Russia Ice Cream Market Size, Share, Trends and Forecast by Flavor, Category, Product, Distribution Channel, and Region, 2025-2033

Russia Ice Cream Market Overview:

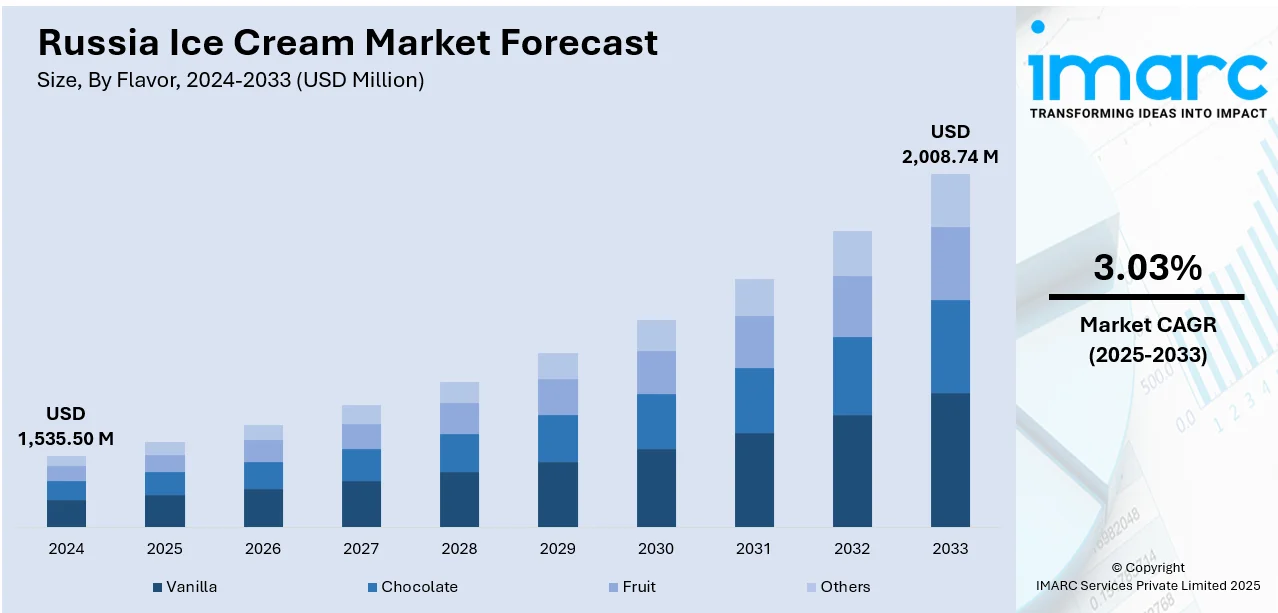

The Russia ice cream market size reached USD 1,535.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,008.74 Million by 2033, exhibiting a growth rate (CAGR) of 3.03% during 2025-2033. The market is driven by rising consumer demand for indulgent desserts, expanding retail infrastructure, and growing popularity of premium and artisanal ice cream offerings. Seasonal consumption peaks during warmer months, while innovation in flavors and packaging continues to attract younger demographics. Domestic brands competing alongside international players, focusing on affordability and taste preferences, and the growth of the urban population further contributes to the Russia ice cream market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,535.50 Million |

| Market Forecast in 2033 | USD 2,008.74 Million |

| Market Growth Rate 2025-2033 | 3.03% |

Russia Ice Cream Market Trends:

Rising Demand for Premium Products

In the Russian ice cream market, premium product lines have gained significant momentum with consumers looking for something beyond plain frozen desserts. The trend is fuelled by the growing desire for indulgent experiences and unique taste profiles. Artisan, gourmet, and craft ice creams featuring high-quality ingredients like natural flavors, organic milk, and exotic mix-ins are gaining traction, particularly among urban and younger consumers. These items tend to highlight richness, texture, and uniqueness, appealing to consumers who are willing to pay a little extra for greater quality. The premium brands also invest heavily in storytelling, branding, and visually appealing packaging, making them even more desirable. This trend marks a withdrawal from mass-produced products towards bespoke and indulgent ice cream experience

To get more information on this market, Request Sample

Health-Conscious Offerings

In response to growing wellness trends, the Russia ice cream market growth is increasingly driven by health-conscious consumers seeking better-for-you alternatives. Manufacturers are introducing products like low-fat, sugar-free, and dairy-free ice creams that cater to dietary preferences without sacrificing taste. These offerings often utilize natural sweeteners such as stevia or erythritol and plant-based milks like almond, oat, or coconut to reduce calories and improve nutritional profiles. Brands are highlighting clean-label ingredients, including no artificial additives or preservatives, to appeal to discerning buyers. Additionally, gluten-free and lactose-free variants are gaining traction, expanding the category’s inclusivity. Altogether, this pivot toward healthier formulations aligns with broader global wellness movements and is a key driver in the sustained Russia ice cream market growth.

Seasonal and Limited Editions Launch

In the Russia ice cream market, seasonal and limited-edition offerings have emerged as an effective strategy to capture consumer attention and stimulate short-term sales. Brands frequently introduce flavors tied to holidays, cultural themes, or seasonal ingredients such as berry varieties in summer or spiced flavors during winter festivities. These time-bound releases create a sense of urgency and exclusivity, encouraging impulse purchases and repeat visits. Limited editions also allow companies to test new flavor profiles and gauge consumer response without long-term risk. By tapping into local traditions and seasonal preferences, brands foster stronger emotional connections with consumers. This trend enhances brand visibility and contributes significantly to dynamic shelf presence and sustained consumer engagement in an increasingly competitive market.

Russia Ice Cream Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on flavor, category, product, and distribution channel.

Flavor Insights:

- Vanilla

- Chocolate

- Fruit

- Others

The report has provided a detailed breakup and analysis of the market based on the flavor. This includes vanilla, chocolate, fruit, and others.

Category Insights:

- Impulse Ice Cream

- Take-Home Ice Cream

- Artisanal Ice Cream

A detailed breakup and analysis of the market based on the category have also been provided in the report. This includes impulse ice cream, take-home ice cream, and artisanal ice cream.

Product Insights:

- Cup

- Stick

- Cone

- Brick

- Tub

- Others

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes cup, stick, cone, brick, tub, and others.

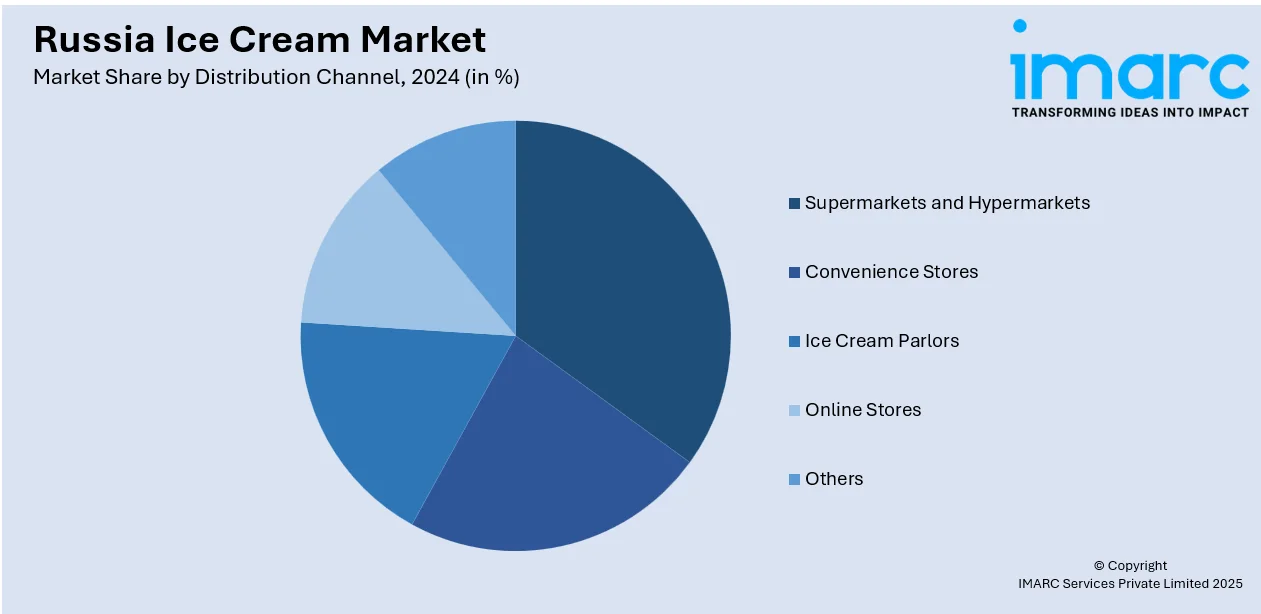

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Ice Cream Parlors

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, ice cream parlors, online stores, and others.

Regional Insights:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Central District, Volga District, Urals District, Northwestern District, Siberian District, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Russia Ice Cream Market News:

- In May 2024, Unilever announced its plans to continue producing its ice cream brands, including Cornetto and Carte D’Or, in Russia despite plans to spin off its global ice cream division.

Russia Ice Cream Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Flavors Covered | Vanilla, Chocolate, Fruit, Others |

| Categories Covered | Impulse Ice Cream, Take-Home Ice Cream, Artisanal Ice Cream |

| Products Covered | Cup, Stick, Cone, Brick, Tub, Others |

| Distribution Channels Covered | Supermarkets And Hypermarkets, Convenience Stores, Ice Cream Parlors, Online Stores, Others |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Russia ice cream market performed so far and how will it perform in the coming years?

- What is the breakup of the Russia ice cream market on the basis of flavor?

- What is the breakup of the Russia ice cream market on the basis of category?

- What is the breakup of the Russia ice cream market on the basis of product?

- What is the breakup of the Russia ice cream market on the basis of distribution channel?

- What is the breakup of the Russia ice cream market on the basis of region?

- What are the various stages in the value chain of the Russia ice cream market?

- What are the key driving factors and challenges in the Russia ice cream market?

- What is the structure of the Russia ice cream market and who are the key players?

- What is the degree of competition in the Russia ice cream market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia ice cream market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Russia ice cream market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia ice cream industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)