Russia EdTech Market Size, Share, Trends and Forecast by Sector, Type, Deployment Mode, End User, and Region, 2025-2033

Russia EdTech Market Overview:

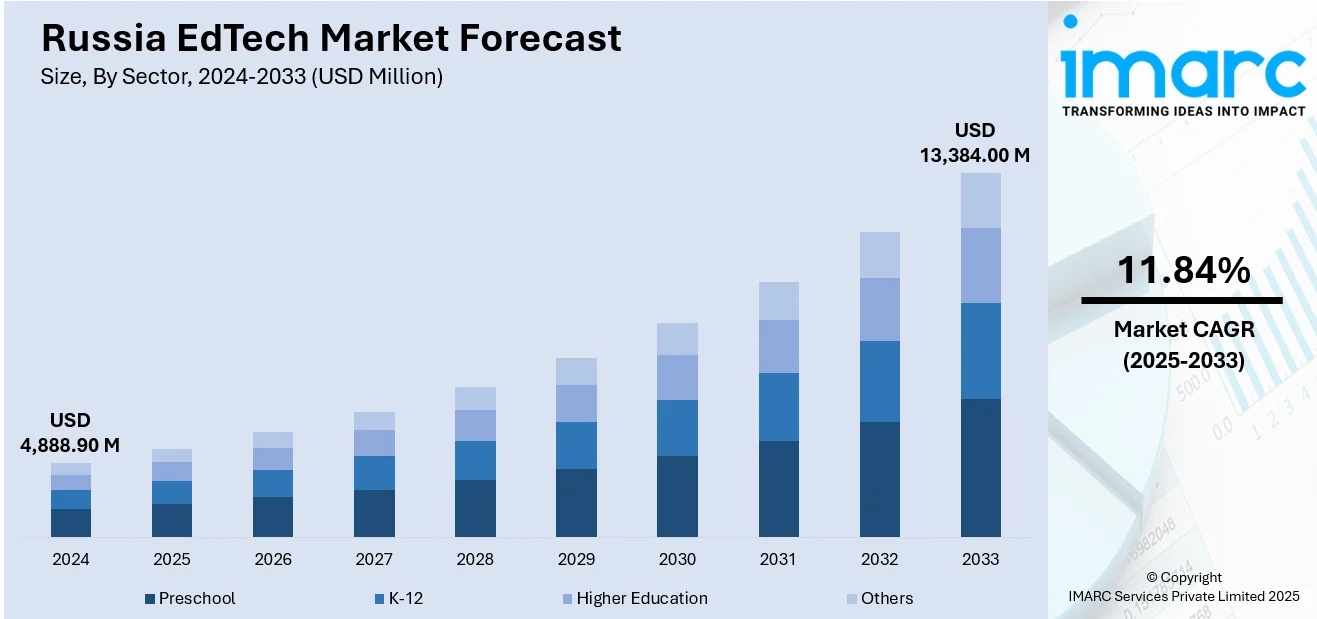

The Russia edtech market size reached USD 4,888.90 Million in 2024. The market is projected to reach USD 13,384.00 Million by 2033, exhibiting a growth rate (CAGR) of 11.84% during 2025-2033. The market is driven by strong government support through national digitalization programs, a growing demand for lifelong learning and professional upskilling amid technological shifts, and rapid expansion of mobile and internet infrastructure across the country. State initiatives foster digital education adoption in schools and universities, while adults increasingly seek flexible online courses to stay competitive in the job market. Improved connectivity, especially in rural areas, enables wider access to online learning platforms, expanding the Russia edtech market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4,888.90 Million |

| Market Forecast in 2033 | USD 13,384.00 Million |

| Market Growth Rate 2025-2033 | 11.84% |

Russia EdTech Market Trends:

Government Support and Digital Transformation Initiatives

The government plays a pivotal role in driving Russia Edtech market growth through national projects like "Education" and "Digital Economy." These programs aim to modernize the country's educational infrastructure, especially by integrating digital platforms into public schools and higher education. Subsidies, state contracts, and public-private partnerships encourage EdTech startups and large information technology (IT) firms to create online learning platforms, adaptive learning tools, and AI-driven educational content. Additionally, the pandemic accelerated policy reforms supporting distance learning across the country. Government-backed initiatives focus not only on accessibility but also on aligning education with Russia’s future economic needs, such as digital literacy, cybersecurity, and artificial intelligence (AI) development. This structured and strategic state involvement provides a secure ecosystem for EdTech companies to scale, innovate, and respond to the needs of millions of learners across urban and rural areas.

To get more information on this market, Request Sample

Rising Demand for Lifelong Learning and Upskilling

A major driver in Russia’s EdTech market is the growing need for lifelong learning and professional upskilling. Economic uncertainty, automation, and technological disruption across industries compel workers to acquire new digital competencies, ranging from data science to coding and foreign languages. Platforms like Skillbox, GeekBrains, and Netology have seen a surge in adult learners aiming to stay competitive in the job market. Employers are also investing in corporate e-learning solutions to keep their workforce adaptable. This demand has fostered the rise of micro-credentialing, online certification programs, and modular learning pathways that allow individuals to reskill affordably and flexibly. The growing middle class and an increasingly tech-savvy population view online education as a means to improve career prospects, making continuous skill development a permanent Russia Edtech market trend.

Expansion of Mobile and Internet Infrastructure

Russia’s vast geography presents unique challenges for equitable education delivery. However, the rapid expansion of mobile and broadband internet infrastructure especially in remote and rural regions is transforming these challenges into growth opportunities for EdTech providers. Affordable smartphones, widespread fourth generation (4G) coverage, and national broadband initiatives have enabled even distant populations to access online learning platforms. This connectivity boom fuels demand for mobile-friendly, offline-accessible, and data-light educational apps designed for learners outside major urban centers like Moscow and St. Petersburg. Additionally, the proliferation of smart devices in homes, combined with parental interest in early childhood digital education, is creating new market segments. As rural access improves, EdTech firms can tap into millions of potential users, contributing to both market growth and social inclusion by bridging Russia’s longstanding urban-rural educational gap.

Russia EdTech Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on sector, type, deployment mode, and end user.

Sector Insights:

- Preschool

- K-12

- Higher Education

- Others

The report has provided a detailed breakup and analysis of the market based on the sector. This includes preschool, K-12, higher education, and others.

Type Insights:

- Hardware

- Software

- Content

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes hardware, software, and content.

Deployment Mode Insights:

- Cloud-based

- On-premises

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes cloud-based, and on-premises.

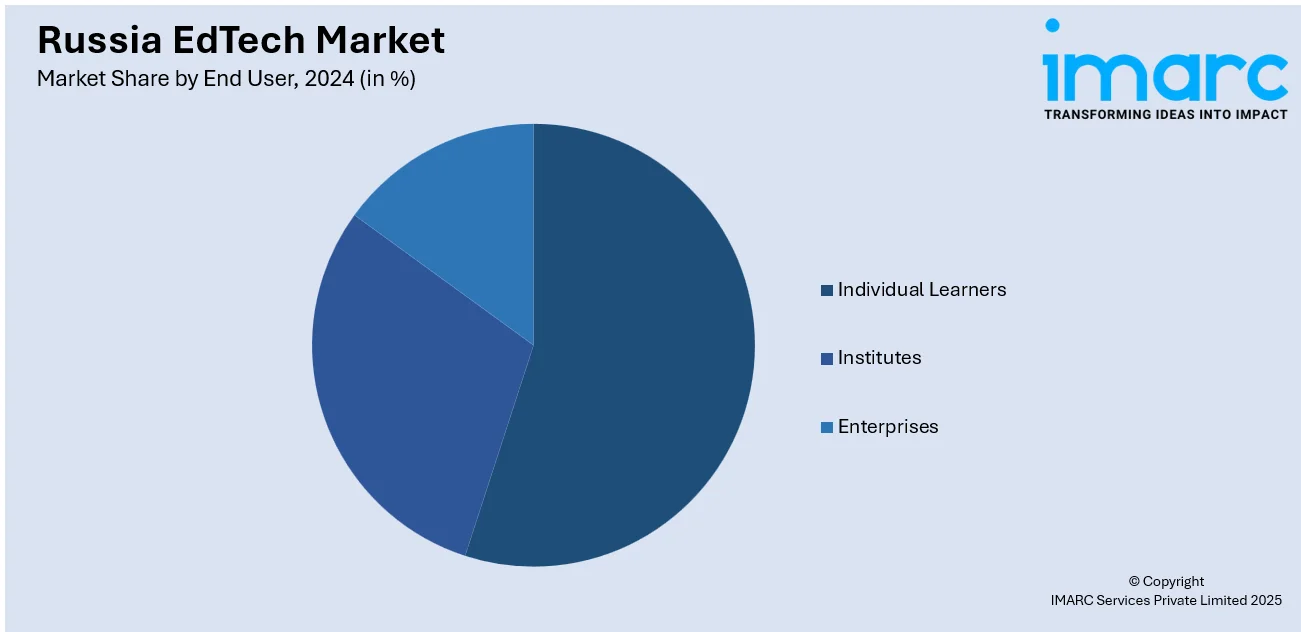

End User Insights:

- Individual Learners

- Institutes

- Enterprises

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes individual learners, institutes, and enterprises.

Regional Insights:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Central District, Volga District, Urals District, Northwestern District, Siberian District, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Russia EdTech Market News:

- In April 2025, Russian school students successfully launched a stratospheric probe carrying a satellite they designed and built, as part of a national programme supported by the Ministry of Education and Science. The satellite, equipped with sensors and cameras, will gather atmospheric and environmental data at an altitude of 30 kilometres. This mission is part of preparations for Yakutia’s first miniaturised spacecraft launch, scheduled for 31 July 2025, following a similar joint Russia-China probe flight in 2024.

Russia EdTech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sectors Covered | Preschool, K-12, Higher Education, Others |

| Types Covered | Hardware, Software, Content |

| Deployment modes Covered | Cloud-based, On-premises |

| End Users Covered | Individual Learners, Institutes, Enterprises |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Russia Edtech market performed so far and how will it perform in the coming years?

- What is the breakup of the Russia Edtech market on the basis of sector?

- What is the breakup of the Russia Edtech market on the basis of type?

- What is the breakup of the Russia Edtech market on the basis of deployment mode?

- What is the breakup of the Russia Edtech market on the basis of end user?

- What is the breakup of the Russia Edtech market on the basis of region?

- What are the various stages in the value chain of the Russia Edtech market?

- What are the key driving factors and challenges in the Russia Edtech market?

- What is the structure of the Russia Edtech market and who are the key players?

- What is the degree of competition in the Russia Edtech market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia Edtech market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Russia Edtech market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia edtech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)