Running Gear Market Size, Share, Trends and Forecast by Product, Gender, Distribution Channel, and Region, 2026-2034

Running Gear Market Size and Share:

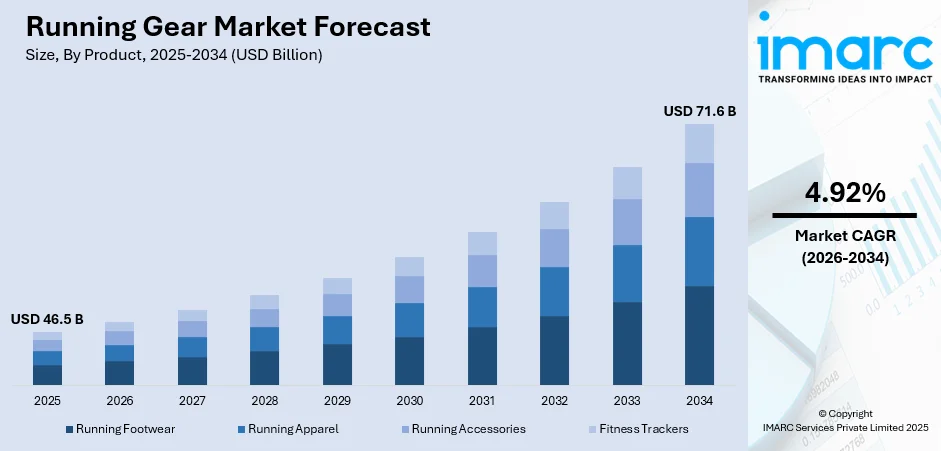

The global running gear market size was valued at USD 46.5 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 71.6 Billion by 2034, exhibiting a CAGR of 4.92% from 2026-2034. North America currently dominates the market, holding a market share of over 31.1% in 2025. The running gear market share is driven by moderate growth driven by ongoing technological advancements, increasing health and fitness consciousness among consumers, and rising participation in marathons, trail running, and other organized running events.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 46.5 Billion |

|

Market Forecast in 2034

|

USD 71.6 Billion |

| Market Growth Rate 2026-2034 | 4.92% |

One major driver in the running gear market outlook is the rising health consciousness among consumers. As awareness about the benefits of regular exercise grows, more individuals are engaging in running and jogging to maintain physical fitness and manage lifestyle-related health conditions. This trend is particularly prominent in urban areas, where sedentary lifestyles have spurred a greater focus on personal health and wellness. Consequently, there is increased demand for specialized running gear such as performance footwear, moisture-wicking apparel, and fitness trackers that enhances comfort and supports endurance. Brands are leveraging this momentum by offering innovative products tailored to fitness-focused consumers.

To get more information on this market Request Sample

In the U.S. running gear market, the growing emphasis on active lifestyles and fitness culture with a market share of 82.80%. With rising awareness of the physical and mental health benefits of regular exercise, more Americans are turning to running as a daily fitness activity. In line with this, government data from 2021 reported that 164.2 million Americans aged six and over participated in outdoor recreation at least once the highest number recorded. This surge in outdoor activity aligns with growing demand for high-performance running gear that offers comfort, durability, and injury prevention. Consumers are increasingly opting for breathable apparel, cushioned footwear, and wearable fitness devices. Additionally, social media trends, fitness communities, and organized events further support this cultural shift toward health, personal achievement, and performance enhancement.

Running Gear Market Trends:

Emerging health and fitness trends

The rising health and fitness is one of the major running gear market trends, spurred by the desire for overall well-being, is propelling the running gear market's growth as consumers recognize the importance of appropriate gear in optimizing their running experiences and fitness goals. According to reports, there were around 90,699 businesses in the gym, health & fitness club segment, as of 2023, in the United States. In recent years, there has been a global shift toward prioritizing health and wellness, with individuals of all ages recognizing the numerous benefits associated with physical activity, particularly running. As more people embrace running as an integral part of their healthy lifestyle, the demand for specialized running gear and apparel has escalated. This trend encompasses a growing awareness about the importance of comfortable and performance-enhancing running gear, including moisture-wicking clothing, cushioned footwear, and wearable fitness technology. Consumers are also seeking to improve their physical health and their overall well-being, and running provides an accessible and effective means of achieving these goals. As a result, the running gear market continues to expand, fueled by an expanding health-conscious population that values the role of proper gear in optimizing their running experiences and enhancing their fitness journeys.

Rising participation in running events

The heightening popularity of running events, ranging from marathons to charity runs and trail races, has witnessed substantial growth in recent years. For instance, more than 30 million people participate in endurance sporting events, like marathons, long-distance cycling, and triathlons, in the United States. These events promote physical fitness and camaraderie and necessitate the use of specialized running gear and attire to enhance performance and comfort. Runners participating in marathons and races understand the importance of proper footwear, moisture-wicking clothing, and accessories like hydration packs and GPS watches. This awareness drives increased sales in the market as event participants seek running gear that complements their training and contributes to their success on race day. Apart from this, the growing community of avid runners and event enthusiasts has become a key market segment, fostering innovations in running gear design and technology. As participation in such events continues to rise, so does the demand for high-quality running gear, making it an essential driver in the propelling the running gear market growth.

Ongoing technological advancements

The constant innovation in materials, including moisture-wicking fabrics and advanced footwear technologies, is capturing consumer interest in high-performance running gear. Additionally, the integration of smart wearables and fitness tracking devices into running gear is further stimulating market growth. According to a Pew Research Center survey, around 21% of Americans use smartwatches or wearable fitness trackers. These innovations enhance the functionality of running gear, providing runners with features like moisture management, cushioning, and data tracking for performance optimization. This blend of technology and apparel caters to the modern runner's demands for comfort and performance and aligns with the increasing use of data and wearables in fitness routines, making it a key driver in the running gear market's expansion. These technological advancements in running gear improve the overall running experience and address the specific needs and preferences of individual runners. As consumers seek gear that enhances their performance and provides valuable data insights, the market continues to evolve, emphasizing the integration of cutting-edge technology into running apparel and accessories as a major driver of its growth.

Running Gear Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global running gear market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on product, gender and distribution channel.

Analysis by Product:

- Running Footwear

- Running Apparel

- Running Accessories

- Fitness Trackers

Running footwear accounts for the majority of the market with a 50.3% share, driven by its essential role in enhancing performance, providing comfort, and preventing injuries. As running continues to gain popularity as a daily fitness routine, consumers prioritize high-quality shoes designed to support various terrains, foot types, and training intensities. Innovations in cushioning, arch support, breathability, and lightweight materials further boost demand for advanced footwear. Major brands consistently introduce new models featuring smart technology, such as gait analysis and impact absorption, which appeal to both casual runners and serious athletes. Additionally, the influence of sports celebrities and fitness influencers promoting specific shoe models contributes to strong consumer interest. Running footwear remains the most frequently replaced gear, ensuring steady running gear market demand.

Analysis by Gender:

- Male

- Female

- Unisex

Males represent the largest segment in the running gear market, with a 54.1% market share, owing to higher participation rates in running, fitness training, and competitive sports. This demographic tends to invest more in performance-oriented gear, including technologically advanced footwear, compression apparel, and smart fitness accessories. Men are generally more inclined toward regular gym routines, marathons, and endurance sports, which drives the demand for specialized running products. Additionally, targeted marketing campaigns by major athletic brands often emphasize masculinity, strength, and performance, further influencing purchasing behavior. The presence of male-focused fitness influencers and sports figures on digital platforms also contributes to increased product awareness and brand engagement. This combination of lifestyle preferences and marketing focus underpins the dominance of the male consumer segment.

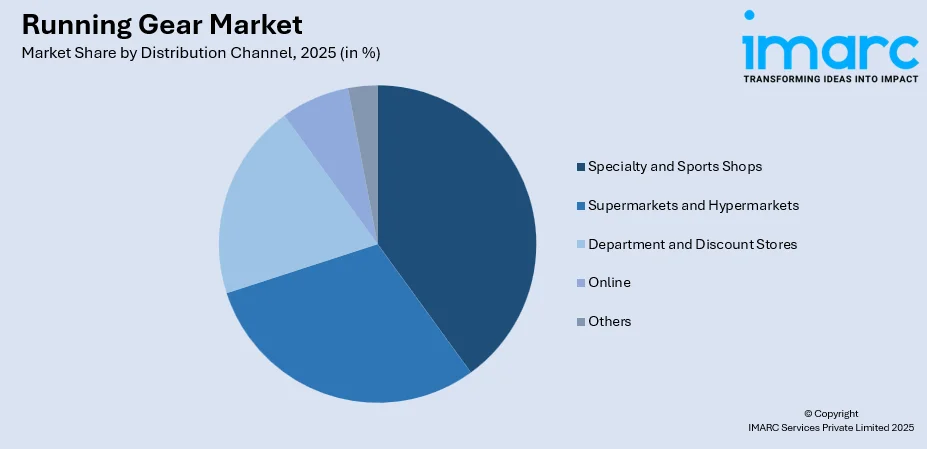

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Specialty and Sports Shops

- Supermarkets and Hypermarkets

- Department and Discount Stores

- Online

- Others

Specialty and sports shops dominate the running gear market share with 43.8%, primarily due to their ability to offer expert guidance, curated product selections, and personalized customer experiences. These outlets cater specifically to fitness enthusiasts and runners, providing high-quality gear, including performance footwear, technical apparel, and fitness accessories tailored to varying skill levels and preferences. Their staff often includes trained professionals who offer insights on product fit, performance, and usage, helping consumers make informed decisions. Additionally, these stores frequently host community events, running clinics, and brand activations, which foster strong customer engagement and brand loyalty. Their focused retail environment, combined with exclusive product offerings and in-store trial options, makes them the preferred choice for dedicated runners and active consumers.

Regional Analysis:

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

Based on the running gear market forecast, the North America is the leading region driven by a strong fitness culture and a high level of consumer awareness regarding health and wellness. With a market share of 31.1%, the region benefits from widespread participation in running, jogging, and outdoor recreational activities. The popularity of organized marathons, fitness challenges, and community-based wellness programs further supports consistent demand for advanced running gear. Consumers in the region prioritize high-performance products that offer comfort, durability, and technological enhancements, such as smart wearables and moisture-wicking fabrics. Additionally, the influence of social media fitness trends and celebrity endorsements fuels product interest. A robust retail infrastructure and the presence of leading athletic brands also contribute to North America’s dominant position in the market.

Key Regional Takeaways:

United States Running Gear Market Analysis

The United States experiences rising running gear adoption due to increasing health and fitness consciousness, as individuals focus on maintaining active lifestyles. For instance, in 2023, around 242 million Americans, accounting to 78.8% of the total population, participated in an activity one or more times, according to a Sports & Fitness Industry Association (SFIA) report. Expanding awareness of the benefits of regular exercise drives demand for high-performance running shoes, moisture-wicking apparel, and smart wearables. Fitness-conscious consumers seek advanced cushioning, breathability, and durability in running gear to enhance performance and comfort. Gyms, parks, and running tracks witness heightened engagement, pushing the need for specialized footwear and apparel. Endorsements from athletes and fitness influencers encourage consumers to invest in premium running products. Subscription-based fitness programs further boost interest in high-quality running gear. Customization trends allow runners to select personalized designs, colors, and fits, contributing to market expansion. Evolving material technology enhances product longevity and sustainability, driving market momentum.

Asia Pacific Running Gear Market Analysis

Asia-Pacific sees increasing adoption of running gear due to growing multi-brand stores, which expand product visibility and accessibility. According to a survey, approximately 40.8% of 22–25-year-old Indians agreed to purchase shoes from multi-brand stores. The presence of leading brands in organized retail outlets allows consumers to compare features and prices, enhancing purchase decisions. Promotions, discounts, and loyalty programs attract fitness enthusiasts, fueling market expansion. In-store experiences, including expert consultations and trial zones, encourage buyers to invest in specialized footwear and apparel. Dedicated running sections in hypermarkets introduce new product lines, catering to different fitness levels. Seasonal sales and limited-edition collections drive higher foot traffic, increasing brand engagement. Expanding urban retail spaces accommodate a variety of running accessories, from hydration packs to performance socks. Supermarkets and hypermarkets also provide flexible payment options, making premium running gear more attainable.

Europe Running Gear Market Analysis

Europe experiences rising running gear adoption due to growing online e-commerce platforms, which offer a vast range of products, competitive pricing, and convenient home delivery. For instance, in 2024, 46% of EU internet users aged between 16-74 years bought or ordered 'clothes (including sportswear), shoes and accessories' online. Digital marketing strategies, influencer collaborations, and targeted advertisements attract a diverse consumer base seeking performance-driven apparel and footwear. Subscription-based services introduce exclusive product launches, boosting online sales. Virtual try-on features and AI-driven size recommendations enhance consumer confidence in purchasing running gear online. Limited-edition drops and online-only discounts create urgency, encouraging frequent purchases. Reviews, ratings, and comparison tools assist in informed buying decisions. Seamless return policies and fast shipping contribute to a hassle-free shopping experience.

Latin America Running Gear Market Analysis

In Latin America, the running gear market is evolving rapidly, driven by changing consumer preferences favoring active lifestyles and wellness. The growing popularity of both local marathons and international sporting events such as the Pan American Games and Ironman triathlons is further stimulating interest in high-quality running gear. Global brands are forming strategic partnerships with Latin American retailers and sports organizations to expand their presence, while regional companies collaborate with international technology firms to integrate performance-enhancing materials. For instance, the Brazilian Football Federation (CBF) extended its partnership with Nike for 12 years. The deal, starting in 2027, includes royalties from jersey sales, licensing opportunities, and a focus on growing women’s soccer, inclusion, and youth participation. These partnerships enhance product availability and innovation, aligning offerings with local preferences and global standards, making Latin America a promising landscape for running gear growth.

Middle East and Africa Running Gear Market Analysis

Middle East and Africa witness increasing running gear adoption due to growing sports events and participation, fostering interest in performance-driven footwear and apparel. According to a report, the number of internationally recognized sporting events doubled from 9 in 2018 to 19 in 2019 in Saudi Arabia. International marathons, local races, and fitness challenges push demand for advanced cushioning and sweat-resistant clothing. Competitive running culture encourages athletes and enthusiasts to upgrade their gear for enhanced speed and endurance. Sponsorships and promotional events introduce new product lines, increasing awareness. Community-driven fitness initiatives and corporate wellness programs further boost running gear purchases.

Competitive Landscape:

Key players in the market are actively engaging in several strategic initiatives to maintain and expand their market presence. These initiatives include continuous research and development (R&D) to introduce innovative technologies and materials that enhance the performance and comfort of running gear. Additionally, these industry leaders are focusing on sustainability by incorporating eco-friendly materials and production processes to meet the growing demand for sustainable products. Marketing efforts also play a pivotal role, with partnerships with professional athletes, sponsorships of running events, and digital marketing campaigns to reach a wider audience. Furthermore, expanding their online presence and e-commerce platforms allows these players to cater to the rising trend of online shopping for running gear. Overall, these strategic moves ensure that key players stay competitive and responsive to evolving consumer preferences in the dynamic running gear market.

The report provides a comprehensive analysis of the competitive landscape in the running gear market with detailed profiles of all major companies, including:

- Adidas AG

- Altra Running (VF Corporation)

- ASICS Corporation

- Brooks Sports, Inc. (Berkshire Hathaway Inc.)

- Ciele Athletics Inc.

- Columbia Sportswear Company

- Deckers Brands

- Garmin Ltd.

- Helly Hansen

- New Balance, Inc.

- Newton Running Company, Inc.

- Nike, Inc.

- Puma SE

- Skechers USA, Inc.

- Under Armour, Inc.

Latest News and Developments:

- February 2025: Arc’teryx deepened its focus on mountain running by unveiling four new footwear models during a virtual event at the Portland Creation Center. The Norvan LD 4, Vertex Speed, Konseal, and Norvan Nivalis were introduced to enhance performance in mountain terrain.

- November 2024: Nike introduced its new road running footwear lineup, offering enhanced cushioning for every run. The three categories include: Pegasus, Vomero, and Structure. The brand simplified its selection process to help athletes choose the right shoe more intuitively. Runners’ feedback led to this streamlined lineup, ensuring clarity across Nike’s franchises. The footwear catered to various needs, from casual jogging to marathon training.

- November 2024: Adidas AG launched Supernova Rise 2, enhancing comfort and stability for everyday running. The shoe featured a redesigned breathable upper and an improved heel construction with a refined foam collar. It is 4% lighter than its predecessor, elevating the running experience.

- July 2024: A Swiss sportswear brand, On, launched the Prism Collection, a high-performance running shoe line. The collection included the Cloudboom Strike for marathons, Cloudspike Citius for track sprints, and Cloudspike Amplius for long-distance track events. Designed for speed and innovation, the shoes combined advanced technology with a bold aesthetic.

- April 2024: HOKA announced the launch of the Skyward X running shoe, featuring maximalist cushioning. The shoe integrated a carbon fiber plate system for a responsive and stable ride. It combined PEBA and EVA foams to enhance comfort and support during runs.

Running Gear Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Running Footwear, Running Apparel, Running Accessories, Fitness Trackers |

| Genders Covered | Male, Female, Unisex |

| Distribution Channels Covered | Specialty and Sports Shops, Supermarkets and Hypermarkets, Department and Discount Stores, Online, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Adidas AG, Altra Running (VF Corporation), ASICS Corporation, Brooks Sports, Inc. (Berkshire Hathaway Inc.), Ciele Athletics Inc., Columbia Sportswear Company, Deckers Brands, Garmin Ltd., Helly Hansen, New Balance, Inc., Newton Running Company, Inc., Nike, Inc., Puma SE, Skechers USA, Inc., Under Armour, Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the running gear market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global running gear market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the running gear industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The running gear market was valued at USD 46.5 Billion in 2025.

The running gear market was valued at USD 71.6 Billion in 2034, exhibiting a CAGR of 4.92% during 2026-2034.

Key factors driving the running gear market include rising health consciousness, increasing participation in fitness and outdoor activities, and growing demand for performance-enhancing apparel and footwear. Technological advancements in smart wearables and materials, along with strong influence from social media, fitness influencers, and organized events, further fuel market growth.

North America currently dominates the running gear market due to a strong fitness culture, high consumer awareness, and widespread participation in running and outdoor activities. The presence of leading athletic brands, robust retail infrastructure, and the popularity of marathons and wellness programs further support the region’s leading market position.

Some of the major players in the running gear market include Adidas AG, Altra Running (VF Corporation), ASICS Corporation, Brooks Sports, Inc. (Berkshire Hathaway Inc.), Ciele Athletics Inc., Columbia Sportswear Company, Deckers Brands, Garmin Ltd., Helly Hansen, New Balance, Inc., Newton Running Company, Inc., Nike, Inc., Puma SE, Skechers USA, Inc., Under Armour, Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)