Russia Alternative Data Market Size, Share, Trends and Forecast by Data Type, Industry, End User, and Region, 2026-2034

Russia Alternative Data Market Summary:

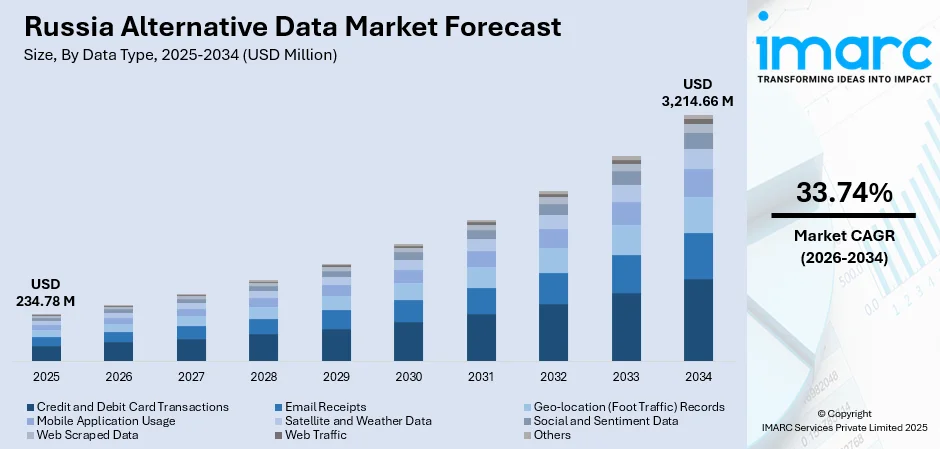

The Russia alternative data market size was valued at USD 234.78 Million in 2025 and is projected to reach USD 3,214.66 Million by 2034, growing at a compound annual growth rate of 33.74% from 2026-2034.

The market expansion is driven by the accelerating adoption of artificial intelligence (AI) and machine learning (ML) technologies across key economic sectors, coupled with the government's aggressive digital transformation initiatives under the Digital Economy of the Russian Federation program. Financial institutions and investment firms are increasingly leveraging non-traditional data sources to enhance risk assessment capabilities, generate alpha, and maintain competitive positioning in evolving market conditions.

Key Takeaways and Insights:

- By Data Type: Credit and debit card transactions dominate the market with a share of 20% in 2025, driven by the extensive digitalization of payment systems across Russia, widespread adoption of contactless payments, and robust transaction data analytics infrastructure supporting consumer spending pattern analysis and merchant performance evaluation.

- By Industry: BFSI leads the market with a share of 20% in 2025, owing to the sector's substantial reliance on alternative data sources for risk assessment, fraud detection algorithms, credit scoring enhancement, and investment strategy optimization across banking and insurance operations.

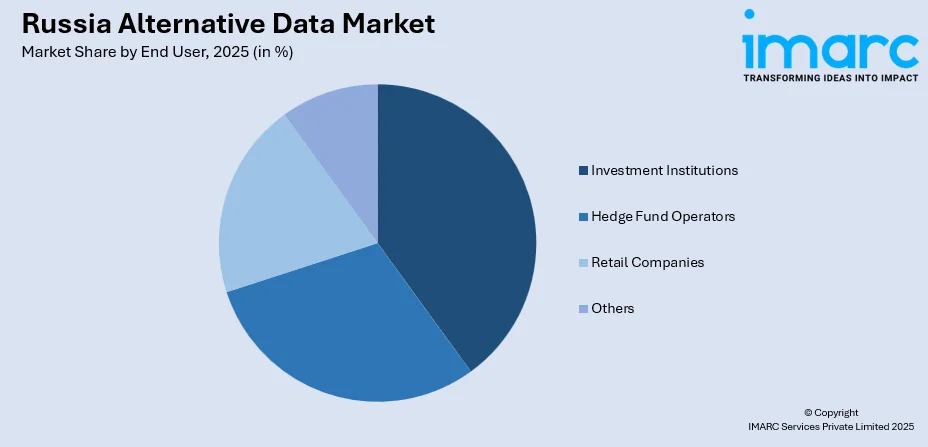

- By End User: Investment institutions represent the largest segment with a market share of 35% in 2025, due to increasing demand for unique market insights, alpha generation requirements, and the growing adoption of quantitative research methodologies among asset management firms and institutional investors.

- Key Players: The Russia alternative data market exhibits a moderately fragmented competitive landscape, with domestic technology corporations competing alongside specialized analytics providers across various data acquisition and processing segments.

To get more information on this market Request Sample

The market continues to benefit from substantial government support, including the National Strategy for AI Development through 2030 and substantial federal funding allocations for digital infrastructure. In August 2024, the Russian government designated over USD 27.6 Million from its Reserve Fund to enhance local digital transformation projects. Transaction data, mobile location insights, social sentiment, and satellite imagery are gaining relevance due to demand for real-time intelligence in volatile economic conditions. Local data providers and in-house analytics teams are likely to dominate, as firms reduce reliance on overseas vendors and prioritize data sovereignty. State influence over data ecosystems is encouraging the use of government and public-sector datasets for commercial analytics. ML adoption will deepen, enabling faster pattern recognition from unstructured datasets.

Russia Alternative Data Market Trends:

Accelerating AI and ML Integration

Russian enterprises are rapidly adopting AI-powered analytics platforms to extract actionable insights from alternative data sources. The government's National Strategy for AI Development has catalyzed substantial investments in ML infrastructure and research capabilities. Major technology firms and financial institutions are deploying advanced algorithms for sentiment analysis, predictive modeling, and pattern recognition across diverse data streams. The Strategic Agency for Support and Formation of AI Development (SAPFIR), established on the basis of the Skolkovo Foundation, began operations in early 2025 to coordinate national AI advancement efforts.

Strengthening Data Localization and Sovereignty Requirements

Russia is implementing increasingly stringent data localization mandates that require organizations to store and process citizen data within domestic infrastructure. New regulations effective from July 2025 under Federal Law No. 23-FZ significantly tightened requirements for database localization, mandating complete physical location of all infrastructure elements involved in data collection and processing within Russian territory. This regulatory evolution is driving substantial investments in domestic data center capacity and creating opportunities for local alternative data providers to develop compliant analytics solutions.

Expansion of Cloud-Based Analytics Infrastructure

With increasing establishments of data centers, organizations are increasingly adopting cloud-native deployments for alternative data processing, enabling scalable analytics capabilities and real-time data integration. As per IMARC Group, the Russia data center market is set to reach USD 8.7 Billion by 2033, exhibiting a growth rate (CAGR) of 8.40% during 2025-2033. Major cities, including Moscow, St. Petersburg, Kazan, and Novosibirsk, are emerging as key data infrastructure hubs, with commercial data processing center capacity expected to surge, supporting the expanding alternative data ecosystem.

Market Outlook 2026-2034:

The Russia alternative data market is set to witness exponential growth during the forecast period, driven by accelerating digital transformation across economic sectors and sustained government investment in data economy infrastructure. The market generated a revenue of USD 234.78 Million in 2025 and is projected to reach a revenue of USD 3,214.66 Million by 2034, growing at a compound annual growth rate of 33.74% from 2026-2034. The proliferation of AI-enabled analytics platforms, combined with increasing data generation from connected devices and digital transactions, will fuel the demand for sophisticated alternative data solutions. Financial institutions and investment firms will remain one of the primary revenue contributors, while retail, energy, and telecommunications sectors are expected to demonstrate accelerated adoption rates throughout the forecast period.

Russia Alternative Data Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Data Type | Credit and Debit Card Transactions | 20% |

| Industry | BFSI | 20% |

| End User | Investment Institutions | 35% |

Data Type Insights:

- Credit and Debit Card Transactions

- Email Receipts

- Geo-location (Foot Traffic) Records

- Mobile Application Usage

- Satellite and Weather Data

- Social and Sentiment Data

- Web Scraped Data

- Web Traffic

- Others

Credit and debit card transactions dominate with a market share of 20% of the total Russia alternative data market in 2025.

The segment's dominance stems from the extensive capabilities of data providers to classify and analyze consumer spending patterns across multiple dimensions, including demographic segments, merchant categories, geographic regions, and temporal trends. Russian financial technology companies have developed sophisticated platforms that aggregate and anonymize transaction data to reveal consumer behavior insights without compromising individual privacy.

The widespread adoption of digital payment systems, with mobile and contactless transactions experiencing substantial growth, generates massive volumes of transactional data suitable for alternative analytics applications. Bank of Russia statistics indicated that in the first quarter of 2025, approximately 800 Million payments were conducted via quick response (QR) codes or biometric data, nearly double the amount during the same timeframe in 2024. The segment benefits from Russia's advanced payment infrastructure, where leading fintech platforms process billions of transactions annually. Organizations leverage transaction data to inform investment decisions, assess retail sector performance, evaluate economic health indicators, and develop predictive models for consumer spending patterns. The increasing integration of payment data with AI-powered analytics platforms enables real-time processing and insight generation, enhancing the value proposition for financial institutions and investment managers seeking alpha-generating market intelligence.

Industry Insights:

- Automotive

- BFSI

- Energy

- Industrial

- IT and Telecommunications

- Media and Entertainment

- Real Estate and Construction

- Retail

- Transportation and Logistics

- Others

BFSI leads with a share of 20% of the total Russia alternative data market in 2025.

The BFSI sector's leadership reflects substantial reliance on alternative data sources for enhanced risk assessment, fraud detection, credit scoring, and investment strategy development. Russian financial institutions are increasingly deploying AI-driven analytics platforms to gain competitive advantages through superior market intelligence and customer insights.

The sector's established quantitative research capabilities and regulatory requirements for robust risk management drive continuous demand for diverse alternative data streams. Major Russian banks have made significant investments in data analytics capabilities to maintain competitiveness and address evolving customer expectations for personalized digital services. These institutions utilize transaction data, sentiment analysis, and behavioral insights to inform lending decisions, detect fraudulent activities, and optimize product offerings. The growing emphasis on digital banking transformation and the development of comprehensive financial ecosystems among leading players continue to accelerate alternative data adoption across the BFSI sector.

End User Insights:

Access the Comprehensive Market Breakdown Request Sample

- Hedge Fund Operators

- Investment Institutions

- Retail Companies

- Others

Investment Institutions exhibit a clear dominance with a 35% share of the total Russia alternative data market in 2025.

Investment institutions command the largest market share due to their sophisticated requirements for unique market insights and alpha generation capabilities. These organizations deploy alternative data across multiple investment strategies, including fundamental research enhancement, systematic trading signals, and portfolio risk management.

The increasing difficulty of generating returns through traditional data sources drives institutional investors to seek differentiated information advantages through alternative data integration. Russian investment institutions have developed robust data acquisition and processing capabilities to support quantitative and discretionary investment approaches. These organizations leverage credit card transaction data, satellite imagery, web traffic analytics, and sentiment analysis to evaluate company performance, assess market trends, and identify investment opportunities ahead of conventional information dissemination. The growing availability of AI-powered analytics platforms enables smaller institutional investors to access sophisticated alternative data capabilities previously available only to the largest market participants.

Regional Insights:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The Central District holds prominence due to dense business activities, strong digital infrastructure, and the presence of major financial institutions. High demand comes from the banking, e-commerce, and telecom sectors using transaction data, web traffic insights, and consumer behavior analytics to drive faster, data-led decisions.

The Volga District shows growing adoption, driven by manufacturing, logistics, and regional trade hubs. Companies increasingly use mobility data, supplier intelligence, and pricing datasets to enhance operational efficiency. Expanding digital literacy is supporting wider usage of alternative data tools across industrial and commercial segments.

In the Urals District, alternative data demand is shaped by mining, metals, and heavy industries. Satellite imagery, asset monitoring data, and environmental datasets are widely applied for production forecasting and risk management. Investments in industrial digitalization are boosting awareness and long-term usage across the regional energy ecosystem.

The Northwestern District benefits from proximity to ports and international trade routes, encouraging usage in logistics, shipping, and retail analytics. Demand is rising for trade-flow data, geolocation insights, and customer sentiment analytics, helping businesses optimize supply chains and adapt to shifting regional consumption patterns effectively.

In the Siberian District, the market growth is linked to natural resources, transportation networks, and infrastructure development. Firms use alternative data like satellite monitoring and climate analytics for project planning and asset safety. Harsh geography makes real-time insights valuable, increasing reliance on technology-enabled decision-making across industrial operations.

Market Dynamics:

Growth Drivers:

Why is the Russia Alternative Data Market Growing?

Growth of E-Commerce and Consumer Analytics

Online retail in Brazil creates valuable behavioral data related to search habits, purchasing patterns, and product preferences. As per industry reports, in 2024, sales in the e-commerce industry in Russia were expected to amount to 10.7 Trillion Rubles, which was 36% more than in 2023. Retailers use alternative data for demand forecasting, pricing strategies, and inventory optimization. Personalized marketing campaigns depend on user behavior tracking across channels. Social sentiment analysis also informs merchandising decisions. Consumer expectations for tailored experiences drive demand for deeper customer insights. Companies are investing in technology that transforms data into marketing intelligence. As competition is increasing, retailers continue to rely on data to differentiate offerings. Alternative data empowers Brazilian retailers to optimize supply chains, increase sales conversion, and improve customer loyalty, reinforcing market growth.

Accelerating Financial Sector Digitalization

The Russian banking and financial services sector is undergoing rapid digital transformation, with major institutions investing substantially in advanced analytics capabilities and AI-powered platforms. Leading banks have developed comprehensive digital ecosystems that generate massive volumes of alternative data from payment transactions, mobile application usage, and customer interactions. In 2024, the Bank of Russia's approval of the Guidelines for Financial Technologies Development for 2025-2027 established clear priorities for fintech innovation and data-driven financial services. This regulatory support, combined with competitive pressures driving digital banking adoption, is creating expanding demand for alternative data solutions that enable superior risk assessment, personalized services, and investment signal generation across the financial sector.

Broadening of Data Centers

The expansion of data centers is strongly driving the market growth in Russia by improving data storage, processing capacity, and access to high-performance computing. As more data centers are being built, organizations can store massive volumes of structured and unstructured data generated from digital platforms, mobile devices, and the Internet of Things (IoT) systems. In July 2025, Russia’s Megafon opened data centers in Yekaterinburg and Tver. Through this release, the company focused on the demands for energy efficiency and superior computing performance. Increased capacity allows faster analysis and real-time insights, making alternative data more valuable to businesses. Data centers also enhance data security and reliability, building confidence among enterprises handling sensitive information. Improved connectivity reduces latency and ensures better performance for analytics platforms. In addition, the availability of localized data infrastructure encourages companies to adopt cloud-based data solutions without depending on foreign systems. This expansion lowers barriers for startups and analytics firms, enabling them to scale operations efficiently. Overall, data center growth forms the backbone of Brazil’s rising alternative data ecosystem.

Market Restraints:

What Challenges the Russia Alternative Data Market is Facing?

International Sanctions and Technology Restrictions

Economic sanctions imposed by Western nations have created significant barriers to technology acquisition and international collaboration for Russian alternative data providers and consumers. Restrictions on advanced semiconductor imports, cloud computing services, and software platforms constrain infrastructure development and analytical capabilities. These limitations increase operational costs and complicate access to cutting-edge technologies essential for competitive alternative data solutions.

Stringent Data Localization Compliance Requirements

Stringent data localization compliance requirements are slowing the growth of the market by increasing operational complexity and costs for data providers. Companies must invest in local storage infrastructure and compliance systems, which raises entry barriers for smaller firms. These rules also limit cross-border data sharing, reducing access to global datasets. As a result, scaling operations becomes harder and time-to-market increases, affecting innovation speed and partnerships within the alternative data ecosystem.

Skilled Workforce Shortages in Data Science Disciplines

The alternative data market faces constraints from limited availability of qualified professionals in artificial intelligence, machine learning, and advanced analytics domains. Competition from technology sectors globally and domestic talent migration create persistent workforce challenges. Organizations struggle to recruit and retain specialists with the technical expertise required to develop and deploy sophisticated alternative data solutions.

Competitive Landscape:

The Russia alternative data market features a competitive environment, characterized by participation from diverse organization types, including domestic technology corporations, financial institution analytics divisions, specialized data providers, and international firms with local operations. Market participants compete across multiple dimensions, inculcating data acquisition capabilities, analytical sophistication, processing infrastructure, and integration with client workflows. Domestic technology leaders have established substantial positions through extensive data generation capabilities from digital platforms and financial services operations. The market is experiencing consolidation, as larger organizations are acquiring specialized providers to enhance capabilities, while emerging participants are focusing on niche data types and industry-specific solutions. Competitive dynamics are influenced by regulatory requirements that favor organizations with robust domestic infrastructure and compliance capabilities.

Russia Alternative Data Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Data Types Covered | Credit and Debit Card Transactions, Email Receipts, Geo-location (Foot Traffic) Records, Mobile Application Usage, Satellite and Weather Data, Social and Sentiment Data, Web Scraped Data, Web Traffic, Others |

| Industries Covered | Automotive, BFSI, Energy, Industrial, IT and Telecommunications, Media and Entertainment, Real Estate and Construction, Retail, Transportation and Logistics, Others |

| End Users Covered | Hedge Fund Operators, Investment Institutions, Retail Companies, Others |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Russia alternative data market size was valued at USD 234.78 Million in 2025.

The Russia alternative data market is expected to grow at a compound annual growth rate of 33.74% from 2026-2034 to reach USD 3,214.66 Million by 2034.

Credit and debit card transactions dominate the market with 20% revenue share, driven by extensive payment digitalization, sophisticated transaction analytics capabilities, and strong demand for consumer spending pattern insights from financial institutions and investment managers.

Key factors driving the Russia alternative data market include government-led digital economy transformation initiatives, accelerating financial sector digitalization with substantial investments in AI-powered analytics, and expanding data infrastructure and cloud computing adoption across major urban centers.

Major challenges include international sanctions restricting technology access and collaboration, stringent data localization compliance requirements, skilled workforce shortages in data science and AI disciplines, and infrastructure investment constraints related to economic conditions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)