RNAi Pesticides Market Size, Share, Trends and Forecast by Product, Formulation, Crop Type, Application, and Region, 2025-2033

RNAi Pesticides Market Size and Share:

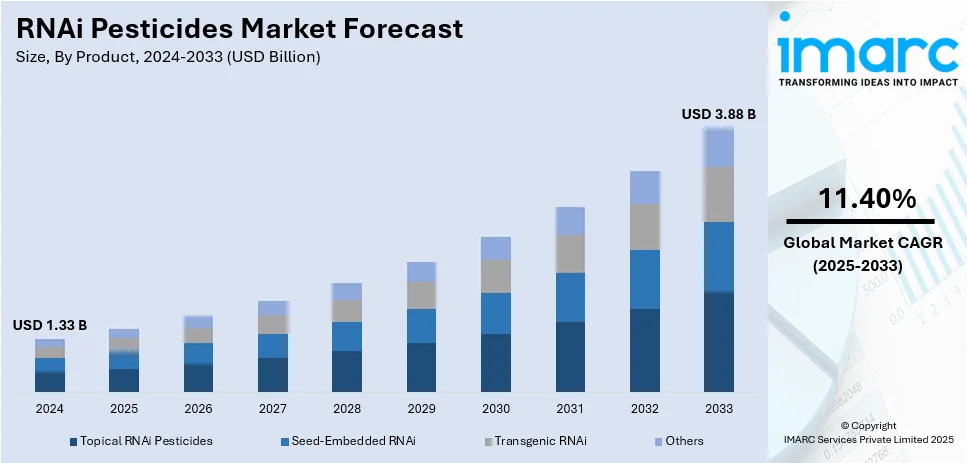

The global RNAi pesticides market size was valued at USD 1.33 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 3.88 Billion by 2033, exhibiting a CAGR of 11.40% from 2025-2033. North America currently dominates the market, holding a market share of over 35.7% in 2024. The increasing regulatory restrictions on chemical pesticides, rising pest resistance to conventional crop protection methods, growing adoption of sustainable agricultural practices, advancements in RNAi delivery technologies, and increasing investments in biopesticide research are positively impacting the RNAi pesticides market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.33 Billion |

| Market Forecast in 2033 | USD 3.88 Billion |

| Market Growth Rate (2025-2033) | 11.40% |

The market is significantly influenced by the growing emphasis on precision agriculture and targeted pest management. Additionally, continual advancements in nanoparticle-based RNA delivery systems are improving the stability and uptake of RNAi molecules, enhancing field efficiency. Furthermore, expanding investments in agri-genomics and RNA-based biocontrol platforms are facilitating product development, which is providing an impetus to the RNAi pesticides market growth. The market is advancing due to increasing regulatory approvals for bio-based pest control solutions, fostering commercial adoption. For instance, on May 31, 2023, Renaissance BioScience Corp. announced that the Canadian Pest Management Research Agency approved field studies for its RNA interference (RNAi) biopesticide technology. This approval enables comprehensive field research across Canada during the summer of 2023, concentrating on a major issue for potato crops, the Colorado potato beetle.

The market in the United States is witnessing significant growth driven by the stringent environmental regulations limiting synthetic pesticide usage and encouraging bio-based alternatives. In line with this, government initiatives promoting sustainable agricultural inputs are incentivizing the development of RNAi pesticides with enhanced environmental safety. Moreover, the commercialization of RNA interference (RNAi) technology in agriculture is supporting the market expansion. According to an industry report, Bayer's U.S. launch of VT4PRO™ with RNAi Technology is anticipated in the early 2024 growing season, following EPA approval. This product integrates three modes of action from Trecepta Technology with an RNAi-based mechanism to combat corn rootworms, offering enhanced protection against both above-ground and below-ground pests. Large-scale field testing was conducted during the 2022 and 2023 seasons to ensure its efficacy and readiness for commercial deployment. Apart from this, climate change-driven pest population shifts are necessitating advanced pest control solutions, further stimulating RNAi pesticides market demand.

RNAi Pesticides Market Trends:

Growth of Yeast-powered RNAi as a Scalable Delivery Platform

Yeast-based RNAi systems are gaining traction as a cost-effective and scalable method for production and delivery, which is an emerging RNAi pesticides market trend. Engineered yeast strains can be inactivated and used as a bioactive formulation that delivers RNAi when consumed by insects. According to an industry report published on July 2024, precision pest management's future lies in RNAi driven by yeast. Renaissance Bioscience uses baker's yeast to deliver RNAi-based biopesticides, ensuring stability and long shelf life. Their approach precisely targets chewing insects like the Colorado potato beetle without harming the environment. The company has developed multi-RNA yeast strains to enhance pest control and increase efficacy. Their next-generation technology boosts RNA production eightfold, expanding potential applications. This approach simplifies production compared to chemical synthesis, lowering costs and enabling large-scale deployment. Yeast-powered RNAi also improves dsRNA stability, as the yeast cell wall provides a natural protective barrier against environmental degradation. Additionally, regulatory pathways for yeast-based biopesticides are being streamlined in regions such as the U.S. and Brazil, accelerating commercialization efforts.

Expanding Research and Development (R&D) in RNAi-Based Pesticides

The RNAi pesticide sector is witnessing intensified research and development (R&D) activities, which is positively influencing the RNAi pesticides market outlook. For instance, a study published on December 2024 examines the potential of RNA interference (RNAi)-based biopesticides as a sustainable and highly specific pest control solution. These biopesticides reduce the impact of pests on crops while causing the least amount of harm to non-target organisms (NTOs) by identifying and inhibiting key genes in the pests. However, concerns regarding off-target effects, environmental persistence, and human health risks necessitate stringent bioinformatics analysis and thorough risk assessments before market approval. Despite potential risks, current research suggests that RNAi-based biopesticides have limited environmental and human health impacts due to their rapid degradation in agricultural ecosystems. With rigorous safety evaluations, these biopesticides could become a viable solution for sustainable pest management. Furthermore, advances in bioinformatics and genetic sequencing are improving the selection of pest-specific gene targets and reducing potential resistance development. Major agrochemical firms and biotech startups are securing patents and forming partnerships to accelerate product commercialization.

Integration with Precision Agriculture for Targeted Pest Control

The application of RNAi pesticides is becoming increasingly aligned with precision agriculture techniques, enhancing efficiency and reducing waste. According to an industry report, drones are used for 30% of South Korea's pesticide spraying. This increase in drone-assisted spraying and automated irrigation systems is enabling precise dsRNA delivery to affected crop areas, minimizing environmental impact. Advanced pest-monitoring systems, including AI-driven analytics and real-time field sensors, are being integrated with RNAi applications to ensure targeted pest control. This reduces the need for broad-spectrum insecticides, preserving beneficial organisms while maintaining yield protection. Farmers are adopting decision-support platforms that use predictive analytics to determine the optimal timing for RNAi treatments, improving cost-effectiveness. Additionally, RNAi pesticides degrade quickly, preventing long-term soil contamination and aligning with sustainable farming initiatives. With growing regulatory pressure to reduce chemical pesticide use, precision agriculture is positioning RNAi-based solutions as a viable alternative. Companies investing in data-driven farming technologies are leveraging RNAi pesticides as part of a broader shift toward sustainable and intelligent pest management strategies.

RNAi Pesticides Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global RNAi pesticides market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, formulation, crop type, and application.

Analysis by Product:

- Topical RNAi Pesticides

- Seed-Embedded RNAi

- Transgenic RNAi

- Others

Topical RNAi pesticides lead the market in 2024. It offers a sustainable and targeted alternative to traditional chemical pesticides. Topical RNAi pesticides focus on specific pest genes by applying double-stranded RNA (dsRNA) directly on plant leaves, suppressing or killing them. The advantage of topical RNAi pesticides is their ability to provide species-specific pest control with minimal risk of killing non-target organisms and beneficial insects. It also eliminates pesticide resistance issues since RNAi processes can be designed to target evolving pest populations. Additionally, topical applications are flexible with no crop genetic modification, offering an attractive opportunity for farmers needing regulatory approval and consumer acceptance. With increased demand for environmentally sustainable pest control products, topical RNAi pesticides are poised to gain market share, driving innovation and investment in the sector.

Analysis by Formulation:

- Liquid Formulation

- Granular Formulation

- Powder Formulation

- Others

Liquid formulation leads the market with around 67.6 % of market share in 2024. It provides an effective and convenient delivery system for RNA-based pest control. Liquid formulation improves the stability and bioavailability of double-stranded RNA (dsRNA) in a manner that allows efficient uptake by target pest species through soil treatment, seed treatment, or foliar sprays. Uniform coverage by liquid formulations guarantees effective plant surface protection, enhancing RNAi pesticide performance while being cost-efficient. This type of formulation is also compatible with traditional agricultural spray equipment, providing an easy adoption path for farmers. The liquid form is especially attractive for commercial, large-scale use in agriculture because it is scalable and provides an economic means of incorporating RNAi capability into pest control. With an increasing need for sustainable and targeted pest management technology, liquid forms are poised to make RNAi pesticides commercially feasible in global markets.

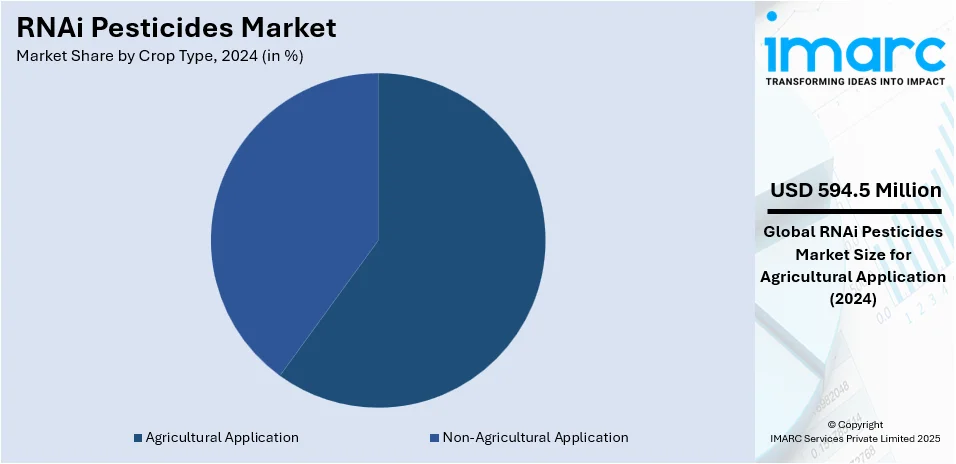

Analysis by Crop Type:

- Agricultural Application

- Fruits and Vegetables

- Cereals and Grains

- Oilseed and Pulses

- Others

- Non-Agricultural Application

- Turf and Ornamentals

- Forestry

- Residential Pest Control

Agriculture application (fruits and vegetables) leads the market with around 44.7 % of market share in 2024, driven by the need for targeted and environment-friendly pest control strategies. RNAi pesticides offer targeted gene silencing, managing pests without harming beneficial insects, pollinators, and the environment. Fruits and vegetables are highly susceptible to insect pests and virus infections, affecting yield, quality, and market price greatly. Traditional chemical pesticides have a residual effect, raising regulatory and consumer concerns, whereas RNAi pesticides offer a residue-free option as per stringent food safety guidelines. Additionally, the fast life cycle and high perishable nature of fruits and vegetables make efficient pest control solutions with minimal environmental footprint a necessity. As consumers become more interested in sustainable and non-toxic agricultural practices, RNAi pesticides in this sector are likely to see extensive application, enabling greater crop yield and improved food security.

Analysis by Application:

- Insect Pest Control

- Weed Management

- Disease Management

- Resistance Management

Insect pest control leads the market with around 34.7% of market share in 2024. It provides a secure and eco-friendly way of regulating pest populations. RNA interference (RNAi) technology allows specific silencing of genes across species, arresting essential biological activities in pest insects without influencing helpful organisms such as pollinators and natural parasites. This specificity largely eliminates the environmental and ecological footprint compared to conventional chemical insecticides, which are proven to trigger resistance and non-target responses. RNAi-based insect pest management products find extensive application in agriculture, where pest infestation results in staggering crop losses as well as financial losses. Using RNAi processes, farmers can address significant insect pests such as beetles, caterpillars, and aphids without leaving any pesticide residues on food crops. With regulatory authorities, consumers, and policymakers gravitating towards safer, residue-free pest management products, RNAi pesticides for insect pest management is on the rise.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East

- Africa

In 2024, North America accounted for the largest market share of over 35.7%, driven by advanced agricultural practices, strong research capabilities, and regulatory support for sustainable pest control solutions. The region, particularly the United States and Canada, has a well-established biotechnology sector, enabling rapid development and commercialization of RNAi-based pesticides. The growing concerns over pesticide resistance, environmental safety, and food security, leads to increased adoption of innovative pest management solutions. Government agencies, such as the U.S. Environmental Protection Agency (EPA), are evaluating RNAi-based pesticides for regulatory approval, shaping market adoption. Additionally, the region's high-value crops, including fruits, vegetables, and grains, face significant insect pest challenges, creating demand for precise, residue-free alternatives. Investments from leading agrochemical companies and collaborations between biotech firms and agricultural stakeholders further accelerate the market’s growth. As consumer preference shifts toward sustainable food production, North America is expected to remain a key region in the market.

Key Regional Takeaways:

United States RNAi Pesticides Market Analysis

The United States holds a substantial share of the North America RNAi pesticides market with 88.70% in 2024.The market is expanding due to strong research and development (R&D) investments, regulatory advancements, and the presence of major agrochemical companies. The Environmental Protection Agency (EPA) is actively evaluating RNAi-based pesticides, influencing the speed of market adoption. Companies such as Bayer and Syngenta are leading innovations, particularly in pest-specific solutions that reduce off-target effects. According to an industry report, the percentage of applications for biopesticides increased from 19% in 2023 to 22% in 2024. The growing concerns over chemical pesticide resistance and environmental sustainability further drive the adoption of RNAi pesticides. Increasing demand for precision agriculture and biopesticides further supports market expansion. Also, the U.S. market benefits from extensive collaborations between biotech firms and academic institutions, fostering new product development. Farmers' willingness to adopt RNAi-based solutions depends on cost-effectiveness and performance compared to conventional pesticides. Continuous advancements in formulation techniques and delivery methods are crucial to ensuring RNAi pesticides gain broader acceptance in United States agriculture.

Europe RNAi Pesticides Market Analysis

Europe represents a promising yet highly regulated market for RNAi pesticides, with the European Food Safety Authority (EFSA) playing a critical role in shaping product approvals. According to an industry report, the European Commission proposed a plan to to implement a 50% reduction in the usage of chemical pesticides by 2030 as part of the EU's Farm to Fork and Green Deal initiatives. The initiative aims to protect biodiversity and public health while promoting sustainable agricultural practices. Stringent regulatory frameworks focusing on environmental and human health safety influence the pace of RNAi adoption. Countries like Germany, France, and the Netherlands are leading in sustainable agriculture initiatives, supporting interest in RNAi-based pest control. The market benefits from research funding by the European Union, aimed at reducing chemical pesticide reliance under the Farm to Fork strategy. European agrochemical firms and startups are investing in RNAi technology as an alternative to synthetic chemicals. Consumer preference for organic and minimally processed food further propels interest in sustainable pest management solutions.

Asia Pacific RNAi Pesticides Market Analysis

The market in Asia Pacific is developing rapidly, driven by increasing agricultural demand, government support for biopesticides, and rising concerns over pesticide resistance. China, India, and Japan are key contributors, with the region's continual industry events and increased state-funded projects focusing on RNAi-based pest control solutions. For instance, the 6th Biopesticides, Biostimulants, and Biofertilizers Summit (BioEx 2025) are scheduled for March 13-14, 2025, in Shanghai, focusing on innovative agricultural biological technologies. The key topics include RNA interference (RNAi) for precision pest control, with Innatrix presenting advancements in nematode management. India's agricultural sector is gradually adopting biological pest control solutions, with government policies promoting sustainable farming practices. The region's large agricultural base and reliance on high-yield crop production create demand for innovative pest control methods. Regulatory frameworks vary significantly across countries, influencing market entry strategies for RNAi developers. Strategic partnerships between biotech firms, government bodies, and research institutions are vital for accelerating product commercialization, ensuring long-term growth in the market.

Latin America RNAi Pesticides Market Analysis

Latin America is emerging as a key market for RNAi pesticides, driven by the region's strong agricultural sector and the need for alternative pest control solutions. According to the USDA's International Production Assessment Division, in comparison to the five-year average from 2019 to 2023, Brazil's agricultural production is expected to witness significant gains across a number of important crops for the 2024/2025 marketing year. It is anticipated that soybean production will increase by 18% to 169 million tons. A 12% increase in corn is anticipated, reaching 126 million tons. Therefore, countries such as Brazil and Argentina are leading adopters, particularly in soybean and corn farming, where RNAi-based solutions help combat resistant pests like the fall armyworm. Regulatory agencies, including Brazil's National Biosafety Technical Commission (CTNBio), are evaluating RNAi-based agricultural innovations, shaping the market's trajectory. Collaborations between multinational agrochemical firms and regional research institutions are fostering innovation and facilitating market entry. As regulatory clarity improves, Latin America has the potential to become a major consumer of RNAi-based crop protection products.

Middle East and Africa RNAi Pesticides Market Analysis

The RNAi pesticides market in the Middle East and Africa is developing with commercial applications and growing interest in sustainable pest control. The MENA agricultural sector struggles with pest infestations, climate variability, and pesticide resistance. According to a study done in Ethiopia's Gasser district, recurrent droughts have worsened farming, with a 2.92 mm/year rainfall decline and rising temperatures. Farmers report erratic rainfall (86.47%) and frequent droughts (89.73%), highlighting the need for resilient pest control. These challenges create a strong demand for RNAi-based pesticides, offering targeted, sustainable solutions amid climate stress. South Africa is leading RNAi research and adoption, with institutions working on biopesticides targeting crop-damaging insects like the maize stem borer. In the Middle East, countries such as Saudi Arabia and the UAE are exploring advanced agricultural technologies, including RNAi-based pest control, to enhance food security and reduce dependence on imported agrochemicals. The growing collaborations with global biotech firms, and the rising need for climate-resilient pest control methods are expected to drive gradual market growth in this region.

Competitive Landscape:

The RNAi pesticides market is experiencing growing competition fueled by advances in RNA interference technology, regulatory advancements, and expanding demand for eco-friendly pest control products. Firms are working towards creating effective and stable RNA-based products with enhanced delivery mechanisms to increase field efficacy. Strategic collaborations, mergers, and acquisitions are influencing the market as companies attempt to consolidate product pipelines and build market presence. Research and development (R&D) investments are rising, with a focus on maximizing cost-effectiveness and overcoming scalability issues. Compliance with regulatory approvals is important, which dictates market entry and expansion plans. Competitive positioning is also influenced by partnering with farm stakeholders, such as growers and researchers, to test product performance. New startups and companies are competing on innovation, seeking to create RNAi pesticides with targeted specificity, lower environmental footprint, and greater resistance management value.

The report provides a comprehensive analysis of the competitive landscape in the RNAi pesticides market with detailed profiles of all major companies, including:

- Syngenta

- GreenLight Biosciences, Inc

- TRILLIUM AG

- Innatrix, Inc

- Pebble Labs

- AgroSpheres

- Vestaron Corporation

- Invaio Sciences

- Corteva

- Bayer AG

Latest News and Developments:

- October 24, 2023: The China Patent Office granted Renaissance BioScience Corp. a patent for their novel yeast-based platform technology, which is intended to produce and transport RNA bioactive compounds. With potential uses in human and animal health, this unique technique seeks to provide precise, targeted biological solutions for pest management. The patent adds to Renaissance's portfolio of intellectual property, which currently consists of 11 pending applications and 50 granted patents globally.

- December 22, 2023: For a three-year term, the U.S. Environmental Protection Agency (EPA) authorized the registration of Ledprona, a new biopesticide based on RNA interference (RNAi). A precise substitute for conventional chemical pesticides, Ledprona is a double-stranded RNA spray that works by blocking a gene that the Colorado potato beetle needs to survive. The EPA's dedication to developing cutting-edge and environmentally friendly agricultural technologies is demonstrated by this registration.

- May 9, 2024: AgroSpheres and FMC Corporation established a multi-year research partnership to expedite the development of innovative bioinsecticides, in line with FMC's strategy emphasis on sustainable agriculture. This collaboration combines AgroSpheres' RNA production and formulation technology with FMC's testing and market capabilities, aiming to enhance sustainable crop protection solutions. In 2023, FMC Ventures invested in AgroSpheres, supporting their biodegradable micro-encapsulation technology for RNA interference (RNAi) based products.

RNAi Pesticides Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Topical RNAi Pesticides, Seed-Embedded RNAi, Transgenic RNAi, Others |

| Formulations Covered | Liquid Formulation, Granular Formulation, Powder Formulation, Others |

| Crop Types Covered |

|

| Applications Covered | Insect Pest Control, Weed Management, Disease Management, Resistance Management |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Syngenta, GreenLight Biosciences, Inc., TRILLIUM AG, Innatrix, Inc., Pebble Labs, AgroSpheres, Vestaron Corporation, Invaio Sciences, Corteva, Bayer AG, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the RNAi pesticides market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global RNAi pesticides market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the RNAi pesticides industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The RNAi pesticides market was valued at USD 1.33 Billion in 2024.

The RNAi pesticides market is projected to exhibit a CAGR of 11.40% during 2025-2033, reaching a value of USD 3.88 Billion by 2033.

The market is driven by increasing demand for eco-friendly pest control solutions, regulatory restrictions on chemical pesticides, and advancements in RNA interference technology. Rising concerns over pesticide resistance, targeted pest management with minimal environmental impact, and growing adoption in agriculture and horticulture further boost market growth. Investments in biotechnology, research funding, and supportive government policies also contribute to the expanding market landscape.

North America currently dominates the RNAi pesticides market, accounting for a share of 35.7% in 2024. The dominance is fueled by strong regulatory support, increasing adoption of biopesticides, advanced agricultural biotechnology infrastructure, and rising concerns over chemical pesticide resistance. Investments in RNAi-based crop protection solutions by key players further strengthen the region's market dominance.

Some of the major players in the RNAi pesticides market include Syngenta, GreenLight Biosciences, Inc., TRILLIUM AG, Innatrix, Inc., Pebble Labs, AgroSpheres, Vestaron Corporation, Invaio Sciences, Corteva, and Bayer AG, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)