Russia Animal Feed Market Size, Share, Trends and Forecast by Form, Animal Type, Ingredient, and Region, 2025-2033

Russia Animal Feed Market Size and Share:

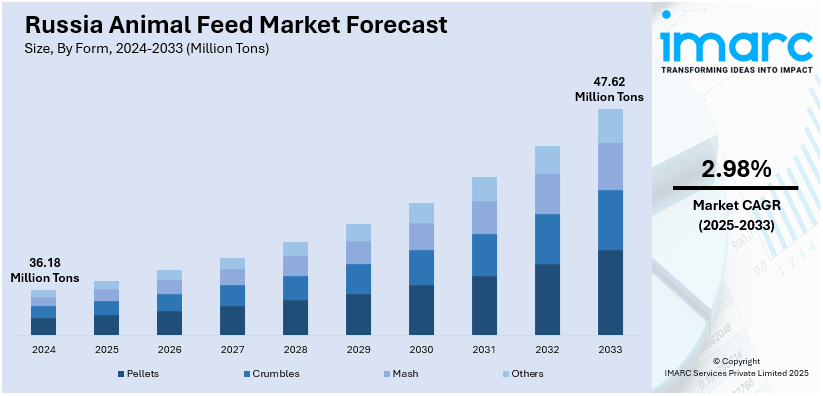

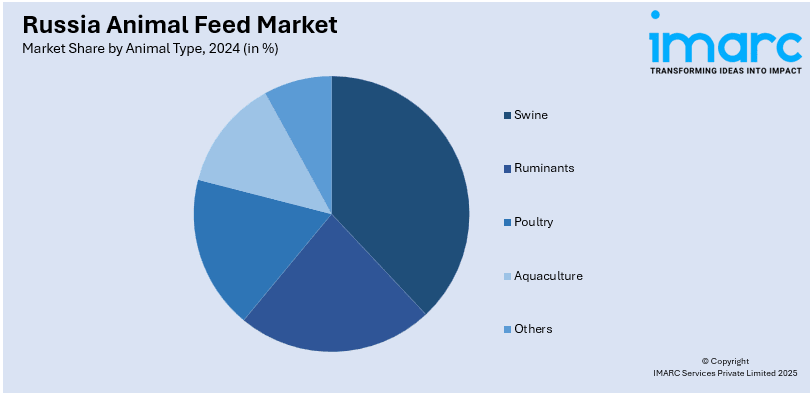

The Russia animal feed market size was valued at 36.18 Million Tons in 2024. Looking forward, IMARC Group estimates the market to reach 47.62 Million Tons by 2033, exhibiting a CAGR of 2.98% from 2025-2033. The market is driven by growing demand for efficient, sustainable feed solutions across poultry, swine, ruminants and aquaculture sectors. Adoption of advanced feed technologies, increased focus on alternative ingredients and rising consumer demand for ecofriendly products are also contributing positively to the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 36.18 Million Tons |

| Market Forecast in 2033 | 47.62 Million Tons |

| Market Growth Rate (2025-2033) | 2.98% |

The Russia animal feed market is primarily driven by the growing demand for animal products particularly meat and dairy as the population increases and disposable incomes are higher. According to the data published by Worldometer, as of February 2025, Russia's population stands at 144,311,633 with an estimated mid-year figure of 143,997,393. The country comprises 1.75% of the global population ranking 9th worldwide. With a density of 9 people per km² 75% of the population reside in urban areas. Farmers, in an attempt, to improve animal productivity are increasingly using advanced feed formulations that improve growth rates, feed conversion and overall animal health. This trend coupled with the demand for sustainable farming practices has spurred the demand for specialty animal feed including organic and nutritionally enriched feed.

The growing industrialization of the agriculture sector is another major driver. As more large-scale commercial farms are being commissioned the demand for bulk feed is growing. These farms require cost-effective and high-quality feed to ensure production efficiency and meet market demands. Government support in the form of subsidies, policies and research on alternative feed sources including plant protein and biofuels further propels market growth. For instance, Russia's new legislation effective from September 1, 2024, will enable feed additive manufacturers to access state aid including subsidized loans aiming to reduce import dependence and enhance food security. The Russian National Feed Union highlights this as a key step towards technological independence for the country's agriculture sector. Increased livestock importation and processing also drive a stronger demand for feed solutions in Russia.

Russia Animal Feed Market Trends:

Shift to Sustainable Feed Solutions

The transition towards sustainable feed solutions in Russia's animal feed industry is mainly fueled by increasing consumer demand for environmentally friendly, organic and ethically sourced livestock products, representing one of the key Russia animal feed market trends. As consumers increasingly become aware of environmental and health effects there is an increasing demand for sustainably sourced and nutritionally balanced animal feed. This trend is affecting feed manufacturers to seek out plant-based, non-GMO and organic feed ingredients minimizing the application of chemicals and additives. The use of circular economy principles such as using by-products from other industries (e.g., food or biofuel production) is also on the rise as a means to reduce waste and enhance feed sustainability. For instance, in September 2024, Russia officially implemented regulations allowing food waste to be used as livestock feed, benefiting the dairy industry. Despite optimism from some farmers, concerns about safety standards and compliance costs persist. The government estimates 700,000 tonnes of food waste could be repurposed annually, raising questions about economic viability.

Government Support

Government assistance is the determining factor in Russia animal feed market growth through subsidies, research grants and supportive policies for domestic feed production. The government promotes domestic producers' improvement of feed quality, efficiency and sustainability through subsidies and research grants. In addition to financial and research support, the Russian government is taking significant steps to enhance market transparency and ensure product integrity. For instance, in June 2024, Russian government announced its plans to implement mandatory labeling for animal feed and health products starting September 1, 2024. Registration in the 'Chestny ZNAK' system begins this September with labeling for dry feed and treats starting October 2024 followed by wet feeds in March 2025. This move intends to combat counterfeit goods in the market. Promoting technological advancements e.g., producing alternative feedstuffs or more efficient feed processing is more prevalent. Government assistance through regulation also assures raw material availability, reduces imports and promotes the development of more efficient and sustainable feed systems which promotes the growth of the whole market.

Growth in Aquaculture Feed

The rapid expansion of Russia's aquaculture sector is driving a significant increase in the demand for specialty animal feed for fish and other aquatic animals. As aquaculture is becoming a major driver of food production the demand for high-quality nutritionally balanced feed that meets the specific dietary requirements of different aquatic animals is on the rise. Improvements in aquaculture feed including the application of functional ingredients like omega-3 fatty acids, plant proteins and probiotics are improving fish health, growth rate and feed conversion rate. For instance, in November 2024, Russia announced its plans to meet 90% of its aquaculture feed demand by 2030 with domestic production projected to exceed 220,000 tonnes annually by 2027. Recent initiatives include government subsidies for feed facility upgrades. Notable investments, like a new plant in Astrakhan highlight the country's commitment to enhancing self-sufficiency in fish feed. This is driving the overall demand for specialty and sustainable feed solutions in Russia's animal feed market.

Russia Animal Feed Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Russia animal feed market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on form, animal type, and ingredient.

Analysis by Form:

- Pellets

- Crumbles

- Mash

- Others

Pellets are the most prevalent form of animal feed in Russia due to their convenience, consistency, and ease of storage. They consist of compressing ground feed material into small, uniform pellets, which improves digestibility and feed conversion. Pellets are particularly preferred by large-scale livestock and poultry operations due to their efficient handling, low waste, and consistent nutrient supply, making them a favorite for contemporary animal agriculture.

Crumbles are small, irregular pieces of feed generated by breaking pellets into small pieces. They are applied to poultry and young animals, providing a texture stimulating feed intake and digestive health. Crumbles provide a compromise between pellet digestibility and mash flexibility, making them ideal for young animals or between-feed type changing animals. They enhance feed conversion and reduce waste.

Mash is loose, unprocessed animal feed consisting of finely ground material. It is applied in small-scale or traditional operations where feed is produced on the farm. While more to handle and having more waste potential than pellets, mash is preferred by some due to it being cost-effective and convenient. Mash is particularly ideal for poultry, where it can easily be adjusted according to individual dietary needs at different growth stages.

Analysis by Animal Type:

- Swine

- Starter

- Finisher

- Grower

- Ruminants

- Calves

- Dairy Cattle

- Beef Cattle

- Others

- Poultry

- Broilers

- Layers

- Turkeys

- Others

- Aquaculture

- Carps

- Crustaceans

- Mackeral

- Milkfish

- Mollusks

- Salmon

- Others

- Others

The swine segment in Russia’s animal feed market is divided into starter, finisher and grower feeds. Starter feeds are formulated to meet the nutritional needs of piglets focusing on growth and health. Finisher feeds are designed for pigs nearing market weight promoting rapid weight gain and efficient feed conversion. Grower feeds support pigs during the intermediate growth stages, balancing protein, energy and minerals to optimize overall development.

Ruminant feed in Russia targets various categories including calves, dairy cattle and beef cattle. Calf feed focuses on early-stage growth providing essential nutrients for bone development and immunity. Dairy cattle feed emphasizes high-energy and protein levels to support milk production while beef cattle feed is designed for optimal weight gain and muscle development. Specialized feeds for other ruminants address specific dietary requirements for health and productivity.

The poultry feed segment covers broilers, layers, turkeys and other poultry types. Broiler feed is designed to promote rapid growth and high feed conversion rates. Layer feed supports egg production offering balanced nutrients for laying hens. Turkey feed is optimized for growth and health during different life stages while other poultry species may require tailored formulations based on breed-specific nutritional needs ensuring optimal performance in both commercial and small-scale operations.

The aquaculture feed segment in Russia includes species like carps, crustaceans, mackerel, milkfish, mollusks and salmon. Carps and milkfish require feeds rich in plant-based proteins while crustaceans and mollusks often benefit from feeds high in marine ingredients for enhanced growth and health. Mackerel and salmon require high-protein and lipid-rich diets for optimal growth and reproduction. Specialized feed formulations address the unique nutritional needs of each aquatic species promoting sustainable aquaculture practices and improving production efficiency.

Analysis by Ingredient:

- Cereals

- Oilseed Meal

- Molasses

- Fish Oil and Fish Meal

- Additives

- Antibiotics

- Vitamins

- Antioxidants

- Amino Acids

- Feed Enzymes

- Feed Acidifiers

- Others

- Others

Cereal grains, such as wheat, corn and barley are the primary energy sources in animal feed. They provide essential carbohydrates for livestock and poultry promoting growth and high feed conversion rates. Cereal-based feeds are widely used due to their affordability and availability making them a staple in both commercial and small-scale animal farming across Russia.

Oilseed meals such as soybean, sunflower and canola meal are rich in protein and amino acids making them a key ingredient in livestock and poultry feed. They support muscle development, growth and egg production in poultry. Oilseed meals also serve as an economical alternative to animal protein sources promoting more sustainable and cost-efficient feed formulations.

Molasses is a by-product of sugar production is used in animal feed for its energy content and palatability. Rich in sugars and minerals it helps enhance feed intake particularly in ruminants like cattle. Molasses is also utilized as a binder in pellet production contributing to feed consistency and reducing dust which improves handling and storage.

Fish oil and fish meal are high-quality protein and fat sources rich in omega-3 fatty acids essential for improving animal health, growth and immunity. Fish meal is particularly used in aquaculture feeds while fish oil supports fat metabolism and improves feed conversion. They are vital in the production of high-performance feed for species like salmon, mackerel and crustaceans.

Feed additives like antibiotics, vitamins, antioxidants, amino acids, enzymes and acidifiers play a crucial role in enhancing animal feed quality. Antibiotics promote growth and prevent diseases while vitamins and antioxidants boost overall animal health. Amino acids and enzymes improve feed digestibility while acidifiers support gut health ensuring optimal nutrition and performance across all animal types.

Regional Analysis:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The Central District is a key market for animal feed in Russia, driven by its large agricultural base and proximity to major livestock operations. With a strong focus on dairy, poultry, and swine production, this region demands high-quality feed ingredients and innovations in feed formulations to support intensive farming practices and maintain competitive productivity levels.

The Volga District is a significant hub for Russia’s animal feed market, known for its expansive grain and oilseed production. It supplies feed for a variety of livestock, including cattle, poultry, and swine. The region's agricultural infrastructure and access to raw materials make it an important area for feed production, with growth driven by expanding industrial farming practices.

The Urals District has a growing demand for animal feed, particularly for poultry and cattle. The region’s diverse agricultural activities, combined with its strategic location, support both livestock farming and feed production. As livestock operations expand, the Urals District is seeing an increase in the demand for specialized feeds, including those for dairy cattle and broilers.

The Northwestern District is crucial for Russia’s animal feed market due to its strong focus on poultry and swine farming. This region benefits from proximity to major ports, facilitating the import of feed ingredients and additives. The growing demand for high-quality feed and sustainable farming practices is fueling growth in both urban and rural agricultural areas in this region.

The Siberian District, with its vast land area, has significant potential in the animal feed market, especially for cattle, poultry, and aquaculture. The region's cold climate and extensive agricultural resources support livestock production, with increasing demand for efficient, nutritionally balanced feed. Investments in infrastructure and feed production technologies are driving the Russia animal feed market growth.

Competitive Landscape:

The competitive landscape of the Russia Animal Feed Market is marked by a mix of domestic producers and international players vying for market share. Local feed manufacturers dominate the market, leveraging regional supply chains and a strong understanding of local livestock needs. However, international companies are increasingly entering the market, introducing advanced feed formulations and technologies to cater to growing demands for specialized and sustainable solutions. The market is highly fragmented, with companies focusing on various segments such as poultry, swine, ruminants, and aquaculture. To stay competitive, companies are investing in research and development, seeking innovations like alternative protein sources, functional additives, and precision feeding technologies. Additionally, regulatory changes and increasing demand for transparency are reshaping the competitive dynamics, requiring companies to adapt quickly to market shifts.

The report provides a comprehensive analysis of the competitive landscape in the Russia animal feed market with detailed profiles of all major companies.

Latest News and Developments:

- In February 2025, the Russian Ministry of Agriculture announced its plans to launch an agricultural information system by 2025 to monitor livestock breeding resources. This system will feature a comprehensive database on animal pedigrees, production indicators and breed characteristics along with a breeding value index to aid farmers in selecting suitable animals.

- In October 2024, Belarus and Russia's Amur Oblast announced their strategic alliance to enhance agricultural cooperation, focusing on dairy exports and soybean trade. Recent online discussions aim to boost dairy production and exports while improving supply chains, agricultural technology, and veterinary drug exports, promising economic growth and food security for both regions.

- In October 2024, Russian scientists at Izhevsk State Medical Academy developed the world's first anti-aging pet food claiming it can enhance longevity in pets. The formula includes geroprotective substances like curcumin and resveratrol showed promising results in trials potentially slowing aging and improving health in cats.

- In March 2024, Cherkizovo Group, Russia's leading meat and feed producer announced the acquisition of Venta-Oil, enhancing feed supplies for its pig facilities in Orenburg. The facility boasts a 50,000-tonne production capacity and advanced storage capabilities. This acquisition aims to strengthen vertical integration and improve biosecurity for Cherkizovo's operations in the region.

- In November 2023, the Sobskaya hatchery in Siberia experimented with gaprin a protein derived from methane to improve the growth of muksun fry. Early results indicated that the weight of the fry doubled along with improved survival rates. With increased interest from Russian authorities there were plans to revive industrial production of gaprin bringing back the controversial gas-to-protein technology for fish feed.

- In October 2023, Vladivostok-based feed additive manufacturer Arnica announced its plans to expand its exports to Asia after reaching 40% of its production capacity. The company aims to meet 50% of Russian demand and has recently made initial vitamin B4 shipments to Vietnam, with plans for further exports to Japan and other countries.

Russia Animal Feed Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Forms Covered | Pellets, Crumbles, Mash, Others |

| Animal Types Covered |

|

| Ingredients Covered |

|

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia animal feed market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Russia animal feed market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia animal feed industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The animal feed market was valued at 36.18 Million Tons in 2024.

The growth of the Russia animal feed market is primarily driven by increasing demand for meat, dairy, and fish products as population and disposable incomes rise. Additionally, government support, advancements in feed technologies, and a shift toward sustainable, eco-friendly feed solutions are also propelling market growth. The industrialization of agriculture further boosts the demand for high-quality, cost-effective animal feed.

IMARC estimates the animal feed market to exhibit a CAGR of 2.98% from 2025-2033, with the market projected to reach 47.62 Million Tons by 2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)