Russia Craft Beer Market Size, Share, Trends and Forecast by Product Type, Age Group, Distribution Channel, and Region, 2025-2033

Russia Craft Beer Market Overview:

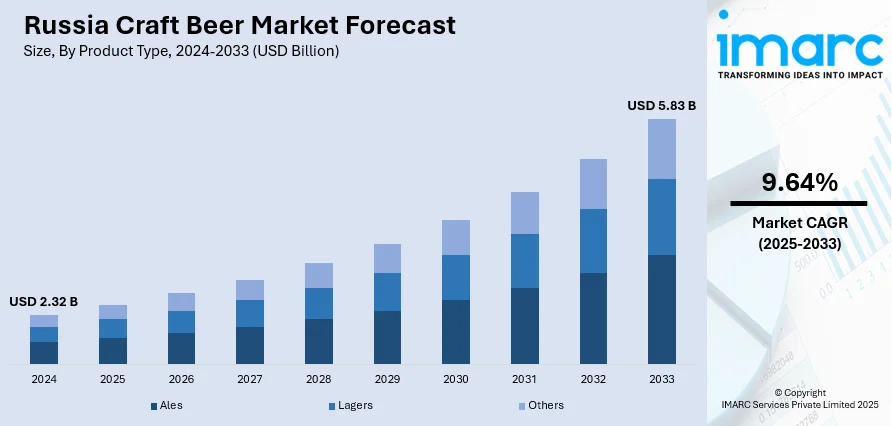

The Russia craft beer market size reached USD 2.32 Billion in 2024. The market is projected to reach USD 5.83 Billion by 2033, exhibiting a growth rate (CAGR) of 9.64% during 2025-2033. The market is experiencing steady growth, driven by increasing consumer interest in premium and locally produced beverages. Younger demographics are showing a strong preference for diverse flavor profiles and innovative brewing styles, encouraging the rise of microbreweries across urban regions. Expansion of modern retail and online channels is also improving product accessibility nationwide. As Russian breweries continue to adapt to evolving tastes, these developments provide comparative insights into regional trends influencing the broader France craft beer market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.32 Billion |

| Market Forecast in 2033 | USD 5.83 Billion |

| Market Growth Rate 2025-2033 | 9.64% |

Russia Craft Beer Market Trends:

Domestic Sales Growth Amid Market Transformation

In 2024, beer sales in Russia saw an 8.7% year-on-year increase, outpacing other fast-moving consumer goods. This growth is attributed to rising prices for stronger alcoholic drinks like wine and spirits, which have led consumers to opt for more affordable beer options. The stability in beer prices has made it an attractive alternative, supporting Russia craft beer market growth. While macro-breweries continue to dominate in volume, there is a noticeable shift towards premium and craft varieties, especially in urban and suburban regions. Consumers are increasingly drawn to locally brewed ales, stouts, and experimental styles, reflecting a growing appreciation for quality and authenticity. This trend is further supported by expanding retail distribution through specialty stores and e-commerce platforms focused on craft products. The uptick in beer consumption, combined with a preference for premium craft options, which indicates a significant market shift, presenting opportunities for producers aligned with these evolving consumer preferences.

To get more information of this market, Request Sample

Surge in Microbreweries Reviving Local Beverage Culture

The Russia craft beer industry has seen substantial growth in 2024 with the increase in microbreweries in the country's major cities like Moscow and Saint Petersburg. The small-scale breweries are adopting traditional brewing practices and using native ingredients such as Siberian pine and wild berries to produce unique flavors that support Russia's rich regional diversity. The increase in craft beer festivals and taproom openings has further driven consumer interest and fostered vibrant communities for these brands. Industry observers note that the number of craft breweries that exist in Russia reached over 250 early in 2024, representing significant growth from earlier years. This is creating a new consciousness for quality and innovation, elevating Russia craft beer market trends as consumers are increasingly looking for real and locally derived products. Cultural renaissance in the form of craft brewing is not only transforming consumption but also adding to the diversification of the overall beverage industry in Russia.

Innovation and Quality Raise Consumer Expectations

Russian craft breweries prioritized innovation and quality, adopting modern brewing techniques to meet the evolving tastes of discerning consumers. Seasonal and limited releases, like barrel-aged sours and fruit-infused ales, are becoming more popular, mostly being promoted through special taproom events or social media to generate hype and consumer interest. Educational efforts, such as homebrew clubs and brewery tours, are contributing to increased awareness of brewing methods and sourcing of ingredients, creating an educated and loyal customer base. The incorporation of sophisticated equipment, such as temperature-controlled fermentation tanks and stainless-steel fermenters, enables manufacturers to enhance consistency of product and expand operations without compromising artisanal quality. These advances coincide with increasing consumer preferences for authenticity, origin, and craftsmanship. This trend is one of the major elements of Russia craft beer market, showing that ongoing innovation and quality enhancement are crucial to maintaining growth and further improving the sector's image in the overall Russian beverage market.

Russia Craft Beer Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, age group, and distribution channel.

Product Type Insights:

- Ales

- Lagers

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes ales, lagers, and others.

Age Group Insights:

- 21–35 Years Old

- 40–54 Years Old

- 55 Years and Above

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes 21–35 years old, 40–54 years old, and 55 years and above.

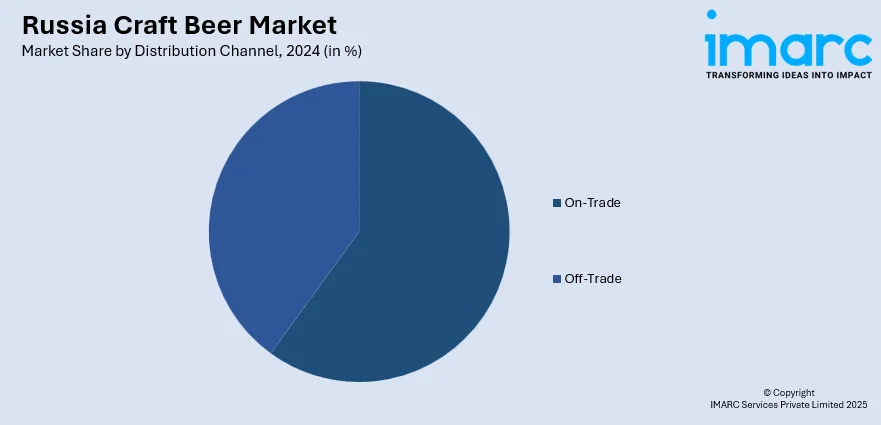

Distribution Channel Insights:

- On-Trade

- Off-Trade

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes on-trade and off-trade.

Regional Insights:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Central District, Volga District, Urals District, Northwestern District, Siberian District, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Russia Craft Beer Market News:

- May 2025: Baltika Brewing Company, a leading Russian brewer, announced significant production expansion in years, attributing it to strong domestic demand and strategic investments. The company is operating at full capacity and plans to develop new facilities to support future growth, according to President Taimuraz Bolloyev. As part of its investment agenda, Baltika is strengthening domestic production and expanding its craft brewing arm. This initiative demonstrates the company’s commitment to enhancing Russia’s beverage sector and aligns with evolving global craft beer market.

Russia Craft Beer Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Ales, Lagers, Others |

| Age Groups Covered | 21–35 Years Old, 40–54 Years Old, 55 Years and Above |

| Distribution Channels Covered | On-Trade, Off-Trade |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Russia craft beer market performed so far and how will it perform in the coming years?

- What is the breakup of the Russia craft beer market on the basis of product type?

- What is the breakup of the Russia craft beer market on the basis of age group?

- What is the breakup of the Russia craft beer market on the basis of distribution channel?

- What is the breakup of the Russia craft beer market on the basis of region?

- What are the various stages in the value chain of the Russia craft beer market?

- What are the key driving factors and challenges in the Russia craft beer?

- What is the structure of the Russia craft beer market and who are the key players?

- What is the degree of competition in the Russia craft beer market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia craft beer market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Russia craft beer market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia craft beer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)