living in cities, and this figure is likely to increase to 68% by 2050. This urbanization is fueling the expansion of the ride-hailing service market, as consumers increasingly turn to on-demand, convenient transportation solutions to move around congested cities in an efficient manner. As the world urban population grows, ride-hailing services stand ready to become an integral part of addressing the changing transportation needs of city residents.

Ride-Hailing Service Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global ride-hailing service market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on vehicle type, service type, payment method, location type and end user.

Analysis by Vehicle Type:

- Two-wheeler

- Three-wheeler

- Four-wheeler

- Others

Four-wheelers dominate the ride-hailing market with a 67.5% share due to their comfort, safety, and capacity advantages over two- and three-wheelers. Consumers prefer cars for daily commuting, business travel, and family transportation, as they offer better weather protection, luggage space, and seating capacity. The presence of multiple ride options, including economy, premium, and shared rides, caters to diverse user preferences. Additionally, corporate partnerships and airport transfers drive demand for four-wheeler ride-hailing services. The rise of electric and hybrid cars in fleets supports sustainability goals while reducing operational costs. Moreover, increasing urbanization, rising disposable incomes, and enhanced app-based features like real-time tracking and digital payments further fuel the dominance of four-wheelers in the market.

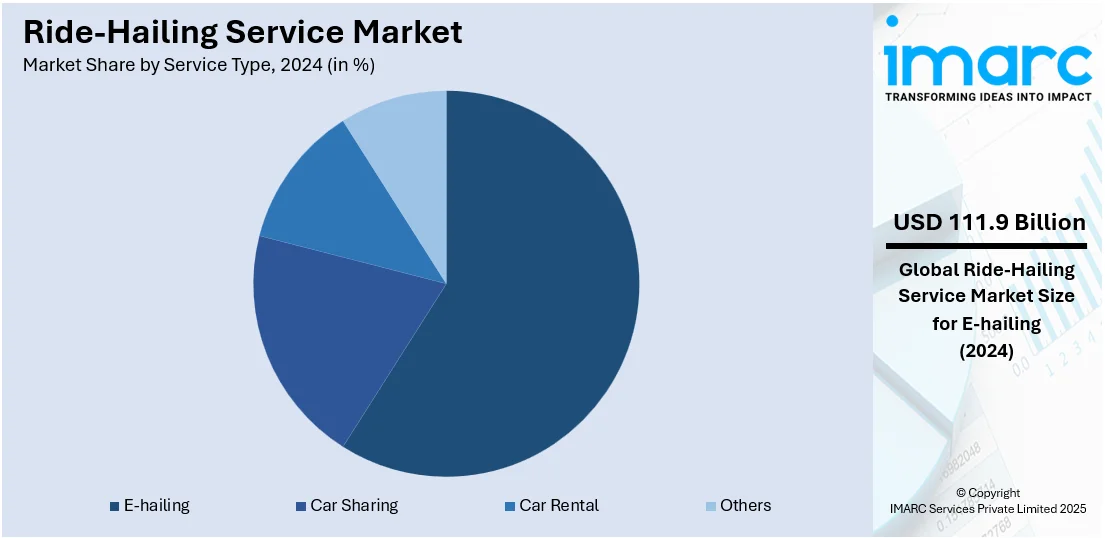

Analysis by Service Type:

- E-hailing

- Car Sharing

- Car Rental

- Others

E-hailing holds the largest market growth at 58.5% due to its convenience, affordability, and seamless digital integration. App-based ride-hailing platforms offer real-time ride matching, dynamic pricing, and GPS tracking, enhancing user experience. The increasing adoption of smartphones and digital payments accelerates e-hailing penetration, especially in urban areas. Consumers prefer on-demand mobility over traditional taxi services due to transparent pricing, faster response times, and flexible ride options. Additionally, AI-driven route optimization improves efficiency, reducing wait times and fuel costs. Expanding corporate partnerships for employee mobility and integration with public transit further drive growth. The rise of electric and shared mobility solutions within e-hailing platforms aligns with sustainability goals, contributing to continued market expansion globally.

Analysis by Payment Method:

- Cash

- Online

Online account for the majority of ride-hailing market shares at 67.5% due to widespread smartphone adoption, seamless app-based booking systems, and digital payment integration. The convenience of instant ride requests, real-time tracking, and fare transparency attracts a large customer base. Enhanced user experience through AI-driven route optimization and dynamic pricing further boosts engagement. The shift toward cashless transactions, supported by e-wallets and fintech solutions, accelerates digital adoption. Additionally, loyalty programs, ride subscriptions, and corporate tie-ups enhance customer retention. The expansion of internet connectivity, particularly in emerging markets, facilitates the growth of online ride-hailing services. Furthermore, the rise of super apps integrating multiple mobility services strengthens consumer reliance on online platforms for transportation needs.

Analysis by Location Type:

- Urban

- Rural

Urban represent the largest market growth in the ride-hailing sector, accounting for 84.8%, due to high population density, increased traffic congestion, and greater reliance on shared mobility solutions. The convenience of app-based transportation, coupled with the decline in car ownership among younger demographics, drives adoption. Cities have well-established digital infrastructure, supporting seamless bookings, cashless payments, and AI-driven route optimization. Additionally, urban commuters seek cost-effective alternatives to public transit, further fueling demand. The rise of corporate partnerships for employee transportation and last-mile connectivity solutions also contributes to market expansion. Moreover, growing investments in electric and autonomous ride-hailing services enhance sustainability efforts, aligning with urban regulations aimed at reducing carbon emissions and traffic congestion.

Analysis by End User:

- Personal

- Commercial

The personal segment dominates the ride-hailing market as individuals increasingly prefer cost-effective, convenient, and flexible transportation over car ownership. Urban dwellers, tourists, and daily commuters rely on these services for short-distance travel. Features like app-based bookings, real-time tracking, and multiple ride options enhance user convenience and demand.

The commercial segment is expanding as businesses integrate ride-hailing services for employee transportation, corporate travel, and delivery logistics. Companies utilize these platforms for cost-efficient mobility solutions, reducing fleet maintenance expenses. Ride-hailing partnerships with enterprises, food delivery services, and e-commerce platforms further drive demand, improving operational efficiency and service accessibility.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia leads the ride-hailing market with a 35.0% share due to rapid urbanization, high smartphone penetration, and growing middle-class disposable income. Countries like China, India, and Southeast Asian nations have dense metropolitan areas where ride-hailing services offer affordable and efficient transportation alternatives. The presence of dominant regional players such as Didi, Ola, and Grab, along with aggressive expansion strategies, boosts market growth. Government initiatives supporting smart mobility and digital payment adoption further enhance service accessibility. Additionally, rising fuel prices and increasing traffic congestion encourage consumers to shift from private vehicle ownership to ride-hailing. The integration of electric and shared mobility solutions, along with corporate collaborations and food delivery services, strengthens the market’s expansion across Asia’s urban and semi-urban regions.

Key Regional Takeaways:

North America Ride-Hailing Service Market Analysis

The North American ride-hailing service market is driven by advanced digital infrastructure, high smartphone penetration, and strong consumer demand for convenient mobility solutions. Urban congestion and declining car ownership among younger demographics contribute to market expansion. The region sees widespread adoption of AI-driven route optimization, dynamic pricing, and seamless digital payment systems, enhancing user experience. Regulatory challenges, including labor classification laws and safety standards, impact market operations. However, strategic partnerships with corporate sectors, airports, and public transit systems strengthen service accessibility. The increasing adoption of electric and autonomous vehicles aligns with sustainability goals, further shaping market trends. Growing demand for shared mobility solutions and subscription-based ride services contributes to sustained growth. Additionally, integration with food delivery and logistics services enhances market diversification. Ride-hailing companies continuously innovate by expanding multi-modal transport options, ensuring competitiveness. The combination of technological advancements and evolving consumer preferences solidifies North America's role as a key market in the global ride-hailing industry.

United States Ride-Hailing Service Market Analysis

The US ride-hailing industry is poised to experience massive growth due to urbanization, consumer demand, and technological progress. As per the Center for Sustainable Systems (CSS), nearly 89% of America will be urban by 2050, hence significantly fuelling demand for flexible and efficient transportation. Ride-hailing services are getting popular because they are convenient, affordable, and have the capability of providing different types of vehicles from conventional taxis. In line with this trend, consumer spending reports for March 2024 indicate a sharp rise in rideshare sales, with Uber sales being 10% higher year on year, while Lyft saw a 3% year-on-year increase. The above figures attest to the growing reliance of consumers on ride-hailing services. Apart from that, the growing demand for electric vehicles and the coming of age of autonomous cars will further drive the market growth, promoting steady growth in the U.S. ride-hailing services market.

Europe Ride-Hailing Service Market Analysis

The Europe ride-hailing market is set for expansion, stimulated by a heavy thrust towards sustainability and the widespread use of electric vehicles (EVs). As part of environmental aspirations, Uber has an ambitious aim of making every vehicle on its platform in London electric by 2025. In accordance with this, the company has announced the Uber Clean Air Plan to help drivers transition to clean electric vehicles. This move captures the bigger European trend of governments and consumers moving towards sustainability and reducing carbon footprint. In addition, growing urbanization, as more and more individuals move into urban areas seeking convenient and cost-effective transportation options, is further propelling the demand for ride-hailing services. Governments imposing stricter environmental controls, such as emissions controls, will result in ride-hailing firms with EVs included in their fleets being well-positioned to capture market share, and hence sustainability will be a key growth driver in the European ride-hailing services market.

Asia Pacific Ride-Hailing Service Market Analysis

The Asia-Pacific ride-hailing industry is growing at a rapid pace owing to the interplay of urbanization, technological shift, and governmental encouragement. Urbanization and the growth in population in the region are propelling the need for effective, convenient, and economical transport services. Uber's cooperation with IAS Secretary of the Transport Department, Government of West Bengal, in November 2023 to introduce a bus shuttle service in Kolkata is a typical example of making a transition towards integrating ride-hailing services with public transport systems. Additionally, the plans of the Karnataka government to launch its own ride-hailing app in December 2023 are also reflective of the growing competition and localisation in the market. Growing adoption of electric and autonomous vehicles in the region also mitigates operational costs and enhances sustainability, which attracts more consumers to ride-hailing services. With the transportation dynamics of the region continuing to move, government regulation and innovation in mobile technology will continue to fuel ride-hailing service growth in the Asia-Pacific region.

Latin America Ride-Hailing Service Market Analysis

The Latin American ride-hailing services market is steadily growing, with Brazil being the leader. According to reports, the market is expected to expand by 3.70% from 2025 to 2029, spurred by a number of factors. A primary factor that is facilitating increased access to ride-hailing services is the growing smartphone and app adoption. With rising internet penetration, more consumers are opting for hassle-free, affordable modes of transport. The ride-hailing business in Brazil alone is poised for tremendous growth, thanks to its huge, urbanized population and increasing need for hassle-free transport solutions.

Also, the drive towards sustainability and innovation is defining the market's future. The use of electric vehicles (EVs) in ride-hailing fleets is gaining traction, as businesses seek to cut costs and enhance environmental performance. Government incentives for electric mobility and programs such as shared ride services are also driving the market, with ride-hailing emerging as a central component of the urban transportation ecosystem in the region.

Middle East and Africa Ride-Hailing Service Market Analysis

The Middle East and Africa (MEA) ride-hailing industry will see heavy growth with technological advancements and urbanization. Over the next five years, the region can expect nearly 200 million additional smartphone connections, reaching 565 million by the end of 2025, according to reports. This mobile revolution is instrumental in driving the demand for on-demand ride-hailing services because it enables users to access mobile platforms much more effectively and conveniently.

Urbanization in the key MEA cities, combined with increased mobility requirements, is also driving the demand for affordable and convenient means of transportation. The increasing popularity of electric and autonomous cars in the region also presents prospective opportunities, including lower operating costs and a lighter environmental footprint, thus making ride-hailing services more attractive. Moreover, government policies to promote competition and enhance safety within the general population will also continue to ensure enabling conditions for the growth of the ride-hailing market in the MEA region.

Competitive Landscape:

The ride-hailing market is highly competitive, driven by innovation, service diversification, and regional expansion. Companies focus on enhancing user experience through AI-driven route optimization, dynamic pricing, and seamless payment integration. Competition intensifies with the introduction of loyalty programs, ride subscriptions, and multi-modal transport options, including electric and shared mobility. Market players invest in technological advancements such as autonomous vehicles and real-time tracking to gain an edge. Regulatory challenges, driver retention, and fluctuating fuel prices influence market dynamics. Strategic partnerships with public transit systems, corporate sectors, and food delivery services strengthen market positioning. Additionally, regional players leverage localized strategies, while global platforms expand aggressively, intensifying competition across urban and semi-urban markets worldwide.

The report provides a comprehensive analysis of the competitive landscape in the ride-hailing service market with detailed profiles of all major companies, including:

- Aptiv PLC

- Be Group JSC

- BlaBlaCar

- Bolt Technology OÜ

- FREE NOW

- Gett

- Grab

- InDriver

- Lyft Inc.

- Ola Cabs

- Ridecell Inc.

- TomTom N.V.

- Uber Technologies Inc

Latest News and Developments:

- April 2024: The government of Japan formally approved the use of private ride-hailing services, including Uber and Go, that are accessible via mobile apps.

- In March 2024, Alphabet's autonomous driving division, Waymo, launched its ride-hailing service, Waymo One, in Los Angeles, California. Initially, the service was made available to the public for free after the successful completion of the Waymo One Tour program.

- December 2023: BluSmart, an electric mobility firm, raised USD 24 million from its recent fundraise. This money will go towards building massive-scale charging superhubs for supporting the scale-up of its electric ride-hailing business.

- May 2023: Uber has announced a deal with fleet operators like Lithium, Everest, and Moove to launch 25,000 electric cars for the Indian market. Further, the company also shared plans to launch 10,000 electric two-wheelers in Delhi by end-2024, in association with EV startup Zypp Electric.

Ride-Hailing Service Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Two-wheeler, Three-wheeler, Four-wheeler, Others |

| Service Types Covered | E-hailing, Car Sharing, Car Rental, Others |

| Payment Methods Covered | Cash, Online |

| Location Types Covered | Urban, Rural |

| End Users Covered | Personal, Commercial |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Aptiv PLC, Be Group JSC, BlaBlaCar, Bolt Technology OÜ, FREE NOW, Gett, Grab, InDriver, Lyft Inc., Ola Cabs, Ridecell Inc., TomTom N.V. and Uber Technologies Inc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the ride-hailing service market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global ride-hailing service market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the ride-hailing service industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The ride-hailing service market was valued at USD 191.3 Billion in 2024.

The ride-hailing service market was valued at USD 381.3 Billion in 2033 exhibiting a CAGR of 7.97% during 2025-2033.

Key factors driving the ride-hailing service market include rising urbanization, increasing smartphone penetration, and demand for cost-effective mobility solutions. AI-driven route optimization, digital payments, and multi-modal transport options enhance user experience. Corporate partnerships, electric vehicle adoption, and integration with public transit further boost market growth, improving accessibility and sustainability.

Asia Pacific dominates the ride-hailing market due to high urbanization, dense populations, and widespread smartphone adoption. Strong regional players, digital payment integration, and growing middle-class demand drive growth. Government support for smart mobility, increasing fuel costs, and shared mobility trends further enhance the region’s leadership in the global market.

Some of the major players in the ride-hailing service market include Aptiv PLC, Be Group JSC, BlaBlaCar, Bolt Technology OÜ, FREE NOW, Gett, Grab, InDriver, Lyft Inc., Ola Cabs, Ridecell Inc., TomTom N.V. and Uber Technologies Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)