Russia Air Freight Market Size, Share, Trends and Forecast by Service, Destination, End-User, and Region, 2025-2033

Russia Air Freight Market Overview:

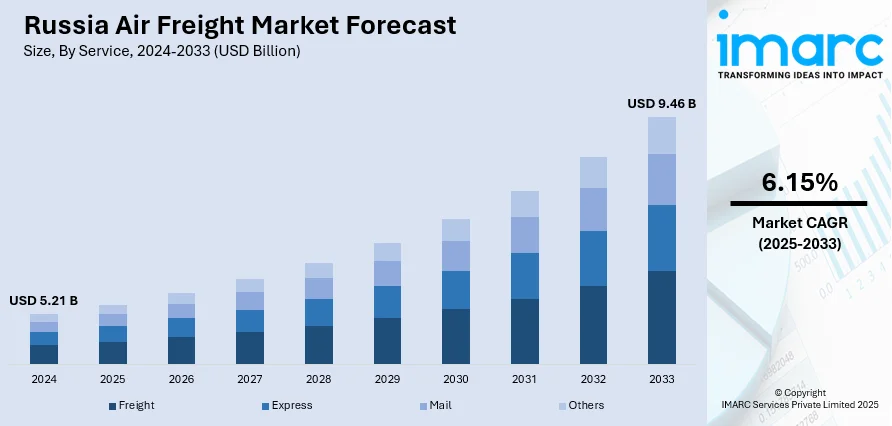

The Russia air freight market size reached USD 5.21 Billion in 2024. The market is projected to reach USD 9.46 Billion by 2033, exhibiting a growth rate (CAGR) of 6.15% during 2025-2033. The market is progressing steadily, supported by growing demand for time-sensitive cargo and the expansion of logistics infrastructure. This momentum is reinforced by the development of domestic networks and the optimization of international freight corridors, improving service reach and reliability. Continued upgrades at key airports are enhancing operational efficiency, while improved regional connectivity is streamlining cargo movement across major hubs. Together, these integrated advancements are shaping a more resilient and responsive sector, reflecting similar trends seen in the Russia air freight market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.21 Billion |

| Market Forecast in 2033 | USD 9.46 Billion |

| Market Growth Rate 2025-2033 | 6.15% |

Russia Air Freight Market Trends:

Infrastructure Expansion Unleashes Cargo Capacity

Russia's air freight industry is experiencing significant growth due to major infrastructure developments across key logistics hubs. In 2024, upgrades were completed at Novosibirsk Tolmachevo Airport and Krasnoyarsk's Yemelyanovo Airport, including larger cargo terminals, automated conveyor systems, and climate-controlled storage zones to handle sensitive goods. These projects have improved cargo handling efficiency and supported the rising demand for e-commerce and cross-border trade. At Ust-Luga, a new multimodal cargo terminal is under development, integrating air, sea, and rail logistics. This facility aims to reduce transshipment delays and enhance connectivity to Europe and Asia. Additionally, autonomous cargo transport vehicles and smart monitoring systems are being introduced to optimize handling times and maintain shipment integrity. These advancements significantly contribute to Russia air freight market growth, enabling increased processing volumes, streamlined cargo flow, and increased international competitiveness. Collectively, this infrastructure push reinforces Russia’s position as a strategic freight hub within the Eurasian corridor.

To get more information of this market, Request Sample

Digitalization Elevates Operational Precision

Russia is witnessing rapid development in integrated logistics, which is significantly enhancing the efficiency of air freight operations. Key air cargo terminals are being integrated with rail and road transport networks, particularly around Moscow and regional economic zones. These hubs are streamlining the movement of goods across borders and supporting accelerated distribution timelines. Notably, a major logistics hub under construction in the Moscow Region, expected to become operational in 2025, is designed to support international air freight alongside domestic intermodal transport. This strategy aligns with Russia’s broader initiative to modernize trade corridors and reduce delivery times for high-value and time-sensitive cargo. As air logistics facilities become more interconnected with surface transportation systems, companies gain more flexibility in managing supply chains. These advancements are strengthening operational capabilities and supporting the air freight market, especially in time-critical sectors like pharmaceuticals and perishables. The integration of air cargo terminals into wider logistics ecosystems is a pivotal feature of current Russia air freight market trends.

Adoption of High-Tech Cold Chain Enhances Cargo Reliability

A notable trend in Russia’s air freight sector is the advancement of modern cold chain infrastructure, aimed at addressing the growing need for secure transportation of temperature-sensitive goods. As of September 2024, Russia has been adopting IoT-enabled sensors, AI-powered monitoring systems, and blockchain technologies to build fully traceable cold supply chains, particularly vital for pharmaceuticals, perishable foods, and chemical shipments. Domestic airports are now outfitted with precise climate-control systems, real-time condition tracking, and automated alert systems, ensuring the integrity of critical shipments. This tech-forward infrastructure not only protects product quality but also streamlines compliance with international standards. Furthermore, the adoption of autonomous refrigeration units during intermodal transfers is minimizing product spoilage and enhancing end-to-end logistics efficiency. These investments directly contribute to the market, reinforcing the country's capability to handle global cold-chain volumes with greater reliability and speed. By embracing innovation in refrigerated cargo handling, Russia positions itself as a emerging hub for high-value, time-sensitive exports in the global air freight market.

Russia Air Freight Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on service, destination, and end-user.

Service Insights:

- Freight

- Express

- Others

The report has provided a detailed breakup and analysis of the market based on the service. This includes freight, express, mail, and others.

Destination Insights:

- Domestic

- International

A detailed breakup and analysis of the market based on the destination have also been provided in the report. This includes domestic and international.

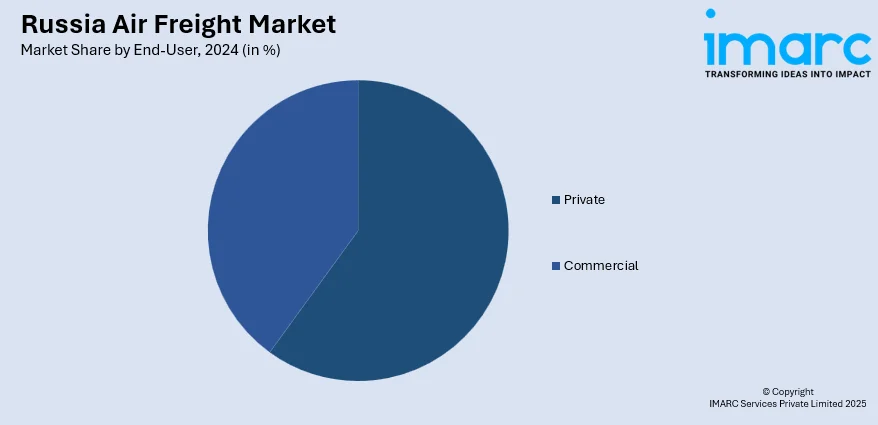

End-User Insights:

- Private

- Commercial

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes private and commercial.

Regional Insights:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Central District, Volga District, Urals District, Northwestern District, Siberian District, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Russia Air Freight Market News:

- March 2025: Sky Gates Airlines, a Red Wings subsidiary, has received its second Ilyushin Il‑96‑400T freighter, tail number RA‑96101, a 27‑year‑old aircraft previously operated by Polet Airlines. This widebody freighter of transporting up to 92 tonnes over 5,000 km is now actively contributing to the carrier’s expanding long‑haul cargo operations. Sky Gates, currently the only commercial operator of the Il‑96‑400T, is enhancing its fleet with domestically produced aircraft, aiming to boost capacity to remote regions.

- March 2025: AmCham Russia has taken a constructive step by advocating for the resumption of support for Western-built aircraft operating in Russia. Highlighting safety and humanitarian considerations, the organization emphasized the importance of access to spare parts and technical maintenance for the well-being of passengers. With over 600 Western aircraft still in service, this initiative reflects a practical approach to maintaining operational standards. AmCham is preparing a white paper to engage with U.S. authorities, aiming to promote safe and responsible aviation practices.

Russia Air Freight Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Freight, Express, Mail, Others |

| Destinations Covered | Domestic, International |

| End-Users Covered | Private, Commercial |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Russia air freight market performed so far and how will it perform in the coming years?

- What is the breakup of the Russia air freight market on the basis of service?

- What is the breakup of the Russia air freight market on the basis of destination?

- What is the breakup of the Russia air freight market on the basis of end-user?

- What is the breakup of the Russia air freight market on the basis of region?

- What are the various stages in the value chain of the Russia air freight market?

- What are the key driving factors and challenges in the Russia air freight?

- What is the structure of the Russia air freight market and who are the key players?

- What is the degree of competition in the Russia air freight market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia air freight market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Russia air freight market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia air freight market and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)