Russia IT Training Market Size, Share, Trends and Forecast by Application, End-User, and Region, 2025-2033

Russia IT Training Market Overview:

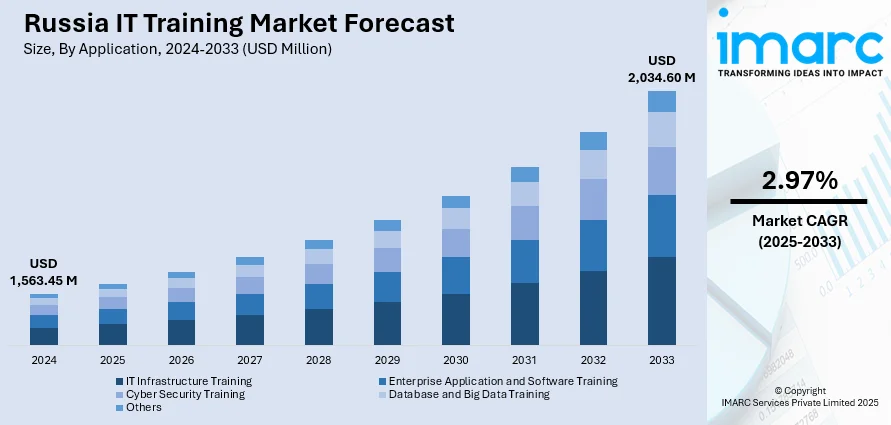

The Russia IT training market size reached USD 1,563.45 Million in 2024. The market is projected to reach USD 2,034.60 Million by 2033, exhibiting a growth rate (CAGR) of 2.97% during 2025-2033. The market is experiencing steady growth fueled by increasing demand for digital skills, cloud computing, cybersecurity, and AI technologies. Government initiatives and private sector efforts are driving large-scale workforce upskilling across the country. Online learning platforms and corporate training programs are becoming more popular as businesses accelerate digital transformation. The emphasis on building a technologically skilled workforce supports national objectives for innovation and economic modernization. Key providers are expanding services to strengthen their position in the growing Russia IT training market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,563.45 Million |

| Market Forecast in 2033 | USD 2,034.60 Million |

| Market Growth Rate 2025-2033 | 2.97% |

Russia IT Training Market Trends:

Surge in Cloud & Cybersecurity Training Programs

Russia’s IT training sector is witnessing significant growth in cloud computing and cybersecurity education, driven by increasing national and global demand for skilled professionals. In 2024, Russia expanded its cybersecurity training programs, creating more opportunities for both domestic and international students through specialized centers like Innopolis University and the Russian Cybersecurity Competence Center. These initiatives offer comprehensive training in cloud security, threat detection, incident response, and advanced encryption protocols. The programs integrate practical simulations, allowing participants to navigate real-world cybersecurity scenarios, ensuring they gain hands-on expertise. With rising digital transformation across key sectors such as finance, government, and healthcare, organizations require experts capable of safeguarding complex digital infrastructures. Educational institutions have responded by adopting hybrid learning models that combine virtual classrooms, self-paced content, and live practical labs, broadening accessibility across the country. As Russia continues strengthening its digital resilience, these developments are directly contributing to Russia IT training market growth, ensuring a steady pipeline of well-equipped cybersecurity professionals.

To get more information of this market, Request Sample

Expansion of Full-Stack & DevOps Curricular

Since mid-2024, Russia’s IT training ecosystem has placed increased emphasis on full-stack development and DevOps methodologies to align with the rapid digital transformation taking place across the nation. A notable development was the two-week intensive boot camp launched in June 2024 at ITMO University, in collaboration with Yandex Education, which offered highly specialized training in high-load system architecture, Agile project management, and DevOps practices executed in real-world enterprise environments. This program allowed participants to not only build but also deploy complex applications using cloud-native tools, integrating both development and operations workflows, which precisely mirror the deployment pipelines used across leading global industries. The market’s rising demand for multi-skilled professionals who possess the versatility to manage both code creation and IT infrastructure is driving these initiatives. As modern enterprises continue seeking faster product launches and highly resilient systems, additional coordinated programs modeled after this boot camp are being developed at other leading Russian technology institutions. This targeted shift is actively shaping Russia IT training market trends, ensuring learners gain comprehensive end-to-end software delivery skills essential for the evolving digital economy.

Integration of Mobile Development with Data Analytics in IT Training

Since 2024, Russia’s IT training sector has witnessed strong momentum in programs that combine mobile application development with data analytics. These blended programs are specifically designed to train professionals in native iOS and Android app development, including essential aspects of UI/UX design, backend integration, and seamless user experiences. In parallel, the courses offer comprehensive instruction in Python programming, business intelligence tools, data visualization, and introductory machine learning, enabling participants to process and interpret complex data sets effectively. Educational institutions have introduced flexible learning formats such as virtual classes, part-time workshops, and project-based mentorship, allowing both entry-level learners and experienced professionals to access advanced training. Higher education institutions launched specialized programs in 2024 to meet the growing demand for integrated mobile and analytics expertise. These programs directly support Russia IT training market, equipping professionals to create data-powered mobile solutions that serve finance, healthcare, logistics, and public administration, which are rapidly advancing Russia’s digital infrastructure.

Russia IT Training Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on application and end-user.

Application Insights:

- IT Infrastructure Training

- Enterprise Application and Software Training

- Cyber Security Training

- Database and Big Data Training

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes IT infrastructure training, enterprise application and software training, cyber security training, database and big data training, and others.

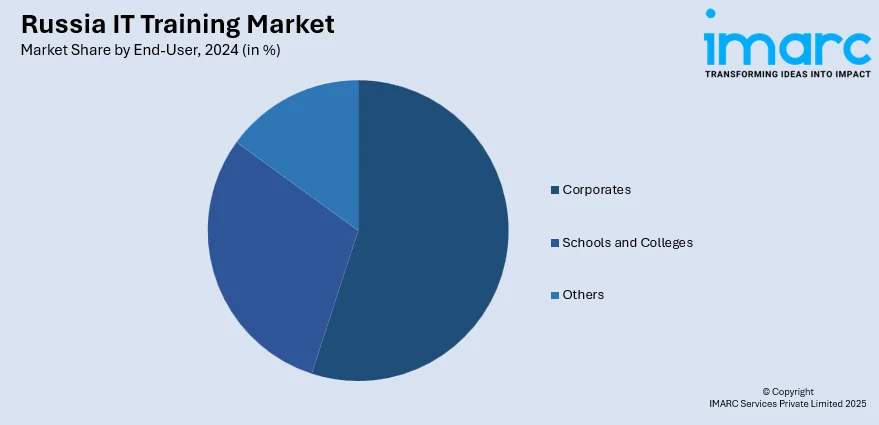

End-User Insights:

- Corporates

- Schools and Colleges

- Others

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes corporates, schools and colleges, and others.

Regional Insights:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Central District, Volga District, Urals District, Northwestern District, Siberian District, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Russia IT Training Market News:

- In 2024, Yandex significantly expanded its IT education initiatives, training over 25,000 specialists in fields such as software development, data analysis, machine learning, and artificial intelligence. The company partnered with 33 universities across 12 regions through programs like the School of Data Analysis, Yandex Practicum, Yandex Lyceum, and seasonal schools. Additionally, nearly 60,000 individuals participated in various Yandex educational projects and internship programs, further strengthening Russia's IT talent pipeline.

- June 2024: ITMO University and Yandex Practicum have introduced a groundbreaking online master’s program, Innovative Technologies for Graphic Design, blending generative AI (GANs) with hands-on design across web and mobile platforms. Using real-world case studies from Yandex and industry partners, students receive career mentorship and access to university resources such as coworking, libraries, and startup accelerators. This innovative cross-disciplinary initiative combines technical complexity and creative design, positioning Yandex as a leader in next-generation IT training.

Russia IT Training Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | IT Infrastructure Training, Enterprise Application and Software Training, Cyber Security Training, Database and Big Data Training, Others |

| End-Users Covered | Corporate, Schools and Colleges, Others |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request |

Key Questions Answered in This Report:

- How has the Russia IT training market performed so far and how will it perform in the coming years?

- What is the breakup of the Russia IT training market on the basis of application?

- What is the breakup of the Russia IT training market on the basis of end-user?

- What is the breakup of the Russia IT training market on the basis of region?

- What are the various stages in the value chain of the Russia IT training market?

- What are the key driving factors and challenges in the Russia IT training market?

- What is the structure of the Russia IT training market and who are the key players?

- What is the degree of competition in the Russia IT training market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia IT training market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Russia IT training market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia IT training industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)