Russia E-Learning Market Size, Share, Trends and Forecast by Technology, Provider, Application, and Region, 2025-2033

Russia E-Learning Market Size and Share

The Russia e-learning market size was valued at USD 1.66 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 11.15 Billion by 2033, exhibiting a CAGR of 23.13% from 2025-2033. The market is experiencing rapid growth, driven by digital adoption, government initiatives, and rising demand for professional training. Expanding internet access and corporate investments further accelerate market expansion. Key segments include K-12, higher education, and workforce upskilling, with increasing adoption of hybrid learning models and AI-driven educational technologies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.66 Billion |

| Market Forecast in 2033 | USD 11.15 Billion |

| Market Growth Rate 2025-2033 | 23.13% |

The expansion of high-speed internet and mobile connectivity across Russia is a key driver of the e-learning market. For instance, as per industry reports, during the beginning of 2024, Russia had around 219.8 Million of mobile connections (cellular). Increased accessibility, particularly in remote and underserved regions, enables broader participation in online education. The widespread use of smartphones, tablets, and digital devices supports flexible learning solutions, driving demand for mobile-based and on-demand courses. Advancements in cloud computing, AI, and virtual learning environments further enhance the quality of e-learning experiences. As digital adoption accelerates, educational institutions, corporations, and individuals increasingly embrace online platforms for skill development, professional training, and academic learning.

.webp)

Strong government support through national education digitalization programs and policy incentives fuels the growth of Russia’s e-learning sector. For instance, in September 2024, the government of Russia launched a single state platform facilitating online education for IT as well as school students. This innovative system will aid students learning skills in AI, programming, and data analysis. Moreover, investments in digital infrastructure, teacher training, and online curriculum development promote wider adoption in schools and universities. Additionally, corporations prioritize e-learning for employee training and professional development, driving demand for industry-specific courses. Partnerships between edtech firms, universities, and businesses contribute to the expansion of high-quality online education. As both public and private sectors recognize the benefits of digital learning, sustained investments continue to strengthen the market’s long-term growth potential.

Russia E-Learning Market Trends:

Growing Demand for Professional and IT Training

Russia’s e-learning market is witnessing increased requirement for professional development, especially in IT, business management, and technical fields. With the rise of digital transformation across industries, companies prioritize workforce upskilling through online courses in programming, cybersecurity, and data science. For instance, as per industry reports, digital transformation is significantly intensifying across Russia with country adopting strategies for the development of AI until the year 2030. In line with this, around 60% of the people in Russia obtain several services digitally. Government-backed initiatives promoting digital literacy further accelerate this trend. Major e-learning platforms collaborate with universities and corporations to offer certification programs, ensuring industry relevance. The flexibility of online learning, combined with the need for specialized skills, continues to drive growth in professional and IT training segments.

Expansion of Hybrid and Blended Learning Models

Educational institutions in Russia are increasingly integrating blended and hybrid learning models, combining online and traditional classroom instruction. Universities, colleges, and K-12 schools leverage digital tools, virtual labs, and AI-powered platforms to enhance student engagement. For instance, in February 2024, Cheboksary affiliation unveiled their academic labs in Russia, encompassing academic center Digital Technologies, Polytech MEdia, and OOO NPO Kaskad Group lab. These new labs will facilitate students in enhancing their skills. The labs are equipped with unmanned vehicle program, VR technology, tuning for digital systems, and robots. Furthermore, the shift toward interactive and personalized learning experiences supports accessibility, particularly in remote regions. Institutions collaborate with edtech firms to develop adaptive learning solutions, ensuring curriculum alignment with industry needs. This trend is further strengthened by government initiatives promoting digital education, making hybrid learning a core component of Russia’s evolving education landscape.

Government Support and Digital Infrastructure Development

The Russian government exhibits a crucial role in advancing the e-learning industry through policies promoting digital education and infrastructure investment. Initiatives such as national digitalization programs aim to enhance internet accessibility and integrate online learning into public education systems. For instance, industry reports indicate that as of 2024, the government is actively working on its national project, titled Data Economy, that encompasses crucial segments like AI, digital infrastructure. The total expenditure set for the project is around USD 7.6 Billion. Moreover, increased funding for edtech startups and partnerships between institutions and technology providers accelerate innovation. Additionally, regulatory frameworks are evolving to ensure content quality and data security. These efforts contribute to the widespread utilization of e-learning, particularly in underserved areas, fostering long-term market growth and accessibility improvements.

Russia E-Learning Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Russia e-learning market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on technology, provider, and application.

Analysis by Technology:

- Online E-Learning

- Learning Management System

- Mobile E-Learning

- Rapid E-Learning

- Virtual Classroom

- Others

Online e-learning represents a crucial segment in Russia’s digital education market, driven by increasing internet penetration and growing demand for flexible learning solutions. Universities, businesses, and independent learners widely adopt online courses for professional development, academic studies, and skill enhancement. Key industries such as IT, finance, and language training benefit from interactive platforms offering video lectures, virtual classrooms, and AI-driven assessments. Government initiatives promoting digital education further fuel market expansion, while collaboration between educational institutions and technology providers enhances course accessibility and content diversity.

The adoption of learning management systems (LMS) in Russia is expanding across corporate, academic, and government sectors. Businesses leverage LMS platforms for employee training, compliance programs, and skills development, while universities integrate them into blended learning models. Advanced features such as AI-driven analytics, personalized learning paths, and cloud-based accessibility enhance engagement and efficiency. Demand is bolstered by the need for adaptable and cost-efficient training solutions, with both domestic and international LMS providers competing to offer customized platforms tailored to Russian educational and business requirements.

Mobile e-learning is rapidly gaining traction in Russia, driven by high smartphone penetration and increasing preference for on-the-go learning. Digital education platforms optimize content for mobile access, offering interactive apps, gamified courses, and microlearning modules. Professionals, students, and corporate trainees benefit from seamless access to educational resources, enhancing engagement and knowledge retention. The rise of 5G and improved mobile networks further boost adoption, enabling high-quality video streaming and real-time interaction. Mobile-first strategies are becoming crucial for e-learning providers aiming to capture Russia’s growing digital learning audience.

Analysis by Provider:

- Services

- Content

The services segment constitutes a significant Russia e-learning market share, encompassing online tutoring, virtual classrooms, corporate training solutions, and learning management systems (LMS). Demand for customized training programs, particularly in IT, business, and language learning, is growing as companies and individuals seek flexible education options. Corporate e-learning services are expanding rapidly, driven by digital transformation initiatives and workforce upskilling needs. Universities and training institutions are increasingly integrating digital services, leveraging AI-driven platforms and interactive tools to enhance learning experiences. The rise of subscription-based models and on-demand training further fuels market expansion. Service providers differentiate themselves through personalized learning experiences, advanced analytics, and seamless user engagement, making innovation and scalability key factors in maintaining market competitiveness.

The content segment plays a crucial role in Russia’s e-learning market, covering digital courses, educational videos, interactive learning modules, and gamified content. High demand for industry-specific training materials, particularly in technology, finance, and engineering, is driving content development. Universities, private institutions, and independent educators contribute to a diverse range of digital learning resources, often leveraging AI and adaptive learning techniques. Localized content, including Russian-language courses and region-specific curricula, remains a key differentiator in the competitive landscape. The market is also witnessing increased collaboration between educational institutions and content creators to expand digital libraries. With growing internet penetration and mobile learning adoption, the demand for engaging, high-quality content continues to rise, making continuous content innovation essential for market players to sustain growth.

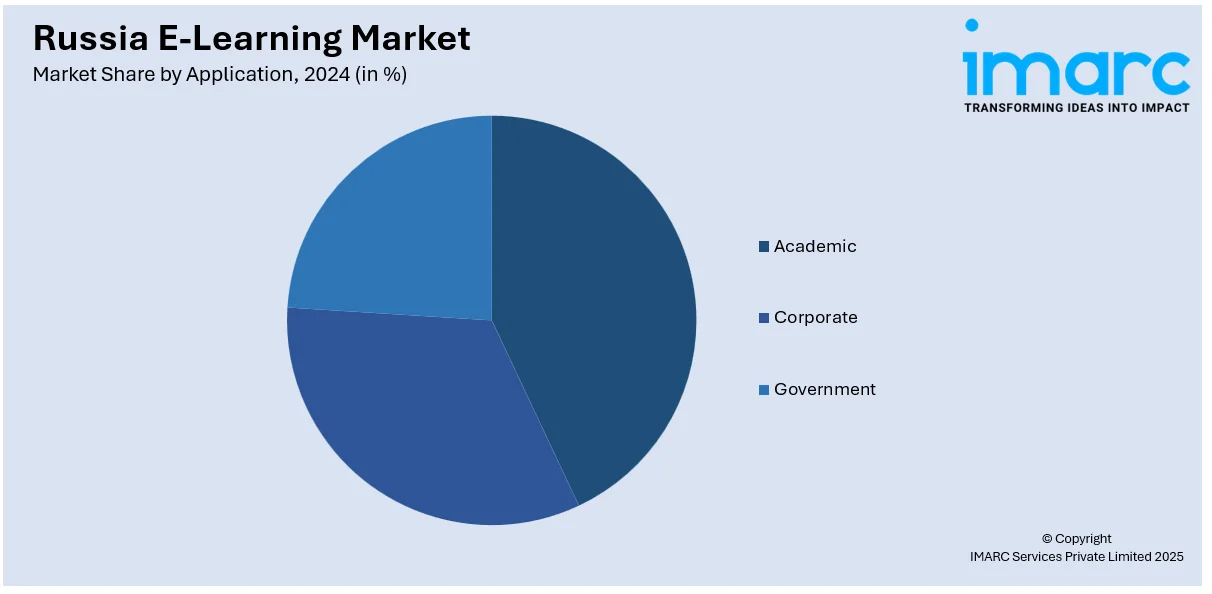

Analysis by Application:

- Academic

- K-12

- Higher Education

- Vocational Training

- Corporate

- Small and Medium Enterprises

- Large Enterprises

- Government

The academic segment in Russia’s e-learning market encompasses diverse educational institutions integrating digital learning tools to enhance curriculum delivery. Universities, colleges, and research centers increasingly adopt online platforms for distance education, skill-based courses, and blended learning models. Government-backed initiatives, such as digital transformation programs in education, drive significant growth. The demand for interactive learning technologies, virtual labs, and AI-powered tutoring systems is rising, improving accessibility and engagement. Partnerships between institutions and edtech companies further expand digital education opportunities across various academic disciplines.

E-learning adoption in Russia’s K-12 sector has accelerated due to government reforms, digitalization efforts, and growing parental demand for flexible learning solutions. Schools increasingly utilize online platforms for supplemental education, exam preparation, and interactive learning. The shift toward hybrid education models enhances student engagement through multimedia content, gamification, and adaptive learning technologies. Remote schooling solutions are particularly beneficial in rural areas, ensuring broader access to quality education. Investments in digital infrastructure and teacher training further support market expansion in this segment.

The higher education segment is a key driver of Russia’s e-learning market, with universities and technical institutes expanding online programs to reach a broader student base. Digital learning platforms facilitate degree programs, professional certifications, and specialized courses in fields such as IT, engineering, and business. The adoption of virtual classrooms, AI-driven tutoring, and interactive courseware enhances learning outcomes. Increased collaboration between universities and edtech firms supports content development and platform innovation. Government initiatives promoting digital transformation in education further fuel sector growth.

Regional Analysis:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The Central District is the prominent market for e-learning in Russia, benefiting from its high population density and strong economic base. Moscow, the nation’s capital, serves as a hub for corporate training, higher education, and digital learning platforms. With well-developed internet infrastructure and significant government and private sector investments, the district has seen rapid adoption of online courses, particularly in IT, finance, and language learning. The region’s affluent and tech-savvy population further drives demand for innovative e-learning solutions.

The Volga District, one of Russia’s key industrial and educational centers, has a growing e-learning market supported by its strong university presence and diverse economy. Cities like Kazan, Nizhny Novgorod, and Samara contribute to a rising demand for digital education, particularly in engineering, manufacturing, and business management. The region's improving digital infrastructure and increasing internet penetration enable wider adoption of remote learning solutions. Government initiatives promoting digital skills and workforce upskilling further bolster market growth.

The Urals District, a vital industrial and resource-driven region, is experiencing steady growth in e-learning adoption, primarily in vocational training and corporate education. With major cities like Yekaterinburg and Chelyabinsk serving as economic centers, there is increasing demand for online courses tailored to the metallurgy, energy, and mining industries. Companies are leveraging digital learning platforms to enhance workforce skills, while universities integrate e-learning solutions into traditional curricula, expanding access to education across the region.

As home to St. Petersburg, Russia’s second-biggest city and a key academic center, the Northwestern District holds a significant share of the country’s e-learning market. The region benefits from a strong concentration of higher education institutions, research centers, and a digitally engaged population. Growth in online education is driven by corporate training, language learning, and specialized professional development programs. The presence of international businesses further fuels demand for digital learning solutions, enhancing workforce competitiveness and skills development.

The Siberian District, despite its vast geography and lower population density, is a rapidly expanding market for e-learning, particularly in remote education and professional upskilling. Major cities such as Novosibirsk, Krasnoyarsk, and Irkutsk serve as regional hubs, fostering innovation in digital learning. The need for accessible education solutions in remote areas has driven investments in online learning platforms. Key sectors benefiting from e-learning include IT, engineering, and healthcare, as organizations seek to address workforce development challenges.

Competitive Landscape:

The market is extremely competitive, driven by a blend of both overseas and domestic firms. Prominent companies encompass major online education platforms, universities, and corporate training providers. Local firms such as Skyeng, Netology, and GeekBrains dominate language learning, IT training, and professional development, while global maintain a strong presence. For instance, as per industry reports, GeekBrains' annual revenue accounts for USD 70.7 Million. This educational platform provides above 50 online courses in several segments. Government-backed initiatives and university-led digital programs further intensify competition. Innovation, localized content, and adaptive learning technologies are critical differentiators, as providers compete to meet the growing demand for flexible, high-quality online education across various industries and demographics.

The report provides a comprehensive analysis of the competitive landscape in the Russia e-learning market with detailed profiles of all major companies.

Latest News and Developments:

- In October 2024, Odnoklassniki, a Russia-based edtech startup, announced to provide free access to its users for its educational online campaign, featuring exclusive broadcasts from 20 theaters and cultural initiatives across the country, which will be conducted under the hashtag #OperaCloser.

- In July 2024, RUDN University, Russia, announced the launch of its virtual learning program for 6-month diploma in media and communications. This e-learning venture will facilitate Africa-based students as well as global media practitioners to attain certification.

- In July 2023, Skyeng, a Russia-based company, unveiled its new ChatGPT-powered chatbot as a digital learning tool that enhances language training, professional development, and interview preparation. By offering interactive, AI-driven simulations the chatbot’s focus on spoken business English and interview readiness.

Russia E-Learning Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | USD Billion |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Online E-Learning, Learning Management System, Mobile E-Learning, Rapid E-Learning, Virtual Classroom, Others |

| Providers Covered | Services, Content |

| Applications Covered |

|

| Regionss Covered |

Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia e-learning market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Russia e-learning market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia e-learning industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Russia e-learning market was valued at USD 1.66 Billion in 2024.

The market growth is driven by increasing internet penetration, government-backed digital education initiatives, and rising demand for professional upskilling in IT and business sectors. Corporate investments, AI-driven learning solutions, and the expansion of hybrid education models further accelerate adoption, making online learning more accessible and industry-relevant.

IMARC estimates the Russia e-learning market to reach USD 11.15 Billion by 2033, exhibiting a CAGR of 23.13% from 2025-2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)