Rigid Plastic Packaging Market Size, Share, Trends and Forecast by Product, Material, Production Process, End Use Industry, and Region, 2025-2033

Rigid Plastic Packaging Market Size and Share:

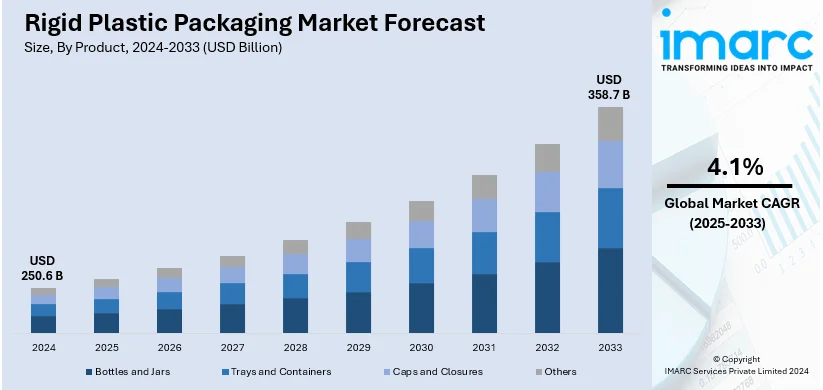

The global rigid plastic packaging market size was valued at USD 250.6 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 358.7 Billion by 2033, exhibiting a CAGR of 4.1% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 39.7% in 2024. The rising focus among key players on product safety and extended shelf life, along with the increasing preference for sustainable packaging solutions is stimulating the market across Asia Pacific.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 250.6 Billion |

| Market Forecast in 2033 | USD 358.7 Billion |

| Market Growth Rate (2025-2033) |

4.1%

|

The global rigid plastic packaging market is driven by the increasing demand for durable and lightweight packaging solutions across various industries, including food and beverages, healthcare, and personal care. The expansion of e-commerce and global trade is also boosting the demand for rigid plastic packaging to ensure safe product delivery. According to a report published by the IMARC Group, the global e-commerce market size reached USD 26.8 Trillion in 2024 and is forecasted to reach USD 214.5 Trillion by 2033, exhibiting a CAGR of 25.83% during 2025-2033. In addition, advancements in plastic manufacturing technologies, such as injection molding and thermoforming, are enhancing design flexibility and production efficiency. Besides this, the recyclability of rigid plastics aligns with the rising emphasis on sustainable packaging solutions, further driving market growth.

The United States has emerged as a key regional market for rigid plastic packaging, driven by the increasing demand for lightweight, durable, and cost-effective packaging across industries such as food and beverages, healthcare, and personal care. Moreover, the expansion of the e-commerce sector and increasing demand for secure and durable packaging for online deliveries further support market growth. As per the IMARC Group, the United States e-commerce market is projected to reach USD 2,083.97 Billion by 2032, exhibiting a CAGR of 6.80% during 2024-2032. Other than this, technological advancements in manufacturing processes, such as injection molding and blow molding, are enhancing production efficiency and design flexibility.

Rigid Plastic Packaging Market Trends:

Introduction of Sustainable Packaging Solutions

The rising consumer environmental consciousness is encouraging manufacturers to adopt recyclable and biodegradable materials, which is propelling the market. Moreover, government bodies and industry players are emphasizing on minimizing plastic waste, thereby promoting the usage of materials that have a lower impact on the environment. Besides this, prominent companies are widely incorporating recycled content into rigid plastic packaging, utilizing industrial scrap or post-consumer recycled (PCR) plastics to minimize reliance on virgin materials and divert waste from landfills. In line with this, in February 2024, Amcor signed a deal with Cadbury Australia, a subsidiary of Mondelēz International, to supply approximately 1,000 tons of post-consumer recycled (PCR) plastic to wrap the core chocolate product range of the company. Apart from this, numerous advancements in biodegradable and compostable plastics are elevating the demand for environmentally conscious packaging solutions, thereby creating a positive rigid plastic packaging market outlook.

Increasing Demand for Convenience

Numerous individuals worldwide are seeking packaging that preserves the quality of the product and offers portability. The durability and versatility provided by rigid plastic packaging make it a preferred choice for consumer convenience. Furthermore, resealable closures, such as screw caps or flip-tops, are found on rigid plastic containers for various products, including condiments, beverages, and personal care items. These closures aid in preserving product freshness and preventing spills, thereby extending the shelf life of packaged goods. For instance, in April 2024, Guillin Group's Fresh produce business unit launched innovative rPET, carton, and hybrid solutions that offer convenience to consumers without compromising on product quality. In line with this, the growing popularity of on-the-go packaging formats, such as cups, pouches, and bottles, made from rigid plastics is further stimulating the rigid plastic packaging market demand.

Introduction of Smart Packaging

Rigid plastic packaging is integral to the implementation and development of smart packaging solutions. Moreover, smart packaging solutions also enable interactive experiences, such as augmented reality (AR) features or personalized content accessible via smartphone apps, which improve consumer engagement and enhance brand loyalty. According to a recent survey, 74% of consumers mentioned product quality inspired loyalty, 66% value for money and 56% customer service. Apart from this, extensive investments in research and development (R&D) activities are further elevating the rigid plastic packaging market revenue. Consequently, these innovations are expected to bolster the market in the coming years.

Rigid Plastic Packaging Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global rigid plastic packaging market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, material, production process, and end use industry.

Analysis by Product:

- Bottles and Jars

- Trays and Containers

- Caps and Closures

- Others

Bottles and jars stand as the largest component in 2024, holding around 40.5% of the market. The rising focus of key players on branding and differentiation is primarily driving the growth in this segmentation. Moreover, bottles and jars offer product protection, visibility, and easy dispensing, thereby improving consumer convenience and maintaining product freshness. Besides this, manufacturers are prioritizing efficient packaging solutions, which is a significant growth-inducing factor. For instance, in January 2022, Ring Container Technologies, one of the manufacturers of plastic containers, launched a customizable PET solution for maintaining carbonation in beverages. Similarly, Vetroplas offers a wide range of high-quality packaging solutions, specializing in premium glass and plastic bottles and jars, with a prime focus on quality and sustainability.

Analysis by Material:

- Polyethylene (PET)

- Polypropylene (PP)

- High Density Polypropylene (HDPE)

- Others

Polypropylene (PP) leads the market with around 24.7% of market share in 2024. Rigid plastic packaging materials, particularly polypropylene (PP), are gaining extensive popularity as they exhibit exceptional properties, such as chemical resistance, high stiffness, and low density. As a result, PP finds widespread applications in producing durable and lightweight packaging solutions. Besides this, numerous innovations in the manufacturing process represent the rigid plastic packaging market's recent opportunities. For instance, in February 2024, Ravago and Repsol inaugurated the opening of a cutting-edge factory in Tangier, which is wholly devoted in producing polypropylene compounds, a critical material extensively adopted in the automotive sector. In addition to this, in March 2024, GEKA, one of Medmix's beauty brands, introduced a post-consumer-recycled (PCR) polypropylene (PP) material suitable for primary cosmetic packaging.

Analysis by Production Process:

- Extrusion

- Injection Molding

- Blow Molding

- Thermoforming

- Others

Extrusion accounts for the majority of the market share in 2024. Extrusion plays an important role in driving innovation and efficiency in the market. It enables the production of numerous packaging components, such as containers, bottles, and caps, with precision and consistency. Moreover, extrusion allows manufacturers to incorporate features such as handles or closures, create intricate designs, and optimize wall thickness for cost-effectiveness and durability. Continuous collaborations will continue to fuel the growth in this segmentation over the forecasted period. For instance, in October 2023, Davis-Standard, LLC (Davis-Standard), a global leader in extrusion equipment, acquired the Extrusion Technology Group (ETG) from entities controlled by the Dutch Investor Nimbus.

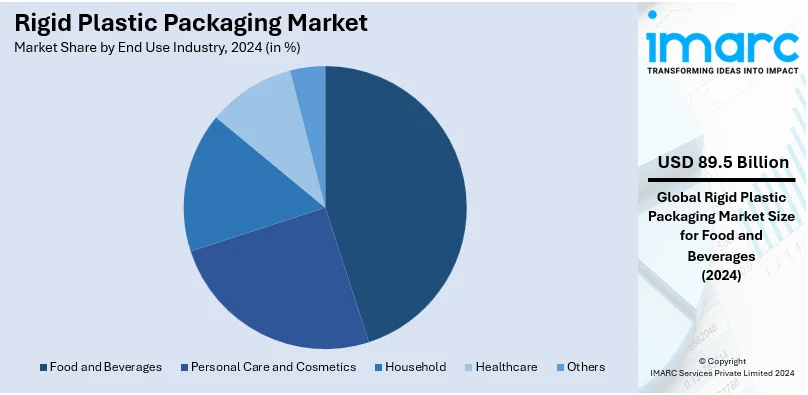

Analysis by End Use Industry:

- Food and Beverages

- Personal Care and Cosmetics

- Household

- Healthcare

- Others

Food and beverages represent the leading segment with around 35.7% of market share in 2024. The escalating demand for functional and durable packaging solutions is primarily augmenting the rigid plastic packaging market's recent price across the food and beverage industry. Additionally, prominent players are using sustainable packaging materials across the sector. For instance, in November 2023, Nestlé, one of the global leaders in the F&B industry, invested in Impact Recycling's pioneering facility to create positive environmental change and advance hard-to-recycle plastic management. In line with this, in April 2024, a new study by multinational food packaging and processing company Tetra Pak revealed a shift in the food and beverage (F&B) industry with various companies prioritizing sustainable practices. Furthermore, the wide presence of key players that cater to the emerging trend of on-the-go consumption is expected to drive the market in this segmentation over the forecasted period.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 39.7%. According to the report, Asia Pacific accounted for the largest market share. Government bodies in the Asia Pacific are implementing stringent regulations to promote a circular economy, which is driving the regional market. For instance, in February 2022, the government bodies in India notified the new Extended Producer Responsibility (EPR) guidelines under the Plastic Waste Management Rules, placing a statutory responsibility on manufacturers to recycle, collect, and reuse used plastic packaging and use recycled content in new plastic packaging. The guidelines also aimed to improve packaging sustainability by setting ambitious targets and promoting improved packaging design. According to the rigid plastic packaging market statistics, advanced recycling partnerships in Asia Pacific will continue to fuel the regional market over the forecasted period.

Key Regional Takeaways:

United States Rigid Plastic Packaging Market Analysis

In 2024, the United States accounts for over 80% of the rigid plastic packaging market in North America. The United States rigid plastic packaging market is growing at present on account of several key factors. Manufacturers are increasingly using lightweight materials that are durable as well in order to meet increasing consumer demand for sustainable and environmental-friendly packaging solutions, driven by constant regulatory pressures and environmental concerns. The food and beverages sector is witnessing a need for long shelf-life packaging since companies are emphasizing freshness and convenience, particularly for ready-to-eat and grab-and-go products. The Centers for Disease Control and Prevention says children of all age groups prefer ready-to-eat cereal that contained high amounts of sugar: 26.8% aged 2-5 years, 26.1% aged 6-11 years, and 17.3% aged 12–19 years. In addition, the health care industry as well as pharmaceutical companies are embracing rigid plastic containers due to its tamper-evident characteristics with respect to medical products as well as devices. Technological advancements in the field of packaging enable such designs as well as customization to satisfy branding and product differentiation strategies. E-commerce development also drives the market, where companies focus on more impact-resistant and lighter packaging solutions that save shipping costs and decrease damage while moving. Along with this, companies are investing in post-consumer recycled plastics and bio-based alternatives to meet sustainability goals, which go along with consumer expectations as well as regulatory mandates. All of these factors are amalgamating together to shape the rigid plastic packaging market in the United States, therefore making it a vital share within many industries.

Asia Pacific Rigid Plastic Packaging Market Analysis

The Asia-Pacific rigid plastic packaging market is currently being driven by the increasing demand for lightweight and durable packaging solutions across various industries, including food and beverages, personal care, and pharmaceuticals. Manufacturers are actively shifting toward rigid plastic packaging due to its ability to provide enhanced product protection, prolonged shelf life, and cost-effective transportation. The food and beverage sector is rapidly adopting rigid plastic packaging for items like ready-to-eat meals, dairy products, and carbonated drinks, aligning with the growing consumer preference for convenience foods. Rigids plastic containers also feature a premium look which enables personal care and cosmetics companies to attract consumers in this region's booming urban markets. Pharmaceutical companies also require rigid plastic packaging due to strict regulatory requirements and the need to maintain product integrity. On account of the e-commerce business growth in countries such as China and India, which are densely populated, the need for packaging that ensures safe deliveries of products is also on the rise. According to the International Trade Administration, Indian E-commerce value stood at about 46.2 Billion US Dollars in the year 2020. In addition to that, sustainability is a rising concern, with companies integrating their packing with reusable plastic and biodegradable plastic packaging material. These factors collectively highlight the market’s dynamic nature and its ongoing response to the region's evolving consumer and industrial demands.

Europe Rigid Plastic Packaging Market Analysis

European rigid plastic packaging market is witnessing growth currently with increasing trend of sustainable packaging solutions amidst rising environmental regulations. Manufacturers are increasingly using recyclable and bio-based rigid plastic materials to meet the European Union's stringent packaging waste directives. Factors influencing this include rising demand in the food and beverage sector, where rigid plastic containers are acquiring prominence because of their durability, lightweight nature, and ability to preserve freshness of the product. Moreover, companies are actively investing in advanced manufacturing technologies, including injection molding, as well as thermoforming, for improving manufacturing efficiency and produce new designs that suit consumer requirements better. E-commerce growth throughout Europe is fueling demand for robust and lightweight packaging, particularly in areas such as personal care and household products where safe and secure transportation is critical. According to the International Trade Administration, Europe is the third biggest retail ecommerce market globally, with total revenue of USD 631.9 Billion. The pharma and healthcare sectors are using rigid plastic packing with the increasingly essential objectives of maintaining product integrity and conformity to safety standards. The market is also embracing digital printing technologies to provide customized and visually attractive packaging that attracts better brand recognition and engages consumers. As brands continue to talk about sustainability and functionality, the European rigid plastic market evolves to fulfill these dynamic needs.

Latin America Rigid Plastic Packaging Market Analysis

The Latin American rigid plastic packaging market is currently driven by an increasing adoption of sustainable and recyclable materials as governments and industries intensify efforts to meet stringent environmental regulations and consumer demand for eco-friendly products. The adoption of advanced technologies such as lightweighting and barrier properties for enhanced packaging efficiency and shelf-life is the primary trend, as the region continues to increasingly prefer convenience in the food and beverage industry. E-commerce penetration is creating an increased demand for tough and protective packaging solutions for products that need to reach their destination safely. Data Privacy Framework reports that in 2018, the e-commerce industry in Brazil saw a 12% increase. There is also the growth of personal care and pharmaceuticals, who actively seek rigid plastic due to its tamper-evident and aesthetic merits. Companies are further diversifying designs in order to adapt to growing markets in cosmetics and beauty. Manufacturers are also entering partnerships with the local suppliers to maximize cost saving and simplify the supply chains in response to fluctuation in resin prices and complications in regional trade. As the market for rigid plastic packaging aligns with these emerging trends, it solidifies its position within the packaging industry in Latin America.

Middle East and Africa Rigid Plastic Packaging Market Analysis

The demand for rigid plastic packaging is rapidly increasing in Middle East and Africa, driven by the growing food and beverage, personal care, and healthcare industries. The focus on enhancing the shelf life of products in extreme hot climates is a motivating factor in adopting rigid plastic with good barrier properties. Increasing focus on innovative, recyclable, and sustainable plastics by manufacturers is ensuring compliance with stringent environmental regulations and catering to the consumer demand for eco-friendly packages. Growth of e-commerce has also fueled the demand for rigid plastic packaging for safe transportation of goods along with storage. Businesses are further employing attractive and customised designs to improve brand differentiation in various markets. According to the International Trade Administration, UAE is the e-commerce leader among Gulf Cooperation Council states, where the market jumped 53% in 2020 with a record of USD 3.9 billion in e-commerce sales. In addition, the market is experiencing constant growth in the packaging of essential drugs such as pharmaceuticals. These companies are now integrating features such as tamper-evident and child-resistant packaging to offer more safety features. Growth in urban populations and increasing disposal incomes further fuels the demand for rigid plastic packaging across various end-users. Besides this, developments in manufacturing technologies are improving cost effectiveness and efficiency thereby supporting continued growth in the Middle East and Africa market.

Competitive Landscape:

Key players in the global rigid plastic packaging market are driving growth through strategic actions such as product innovation and sustainability initiatives. Companies are investing in advanced manufacturing technologies, including recycled and bio-based plastics, to align with environmental regulations and consumer requirement for eco-friendly packaging. Moreover, collaborations and partnerships with brands in the food, beverage, and healthcare sectors are enabling the development of customized packaging solutions. Expansion into emerging markets and the establishment of regional production facilities are improving supply chain efficiency and meeting rising demand. Additionally, key players are adopting digital technologies such as IoT-enabled smart packaging, enhancing product traceability and consumer engagement, further augmenting market growth and competitiveness.

The report provides a comprehensive analysis of the competitive landscape in the rigid plastic packaging market with detailed profiles of all major companies, including:

- ALPLA

- Altium Packaging LLC

- Amcor plc

- Berry Global Inc.

- DS Smith plc

- Graham Packaging Company

- Pactiv Evergreen Inc.

- Plastipak Holdings Inc.

- Saudi Basic Industries Corporation (Saudi Arabian Oil Company)

- Silgan Holdings Inc.

- Sonoco Products Company

- Winpak Ltd.

Latest News and Developments:

- February 2024: Amcor signed a deal with Cadbury Australia, a subsidiary of Mondelēz International, to supply approximately 1,000 tons of post-consumer recycled (PCR) plastic to wrap the core chocolate product range of the company. Additionally, the initiative is set to elevate Cadbury’s efforts to minimize its reliance on virgin plastic for packaging its chocolate range.

- March 2024: AYR-based Emmer Ltd has launched a new 17.5-litre rigid plastic packaging container. Moreover, the company has been designing and manufacturing bespoke containers since 2009. Additionally, the latest innovation is an ‘off the shelf’ plastic bucket and lid measuring 333 x 330mm.

- April 2024: Amcor, a global leader in developing and producing responsible packaging solutions, has launched a polyethylene terephthalate (PET) bottle for the use of carbonated soft drink (CSD) that is made from 100% post-consumer recycled (PCR) content. Moreover, Amcor Rigid Packaging (ARP) is adding this one-liter CSD 100% PCR bottle as the industry leader in packaging innovation to expand stock portfolio of responsible packaging made from recycled content.

- July 2024: Following the collaboration between Versalis, Eni's chemical company, and Forever Plast, Italy's leading company in post-consumer plastic recycling, comes REFENCE, an innovative range of recycled polymers for food contact packaging. The range is already available in the market for polystyrene applications such as yogurt pots, trays for meat and fish, and other types of rigid and expanded packaging.

Rigid Plastic Packaging Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Bottles and Jars, Trays and Containers, Caps and Closures, Others |

| Materials Covered | Polyethylene (PET), Polypropylene (PP), High Density Polypropylene (HDPE), Others |

| Production Processes Covered | Extrusion, Injection Molding, Blow Molding, Thermoforming, Others |

| End Use Industries Covered | Food and Beverages, Personal Care and Cosmetics, Household, Healthcare, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ALPLA, Altium Packaging LLC, Amcor plc, Berry Global Inc., DS Smith plc, Graham Packaging Company, Pactiv Evergreen Inc., Plastipak Holdings Inc., Saudi Basic Industries Corporation (Saudi Arabian Oil Company), Silgan Holdings Inc., Sonoco Products Company, Winpak Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC's industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the rigid plastic packaging market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global rigid plastic packaging market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the rigid plastic packaging industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Rigid plastic packaging refers to sturdy, non-flexible containers made from materials such as polyethylene, polypropylene, or PET. It is used for food, beverages, healthcare, and personal care products as it ensures durability, product safety, and extended shelf life.

The rigid plastic packaging market was valued at USD 250.6 Billion in 2024.

IMARC estimates the global rigid plastic packaging market to exhibit a CAGR of 4.1% during 2025-2033.

The rising demand for lightweight and durable packaging solutions, growth in the food and beverage industry, increasing popularity of recyclable and sustainable packaging materials, advancements in plastic manufacturing technologies, and expansion of the e-commerce sector driving secure packaging needs are the primary factors propelling the growth of the rigid plastic packaging market.

According to the report, bottles and jars represented the largest segment by product due to their widespread use in the food, beverage, and personal care industries for preserving product freshness and safety.

Polypropylene (PP) leads the market by material due to its excellent durability, lightweight nature, and versatility across various applications.

Extrusion exhibits a clear dominance in the market by production process on account of its ability to produce durable and lightweight packaging with high precision and efficiency.

Food and beverages represent the leading market segment by end use industry due to the high demand for durable, lightweight, and protective packaging that ensures product freshness and extends shelf life.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global rigid plastic packaging market include ALPLA, Altium Packaging LLC, Amcor plc, Berry Global Inc., DS Smith plc, Graham Packaging Company, Pactiv Evergreen Inc., Plastipak Holdings Inc., Saudi Basic Industries Corporation (Saudi Arabian Oil Company), Silgan Holdings Inc., Sonoco Products Company, Winpak Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)