Russia E-Invoicing Market Size, Share, Trends and Forecast by Channel, Deployment Type, Application, and Region, 2025-2033

Russia E-Invoicing Market Overview:

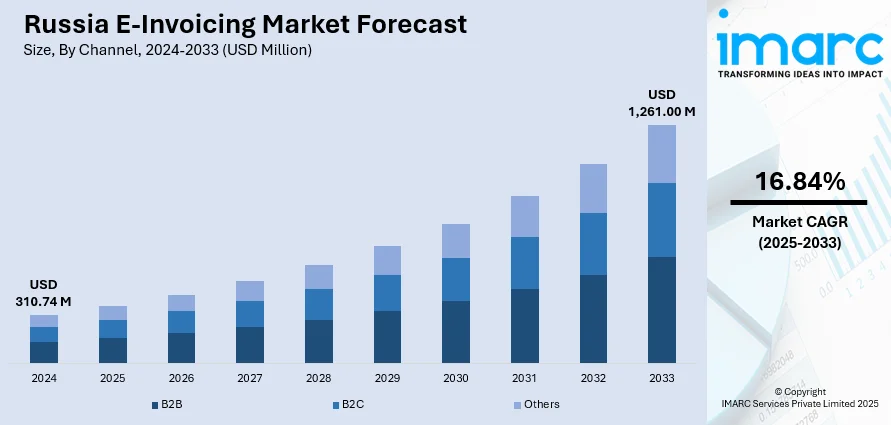

The Russia e-invoicing market size reached USD 310.74 Million in 2024. The market is projected to reach USD 1,261.00 Million by 2033, exhibiting a growth rate (CAGR) of 16.84% during 2025-2033. The market is steadily expanding, supported by the growing shift toward digital financial operations and streamlined tax compliance frameworks. Adoption across sectors is increasing as businesses seek efficiency and transparency in invoicing processes. Deployment via cloud-based platforms continues to rise, offering flexibility and scalability. Additionally, government-backed digitalization initiatives are encouraging wider integration of e-invoicing systems across industries. These developments collectively contribute to the consistent growth of the Russia e-invoicing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 310.74 Million |

| Market Forecast in 2033 | USD 1,261.00 Million |

| Market Growth Rate 2025-2033 | 16.84% |

Russia E-Invoicing Market Trends:

Mandatory Traceability-Linked E‑Invoicing Accelerates Digital Adoption

In 2024, Russia significantly enhanced its e‑invoicing framework by mandating electronic invoicing for a wider range of traceable goods, such as refrigeration equipment, industrial machines, electronics, and baby carriages, under its national Traceability Model. This expansion requires businesses selling, purchasing, or distributing qualifying products to issue digitized invoices in the standardized XML format with unique batch registration numbers. All invoices must now be submitted through certified electronic document exchange providers that facilitate secure transmission. The invoicing data must also be archived electronically for five years, ensuring transparency and accessibility for auditing by the Federal Tax Service. The Traceability Model framework enables real-time linkage between supply chain transactions and national tax records, reducing fiscal evasion and improving enforcement efficiency. By embedding e‑invoicing within the traceability regime, the government is fostering broader digital adoption across B2B trade in key sectors. This regulatory alignment and digitization drive is underpinning Russia e-invoicing market growth, enhancing transactional transparency and supporting the modernization of financial workflows in commerce and industry.

To get more information of this market, Request Sample

Expansion of Certified E‑Invoice Service Providers Diversifies Offerings

In the first quarter of 2025, over 40 certified Electronic Document Exchange Operators (EDEOs) were licensed by the Federal Tax Service to offer e‑invoice generation and transmission services, signaling the rapid maturity of Russia’s digital invoicing ecosystem. These service providers play a key role in supporting the country’s Unified Transfer Document (UTD) framework, offering tools for secure XML-based invoice generation, legally compliant digital signatures, automated regulatory tracking, and long-term electronic archiving Many also support seamless integration with enterprise resource planning (ERP) systems, allowing businesses to automate billing, enable real-time invoice validation, and streamline financial documentation. Additionally, several providers have introduced value-added services like built-in analytics tools, multilingual customer interfaces, and compliance dashboards, which collectively strengthen transparency and operational efficiency. The expansion of certified operators and enhanced service portfolios promote competitive pricing models and increase accessibility for small to large enterprises. As sectors such as retail, automotive, and pharmaceuticals move toward mandatory traceable invoicing, this service diversification strongly supports market growth and shapes ongoing Russia e-invoicing market trends by enabling scalable, secure digital adoption nationwide.

Nationwide Digital Invoice Clearing Gains Momentum

In 2025, Russia’s Federal Tax Service introduced a centralized electronic invoice exchange platform to enhance the accuracy and efficiency of tax reporting. This official system allows certified e-invoice operators to transmit documents in real-time using standardized XML formatting and digital signatures, ensuring full regulatory compliance. The integration streamlines invoice validation, reduces the need for manual data entry, and accelerates the reconciliation process with tax authorities. One of the key advantages of this platform is the ability to provide synchronized updates between suppliers and buyers, minimizing discrepancies and enabling instantaneous audits. It also supports seamless communication across various enterprise systems, promoting consistent and secure data transmission. By facilitating transparency and reducing the risk of fraud, this platform has emerged as a cornerstone of modern invoicing practices in Russia. These advancements represent a pivotal shift in Russia e-invoicing market, supporting structured automation and enhancing business compliance. The system is playing a crucial role in driving Russia e-invoicing market, especially across industries with high-volume transaction needs.

Russia E-Invoicing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on channel, deployment type, and application.

Channel Insights:

- B2B

- B2C

- Others

The report has provided a detailed breakup and analysis of the market based on the channel. This includes B2B, B2C, and others.

Deployment Type Insights:

- Cloud-based

- On-premises

A detailed breakup and analysis of the market based on the deployment type have also been provided in the report. This includes cloud-based and on-premises.

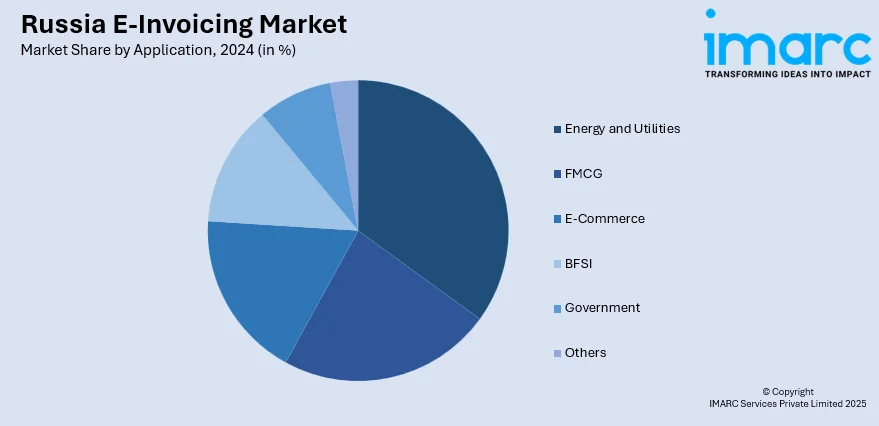

Application Insights:

- Energy and Utilities

- FMCG

- E-Commerce

- BFSI

- Government

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes energy and utilities, FMCG, e-commerce, BFSI, government, and others.

Regional Insights:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Central District, Volga District, Urals District, Northwestern District, Siberian District, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Russia E-Invoicing Market News:

- May 2024: Deloitte and Basware announced a strategic partnership on May 21, 2024, aimed at enhancing global e‑invoicing by advancing touchless invoice processing and accounts‑payable automation. The alliance combines Basware’s AP technology with Deloitte’s finance, procurement, and tax expertise to help businesses streamline operations and stay compliant with evolving financial regulations. Their joint strategy includes developing a unified go‑to‑market approach and training Deloitte consultants on Basware’s platform. The focus remains firmly on optimizing efficiency and regulatory compliance.

Russia E-Invoicing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Channels Covered | B2B, B2C, Others |

| Deployment Types Covered | Cloud-based, On-premises |

| Applications Covered | Energy and Utilities, FMCG, E-Commerce, BFSI, Government, Others |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Russia e-invoicing market performed so far and how will it perform in the coming years?

- What is the breakup of the Russia e-invoicing market on the basis of channel?

- What is the breakup of the Russia e-invoicing market on the basis of deployment type?

- What is the breakup of the Russia e-invoicing market on the basis of application?

- What is the breakup of the Russia e-invoicing market on the basis of region?

- What are the various stages in the value chain of the Russia e-invoicing market?

- What are the key driving factors and challenges in the Russia e-invoicing?

- What is the structure of the Russia e-invoicing market and who are the key players?

- What is the degree of competition in the Russia e-invoicing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia e-invoicing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Russia e-invoicing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia e-invoicing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)