Roofing Materials Market Report by Product (Asphalt Shingles, Concrete and Clay Tiles, Metal Roofs, Plastics, and Others), Construction Type (New Construction, Reroofing), Application (Residential, Non-Residential), and Region 2025-2033

Roofing Materials Market Overview:

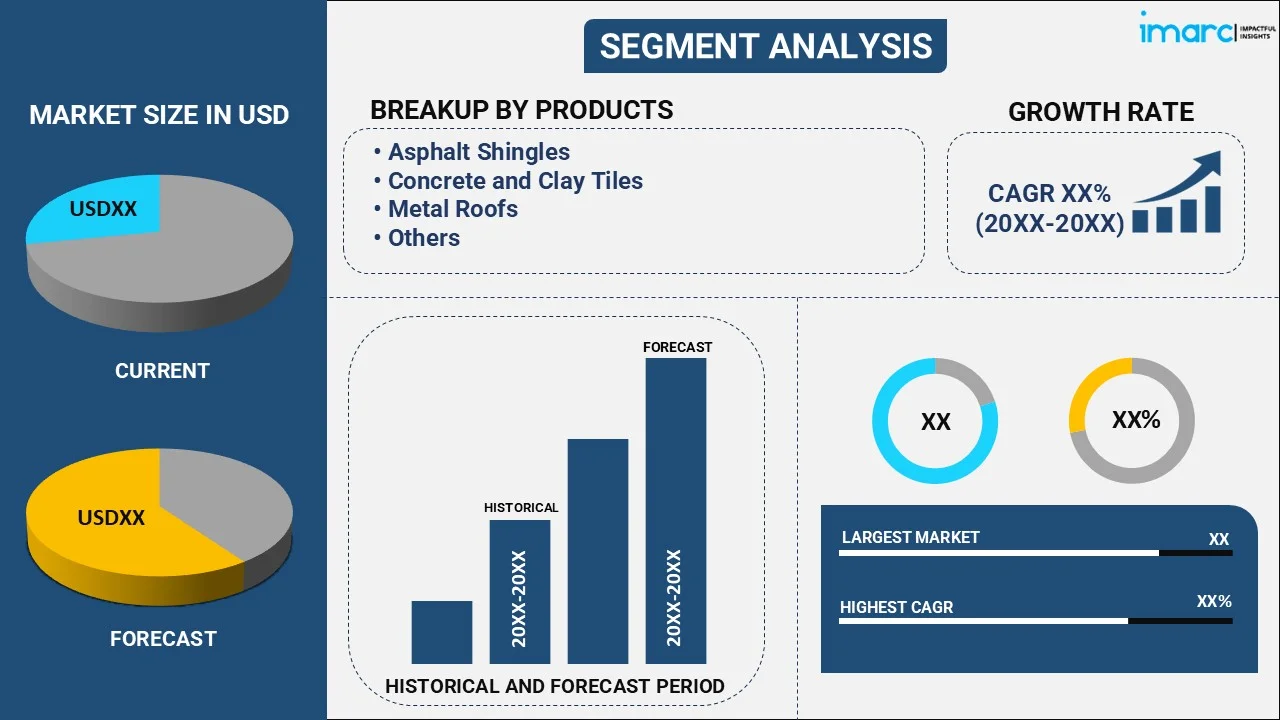

The global roofing materials market size reached USD 140.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 198.3 Billion by 2033, exhibiting a growth rate (CAGR) of 3.69% during 2025-2033. The rising number of commercial and residential spaces worldwide, stringent environmental regulations and building codes prompted by the growing environmental concerns, and advancements in materials science and manufacturing technology are fueling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 140.7 Billion |

|

Market Forecast in 2033

|

USD 198.3 Billion |

| Market Growth Rate (2025-2033) | 3.69% |

Roofing Materials Market Analysis:

- Major Market Drivers: There is a rise in the focus on maintaining the aesthetic appearance of buildings. This, coupled with the increasing need for durable construction materials, is one of the key roofing materials market drivers.

- Key Market Trends: The burgeoning construction sector, along with stringent environmental regulations, represents recent market trends.

- Geographical Trends: Asia Pacific exhibits a clear dominance, accounting for the largest market share due to the increasing capacity expansion.

- Competitive Landscape: Some of the main market players in the roofing materials industry are Atlas Roofing Corporation (Hood Companies Inc.), Boral Roofing LLC (Boral Industries Inc.), Carlisle Companies Inc., CertainTeed Corporation, Crown Building Products LLC, CSR Limited, Eagle Roofing, Etex, GAF (Standard Industries Inc.), Johns Manville (Berkshire Hathaway Inc.), North American Roofing Services Inc, Owens Corning, TAMKO Building Products LLC, Wienerberger AG., among many others.

- Challenges and Opportunities: One of the key challenges hindering the market growth is the high costs of raw materials. Nonetheless, the rising need for eco-friendly materials is offering business opportunities in roofing materials market.

Roofing Materials Market Trends:

Thriving Construction Sector

The rising construction of residential and commercial spaces is impelling the market growth. There is an increase in the need for living, workplace, and shopping spaces among individuals due to rapid urbanization across the globe. Besides this, several players in the market are launching roofing materials that provide enhanced capabilities. For instance, Johns Manville announced two new products, such as DynaSet 1K and 1-Part PermaFlash, on 10 February 2022 for its bituminous system to help improve productivity on the roof. DynaSet 1K is a moisture-curing adhesive and 1-Part PermaFlash is a liquid-applied flashing that are suitable roofing materials.

Innovations in Material and Manufacturing Technology

Advancements in manufacturing technology benefit in attracting individuals looking for better performance and sustainability by providing more durable, efficient, and eco-friendly roofing materials. Moreover, there is a rise in the demand for roofing materials that can withstand environmental impacts. Furthermore, major manufacturers in the market are introducing roofing materials that have advanced technologies and can withstand harsh environmental impact. On 9 March 2021, Atlas Roofing Corporation launched its ‘StormMaster® Hip & Ridge Shingle’ which incorporates the proprietary Core4™ Enhanced Polymer Technology of the company. This technology allows the shingle to offer improved strength, flexibility, durability, and extreme weather resistance.

Stringent Environmental Regulations and Building Codes

Rising concerns about environmental sustainability among individuals are catalyzing the demand for sustainable and eco-friendly roofing material solutions worldwide. Besides this, stringent environmental regulations and building codes are contributing to the roofing materials market growth. These regulations are forcing manufacturers to develop roofing materials that benefit in lowering carbon footprint while aligning with sustainability goals. On 20 April 2021, GAF announced a new patented shingle recycling process that has successfully produced the first asphalt roofing shingles of the industry containing recycled material from post-user and post-manufacture waste shingles. As a result, the product showcases the sustainable and affordable roofing materials.

Roofing Materials Market Challenges:

The roofing materials industry is confronted by various issues that need to be considered with caution by stakeholders. The increase in the prices of raw materials like asphalt, metal, and polymer composites poses a major issue, as it has the potential to erode profitability and prolong construction timelines. An increase or decrease in oil prices also influences petroleum-based roofing materials, thereby complicating planning and budgeting. Sustainability standards and environmental regulations also present challenges, especially for high-carbon-footprint traditional roof materials. Adjustment to green building codes and the inclusion of sustainable materials must necessarily involve significant research investment, innovation, and certification. Supply chain interruptions, even in international markets, can lead to material shortages and longer lead times. Shortages of skilled roof installation labor further complicate project schedules and quality control. To respond to these challenges, contractors and manufacturers might have to spend on training, diversify supply strategies, and consider alternative materials that are performance-friendly yet environmentally friendly.

Roofing Materials Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with roofing materials market forecast at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on product, construction type, and application.

Breakup by Product:

- Asphalt Shingles

- Concrete and Clay Tiles

- Metal Roofs

- Plastics

- Others

Asphalt shingles represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the product. This includes asphalt shingles, concrete and clay tiles, metal roofs, plastics, and others. According to the report, asphalt shingles represented the biggest market share.

Asphalt shingles are roof materials that are made from a combination of asphalt and fiberglass and are covered with a granular surface. They are available as strip, dimensional, and luxury shingles. They can cover many different angles, shapes, and forms. In addition, companies in the roofing materials sector are concentrating on increasing their manufacturing plants. For instance, Northstar Clean Technologies Inc. announced the that it has took the first delivery of manufacturing waste shingles for its upcoming asphalt shingle reprocessing facility in Calgary, Alberta on 18 January 2024.

Breakup by Construction Type:

- New Construction

- Reroofing

New construction holds the largest share of the industry

A detailed breakup and analysis of the market based on the construction type have also been provided in the report. This includes new construction and reroofing. According to the report, new construction accounted for the largest market share.

The growing need for roofing materials in the latest building courtyard and commercial spaces is positively influencing the market. People are seeking more extensive urban living for improved work and education opportunities across the world which in turn requires the new creation of living and working spaces. This is encouraging companies to expand their product portfolios. For example, Atlas Roofing Corporation built a new shingle laminating line at its Ardmore, Okla facility, on 15 January 2021. This will create an increase in the overall laminate shingle capacity of the company and will create efficiencies throughout the plant to help increase overall throughput.

Breakup by Application:

- Residential

- Non-Residential

Residential account for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the application. This includes residential and non-residential. According to the report, residential represented the largest segment.

The rising incorporation of roofing materials in residential spaces due to their easy-to-install process is impelling the market growth. These materials are beneficial in covering and protecting the top of a structure or building. They defend against exterior elements including rain, snow, sunlight, and extreme temperatures. On 20 March 2024, GAF, a North America's largest roofing and waterproofing manufacturer, planned to build a new shingle plant in Newton, Kansas. This investment enables GAF to add residential roofing manufacturing capacity to its network close to end markets and enhance best-in-class service to individuals nationwide.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific dominates the roofing materials market share

The report has also given an analysis of all the major regional markets, which comprise North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific region holds the biggest market share among others.

The Asia Pacific region is witnessing the potential of countries like China and India which are experiencing an increase in the construction sector, which in turn strengthening the need for roofing materials. Furthermore, top players in these countries aims to increase their capacity expansion to support enhanced products to their clients. On 28 March 2023, KPG Roofings launched a showroom in Hyderabad and 40th showroom in India. It will bring innovative roofing solutions to individuals across the country. In addition, the new showroom will provide high-quality products and exceptional service to users.

Key Regional Takeaways:

Asia Pacific Roofing Materials Market Analysis

The Asia Pacific roofing materials market size is experiencing robust growth, spurred by urbanization, infrastructure development, and increasing demand for energy-efficient buildings. Economies such as China, India, and Southeast Asia are witnessing a boom in the construction industry, buoyed by government programs including India's Smart Cities Mission and China's Belt and Road Initiative. Such projects boost the application of roofing materials in residential, commercial, and industrial sectors. The area also reflects increasing interest in sustainable and cool roof technologies for heat abatement in high-density urban areas. Suppliers are responding with changing environmental regulations and coming up with recyclable, light, and affordable products. Despite this, issues remain regarding volatile raw material costs and variable regulatory guidelines in various markets. Rural building expansion and low-cost housing schemes further contribute to long-term growth. Asia Pacific is slated to be the fastest-growing market because of its huge population base, economic growth, and climate-resilient building trends.

Europe Roofing Materials Market Analysis

The market for roofing materials in Europe is influenced heavily by tough environmental laws, energy efficiency targets, and a strong emphasis on sustainability. Green roofing, solar-integrated roofs, and very high insulation products are increasingly being adopted due to the European Green Deal and net-zero carbon targets. Germany, France, and the Nordic countries lead in green building, driving demand for recycled metal, clay tile, and synthetic membranes. Also fueling market demand is renovation of old infrastructure and heritage buildings, particularly traditional roof materials that pass strict performance standards of the modern era. High labor costs, cumbersome permit processes, and complying with regulations are the operating challenges. In addition, geopolitical pressures in the supply chain and raw material import dependency can impact market dynamics. As such, Europe still remains a center of innovation, with producers venturing into research and development to develop technologically sophisticated, climate-resilient roofing products for urban as well as rural use.

North America Roofing Materials Market Analysis

The North American roof material market is supported by consistent building activity in residential, commercial, and industrial markets, especially in the United States and Canada. Weather-resistant and energy-efficient roofing systems are in increasing demand as climate-related issues—like hurricanes, wildfires, and hot and cold temperatures—rise. Asphalt shingles continue to be the leader, particularly in the U.S. residential market, but there is increasing support for metal roofs, synthetic materials, and green roof systems. Policy incentives for solar roof and energy-efficient upgrade are stimulating innovation and uptake of green materials. Nevertheless, shortages in labor, high cost of installation, and raw material price volatility are long-term hindrances. Furthermore, the old building stock in most city centers needs widespread roof overhauls, offering potential for high-tech retrofitting. The Canadian market, while being smaller, also reflects high compliance with green practices and thermal efficiency. In general, North America continues to be a major driver of global roofing trends, with significant investment in product longevity and regulation adherence.

Latin America Roofing Materials Market Analysis

Latin America's market for roofing materials is shaped by varied climatic conditions, urbanization, and increasing low-income housing programs. Brazil, Mexico, and Colombia are experiencing rising construction activity, aided by state-led infrastructure projects and international investments. The market is largely price-driven, with low-cost alternatives like clay tiles, fiber cement, and metal sheets being favored. Yet, unavailability of high-performance materials and expertise is still a major challenge in rural and semi-urban locations. Concerns for the environment are only slowly emerging, with green roof concepts making inroads in urban areas, albeit still in infancy. Recurring weather conditions like heavy rains and heatwaves call for weather-resistant and long-lasting roofing, and thereby create interest in cool roofing and thermal insulation products. Political unrest and economic uncertainty could impact long-term planning procurement cycles. Notwithstanding these limitations, Latin America presents potential for growth through modernization of housing stock and improvement of urban infrastructure specific to regional climatic requirements.

Middle East and Africa Roofing Materials Market Analysis

The Middle East and Africa roofing materials market is influenced by quick population growth, urbanization, and harsh climatic conditions. In the Gulf Cooperation Council (GCC) nations, intense heat and intense solar exposure are increasing demand for reflective and heat-resistant roofing systems. The UAE and Saudi Arabian governments are making investments in smart cities and green construction, enhanced application of metal roofs, insulation systems, and solar-integrated products. In Africa, especially in nations such as Nigeria, Kenya, and South Africa, affordable roofing has increasing demand in both urban development and rural residential construction. Nonetheless, supply chain limitations, restricted access to high-tech materials, and absence of standardized construction standards represent major challenges. Traditional roofing remains prevalent in much of the region, although interest in energy saving and durable alternatives is developing. Public infrastructure investments and international development aid also contribute to market growth. Long-term opportunities lie in climate-adaptive, cost-effective solutions tailored to regional socio-economic conditions.

Competitive Landscape:

- The roofing materials market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all top companies have also been provided. Key market players are Atlas Roofing Corporation (Hood Companies Inc.), Boral Roofing LLC (Boral Industries Inc.), Carlisle Companies Inc., CertainTeed Corporation, Crown Building Products LLC, CSR Limited, Eagle Roofing, Etex, GAF (Standard Industries Inc.), Johns Manville (Berkshire Hathaway Inc.), North American Roofing Services Inc, Owens Corning, TAMKO Building Products LLC, Wienerberger AG.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- Key players in the market are engaging in mergers and acquisitions (M&As), partnerships, and collaborations to provide roofing materials with advanced technologies and high-performance. On 7 September 2021, GAF acquired FT Synthetics, a British Columbia-based manufacturer of the steep slope roofing industry. This will allow GAF to scale the operations of FT Synthetics and ensure the delivery of the highest quality products to users.

Latest News and Developments:

- In October 2024, NanoTech Materials introduced its Wildfire Shield and Cool Roof Coat with Insulative Ceramic Particle (ICP) technology. Meant to cut HVAC usage by 50% and add fire resilience, the items now cover California highways, SpaceX facilities, and are expanding worldwide through certified roofing applicators.

- In June 2024, Magnera's TYPAR brand launched TYPAR Liquid Flashing, a gun-grade elastomeric sealant that provides superior air and water protection for residential and commercial applications. As part of the TYPAR Weather Protection System, it offers primer-free adhesion, flexibility, long-term performance, and limited lifetime warranty.

- In March 2024: ArcelorMittal introduced Granite® Storm, a pre-coated steel roofing solution with outstanding durability, UV resistance, and formability. Specially created for sustainability and looks, this matte-finish roofing option provides more than 30 years of performance and supports Europe's drive towards green, long-lasting building materials.

- 15 November 2021: GAF announced the expansion of its commercial roofing operations with the start of production at the company’s fourth polyisocyanurate insulation manufacturing plant for its EnergyGuard™ line of products. This will enhance the capacity and elevate service to clients.

- 1 February 2022: Carlisle Companies Incorporated acquired MBTechnology, Inc., (MBT) a leading manufacturer of energy-efficient, styrene-butadiene-styrene modified bitumen roofing and underlayment systems for residential and commercial applications. The acquisition benefits in expanding the presence of their product portfolio.

Roofing Materials Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Roofing Materials Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Asphalt Shingles, Concrete and Clay Tiles, Metal Roofs, Plastics, Others |

| Construction Types Covered | New Construction, Reroofing |

| Applications Covered | Residential, Non-Residential |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Atlas Roofing Corporation (Hood Companies Inc.), Boral Roofing LLC (Boral Industries Inc.), Carlisle Companies Inc., CertainTeed Corporation, Crown Building Products LLC, CSR Limited, Eagle Roofing, Etex, GAF (Standard Industries Inc.), Johns Manville (Berkshire Hathaway Inc.), North American Roofing Services Inc, Owens Corning, TAMKO Building Products LLC, Wienerberger AG, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the market from 2019-2033

- The research report provides the latest information on the market drivers, challenges, and opportunities in the market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The roofing materials market was valued at USD 140.7 Billion in 2024.

The roofing materials market is projected to exhibit a CAGR of 3.69% during 2025-2033, reaching a value of USD 198.3 Billion by 2033.

The market for roofing materials is fueled by increased urbanization, infrastructure construction, demand for energy-efficient and green buildings, and refurbishment activity in existing buildings. Continued innovation in weather-resistance and green materials, along with increased investments in residential and commercial building development, also contributes to the global growth of the market.

Based on the construction type, the global roofing materials market has been segmented into new construction and reroofing, where new construction currently exhibits a clear dominance in the market.

Based on the application, the global roofing materials market can be divided into residential and non-residential. Currently, residential accounts for the largest market share.

Asia Pacific currently dominates the roofing materials market, propelled by robust construction growth, fast urban development, and state-supported housing and infrastructure projects. Growing demand for adaptive climate, affordable roofing products, and heightened awareness of energy efficiency also underpin the region's leadership.

Some of the major players in the roofing materials market include Atlas Roofing Corporation (Hood Companies Inc.), Boral Roofing LLC (Boral Industries Inc.), Carlisle Companies Inc., CertainTeed Corporation, Crown Building Products LLC, CSR Limited, Eagle Roofing, Etex, GAF (Standard Industries Inc.), Johns Manville (Berkshire Hathaway Inc.), North American Roofing Services Inc, Owens Corning, TAMKO Building Products LLC, Wienerberger AG, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)